Market Overview:

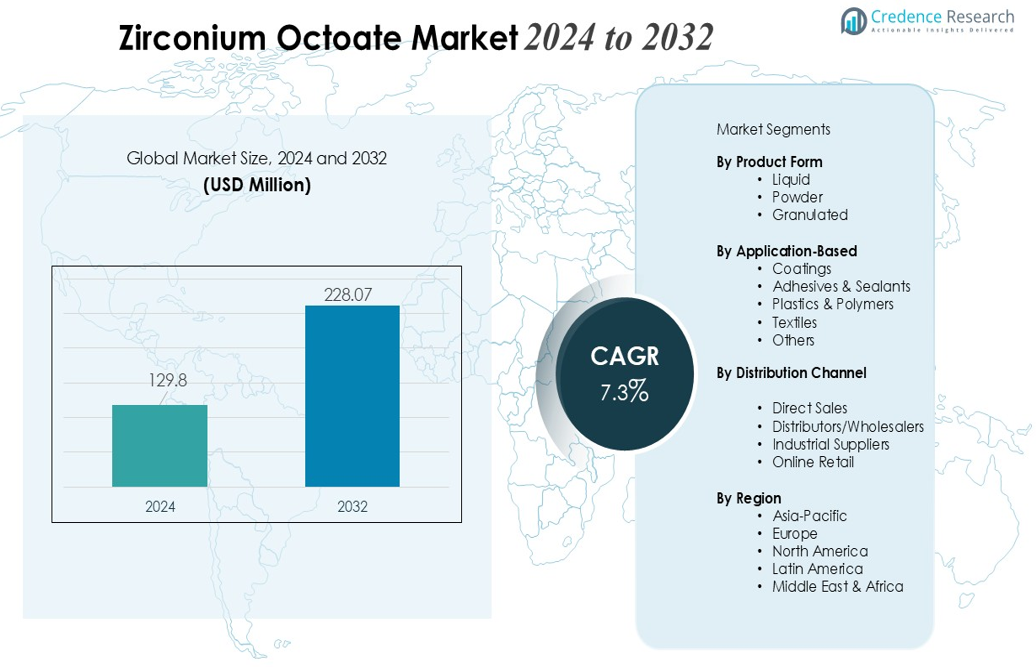

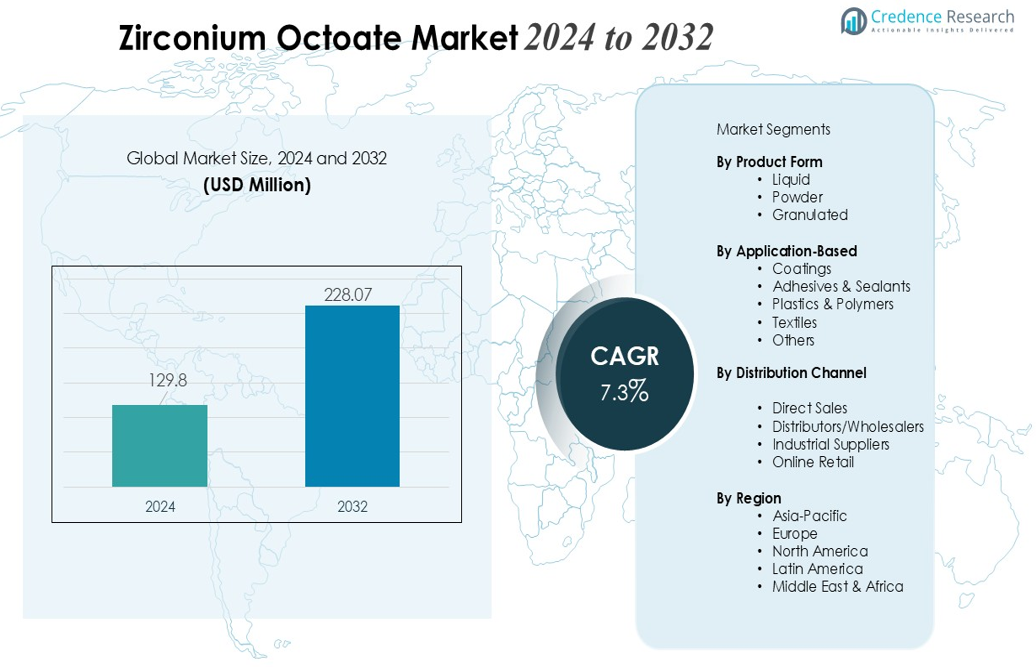

The Zirconium Octoate Market size was valued at USD 129.8 million in 2024 and is anticipated to reach USD 228.07 million by 2032, at a CAGR of 7.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Zirconium Octoate Market Size 2024 |

USD 129.8 million |

| Zirconium Octoate Market, CAGR |

7.3% |

| Zirconium Octoate Market Size 2032 |

USD 228.07 million |

Market growth is primarily fueled by the strong demand for Zirconium Octoate as an efficient auxiliary drier in paints and coatings. It enhances drying performance, water resistance, and durability, making it essential for architectural, automotive, and industrial coatings. The rising focus on low-VOC and environmentally friendly coatings, coupled with increased infrastructure development, further propels the adoption of Zirconium Octoate.

Regionally, Asia-Pacific dominates the market due to rapid industrialization, increasing construction activities, and high demand from emerging economies such as China and India. North America and Europe represent mature markets with stable demand, driven by stringent environmental regulations and the need for sustainable coating solutions. Overall, the market benefits from a combination of strong demand in both emerging and developed regions, ensuring consistent growth and investment opportunities.

Market Insights:

- The Zirconium Octoate Market was valued at USD 129.8 million in 2024 and is projected to reach USD 228.07 million by 2032, driven by strong demand in paints and coatings.

- Growth is fueled by its role as an efficient auxiliary drier that enhances drying performance, water resistance, and durability across architectural, automotive, and industrial coatings.

- Rising demand for high-performance coatings in automotive and industrial sectors boosts adoption due to improved film hardness, gloss retention, and abrasion resistance.

- Regulatory pressure and preference for eco-friendly, low-VOC, and lead-free drier systems encourage formulators to adopt safer alternatives, enhancing worker safety and compliance with environmental standards.

- Rapid urbanization and infrastructure development, particularly in emerging economies, increase demand for architectural and protective coatings with reliable drying and weather resistance.

- Zirconium Octoate’s compatibility with a wide range of coating systems, including alkyd-based paints, varnishes, enamels, and primers, drives broader application across decorative, industrial, and protective segments.

- Challenges such as raw material price volatility and formulation complexity exist, but regional consumption remains strong, with Asia-Pacific leading at 46%, Europe contributing 28%, and North America, Latin America, and Middle East & Africa collectively accounting for 26%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for High‑Performance Coatings in Automotive and Industrial Sectors

Growth in the automotive, industrial equipment, and heavy‑machinery sectors fuels demand for durable and high-performance coatings. Zirconium Octoate improves film hardness, gloss retention, abrasion resistance, and durability in protective, machinery, and automotive coatings. It ensures the coated surface withstands harsh conditions, including abrasion, moisture, and chemical exposure, while maintaining aesthetic appeal. Strong performance in demanding applications drives its adoption across industrial and automotive coatings.

- For Instance, Incorporating Zirconium Octoate into waterborne coatings as an auxiliary drier can improve film properties by functioning as a strong cross-linking agent.

Shift Toward Eco‑Friendly, Low‑VOC and Lead-Free Drier Systems

Regulatory pressure and market preference for environmentally friendly coatings encourage formulators to use safer alternatives. Zirconium Octoate reduces toxicity hazards compared to lead-based or cobalt-based driers and avoids issues such as yellowing in light-colored paints. It enhances worker safety in manufacturing environments and supports compliance with increasingly strict environmental standards.

- For instance, Chemelyne Specialities utilizes Zirconium Octoate solutions to eliminate lead toxicity risks in coatings production lines, substantially boosting workplace safety benchmarks.

Surge in Construction and Infrastructure Projects, Particularly in Emerging Economies

Rapid urbanization and large-scale infrastructure initiatives drive demand for architectural and protective coatings. Markets experiencing intense construction and renovation require coatings that dry reliably, resist weathering, and maintain appearance over time. Zirconium Octoate improves drying performance, film integrity, and weather resistance, making it a preferred additive in architectural and industrial paints for these projects.

Broad Application Versatility Across Multiple Coating Systems

Zirconium Octoate is compatible with a wide range of coating formulations, including alkyd-based paints, varnishes, enamels, primers, and protective coatings on metal. It works effectively as an auxiliary drier or in combination with primary driers to optimize drying profiles. It enhances through-drying, reduces film defects, and ensures stable gloss and color retention, increasing its adoption across decorative, industrial, and protective coatings.

Market Trends:

Growing Preference for Eco‑Friendly, Low‑VOC and Cobalt‑Free Formulations

The coatings industry shifts toward sustainability and regulatory compliance, prompting formulators to favor non‑toxic, low‑VOC solutions. Zirconium octoate emerges as a strong alternative to traditional cobalt- or lead-based driers, enabling safer and more compliant coatings. It supports waterborne and high‑solid coating systems that reduce hazardous emissions while maintaining performance. This trend expands zirconium octoate adoption, especially in regions with strict environmental standards such as North America and Europe.

- For Instance, Zirconium octoate is widely recognized in the coatings industry as an efficient auxiliary drier used in eco-friendly waterborne and solvent-borne formulations, typically in combination with a primary drier like cobalt or manganese.

Advances in Drier Chemistry and Broadening Application Spectrum

Manufacturers invest in improved metal carboxylate chemistry, optimizing zirconium octoate’s catalytic efficiency and resin compatibility. Enhanced formulations deliver faster drying, better through‑drying, stronger film hardness, and improved resistance to moisture and chemicals. These innovations increase its suitability across diverse segments — from architectural and industrial coatings to automotive, marine, wood, and maintenance paints. As coating requirements evolve toward durability, weather resistance, and uniform film quality, demand for zirconium octoate rises in parallel.

- For Instance, Patcham’s product information, Patcham (FZC) offers zirconium octoate driers that are utilized as effective through driers in architectural and industrial coatings to enhance film hardness and support the drying process.

Market Challenges Analysis:

Raw Material Price Volatility and Supply‑Chain Constraints

The cost of producing zirconium octoate depends heavily on underlying chemicals such as zirconium compounds and associated organic acids. Fluctuations in global raw‑material prices and supply disruptions raise production costs and squeeze profit margins for manufacturers. Some regions face difficulties sourcing required feedstocks, which can lead to periodic shortages or supply delays. These constraints hinder stable supply and limit widespread adoption, especially in cost-sensitive markets.

Formulation Complexity and Performance Limitations Across Systems

The compound exhibits limited solubility and stability in certain solvent systems—particularly waterborne or polar formulations—making it less suitable for modern low‑VOC coatings in some cases. Formulators often need to blend zirconium octoate with secondary driers to achieve acceptable drying performance. Incorrect dosage or poor compatibility can lead to slower curing, film defects, or inconsistent coating quality. This technical complexity raises barrier for new entrants and increases development cost for manufacturers relying on zirconium octoate.

Market Opportunities:

Rising Demand in Low‑VOC and Lead‑Free Coating Systems Drives Adoption

Growing regulatory and consumer pressure on chemicals used in paints and coatings creates strong demand for non‑toxic, low‑VOC, lead‑free alternatives. Zirconium Octoate provides comparable performance to traditional heavy metal driers without the toxicity or yellowing risk — making it especially attractive for formulators targeting environmentally compliant architectural and industrial coatings. It enables water‑based and high‑solid coating systems that meet stringent emission standards. This regulatory-driven demand opens an expanding market window, particularly in regions tightening environmental norms.

Expansion into Specialized Coatings and Diverse End-Use Applications Creates New Segments

Developments in coating technology pave the way for Zirconium Octoate to penetrate beyond conventional decorative paints into specialty sectors — including industrial maintenance, marine coatings, protective coatings for metal structures, and automotive refinishing. It improves film hardness, moisture resistance, adhesion, and corrosion resistance, making it suitable for demanding environments. Growing infrastructure, marine, and automotive sectors in emerging economies present significant growth potential. Manufacturers that develop tailored zirconium‑based formulations can capture niche markets requiring high durability and performance.

Market Segmentation Analysis:

By Product Form

The market divides product forms of Zirconium Octoate into liquid, powder, and granulated forms. The liquid form commands the largest share owing to its ease of integration in coating and adhesive formulas and proven stability in solvent-based systems. Liquid Zirconium Octoate enables smooth dispersion and consistent catalytic performance, making it the preferred choice in paints, coatings, and sealants. Powder and granulated forms serve niche or specialized applications that require precise dosing, extended shelf life, or ease of transport and storage. Powder form finds favor in settings where formulators require controlled addition and flexibility over batch sizes; granulated form offers logistical advantages for bulk supply and industrial users.

- For Instance, Liquid Zirconium Octoate is commercially produced by various manufacturers with standard zirconium content variants, typically including 12% and 18%.

By Application‑Based Segmentation

Zirconium Octoate finds its primary application in coatings, adhesives and sealants, plastics and polymers, textiles, and miscellaneous uses. The coatings segment remains dominant, driven by strong demand for durable, water‑resistant paints and high‑performance industrial and automotive coatings. Adhesives and sealants segment offers growth potential where the compound enhances bond strength and longevity under exposure to moisture or chemicals. Plastics and polymer applications leverage its catalytic or stabilizing properties to improve final product resilience or performance. Textile and other niche applications provide additional, albeit smaller, pockets of demand, expanding the overall market reach.

- For example, some textile finishers using zirconium octoate enhanced fabric durability and moisture resistance, significantly improving product longevity and performance in rigorous use cases.

By Distribution Channel

The market channels include direct sales, distributors/wholesalers, industrial suppliers, and online retail. Direct sales link producers directly with large-scale industrial consumers—such as automotive manufacturers, major coating producers, and infrastructure contractors—ensuring consistent supply and tailored bulk contracts. Distributors and wholesalers help reach medium- and small-sized formulators and regional end‑users, broadening geographic coverage. Industrial suppliers support specialized or custom applications, offering technical support along with product delivery. Online retail emerges as a growing channel for smaller buyers or niche users who require smaller volumes or faster procurement cycles.

Segmentations:

- By Product Form

- By Application-Based

- Coatings

- Adhesives & Sealants

- Plastics & Polymers

- Textiles

- Others

- By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Industrial Suppliers

- Online Retail

- By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia‑Pacific Leads Global Consumption

Asia‑Pacific holds 46% of the global Zirconium Octoate Market and remains the largest regional consumer. Rapid industrialization in China and India drives strong demand in coatings, polymers, and construction-related segments. It supports extensive use in architectural paints, industrial coatings, and polymer formulations. Growth in automotive, infrastructure, and manufacturing sectors reinforces consumption. The region’s cost-effective manufacturing base and rising preference for low‑VOC coatings favor zirconium-based additives.

Europe Maintains Significant Demand

Europe contributes 28% of the global Zirconium Octoate Market, driven by stringent environmental regulations promoting low‑VOC and non-toxic coating solutions. Leading economies such as Germany and France push demand through advanced automotive coatings, industrial applications, and sustainable construction materials. It sustains stable growth despite higher production costs. High regulatory compliance and emphasis on durability and performance ensure consistent consumption across architectural and industrial segments.

North America, Latin America, and Middle East & Africa Show Steady Growth

North America accounts for 18% of the global market, led by demand in industrial coatings, infrastructure projects, and sustainable building initiatives. The United States drives regional consumption with large-scale infrastructure investments and the need for water-resistant, durable coatings. Latin America contributes 5%, with growth in automotive refinishing and construction coatings tempered by slower industrialization and limited regulation. Middle East & Africa holds 3% of the market, supported by emerging infrastructure and marine-industry developments, though overall scale remains smaller.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Patcham (FZC)

- Ege Kimya

- Maldeep Catalysts

- Borchers (Milliken)

- Chemelyne Specialities

- DIC Corporation

- Casal de Rey & Cia

- Comar Chemicals

- Ambani Organics

- OPTICHEM

- Venator

- Bira Chemicals

Competitive Analysis:

The competitive landscape of the Zirconium Octoate Market features a combination of global leaders and regional players competing on production scale, innovation, and geographic reach. Major companies such as Patcham (FZC) and Borchers (Milliken) hold significant market positions through large-scale manufacturing, stringent quality control, and reliable global supply networks that serve coatings and industrial clients. Regional players like Ege Kimya and DIC Corporation focus on cost-effective and regulatory-compliant variants to capture demand in Asia-Pacific and emerging markets. Smaller manufacturers address local and niche requirements, offering flexibility and specialized solutions. The market remains fragmented, and all players prioritize product quality, regulatory compliance, and consistent supply to maintain competitiveness and expand their presence across key applications and regions.

Recent Developments:

- In September 2025, Patcham FZC announced Lintech International as its distribution partner for specialty additives across the Northeast, Southeast, and Southwest U.S., effective February 1, 2025.

Report Coverage:

The research report offers an in-depth analysis based on Product Form, Application-Based, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for Zirconium Octoate will continue to grow due to the rising need for durable and high-performance coatings in automotive, industrial, and construction sectors.

- Adoption of low-VOC and environmentally friendly coatings will drive increased use of zirconium-based driers.

- Expansion in infrastructure and urban development projects in emerging economies will create significant consumption opportunities.

- Formulators will increasingly rely on Zirconium Octoate to enhance drying efficiency, film hardness, and moisture resistance in coatings.

- Growth in specialized applications, including marine, wood, and protective coatings, will broaden its market presence.

- Technological innovations in drier chemistry will improve solubility, compatibility, and performance across diverse resin systems.

- Manufacturers will invest in regional production and distribution capabilities to meet localized demand efficiently.

- Regulatory compliance and sustainability trends will push companies to develop advanced zirconium-based formulations.

- Increasing demand for industrial adhesives, sealants, and polymer applications will provide additional growth avenues.

- Competitive pressures and innovation by key players will foster development of high-quality, performance-driven products, ensuring continued market expansion.