Market Overview

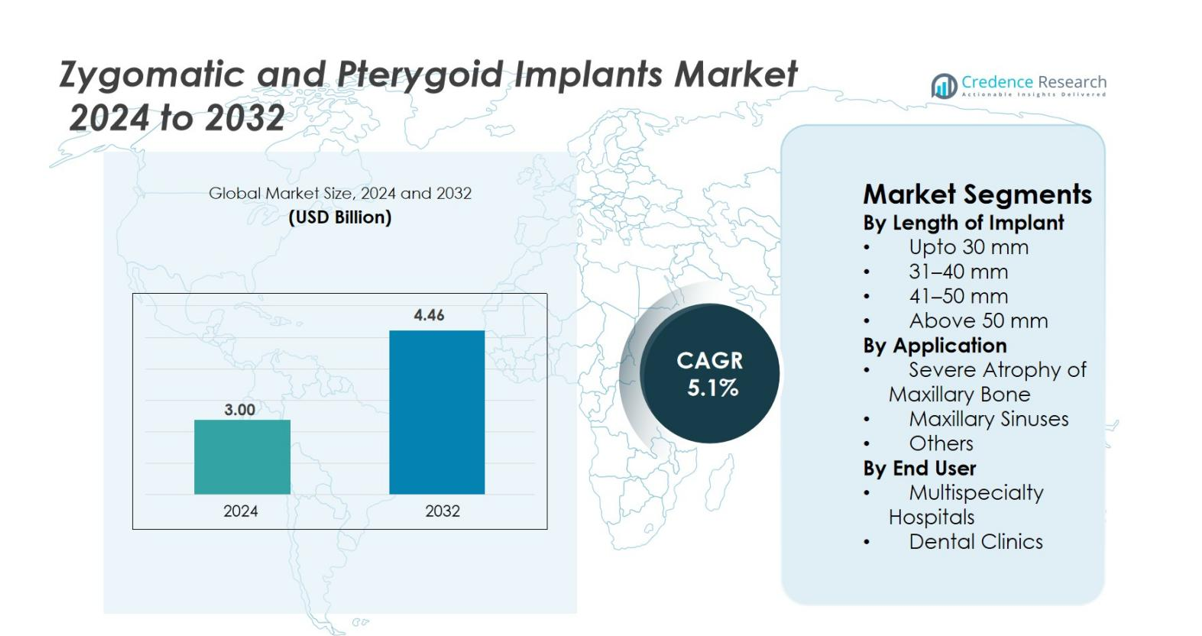

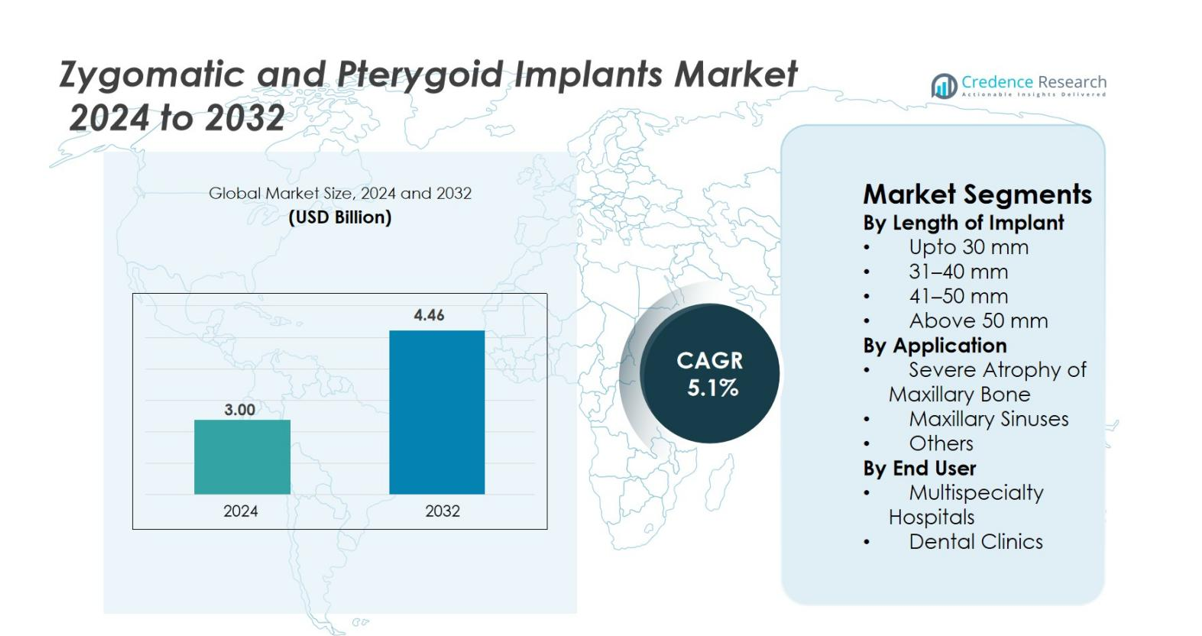

Zygomatic and Pterygoid Implants Market size was valued at USD 3.00 billion in 2024 and is anticipated to reach USD 4.46 billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Zygomatic and Pterygoid Implants Market Size 2024 |

USD 3.00 billion |

| Zygomatic and Pterygoid Implants Market, CAGR |

5.1% |

| Zygomatic and Pterygoid Implants Market Size 2032 |

USD 4.46 billion |

Zygomatic and Pterygoid Implants Market features strong participation from major players such as Straumann Holding A.G., Southern Implants, Noris Medical, Titaniumfix, Silimed, Danaher Corporation, Implance, Jeil Medical Corporation, S.I.N. Implant System, and BioHorizons, all focusing on advanced graftless solutions for severe maxillary atrophy. These companies emphasize innovation in implant design, surface technology, and digital surgery integration to enhance procedural precision and clinical outcomes. North America leads the global market with a 38.6% share, supported by high adoption of complex implantology and strong technological infrastructure, followed by Europe with 32.4% driven by widespread clinical expertise and growing acceptance of immediate-loading protocols.

Market Insights

- Zygomatic and Pterygoid Implants Market was valued at USD 3.0 billion in 2024 and is projected to reach USD 4.46 billion by 2032, growing at a CAGR of 5.1% during the forecast period.

- Market growth is driven by rising cases of severe maxillary atrophy, increasing demand for graftless full-arch rehabilitation, and expanding adoption of immediate-loading protocols that reduce treatment time and improve patient outcomes.

- Key trends include rapid integration of digital workflows, AI-assisted planning, 3D-printed surgical guides, and growing global participation in advanced implantology training programs that support procedural accuracy and wider adoption.

- The market features strong activity from players such as Straumann Holding A.G., Southern Implants, Noris Medical, Titaniumfix, Silimed, Danaher Corporation, Implance, Jeil Medical Corporation, S.I.N. Implant System, and BioHorizons, all focused on innovation and portfolio expansion.

- Regionally, North America leads with 38.6% share, followed by Europe at 32.4%, while Asia-Pacific grows fastest at 20.7%; the 41–50 mm implant segment dominates with a 38.4% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Length of Implant

In the Zygomatic and Pterygoid Implants market, the 41–50 mm segment leads with a 38.4% share, driven by its optimal balance between structural stability and suitability for most severe maxillary atrophy cases. Surgeons prefer this length for delivering predictable anchorage in compromised bone conditions without requiring excessive surgical manipulation. The 31–40 mm category follows, supported by demand in moderate reconstruction procedures. Increasing adoption of advanced imaging and guided-surgery systems enhances precision in implant placement, further supporting uptake of mid-range and longer implant lengths across dental and craniofacial restoration practices.

- For instance, NobelZygoma TiUltra implants are cleared in lengths from 30 mm to 60 mm in 2.5 mm increments, allowing surgeons to select 40–50 mm fixtures to anchor in the zygomatic bone for severely atrophic maxillae while maintaining high primary stability suitable for immediate function

By Application

The Severe Atrophy of Maxillary Bone segment dominates the market with a 46.7% share, as zygomatic and pterygoid implants offer a reliable alternative to bone grafting in patients with extensive bone loss. Their ability to provide immediate loading, reduce treatment timelines, and enhance prosthetic stability drives widespread clinical preference. Procedures involving the maxillary sinuses continue to expand with growing acceptance of minimally invasive sinus bypass techniques. Rising prevalence of edentulism, aging populations, and increasing demand for fixed prosthetic rehabilitation reinforce strong uptake across clinical centers.

- For instance, Nobel Biocare’s NobelZygoma implants are clinically validated for immediate loading in severely atrophic maxillae, with published outcomes showing high survival rates in cases where conventional implants are not feasible due to extreme bone deficiency.

By End User

Dental Clinics account for the largest share at 52.1%, owing to rapid adoption of specialized implantology services, increased investment in digital surgical planning systems, and growing patient preference for clinic-based rehabilitation. These facilities offer cost-effective procedures, shorter waiting times, and personalized care, strengthening their market position. Multispecialty hospitals retain steady growth due to handling complex reconstructive cases and providing multidisciplinary expertise. Expansion of private dental networks, rising numbers of trained maxillofacial surgeons, and growing acceptance of graftless implant solutions support continued dominance of the clinic segment.

Key Growth Drivers

Rising Prevalence of Severe Maxillary Atrophy and Edentulism

The increasing prevalence of severe maxillary atrophy and complete edentulism remains one of the strongest drivers of the Zygomatic and Pterygoid Implants market. A growing number of aging individuals experience advanced bone loss that renders conventional implants unsuitable without extensive grafting. Zygomatic and pterygoid implants provide a graftless alternative that significantly reduces treatment time, surgical complexity, and overall rehabilitation costs. Their ability to anchor into dense zygomatic or pterygoid bone allows clinicians to offer immediate loading protocols, improving patient satisfaction and functional outcomes. Rising demand for full-arch fixed restorations among elderly and medically compromised individuals further accelerates adoption. Increasing global awareness of graftless implant solutions, coupled with improvements in prosthetic materials and surgical workflows, enables broader acceptance across dental specialists. As edentulism continues to increase worldwide, particularly in developing regions, these advanced implant systems are poised to witness sustained growth.

- For instance, Nobel Biocare’s graftless “Zygoma Concept” rehabilitation protocol is clinically supported by long-term studies showing survival rates above 95% in patients with severe maxillary atrophy, enabling predictable immediate-loading full-arch restorations without bone grafting.

Advancements in Imaging, Navigation, and Guided Surgery

Rapid advancements in digital dentistry significantly strengthen the demand for zygomatic and pterygoid implants. High-resolution CBCT imaging, intraoral scanners, and virtual planning software allow precise mapping of anatomical structures, enabling clinicians to plan complex procedures more accurately. Navigation-guided surgery and customized drilling templates reduce intraoperative risks and improve accuracy in anchoring implants into the zygomatic and pterygoid regions. These technologies also shorten learning curves, encouraging more surgeons to adopt complex implant techniques. Digital workflows enhance patient communication, streamline clinical protocols, and facilitate same-day restorations, improving overall treatment efficiency. As clinics increasingly invest in advanced imaging and surgical navigation solutions, the reliability and safety of graftless implant procedures improve. Manufacturers are integrating digital platforms with implant systems to strengthen procedural success rates, which further boosts surgeon confidence and widens the market. The convergence of digital tools and implantology continues to play a transformative role in shaping market expansion.

- For instance, Nobel Biocare’s DTX Studio Implant software allows surgeons to merge CBCT and intraoral scan data for fully guided zygomatic implant planning, supporting precise trajectory control and reducing complications in severe maxillary atrophy cases.

Growing Preference for Graftless, Immediate-Loading Implant Solutions

Patient demand for faster, less invasive, and more predictable restoration is driving strong uptake of graftless implant methods. Zygomatic and pterygoid implants eliminate the need for sinus lifts, ridge augmentation, significantly reducing healing time and overall treatment duration. Immediate-loading protocols allow patients to receive fixed prostheses within days, improving function and aesthetics more quickly than traditional techniques. This enhanced patient experience aligns with global trends toward minimally invasive dentistry. Clinics benefit from reduced procedural stages, fewer follow-up visits, and stronger differentiation in competitive implantology markets. Surgeons also prefer these implants for their biomechanical stability in compromised bone conditions, improving long-term treatment success. As healthcare systems focus on efficiency and patient-centric outcomes, demand for graftless full-arch rehabilitation solutions continues to accelerate, reinforcing the strong market momentum behind zygomatic and pterygoid implant adoption worldwide.

Key Trends & Opportunities

Integration of Digital Workflow, AI-Assisted Planning, and 3D Printing

A major trend shaping the Zygomatic and Pterygoid Implants market is the rapid integration of digital workflows that enhance precision and reduce surgical complications. AI-driven diagnostic tools assist clinicians in assessing bone density, identifying optimal implant positions, and simulating prosthetic outcomes. 3D printing enables fabrication of patient-specific surgical guides and customized prosthetic components, improving fit accuracy and reducing procedural time. These technologies improve predictability in complex cases such as severe atrophy or sinus involvement, expanding the pool of treatable patients. Digital workflows also support seamless communication between clinics, labs, and manufacturers, allowing faster turnaround for prosthetic fabrication. As investments in chairside CAD/CAM and smart surgical navigation systems rise, implantology practices benefit from improved operational efficiency and elevated clinical outcomes. The ongoing integration of AI and additive manufacturing opens new opportunities for product innovation, customized patient care, and differentiated implant solutions.

- For instance, 3D Systems’ VSP (Virtual Surgical Planning) technology is routinely used in craniofacial and maxillofacial reconstruction, providing surgeons with patient-specific anatomical models and guides that enhance accuracy in procedures involving zygomatic anchorage.

Expansion of Advanced Training Programs and Global Implantology Education

Increasing availability of specialized training programs in zygomatic and pterygoid implantology presents a major opportunity for market expansion. Historically, these procedures were limited to a small group of highly experienced surgeons due to anatomical complexity and surgical risks. However, global dental education providers, implant companies, and universities now offer hands-on cadaver courses, simulation-based training, and mentorship programs that lower entry barriers. These initiatives empower younger clinicians to adopt advanced graftless techniques confidently. Additionally, online modules, immersive 3D learning tools, and AR-based surgical training improve procedural understanding and shorten learning curves. As more surgeons become proficient in complex implant placement, accessibility for patients increases, boosting overall demand. Expanding educational infrastructure not only supports safe procedural adoption but also drives greater utilization of premium implant systems, creating strong growth potential across emerging markets.

- For instance, the University of Coimbra and Malo Clinic Education Center run cadaver-based zygomatic implant masterclasses, providing surgeons with full protocols for extra-maxillary and quad-zygoma approaches under expert supervision.

Key Challenges

High Surgical Complexity and Limited Surgeon Expertise

Despite strong market momentum, the high complexity of zygomatic and pterygoid implant placement remains a major challenge. These procedures require advanced anatomical knowledge, precise angulation control, and extensive surgical skill due to proximity to critical structures such as the orbit, nasal cavity, and pterygoid plates. Limited surgeon expertise restricts adoption, especially in developing regions where training centers and specialized facilities are scarce. Inexperienced clinicians face risks of sinus perforation, soft-tissue complications, or prosthetic misalignment, which can reduce treatment success rates. Additionally, steep learning curves and limited access to mentorship programs discourage new practitioners from adopting these techniques. The challenge is further compounded by patient variability in bone quality and anatomical complexity. Overcoming this barrier requires expansion of structured training programs, increased availability of simulation tools, and wider dissemination of standardized treatment protocols to improve confidence and competency among clinicians.

High Treatment Costs and Limited Reimbursement Coverage

The high cost of zygomatic and pterygoid implant procedures presents another significant challenge, particularly for price-sensitive markets. These treatments often involve premium implants, advanced imaging systems, surgical navigation tools, and customized prosthetic components, leading to higher overall costs compared with conventional implants. Limited insurance coverage and inconsistent reimbursement policies force many patients to rely on out-of-pocket payments, restricting adoption. Cost barriers are especially prominent in developing economies where access to advanced implantology is still emerging. Clinics also face financial constraints in adopting digital equipment required for safe and precise procedures. Additionally, high procedural fees may discourage patients from choosing graftless solutions despite clinical advantages. Addressing this challenge requires broader reimbursement support, cost-efficient technology integration, and expanded financing options to make advanced implant treatments more accessible across diverse patient groups.

Regional Analysis

North America

North America holds the largest share at 38.6%, driven by a well-established dental implantology ecosystem, strong presence of premium implant manufacturers, and high adoption of advanced graftless rehabilitation techniques. The region benefits from widespread access to CBCT imaging, guided surgery systems, and skilled maxillofacial surgeons experienced in complex implant placement. Growing demand for full-arch restorations, increasing geriatric edentulous population, and higher spending on aesthetic and functional dental treatments support continued market growth. Expanding clinical training programs and rising awareness of immediate-loading solutions further strengthen the region’s leadership position.

Europe

Europe accounts for 32.4% of the market, supported by strong clinical adoption of zygomatic and pterygoid implants across Germany, the U.K., Italy, Spain, and the Nordic countries. The region benefits from advanced healthcare infrastructure, high procedural success rates, and widespread integration of digital dentistry. Increasing prevalence of severe maxillary atrophy among aging populations, coupled with growing preference for graftless implant solutions, continues to drive demand. Government-backed dental care initiatives and extensive continuing education platforms strengthen surgical capabilities. Rising investment in training centers and implantology research keeps Europe a key contributor to global market expansion.

Asia-Pacific

Asia-Pacific holds 20.7% of the market and represents the fastest-growing region due to expanding dental tourism, rising disposable incomes, and increasing adoption of advanced implant procedures in China, India, South Korea, and Japan. Growing awareness of graftless full-arch solutions and rapid modernization of dental clinics support strong market momentum. Surge in CBCT installations, improvements in clinical training infrastructure, and the presence of cost-effective implant providers also drive regional uptake. The rising burden of edentulism and a shift toward premium prosthetic rehabilitation strengthen long-term growth prospects across emerging economies. APAC is expected to witness substantial penetration over the forecast period.

Latin America

Latin America captures 5.8% of the market, supported by growing procedural adoption in Brazil, Mexico, Chile, and Colombia. Increasing dental tourism and rising demand for affordable full-arch rehabilitation contribute to market expansion. Skilled implantologists in Brazil drive strong uptake of zygomatic implants for treating severe maxillary bone loss. However, cost constraints and uneven access to advanced digital technologies limit broader adoption. Ongoing investments in professional training, expanding private dental networks, and improved availability of premium implant systems are expected to enhance regional penetration over the coming years.

Middle East & Africa

The Middle East & Africa region accounts for 2.5% of the global market, driven by rising investments in specialized dental centers, growing medical tourism in the UAE and Saudi Arabia, and increasing awareness of advanced graftless implant options. Adoption remains higher in urban centers where access to CBCT imaging and experienced surgeons is improving. However, limited reimbursement coverage, high procedural costs, and uneven distribution of dental expertise slow widespread market growth. Continued expansion of private clinics, government-backed healthcare modernization, and emerging implant training platforms are expected to support steady market progression.

Market Segmentations

By Length of Implant

- Upto 30 mm

- 31–40 mm

- 41–50 mm

- Above 50 mm

By Application

- Severe Atrophy of Maxillary Bone

- Maxillary Sinuses

- Others

By End User

- Multispecialty Hospitals

- Dental Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Zygomatic and Pterygoid Implants market features a robust competitive landscape shaped by innovation-driven manufacturers and expanding clinical adoption. Leading companies such as Straumann Holding A.G., Southern Implants, Noris Medical, Titaniumfix, Silimed, Danaher Corporation, Implance, Jeil Medical Corporation, S.I.N. Implant System, and BioHorizons focus on developing advanced graftless implant systems designed for high primary stability and predictable outcomes in severe maxillary atrophy cases. These players invest heavily in R&D to enhance implant surface technology, biomechanics, and digital integration with guided surgery platforms. Strategic initiatives, including surgeon-training programs, global distribution partnerships, and product portfolio expansion, strengthen their market positioning. Growing emphasis on digital workflows, customized surgical guides, and immediate-loading protocols intensifies competition as companies aim to differentiate through clinical efficiency and improved patient outcomes. Additionally, expansion into emerging markets and increasing investment in educational collaborations further shape the competitive dynamics in this rapidly evolving implantology segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Southern Implants organized a pre-congress workshop (as part of a larger event) providing advanced training on pterygoid, zygomatic, and “Co-Axis” implants highlighting continuing professional development and interest in these implant types.

- In April 2024 industry-wide “advanced implant technology” updates highlighted development of improved implant materials/coatings (e.g. porous-surface implants) that enhance osseointegration changes which can benefit zygomatic/pterygoid implants as part of the evolution of implant dentistry.

- In March 2025, DelveInsight Business Research LLP published a market-analysis report forecasting growth of the Zygomatic and Pterygoid Implants market through 2032.

Report Coverage

The research report offers an in-depth analysis based on Length of Implant, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as demand rises for graftless implant solutions in severe maxillary atrophy cases.

- Adoption of digital planning, AI-assisted diagnostics, and guided surgery will improve treatment accuracy and expand clinical acceptance.

- Immediate-loading protocols will gain wider use as clinics prioritize faster rehabilitation and enhanced patient satisfaction.

- Manufacturers will continue advancing implant surface technologies to improve osseointegration and long-term stability.

- Training programs and global education initiatives will expand the pool of surgeons skilled in complex implant procedures.

- Emerging markets will witness increased penetration as awareness and access to advanced implantology improve.

- Dental tourism will contribute to higher procedural volumes, particularly in Asia-Pacific and Latin America.

- Integration of 3D printing for patient-specific surgical guides and prosthetics will enhance procedural outcomes.

- Strategic partnerships between implant manufacturers and dental networks will strengthen distribution and adoption.

- Continued innovation toward minimally invasive surgical approaches will shape future market competitiveness.