Market Overview

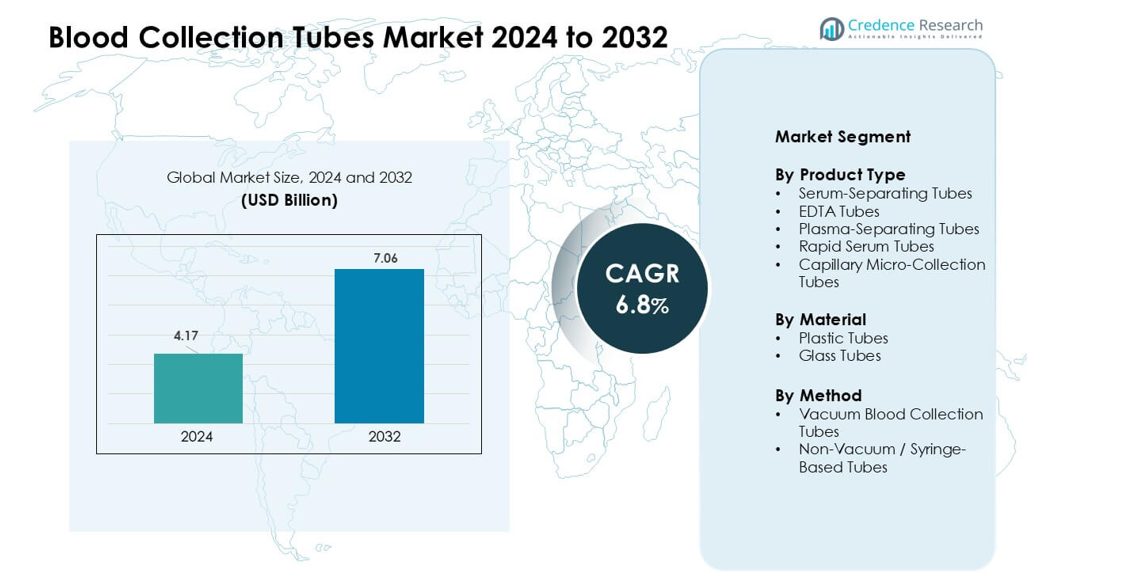

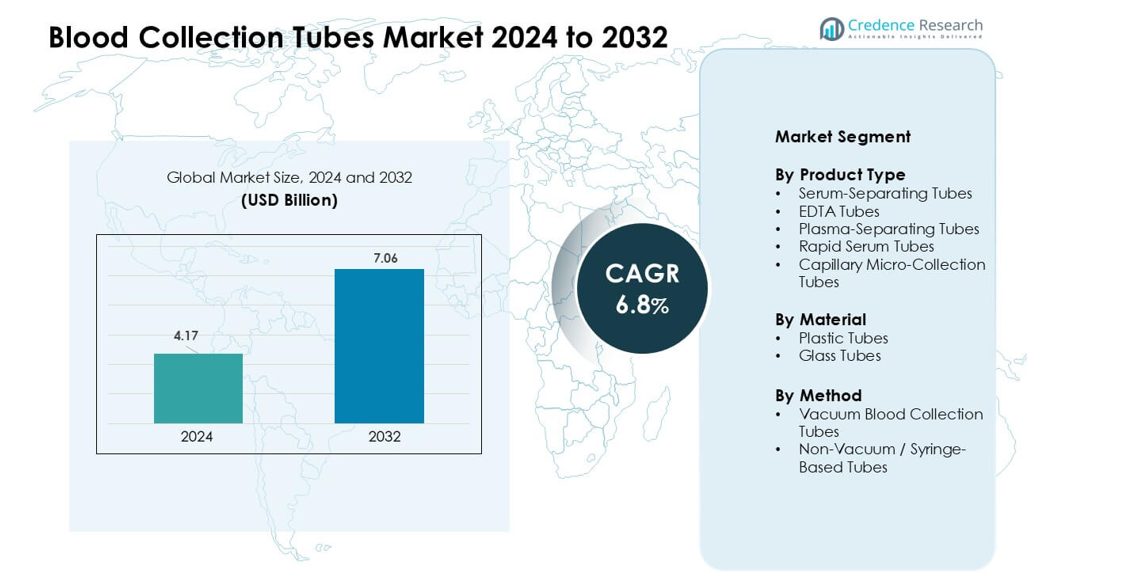

Blood Collection Tubes Market was valued at USD 4.17 billion in 2024 and is anticipated to reach USD 7.06 billion by 2032, growing at a CAGR of 6.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blood Collection Tubes Market Size 2024 |

USD 4.17 billion |

| Blood Collection Tubes Market, CAGR |

6.8% |

| Blood Collection Tubes Market Size 2032 |

USD 7.06 billion |

The Blood Collection Tubes Market is shaped by major players including BD, Haemonetics, Terumo BCT, Fresenius Kabi AG, Grifols S.A., Nipro Medical Corporation, Greiner Holding, Quest Diagnostics, SARSTEDT AG & Co. KG, and Macopharma. These companies compete through advanced vacuum tubes, improved additives, automation-ready designs, and strong global distribution networks. Their focus on safety, sample integrity, and compatibility with high-throughput laboratory systems strengthens market adoption across clinical and diagnostic settings. North America emerged as the leading region in 2024 with a 36% share, supported by advanced healthcare infrastructure, strong testing volumes, and rapid uptake of modern blood collection technologies.

Market Insights

- The Blood Collection Tubes Market reached USD 4.17 billion in 2024 and is projected to hit USD 7.06 billion by 2032, growing at a CAGR of 6.8 %.

- Rising diagnostic workloads, chronic disease prevalence, and strong adoption of vacuum tubes drive steady demand across hospitals, clinics, and research labs.

- Automation-ready tubes, molecular testing requirements, and safety-engineered designs shape emerging trends, supported by growing use of stabilized serum-separating and EDTA tubes, which together held a leading 38% segment share.

- Competitive intensity grows as BD, Haemonetics, Terumo BCT, Fresenius Kabi AG, Grifols S.A., and others invest in material innovation, production expansion, and regulatory compliance; however, cost pressures and supply chain variability remain key restraints.

- North America led the market with a 36% share in 2024, followed by Europe at 29% and Asia-Pacific at 24%, driven by expanding diagnostics, rapid lab automation, and increasing screening programs across major countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Serum-separating tubes led the product segment in 2024 with about 38% share. Clinical labs preferred these tubes because the built-in gel barrier supports clean serum separation and reduces processing errors. Hospitals used them widely for chemistry, immunology, and infectious-disease testing, which lifted demand across high-volume diagnostics. EDTA tubes also grew due to strong use in hematology and molecular testing, while plasma-separating tubes and rapid serum tubes gained adoption in emergency and high-throughput settings. Capillary micro-collection tubes expanded use in pediatrics and point-of-care units.

- For instance, BD’s Vacutainer SST™ serum tubes use a clot activator and gel barrier to separate serum during centrifugation. Clinical laboratories widely use these tubes for routine chemistry testing. The separated serum can be analyzed directly without additional transfer steps.

By Material

Plastic tubes dominated the material segment in 2024 with nearly 71% share. Healthcare facilities shifted toward plastic because the material reduces breakage risk, improves safety during transport, and supports automation in modern analyzers. Plastic tubes also remain lighter and easier to dispose of under regulatory waste rules, which encourages steady replacement of glass formats. Glass tubes still served niche workflows needing chemical stability for specialized assays, but their share continued to decline as hospitals prioritized safety standards and operational efficiency.

- For instance, Terumo’s Venoject® glass tubes are used in select coagulation and chemistry tests due to low gas permeability and stable additive performance under controlled lab conditions.

By Method

Vacuum blood collection tubes held the leading position in 2024 with roughly 82% share. Hospitals and labs favored vacuum systems because they ensure consistent fill volume, reduce hemolysis risk, and enable faster, cleaner sample handling. Rising automation across clinical labs also increased the use of vacuum tubes due to compatibility with conveyor-based analyzers and automated decapping units. Non-vacuum or syringe-based tubes remained useful in low-resource settings, geriatrics, and cases requiring manual control, but their adoption rate stayed lower due to higher contamination and variability risks.

Key Growth Drivers

Increasing Diagnostic Testing Volume

The Blood Collection Tubes Market grows strongly due to rising diagnostic workloads across hospitals, clinics, and independent labs. Higher incidence of chronic diseases such as diabetes, cardiovascular disorders, and cancer pushes routine blood testing volumes upward. Ageing populations also increase the frequency of biochemical, hematology, and immunology tests, which raises the need for reliable collection tubes. Expanding preventive health check-up programs and wider access to laboratory services further accelerate demand in urban and semi-urban regions. Molecular diagnostics and advanced biomarker testing require high-integrity samples, encouraging hospitals to adopt premium tubes with gel separators, anticoagulants, or stabilizing additives. Rapid expansion of emergency and critical care units also drives the need for faster and safer blood collection solutions.

Shift Toward Automation in Clinical Laboratories

Clinical laboratories continue adopting high-throughput automation platforms, which boosts the use of standardized and automation-compatible blood collection tubes. Automated analyzers, robotic sample handlers, and integrated testing lines require tubes with consistent dimensions, secure closures, and compatible barcode labeling. This shift reduces manual handling, lowers contamination risk, and improves efficiency, driving strong demand for vacuum-based tubes. Growing investment in smart labs, digital workflows, and automated pre-analytical systems increases reliance on advanced tube designs that support stable sample separation and long shelf-life. Hospitals also prioritize safety-focused tubes with leak-proof caps and improved materials, supporting smoother integration with automated decappers and transport racks. As laboratories scale up testing workloads, automation-ready tubes become essential for operational continuity.

- For example Greiner Bio-One confirms that VACUETTE® tubes are designed and validated for use on automated decapping and conveyor-based laboratory systems in high-throughput reference labs.

Rising Emphasis on Infection Control and Safety

Global healthcare systems continue increasing focus on infection prevention, boosting demand for safer and more reliable blood collection tubes. Hospitals aim to reduce needlestick injuries, cross-contamination, and sample leakage, which drives adoption of advanced vacuum tubes with safety-engineered caps. Regulatory bodies strengthen guidelines for biosafety, waste handling, and material quality, encouraging use of plastic tubes that minimize breakage and enable safer disposal. The rise of infectious disease outbreaks also expands testing volumes in microbiology and molecular labs, elevating the need for high-standard sample collection products. Medical staff in emergency departments and mobile health units rely on easy-to-use tubes that support fast and sterile sample acquisition, driving growth across both developed and developing markets. Safety compliance and occupational health mandates further amplify long-term demand.

- For example, Terumo’s plastic and glass Venoject® tubes support closed-system vacuum collection, lowering contamination risk during emergency and infectious disease testing.

Key Trends & Opportunities

Growing Adoption of Molecular and Genetic Testing

The Blood Collection Tubes Market benefits from rising adoption of molecular diagnostics, genomic profiling, and PCR-based infectious disease testing. These tests require stable, contamination-free samples, which increases the use of specialized tubes containing anticoagulants, stabilizers, or nucleic acid preservatives. Demand rises in oncology, prenatal testing, and personalized medicine, where accurate biomarker analysis depends on high-quality blood specimens. Pharmaceutical research and clinical trials also boost consumption of premium tubes designed for long-term sample integrity. As precision medicine expands, manufacturers introduce advanced vacuum tubes that protect DNA, RNA, and plasma quality across extended transport durations.

- For instance, Norgen Biotek’s cfDNA/cfRNA Preservative Tubes stabilize circulating cell-free DNA and RNA at room temperature for extended storage.

The tubes are designed to maintain nucleic acid integrity during transport without immediate processing. They support downstream PCR and next-generation sequencing workflows.

Expansion of Point-of-Care and Home-Based Collection

Point-of-care testing and home-based sample collection create new opportunities for lightweight, easy-to-handle, and safe blood collection tubes. Growth in telehealth and remote patient monitoring expands the need for capillary micro-collection tubes designed for finger-prick sampling. These tubes support decentralized diagnostics and reduce the burden on central labs. Manufacturers focus on compact tubes with secure seals and minimal blood volume requirements to suit pediatric, geriatric, and chronic disease patients who undergo frequent testing. Rising adoption of at-home services, supported by digital platforms, opens a new revenue stream for tube manufacturers.

- For instance, BD’s Microtainer® contact-activated lancet and tube systems enable capillary blood collection with volumes as low as 200–500 µL for point-of-care testing. The tubes use integrated additives to support hematology and chemistry assays from finger-prick samples. This design supports home-based and decentralized diagnostic workflows.

Key Challenges

Quality Variability and Material Limitations

Variability in tube quality, additives, and materials remains a challenge for consistent diagnostic results. Different manufacturers use varying gelling agents, anticoagulants, and plastics, which sometimes affect analyte stability or cause assay interference. Laboratories face concerns about tube lot consistency, shelf-life, and trace elements leaching from materials. Glass tube usage continues to decline due to safety risks, while plastic tubes face scrutiny related to chemical stability under extreme storage conditions. Ensuring global compliance with ISO and CLSI guidelines adds pressure on manufacturers to maintain strict quality standards.

Supply Chain Disruptions and Cost Constraints

The Blood Collection Tubes Market faces challenges from raw material fluctuations, global supply chain disruptions, and rising manufacturing costs. Dependence on medical-grade plastics, rubber stoppers, and specialty additives increases vulnerability during geopolitical or pandemic-related disruptions. Healthcare facilities in developing regions often struggle with the higher cost of premium vacuum tubes, limiting adoption. Import dependencies further increase procurement costs and delay delivery cycles. Manufacturers must balance affordability with quality, while also investing in expanded capacity, automation, and regulatory compliance, adding pressure to overall margins.

Regional Analysis

North America

North America held the leading share in the Blood Collection Tubes Market in 2024 with about 36%. Hospitals and diagnostic centers in the region adopt advanced vacuum tubes to support high testing volumes driven by chronic disease prevalence and routine preventive screenings. Strong laboratory automation, strict safety regulations, and rapid adoption of molecular testing further increase demand. The presence of global manufacturers and steady investment in healthcare infrastructure strengthen market growth. The U.S. accounts for most regional consumption due to its extensive lab networks, while Canada supports growth through rising chronic care diagnostics.

Europe

Europe accounted for nearly 29% of the Blood Collection Tubes Market in 2024, supported by well-established healthcare systems and strong emphasis on diagnostic accuracy. Countries such as Germany, the U.K., and France drive high usage due to advanced laboratory automation and strict sample-handling standards. Growing adoption of molecular tests and increasing prevalence of cardiovascular and metabolic disorders also stimulate demand. Expanded public health screening programs and rising geriatric populations reinforce steady tube consumption. Regulatory focus on safety and waste management further accelerates the shift toward plastic vacuum tubes across hospitals and laboratories.

Asia-Pacific

Asia-Pacific held around 24% share of the Blood Collection Tubes Market in 2024 and remains the fastest-growing region. China, India, Japan, and South Korea drive significant demand due to expanding diagnostic infrastructure and rising testing volumes linked to chronic diseases and infectious outbreaks. Growing investments in hospital networks, higher adoption of automated analyzers, and increasing health check-up participation support rapid market expansion. The region also benefits from large-scale manufacturing capabilities and competitive product pricing. Urbanization and a rising middle-class population strengthen long-term demand for safe, reliable blood collection solutions.

Latin America

Latin America captured nearly 7% share of the Blood Collection Tubes Market in 2024, driven by expanding healthcare access and increasing diagnostic testing needs in countries such as Brazil, Mexico, and Argentina. Public and private hospitals invest more in modernizing laboratory capabilities, which boosts adoption of vacuum-based tubes. Rising prevalence of diabetes, cardiovascular issues, and infectious diseases increases routine blood testing frequency. Budget limitations in some nations slow transition from non-vacuum tubes, yet safety-focused regulations and improved supply chains support gradual market growth across the region.

Middle East & Africa

The Middle East & Africa region held about 4% share of the Blood Collection Tubes Market in 2024. Growth is supported by expanding hospital networks, rising chronic disease screening, and increasing adoption of modern diagnostic tools in Gulf countries. Improved healthcare spending in Saudi Arabia, the UAE, and Qatar drives demand for vacuum blood collection tubes. Africa shows steady but slower progress due to limited laboratory infrastructure and cost constraints, yet rising investments in public health programs and infectious disease surveillance strengthen long-term potential.

Market Segmentations:

By Product Type

- Serum-Separating Tubes

- EDTA Tubes

- Plasma-Separating Tubes

- Rapid Serum Tubes

- Capillary Micro-Collection Tubes

By Material

- Plastic Tubes

- Glass Tubes

By Method

- Vacuum Blood Collection Tubes

- Non-Vacuum / Syringe-Based Tubes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Blood Collection Tubes Market features strong competition led by BD, Haemonetics, Terumo BCT, Fresenius Kabi AG, Grifols S.A., Nipro Medical Corporation, Greiner Holding, Quest Diagnostics, SARSTEDT AG & Co. KG, and Macopharma. These companies compete through extensive product portfolios covering serum-separating tubes, EDTA tubes, plasma tubes, and advanced vacuum-based systems tailored for clinical, diagnostic, and research needs. Leading players focus on material innovation, precision additives, and automation-compatible designs that support high-throughput laboratory workflows. Many manufacturers expand global reach by strengthening distribution networks and establishing production facilities closer to healthcare hubs. Strategic focus remains on improving sample integrity, biosafety, and compliance with international standards. Mergers, partnerships, and R&D investments help companies introduce specialized tubes for molecular diagnostics, genetics, and infectious disease testing. As demand rises across hospitals, diagnostic labs, and point-of-care settings, competitive intensity continues to increase, driving steady advancements in safety, efficiency, and performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Loop Medical announced that its Maxflow micro-collection system achieved broad compatibility with standard evacuated tubes like BD Vacutainer®, Greiner VACUETTE®, and Sarstedt S-Monovette®. This expands integration options for healthcare providers.

- In April 2024, BD India introduced the Vacutainer® UltraTouch™ push-button blood collection set to reduce patient pain and improve single-prick success during venipuncture procedures. The design uses BD RightGauge™ and PentaPoint™ technologies for safer and gentler collection.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Method and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced vacuum tubes will rise as diagnostic testing volumes continue to grow.

- Laboratories will adopt more automation-compatible tubes to support high-throughput workflows.

- Safety-engineered caps and materials will gain wider use due to stricter infection-control standards.

- Molecular diagnostics and genetic testing will increase the need for stabilized and preservative-based tubes.

- Point-of-care and home-collection trends will boost demand for micro-collection tubes.

- Manufacturers will expand production capacity to strengthen global supply stability.

- Plastic tubes will continue replacing glass as hospitals prioritize safety and waste reduction.

- Emerging markets will contribute strongly due to rising chronic disease screening and healthcare expansion.

- Innovation in additives and gel separators will enhance sample integrity for complex assays.

- Strategic partnerships and regional distribution growth will improve market accessibility worldwide.