Market Overview

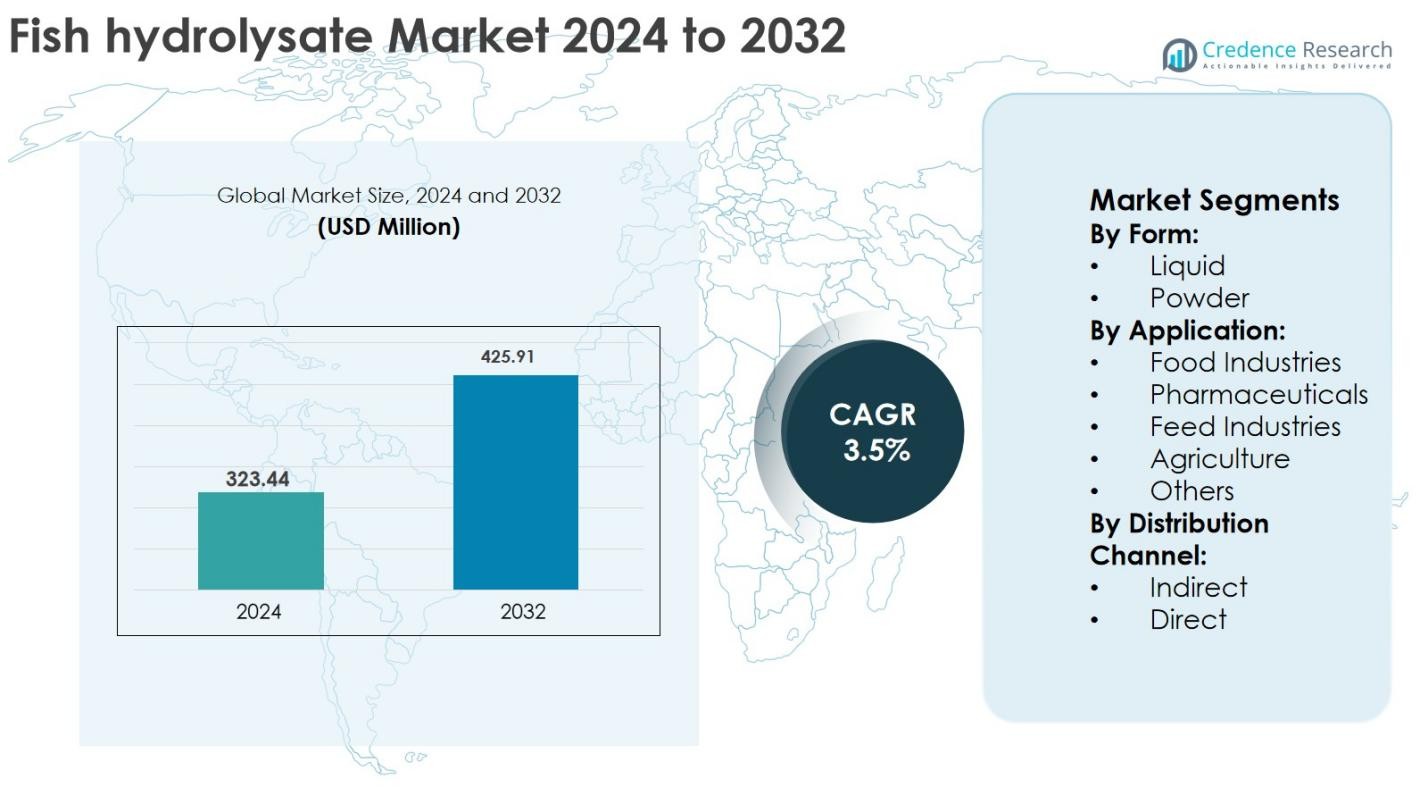

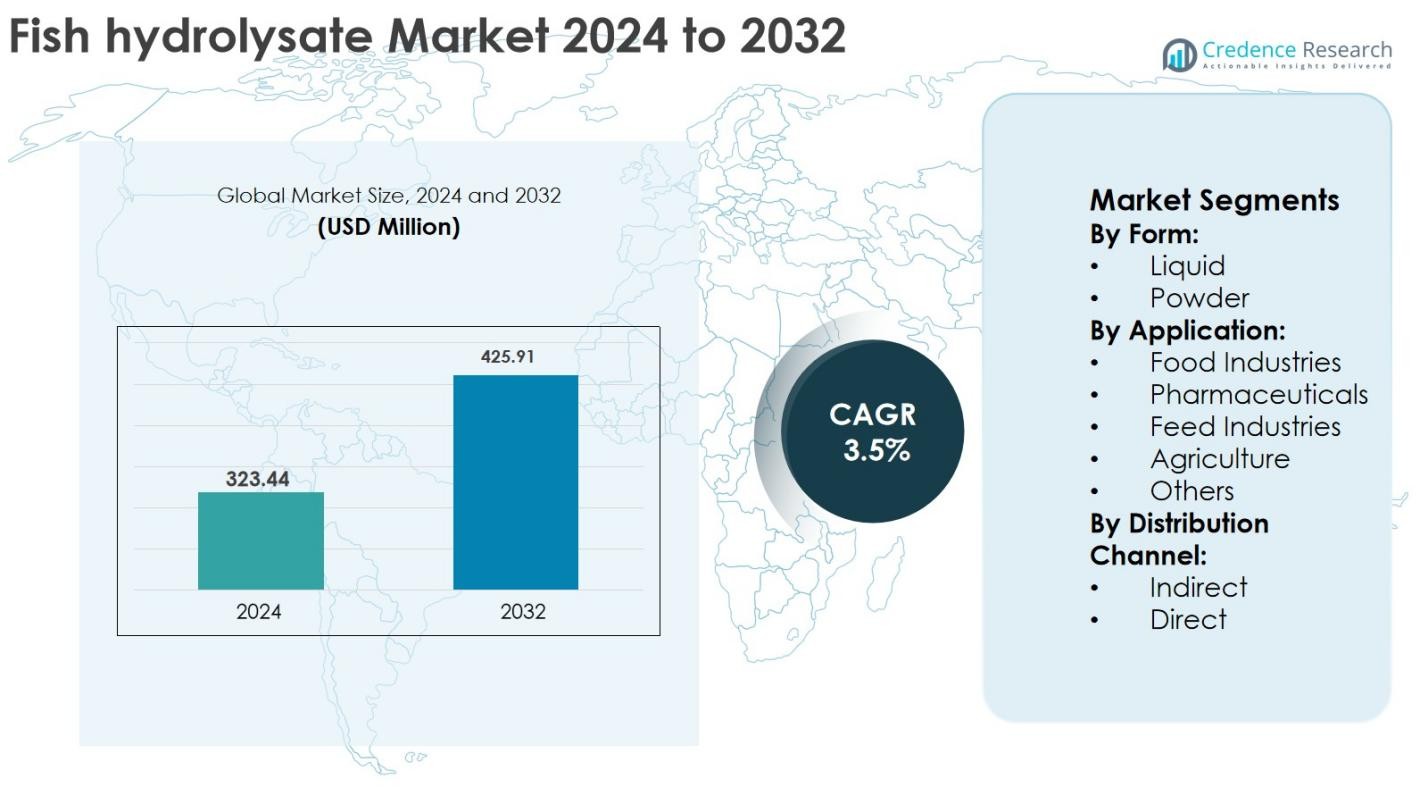

Fish Hydrolysate Market size was valued at USD 323.44 million in 2024 and is anticipated to reach USD 425.91 million by 2032, at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fish Hydrolysate Market Size 2024 |

USD 323.44 Million |

| Fish Hydrolysate Market, CAGR |

3.5% |

| Fish Hydrolysate Market Size 2032 |

USD 425.91 Million |

Fish hydrolysate market is characterized by the presence of established global and regional players focusing on sustainable sourcing, application-specific formulations, and value-added processing. Leading companies such as Hofseth BioCare ASA, Diana Group S.r.l, Bio-marine Ingredients Ireland, Copalis, Scanbio Marine Group AS, Omega Protein Corporation, Sopropêche, Sociedad Pesquera Landes SA, Janatha Fish Meal & Oil Products, and TC Union Agrotech actively compete through product innovation and diversified end-use offerings across feed, agriculture, and nutraceutical segments. Regionally, North America dominated the Fish hydrolysate market with 32% market share in 2024, supported by strong demand from feed and organic agriculture. Europe followed with 29% share, driven by circular economy practices and aquaculture strength, while Asia Pacific accounted for 26%, reflecting rapid aquaculture expansion and raw material availability.

Market Insights

Market Insights

- Fish hydrolysate market was valued at USD 323.44 million in 2024 and is projected to reach USD 425.91 million by 2032, growing at a CAGR of 3.5% during the forecast period.

- Market growth is driven by rising demand for sustainable inputs in agriculture and increasing use in aquaculture and animal feed due to high digestibility and bioactive peptide content.

- Key market trends include expanding adoption in organic farming, growing use in nutraceuticals, and technological advancements in enzymatic hydrolysis to improve product consistency and performance.

- The market shows moderate fragmentation, with leading players focusing on sustainable sourcing, customized formulations, and expansion across feed, agriculture, and food applications.

- North America held 32% market share in 2024, followed by Europe with 29% and Asia Pacific with 26%, while the liquid form segment dominated with 58% share due to higher bioavailability and ease of application.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

The Fish hydrolysate market by form is led by the liquid segment, which accounted for 58% market share in 2024, driven by its high bioavailability, easy absorption, and suitability for direct application in agriculture and animal nutrition. Liquid fish hydrolysates offer faster nutrient uptake, particularly amino acids and peptides, making them highly effective in foliar sprays and liquid feed formulations. The growing adoption of organic farming practices, increasing demand for natural biostimulants, and rising use in aquaculture feed significantly support liquid-form demand, while powder forms gain traction due to longer shelf life and ease of transportation.

- For instance, Ocean Organics’ liquid fish-based biostimulant lines are widely used in specialty crops and turf because they can be applied directly through fertigation and foliar spraying, improving plant vigor and stress tolerance as documented in grower field trials.

By Application

By application, the feed industries segment dominated with 42% market share in 2024, supported by rising demand for protein-rich and digestible feed ingredients in aquaculture, livestock, and pet nutrition. Fish hydrolysates improve feed palatability, nutrient absorption, and gut health, driving their widespread adoption. Expanding aquaculture production, increasing focus on sustainable feed alternatives, and regulatory pressure to reduce synthetic additives are key growth drivers. Food and pharmaceutical applications are also growing steadily, supported by rising interest in bioactive peptides and functional nutrition ingredients.

- For instance, Skretting and Cargill have both reported increased use of marine protein hydrolysates in high-performance aquafeeds to improve palatability and support gut function in species such as salmon and shrimp, as documented in their technical feed guidelines and sustainability reports.

By Distribution Channel

In terms of distribution channel, the indirect channel held 64% market share in 2024, owing to the strong presence of distributors, wholesalers, and regional suppliers that ensure broad market reach. Indirect distribution enables manufacturers to access diverse end-user industries, including agriculture, feed, and food processing, while reducing logistical complexity. Established distributor networks, especially in emerging markets, support consistent product availability and technical assistance. Meanwhile, direct channels are expanding among large buyers seeking cost optimization, customized formulations, and long-term supply agreements.

Key Growth Drivers

Rising Demand for Sustainable and Organic Inputs

The Fish hydrolysate market benefits strongly from the growing global shift toward sustainable, organic, and environmentally responsible products. Fish hydrolysates, derived from fish processing by-products, support circular economy practices by converting waste into high-value inputs. In agriculture, they are increasingly adopted as natural biostimulants that enhance soil health, nutrient uptake, and crop resilience without harming ecosystems. Rising regulatory restrictions on synthetic fertilizers and chemical additives further encourage the use of fish-based alternatives. Additionally, consumer preference for organic food products indirectly drives demand, as farmers seek compliant inputs that improve yields while meeting organic certification standards.

- For instance, companies such as Alaska Sea Grant and Trident Seafoods have promoted the use of liquid fish fertilizer produced from processing by‑products, highlighting its role in reducing waste and creating value‑added agricultural inputs documented in their extension materials and sustainability reports.

Expansion of Aquaculture and Animal Nutrition Industries

Rapid growth in aquaculture and livestock production significantly accelerates demand for fish hydrolysates as functional feed ingredients. Fish hydrolysates offer high digestibility, improved amino acid profiles, and enhanced feed palatability, making them suitable for aquafeed, poultry, swine, and pet nutrition. Increasing global seafood consumption and the need to improve feed efficiency drive adoption, particularly in intensive aquaculture systems. Moreover, the rising focus on animal health, immunity enhancement, and reduced antibiotic usage supports the integration of bioactive peptides present in fish hydrolysates. These benefits position fish hydrolysates as essential inputs for modern, performance-driven feed formulations.

- For instance, Symrise Pet Food uses fish protein hydrolysates as natural palatants in premium dog and cat foods, reporting higher acceptance and intake levels compared with conventional protein meals in their internal palatability trials.

Growing Use in Food and Pharmaceutical Applications

The food and pharmaceutical industries increasingly utilize fish hydrolysates due to their bioactive properties and functional benefits. Rich in peptides, amino acids, and minerals, fish hydrolysates are incorporated into nutraceuticals, dietary supplements, and functional foods targeting gut health, muscle recovery, and immune support. Aging populations, rising health awareness, and demand for natural protein sources strengthen market growth. In pharmaceuticals, ongoing research highlights the antioxidant, anti-inflammatory, and antihypertensive properties of fish-derived peptides, expanding potential therapeutic applications. These developments encourage manufacturers to invest in advanced processing technologies and value-added product development.

Key Trends & Opportunities

Technological Advancements in Enzymatic Hydrolysis

Advancements in enzymatic hydrolysis techniques represent a major trend in the Fish hydrolysate market. Improved enzyme specificity enables the production of consistent, high-quality hydrolysates with targeted peptide profiles. These innovations enhance product efficacy across agriculture, feed, and pharmaceutical applications while reducing processing time and energy consumption. Manufacturers increasingly adopt controlled hydrolysis processes to improve solubility, taste masking, and nutrient bioavailability. This trend creates opportunities for product differentiation, premium formulations, and customized solutions tailored to specific end-use requirements, strengthening competitive positioning and expanding application scope.

- For instance, Hofseth Biocare uses controlled enzymatic hydrolysis of salmon raw material to produce standardized peptide profiles in products like ProGo, reporting high digestibility and specific bioactive properties in its technical documentation and published studies.

Rising Adoption in Organic and Precision Agriculture

Fish hydrolysates are gaining traction in organic and precision agriculture systems as farmers seek inputs that support yield optimization and stress tolerance. Their compatibility with drip irrigation and foliar application aligns well with precision farming practices. Growing awareness of soil regeneration, microbial activity enhancement, and climate-resilient farming creates strong opportunities for market expansion. Emerging economies, in particular, present untapped potential as governments promote sustainable agriculture and reduce dependency on chemical fertilizers. These trends open avenues for partnerships with agribusinesses and expansion into high-growth agricultural regions.

- For instance, OMRI‑listed fish hydrolysate fertilizers from North American manufacturers are widely used by organic growers through fertigation and foliar spraying, helping them comply with USDA National Organic Program requirements while improving crop vigor and soil biological activity.

Key Challenges

Supply Chain Dependence on Raw Material Availability

The Fish hydrolysate market faces challenges related to the availability and consistency of raw fish by-products. Seasonal fishing patterns, regulatory fishing quotas, and environmental factors can disrupt supply chains and affect production stability. Variations in raw material quality also influence hydrolysate composition and performance, requiring strict quality control measures. Dependence on specific fish species and regional processing facilities further increases vulnerability, potentially leading to price volatility and supply constraints for manufacturers.

High Processing Costs and Limited Awareness

High processing costs associated with enzymatic hydrolysis, quality testing, and storage present a barrier to widespread adoption, particularly among small-scale end users. Advanced processing equipment and skilled labor increase production expenses, impacting product pricing. Additionally, limited awareness of fish hydrolysate benefits in certain regions restricts market penetration. In agriculture and feed sectors, knowledge gaps regarding application methods and performance outcomes slow adoption. Addressing these challenges requires targeted education initiatives, cost-effective production innovations, and strategic distribution partnerships.

Regional Analysis

North America

North America accounted for 32% market share in 2024 in the Fish hydrolysate market, driven by strong demand from animal feed, agriculture, and nutraceutical industries. The region benefits from advanced aquaculture practices, high adoption of organic farming inputs, and well-established food and dietary supplement markets. The United States leads regional consumption due to increasing use of fish hydrolysates in pet nutrition and sustainable agriculture. Strong R&D capabilities and the presence of key manufacturers support product innovation. Regulatory support for sustainable by-product utilization further strengthens North America’s market position.

Europe

Europe held 29% market share in 2024, supported by strict environmental regulations and high adoption of circular economy practices. Countries such as Norway, France, and Ireland play a critical role due to strong fisheries, aquaculture operations, and advanced fish processing infrastructure. Fish hydrolysates are widely used in organic agriculture, biostimulants, and aquafeed applications across the region. Growing consumer demand for natural and clean-label food ingredients further supports market growth. Additionally, ongoing research into bioactive peptides for pharmaceutical and nutraceutical applications enhances Europe’s long-term growth outlook.

Asia Pacific

Asia Pacific captured 26% market share in 2024 and represents the fastest-growing regional market for fish hydrolysates. Rapid expansion of aquaculture, particularly in China, India, Vietnam, and Indonesia, drives strong demand for protein-rich and digestible feed ingredients. Increasing agricultural activities and rising awareness of organic inputs further support market expansion. The region benefits from abundant raw material availability due to large-scale fish processing industries. Government initiatives promoting sustainable farming and aquaculture practices, along with growing food and supplement consumption, continue to accelerate regional market growth.

Latin America

Latin America accounted for 8% market share in 2024, supported by expanding aquaculture and agricultural sectors in countries such as Chile, Peru, and Brazil. The region benefits from strong fisheries resources and increasing utilization of fish processing by-products. Fish hydrolysates are gaining traction as natural fertilizers and feed ingredients, particularly in export-oriented aquaculture operations. Growing awareness of sustainable farming practices and improving distribution networks support market development. However, limited processing infrastructure in certain countries slightly restrains faster adoption compared to developed regions.

Middle East & Africa

The Middle East & Africa region held about 5% market share in 2024, reflecting an emerging but steadily growing market. Increasing investments in aquaculture, especially in the Gulf countries, support demand for high-quality feed ingredients such as fish hydrolysates. In Africa, growth is driven by expanding agriculture and rising interest in organic soil enhancers. Limited local processing capacity and lower awareness currently constrain market penetration. However, improving food security initiatives, sustainable farming programs, and gradual development of fisheries infrastructure are expected to support future growth.

Market Segmentations:

By Form:

By Application:

- Food Industries

- Pharmaceuticals

- Feed Industries

- Agriculture

- Others

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Fish hydrolysate market features a moderately fragmented competitive landscape characterized by the presence of both global manufacturers and regional specialists focused on agriculture, feed, and nutraceutical applications. Key players such as Hofseth BioCare ASA, Diana Group S.r.l, Bio-marine Ingredients Ireland, Copalis, Scanbio Marine Group AS, Omega Protein Corporation, Sopropêche, Sociedad Pesquera Landes SA, Janatha Fish Meal & Oil Products, and TC Union Agrotech actively compete through product quality, application-specific formulations, and sustainable sourcing practices. Companies increasingly invest in advanced enzymatic hydrolysis technologies to enhance peptide profiles, improve bioavailability, and ensure consistency. Strategic initiatives include capacity expansions, partnerships with aquaculture and agribusiness firms, and utilization of fish processing by-products to support circular economy objectives. Additionally, players focus on geographic expansion, customized solutions, and regulatory compliance to strengthen market presence and maintain long-term competitiveness.

Key Player Analysis

- Scanbio Marine Group AS

- TC Union Agrotech

- Diana Group S.r.l

- Sociedad Pesquera Landes SA

- Hofseth BioCare ASA

- Janatha Fish Meal & Oil Products

- Omega Protein Corporation

- Sopropêche

- Bio-marine Ingredients Ireland

- Copalis

Recent Developments

- In 2025, BioMar Group completed the acquisition of full ownership of LetSea, enhancing R&D capacity in marine ingredients including functional fish proteins and hydrolysates aimed at improving fish health and performance.

- In February 2025, Hofseth BioCare ASA signed a strategic partnership with Symrise AG to scale its enzymatic hydrolysis capacity and expand market reach for marine-based ingredients in human health and pet nutrition, including financing and exclusive distribution arrangements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Form, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Fish hydrolysate market will witness steady demand growth driven by expanding applications across agriculture, feed, food, and nutraceutical sectors.

- Adoption of fish hydrolysates as natural biostimulants will increase as sustainable and organic farming practices gain wider acceptance.

- Aquaculture and animal nutrition industries will continue to be primary demand generators due to the need for high-digestibility protein sources.

- Advancements in enzymatic hydrolysis technologies will improve product consistency, bioactivity, and application-specific performance.

- Manufacturers will increasingly focus on value-added formulations tailored for precision agriculture and specialty feed applications.

- Utilization of fish processing by-products will strengthen circular economy practices and support sustainability goals.

- Emerging economies will present strong growth opportunities due to expanding aquaculture and agricultural activities.

- Strategic partnerships and capacity expansions will intensify as companies seek to strengthen regional presence.

- Regulatory support for eco-friendly inputs will encourage substitution of synthetic additives with fish-based alternatives.

- Innovation in functional food and nutraceutical applications will broaden the long-term growth potential of the market.

Market Insights

Market Insights