Market Overview

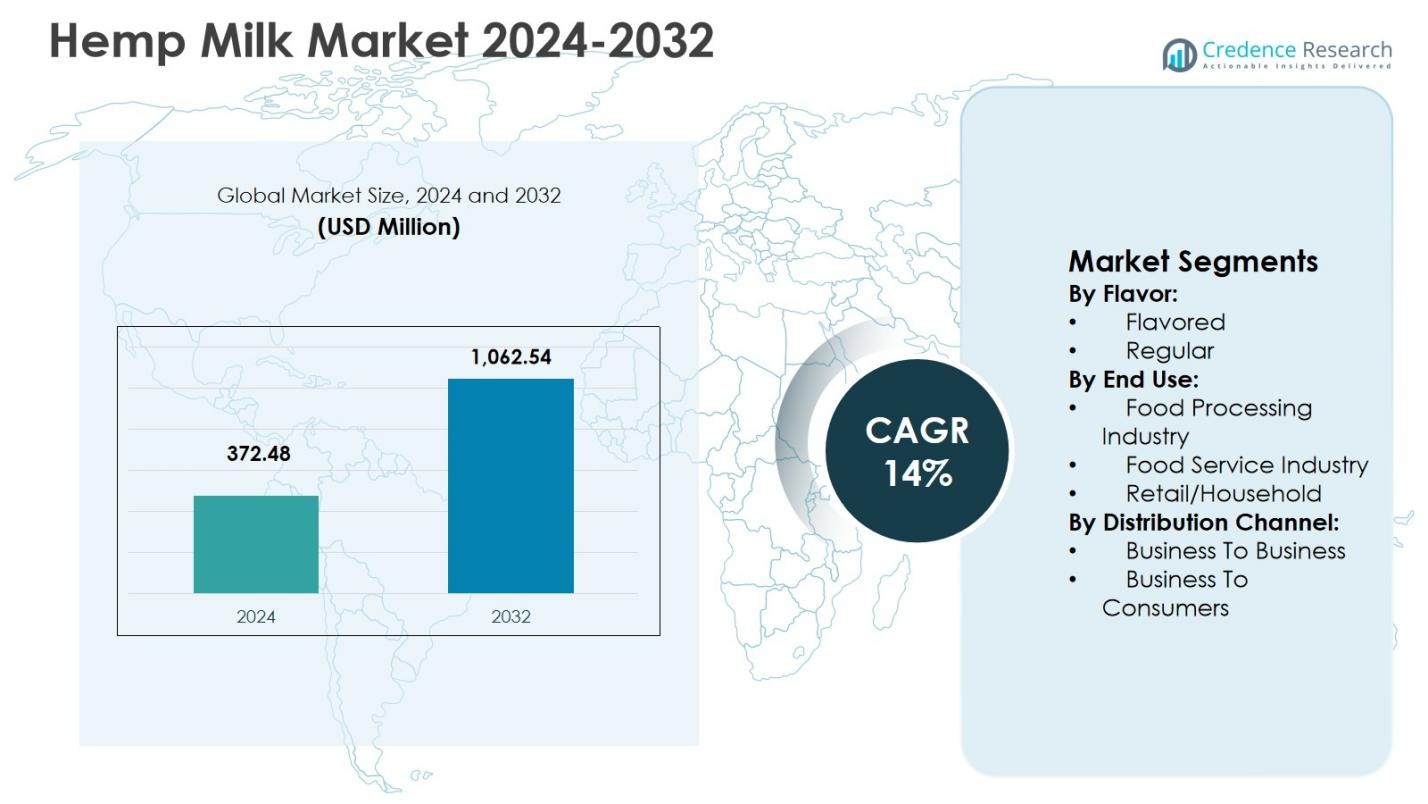

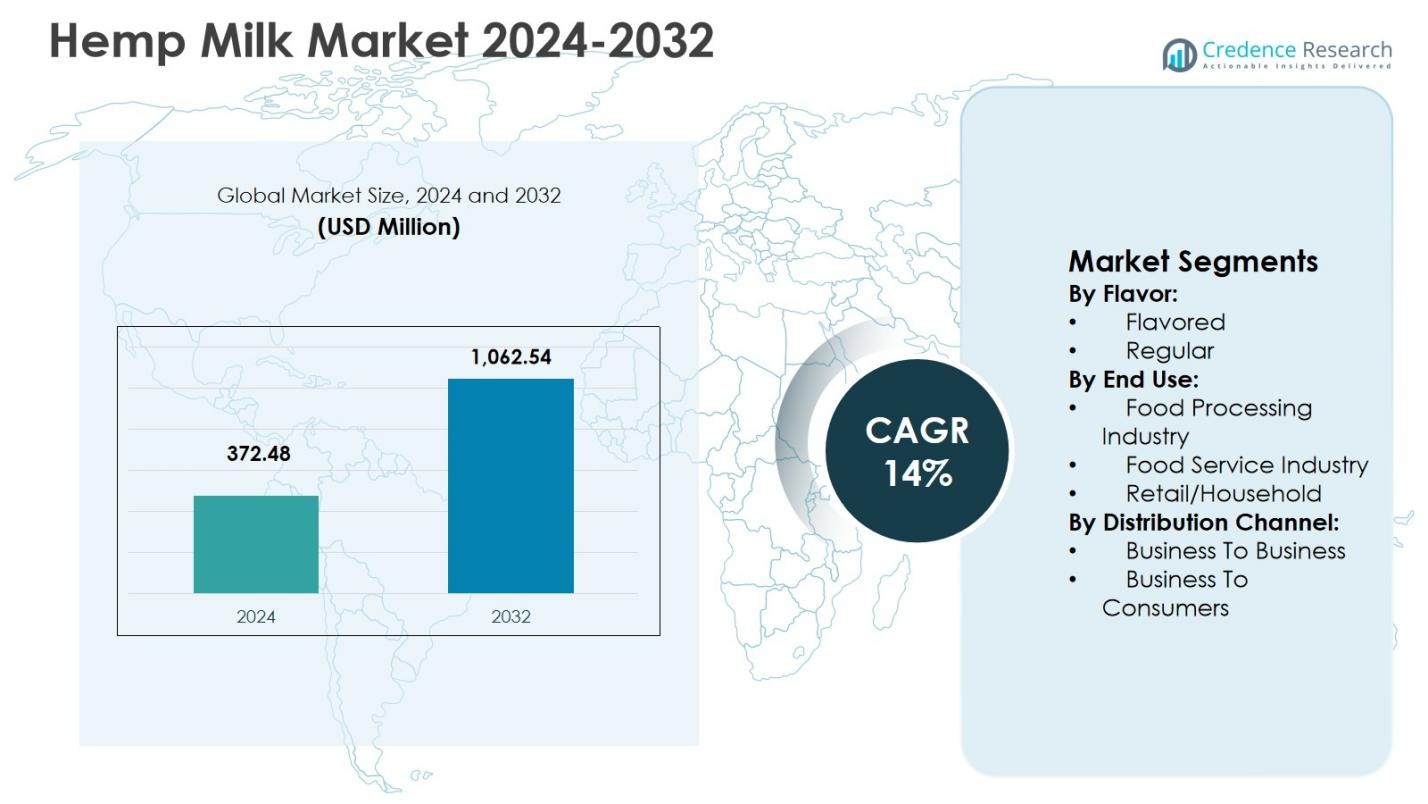

Hemp Milk Market size was valued USD 372.48 million in 2024 and is anticipated to reach USD 1,062.54 million by 2032, at a CAGR of 14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hemp Milk Market Size 2024 |

USD 372.48 Million |

| Hemp Milk Market, CAGR |

14% |

| Hemp Milk Market Size 2032 |

USD 1,062.54 Million |

Hemp milk market is shaped by the presence of established and emerging players including SunOpta, Pacific Foods, Living Harvest Foods, Good Mylk Co., EcoMil, California Natural Products, Hudson River Foods, Braham & Murray (Good Hemp), Golden Hemp Company LLC, and Z-Company. These companies focus on clean-label formulations, organic certifications, and product diversification to strengthen brand positioning and expand consumer reach. Strategic emphasis on retail expansion, e-commerce penetration, and direct-to-consumer sales supports volume growth. Regionally, North America leads the Hemp milk market with an exact 38.6% market share in 2024, driven by high adoption of plant-based beverages, strong health awareness, and well-developed distribution infrastructure, followed by Europe and Asia Pacific showing steady growth momentum.

Market Insights

Market Insights

- The Hemp milk market was valued at USD 372.48 million in 2024 and is projected to reach USD 1,062.54 million by 2032, growing at a CAGR of 14% during the forecast period, supported by rising adoption of plant-based beverages.

- Growth of the Hemp milk market is driven by increasing lactose intolerance, vegan lifestyles, and health-conscious consumers seeking dairy-free, cholesterol-free, and omega-3-rich alternatives.

- Market trends indicate rising demand for clean-label products, flavor diversification, and fortified hemp milk variants, with the Regular (unflavored) segment leading at 61.3% share in 2024 and Retail/Household end use dominating with 54.7%.

- Market restraints include higher pricing compared to dairy milk, limited consumer awareness, and supply chain challenges linked to hemp cultivation regulations, which affect affordability in price-sensitive regions.

- Regionally, North America led the Hemp milk market with 38.6% share in 2024, followed by Europe at 32.4% and Asia Pacific at 21.1%, while Latin America and Middle East & Africa together accounted for 7.9% share, indicating emerging growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Flavor:

The Hemp Milk Market by flavor is led by the Regular (unflavored) segment, which accounted for 61.3% market share in 2024, driven by its broad acceptance across health-conscious consumers and clean-label preferences. Regular hemp milk is widely used as a direct dairy substitute in beverages, cereals, and cooking applications due to its neutral taste and nutritional profile. Demand is further supported by rising vegan adoption, lactose intolerance, and preference for low-sugar products. Meanwhile, flavored variants continue to gain traction among younger consumers seeking taste variety, but their adoption remains secondary to functional and nutritional considerations.

- For instance, Pacific Foods Unsweetened Hemp Milk, made from hulled hemp seeds, offers a smooth nutty texture with added calcium, vitamin D, and omega-3 ALA per cup as a vegan dairy alternative. It works well in baking, soups, hot beverages, or as a creamer without overpowering flavors.

By End Use:

By end use, the Retail/Household segment dominated the Hemp Milk Market with a 54.7% share in 2024, supported by increasing at-home consumption of plant-based beverages. Growth is driven by rising awareness of hemp milk’s omega-3 content, protein value, and allergen-free nature, making it a preferred alternative to soy and almond milk. Expanding availability through supermarkets and online grocery platforms further strengthens household penetration. The food processing and food service industries also contribute to demand, particularly in vegan product formulations and specialty cafés, but household consumption remains the primary revenue driver.

- For instance, Living Harvest Tempt Unsweetened Original Hemp Milk. Sold at H-E-B and other grocers, it provides 6g polyunsaturated fats per serving from hemp seeds, plus all 10 essential amino acids for household uses like smoothies and cereal.

By Distribution Channel:

The Business to Consumers (B2C) channel held the dominant position in the Hemp Milk Market, capturing 68.9% market share in 2024, owing to strong direct retail sales through supermarkets, specialty health stores, and e-commerce platforms. B2C growth is driven by improved product visibility, brand marketing, and rising impulse purchases of plant-based beverages. E-commerce expansion and subscription-based delivery models further enhance consumer access. In contrast, the B2B segment supports steady volumes through bulk procurement for food service and processing, but consumer-led retail demand remains the key growth engine.

Key Growth Drivers

Rising Demand for Plant-Based and Dairy-Free Beverages

The Hemp Milk Market is strongly driven by the growing consumer shift toward plant-based and dairy-free beverage alternatives. Increasing prevalence of lactose intolerance, milk allergies, and vegan lifestyles has accelerated demand for non-dairy milk options. Hemp milk benefits from its natural nutritional profile, offering omega-3 fatty acids, plant-based protein, and low saturated fat content. Additionally, rising awareness of sustainable food consumption and ethical sourcing supports adoption. These factors collectively position hemp milk as a preferred alternative within the expanding plant-based beverage category.

- For instance, Good Hemp offers Seed Milk as a low-sugar dairy-free option rich in omega-3 fatty acids, providing 50% of the recommended daily intake per glass. This supports heart health and brain function through its polyunsaturated fats.

Increasing Health and Wellness Awareness

Heightened consumer focus on health, nutrition, and preventive wellness continues to fuel growth in the Hemp Milk Market. Consumers are increasingly selecting beverages that support heart health, digestive balance, and overall immunity. Hemp milk aligns with these preferences due to its cholesterol-free composition and favorable fatty acid balance. Clean-label formulations and minimal processing further enhance product appeal. Manufacturers are emphasizing nutritional transparency and functional benefits, which strengthens consumer confidence and supports sustained market expansion.

- For instance, Pacific Foods Original Hemp Milk delivers 260mg of calcium and 1mg of iron per cup, nutrients that bolster immune function and oxygen transport in fortified, vegan servings. The product’s transparency in listing hemp seed as the primary ingredient enhances trust in its functional benefits.

Expansion of Retail and E-Commerce Distribution

The rapid expansion of retail networks and digital commerce platforms is a major growth driver for the Hemp Milk Market. Supermarkets, specialty health stores, and online grocery platforms have significantly improved product visibility and accessibility. E-commerce channels enable direct-to-consumer engagement, subscription models, and wider geographic reach. These channels support impulse buying and repeat purchases while allowing brands to communicate sustainability and nutritional benefits effectively, thereby accelerating overall market penetration.

Key Trends & Opportunities

Product Innovation and Flavor Diversification

Product innovation represents a key trend and opportunity within the Hemp Milk Market. Manufacturers are introducing flavored, fortified, and barista-grade hemp milk variants to attract diverse consumer segments. Additions such as vitamins, minerals, and natural sweeteners enhance functional value and broaden usage occasions. Flavor diversification helps address taste barriers associated with plant-based beverages, supporting increased adoption among younger consumers and mainstream households. In addition, improved texture, shelf stability, and foam performance are enabling wider use in coffee applications and ready-to-drink formats, further strengthening consumer acceptance and repeat purchase behavior.

- For instance, Pacific Foods Barista Series Hemp Milk uses hulled hemp seed and brown rice syrup to create smooth, glossy micro-foam ideal for latte art, with no burnt notes even in cold drinks. Improved texture and foam performance enable wider coffee shop applications and consumer acceptance.

Rising Demand for Sustainable and Eco-Friendly Nutrition

Sustainability is emerging as a significant opportunity in the Hemp Milk Market, driven by growing environmental awareness. Hemp cultivation requires less water and fewer chemical inputs compared to conventional dairy and other plant-based sources. Brands highlighting low carbon footprints, recyclable packaging, and ethical sourcing are gaining competitive advantage. This alignment with environmental values enhances brand loyalty and creates long-term growth opportunities across eco-conscious consumer segments. Additionally, transparency in sustainability claims and third-party certifications are strengthening consumer trust and supporting premium positioning within the expanding plant-based beverage category.

- For instance, Fresh Hemp Foods holds B-Corp certification, guiding decisions with a triple-bottom-line focus on people, planet, and profits. They also secured Carbonzero Certification by quantifying emissions across facilities and purchasing offsets for net-zero impact.

Key Challenges

Limited Consumer Awareness and Perception Barriers

Despite growing adoption, limited awareness and misconceptions remain key challenges for the Hemp Milk Market. Some consumers associate hemp with regulatory concerns or lack clarity regarding its nutritional benefits. Taste perception also acts as a barrier compared to more established alternatives such as almond and oat milk. Overcoming these challenges requires sustained consumer education, clear labeling, and targeted marketing strategies to improve product understanding and acceptance. In addition, sampling initiatives, in-store promotions, and influencer-led campaigns can help normalize hemp milk consumption and build familiarity among first-time buyers.

Pricing Pressure and Supply Chain Constraints

Higher pricing compared to conventional dairy milk presents a challenge for broader adoption of hemp milk. Costs associated with hemp seed sourcing, processing, and certification impact final product pricing. Additionally, regional variability in hemp cultivation regulations can affect supply stability. These factors place pressure on manufacturers to optimize production efficiency and sourcing strategies while maintaining quality, potentially limiting market penetration in price-sensitive regions. Scaling production, improving processing technologies, and developing local sourcing networks are increasingly necessary to reduce costs and support competitive pricing strategies.

Regional Analysis

North America

North America leads the Hemp Milk Market, accounting for 38.6% market share in 2024, supported by strong consumer adoption of plant-based beverages. High awareness of lactose intolerance, vegan diets, and clean-label nutrition significantly drives demand across the United States and Canada. Well-established retail infrastructure, wide product availability, and strong brand presence further strengthen regional growth. Consumers increasingly prefer hemp milk for its omega-3 content and sustainability profile. Continuous product innovation, flavored variants, and expansion of e-commerce channels continue to reinforce North America’s dominant position in the global hemp milk landscape.

Europe

Europe held a 32.4% market share in 2024, positioning it as the second-largest region in the Hemp Milk Market. Growth is driven by rising vegan populations, stringent sustainability regulations, and strong consumer preference for organic and non-GMO products. Countries such as Germany, the United Kingdom, and France show high adoption due to advanced health awareness and environmental consciousness. Retail penetration through supermarkets and specialty health stores remains strong. Additionally, supportive regulations for hemp cultivation and processing contribute to supply stability, enabling manufacturers to expand product offerings and meet rising consumer demand efficiently.

Asia Pacific

Asia Pacific captured 21.1% market share in 2024, driven by increasing urbanization, changing dietary habits, and rising disposable incomes. Growing awareness of plant-based nutrition in countries such as China, Australia, and Japan supports market expansion. Consumers are increasingly shifting toward dairy alternatives due to digestive health concerns and lifestyle changes. Expanding modern retail formats and online grocery platforms enhance accessibility across urban centers. While the market is still developing compared to Western regions, increasing investments by regional and international players are accelerating product availability and long-term growth potential.

Latin America

Latin America accounted for 4.6% market share in 2024, reflecting steady but emerging adoption of hemp milk products. Growth is supported by rising health awareness, increasing vegan consumer base, and gradual expansion of plant-based food categories. Brazil and Mexico are key contributors, driven by improving retail distribution and growing interest in functional beverages. Although price sensitivity remains a challenge, increasing availability through supermarkets and online platforms supports demand. Manufacturers are focusing on affordability and localized marketing strategies to strengthen penetration and expand consumer acceptance across the region.

Middle East & Africa

The Middle East & Africa region held 3.3% market share in 2024, indicating early-stage market development for hemp milk. Growth is driven by increasing health consciousness, rising lactose intolerance, and gradual adoption of plant-based diets in urban areas. Countries such as the UAE and South Africa show improving demand due to premium retail expansion and exposure to global food trends. Limited awareness and regulatory variations continue to restrict rapid growth. However, increasing imports, expanding health food stores, and evolving consumer preferences present long-term growth opportunities for the region.

Market Segmentations:

By Flavor:

By End Use:

- Food Processing Industry

- Food Service Industry

- Retail/Household

By Distribution Channel:

- Business To Business

- Business To Consumers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Hemp Milk Market includes key players such as SunOpta, Pacific Foods, Living Harvest Foods, Good Mylk Co., EcoMil, California Natural Products, Hudson River Foods, Braham & Murray (Good Hemp), Golden Hemp Company LLC, and Z-Company. The market remains moderately fragmented, with established brands leveraging strong retail partnerships and product diversification to expand their presence. Companies focus on clean-label formulations, organic certifications, and fortified product lines to differentiate offerings. Strategic emphasis on direct-to-consumer channels, private-label manufacturing, and regional expansion strengthens market positioning. Innovation in flavor profiles and barista-grade variants supports penetration into foodservice channels. Additionally, players are investing in sustainable sourcing and eco-friendly packaging to align with consumer preferences. Competitive intensity is increasing as new entrants target niche health segments, driving continuous product improvement and marketing investment across global markets.

Key Player Analysis

- EcoMil

- SunOpta

- Good Mylk Co.

- Golden Hemp Company LLC

- Hudson River Foods

- Pacific Foods

- Z-COMPANY

- Living Harvest Foods

- Braham & Murray (Good Hemp)

- California Natural Products

Recent Developments

- In February 2024, Manitoba Harvest Hemp Foods partnered with Brightseed to launch Manitoba Harvest Bioactive Fiber, an innovative bioactive-rich fiber solution exclusively available at Whole Foods Market stores nationwide.

- In June 2023, Good Hemp introduced a fortified hemp seed milk range, available in the U.K. and enhanced with calcium and vitamin D to meet the requirements of health-conscious consumers.

- In February 2022, Gaia’s Farming Co. launched a new line of plant-based milk products made from hemp and oats. The company introduced two products: Hemp & Oat Mlk and Hemp & Coco Mlk, both organic, vegan, and free from dairy, soy, and nuts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Flavour, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The hemp milk market will continue expanding due to rising adoption of plant-based and dairy-free beverages across global consumer segments.

- Increasing awareness of lactose intolerance and milk allergies will support sustained demand growth in both developed and emerging regions.

- Product innovation focusing on improved taste, texture, and nutritional fortification will enhance mainstream consumer acceptance.

- Expansion of retail and e-commerce channels will improve product accessibility and drive higher household penetration.

- Foodservice adoption, particularly in cafés and specialty beverage outlets, will strengthen volume demand.

- Sustainability-driven purchasing behavior will favor hemp milk due to its lower environmental impact compared to conventional dairy.

- Regulatory clarity and broader approval for hemp-derived food products will improve supply stability and market confidence.

- Strategic partnerships between manufacturers and retailers will accelerate geographic expansion.

- Private-label and regional brands will increase competition and encourage price optimization.

- Rising health-focused marketing and consumer education initiatives will reinforce long-term market growth.

Market Insights

Market Insights