Market Overview

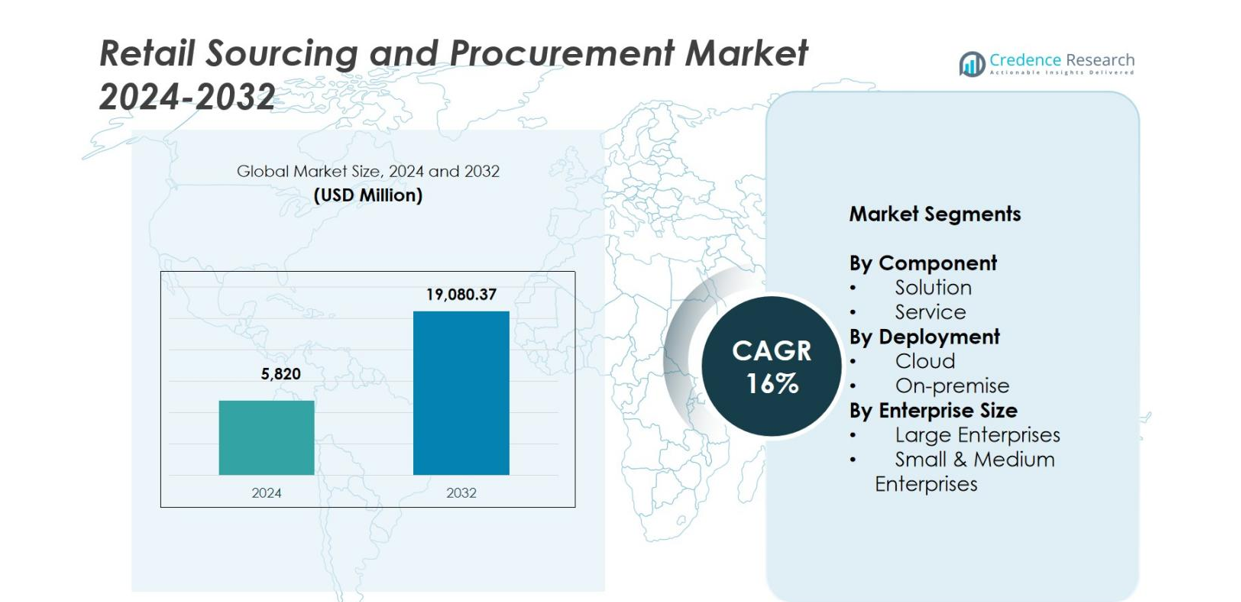

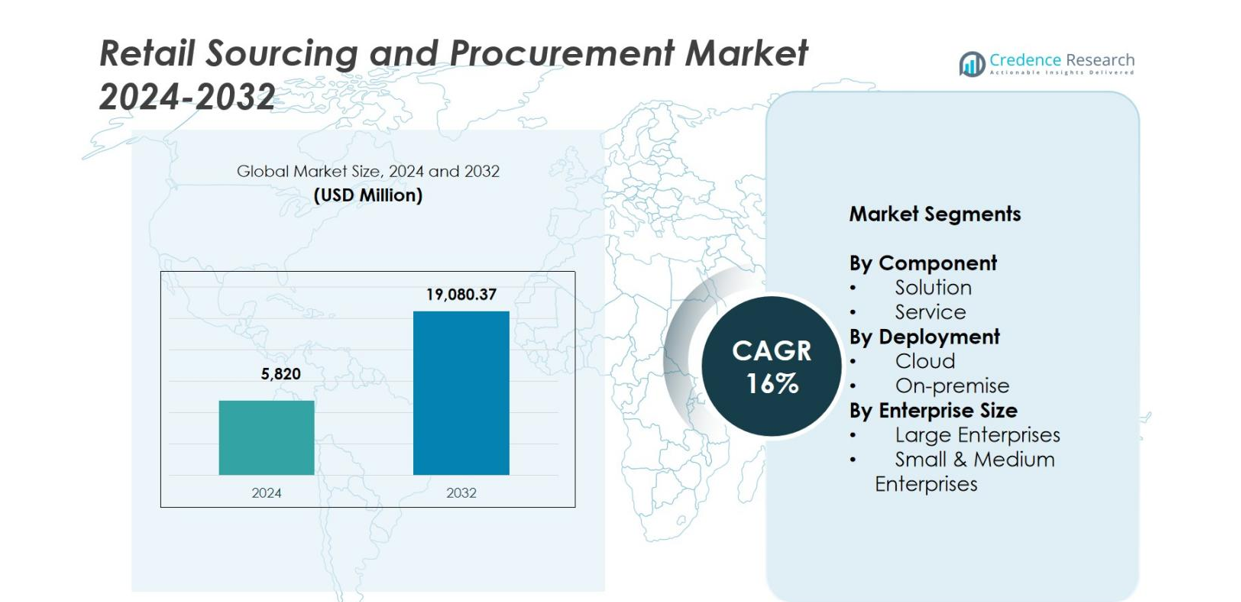

Retail Sourcing and Procurement Market size was valued at USD 5,820 million in 2024 and is anticipated to reach USD 19,080.37 million by 2032, at a CAGR of 16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Retail Sourcing and Procurement Market Size 2024 |

USD 5,820 million |

| Retail Sourcing and Procurement Market, CAGR |

16% |

| Retail Sourcing and Procurement Market Size 2032 |

USD 19,080.37 million |

Retail Sourcing and Procurement Market is shaped by leading players including Cegid, Epicor Software Corporation, GEP, Infor, International Business Machines Corporation, Ivalua Inc., Blue Yonder Group, Inc., Oracle, Proactis Holdings Limited, and SAP SE, all of which enhance procurement efficiency through advanced analytics, cloud platforms, and supplier management tools. These companies focus on automation, cost optimization, and improved supply-chain visibility to meet evolving retailer needs. Regionally, North America led the market with 34.7% share in 2024, driven by strong digital procurement adoption, while Europe and Asia-Pacific followed, supported by sustainability mandates and rapid e-commerce expansion.

Market Insights

- Retail Sourcing and Procurement Market was valued at USD 5,820 million in 2024 and is projected to reach USD 19,080.37 million by 2032, registering a CAGR of 16%.

- The market is driven by rising digital procurement adoption, increasing focus on cost optimization, and stronger supplier management needs across large retailers and SMEs.

- Key trends include rapid uptake of AI-driven sourcing tools, predictive analytics, cloud deployment dominance with over 70% share, and growing emphasis on sustainable and ethical procurement practices.

- Leading players such as Cegid, Epicor Software Corporation, GEP, Ivalua Inc., Blue Yonder Group, Oracle, and SAP SE focus on automation, supplier analytics, and scalable cloud platforms to strengthen their presence.

- North America held 34.7% share in 2024, followed by Europe at 28.4% and Asia-Pacific at 24.9%, while the solution segment dominated with 63.4% share due to strong demand for automated sourcing workflows.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Component

The solution segment led the Retail Sourcing and Procurement Market with 63.4% share in 2024, supported by rising demand for automated sourcing workflows, supplier performance analytics, and centralized procurement visibility. Retailers are increasingly deploying AI-enabled sourcing platforms to optimize supplier evaluation, contract governance, and spend management. These solutions also enhance compliance monitoring and collaboration across multi-enterprise ecosystems. The service segment continues to expand as companies rely on consulting, system integration, and managed services to maximize platform efficiency and support digital procurement transformation.

- For instance, in August 2024, Costa Coffee adopted an AI-enabled procurement platform from GEP to automate global direct and indirect spend processes.

By Deployment

The cloud segment dominated the market with 71.6% share in 2024, driven by its scalability, cost-efficiency, and ability to support distributed and omnichannel retail operations. Cloud-based procurement platforms enable seamless upgrades, improved security frameworks, and remote accessibility critical for real-time sourcing decisions. Rapid adoption of e-procurement tools, supplier collaboration portals, and data analytics further accelerates cloud deployment. The on-premise segment remains relevant for enterprises with strict regulatory, customization, or data-sovereignty requirements.

- For instance, Accenture migrated to SAP Ariba Buying and Invoicing SaaS, deploying Guided Buying for over 775,000 employees across 60 countries in 12 months. This cloud shift achieved a five-fold increase in contract compliance within the first two years.

By Enterprise Size

Large enterprises accounted for 58.9% share in 2024 due to their extensive supplier ecosystems, high procurement complexity, and strong investment capacity for advanced digital solutions. These organizations prioritize automated sourcing workflows, AI-driven analytics, and strategic supplier management to improve operational agility and reduce costs. Small and medium enterprises are witnessing faster growth as cloud-native procurement platforms lower overall implementation barriers, enabling streamlined vendor evaluation, contract lifecycle management, and spending optimization.

Key Growth Drivers

Rising Digital Transformation Across Retail Supply Chains

Digital transformation is reshaping the Retail Sourcing and Procurement Market as retailers adopt advanced procurement technologies to streamline sourcing, automate workflows, and improve supplier collaboration. AI, machine learning, and analytics enhance spend visibility, supplier evaluation, and process transparency. The rise of omnichannel retailing increases the demand for integrated procurement systems that support dynamic inventory needs and real-time decisions. Cloud-based platforms further accelerate adoption by offering scalability, remote accessibility, and strong security. These advancements shorten procurement cycles, improve operational efficiency, and strengthen compliance across retail supply chains, driving rapid adoption of digital procurement tools.

- For instance, Unilever implemented advanced digital procurement dashboards across its retail channels to improve real-time spend transparency and category-level forecasting.

Increasing Focus on Cost Optimization and Supplier Efficiency

Retailers are prioritizing structured procurement strategies to address rising operational costs, supply-chain uncertainties, and fluctuating material prices. Modern procurement systems provide real-time cost tracking, improved supplier performance monitoring, and streamlined contract management, reducing wastage and spending leakages. Automated sourcing platforms strengthen negotiation capabilities by consolidating demand and enhancing category visibility. Centralized procurement also ensures policy compliance, reduces manual errors, and fosters consistent supplier engagement. As a result, retailers increasingly adopt digital procurement tools that help optimize costs, enhance productivity, and build greater supply-chain resilience.

- For instance, Walmart publicly announced an expansion of its AI-driven supply-chain and logistics tools to boost efficiency and automate procurement workflows part of a broader digital-transformation push across sourcing, logistics and procurement functions.

Expansion of Global Retail Networks and Supplier Ecosystems

Global expansion is driving retailers to adopt procurement platforms capable of managing diverse supplier ecosystems across multiple regions. Cross-border sourcing requires systems that support multilingual documentation, varying regulatory needs, and real-time coordination. Retailers are diversifying sourcing bases to mitigate risks, increasing the need for streamlined vendor onboarding, quality checks, and contract lifecycle management. As global networks grow, retailers require stronger visibility into supplier performance, logistics timelines, and sustainability compliance. Integrated procurement platforms enable standardized processes, improve supply reliability, and support high-quality sourcing across expanding retail ecosystems.

Key Trends & Opportunities

Growing Adoption of AI-Driven and Predictive Procurement Technologies

AI-enabled procurement is emerging as a major opportunity, enabling predictive intelligence and automation across sourcing workflows. Predictive analytics improve demand forecasting, identify supplier risks, and optimize purchasing decisions with high accuracy. Intelligent assistants and chatbots automate approvals, respond to sourcing queries, and detect anomalies in pricing or supplier behavior. Machine learning enhances supplier evaluation by uncovering trends and performance patterns. These capabilities reduce manual work, strengthen decision-making, and create significant value for retailers seeking smarter, scalable procurement systems tailored to fast-changing retail environments.

- For instance, IBM’s Watson Supply Chain Insights employs NLP-based assistants to monitor supplier performance and automatically notify procurement teams of disruptions or risk signals.

Rising Demand for Sustainable and Ethical Procurement Practices

Sustainability and ethical sourcing are influencing procurement strategies as retailers align with ESG goals and regulatory requirements. Retailers increasingly evaluate suppliers on environmental performance, labor practices, and compliance with sustainability standards. Digital procurement platforms integrate sustainability scoring, traceability tools, and blockchain audit trails to provide transparency across supply chains. Ethical sourcing strengthens brand reputation and reduces regulatory risks associated with non-compliant suppliers. This shift presents strong opportunities for vendors offering sustainability analytics, supplier risk monitoring, and traceability solutions, enabling retailers to embed responsible sourcing into procurement operations.

- For instance, Walmart expanded its “Sustainability Hub” and digital supplier assessment tools to evaluate emissions, regenerative practices, and ethical compliance across global suppliers.

Key Challenges

Supplier Risk and Disruptions in Global Retail Supply Chains

Retailers face increasing supplier-related risks from geopolitical shifts, logistics delays, material shortages, and climate-driven disruptions. Managing diverse supplier networks across multiple regions becomes challenging without real-time visibility tools. Limited insights into supplier performance, compliance, and operational stability can lead to cost overruns and inventory shortages. Expanding supplier bases adds complexity that many retailers struggle to manage effectively. Ensuring supply continuity, maintaining service levels, and adapting to volatile supplier conditions remain persistent challenges that affect procurement efficiency and overall operational resilience.

Data Integration Complexity and Legacy System Limitations

Integration difficulties between modern procurement platforms and legacy ERP, finance, and inventory systems hinder digital transformation. Fragmented data across business units leads to inconsistencies in spend analysis, supplier evaluation, and contract management. Legacy systems often lack flexibility, slow data exchange, and reduce process transparency, affecting decision-making accuracy. Transitioning to advanced procurement technologies requires IT upgrades, skilled personnel, and organizational adaptation, which may delay implementation. Without seamless integration, retailers struggle to unlock the full value of automated procurement and face operational inefficiencies across sourcing activities.

Regional Analysis

North America

North America held the largest share of the Retail Sourcing and Procurement Market with 34.7% in 2024, driven by strong adoption of digital procurement platforms, advanced retail infrastructures, and a clear focus on automation and spend optimization. Retailers in the U.S. and Canada increasingly invest in AI-enabled sourcing tools, cloud-based suites, and supplier analytics to enhance operational efficiency. The region benefits from a mature technology ecosystem and widespread acceptance of compliance-focused procurement practices. Growing emphasis on ESG-aligned sourcing and strategic supplier partnerships continues to reinforce North America’s leadership position.

Europe

Europe accounted for 28.4% market share in 2024, supported by strict regulatory frameworks, sustainability mandates, and accelerated digital transformation across retail supply chains. Retailers in Germany, the U.K., France, and the Nordics prioritize supplier transparency, ethical sourcing, and compliance-driven procurement, driving adoption of advanced sourcing platforms. Expansion of cross-border retail operations increases demand for integrated procurement systems that manage diverse supplier networks. Government-backed initiatives promoting digital procurement, traceability, and standardized reporting further strengthen adoption. Europe’s focus on green procurement increasingly positions the region as a leader in sustainable sourcing technologies.

Asia-Pacific

Asia-Pacific captured 24.9% share in 2024, emerging as the fastest-growing region due to rapid retail expansion, strong e-commerce penetration, and rising deployment of digital procurement tools. Retailers in China, India, Japan, and South Korea are modernizing procurement functions to handle complex supplier ecosystems and high-volume sourcing operations. Investments in cloud-based procurement solutions and AI-driven analytics support efficiency and scalability across expanding retail networks. Government digitalization programs and supply chain modernization initiatives further accelerate adoption. The region’s large supplier base and strong focus on cost optimization reinforce Asia-Pacific as a major growth hub.

Latin America

Latin America held 7.3% market share in 2024, driven by increasing digital adoption among retail chains in Brazil, Mexico, Chile, and Colombia. Retailers are integrating procurement automation to better manage rising supply-chain costs and enhance transparency in vendor interactions. The growth of modern retail formats and regional e-commerce platforms fuels demand for scalable sourcing solutions. However, varying regulatory environments and uneven digital infrastructure pose challenges. Despite these constraints, cloud-based procurement adoption is expanding, and ongoing investments in retail modernization support steady long-term growth in sourcing and procurement technologies.

Middle East & Africa

The Middle East & Africa region accounted for 4.7% share in 2024, supported by rising digital procurement adoption in the UAE, Saudi Arabia, and South Africa. Expanding retail infrastructure, increasing investments in cloud technologies, and a growing focus on supplier compliance drive market growth. Retailers are adopting sourcing platforms to improve visibility, reduce procurement cycle times, and strengthen supplier management. Government initiatives promoting digital transformation and supply-chain modernization further encourage adoption. While some markets face scaling challenges, interest in automated procurement and sustainable sourcing practices supports gradual expansion across the region.

Market Segmentations

By Component

By Deployment

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Retail Sourcing and Procurement Market features a diverse landscape of global and regional solution providers focused on enhancing sourcing efficiency, supplier collaboration, and digital procurement automation. Key players such as Cegid, Epicor Software Corporation, GEP, Infor, International Business Machines Corporation, Ivalua Inc., Blue Yonder Group, Inc., Oracle, Proactis Holdings Limited, and SAP SE actively expand their capabilities through AI-driven analytics, cloud-based procurement suites, and integrated supplier management platforms. These companies emphasize modular, scalable, and compliance-focused solutions tailored to dynamic retail environments. Strategic initiatives including product upgrades, platform modernization, and ecosystem partnerships strengthen their market presence. Vendors increasingly invest in predictive procurement, sustainability tracking, and real-time supplier performance monitoring to differentiate offerings. With retailers prioritizing cost optimization, transparency, and ESG-aligned sourcing, leading providers compete by delivering advanced automation, stronger interoperability, and enhanced user experiences, shaping a rapidly evolving and innovation-driven competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2024, Costa Coffee revealed its plan to utilize the GEP SOFTWARE procurement platform to automate and streamline procurement activities across its global direct and indirect spend categories.

- In June 2025, Levelpath an AI-native procurement platform completed a US $55 million Series B funding round to accelerate its AI-driven sourcing, contracting and supplier-management tools.

- In June 2024, Infor Nexus introduced its new ‘Map and Trace’ application, created in collaboration with Burton Snowboards, to provide efficient supplier mapping, multi-tier visibility, and detailed transactional traceability to support chain-of-custody requirements.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Enterprise Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see accelerated adoption of AI-driven sourcing and predictive procurement tools.

- Cloud-based procurement platforms will continue to dominate due to scalability and lower operating costs.

- Retailers will increasingly integrate sustainability metrics into supplier evaluation and sourcing decisions.

- Automation will streamline contract management and reduce manual intervention across procurement workflows.

- Supplier risk management solutions will gain traction as global supply-chain disruptions persist.

- Real-time analytics will enable more accurate demand forecasting and spend optimization.

- SMEs will adopt digital procurement platforms at a faster rate due to improved affordability and usability.

- Interoperability between procurement, logistics, and financial systems will become a key investment priority.

- Retailers will expand multi-enterprise collaboration to enhance transparency across supplier ecosystems.

- Adoption of blockchain and traceability technologies will strengthen retail procurement accountability