Market Overview

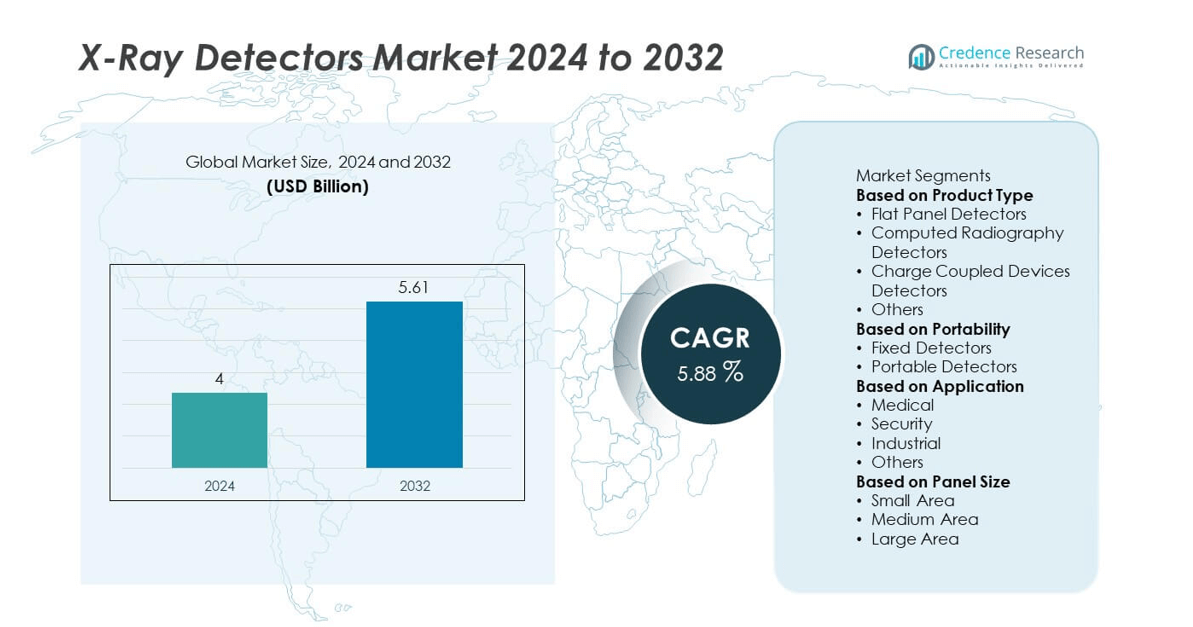

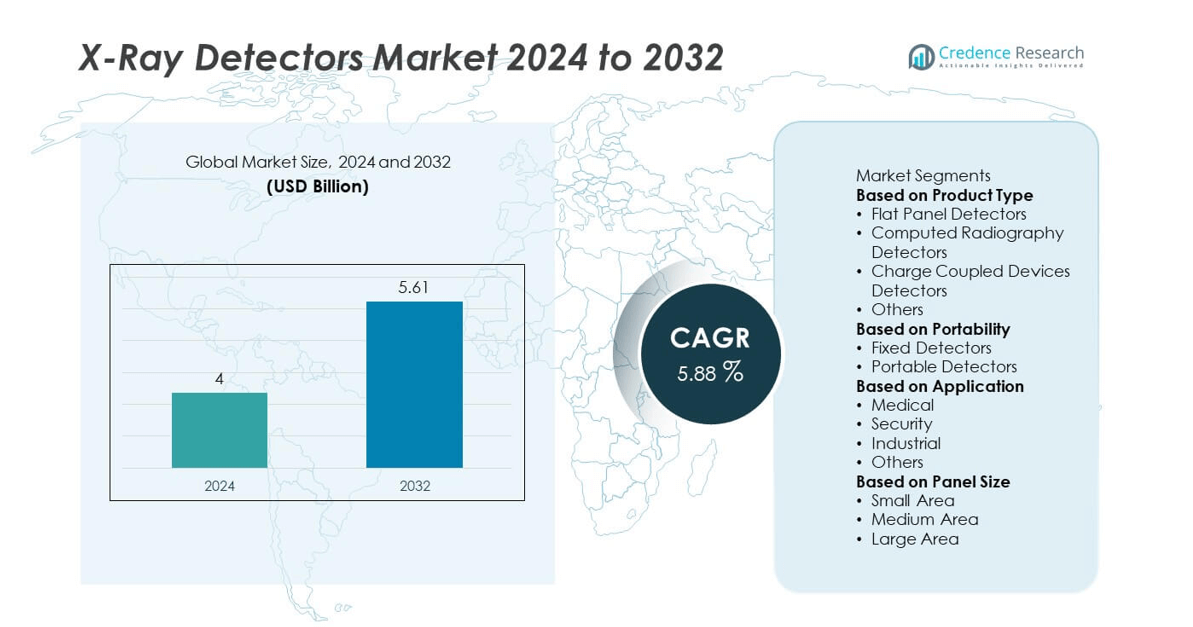

The global X-ray detectors market was valued at USD 4 billion in 2024 and is projected to reach USD 5.61 billion by 2032, growing at a CAGR of 5.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| X-Ray Detectors Market Size 2024 |

USD 4 billion |

| X-Ray Detectors Market, CAGR |

5.88% |

| X-Ray Detectors Market Size 2032 |

USD 5.61 billion |

The X-ray detectors market is led by key players including Ziehm Imaging GmbH, Canon Inc., Carestream Health, FUJIFILM Holdings Corporation, GMM Pfaudler, Toshiba Corporation, General Electric Company, Danaher, Koninklijke Philips N.V., and Shenzhen Mindray Bio-Medical Electronics Co., Ltd. These companies focus on flat panel detector innovation, portable imaging systems, and AI-powered diagnostic tools to enhance image quality and reduce radiation exposure. North America held the largest share with 38% in 2024, driven by early adoption of digital radiography and strong healthcare infrastructure. Europe followed with 30% share, supported by modernization programs, while Asia-Pacific captured 24% share, fueled by rapid hospital expansion and rising healthcare investments.

Market Insights

- The X-ray detectors market was valued at USD 4 billion in 2024 and is projected to reach USD 5.61 billion by 2032, growing at a CAGR of 5.88%.

- Rising demand for digital radiography, early disease detection, and low-dose imaging systems is driving adoption of flat panel detectors across hospitals, diagnostic centers, and dental clinics worldwide.

- Key trends include rapid shift toward wireless and portable detectors, integration of AI-based image processing, and expansion of applications in security screening and industrial non-destructive testing.

- The market is competitive with major players such as Ziehm Imaging GmbH, Canon Inc., Carestream Health, FUJIFILM Holdings Corporation, and General Electric Company focusing on product innovation, cost efficiency, and partnerships to strengthen global presence.

- North America led with 38% share in 2024, followed by Europe at 30% and Asia-Pacific at 24%, while flat panel detectors dominated the product type segment with over 55% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Flat panel detectors dominated the X-ray detectors market with over 55% share in 2024, driven by their superior image quality, faster processing time, and lower radiation dose compared to traditional detectors. Their growing adoption in digital radiography, dental imaging, and mammography is fueling demand. Hospitals and diagnostic centers are replacing computed radiography systems with flat panel technology to improve workflow efficiency and patient throughput. Rising demand for wireless and portable flat panel solutions, along with decreasing costs, continues to accelerate their penetration across both developed and emerging healthcare markets.

- For instance, Canon Inc. shipped more than 40,000 units of its CXDI series flat panel detectors globally by November 2017, including wireless models that offer high resolution and improved dose efficiency for diagnostic imaging.

By Portability

Portable detectors held the largest share with around 60% of the market in 2024, reflecting the rising demand for point-of-care diagnostics and mobile radiography solutions. These detectors are widely used in emergency departments, intensive care units, and field applications where quick, on-site imaging is essential. Their lightweight design, wireless connectivity, and ability to integrate with mobile X-ray systems make them highly preferred by healthcare providers. The ongoing shift toward home healthcare and remote diagnostic services further drives adoption of portable detectors worldwide.

- For instance, Shenzhen Mindray Bio-Medical Electronics, a major player in the medical imaging market, deploys various portable X-ray systems and flat panel detectors, such as its MobiEye 700 and DigiEye series, to hospitals and mobile units throughout China and Southeast Asia.

By Application

The medical segment accounted for over 70% share in 2024, making it the largest application segment in the X-ray detectors market. Growth is driven by the increasing prevalence of chronic diseases, rising number of diagnostic imaging procedures, and the shift toward digital radiography. The use of advanced detectors in mammography, fluoroscopy, dental imaging, and general radiography is expanding rapidly. Government initiatives to modernize healthcare infrastructure and the growing focus on early disease detection are encouraging hospitals and imaging centers to upgrade to high-performance digital X-ray detector systems.

Market Overview

Rising Adoption of Digital Radiography

The shift from analog to digital radiography is a major driver for the X-ray detectors market. Digital systems offer faster image acquisition, lower radiation exposure, and improved workflow efficiency, making them highly preferred in hospitals and diagnostic centers. Flat panel detectors are increasingly replacing computed radiography systems, particularly in developed markets, to improve diagnostic accuracy and patient throughput. Government initiatives and reimbursement policies supporting digital imaging upgrades further accelerate adoption, driving consistent demand for advanced detector technologies across medical applications.

- For instance, in 2014, Toshiba America Medical Systems announced that its Kalare R&F digital X-ray system with a dynamic flat panel detector had received U.S. Food and Drug Administration (FDA) clearance. The system’s enclosed table design was reported to reduce scatter radiation by up to 95%.

Increasing Prevalence of Chronic Diseases

The growing burden of chronic diseases such as cancer, cardiovascular disorders, and respiratory conditions is fueling demand for diagnostic imaging. X-ray detectors play a critical role in early detection, monitoring, and treatment planning. Rising awareness about preventive healthcare and higher imaging volumes in aging populations contribute to market growth. Hospitals and imaging centers are expanding capacity by adopting high-performance detectors to handle increasing patient loads efficiently, improving diagnostic outcomes and reducing waiting times for critical imaging procedures.

- For instance, GE Healthcare manufactures and supplies wireless portable X-ray detectors to hospitals and emergency care facilities across the US, supporting high-volume imaging and enhancing mobility and image quality. The company continues to develop AI-enabled portable X-ray technology to address the challenges of efficiency and workflow in high-demand environments.

Technological Advancements and Innovation

Continuous innovation in X-ray detector technology is boosting market growth. The development of wireless flat panel detectors, low-dose imaging systems, and AI-enabled image processing enhances accuracy and patient safety. Manufacturers are focusing on lightweight, portable solutions to support bedside imaging and mobile radiography. Integration with cloud-based systems and PACS is improving image sharing and storage capabilities. These advancements are expanding applications beyond healthcare, including security screening and industrial non-destructive testing, opening new revenue streams for detector manufacturers globally.

Key Trends & Opportunities

Growth of Portable and Wireless Detectors

Portable and wireless X-ray detectors are gaining traction as healthcare providers focus on improving patient mobility and reducing wait times. These systems are widely used in intensive care units, emergency rooms, and field settings where rapid diagnosis is critical. The demand for mobile radiography solutions has increased significantly following the COVID-19 pandemic, driving investment in wireless technologies. This trend creates opportunities for manufacturers to develop compact, battery-efficient detectors with seamless connectivity to hospital information systems and telehealth platforms.

- For instance, Konica Minolta has incorporated wireless connectivity and AI-powered image enhancement features into its AeroDR flat panel detectors to optimize clinical workflows.

Rising Demand from Security and Industrial Applications

Beyond healthcare, X-ray detectors are seeing increased adoption in security screening, aviation checkpoints, and industrial inspection. Growing emphasis on safety standards in manufacturing and infrastructure sectors drives the use of non-destructive testing (NDT) techniques. Detector technologies are being customized for detecting structural flaws, ensuring product quality, and enhancing border security. This diversification into non-medical applications provides manufacturers with additional growth opportunities and reduces dependence on healthcare sector demand cycles.

- For instance, Varex Imaging supplies specialized flat-panel X-ray detectors designed for industrial non-destructive testing (NDT) and airport security screening systems. These products enable high-resolution imaging with durability suited for harsh environments.

Key Challenges

High Cost of Advanced Detectors

The high cost of flat panel detectors and digital radiography systems remains a significant barrier, especially for small hospitals and clinics in developing regions. Upfront investment in equipment, along with maintenance and software upgrade costs, can strain budgets. This slows adoption and limits penetration in price-sensitive markets. Manufacturers must focus on offering affordable, scalable solutions and financing options to expand access and accelerate digital transformation in healthcare facilities.

Data Management and Integration Issues

Managing and integrating large volumes of imaging data poses challenges for healthcare providers. Compatibility with existing hospital information systems, PACS, and electronic health records can be complex. Data storage, cybersecurity concerns, and compliance with regulations such as HIPAA further increase operational burdens. Inadequate IT infrastructure in some regions delays adoption of advanced digital imaging systems, hindering seamless integration of X-ray detectors into clinical workflows.

Regional Analysis

North America

North America held 38% share of the X-ray detectors market in 2024, driven by strong adoption of digital radiography and advanced imaging technologies. The U.S. dominates the region with widespread use of flat panel detectors in hospitals, outpatient imaging centers, and dental clinics. High healthcare expenditure, favorable reimbursement policies, and emphasis on early disease detection support continued market growth. Canada also contributes through investments in healthcare infrastructure modernization and expansion of diagnostic imaging capacity. The presence of leading detector manufacturers and rapid adoption of wireless and portable solutions further strengthen the region’s market leadership.

Europe

Europe accounted for 30% share in 2024, supported by robust healthcare systems and government initiatives to upgrade imaging infrastructure. Countries like Germany, France, and the U.K. are leading adoption of flat panel detectors to enhance diagnostic efficiency and meet radiation dose reduction targets. The European Union’s focus on advanced healthcare technologies and patient safety drives replacement of analog systems with digital detectors. Growth is also fueled by rising imaging volumes due to aging populations and increased screening programs. Manufacturers benefit from strong demand for portable and mobile radiography solutions across both public and private healthcare facilities.

Asia-Pacific

Asia-Pacific captured 24% share in 2024 and is the fastest-growing region due to rapid expansion of healthcare infrastructure in China, India, and Southeast Asia. Rising healthcare expenditure, growing awareness about preventive diagnostics, and government programs supporting digitalization of hospitals are driving adoption. Domestic manufacturers are offering cost-effective flat panel detectors, accelerating penetration in price-sensitive markets. Japan and South Korea lead in advanced technology adoption, with a strong focus on low-dose imaging systems. The region’s increasing burden of chronic diseases and expansion of diagnostic centers in urban and rural areas support sustained demand for X-ray detectors.

Middle East & Africa

The Middle East & Africa held 5% share in 2024, with growth supported by modernization of healthcare infrastructure and rising investment in diagnostic imaging. Gulf countries such as Saudi Arabia, UAE, and Qatar are adopting advanced flat panel detector systems to expand hospital capabilities and meet international care standards. In Africa, market growth is driven by increasing government and NGO funding for radiology equipment in public hospitals. However, limited access to advanced imaging technologies in rural regions and budget constraints slow adoption, creating opportunities for affordable and portable detector solutions tailored for resource-limited settings.

Latin America

Latin America accounted for 3% share in 2024, with Brazil and Mexico leading the adoption of digital X-ray detectors. Investments in public healthcare systems, modernization of diagnostic imaging facilities, and expansion of private clinics drive demand. The shift toward digital radiography is encouraged by government programs aimed at improving patient care and reducing waiting times. Portable and wireless solutions are gaining popularity for use in remote areas and mobile diagnostic units. Despite economic fluctuations, the region is expected to see steady growth, supported by rising awareness of early disease detection and improving healthcare access.

Market Segmentations:

By Product Type

- Flat Panel Detectors

- Computed Radiography Detectors

- Charge Coupled Devices Detectors

- Others

By Portability

- Fixed Detectors

- Portable Detectors

By Application

- Medical

- Security

- Industrial

- Others

By Panel Size

- Small Area

- Medium Area

- Large Area

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the X-ray detectors market is shaped by leading players such as Ziehm Imaging GmbH, Canon Inc., Carestream Health, FUJIFILM Holdings Corporation, GMM Pfaudler, Toshiba Corporation, General Electric Company, Danaher, Koninklijke Philips N.V., and Shenzhen Mindray Bio-Medical Electronics Co., Ltd. These companies focus on developing high-performance flat panel detectors, wireless imaging solutions, and dose-optimized systems to meet the growing demand for digital radiography. Strategic initiatives include collaborations with hospitals and imaging centers, R&D investments in low-dose technology, and the launch of portable and mobile imaging systems. Many players are expanding their product portfolios with AI-enabled image processing and cloud connectivity to improve diagnostic accuracy and workflow efficiency. Intense competition is driving continuous innovation, with companies focusing on cost optimization, user-friendly designs, and expansion into emerging markets to address the rising need for modern diagnostic imaging solutions worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ziehm Imaging GmbH

- Canon Inc.

- Carestream Health

- FUJIFILM Holdings Corporation

- GMM Pfaudler

- Toshiba Corporation

- General Electric Company

- Danaher

- Koninklijke Philips N.V.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Recent Developments

- In February 2025, Ziehm Imaging introduced a new software package for endovascular navigation integrated into its mobile C-arm systems at ECR 2025. This AI-driven fusion imaging technology combines preoperative CT data with intraoperative fluoroscopy, improving precision and reducing radiation exposure during vascular surgeries.

- In February 2025, Canon Healthcare US invested in a $34 million research and development center in Cleveland, Ohio, to advance innovations in X-ray, CT, MRI, and molecular imaging technologies. This expansion is expected to bolster Canon’s medical imaging portfolio and accelerate time-to-market for next-gen X-ray detectors starting in late 2025.

- In 2025, Danaher Corporation expanded its presence in the X-ray detectors market with its new digital flat-panel detector technology incorporated in surgical imaging devices, reaching deployment in 250 hospitals globally by March 2025.

- In December 2024, Canon Inc. received FDA 510(k) clearance and launched its Adora DRFi, a hybrid radiography & fluoroscopy system featuring the wireless CXDI-RF B1 detector; now available for sale.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Portability, Application, Panel Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for flat panel detectors will continue to rise as healthcare systems shift to digital radiography.

- Portable and wireless X-ray detectors will gain traction in point-of-care and emergency settings.

- AI-powered image processing will enhance diagnostic accuracy and reduce reporting time.

- Adoption of low-dose imaging technology will grow to meet patient safety requirements.

- Industrial and security applications will expand, driving detector use beyond healthcare.

- Emerging markets will see higher penetration due to healthcare infrastructure investments and digitalization programs.

- Manufacturers will focus on compact, lightweight, and energy-efficient detector designs.

- Cloud-based data storage and PACS integration will become standard for seamless image sharing.

- Collaborations between technology providers and hospitals will accelerate adoption of advanced systems.

- Competition will intensify, encouraging continuous innovation and cost-optimized solutions for diverse end-users.