Market Overview

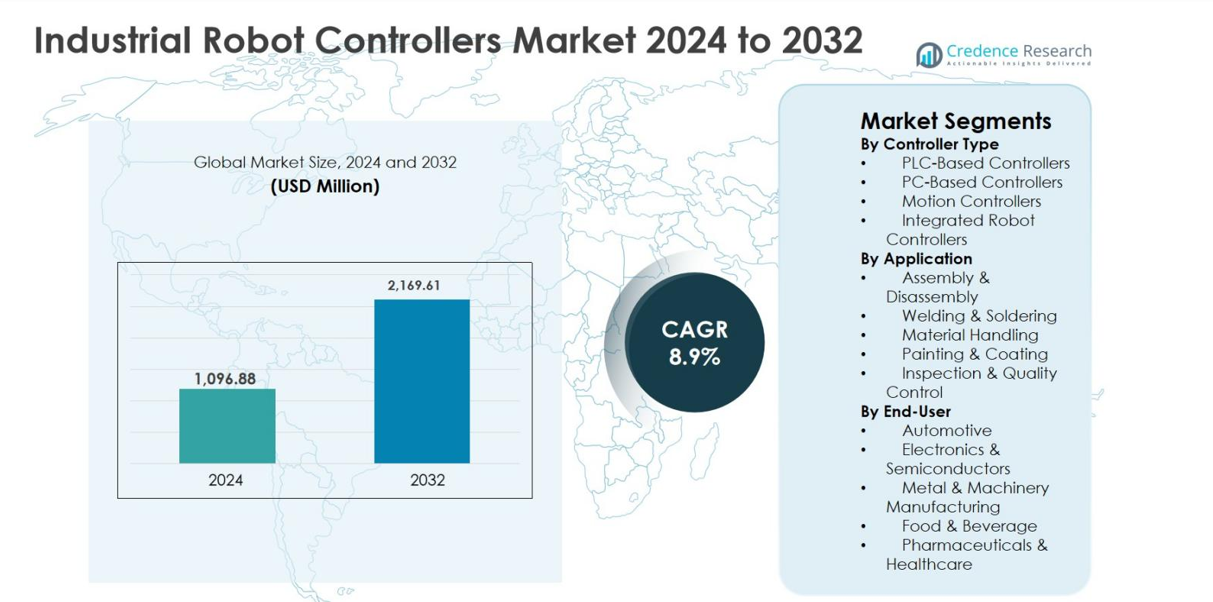

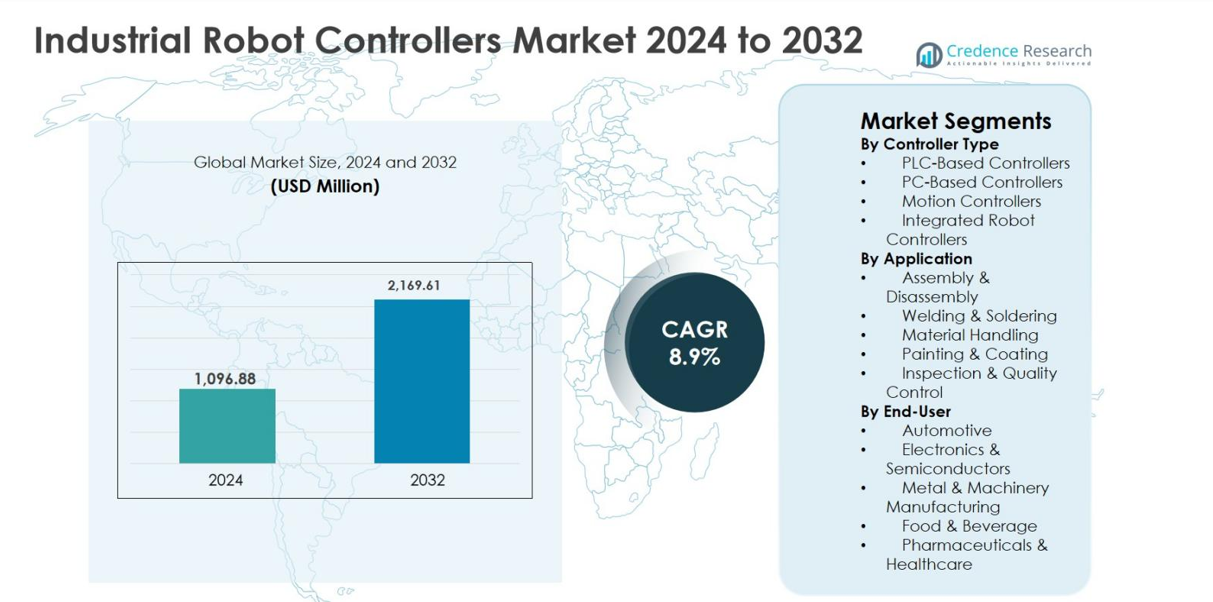

The Industrial Robot Controllers market size was valued at USD 1,096.88 million in 2024 and is anticipated to reach USD 2,169.61 million by 2032, expanding at a CAGR of 8.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Robot Controllers Market Size 2024 |

USD 1,096.88 million |

| Industrial Robot Controllers Market, CAGR |

8.9% |

| Industrial Robot Controllers Market Size 2032 |

USD 2,169.61 million |

The Industrial Robot Controllers market is led by established automation players such as Mitsubishi Electric Corporation, Yaskawa Electric Corporation, KUKA AG, Stäubli International AG, OMRON Corporation, and DENSO Wave Incorporated, which collectively drive technological innovation and large-scale adoption across manufacturing industries. These companies focus on high-performance motion control, seamless system integration, and advanced software capabilities to support smart factory environments. Regionally, Asia Pacific dominates the Industrial Robot Controllers market with a 36.9% share in 2024, supported by strong robotics adoption in China, Japan, and South Korea. North America follows with 27.4% share, driven by advanced automation and reshoring initiatives, while Europe accounts for 24.8%, supported by automotive manufacturing and Industry 4.0 investments.

Market Insights

- The Industrial Robot Controllers market was valued at USD 1,096.88 million in 2024 and is projected to reach USD 2,169.61 million by 2032, growing at a CAGR of 8.9% during the forecast period.

- Market growth is driven by rising industrial automation, expanding automotive and electric vehicle manufacturing, and increasing demand for precision, speed, and flexible production systems across global industries.

- Key trends include integration of AI and IoT-enabled controllers, growing adoption of integrated robot controllers holding 38.6% segment share, and rising use of robotic systems in non-automotive sectors.

- The market features strong presence of global automation leaders focusing on advanced motion control, software-driven architectures, strategic partnerships, and customized controller solutions to strengthen market positioning.

- Asia Pacific leads with 36.9% market share, followed by North America at 27.4% and Europe at 24.8%, while material handling dominates applications with 34.9% share, supported by logistics and manufacturing automation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Controller Type

The Industrial Robot Controllers market by controller type is led by Integrated Robot Controllers, which accounted for 38.6% market share in 2024. This dominance is driven by their compact design, seamless hardware–software integration, reduced installation time, and improved system reliability. Integrated controllers are widely adopted in high-speed and precision-driven manufacturing environments, particularly in automotive and electronics production. PLC-based controllers follow due to their robustness and compatibility with existing factory automation systems. Growing demand for simplified programming, real-time monitoring, and reduced total cost of ownership continues to accelerate adoption across smart manufacturing facilities.

- For instance, FANUC’s R-30iB Plus controller integrates motion control and process functions in a single unit, enabling high-speed assembly and inspection in automotive body and powertrain lines.

By Application

By application, Material Handling emerged as the dominant sub-segment, holding 34.9% share in 2024. The segment’s leadership is supported by increasing automation in logistics, warehousing, and production lines to improve throughput and reduce labor dependency. Industrial robot controllers play a critical role in enabling accurate pick-and-place, palletizing, and packaging operations. Rising e-commerce volumes, lean manufacturing practices, and the need for operational efficiency across discrete and process industries are key growth drivers. Welding and assembly applications also show strong uptake, supported by advancements in motion precision and adaptive control technologies.

- For instance, ABB’s OmniCore controllers support high-speed palletizing and depalletizing with coordinated multi-axis control, used in FMCG packaging lines to handle thousands of cases per hour.

By End-User

The Automotive sector dominated the Industrial Robot Controllers market by end-user with a 41.2% share in 2024, driven by extensive robot deployment across welding, painting, assembly, and material handling operations. Automotive manufacturers increasingly rely on advanced robot controllers to ensure precision, production consistency, and high-speed operations. The transition toward electric vehicles and flexible manufacturing lines further boosts controller demand. Electronics and semiconductor manufacturing follows due to miniaturization trends and high accuracy requirements. Continuous investments in factory automation and Industry 4.0 adoption remain the primary growth drivers across end-user industries.

Key Growth Drivers

Rising Adoption of Industrial Automation and Smart Manufacturing

The Industrial Robot Controllers market is strongly driven by the accelerating adoption of industrial automation and smart manufacturing across global industries. Manufacturers are increasingly deploying robotic systems integrated with advanced controllers to improve productivity, precision, and operational efficiency. Robot controllers enable real-time monitoring, adaptive motion control, and seamless coordination with other automation equipment, making them central to Industry 4.0 initiatives. Automotive, electronics, and metal manufacturing sectors are leading adopters due to rising labor costs and the need for consistent quality output. Additionally, government initiatives supporting digital manufacturing and factory modernization further stimulate demand. As production environments shift toward flexible and intelligent automation, the reliance on advanced robot controllers continues to expand steadily.

- For instance, BMW uses KUKA robots with KR C4 controllers in body-in-white lines for highly repeatable spot welding, contributing to consistent quality in large-scale automotive production.

Expansion of Automotive and Electric Vehicle Manufacturing

The rapid expansion of automotive and electric vehicle manufacturing is a major growth driver for the Industrial Robot Controllers market. Automotive production relies heavily on robotic systems for welding, painting, assembly, and material handling, all of which require precise and reliable controllers. The transition toward electric vehicles has increased production complexity, driving the need for flexible robot controllers capable of handling new battery, powertrain, and lightweight material processes. Automakers are also investing in reconfigurable production lines to support multiple vehicle models, boosting demand for programmable and integrated robot controllers. This sustained investment in advanced manufacturing infrastructure continues to support market growth.

- For instance, Tesla’s Gigafactories use KUKA robots with KR C4 controllers for high-precision body-in-white welding and material handling in Model 3 and Model Y lines, supporting high throughput and repeatability

Growing Demand for Precision and High-Speed Operations

Increasing demand for precision, speed, and repeatability in manufacturing operations significantly drives the Industrial Robot Controllers market. Industries such as electronics, semiconductors, and pharmaceuticals require highly accurate motion control to manage delicate components and stringent quality standards. Advanced robot controllers enable synchronized multi-axis motion, real-time error correction, and enhanced safety features, ensuring consistent output with minimal defects. The need to reduce downtime and optimize throughput further strengthens adoption. As manufacturers focus on improving yield rates and meeting strict regulatory and quality requirements, investment in high-performance robot controllers continues to rise.

Key Trends & Opportunities

Integration of AI, IoT, and Advanced Software Platforms

A key trend shaping the Industrial Robot Controllers market is the integration of artificial intelligence, IoT, and advanced software platforms. Modern controllers increasingly support data analytics, predictive maintenance, and machine learning capabilities, enabling smarter and more autonomous robotic operations. Connectivity with manufacturing execution systems and cloud platforms allows real-time performance tracking and optimization. This trend creates significant opportunities for vendors to offer value-added solutions such as remote diagnostics, adaptive control, and energy optimization. As factories move toward fully connected ecosystems, demand for intelligent and software-driven robot controllers is expected to rise substantially.

- For instance, KUKA’s KR C5 controller supports OPC UA and integration with KUKA iiQoT, enabling centralized monitoring and optimization of robot utilization and energy consumption.

Rising Adoption in Non-Automotive Industries

The expanding adoption of robot controllers in non-automotive industries presents a major growth opportunity. Sectors such as food and beverage, pharmaceuticals, logistics, and consumer goods are increasingly deploying robots to improve hygiene, consistency, and efficiency. Robot controllers tailored for cleanroom environments, collaborative robots, and flexible production lines are gaining traction. Small and medium-sized enterprises are also adopting automation due to declining controller costs and easier programming interfaces. This broadening application base significantly expands the addressable market for industrial robot controller manufacturers.

- For instance, Yaskawa’s FS100/YRC1000 controllers power Motoman HC-series collaborative robots used in pharmaceutical and cosmetics packaging, where cleanroom-compatible designs and gentle handling are critical.

Key Challenges

High Initial Investment and Integration Complexity

High initial investment costs and system integration complexity remain key challenges for the Industrial Robot Controllers market. Advanced controllers, along with compatible robotic hardware and software, require substantial upfront capital, which can deter small and mid-sized manufacturers. Integration with existing legacy systems often involves customization, skilled labor, and extended downtime. Additionally, programming and commissioning advanced controllers demand specialized technical expertise, increasing implementation costs. These factors can slow adoption, particularly in cost-sensitive industries and emerging markets, limiting short-term market expansion.

Cybersecurity Risks and Skill Shortages

Increasing cybersecurity risks and a shortage of skilled professionals pose significant challenges to market growth. As robot controllers become more connected through IoT and cloud-based systems, they are increasingly vulnerable to cyber threats that can disrupt operations or compromise sensitive data. At the same time, there is a growing shortage of engineers and technicians trained in robotics programming, control systems, and automation software. This skills gap can delay deployment, increase operational risks, and raise training costs. Addressing cybersecurity and workforce development remains critical for sustained market growth.

Regional Analysis

North America

North America accounted for 27.4% of the Industrial Robot Controllers market in 2024, driven by strong adoption of advanced automation across automotive, electronics, and aerospace industries. The United States leads regional demand due to high investments in smart factories, robotics integration, and digital manufacturing technologies. Presence of established robot manufacturers and system integrators further supports market expansion. Increasing focus on reshoring manufacturing activities and addressing labor shortages accelerates deployment of robotic systems and controllers. Additionally, rising adoption of AI-enabled controllers and industrial IoT platforms continues to strengthen North America’s position in high-value, technology-intensive manufacturing applications.

Europe

Europe held 24.8% market share in 2024, supported by its strong automotive manufacturing base and early adoption of Industry 4.0 practices. Countries such as Germany, France, and Italy are major contributors, driven by high robot density and continuous modernization of production lines. European manufacturers emphasize energy-efficient, flexible, and safety-compliant robot controllers to meet stringent regulatory standards. Growth is further supported by increasing investment in electric vehicle production and advanced machinery manufacturing. Strong collaboration between robotics vendors, research institutions, and industrial users sustains steady demand across both large enterprises and mid-sized manufacturers.

Asia Pacific

Asia Pacific dominated the Industrial Robot Controllers market with a 36.9% share in 2024, led by China, Japan, South Korea, and India. Rapid industrialization, expanding electronics manufacturing, and large-scale automotive production drive high robot deployment across the region. China remains the largest contributor due to aggressive automation initiatives and government-backed smart manufacturing programs. Japan and South Korea continue to lead in robotics innovation and precision manufacturing. Rising labor costs and growing adoption of automation in emerging Southeast Asian economies further accelerate demand for advanced robot controllers across diverse industrial applications.

Latin America

Latin America accounted for 6.3% of the Industrial Robot Controllers market in 2024, with Brazil and Mexico leading regional adoption. Growth is driven by increasing automation in automotive assembly, food and beverage processing, and packaging industries. Multinational manufacturers operating in the region are investing in robotic solutions to improve productivity and quality while reducing labor dependency. Government initiatives supporting industrial modernization and foreign direct investment further support market growth. Although adoption remains lower compared to developed regions, improving industrial infrastructure and declining automation costs are expected to drive steady expansion.

Middle East & Africa

The Middle East & Africa region captured 4.6% market share in 2024, supported by gradual industrial automation across manufacturing, oil & gas, and logistics sectors. Countries such as the United Arab Emirates and Saudi Arabia are investing in smart manufacturing as part of economic diversification strategies. Industrial robot controllers are increasingly adopted in packaging, metal fabrication, and warehouse automation. In Africa, adoption remains limited but is gradually increasing in automotive assembly and food processing industries. Continued investment in industrial infrastructure and digital transformation initiatives is expected to support long-term regional growth.

Market Segmentations:

By Controller Type

- PLC-Based Controllers

- PC-Based Controllers

- Motion Controllers

- Integrated Robot Controllers

By Application

- Assembly & Disassembly

- Welding & Soldering

- Material Handling

- Painting & Coating

- Inspection & Quality Control

By End-User

- Automotive

- Electronics & Semiconductors

- Metal & Machinery Manufacturing

- Food & Beverage

- Pharmaceuticals & Healthcare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Industrial Robot Controllers market features a well-established landscape characterized by global automation leaders and specialized robotics solution providers focusing on innovation, reliability, and system integration. Major companies such as Mitsubishi Electric Corporation, Yaskawa Electric Corporation, KUKA AG, Stäubli International AG, OMRON Corporation, and DENSO Wave Incorporated maintain strong market positions through advanced controller architectures, high-precision motion control, and seamless compatibility with industrial robots. These players continuously invest in software upgrades, AI-enabled control systems, and connectivity features to support smart manufacturing environments. Companies including WAGO, SEPRO Group, NexCOM Inc., Motion Controls Robotics Inc., and Wynright Corporation strengthen the market by offering customized and application-specific controller solutions. Strategic partnerships with system integrators, expansion into emerging manufacturing hubs, and ongoing product innovation remain central strategies, enabling companies to address evolving automation demands across automotive, electronics, and industrial manufacturing sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2025, Union Park Capital completed the acquisition of GAM Enterprises, expanding its precision motion control platforms that feed into advanced industrial automation and robot control ecosystems.

- In October 2025, HD Hyundai Robotics launched its next-generation Hi7 industrial robot controller featuring enhanced safety functions and integrated AI capabilities to optimize factory automation performance.

- In March 2025, SEER Robotics continued to expand its robot controller product line by offering a portfolio of SRC robot controllers aimed at accelerating robot development and industrial integration.

Report Coverage

The research report offers an in-depth analysis based on Controller Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Industrial Robot Controllers market will witness sustained growth driven by increasing adoption of smart manufacturing and Industry 4.0 practices.

- Demand for integrated and software-driven robot controllers will rise as manufacturers seek compact, flexible, and scalable automation solutions.

- Automotive and electric vehicle production will continue to generate strong demand for advanced robot control systems.

- Non-automotive sectors such as electronics, food processing, pharmaceuticals, and logistics will increasingly adopt robot controllers.

- Artificial intelligence and machine learning integration will enhance adaptive control, predictive maintenance, and operational efficiency.

- Cloud connectivity and industrial IoT integration will support real-time monitoring and remote diagnostics.

- Customizable and application-specific controllers will gain traction to support flexible production environments.

- Safety-focused controller designs will see higher adoption alongside collaborative robots in shared workspaces.

- Emerging economies will present new growth opportunities due to rising automation investments.

- Continuous advancements in controller software and cybersecurity features will shape long-term market evolution.