Market Overview

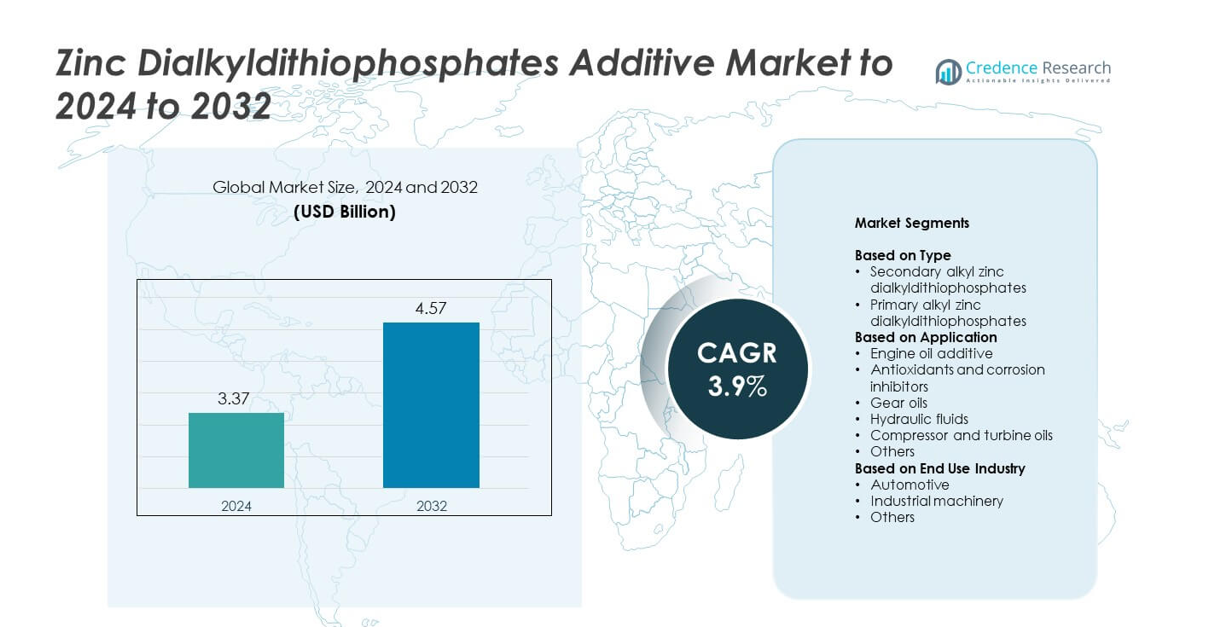

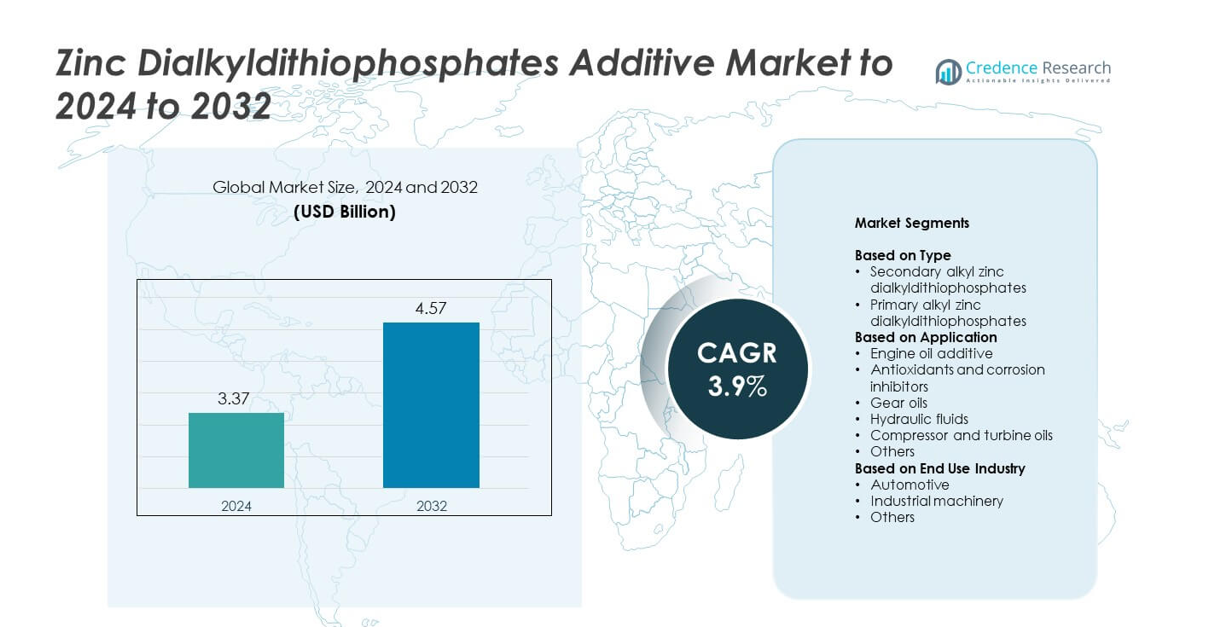

Zinc Dialkyldithiophosphates Additive Market size was valued at USD 3.37 Billion in 2024 and is anticipated to reach USD 4.57 Billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Zinc Dialkyldithiophosphates Additive Market Size 2024 |

USD 3.37 Billion |

| Zinc Dialkyldithiophosphates Additive Market, CAGR |

3.9% |

| Zinc Dialkyldithiophosphates Additive Market Size 2032 |

USD 4.57 Billion |

The Zinc Dialkyldithiophosphates Additive Market is led by major players such as Infineum, Ganesh Benzoplast, Afton Chemical, Yasho Industries, Chevron Oronite, Gbl Chemical, Ruhani Lubricants, RB Products, Lubrizol, Addilex, and Chetas Biochem. These companies compete through advanced additive technologies that enhance wear protection, thermal stability, and lubricant durability for automotive and industrial applications. Their focus on performance-driven formulations and compliance with evolving emission standards strengthens market positioning across global lubricant manufacturers. North America emerged as the leading region in 2024 with about 34% share, supported by strong vehicle maintenance demand and high adoption of premium engine oils.

Market Insights

- The Zinc Dialkyldithiophosphates Additive Market was valued at USD 3.37 Billion in 2024 and will reach USD 4.57 Billion by 2032 at a CAGR of 3.9%.

• Higher demand for strong anti-wear protection in engines drives market growth, led by secondary alkyl ZDDP with about 62% share and engine oil additives with nearly 48% share in 2024.

• Key trends include rising use of synthetic oils, longer drain intervals, and growing need for thermal stability in hybrid and downsized engines across major markets.

• Competition stays active as producers focus on better additive blends, regulatory-ready formulations, and improved performance for both automotive and industrial users.

• North America led the market with about 34% share, followed by Europe at 28%, Asia Pacific at 30%, Latin America at 5%, and Middle East and Africa at 3%, supported by strong lubricant consumption and expanding machinery use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Secondary alkyl zinc dialkyldithiophosphates held the dominant position in 2024 with about 62% share of the Zinc Dialkyldithiophosphates Additive Market. This grade remained the preferred choice because secondary alkyl ZDDP provides stronger anti-wear protection and better thermal stability in high-load engines. Demand increased as OEMs focused on longer drain intervals and improved engine durability. Primary alkyl ZDDP continued to serve niche applications where lower volatility and cleaner performance were required, but the broader shift toward advanced lubrication pushed secondary alkyl variants ahead in overall consumption.

- For instance, Biosynthetic Technologies reported that while typical conventional base oil formulations achieve Sequence IIIH weighted piston deposit ratings around 4.7 (Group III) to 4.9 (Group II) merits, its own BT4 base-stock formulations achieved superior ratings of 5.5 and 5.8 merits, indicating significantly cleaner engine operation.

By Application

Engine oil additives led the application segment in 2024 with nearly 48% share of the Zinc Dialkyldithiophosphates Additive Market. Automakers and lubricant producers relied on ZDDP for strong wear control, oxidation resistance, and stable performance under high temperature. Growth stayed steady due to rising vehicle parc, increased use of synthetic oils, and the need to protect metal-to-metal contact surfaces in modern engines. Antioxidants and corrosion inhibitors, gear oils, and hydraulic fluids also recorded solid demand as industries sought reliability in high-stress machinery environments.

- For instance, Intertek’s engine-oil overview lists Sequence IIIH running 90 hours at 3900 rpm with an oil-block temperature target near 151 degrees Celsius.

By End Use Industry

Automotive emerged as the leading end-use industry in 2024 with around 58% share of the Zinc Dialkyldithiophosphates Additive Market. Rising production of passenger and commercial vehicles supported the wider use of ZDDP-based formulations in engine oils and driveline lubricants. The shift toward higher-performance engines and longer service intervals also raised demand for strong anti-wear chemistry. Industrial machinery followed with stable growth as manufacturers adopted ZDDP-containing oils to maintain component life and reduce downtime in heavy-duty operations.

Key Growth Drivers

Rising Demand for High-Performance Engine Oils

Growing use of high-performance engine oils remains a major growth driver in the Zinc Dialkyldithiophosphates Additive Market. Vehicle manufacturers focus on better wear protection and longer oil drain intervals, which pushes lubricant formulators to rely on ZDDP chemistry. Modern engines generate higher thermal stress, raising the need for additives that prevent metal-to-metal contact. Expanding vehicle fleets in Asia-Pacific and increasing adoption of synthetic lubricants further support demand. These factors keep ZDDP essential in meeting durability, stability, and anti-wear requirements across passenger and commercial vehicles.

- For instance, Shell states that Helix Ultra with PurePlus Technology delivers up to three times faster oil flow at minus 40 degrees Celsius compared with the API SN reference oil.

Expansion of Industrial Machinery and Equipment Use

Rapid industrial development drives higher consumption of lubricants containing ZDDP across manufacturing, mining, and heavy engineering. Industrial machinery operates under heavy loads and extreme temperatures, creating strong demand for additives that deliver oxidation stability and wear resistance. Growing installation of hydraulic systems, compressors, and turbines increases reliance on robust anti-wear formulations. Emerging economies continue to expand industrial output, which lifts lubricant requirements across factories and construction fleets. This broad industrial growth strengthens the long-term need for ZDDP-based additive blends.

- For instance, Afton Chemical’s HiTEC 11100 data sheet lists the physical properties of the concentrated additive package itself, showing a kinematic viscosity of about 89 square millimeters per second at 100 degrees Celsius and a total base number (TBN) near 78 milligrams KOH per gram.

Continuous Upgrades in Lubrication Technology

Ongoing improvements in lubricant technology act as a key growth driver for the market. Lubricant producers work toward advanced formulations that enhance engine efficiency, reduce friction, and meet tougher equipment standards. ZDDP remains vital due to its balanced anti-wear and antioxidant properties, supporting compatibility with both mineral and synthetic base oils. New blending techniques and better additive synergies raise the effectiveness of ZDDP even in modern low-viscosity oils. These advancements reinforce the importance of ZDDP in next-generation lubrication systems.

Key Trends and Opportunities

Shift Toward Longer Drain Intervals and High-Temperature Stability

A key trend involves the growing shift toward lubricants that support extended drain intervals and improved thermal stability. Fleets and vehicle owners prefer oils that reduce maintenance frequency and deliver consistent performance. ZDDP additives help maintain film strength at high temperatures, supporting this trend. As synthetic oils gain popularity due to efficiency benefits, the opportunity for ZDDP-integrated formulations increases. This creates new potential across automotive workshops, commercial fleets, and heavy-duty equipment operators seeking durability and cost savings.

- For instance, Southwest Research Institute’s Sequence VH documentation describes a 216 hour test made of 54 cycles, each cycle combining stages at 1200, 2900, and 700 revolutions per minute.

Increased Focus on Hybrid and Downsized Engines

The rise of hybrid and downsized engines creates new opportunities for ZDDP-based additives. These engines place harsher demands on lubricants due to frequent start-stop cycles and fluctuating temperatures. ZDDP provides critical wear protection for valve trains and metal contact surfaces, supporting stable performance. As automakers continue launching compact, fuel-efficient engines, the need for strong anti-wear chemistry expands. This trend enhances adoption across OEM-approved lubricant specifications and opens growth prospects in premium oil formulations.

- For instance, Infineum’s description of Ford’s Sequence IX test notes a 2.0 liter turbo engine running four iterations of 175000 cycles, with a limit of five low-speed pre-ignition events overall.

Key Challenges

Regulatory Pressure on Phosphorus and Sulfur Limits

A key challenge arises from global regulations restricting phosphorus and sulfur content in lubricants. These limits aim to protect catalytic converters and reduce emissions, but they directly affect traditional ZDDP formulations. Lubricant producers must balance compliance with performance requirements, often reducing ZDDP concentrations. This creates difficulties in maintaining the same level of anti-wear protection. Regulatory tightening in North America, Europe, and parts of Asia pushes manufacturers toward optimized blends or partial ZDDP replacements.

Competition from Emerging Anti-Wear Additives

Competitive pressure from alternative anti-wear technologies challenges market expansion. New ashless additives, organic molybdenum compounds, and advanced phosphorus-free formulations gain attention as equipment makers look for cleaner solutions. These alternatives aim to meet emission standards and improve compatibility with modern after-treatment systems. Their rising adoption in premium synthetic oils may limit ZDDP growth in certain applications. The need to prove long-term durability and cost-effectiveness further increases pressure on traditional ZDDP chemistry

Regional Analysis

North America

North America led the Zinc Dialkyldithiophosphates Additive Market in 2024 with about 34% share. The region maintained strong demand due to high vehicle ownership, steady production of light trucks and SUVs, and widespread use of premium engine oils. Growth also came from industrial users that relied on ZDDP-based lubricants for machinery protection. Rising adoption of synthetic oils supported higher consumption across automotive workshops and fleet services. Regulatory pressure encouraged optimized formulations, but ZDDP remained essential for wear control in engines and gear systems. Stable automotive maintenance spending further reinforced market dominance.

Europe

Europe held nearly 28% share of the Zinc Dialkyldithiophosphosphates Additive Market in 2024. Demand stayed stable as the region focused on high-quality lubricants that meet strict emission and performance standards. Automotive manufacturers relied on ZDDP for valve-train protection, especially in older and high-mileage vehicles. Industrial sectors such as manufacturing, heavy engineering, and energy generation added steady consumption. Adoption of synthetic and low-viscosity oils drove interest in optimized ZDDP blends. Ongoing technical upgrades in machinery and strong maintenance culture supported lubricant demand despite tightening phosphorus and sulfur regulations.

Asia Pacific

Asia Pacific accounted for about 30% share in 2024, driven by large vehicle parc, rapid urban growth, and expanding industrial activity. China, India, and Southeast Asia showed strong use of ZDDP-enhanced lubricants in both passenger cars and commercial fleets. Rising production of two-wheelers and light vehicles supported wider adoption of engine oils containing ZDDP. Growing industrial machinery installations in manufacturing, construction, and mining also boosted demand. The region’s increasing preference for synthetic oils advanced the use of improved anti-wear additives. Expanding automotive aftermarket networks further strengthened overall consumption.

Latin America

Latin America captured nearly 5% share of the Zinc Dialkyldithiophosphates Additive Market in 2024. Demand remained supported by steady vehicle servicing activities and reliance on cost-effective lubricant formulations. Countries such as Brazil and Mexico used ZDDP-based engine oils widely due to the need for strong wear protection in older and high-mileage vehicles. Industrial operations in mining, agriculture, and manufacturing also contributed to additive consumption. Limited penetration of synthetic oils slowed premium growth, but the aftermarket’s consistent lubricant turnover sustained market stability. Gradual economic recovery offered moderate improvement in lubricant demand.

Middle East and Africa

Middle East and Africa held around 3% share in 2024, supported by the region’s dependence on heavy-duty vehicles, power equipment, and industrial machinery. Demand for ZDDP additives grew in markets with expanding construction and mining activity. Engine oils with strong anti-wear properties remained essential under high-temperature operating conditions. Countries in the Gulf maintained stable consumption through regular vehicle maintenance and industrial lubrication needs. Limited automotive production reduced growth potential, but aftermarket servicing ensured continued demand. Increasing adoption of synthetic and semi-synthetic oils provided gradual opportunities for advanced ZDDP formulations.

Market Segmentations:

By Type

- Secondary alkyl zinc dialkyldithiophosphates

- Primary alkyl zinc dialkyldithiophosphates

By Application

- Engine oil additive

- Antioxidants and corrosion inhibitors

- Gear oils

- Hydraulic fluids

- Compressor and turbine oils

- Others

By End Use Industry

- Automotive

- Industrial machinery

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Zinc Dialkyldithiophosphates Additive Market is shaped by leading companies such as Infineum, Ganesh Benzoplast, Afton Chemical, Yasho Industries, Chevron Oronite, Gbl Chemical, Ruhani Lubricants, RB Products, Lubrizol, Addilex, and Chetas Biochem. Market participants focus on delivering high-performance additive formulations that enhance wear protection, oxidation stability, and long-term engine durability. Many producers invest in research to create cleaner blends that meet evolving phosphorus and sulfur regulations while maintaining strong lubrication performance. Companies also strengthen their supply chains to support rising demand across automotive and industrial sectors. Strategic collaborations with lubricant manufacturers help broaden product reach, while advancements in synthetic oil formulations encourage development of optimized ZDDP additives. Ongoing innovation, regulatory alignment, and competitive pricing continue to influence positioning across global and regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Infineum

- Ganesh Benzoplast

- Afton Chemical

- Yasho Industries

- Chevron Oronite

- Gbl Chemical

- Ruhani Lubricants

- RB Products

- Lubrizol

- Addilex

- Chetas Biochem

Recent Developments

- In 2025, the niche lubricant additive supplier Addilex Co. published marketing material on its website promoting its ZDDP component ADDILEX C-340.

- In 2024, Afton Chemical Corporation Continued investment in R&D to provide technology platforms allowing customers to meet future OEM specifications and enhance fuel economy.

- In 2024, Chevron Oronite made the final investment decision to proceed with the second phase of expansion for its lubricant additive facility in Ningbo, China.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth as demand for high-performance lubricants increases.

- Automotive engines will need stronger anti-wear chemistry, supporting continued use of ZDDP additives.

- Industrial machinery expansion will drive higher consumption across heavy-duty applications.

- Synthetic and semi-synthetic oils will boost adoption of optimized ZDDP formulations.

- Regulatory limits on phosphorus and sulfur will push manufacturers toward improved and cleaner blends.

- Hybrid and downsized engines will raise the need for additives that handle thermal stress.

- Advancements in lubricant technology will enhance the compatibility of ZDDP with low-viscosity oils.

- Additive producers will invest in research to balance performance with emission compliance.

- Growth in emerging markets will create new opportunities for lubricant manufacturers.

- Competition from alternative anti-wear additives will shape future product development strategies.