Market Overview

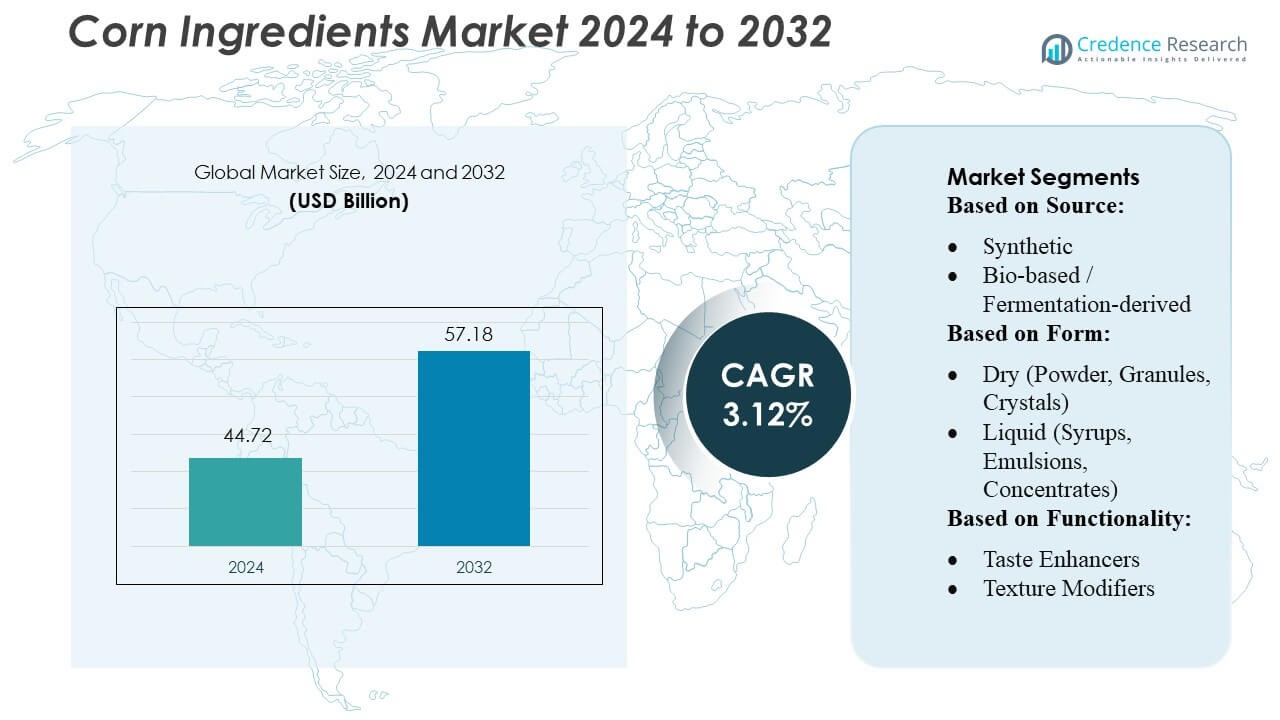

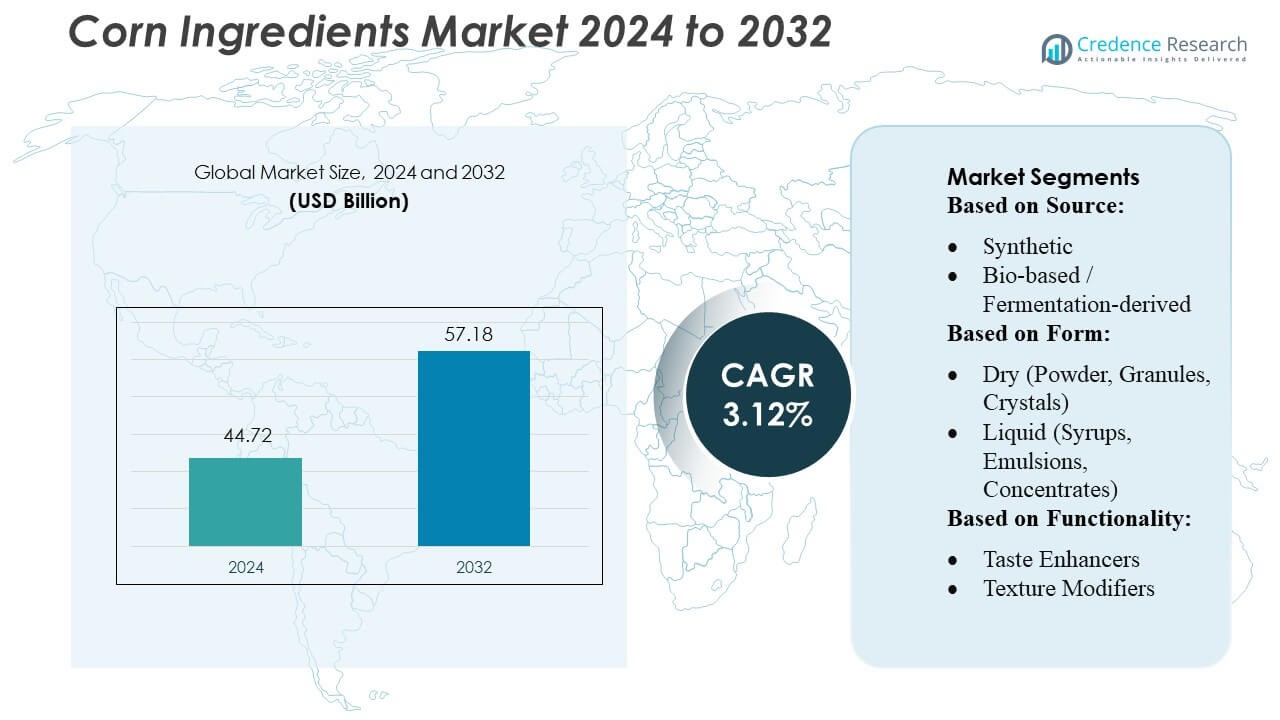

Corn Ingredients Market size was valued USD 44.72 billion in 2024 and is anticipated to reach USD 57.18 billion by 2032, at a CAGR of 3.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Corn Ingredients Market Size 2024 |

USD 44.72 Billion |

| Corn Ingredients Market, CAGR |

3.12% |

| Corn Ingredients Market Size 2032 |

USD 57.18 Billion |

The corn ingredients market is dominated by leading companies such as Omega Protein Corporation, Roquette Frères, FMC Corporation, Golden Grain Group Limited, Cargill, Incorporated, NutriBiotic, Plasma Nutrition Inc., ADM, Ingredion Incorporate, and Tate & Lyle. These players compete through product innovation, strategic partnerships, and regional expansions, offering a wide range of corn-derived products including starches, sweeteners, syrups, and protein concentrates. Technological advancements in processing and a focus on non-GMO and plant-based ingredients enable differentiation and cater to evolving consumer preferences. Among regions, Asia-Pacific leads the market, accounting for 35% of the global share, driven by rising demand from food, beverage, and feed industries, coupled with increasing urbanization and disposable incomes. The region’s strong production capacity and expanding export potential reinforce its position as the primary growth engine in the global corn ingredients market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The corn ingredients market size was valued at USD 44.72 billion in 2024 and is projected to reach USD 57.18 billion by 2032, growing at a CAGR of 3.12% during the forecast period.

- Rising demand from food, beverage, and feed industries, along with urbanization and increasing disposable incomes, drives market growth, particularly in Asia-Pacific, which holds 35% of the global share.

- Leading companies compete through product innovation, strategic partnerships, and regional expansion, offering corn-derived starches, syrups, sweeteners, and protein concentrates, while focusing on non-GMO and plant-based ingredients to meet consumer preferences.

- Trends include increasing adoption of functional and clean-label ingredients, investment in sustainable and eco-friendly processing methods, and growing use of corn products in processed and convenience foods.

- Market restraints include price volatility of raw corn, supply chain disruptions, and stringent regulatory requirements, which may impact growth in certain regions such as the Middle East & Africa and Latin America.

Market Segmentation Analysis:

By Source

The corn ingredients market is primarily segmented into natural, synthetic, and bio-based/fermentation-derived sources. Natural sources, particularly plant-based ingredients derived from grains and vegetables, dominate the market due to their clean-label appeal and consumer preference for minimally processed ingredients. For instance, corn starch extracted from non-GMO maize is widely used in food and beverage applications for its functional versatility. Drivers include increasing demand for plant-based diets, regulatory incentives promoting natural additives, and the ability to offer allergen-free, sustainable ingredient options that align with current consumer trends.

- For instance, a conventional wet‑milling process applied to normal (yellow dent) maize typically yields about 65–68% of the processed dry mass as pure starch.

By Form

Corn ingredients are available in dry, liquid, and semi-solid forms, with dry forms such as powders, granules, and crystals leading the market. Dry forms are preferred for their long shelf life, ease of transport, and flexibility in formulation across food, beverage, and pharmaceutical applications. For instance, modified corn starch in powdered form is extensively used in bakery and confectionery applications to improve texture and moisture retention. Growth is driven by manufacturers’ need for stable, easy-to-handle ingredients that can be incorporated into both industrial and retail-scale production efficiently.

- For instance, Roquette’s Native maize starch marketed as POWDERED NF Corn Starch has a mean particle diameter of about 16 µm and a maximum water content (loss on drying) of 13.5% — producing a very fine, white/off-white powder that is suitable as filler, binder or disintegrant in tablets, capsules, granules or premixes.

By Functionality

The market is segmented by functionality into taste enhancers, texture modifiers, shelf-life extenders, nutritional fortification, and color & appearance agents. Texture modifiers, including corn starch and dextrins, dominate the segment, owing to their wide applications in thickening, gelling, and stabilizing formulations. For instance, high-amylose corn starch improves the mouthfeel and viscosity of dairy and snack products without altering flavor. Key drivers include the rising demand for processed and convenience foods, product innovation targeting improved sensory properties, and the multifunctional capabilities of corn-derived texture agents.

Key Growth Drivers

- Rising Demand for Functional and Nutritional Foods

The growing consumer preference for functional and nutritionally enriched foods has driven corn ingredient consumption. Corn-derived products such as corn starch, corn syrup, and corn protein are increasingly incorporated into processed foods, beverages, and dietary supplements. For instance, major food manufacturers are integrating high-purity corn protein to enhance protein content in snacks and ready-to-drink beverages, reflecting the shift toward health-conscious consumption. This trend fuels consistent demand, encouraging manufacturers to expand production capacity and invest in product innovation.

- For instance, GG advertises that it has completed over 1,000 domestic and international milling and grain‑processing projects — a metric that underscores its scale and footprint in the global grain-handling and processing industry.

- Expansion of the Food & Beverage Industry

The food and beverage sector’s rapid expansion, particularly in emerging economies, significantly contributes to corn ingredient market growth. Corn derivatives serve as thickeners, sweeteners, and stabilizers in confectionery, bakery, and dairy products, making them essential to large-scale production. For instance, global beverage companies increasingly utilize high-fructose corn syrup for cost-effective sweetening in carbonated drinks. The rising consumption of processed foods and beverages ensures steady demand for corn ingredients, prompting industry players to invest in technological upgrades and supply chain enhancements.

- For instance, Saatvik Agro Processors, with an initial production capacity of 500 tons per day, scalable up to 1,000 tons per day of starch derivatives tailored to serve confectionery, infant‑formula and dairy manufacturers.

- Technological Advancements in Corn Processing

Advancements in processing technologies, such as enzymatic hydrolysis and fractionation, have improved the efficiency and versatility of corn ingredients. These innovations allow manufacturers to produce high-quality starches, sweeteners, and proteins with tailored functionalities for diverse applications. For instance, companies have adopted precision fractionation to yield corn protein isolates with higher solubility for beverage fortification. Such technological progress enhances product performance, reduces production costs, and enables the development of specialized applications, thereby supporting market growth.

Key Trends & Opportunities

- Shift Toward Plant-Based Proteins

Rising consumer interest in plant-based diets has created opportunities for corn protein as an alternative to animal-derived proteins. Corn protein is increasingly used in protein bars, meat analogues, and dairy substitutes due to its neutral taste and high digestibility. For instance, several food manufacturers have incorporated corn protein isolates into plant-based beverages to improve texture and protein content. This trend provides a significant growth avenue for corn ingredient producers while aligning with sustainability and health-conscious consumer preferences.

- For instance, ADM announced a strategic partnership with Solugen: Solugen will build a new 500,000-square-foot biomanufacturing facility adjacent to ADM’s corn complex in Marshall, Minnesota.

- Demand for Clean Label and Natural Ingredients

Consumers increasingly prefer clean-label products free from artificial additives, driving demand for natural corn-derived ingredients. Corn starch, syrups, and fibers are widely adopted as natural thickeners, sweeteners, and bulking agents. For instance, snack and bakery brands leverage corn starch to replace modified starches, enhancing product appeal to health-conscious buyers. The rising emphasis on transparency and natural formulations presents opportunities for suppliers to innovate, expand product lines, and meet evolving regulatory and consumer expectations.

- For instance, CLARIA® G — that reduces water use by 35% and cuts carbon footprint by 34% (relative to previous CLARIA production), without compromising starch functionality.

- Growth in Emerging Markets

Emerging economies present a lucrative opportunity due to urbanization, rising disposable incomes, and changing dietary patterns. Corn ingredients are increasingly integrated into processed foods, beverages, and convenience products in these regions. For instance, manufacturers in Southeast Asia and Latin America have scaled corn syrup production to meet growing demand from soft drink and confectionery sectors. Expanding distribution networks and localized production strategies allow companies to capitalize on the increasing consumption of processed foods in emerging markets.

Key Challenges

- Price Volatility of Raw Corn

The corn ingredient market is highly sensitive to fluctuations in raw corn prices caused by climatic conditions, trade policies, and global supply-demand dynamics. For instance, droughts in major corn-producing regions can sharply increase production costs, affecting profitability for ingredient manufacturers. Such volatility complicates long-term planning and pricing strategies, forcing companies to adopt risk mitigation measures, including diversified sourcing, strategic reserves, and forward contracts to stabilize supply and maintain competitive market positioning.

- Regulatory and Compliance Pressure

Strict regulatory frameworks related to food safety, labeling, and genetically modified organisms (GMOs) pose challenges for corn ingredient producers. For instance, compliance with regional standards for non-GMO verification and allergen labeling requires additional testing, documentation, and process adjustments. Adhering to these regulations increases operational costs and limits flexibility in product development. Companies must continuously monitor regulatory changes, implement quality assurance systems, and maintain transparency to ensure market access and consumer trust.

Regional Analysis

North America

North America holds a significant position in the corn ingredients market, accounting for approximately 28% of the global share. Strong demand from the food and beverage sector, particularly in snacks, sweeteners, and processed foods, drives growth. The U.S., as the leading producer, benefits from advanced corn processing infrastructure and technological adoption in manufacturing. For instance, companies are increasingly leveraging high-fructose corn syrup and corn starch in industrial and retail applications, enhancing product versatility. Government support for bio-based products and consistent corn cultivation further strengthens market stability, positioning the region as a key contributor to global corn ingredient supply.

Europe

Europe represents around 22% of the global corn ingredients market, driven by rising demand for functional foods, beverages, and industrial starch applications. The region emphasizes clean-label and non-GMO ingredients, with countries such as Germany, France, and the U.K. leading consumption. For instance, corn-derived glucose syrups are widely utilized in confectionery and bakery industries, while modified starches support manufacturing efficiency. Sustainability initiatives, including the use of bio-based and eco-friendly production methods, further enhance market growth. Regulatory frameworks favor quality and safety, enabling manufacturers to innovate while meeting consumer preferences, making Europe a steadily expanding market for corn ingredients.

Asia-Pacific

Asia-Pacific dominates the global corn ingredients market with an estimated 35% share, driven by escalating demand from food, beverage, and feed industries. Rapid urbanization, rising disposable incomes, and evolving dietary patterns in China, India, and Japan fuel consumption. For instance, corn starch and syrups are increasingly incorporated into processed foods and traditional culinary products. The expansion of corn cultivation and improvements in processing technologies, coupled with growing exports of corn-based products, strengthen regional leadership. Additionally, increasing health-consciousness and demand for functional ingredients encourage innovation, positioning Asia-Pacific as a critical growth engine for the global corn ingredients market.

Latin America

Latin America contributes roughly 10% to the global corn ingredients market, with Brazil and Argentina as the key players. The region benefits from abundant corn production and cost-effective manufacturing capabilities. For instance, corn starch and sweeteners are widely adopted in both domestic food processing and export-oriented industries. The growing demand from bakery, confectionery, and beverage sectors, alongside expanding industrial applications, supports market expansion. Investments in modern processing facilities and government incentives for agricultural growth further bolster the market. Latin America’s strategic positioning for exports to North America and Europe also enhances its role as a competitive supplier in the global corn ingredients landscape.

Middle East & Africa

The Middle East & Africa accounts for around 5% of the global corn ingredients market, with demand primarily driven by food and beverage industries in countries such as Saudi Arabia, UAE, and South Africa. For instance, corn-derived starches and syrups are increasingly used in confectionery, dairy, and processed food products. Limited domestic corn cultivation has led to a reliance on imports, creating opportunities for regional trade expansion. Urbanization, population growth, and rising disposable incomes contribute to increased consumption, while food manufacturing and industrial applications continue to develop. Investments in processing infrastructure and logistics improve market accessibility, supporting steady regional growth.

Market Segmentations:

By Source:

- Synthetic

- Bio-based / Fermentation-derived

By Form:

- Dry (Powder, Granules, Crystals)

- Liquid (Syrups, Emulsions, Concentrates)

By Functionality:

- Taste Enhancers

- Texture Modifiers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The corn ingredients market, including Omega Protein Corporation, Roquette Frères, FMC Corporation, Golden Grain Group Limited, Cargill, Incorporated, NutriBiotic, Plasma Nutrition Inc., ADM, Ingredion Incorporate, and Tate & Lyle. The corn ingredients market is highly competitive, driven by continuous innovation, capacity expansion, and strategic collaborations across the value chain. Companies focus on developing high-quality corn-derived products such as starches, syrups, sweeteners, and protein concentrates to meet diverse food, beverage, and industrial applications. Innovation in enzymatic processing, non-GMO formulations, and plant-based ingredients enables differentiation and caters to evolving consumer preferences. Strategic mergers, acquisitions, and regional expansions are widely adopted to strengthen supply chains and enhance market reach. Additionally, sustainability initiatives, including eco-friendly production methods and resource optimization, are prioritized to comply with regulatory standards and environmental guidelines, ensuring long-term competitiveness. Cost efficiency, product quality, and adaptability remain key factors that define market leadership in this dynamic industry.

Key Player Analysis

- Omega Protein Corporation

- Roquette Frères

- FMC Corporation

- Golden Grain Group Limited

- Cargill, Incorporated

- NutriBiotic

- Plasma Nutrition Inc.

- ADM

- Ingredion Incorporate

- Tate & Lyle

Recent Developments

- In May 2025, Cinco de Mayo and Chipotle are celebrating with a new gaming experience that can score fans some free food. The company has created “Ingredient Quest” to “educate its Gen Z fans on the brand’s 53 real ingredients while allowing them to claim a reward of free Chipotle in the physical world.”

- In April 2025, Arla Foods Ingredients launched the Lacprodan MicelPure portfolio at Vitafoods Europe 2025, including a range of MCI solutions that are relevant for medical nutrition.

- In March 2025, Nestlé India announced the launch of its new CEREGROW with no refined sugar, to enhance its commitment to offering nutritious choices to its consumers through meaningful innovations.

- In August 2023, Bayer launched its biotech corn seed ‘Dekalb DK 95R’ in Indonesia with the goal of increasing the country’s corn production. The new hybrid is expected to boost yields and reduce costs for farmers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Functionality and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for corn-derived sweeteners and starches is expected to grow steadily across food and beverage industries.

- Increasing consumer preference for clean-label and non-GMO products will drive innovation in corn ingredients.

- Expansion of processed food and convenience food sectors will boost regional consumption.

- Technological advancements in corn processing will improve product quality and operational efficiency.

- Rising health-conscious trends will encourage development of functional and high-protein corn-based products.

- Sustainability initiatives will lead to eco-friendly production methods and reduced environmental impact.

- Growth in animal feed and industrial applications will continue to support market diversification.

- Emerging economies will present new opportunities due to rising disposable incomes and urbanization.

- Strategic collaborations, mergers, and acquisitions will strengthen market presence and supply chain networks.

- Regulatory support for bio-based and renewable ingredients will enhance long-term market stability.