Market Overview:

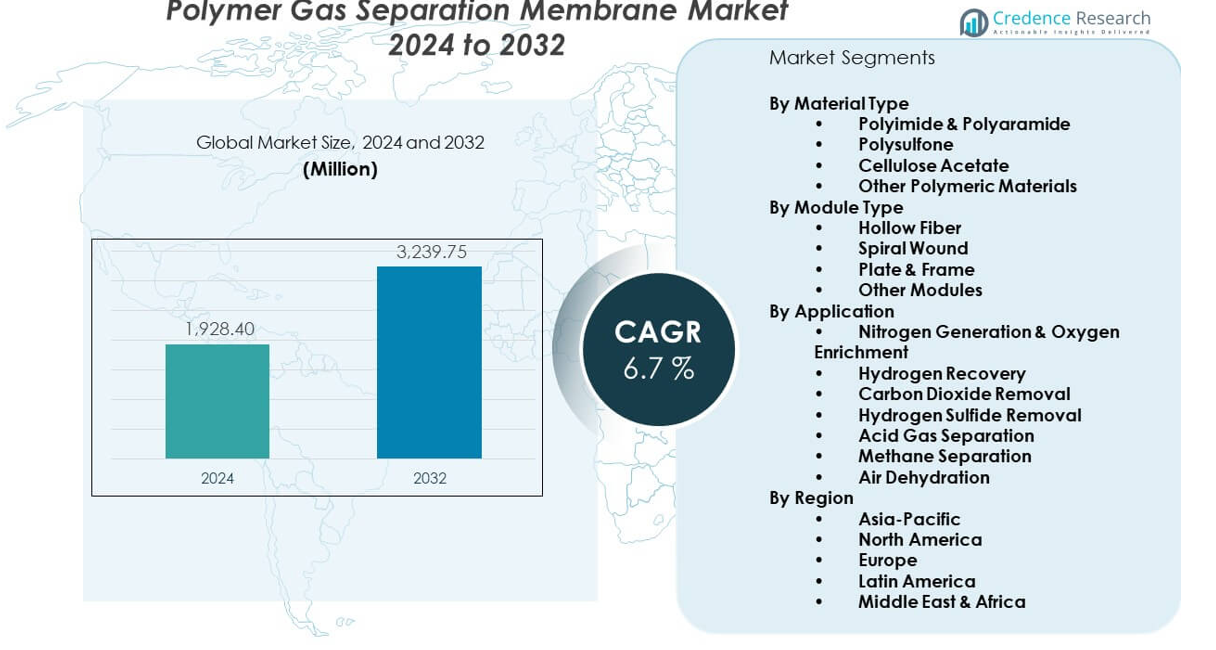

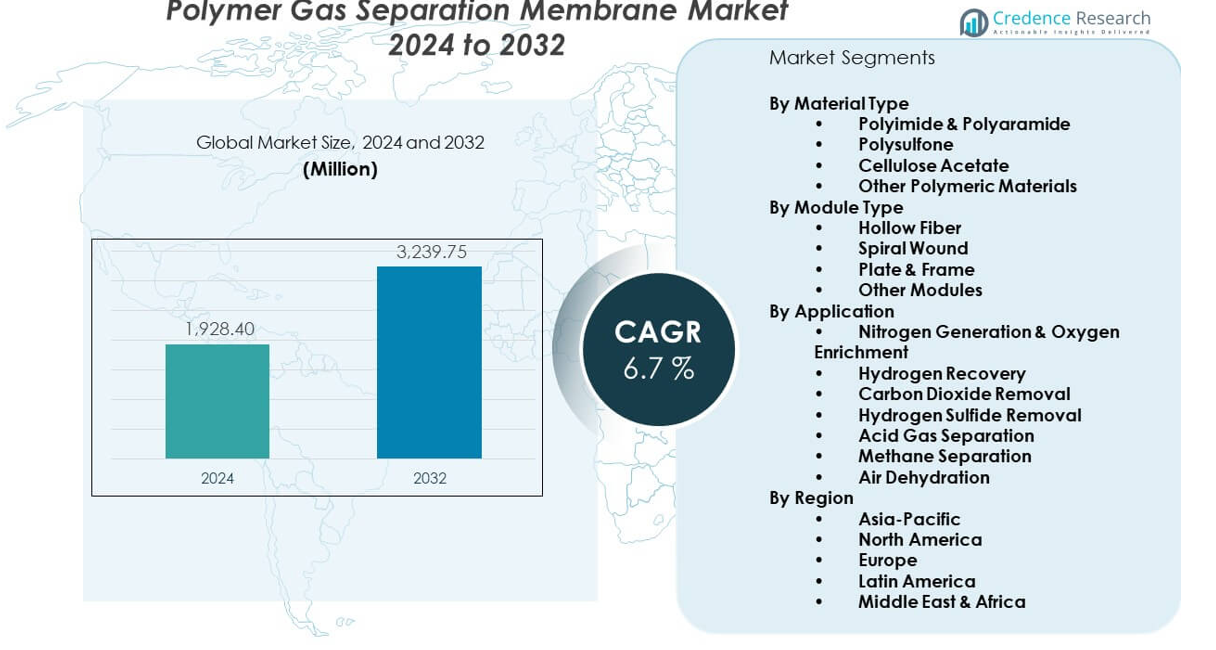

The Polymer Gas Separation Membrane Market is projected to grow from USD 1,928.4 million in 2024 to an estimated USD 3,239.75 million by 2032, reflecting a CAGR of 6.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polymer Gas Separation Membrane Market Size 2024 |

USD 1,928.4 million |

| Polymer Gas Separation Membrane Market, CAGR |

6.7% |

| Polymer Gas Separation Membrane Market Size 2032 |

USD 3,239.75 million |

Demand rises due to efforts to improve gas separation efficiency and lower dependence on energy-intensive processes. Chemical plants use these membranes to enhance nitrogen production and oxygen enrichment. Natural gas processors prefer compact membrane setups that reduce space needs and maintenance cycles. Producers invest in advanced polymer grades that improve permeability and selectivity for tougher gas streams. Biogas units adopt membrane modules to meet clean-energy targets. Industrial sectors also pursue lower emissions, which lifts long-term use of membrane-based systems across diverse facilities.

North America leads due to strong deployment across natural gas processing and hydrogen recovery plants. Europe gains traction with growth in biogas upgrading and strict decarbonization policies that encourage low-energy separation systems. Asia Pacific emerges as the fastest-growing region due to rapid industrial expansion and the rise of large-scale chemical and petrochemical complexes. China, Japan, and South Korea invest in membrane technologies that support cleaner production targets. Latin America and the Middle East show steady adoption driven by natural gas processing and long-term sustainability goals across energy infrastructure.

Market Insights:

- The Polymer Gas Separation Membrane Market is valued at USD 1,928.4 million in 2024 and is projected to reach USD 3,239.75 million by 2032, reflecting a steady CAGR of 6.7% driven by strong demand for efficient gas purification technologies.

- Asia-Pacific holds 38% share, supported by rapid industrial growth and expanding clean-energy projects. North America accounts for 27%, driven by mature gas processing and hydrogen recovery infrastructure. Europe holds 22%, backed by strict emission norms and strong biogas upgrading activity.

- Asia-Pacific is the fastest-growing region, holding the largest share and gaining momentum from rising hydrogen initiatives, large petrochemical bases, and strong investment in advanced membrane systems.

- By material, Polyimide & Polyaramide lead with 36% share, driven by superior durability and high selectivity across demanding gas streams.

- By module type, Hollow Fiber dominates with the highest adoption, supported by strong efficiency, compact design, and suitability for large-scale natural gas and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Need For Energy-Efficient Gas Separation Technologies

The Polymer Gas Separation Membrane Market gains steady growth through strong demand for low-energy purification systems. Industries replace older separation units to reduce operational strain and emissions. Firms prefer compact membrane setups that cut power use and lower downtime. It supports cleaner processing across natural gas, hydrogen, and industrial gas plants. Growing climate-focused policies lift adoption across major sectors. Producers expand high-performance membrane grades to improve selectivity. Energy-intensive plants shift toward modular gas separation blocks for faster integration. This shift strengthens sustained adoption across diverse facilities.

- For instance, Evonik’s SEPURAN® Green membranes enable methane purities above 99% while reducing energy consumption by nearly 30% in biogas upgrading systems, supporting energy-efficient operations.

Rising Use In Natural Gas Processing And Refining Operations

Oil and gas operators deploy membrane units to remove CO₂ and H₂S with higher precision. The Polymer Gas Separation Membrane Market benefits from this transition toward cleaner and safer output. Plants invest in membrane lines to reduce space needs and avoid complex moving parts. It supports stable performance in remote and offshore fields. Refineries adopt membranes to support hydrogen recovery and nitrogen production. Demand grows as operators seek flexible systems for variable gas streams. Producers launch improved polymer structures for harsh gas feeds. Rising investment in gas treatment capacity drives continuous uptake.

- For instance, Honeywell UOP’s Polybed™ membrane systems deliver hydrogen recovery rates up to 90% in refinery off-gas streams, helping operators reduce flaring and improve fuel efficiency.

Expanding Deployment In Biogas Upgrading And Clean Energy Systems

Biogas developers use membrane modules to convert raw gas into pipeline-grade biomethane. It pushes sustained interest in green technologies across commercial and municipal units. The Polymer Gas Separation Membrane Market gains support from rising sustainability goals. Operators adopt membranes to improve methane purity and reduce processing stages. Growth in waste-to-energy projects fuels consistent installation of membrane skids. Producers refine permeability levels to treat complex biogas flows. Plants select membrane units for lower maintenance workloads. Government programs strengthen market confidence in bio-based energy systems.

Growing Integration Across Chemical, Petrochemical, And Industrial Plants

Chemical producers rely on membranes to support nitrogen generation, oxygen enrichment, and solvent recovery. The Polymer Gas Separation Membrane Market benefits from this wide industrial footprint. It helps companies reduce operating costs and meet tightening environmental norms. Petrochemical hubs use membranes to separate key components with higher efficiency. Industrial users prefer modular designs that simplify retrofits. Demand grows for multi-stage membrane layouts that deliver targeted purity levels. Producers work on stronger polymers for extreme operating conditions. This trend ensures long-term use across large-scale industrial networks.

Market Trends:

Shift Toward Advanced High-Selectivity Polymer Materials

The Polymer Gas Separation Membrane Market shows rapid progress in material innovation. Producers create new polymer blends that improve precision for CO₂, H₂, and N₂ separation. It drives interest from industries seeking tighter purity control. Research groups introduce thin-film composite membranes that raise performance margins. Plants adopt these membranes to meet growing energy-efficiency targets. Demand rises for materials with better thermal and chemical resistance. Firms explore nanostructured polymers for challenging applications. This trend reshapes long-term membrane development strategies.

- For instance, MTR’s Polaris™ membranes achieve CO₂ permeance levels exceeding 1,000 GPU, offering one of the highest commercially available selectivity levels for post-combustion carbon capture.

Strong Movement Toward Modular And Scalable Gas Separation Systems

Companies prefer membrane units designed for quick expansion and flexible capacity. The Polymer Gas Separation Membrane Market benefits from rising interest in modular skids. It helps plants adjust to fluctuating gas loads without major redesigns. Small industrial units adopt scalable systems to support phased growth. Larger plants integrate modular layouts to reduce installation time. Engineering firms design compact frames for faster deployment. This trend supports broader adoption across remote and distributed sites. Growing demand for plug-and-play solutions strengthens overall market penetration.

- For instance, Air Liquide’s MEDAL™ membrane modules offer scalable hollow-fiber bundles capable of processing up to 200,000 standard cubic feet per hour (SCFH) of natural gas per unit, enabling flexible multi-train installations.

Increasing Adoption Of Membrane Systems In Hydrogen Value Chains

Hydrogen producers deploy membrane units to support purification, recovery, and fuel-cell-grade output. The Polymer Gas Separation Membrane Market gains from rising investment in hydrogen ecosystems. It enables more efficient gas handling across production and distribution lines. Energy firms build dedicated membrane stations for hydrogen separation. Industries invest in cleaner fuel systems driven by decarbonization goals. Strong policy support lifts momentum across global hydrogen corridors. Equipment makers refine membranes to handle wider pressure ranges. This trend boosts relevance in next-generation energy systems.

Growing Integration With Digital Monitoring And Predictive Performance Tools

Industrial plants adopt digital tools to monitor membrane efficiency in real time. The Polymer Gas Separation Membrane Market benefits from this move toward intelligent operations. It allows operators to track pressure, purity, and membrane health. Sensors support maintenance planning for longer system life. Plants use analytics to fine-tune module usage and reduce downtime. Automation supports consistent gas flow stability across complex networks. Monitoring tools help operators manage variable feed conditions. This trend encourages wider use of smart, membrane-based separation lines.

Market Challenges Analysis:

Performance Limitations Under Harsh Operating And High-Pressure Conditions

The Polymer Gas Separation Membrane Market faces hurdles linked to performance drops in demanding environments. It struggles with durability when exposed to extreme temperatures and corrosive gases. Plants must invest in protective layers to maintain long-term stability. High-pressure operations create risks of premature membrane wear. Operators often prefer alternative technologies for severe gas feeds. Maintenance costs increase when membranes need frequent replacement. Limited resistance to aggressive contaminants slows adoption in heavy industrial sites. These challenges require stronger material innovation across global facilities.

Competition From Mature Separation Technologies And Cost Barriers

The Polymer Gas Separation Membrane Market competes with well-established methods like PSA, cryogenic distillation, and solvent absorption. It faces resistance from operators familiar with older systems. High initial costs create hesitation for large-scale installations. Firms evaluate return timelines closely before shifting to membrane units. Limited awareness in emerging regions slows early adoption. Some industrial plants require hybrid setups to reach target purity levels. Stronger regulatory support is needed to accelerate transition. These issues create pressure on membrane suppliers to improve cost efficiency.

Market Opportunities:

Rising Scope Across Hydrogen, Biogas, And Low-Carbon Energy Networks

The Polymer Gas Separation Membrane Market gains strong prospects across new-energy ecosystems. It helps hydrogen producers improve purification and deliver cleaner fuel streams. Biogas plants use membranes to produce upgraded biomethane for grids and vehicles. Cleaner energy goals push wider adoption across industrial hubs. Producers develop improved polymer designs to match emerging green standards. Demand from refineries and gas processing units strengthens the opportunity base. This trend supports steady installation of advanced gas treatment units.

Growing Use In Decentralized And Small-Scale Industrial Applications

The Polymer Gas Separation Membrane Market benefits from expansion across compact industrial sites. It supports small plants needing flexible and low-maintenance gas separation. Modular layouts allow simple integration with limited space. Local manufacturing units prefer membranes for quicker setup timelines. Demand grows for scalable units that offer faster upgrades. Rising industrial automation boosts acceptance of digital-ready membrane systems. Broad industry interest strengthens opportunities across multiple regions.

Market Segmentation Analysis:

By Material Type

Polyimide and Polyaramide hold the leading position due to strong thermal resistance and stable separation performance across demanding industrial flows. Polysulfone follows with steady use in mid-pressure systems where reliability and cost balance matter. Cellulose Acetate supports applications that require lower-temperature operation and controlled selectivity. Other polymeric materials serve niche needs where custom permeability or chemical compatibility is important. The Polymer Gas Separation Membrane Market benefits from these diverse material choices that align with varying feed conditions and purity targets.

- For instance, UBE’s polyimide membranes deliver CO₂/CH₄ selectivity of around 40, making them a preferred choice for natural gas sweetening applications.

By Module Type

Hollow Fiber dominates due to high surface-area efficiency and compact layouts suited for gas processing and refinery units. Spiral Wound modules gain traction in large-scale plants that require dense packing and consistent output. Plate & Frame modules support environments where simple cleaning and low fouling are priorities. Other module designs address specialized industrial setups that need unique flow patterns or quick replacement cycles. Each configuration delivers targeted value across different operating conditions.

By Application

Nitrogen Generation and Oxygen Enrichment lead due to broad deployment across manufacturing, processing, and safety systems. Hydrogen Recovery grows quickly with rising demand for cleaner fuels and refinery optimization. Carbon Dioxide Removal and Hydrogen Sulfide Removal support natural gas treatment and industrial purification lines. Acid Gas Separation and Methane Separation remain essential in petrochemical and biogas operations. Air Dehydration holds steady demand across plants needing dry air for efficient equipment performance. These applications strengthen the market’s broad industrial reach.

Segmentation:

By Material Type

- Polyimide & Polyaramide

- Polysulfone

- Cellulose Acetate

- Other Polymeric Materials

By Module Type

- Hollow Fiber

- Spiral Wound

- Plate & Frame

- Other Modules

By Application

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- Hydrogen Sulfide Removal

- Acid Gas Separation

- Methane Separation

- Air Dehydration

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific

Asia-Pacific holds the dominant position with roughly 38% market share, supported by rapid industrial expansion and strong investment across chemical, petrochemical, and natural gas processing sectors. The Polymer Gas Separation Membrane Market benefits from rising adoption of high-performance membrane modules in China, Japan, South Korea, and India. It gains momentum from expanding hydrogen initiatives and large-scale clean energy programs. Regional manufacturers invest in upgraded polymer materials to meet strict efficiency needs. Growing biogas upgrading activities strengthen membrane usage in emerging economies. Strong government policies drive wider deployment across industrial corridors. Rising demand for flexible gas separation supports sustained growth across the region.

North America

North America accounts for about 27% market share, driven by mature natural gas infrastructure and strong hydrogen recovery demand. It benefits from early adoption of advanced membrane systems across refineries, gas processing plants, and industrial purification units. The Polymer Gas Separation Membrane Market expands in the region due to stronger focus on energy efficiency and emission control. Technology providers launch upgraded hollow fiber and spiral wound modules tailored for U.S. and Canadian plants. Rising biogas upgrading projects contribute to steady demand growth. Industrial users adopt modular separation systems to reduce operational strain. Strong R&D capabilities support continuous membrane innovation.

Europe, Latin America, and Middle East & Africa

Europe maintains about 22% market share, supported by strict environmental regulations and strong momentum in biogas upgrading and clean hydrogen pathways. It reports rising adoption of membrane systems across industrial gas purification and advanced chemical processing. Latin America represents roughly 7% market share, driven by expansion in natural gas treatment and refinery modernization. The Polymer Gas Separation Membrane Market gains steady traction across Middle East & Africa, which hold close to 6% share, supported by gas processing and petrochemical investments. It grows in these regions due to increasing demand for compact, energy-efficient separation units. Industrial modernization projects strengthen long-term interest. Diverse energy profiles across these markets create stable opportunities for membrane suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Polymer Gas Separation Membrane Market shows strong competition shaped by material innovation, module efficiency, and application-specific performance. Leading companies invest in advanced polymer chemistries to improve selectivity and durability across diverse gas streams. It drives continuous product upgrades focused on energy savings and operational reliability. Suppliers expand hollow fiber and spiral wound portfolios to meet rising demand across natural gas, hydrogen, and biogas sectors. Global players strengthen partnerships with industrial plants to secure long-term contracts. Regional manufacturers compete on cost, local availability, and tailored engineering support. Rapid technology evolution keeps competitive intensity high across core markets.

Recent Developments:

- In November 2025, Parker-Hannifin announced that it has entered into a definitive agreement to acquire Filtration Group Corporation for a cash purchase price of $9.25 billion. This strategic transaction creates one of the largest global industrial filtration businesses and includes expertise in clean air, liquid, and gas filtration technologies. The acquisition targets high-growth filtration technology market with expertise spanning multiple sectors including industrial, aerospace, and environmental filtration, representing a strategic move to strengthen Parker-Hannifin’s industrial and aerospace equipment portfolio.

- In August 2025, Air Liquide announced the signing of a binding agreement to acquire DIG Airgas, a leading industrial gas company in South Korea, for €2.85 billion (approximately $3.3 billion). The acquisition is expected to close in the first half of 2026, subject to regulatory approvals. This strategic move strengthens Air Liquide’s position in South Korea, one of the world’s fastest-growing markets and the fourth-largest industrial gas market globally, particularly in high-growth sectors including semiconductors, clean energy, and mobility. Additionally, in June 2025, Air Liquide invested up to USD 200 million in modernizing its Louisiana Air Separation Unit (ASU) and expanding pipeline infrastructure to support a long-term oxygen and nitrogen supply contract with Dow, enhancing delivery efficiency and reliability.

- In February 2025, Evonik announced that it is building a pilot plant in Marl, Germany, for the production of its innovative anion exchange membrane (AEM) marketed under the name DURAION®. Evonik is investing a low double-digit million euro amount in the AEM plant, which is scheduled to go online at the end of 2025. This strategic investment aligns with Evonik’s business goals to grow its pioneering membranes as a true enabler of the burgeoning green hydrogen economy, as DURAION® membranes enable cost-competitive production of green hydrogen through water electrolysis. In September 2024, Evonik unveiled its latest biogas membrane, the SEPURAN® Green G5X 11″, featuring the highest capacity of its kind currently on the market and designed for large-flow biogas upgrading projects. The company has also expanded capacity for production of its SEPURAN® hollow fiber membranes in Schörfling and Lenzing, Austria, with a new hollow fiber spinning facility in Schörfling already operational and additional production lines scheduled for completion in the first half of 2025, creating around 50 new jobs. Additionally, in May 2025, Evonik and Gas Malaysia signed a Memorandum of Collaboration focusing on upgrading biogas into biomethane at Malaysia’s first biomethane injection site, marking a historic milestone for sustainable energy in the nation.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Module Type, and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage].

Future utlook:

- Growing demand for cleaner gas processing strengthens adoption across major industries.

- Rising interest in hydrogen ecosystems expands membrane use in purification and recovery.

- Progress in polymer chemistry enables higher selectivity and longer operational life.

- Modular membrane systems gain traction for flexible deployment in industrial plants.

- Biogas upgrading emerges as a strong growth area supported by sustainability targets.

- Digital monitoring tools support predictive operation and better membrane efficiency.

- Regional energy transitions drive steady installations across Asia-Pacific and Europe.

- Lower maintenance needs lift preference over conventional gas separation technologies.

- Strategic partnerships accelerate product upgrades and global market expansion.

- Strong focus on emission control supports long-term relevance across industrial sectors.