Market Overview

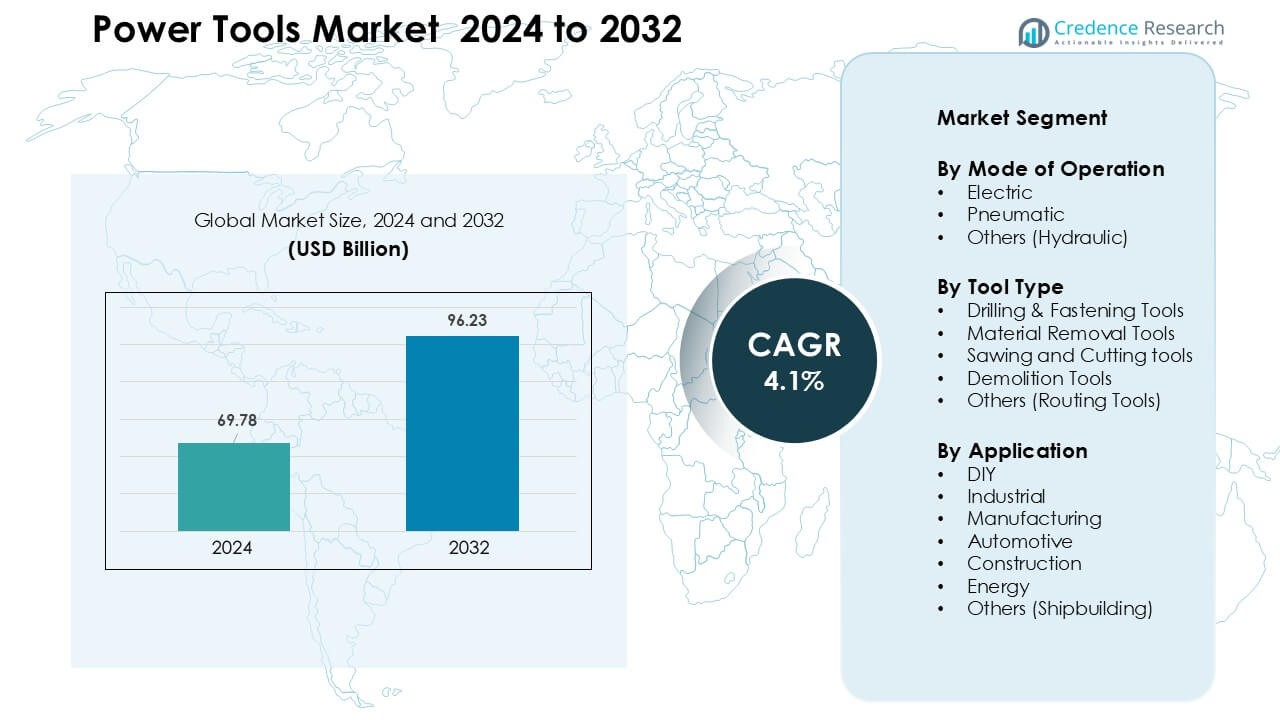

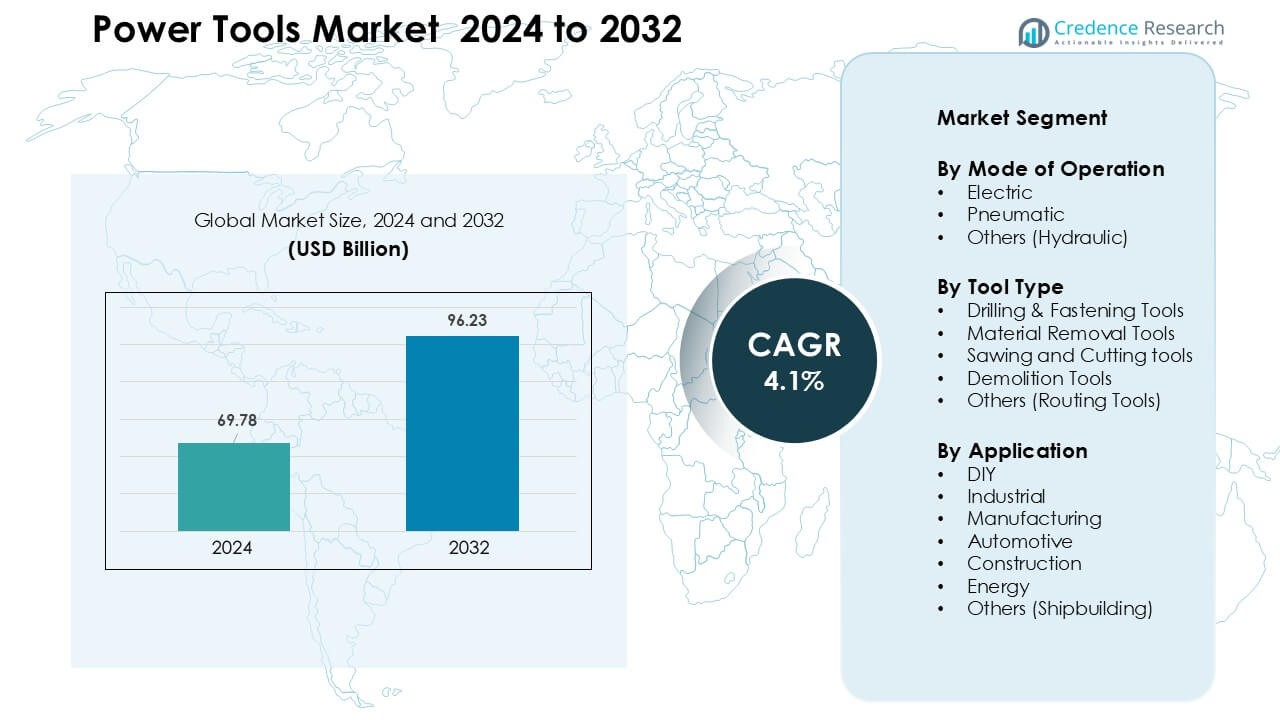

Power Tools Market was valued at USD 69.78 billion in 2024 and is anticipated to reach USD 96.23 billion by 2032, growing at a CAGR of 4.1 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Tools Market Size 2024 |

USD 69.78 Billion |

| Power Tools Market, CAGR |

4.1 % |

| Power Tools Market Size 2032 |

USD 96.23 Billion |

The power tools market is shaped by strong global players such as Makita Corporation, Tectronic Industries Co. Ltd., Stanley Black & Decker Inc., Hilti Corporation, Emerson Electric Co., Robert Bosch GmbH, Koki Holdings Co. Ltd., Ingersoll Rand, Enerpac Tool Group, and Atlas Copco AB. These companies compete through broad cordless portfolios, advanced brushless motor systems, and strong after-sales networks. Their focus on durability, safety, and ergonomic design supports high adoption across construction, manufacturing, automotive, and DIY segments. North America emerged as the leading region in 2024 with 34% share, driven by high renovation activity, wider professional uptake, and strong retail distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The power tools market was valued at USD 69.78 billion in 2024 and is expected to reach USD 96.23 billion by 2032, growing at a 4.1% CAGR.

- Rising construction activity and strong demand for cordless systems drive wider adoption across professional and DIY applications.

- Smart, connected tools and brushless motor technology shape key trends as buyers prefer higher efficiency, longer battery life, and safer operation.

- Leading players compete through advanced cordless platforms, ergonomic designs, and stronger distribution networks, increasing pressure on smaller regional brands.

- North America led the market with 34% share, while electric tools dominated by mode of operation with 67% share; construction remained the top application segment with 36% share, supporting overall regional and global growth.

Market Segmentation Analysis:

By Mode of Operation

Electric power tools held the leading position in 2024 with about 67% share, driven by strong use in residential projects, light commercial jobs, and growing preference for corded and cordless systems. Buyers selected electric tools for steady power delivery, longer runtime with advanced batteries, and lower upkeep when compared with pneumatic or hydraulic versions. Pneumatic tools stayed important in heavy-duty industrial tasks that need high torque and continuous operation, while hydraulic tools remained a small niche used in demanding repair and maintenance work.

- For instance, Bosch launched its Expert 18V battery range with capacities of 4.0 Ah, 5.5 Ah, 8.0 Ah and 15.0 Ah, enabling models like the EXBA18V-150 (15.0 Ah) to deliver up to 2,400 W of temporary maximum power.

By Tool Type

Drilling and fastening tools dominated the tool type segment in 2024 with around 41% share, supported by broad use across construction, renovation, automotive repair, and factory assembly lines. These tools gained traction because they improve task speed, enhance accuracy, and suit a wide range of DIY and professional needs. Material removal tools advanced due to rising metal fabrication work, while sawing and cutting tools expanded with steady growth in woodworking and infrastructure projects. Demolition tools remained vital in structural repair jobs, and routing tools served specialized finishing tasks.

- For instance, the Bosch GSB 450 Professional Impact Drill from Bosch offers a power consumption of 450 W and supports drilling diameters up to 8 mm in steel.

By Application

Construction applications led the market in 2024 with close to 36% share, driven by rapid urban projects, wider adoption of cordless equipment, and strong demand for tools that speed up on-site workflows. Industrial and manufacturing units increased purchases to support automation, reduce downtime, and meet tighter production cycles. Automotive workshops relied on high-torque systems for engine repair and assembly jobs. DIY users showed rising interest as households invested in small maintenance and improvement tasks. Energy and shipbuilding segments continued steady use for repair, installation, and heavy-material work.

Key Growth Drivers

Rapid Expansion of Construction and Infrastructure Projects

The construction sector continues to push strong demand for power tools as countries invest in roads, housing, commercial buildings, and industrial corridors. Contractors prefer high-performance cordless drills, demolition tools, and sawing systems that reduce task time and improve labor productivity. Urban upgrades, smart-city projects, and public infrastructure spending create a steady need for tools that support concrete cutting, steel fixing, and finishing work. Growth in residential renovation also increases sales of compact electric tools used for drilling, fastening, and material shaping. As regulatory bodies enforce higher safety and quality standards, builders adopt advanced tools with better control, torque, and battery efficiency. This steady pipeline of new construction and refurbishment activity acts as a major engine for market growth.

- For instance, Bosch GSB 120‑Li Cordless Kit offers an 12 V system that enables drilling in masonry, metal and wood supporting versatility needed for mixed residential-commercial renovation jobs.

Rising Shift Toward Cordless and Battery-Powered Tools

Cordless tools have grown sharply due to longer battery life, improved motor efficiency, and wider compatibility across tool families. Lithium-ion and brushless motor technologies give higher runtime, faster charging, and lower maintenance, making cordless tools suitable for heavy-duty and all-day field operations. Professionals prefer these systems because they remove dependence on power outlets and air compressors, allowing work in remote or confined job sites. Tool makers continue expanding their cordless ecosystems, enabling workers to use one battery platform for drills, grinders, saws, and fastening tools. This shift supports productivity gains, reduces total ownership cost, and strengthens demand across industrial, construction, and DIY applications.

- For instance, the INGCO 20 V Brushless Cordless Impact Drill & Wrench Combo Kit delivers up to 66 Nm in the drill mode and 400 Nm (up to 550 Nm nut-busting) in the wrench mode using its 20 V lithium-ion battery platform – underscoring how the newer cordless systems are matching even traditionally cord-powered performance.

Growing Industrial Automation and Manufacturing Activities

Industries such as automotive, electronics, metal fabrication, and machinery production are adopting precision tools to support faster production cycles. Power tools help factories lower downtime, speed assembly, and maintain uniform quality during repetitive manufacturing tasks. The rise of automated and semi-automated lines increases the need for fastening tools, torque-controlled systems, and specialized cutting and grinding equipment. Manufacturers focus on tools that offer sensor integration, torque feedback, and reduced vibration to improve worker safety and product consistency. As global production expands and factories aim for leaner workflows, advanced power tools become essential for meeting tight delivery schedules and quality standards.

Key Trend & Opportunity

Integration of Smart, Connected, and Sensor-Enabled Tools

Smart power tools are gaining traction as companies introduce Bluetooth-enabled and app-linked systems that track usage, battery health, and performance. These connected tools help teams monitor tool conditions, prevent unplanned downtime, and improve asset management on job sites. Features such as digital torque control, geofencing, and auto-shutdown enhance safety and reduce misuse. For fleet operators, smart platforms offer analytics that optimize tool deployment across multiple projects. This digital shift opens new opportunities for subscription-based software, cloud diagnostics, and predictive maintenance, creating value for both manufacturers and end-users as industrial operations move toward IoT-driven ecosystems.

- For instance, the Milwaukee ONE-KEY™ platform supports over 120 connected smart tools and devices, offering capabilities such as remote tool-lock, usage-tracking and location alerts via Bluetooth tags (signal range up to 90+ m).

Strong Adoption of Lightweight, Ergonomic, and Low-Vibration Tools

Workforce safety rules and rising ergonomic awareness are driving interest in lighter and low-vibration power tools. Manufacturers design compact drills, grinders, and impact drivers that reduce operator fatigue and improve precision during long shifts. Anti-kickback systems, advanced grip materials, and noise-reducing features support safer working conditions in construction, shipbuilding, and manufacturing plants. As job sites grow more regulated, demand rises for tools that balance high torque with user comfort. This trend creates an opportunity for companies to differentiate through improved design, better weight distribution, and modular accessories that enhance user productivity without compromising safety.

- For instance, Bosch’s GEX 185-LI random orbit sander weighs at a compact size (compatible with 18 V batteries), and features a vibration emission value (ah) of 2.2 m/s² in its ergonomic design.

Growth of DIY Culture and E-Commerce Expansion

Homeowners are buying more power tools for small repairs, décor upgrades, and hobby-based work. E-commerce marketplaces boost this trend by offering wide product choices, transparent pricing, and easy access to tool kits for new users. Influencer-driven tutorials and online learning channels encourage beginners to take on projects that earlier required professionals. Brands use digital platforms to launch exclusive cordless ranges, bundle starter kits, and provide virtual demos that attract inexperienced buyers. This broader DIY movement expands market reach and supports steady year-round sales, especially for drills, sanders, compact saws, and multi-function tools.

Key Challenge

Safety Risks and Rising Workplace Regulations

Power tools pose risks such as kickbacks, cuts, noise exposure, and hand-arm vibration, making safety compliance a major challenge. Industries must follow strict rules on tool handling, protective gear, and operator training, increasing operational effort and cost. Frequent updates to global safety standards require manufacturers to redesign products with enhanced safeguards, which extends development time and raises production expenses. Many small contractors struggle to adopt advanced tools with embedded safety features due to higher upfront prices. Balancing innovation with compliance remains a constant challenge as regulators enforce stricter norms across construction and manufacturing sites.

Volatility in Raw Material Prices and Supply Chain Disruptions

Power tool manufacturing depends on steel, aluminum, copper, lithium-ion cells, and electronic components, all susceptible to price swings. Global shortages of semiconductors and battery materials disrupt production schedules and raise costs for tool makers. Freight delays, trade restrictions, and geopolitical tensions further strain supply chains, leading to longer lead times and limited product availability. Smaller brands face difficulty securing stable supply compared to large multinational players. These disruptions increase final product prices and slow market expansion, forcing companies to redesign sourcing strategies, diversify suppliers, and improve local manufacturing capabilities to maintain competitiveness.

Regional Analysis

North America

North America held the largest share in 2024 at about 34%, supported by strong construction activity, high DIY participation, and rapid adoption of cordless tools. The U.S. led demand due to frequent home renovation projects, established industrial facilities, and ongoing infrastructure upgrades. Contractors preferred advanced electric and battery-powered tools that reduce labor time and improve precision. Canada contributed steady growth through residential repair work and rising interest in ergonomic tools. Major brands expanded retail penetration and service networks, which helped strengthen long-term market stability across the region.

Europe

Europe accounted for nearly 27% share in 2024, driven by strict workplace safety rules and strong use of advanced power tools across manufacturing, automotive, and construction industries. Germany, the U.K., and France remained key markets with high adoption of cordless systems that support faster and cleaner job-site operations. Renovation activities in aging residential structures further boosted electric drilling, fastening, and cutting tools. EU-led sustainability goals encouraged demand for energy-efficient designs and lower-emission pneumatic systems. Growing preference for ergonomic and low-vibration tools also shaped purchasing behavior in professional and DIY segments.

Asia Pacific

Asia Pacific held the fastest-growing position with around 29% share in 2024, fueled by rapid urbanization, large-scale infrastructure development, and expanding manufacturing bases in China, India, and Southeast Asia. Construction contractors increasingly selected cordless and brushless-motor tools to improve productivity on dense job sites. Rising middle-class income boosted DIY adoption and demand for compact, lower-cost models. Industrial growth in electronics, automotive, and metal fabrication further increased tool consumption. Strong distribution expansion through online channels and global brand entry supported wider market penetration across both urban and semi-urban regions.

Latin America

Latin America captured about 6% share in 2024, supported by recovering construction investment and growth in automotive repair and small-scale manufacturing. Brazil and Mexico led demand with rising adoption of electric drilling, grinding, and demolition tools used in both residential and commercial projects. Economic fluctuations slowed large capital projects, but DIY sales and renovation activities maintained steady tool demand. Regional buyers leaned toward affordable cordless systems with long battery life and lower maintenance needs. Expanding retail chains and online marketplaces also improved access to global and regional brands.

Middle East & Africa

The Middle East & Africa held nearly 4% share in 2024, driven by ongoing infrastructure expansion, industrial diversification efforts, and steady construction of commercial and residential projects. GCC countries adopted high-performance tools for large development projects, while African markets relied on cost-effective electric and pneumatic tools for small-scale construction and repair. Energy-sector maintenance activities supported demand for heavy-duty cutting and fastening tools. Import reliance and price sensitivity remained key challenges, yet wider availability through distributors and e-commerce improved market access across emerging cities and industrial zones.

Market Segmentations:

By Mode of Operation

- Electric

- Pneumatic

- Others (Hydraulic)

By Tool Type

- Drilling & Fastening Tools

- Material Removal Tools

- Sawing and Cutting tools

- Demolition Tools

- Others (Routing Tools)

By Application

- DIY

- Industrial

- Manufacturing

- Automotive

- Construction

- Energy

- Others (Shipbuilding)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the power tools market features strong global participation led by companies such as Makita Corporation, Tectronic Industries Co. Ltd., Stanley Black & Decker Inc., Hilti Corporation, Emerson Electric Co., Robert Bosch GmbH, Koki Holdings Co. Ltd., Ingersoll Rand, Enerpac Tool Group, and Atlas Copco AB. These companies compete through wide product portfolios, continuous innovation in cordless and brushless motor technology, and strong service networks across major regions. Most players invest heavily in battery platforms that support multiple tool categories, improving user efficiency and long-term value. Manufacturers also focus on ergonomic design, vibration control, and smart connectivity features to meet safety rules and enhance precision. Partnerships with distributors, expansion of e-commerce channels, and targeted launches for professional and DIY users help strengthen brand visibility. Rising demand for durable and energy-efficient tools pushes companies to refine materials, advance motor systems, and expand manufacturing capabilities to maintain competitiveness in a fast-evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Ingersoll Rand (U.S.) Introduced the G4911 IQV20™ 20V Cordless Tire Buffer (marketed as the world first 20V tire buffer). Product page/announcement (features, battery runtime, dual-speed for reaming/buffing).

- In February 2025, Ingersoll Rand (U.S.) Several Ingersoll Rand tools (including the W7153 IQV20™ impact wrench and H3111 20V heat gun) were recognized in Popular Mechanics’ 2025 tool awards positive product recognition that can boost market visibility.

- In September 2024, Enerpac Tool Group (U.S.) Acquired DTA (specialist in automated on-site horizontal movement products) to expand its Heavy Lifting Technology (HLT) portfolio and automation/solutions capability across rail, wind, infrastructure, aerospace and nuclear markets. This acquisition is part of Enerpac’s push toward broader, automated industrial-tools solutions.

Report Coverage

The research report offers an in-depth analysis based on Mode of Operation, Tool Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cordless power tools will rise as batteries gain longer runtime and faster charging.

- Smart and connected tools will expand with wider adoption of sensors and app-based control.

- Brushless motors will become the standard due to higher efficiency and reduced maintenance.

- Construction and infrastructure growth will continue to drive strong tool consumption worldwide.

- DIY adoption will increase as consumers invest more in home improvement and repair projects.

- Manufacturers will focus on lighter, ergonomic designs to improve worker safety and comfort.

- E-commerce sales will grow as buyers prefer online comparisons, bundles, and faster delivery.

- Industrial automation will boost demand for precision fastening and material-removal tools.

- Sustainability goals will push brands to develop energy-efficient tools and recyclable battery systems.

- Emerging markets in Asia Pacific and Latin America will offer new growth opportunities through rapid urbanization and manufacturing expansion.