Market Overview

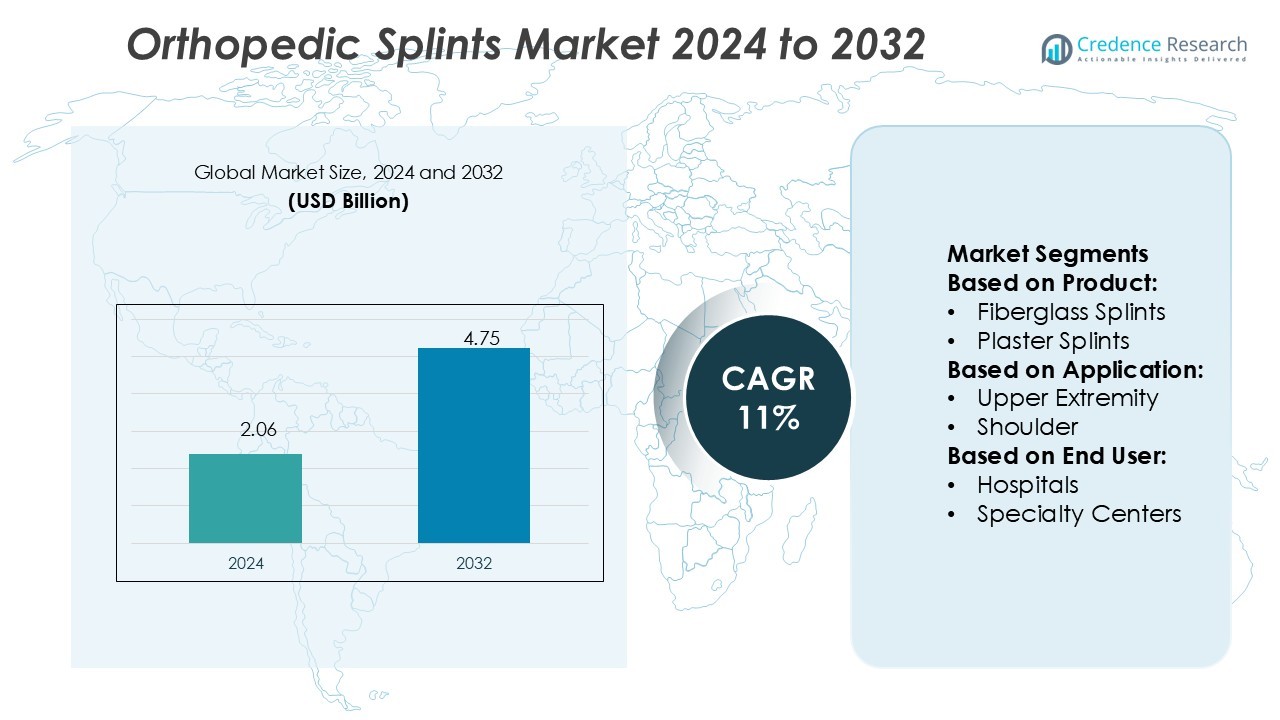

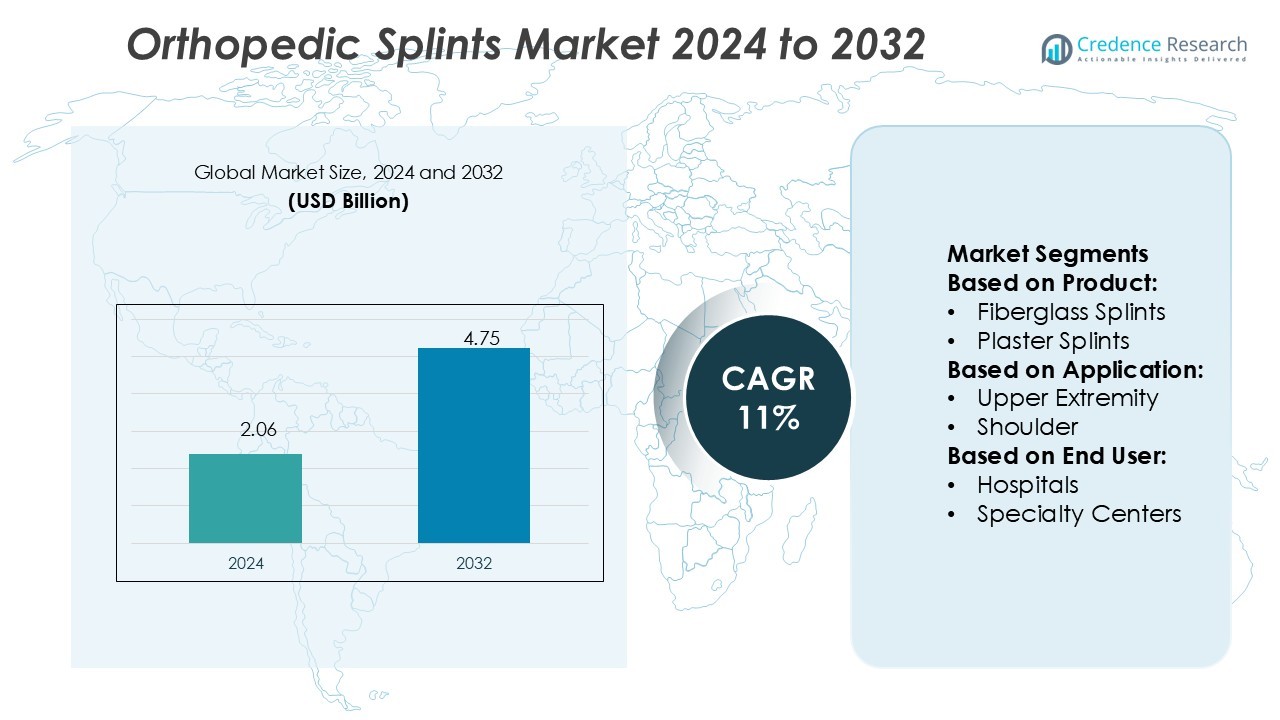

Orthopedic Splints Market size was valued USD 2.06 billion in 2024 and is anticipated to reach USD 4.75 billion by 2032, at a CAGR of 11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopedic Splints Market Size 2024 |

USD 2.06 Billion |

| Orthopedic Splints Market, CAGR |

11% |

| Orthopedic Splints Market Size 2032 |

USD 4.75 Billion |

The orthopedic splints market is shaped by prominent players including 3M, Becton, Dickinson and Company, Breg, Inc., DeRoyal Industries, Inc., DJO Global, Dynatronics Corporation, Essity AB, Medi GmbH & Co. KG, and Orthosys. These companies emphasize innovation in materials, lightweight designs, and patient-centric solutions to enhance treatment outcomes. Strategic partnerships, strong distribution channels, and advancements such as thermoplastic and fiberglass splints strengthen their competitive positions. Among regions, North America leads the market with a 38% share, supported by advanced healthcare infrastructure, higher adoption of innovative technologies, and increasing demand for effective fracture and injury management solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The orthopedic splints market size was valued at USD 2.06 billion in 2024 and is projected to reach USD 4.75 billion by 2032, at a CAGR of 11%.

- Rising incidence of fractures, sports injuries, and trauma cases drives demand, while technological advancements in fiberglass and thermoplastic splints improve comfort, durability, and recovery outcomes.

- The market shows strong trends toward customization, with 3D printing and lightweight materials gaining traction, and key players like 3M, DJO Global, and DeRoyal Industries, Inc. strengthening competitiveness through innovation and strategic partnerships.

- High costs of advanced splints and limited awareness in rural healthcare settings act as restraints, creating adoption challenges, especially in cost-sensitive regions.

- North America leads with 38% share supported by advanced healthcare infrastructure, while lower extremity applications dominate with 52% share, highlighting strong regional and segmental demand across hospitals and specialty centers.

Market Segmentation Analysis:

By Product

Fiberglass splints hold the dominant share in the orthopedic splints market, accounting for 46%. Their leadership is driven by lightweight construction, durability, and superior patient comfort compared to plaster alternatives. Fiberglass also allows faster setting time and better radiolucency, which supports accurate imaging during treatment. While plaster splints remain in use for cost-sensitive applications, adoption is declining due to heavier weight and lower durability. Tools and accessories support surgical procedures but form a smaller share. The segment’s growth reflects increasing preference for advanced, patient-friendly splinting materials.

- For instance, Norman Noble, Inc. invested in its proprietary athermal, ultra-short-pulse laser technology (Noble STEALTH), which produces the industry’s narrowest laser-cut kerfs of 0.00025 inches (approx. 6.35 microns) in bioabsorbable materials.

By Application

Lower extremity applications dominate the market with a 52% share, led by high incidence of knee, ankle, and foot injuries. Rising cases of sports injuries, road accidents, and orthopedic conditions such as osteoarthritis fuel demand for these splints. Knee and ankle splints are particularly important in trauma care and rehabilitation, ensuring stability and faster recovery. Upper extremity applications such as shoulder, elbow, and wrist follow, supported by rising outpatient procedures. Growth in this segment is reinforced by the aging population and demand for mobility-preserving treatments across healthcare systems.

- For instance, Paragon Medical operates a 34,000 square-foot additive manufacturing facility dedicated to 3D printing porous titanium implant architectures, and its subtractive capabilities include machining tolerances down to 20 millionths of an inch with surface finishes reaching 1 microinch (40 millionths of an inch) in polishing.

By End-user

Hospitals account for the largest share at 61% in the orthopedic splints market, driven by high patient volumes, trauma admissions, and access to advanced splinting materials. They serve as the primary treatment centers for acute injuries, fractures, and post-surgical recovery cases. Specialty centers, including orthopedic and sports injury clinics, are expanding steadily with rising demand for customized and minimally invasive treatments. Other end-users, such as rehabilitation facilities and ambulatory centers, contribute niche demand. The dominance of hospitals reflects their broad service capacity, while specialty centers capture growth from focused care delivery.

Key Growth Drivers

Rising Incidence of Orthopedic Injuries

The increasing prevalence of fractures, sports injuries, and trauma cases significantly drives the orthopedic splints market. Growing participation in high-impact sports, coupled with a rise in road accidents, contributes to higher injury rates requiring splinting solutions. Additionally, the global aging population is more prone to bone fragility and joint disorders, further fueling demand. Hospitals and specialty centers adopt advanced splints to provide effective stabilization and faster recovery. This consistent rise in injury-related cases positions splints as a critical component of orthopedic treatment worldwide.

- For instance, ARCH Medical Solutions operates over 700,000 square feet of manufacturing capacity across numerous ISO 13485-certified and FDA-registered U.S. facilities, leveraging a large network to enable scalable and large-volume production of implants and instruments.

Technological Advancements in Splint Materials

Continuous innovation in splint design and materials strengthens market adoption, especially with fiberglass and thermoplastic options replacing traditional plaster. Fiberglass splints are lightweight, water-resistant, and radiolucent, improving both patient comfort and diagnostic accuracy. Thermoplastic splints allow custom molding, supporting personalized treatment and rehabilitation. These advancements reduce complications, enhance durability, and shorten immobilization times. Growing preference for patient-friendly solutions accelerates the shift toward modern splinting technologies. Manufacturers investing in research and development capture competitive advantage by meeting rising demand for efficient, innovative, and sustainable orthopedic care products.

- For instance, Tecomet’s purpose-built orthopedic casting line can produce complex net-shape CoCr implant blanks. Using a lost-wax process, it can achieve tight tolerances of ±0.2 mm across a 50 mm span, before final precision machining and polishing.

Expansion of Healthcare Infrastructure

The expansion of hospitals, trauma care centers, and specialty clinics in emerging markets boosts orthopedic splint adoption. Increasing healthcare spending, insurance penetration, and government-backed initiatives to strengthen orthopedic care infrastructure fuel growth. Facilities are investing in advanced diagnostic and treatment technologies, creating opportunities for high-quality splint usage in both urban and rural areas. The shift toward outpatient care and rehabilitation centers further widens accessibility. This infrastructure development enhances patient reach and ensures timely treatment for fractures and injuries, positioning orthopedic splints as an essential component of modern healthcare delivery.

Key Trends & Opportunities

Shift Toward Customization and Patient Comfort

The market shows a strong trend toward customized splints that improve patient outcomes. Thermoplastic and 3D-printed splints allow individualized fitting, reducing complications such as skin irritation and improving rehabilitation results. Growing awareness of patient comfort and recovery times drives adoption of these solutions. Companies offering lightweight, breathable, and easily adjustable designs gain market traction. Customization also opens opportunities in pediatric orthopedics, where patient-specific needs are high. The trend highlights the industry’s transition from standardized immobilization methods to advanced, patient-centric solutions tailored for faster and safer recovery.

- For instance, CRETEX runs Direct Metal Printing (DMP) builds in its 30,000 sq ft additive hub, enabling the delivery of custom titanium implants from powder to finished part through a vertically integrated process.

Growth Opportunities in Emerging Markets

Emerging economies present significant opportunities due to increasing healthcare investments and a rising middle-class population. Countries in Asia-Pacific, Latin America, and the Middle East are witnessing higher demand for orthopedic treatments as access to healthcare improves. The surge in road accidents and trauma cases in these regions amplifies the need for splints. Government initiatives to modernize healthcare systems and expand trauma care infrastructure create favorable conditions for manufacturers. Companies entering these markets with cost-effective yet advanced splinting products are well-positioned to capture long-term growth potential.

- For instance, Viant expanded its Costa Rica medical device facility in Heredia in late 2022, adding over 90,000 square feet of cleanroom space and significantly enhancing production capacity for complex medical devices.

Key Challenges

High Cost of Advanced Splints

Despite clear clinical benefits, advanced fiberglass and thermoplastic splints are more expensive than traditional plaster options. This cost difference limits adoption in low-income regions and among patients lacking comprehensive insurance coverage. Hospitals in developing economies often prioritize cost over performance, restricting the penetration of modern splints. Additionally, reimbursement gaps in certain healthcare systems create financial barriers. Manufacturers must balance innovation with affordability to address diverse markets. The challenge lies in offering advanced solutions at competitive prices without compromising quality, durability, and patient comfort.

Limited Awareness in Rural and Underserved Areas

In many rural regions, awareness and access to advanced splints remain limited. Patients often rely on outdated or traditional methods of fracture care due to lack of resources, trained professionals, or infrastructure. This gap restricts the market potential in underserved areas despite growing demand. Furthermore, limited training among healthcare providers in adopting modern splinting techniques affects treatment outcomes. Bridging this gap requires stronger educational initiatives, supply chain improvements, and collaborations between manufacturers and healthcare systems to expand awareness and accessibility of advanced orthopedic splint solutions.

Regional Analysis

North America

North America leads the orthopedic splints market with a 38% share, driven by advanced healthcare infrastructure and high adoption of innovative splinting materials. Strong presence of leading manufacturers and wide insurance coverage enhance accessibility for patients. Rising cases of sports injuries and orthopedic conditions among aging populations fuel consistent demand. Hospitals and specialty centers integrate fiberglass and thermoplastic splints to improve patient comfort and recovery outcomes. Regulatory support for advanced medical devices further accelerates innovation and adoption. The region’s focus on quality healthcare and technology-driven treatment positions it as a dominant hub for orthopedic splint solutions.

Europe

Europe holds a 27% market share, supported by strong demand for advanced orthopedic care across key economies such as Germany, France, and the UK. The region benefits from government-backed healthcare systems and growing preference for patient-centric splints. Increasing geriatric population and rising musculoskeletal disorders drive consistent need for immobilization solutions. Emphasis on sustainable and lightweight materials, including fiberglass, supports innovation. Orthopedic clinics and rehabilitation centers in Europe prioritize customized splinting for faster recovery. The region’s strong research ecosystem and focus on high-quality healthcare services contribute to steady adoption, making it a significant contributor to global market growth.

Asia-Pacific

Asia-Pacific accounts for a 22% share of the orthopedic splints market, with rapid growth driven by expanding healthcare infrastructure in countries like China, India, and Japan. Rising trauma cases from road accidents and sports activities fuel demand for advanced splints. Increasing healthcare investments, coupled with government programs to strengthen trauma care, improve accessibility to modern solutions. Growing middle-class population and higher insurance penetration support affordability. Fiberglass and thermoplastic splints gain traction as hospitals shift from traditional plaster solutions. Asia-Pacific’s combination of large patient base, infrastructure expansion, and rising awareness positions it as a key growth frontier.

Latin America

Latin America holds an 8% share of the orthopedic splints market, driven by improving healthcare systems and rising orthopedic cases across Brazil, Mexico, and Argentina. Growth is fueled by increasing investments in trauma care and expanding access to modern hospitals. Road accidents and sports-related injuries drive steady demand for immobilization products. However, limited affordability in rural regions creates uneven adoption of advanced fiberglass splints. Governments and private players are investing in rehabilitation centers, opening opportunities for market expansion. Latin America’s improving healthcare accessibility and gradual adoption of innovative materials position it as an emerging regional contributor.

Middle East & Africa

The Middle East & Africa region contributes 5% to the orthopedic splints market, with adoption concentrated in urban centers such as the UAE, Saudi Arabia, and South Africa. Growing investments in healthcare infrastructure and medical tourism support demand for advanced orthopedic treatments. However, limited accessibility in rural and underdeveloped areas restricts widespread penetration. Increasing prevalence of road accidents and trauma cases fuels splint requirements across emergency care. Hospitals and specialty centers in wealthier nations adopt fiberglass and thermoplastic splints, while cost-sensitive markets still rely on plaster solutions. Gradual modernization makes the region a developing growth avenue.

Market Segmentations:

By Product:

- Fiberglass Splints

- Plaster Splints

By Application:

By End User:

- Hospitals

- Specialty Centers

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The orthopedic splints market features strong competition among leading players such as Esaote, Materialise NV, McKesson Corporation, Intellijoint Surgical, Merge Healthcare (IBM), Brainlab AG, Medstrat, Inc., DePuy Synthes, Carestream Health, and GE Healthcare. The orthopedic splints market is highly competitive, with companies focusing on innovation, material advancements, and patient-centric solutions to strengthen their presence. Market dynamics are shaped by the growing demand for lightweight, durable, and customizable splints that enhance recovery outcomes. Manufacturers increasingly invest in research and development to integrate advanced materials such as fiberglass and thermoplastics, offering superior comfort and functionality compared to traditional options. Digital technologies, including 3D printing and imaging integration, further support the customization trend. Strong distribution networks, strategic partnerships, and expansion into emerging markets remain central strategies, enabling players to capture a wider consumer base.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Esaote

- Materialise NV

- McKesson Corporation

- Intellijoint Surgical

- Merge Healthcare (IBM)

- Brainlab AG

- Medstrat, Inc.

- DePuy Synthes

- Carestream Health

- GE Healthcare

Recent Developments

- In June 2025, Dimension Ortho, along with Rothman Orthopaedics, announced a partnership to improve orthotic care through 3D printing orthopedic solutions. These two industry leaders aim to have custom-fit braces that lead to improved patient comfort and healing outcomes while modernizing the way orthopedics has traditionally treated patients.

- In January 2025, Aspen Medical Products acquired Advanced Orthopaedics to promote its offerings of spinal and orthopedic bracing products. In addition to advancing Aspen distribution capabilities, the acquisition will help Aspen branch into new orthopedic care markets throughout the United States.

- In June 2024, Zimmer Biomet and THINK Surgical signed a deal to distribute TMINI, a handheld robotic system for knee replacement surgery. This complements Zimmer Biomet’s existing ROSA robotic arm system and offers surgeons more choices for knee replacement procedures.

- In January 2024, Enovis launched the DonJoy ROAM OA knee brace in the U.S. for patients with osteoarthritis. The brace contains two new telescoping hinges and magnetic buckles to improve patient mobility or comfort by offloading pressure from the knee joint that commonly causes pain for patients.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising orthopedic injuries and trauma cases worldwide.

- Fiberglass and thermoplastic splints will replace traditional plaster solutions at a faster pace.

- Digital technologies like 3D printing will drive demand for customized splints.

- Hospitals will continue to dominate adoption due to high patient volumes and trauma care needs.

- Specialty centers will gain traction with a focus on personalized orthopedic treatments.

- Emerging economies will present strong growth opportunities with improving healthcare infrastructure.

- Rising geriatric populations will increase demand for fracture stabilization solutions.

- Partnerships between manufacturers and healthcare providers will enhance product reach.

- Sustainability concerns will push innovation in eco-friendly splinting materials.

- Growing awareness of patient comfort will drive the design of lightweight, user-friendly splints.