Market Overview:

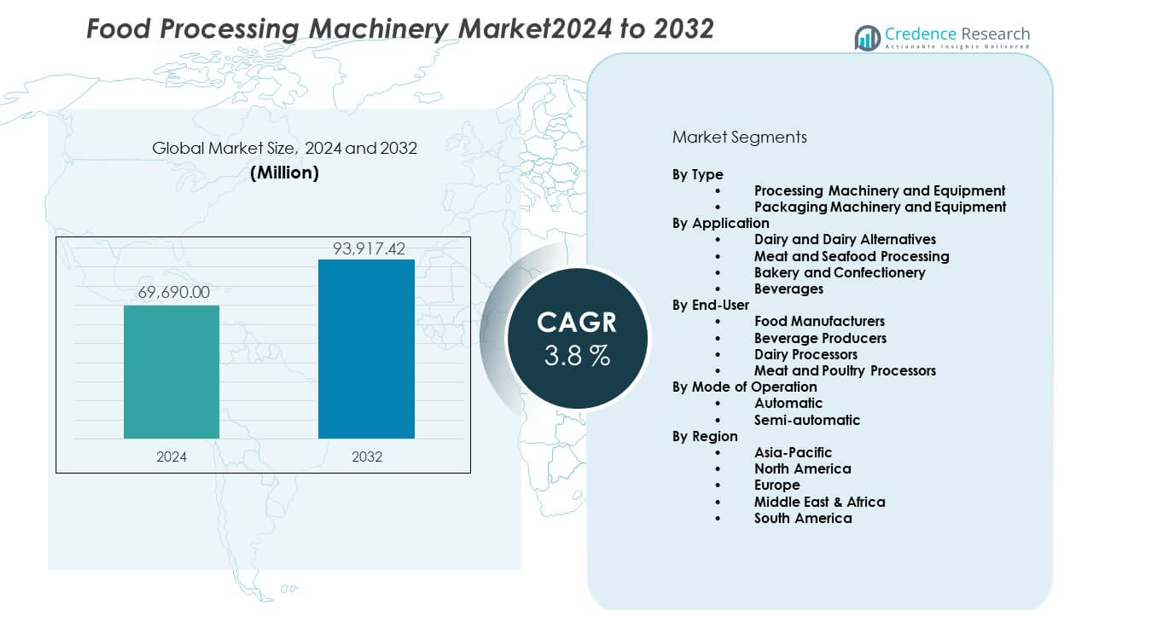

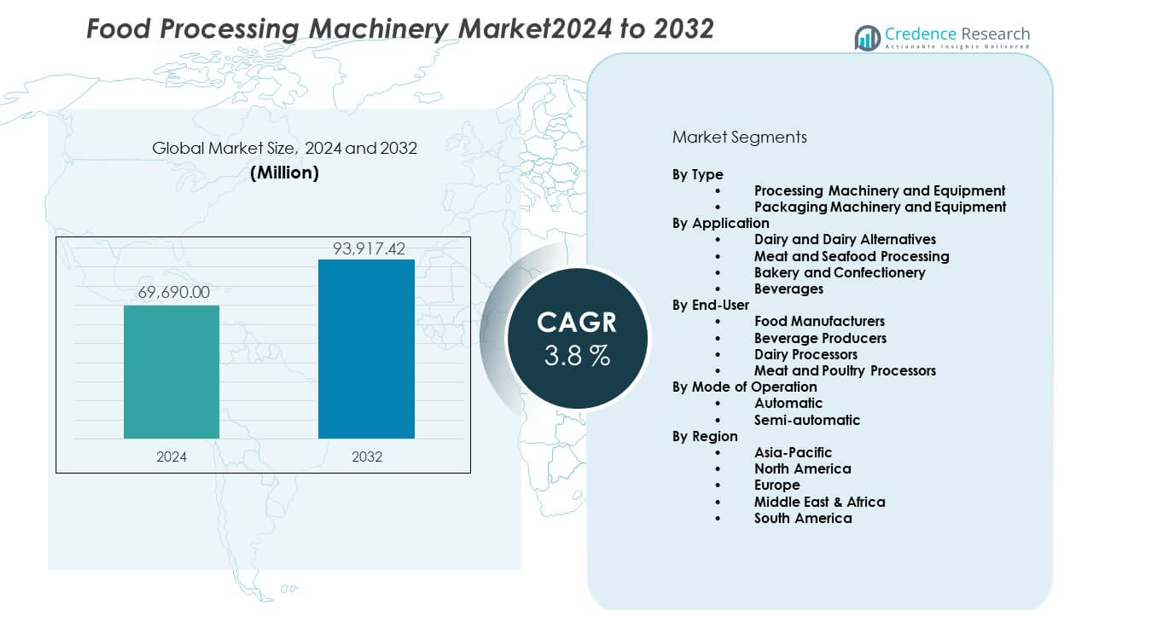

The Food Processing Machinery Market was valued at USD 69,690 million in 2024 and is projected to reach USD 93,917.42 million by 2032, expanding at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Processing Machinery Market Size 2024 |

USD 69,690 million |

| Food Processing Machinery Market, CAGR |

3.8% |

| Food Processing Machinery Market Size 2032 |

USD 93,917.42 million |

Market growth is driven by rising consumption of packaged and processed foods worldwide. Food producers seek machinery that improves productivity and reduces manual handling. Automation helps manufacturers manage labor shortages and control operating costs. Stricter food safety regulations push adoption of hygienic and standardized equipment. Urban lifestyles increase demand for ready-to-eat and convenience foods. Processors invest in energy-efficient and multi-function machines to lower waste. Technological improvements also enable better quality control and longer product shelf life.

North America and Europe lead the market due to advanced food industries and strong safety regulations. The United States, Germany, and France show high adoption of automated processing lines. Asia Pacific is the fastest-emerging region, driven by China, India, and Southeast Asia. Rising population, urbanization, and expanding food manufacturing support growth in this region. Latin America shows steady progress with expanding meat and beverage processing. Middle East and Africa markets grow gradually, supported by food security initiatives and local processing investments.

Market Insights:

- The Food Processing Machinery Market stood at USD 69,690 million in 2024 and will reach USD 93,917.42 million by 2032, growing at a CAGR of 3.8%, supported by steady industrial food production demand.

- Asia-Pacific leads with about 30% share due to large-scale food manufacturing in China and India, while Europe holds nearly 25% driven by strict food safety standards and advanced processing, and North America accounts for around 19% supported by automation-led upgrades.

- Asia-Pacific is also the fastest-growing region with a 30% share, driven by urbanization, rising packaged food consumption, and government support for domestic food processing.

- Processing machinery and equipment dominate by type with over 52% share, reflecting high usage in core production activities across dairy, meat, and bakery operations.

- Automatic mode of operation accounts for about 50.4% share, as large processors prioritize efficiency, labor reduction, and consistent output quality.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand For Processed And Convenience Food Products

Consumers prefer packaged, ready, and shelf-stable food across urban markets. Food producers expand capacity to meet volume and consistency needs. The Food Processing Machinery Market benefits from this shift in eating habits. Equipment supports faster preparation and uniform output. Manufacturers seek machines that ensure repeatable quality. Retail chains expect steady product supply throughout the year. Processors focus on throughput improvement without manual strain. This demand sustains long-term equipment procurement. Production scale drives continuous machinery upgrades.

- For instance, Bühler’s Arrius grinding system or Antares roller mills provide high-capacity grinding for industrial flour production. While a single large-scale milling line can process hundreds of tons of wheat per day to support the packaged food industry, production scale and food safety requirements drive continuous upgrades to integrated digital systems like the Bühler Mercury MES.

Strict Food Safety And Hygiene Compliance Requirements

Governments enforce strong food safety and sanitation standards worldwide. Processors invest in compliant machinery to meet audit norms. The Food Processing Machinery Market aligns with these regulatory needs. Equipment designs support clean surfaces and controlled handling. Automated systems reduce human contact with food. Standardized processing improves traceability and accountability. Food recalls push firms toward reliable equipment. Compliance reduces legal and brand risks. Regulation-driven upgrades remain consistent.

- For instance, Tetra Pak’s aseptic processing systems achieve commercial sterility with heat treatment above 135 °C for a few seconds, extending shelf life without preservatives. Compliance reduces legal and brand risks.

Expansion Of Industrial Food Manufacturing Facilities

Food companies expand plants to serve domestic and export demand. High-capacity machinery supports bulk processing needs. The Food Processing Machinery Market gains from plant modernization plans. Equipment reduces cycle time and process variability. Centralized production requires robust and durable systems. Firms replace legacy units to improve uptime. New facilities prefer integrated processing lines. Capacity growth supports steady equipment demand. Industrial scale favors mechanized solutions.

Labor Efficiency And Cost Control Priorities

Labor shortages affect food manufacturing operations globally. Producers adopt machinery to stabilize output. The Food Processing Machinery Market responds to workforce pressure. Automation reduces dependency on skilled manual labor. Equipment improves shift consistency and reduces fatigue risk. Wage inflation raises interest in capital investment. Machines ensure predictable production schedules. Cost control strengthens profit planning. Efficiency needs reinforce automation demand.

Market Trends:

Integration Of Smart Controls And Digital Monitoring Systems

Processors adopt digital interfaces for real-time control. Smart sensors improve process visibility and precision. The Food Processing Machinery Market reflects this technology shift. Data tracking supports preventive maintenance planning. Operators gain faster response to process deviation. Digital dashboards simplify training requirements. Connectivity improves plant coordination. Analytics support yield improvement goals. Technology adoption reshapes equipment design priorities.

- For instance, GEA’s SmartControl HMI enables real-time monitoring process parameters in dairy processing lines. Analytics support yield improvement goals.

Rising Preference For Modular And Flexible Machine Designs

Food producers handle diverse product portfolios. Modular machinery allows quick configuration changes. The Food Processing Machinery Market adapts to flexible production needs. Equipment supports short batch and seasonal products. Quick changeovers reduce downtime between runs. Manufacturers prefer scalable processing lines. Modular units simplify future capacity expansion. Flexibility supports competitive positioning. Product variety drives this trend.

- For instance, Marel’s modular poultry processing systems enable line reconfiguration within hours instead of days, improving plant utilization rates. Product variety drives this trend.

Growth Of Energy-Efficient And Low-Waste Processing Equipment

Energy costs pressure food manufacturing margins. Efficient machines reduce power consumption. The Food Processing Machinery Market reflects focus on operational efficiency. Equipment limits raw material losses during processing. Process optimization lowers water usage. Sustainability goals influence procurement decisions. Lower waste supports regulatory compliance. Efficiency enhances long-term cost control. Environmental focus shapes innovation.

Customization For Product-Specific Processing Requirements

Food categories demand unique processing conditions. Equipment suppliers offer tailored solutions. The Food Processing Machinery Market supports customized engineering demand. Machinery adapts to texture and temperature needs. Custom designs improve product consistency. Producers value equipment tuned to recipes. Standard machines fail to meet niche needs. Customization strengthens supplier relationships. Specialized food segments drive this trend.

Market Challenges Analysis:

High Capital Investment And Long Payback Periods

Processing machinery requires significant upfront capital. Small processors face funding constraints. The Food Processing Machinery Market experiences adoption delays in cost-sensitive regions. Equipment financing limits purchasing decisions. Long payback periods affect investment planning. Market volatility raises financial risk concerns. Currency fluctuations impact imported machinery costs. Budget pressure slows replacement cycles. Capital intensity restricts rapid adoption.

Technical Complexity And Maintenance Skill Gaps

Advanced machines require skilled operation and upkeep. Training gaps affect performance efficiency. The Food Processing Machinery Market faces service dependency challenges. Downtime rises due to limited technical support. Spare part availability affects continuity. Complex controls increase learning curves. Maintenance costs affect ownership economics. Skill shortages limit automation benefits. Reliability concerns influence buyer confidence.

Market Opportunities:

Growth Potential In Emerging Food Manufacturing Economies

Emerging economies expand local food processing capacity. Urban growth boosts packaged food demand. The Food Processing Machinery Market finds strong opportunity in these regions. Governments support domestic food production. Import substitution encourages local processing. Infrastructure investment improves plant readiness. Rising incomes support processed food consumption. Equipment suppliers gain new customer bases.

Rising Adoption Of Export-Oriented Food Processing Operations

Food exporters require standardized processing systems. Quality consistency supports global trade acceptance. The Food Processing Machinery Market benefits from export compliance needs. Machines enable uniform packaging and preservation. Export regulations favor controlled processing environments. Producers upgrade facilities for global markets. Shelf-life improvement supports long-distance shipping. Export growth drives equipment demand.

Market Segmentation Analysis:

By Type

Processing machinery and equipment dominate core production activities across food facilities. The Food Processing Machinery Market reflects strong demand for cutting, mixing, cooking, and separation systems. These machines support throughput consistency and product safety. Packaging machinery and equipment play a critical role in preservation and distribution. Packaging systems improve shelf life and handling efficiency. Producers select packaging solutions to meet branding and logistics needs. Both types support scalable and compliant operations. Equipment selection depends on product category and output volume.

- For instance, Krones’ high-speed filling lines handle up to 80,000 bottles per hour in beverage plants.

By Application

Dairy and dairy alternatives lead usage due to continuous processing needs. The Food Processing Machinery Market serves this segment with pasteurization and homogenization systems. Meat and seafood processing relies on precision equipment for hygiene and yield control. Bakery and confectionery segments demand mixing and forming accuracy. Beverage processing requires filling and bottling precision. Each application values reliability and process control. Equipment design adapts to texture and temperature needs. Application diversity supports steady machinery demand.

- For instance, Alfa Laval’s plate heat exchangers operate at pressures up to 25 bar, supporting stable thermal processing in dairy and beverage applications.

By End-User

Food manufacturers represent the largest end-user group. The Food Processing Machinery Market supports large-scale and multi-product operations. Beverage producers invest in high-speed processing lines. Dairy processors require equipment that ensures product consistency. Meat and poultry processors focus on sanitation and yield optimization. End-users prioritize uptime and regulatory compliance. Equipment choices align with production scale. Long-term use favors durable machinery.

By Mode of Operation

Automatic systems lead adoption across large facilities. The Food Processing Machinery Market reflects preference for automation to improve efficiency. Automatic machines reduce labor dependency and process variation. Semi-automatic systems suit small and mid-sized processors. These systems offer flexibility with lower capital cost. Operators retain process control in semi-automatic setups. Both modes serve distinct operational needs. Mode selection depends on scale and budget.

Segmentation:

By Type

- Processing Machinery and Equipment

- Packaging Machinery and Equipment

By Application

- Dairy and Dairy Alternatives

- Meat and Seafood Processing

- Bakery and Confectionery

- Beverages

By End-User

- Food Manufacturers

- Beverage Producers

- Dairy Processors

- Meat and Poultry Processors

By Mode of Operation

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific

Asia-Pacific accounts for approximately 30% share of the Food Processing Machinery Market. China and India lead demand through rapid expansion of food manufacturing capacity. Urban population growth supports higher consumption of packaged foods. Governments promote domestic processing to strengthen food security. It benefits from strong demand across dairy, grains, and ready meals. Local producers adopt cost-efficient machinery to support scale. Regional growth remains structurally strong.

North America

North America holds nearly 19% share of the Food Processing Machinery Market. The United States drives adoption through advanced processing facilities. Strict food safety standards support continuous equipment upgrades. It shows strong demand from meat, bakery, and beverage segments. Automation supports labor efficiency and output consistency. Canada and Mexico benefit from integrated food supply chains. Replacement demand sustains stable growth.

Europe, Middle East & Africa, and South America

Europe represents around 25% share of the Food Processing Machinery Market, led by Germany, France, and Italy. Strong compliance requirements drive advanced machinery use. Middle East & Africa hold close to 10% share, supported by food security investments. South America accounts for about 8% share, led by Brazil and Argentina. Meat and beverage processing support equipment demand. Infrastructure development improves adoption rates across these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BAADER Group

- Marel

- Bühler AG

- GEA Group Aktiengesellschaft

- The Middleby Corporation

- Tetra Laval International S.A.

- Alfa Laval

- Krones AG

- JBT Corporation

- SPX Flow Inc.

Competitive Analysis:

The Food Processing Machinery Market features strong competition among global and regional manufacturers. Leading players focus on product reliability, automation depth, and application-specific solutions. It shows high emphasis on food safety compliance and operational efficiency. Companies invest in R&D to improve throughput and energy use. Portfolio breadth helps suppliers serve dairy, meat, bakery, and beverage processors. Strategic acquisitions strengthen geographic reach and service capability. Established brands benefit from long-term customer relationships. Competitive pressure remains high due to price sensitivity and technology parity.

Recent Developments:

- ITT Inc. entered into a definitive agreement with Lone Star Funds to acquire SPX FLOW on December 5, 2025, for a total consideration of $4.775 billion in cash and equity, representing 14.2 times SPX FLOW’s forecasted full year 2026 adjusted EBITDA. SPX FLOW, a leading provider of engineered equipment and process technologies, generated $1.3 billion in revenue in the trailing twelve months ending September 27, 2025, with approximately 42% gross margin and over 21% EBITDA margin, with 43% of revenue from aftermarket sales. The company’s premier brands include Waukesha Cherry-Burrell, Lightnin, and Bran+Luebbe, with operations in more than 25 countries and sales in more than 140 nations. The transaction is expected to close by end of Q1 2026, with ITT estimating $80 million in run-rate cost synergies by end of year three post-close.

- Bühler acquired innovative puffing technology from CEREX on January 15, 2025, for food, petfood, and feed applications. The versatile technology is applicable to snacks, ready-to-eat breakfast cereals, confectionery, bakery items, and dairy products. On June 12, 2025, Bühler opened its Puffing Application Center at its headquarters in Uzwil, Switzerland, providing food and feed producers with industrial-scale capabilities to test new product recipes and develop new processes. The center is fully integrated into Bühler’s network of research and training facilities, enabling customers to develop complete product concepts within a unified innovation process.

Report Coverage:

The research report offers an in-depth analysis based on By Type, By Application, By End-User, By Mode of Operation, and By Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Automation adoption will increase across large and mid-sized food processing facilities.

- Demand for hygienic and compliant machinery will strengthen due to tighter safety norms.

- Emerging economies will expand domestic food processing capacity to reduce import reliance.

- Modular and flexible machinery designs will gain wider acceptance among multi-product processors.

- Energy-efficient equipment will influence purchasing decisions to control operating costs.

- Custom-built processing solutions will grow across specialty and value-added food segments.

- Digital monitoring features will support better process visibility and quality control.

- Replacement demand will sustain sales in mature and developed markets.

- Supplier partnerships will expand service coverage and technical support reach.

- Product innovation will focus on productivity improvement and output consistency.