Market Overview

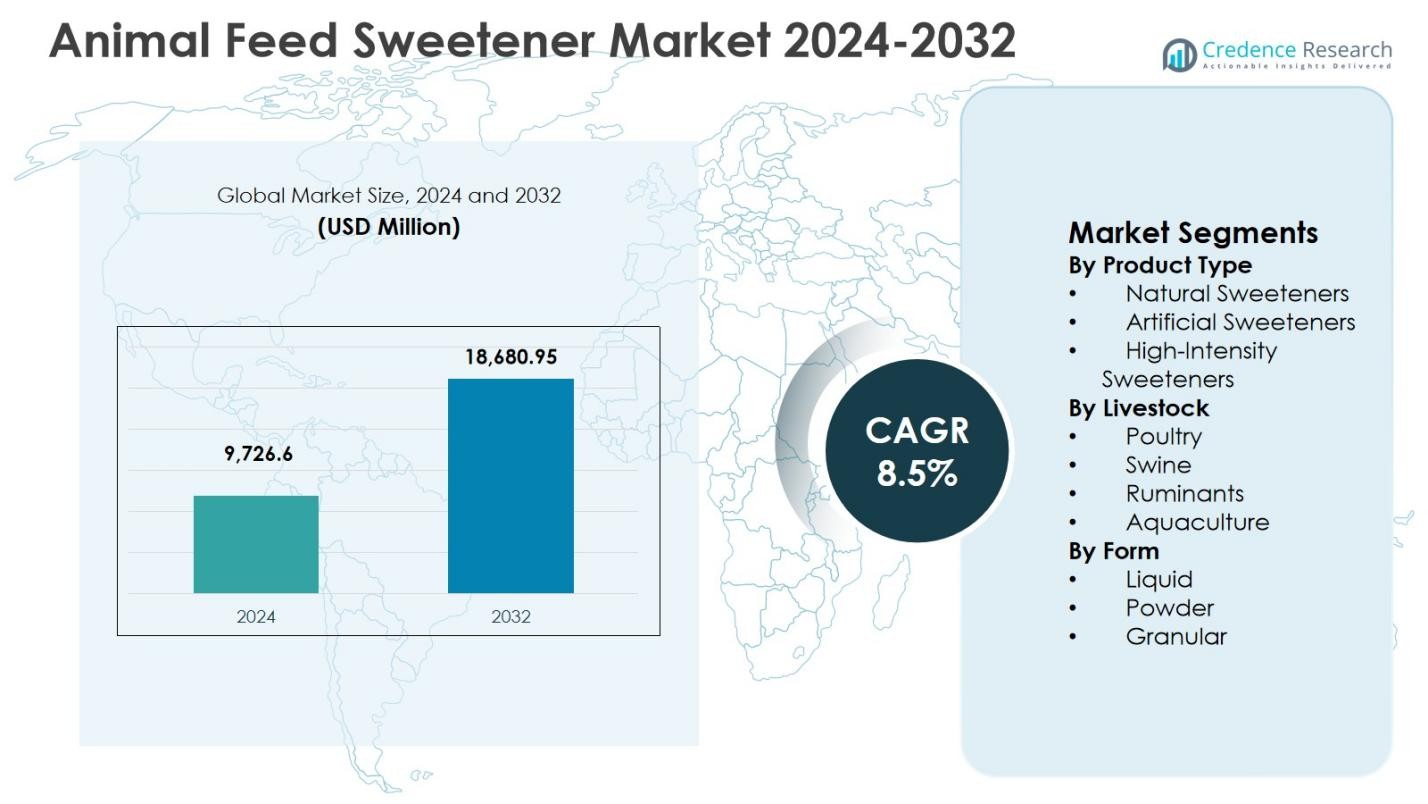

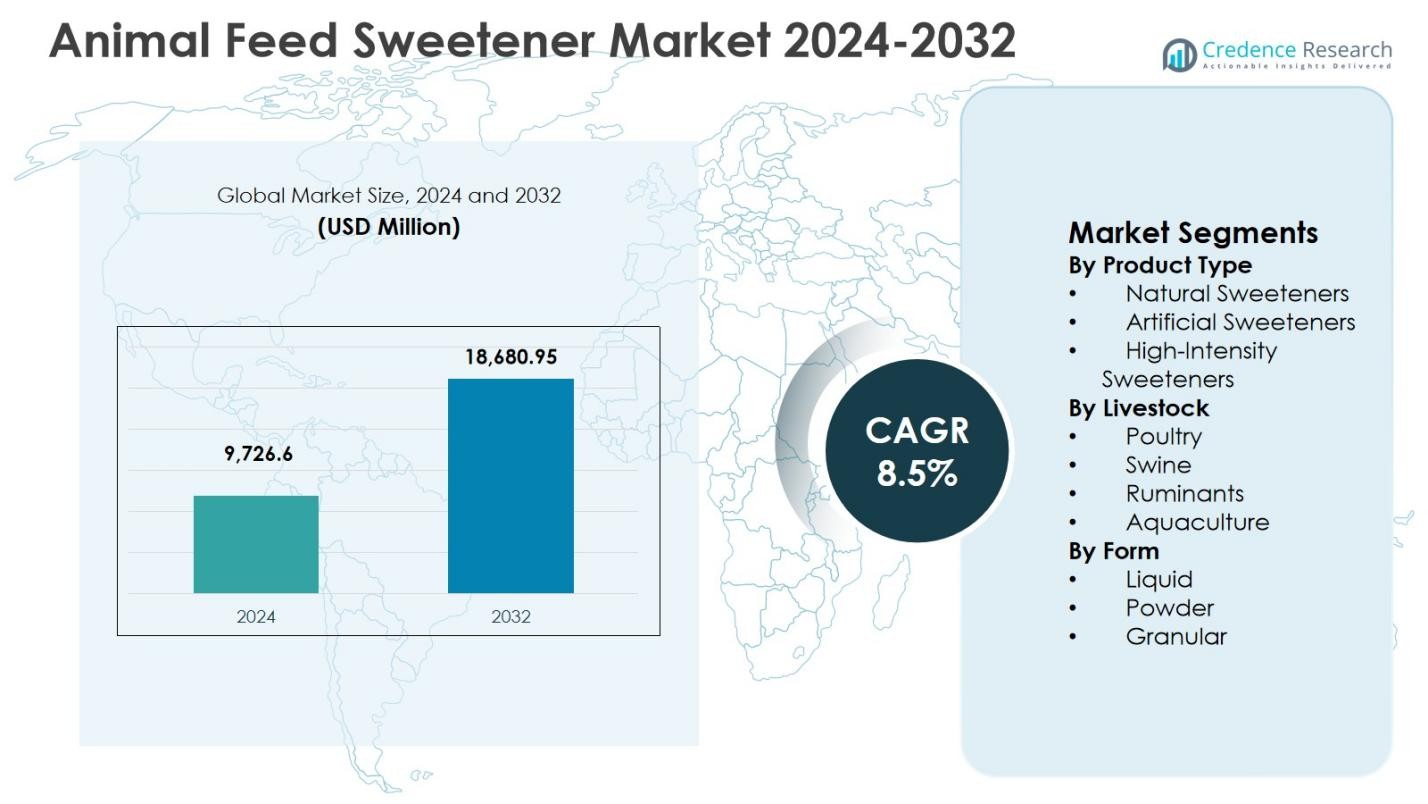

Animal Feed Sweetener Market size was valued at USD 9,726.6 million in 2024 and is anticipated to reach USD 18,680.95 million by 2032, growing at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Feed Sweetener Market Size 2024 |

USD 9,726.6 Million |

| Animal Feed Sweetener Market, CAGR |

8.5% |

| Animal Feed Sweetener Market Size 2032 |

USD 18,680.95 Million |

Animal Feed Sweetener Market is shaped by the strong presence of multinational feed ingredient manufacturers with broad portfolios and global distribution capabilities. Key players such as Cargill, Incorporated; Archer Daniels Midland Company (ADM); Kerry Group plc; BASF SE; DuPont de Nemours, Inc.; Ingredion Incorporated; Tate & Lyle PLC; Alltech, Inc.; Nutreco N.V.; and Kemin Industries, Inc. focus on product innovation, natural sweetener expansion, and species-specific formulations to enhance feed intake efficiency. Asia-Pacific leads the market with a 34.6% share in 2024, driven by large-scale poultry and livestock production, followed by North America holding 27.8% share, supported by advanced feed manufacturing practices. Europe accounted for 23.1% share, reflecting strong regulatory compliance and clean-label adoption across animal nutrition systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The Animal Feed Sweetener Market was valued at USD 9,726.6 million in 2024 and is projected to reach USD 18,680.95 million by 2032, registering a CAGR of 8.5% during the forecast period, supported by rising adoption of functional feed additives across livestock segments.

- Growth is driven by increasing focus on feed palatability and intake efficiency, with poultry holding the largest livestock share at 39.4% in 2024 and natural sweeteners leading by product type with a 46.8% segment share.

- Key market trends include rising demand for clean-label and plant-based sweeteners and growing use of high-intensity sweeteners due to low inclusion rates and cost efficiency in large-scale feed formulations.

- Market structure is shaped by established global players focusing on innovation, regional capacity expansion, and partnerships with compound feed producers to strengthen distribution and product reach.

- Asia-Pacific led with a 34.6% regional share in 2024, followed by North America at 27.8% and Europe at 23.1%, while raw material price volatility and regulatory complexity remain key restraints.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type:

The Animal Feed Sweetener Market by product type is led by Natural Sweeteners, which accounted for 46.8% market share in 2024, driven by rising demand for clean-label, plant-derived, and safe feed additives. Natural sweeteners such as molasses and stevia-based ingredients improve palatability while aligning with regulatory preferences and consumer pressure for natural animal nutrition. Artificial Sweeteners held 32.1% share, supported by cost efficiency and consistent sweetness intensity, particularly in large-scale feed production. High-Intensity Sweeteners, with 21.1% share, are gaining traction due to low inclusion rates and enhanced feed intake efficiency.

- For instance, Indiana Sugars produces liquid molasses-based feed supplements for dairy and beef cattle that improve palatability by providing easily fermentable sugars with approximately 2/3 of the energy value of corn, supporting dairy performance through enhanced milk fat and protein content.

By Livestock:

By livestock, Poultry dominated the Animal Feed Sweetener Market with a 39.4% share in 2024, supported by high global poultry production, shorter growth cycles, and strong focus on feed conversion efficiency. Sweeteners enhance feed intake and uniform growth in broilers and layers. Swine followed with 28.7% share, driven by the need to improve palatability during weaning stages. Ruminants accounted for 20.3%, supported by demand for improved feed acceptance in dairy and beef cattle, while Aquaculture held 11.6%, driven by expanding commercial fish farming.

- For instance, Phytobiotics’ Piggysweet, combining saccharin with Neohesperidin (NHDC), targets piglet feed to boost palatability at weaning. ADM’s SUCRAM M’I Sweet and Specifeek, saccharin-free options from Pancosma, activate swine sweet taste receptors for better young pig feed consumption.

By Form:

Based on form, Liquid sweeteners led the Animal Feed Sweetener Market with a 44.9% share in 2024, owing to easy blending, uniform distribution in feed, and higher absorption efficiency. Liquid formats are widely adopted in compound feed and on-farm mixing operations. Powder sweeteners captured 34.6% share, supported by longer shelf life, ease of storage, and compatibility with dry feed formulations. Granular sweeteners, holding 20.5% share, are used in specialized feed applications where controlled release and handling stability are required, particularly in ruminant and specialty livestock feeds.

Key Growth Drivers

Rising Focus on Feed Palatability and Intake Efficiency

The Animal Feed Sweetener Market is strongly driven by the growing emphasis on improving feed palatability to enhance intake efficiency and livestock performance. Sweeteners help mask bitter feed components, encouraging consistent consumption across poultry, swine, and ruminants. Improved palatability directly supports better feed conversion ratios, weight gain, and animal health outcomes. This driver is particularly significant in young and stress-prone animals, where feed refusal can impact productivity. As producers seek to optimize output while controlling feed costs, the adoption of feed sweeteners continues to expand steadily.

- For instance, in Xiangdong black goats fed chopped rice straw, stevioside supplementation at 400-800 mg/kg dry matter linearly increased forage dry matter intake from 370 g/d to 393 g/d. This improved total diet intake without altering mastication time, aiding young ruminants’ performance.

Expansion of Commercial Livestock and Poultry Production

Rapid growth in commercial livestock and poultry farming is a major driver of the Animal Feed Sweetener Market. Increasing global demand for meat, dairy, and eggs has intensified focus on high-performance feed solutions that support faster growth and uniform production. Sweeteners play a critical role in standardized feed formulations used in large-scale operations by improving feed acceptance and reducing wastage. The shift toward intensive farming systems, especially in Asia-Pacific and Latin America, further accelerates demand for functional feed additives, including both natural and artificial sweeteners.

- For instance, ADM’s SUCRAM range, including SUCRAM M’I Sweet and SUCRAM Specifeek, targets weanling piglets to improve feed palatability during the shift from liquid to solid feed. Piglets fed Sucram-sweetened feed consumed 6% more feed daily, yielding 4.7% greater body weight gain.

Growing Preference for Natural and Clean-Label Feed Additives

Rising regulatory scrutiny and consumer awareness regarding animal nutrition quality are driving demand for natural and clean-label feed ingredients, supporting growth in the Animal Feed Sweetener Market. Natural sweeteners derived from plant-based sources are increasingly favored due to their safety profile and compliance with evolving feed regulations. Livestock producers are adopting these solutions to align with sustainability goals and premium animal product positioning. This driver is reinforced by export-oriented meat and dairy producers seeking regulatory compliance across international markets.

Key Trends & Opportunities

Innovation in High-Intensity and Low-Dosage Sweeteners

Technological advancements in formulation are creating strong opportunities in the Animal Feed Sweetener Market, particularly for high-intensity sweeteners requiring minimal inclusion levels. These products deliver consistent sweetness while lowering overall formulation costs and improving feed stability. Innovations focused on enhanced heat resistance and compatibility with pelleted feeds are expanding application scope. This trend supports manufacturers in developing differentiated products tailored for species-specific nutrition, creating long-term growth opportunities across industrial feed producers.

- For instance, Adisseo developed Optisweet, a synergistic blend of high-intensity sweeteners that stimulates early feed intake in young livestock with long-lasting taste and no aftertaste. This formulation ensures stability during processing, enabling low inclusion rates for cost efficiency in swine and ruminant feeds.

Growth of Aquaculture and Specialty Feed Applications

The expansion of aquaculture farming is emerging as a key opportunity for the Animal Feed Sweetener Market. Sweeteners improve feed acceptance in fish and shrimp, particularly during early growth stages and stress conditions. Increasing investments in commercial aquaculture and specialty feed formulations are driving demand for tailored sweetener solutions. This trend opens new avenues for product innovation, including water-stable and marine-compatible sweeteners, supporting diversification beyond traditional livestock segments while enhancing survival rates, improving feed conversion efficiency, and supporting consistent growth performance in intensive aquaculture production systems.

- For instance, Pancosma’s Sucram sweeteners, developed since 1992, use patented Iso Fusion Technology to combine intense sweeteners, taste modifiers, and enhancers into stable micro-particles for fish and shrimp feeds, improving palatability across production stages.

Key Challenges

Volatility in Raw Material Prices and Supply Chains

Fluctuating prices of raw materials such as molasses, plant extracts, and synthetic inputs pose a significant challenge for the Animal Feed Sweetener Market. Supply chain disruptions and agricultural yield variability directly impact production costs and pricing stability. Manufacturers face pressure to maintain consistent quality while managing input cost volatility. These challenges can affect profit margins and limit adoption in cost-sensitive regions, particularly among small and mid-sized feed producers.

Regulatory Complexity and Approval Requirements

Complex and region-specific regulatory frameworks present a major challenge for the Animal Feed Sweetener Market. Approval processes for new sweetener formulations vary widely across regions, increasing compliance costs and time to market. Restrictions on artificial additives in certain countries further complicate product portfolios. Navigating evolving feed safety standards requires continuous investment in testing and documentation, which can limit innovation and slow market penetration for new entrants and smaller manufacturers.

Regional Analysis

North America

North America accounted for 27.8% market share in 2024 in the Animal Feed Sweetener Market, supported by advanced livestock farming practices and high adoption of functional feed additives. The region benefits from strong poultry and swine production, particularly in the United States, where feed efficiency and animal performance remain top priorities. Stringent feed quality regulations further drive the use of standardized sweetener formulations. The presence of major feed manufacturers, along with growing preference for natural and clean-label additives, continues to support steady market expansion across commercial feed operations.

Europe

Europe held a 23.1% share of the Animal Feed Sweetener Market in 2024, driven by strict regulatory oversight and strong emphasis on animal welfare and sustainable nutrition. Countries such as Germany, France, and the Netherlands actively adopt feed sweeteners to enhance palatability while meeting compliance standards. Demand for natural sweeteners is particularly strong, aligned with clean-label and traceability requirements. The region’s well-developed dairy and poultry sectors further support consistent consumption of sweeteners, while export-oriented meat production sustains long-term demand for high-quality feed formulations.

Asia-Pacific

Asia-Pacific dominated the Animal Feed Sweetener Market with a 34.6% market share in 2024, driven by rapid expansion of commercial livestock and poultry farming. China, India, and Southeast Asian countries are witnessing rising demand for compound feeds to support growing meat, dairy, and egg consumption. Sweeteners play a key role in improving feed intake and productivity in intensive farming systems. Increasing investments in aquaculture and rising awareness of feed efficiency further strengthen regional growth. Large livestock populations and evolving feed modernization initiatives continue to position Asia-Pacific as the leading market.

Latin America

Latin America captured 8.6% market share in 2024 in the Animal Feed Sweetener Market, supported by expanding poultry, beef, and swine industries in Brazil and Argentina. The region’s strong export-oriented meat production drives demand for consistent and high-performance feed additives. Sweeteners are increasingly used to improve feed acceptance and reduce wastage in large-scale farming operations. Growing investments in industrial feed mills and gradual adoption of advanced nutrition practices are strengthening market growth, while rising domestic meat consumption continues to support long-term demand.

Middle East & Africa

The Middle East & Africa region accounted for 5.9% market share in 2024 in the Animal Feed Sweetener Market, driven by growing poultry production and increasing focus on food security. Countries in the Gulf region are investing in modern feed solutions to reduce reliance on imports and improve livestock productivity. Sweeteners support better feed intake in arid environments where stress conditions affect animal performance. In Africa, gradual commercialization of livestock farming and rising demand for affordable protein sources are contributing to steady market development across the region.

Market Segmentations:

By Product Type

- Natural Sweeteners

- Artificial Sweeteners

- High-Intensity Sweeteners

By Livestock

- Poultry

- Swine

- Ruminants

- Aquaculture

By Form

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Animal Feed Sweetener Market reflects a moderately consolidated structure led by Cargill, Incorporated; Archer Daniels Midland Company (ADM); Kerry Group plc; BASF SE; DuPont de Nemours, Inc.; Ingredion Incorporated; Tate & Lyle PLC; Alltech, Inc.; Nutreco N.V.; and Kemin Industries, Inc. These companies leverage strong global supply chains, diversified feed additive portfolios, and established relationships with compound feed producers. Market participants emphasize innovation in natural and high-intensity sweeteners to address rising clean-label demand and regulatory compliance. Investments in research and development enable species-specific formulations that improve feed intake and conversion efficiency. Expansion of regional manufacturing facilities and strategic collaborations with livestock producers enhance market reach. Pricing efficiency, product consistency, and technical support services remain critical factors influencing market positioning and long-term growth.

Key Player Analysis

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Kerry Group plc

- BASF SE

- DuPont de Nemours, Inc.

- Ingredion Incorporated

- Tate & Lyle PLC

- Alltech, Inc.

- Nutreco N.V.

- Kemin Industries, Inc.

Recent Developments

- In November 2025, Cargill launched natural palatability-enhancing flavor systems for poultry and swine feed, improving feed intake efficiency and supporting enhanced livestock performance.

- In September 2025, Heartland Food Products Group, manufacturer of the SPLENDA® brand, acquired the SLIMFAST® US brand, marking strategic expansion in the sweetener space.

- In February 2025, Ingredion partnered with Oobli to accelerate access to natural sweetener systems, combining stevia with sweet protein solutions.

- In May 2022, Batory Foods acquired Sweetener Solutions, a Savannah-based specialist in custom high-intensity sweetener blends for food applications, enhancing its portfolio with advanced formulation and packaging capabilities for sugar reduction solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Report Coverage

The research report offers an in-depth analysis based on Product Type, Livestock, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Animal Feed Sweetener Market will continue to expand due to increasing focus on improving feed palatability and livestock productivity.

- Growing demand for natural and clean-label feed additives will accelerate the adoption of plant-based sweeteners.

- High-intensity sweeteners will gain wider acceptance because of low inclusion rates and cost efficiency in feed formulations.

- Expansion of commercial poultry and swine farming will remain a major growth catalyst.

- Rising aquaculture production will create new opportunities for species-specific sweetener solutions.

- Feed manufacturers will increasingly invest in formulation innovation to enhance stability and heat resistance.

- Regulatory compliance and feed safety standards will influence product development strategies.

- Emerging economies will witness higher adoption due to modernization of livestock farming practices.

- Strategic partnerships between additive suppliers and feed producers will strengthen market penetration.

- Sustainability and resource-efficient feed solutions will shape long-term product differentiation.

Market Segmentation Analysis:

Market Segmentation Analysis: