| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Connector Market Size 2024 |

USD 30,796.80 Million |

| Asia Pacific Connector Market, CAGR |

6.72% |

| Asia Pacific Connector Market Size 2032 |

USD 53,572.48 Million |

Market Overview

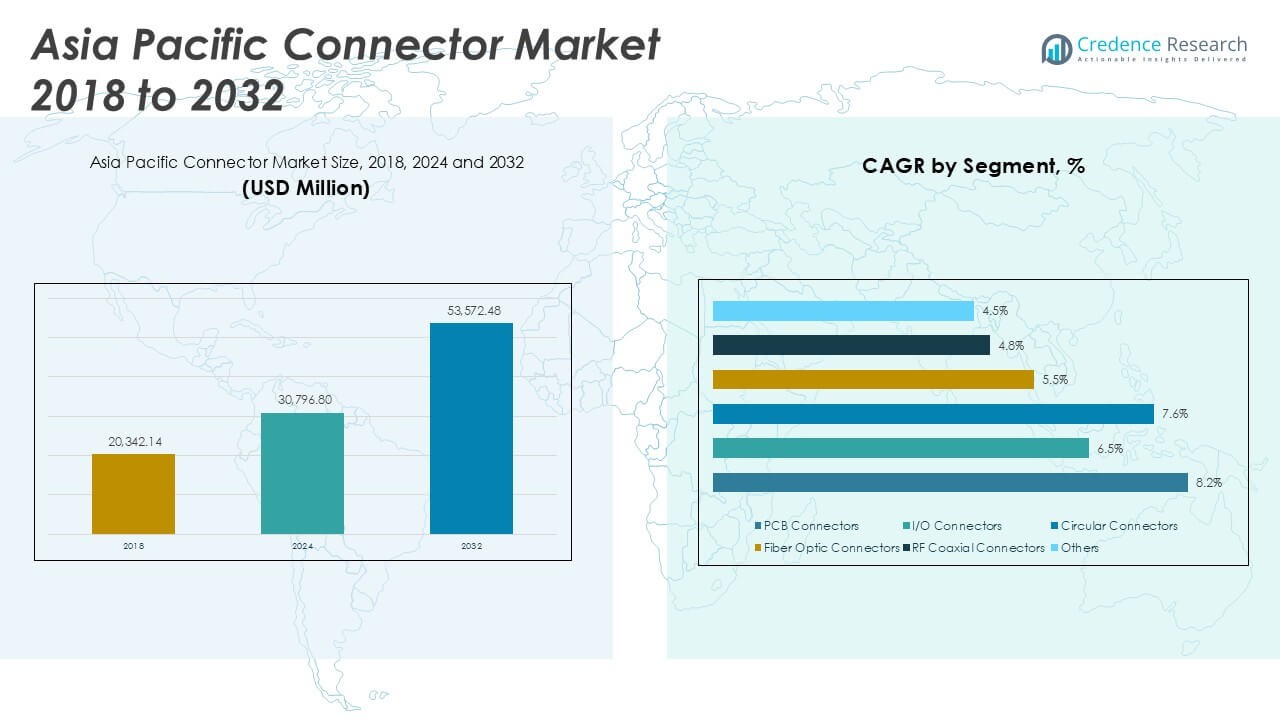

The Asia Pacific Connector Market size was valued at USD 20,342.14 million in 2018, increased to USD 30,796.80 million in 2024, and is anticipated to reach USD 53,572.48 million by 2032, at a CAGR of 6.72% during the forecast period.

The Asia Pacific Connector Market is experiencing significant growth due to rising demand for advanced electronics across automotive, telecommunications, and consumer electronics sectors. Rapid urbanization, increasing smartphone penetration, and expanding 5G infrastructure are driving the need for high-performance and miniaturized connectors. Governments across the region are investing in smart city initiatives and industrial automation, which further accelerates the adoption of robust interconnect solutions. The automotive industry’s shift toward electric and hybrid vehicles also contributes to heightened demand for specialized connectors with high reliability and efficiency. Market trends include the growing use of fiber-optic connectors, the integration of IoT in manufacturing, and rising demand for high-speed data transmission solutions. Moreover, manufacturers are focusing on developing lightweight, compact, and durable connectors to meet the evolving requirements of next-generation electronic devices. These trends collectively support steady market expansion across diverse end-user applications in Asia Pacific.

The Asia Pacific Connector Market demonstrates strong geographical diversity, with major growth concentrated in China, Japan, South Korea, and India. China leads in production due to its established electronics manufacturing base and expanding electric vehicle ecosystem. Japan contributes with advanced technologies and precision engineering, particularly in automotive and medical sectors. South Korea supports growth through its dominance in consumer electronics and semiconductor industries, while India shows rapid expansion in telecom and industrial applications, supported by government-backed manufacturing initiatives. Regional economies in Southeast Asia and Taiwan serve as emerging hubs for electronics assembly and component supply. Key players driving this market include Amphenol Corporation, known for its wide range of connectors across verticals; TE Connectivity Ltd, offering high-performance solutions for automotive and industrial use; Foxconn Interconnect Technology (FIT), supplying interconnect components for consumer electronics; and Hirose Electric Co., Ltd., specializing in miniature and high-speed connectors for telecom and mobile applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific Connector Market was valued at USD 30,796.80 million in 2024 and is projected to reach USD 53,572.48 million by 2032, registering a CAGR of 6.72% during the forecast period.

- Growing demand for advanced electronics in consumer devices, automobiles, and industrial automation systems continues to drive the adoption of reliable and high-performance connectors.

- Expanding deployment of 5G infrastructure and the integration of IoT in smart factories and vehicles are accelerating the use of fiber optic and high-speed connectors across the region.

- Leading players such as Amphenol Corporation, TE Connectivity Ltd, and Foxconn Interconnect Technology (FIT) are actively expanding their regional presence and investing in product innovation to meet growing end-user demand.

- Fluctuations in raw material prices and disruptions in global supply chains pose key challenges, impacting production costs and lead times for connector manufacturers.

- China remains the central hub for manufacturing and demand, followed by Japan, South Korea, and India, while Southeast Asian countries show strong potential due to increasing foreign investments.

- Sustainability trends are shaping product development, with companies shifting toward halogen-free materials and recyclable components to align with environmental standards and corporate ESG goals.

Market Drivers

Rapid Expansion of Consumer Electronics and Mobile Devices Across Emerging Economies

The Asia Pacific Connector Market benefits strongly from the booming consumer electronics sector, particularly in countries like China, India, South Korea, and Vietnam. Growing middle-class populations and rising disposable incomes have accelerated the demand for smartphones, laptops, tablets, and wearable devices. It has pushed manufacturers to design compact, high-speed connectors that support data and power transmission in increasingly miniaturized devices. The market also gains from rising adoption of smart home appliances and personal entertainment systems. Increasing internet penetration and growing demand for portable and multifunctional gadgets sustain momentum. It supports a consistent supply chain across electronic component manufacturers and OEMs in the region.

- For instance, Luxshare Precision Industry Co., Ltd. supplied over 200 million USB Type-C connectors to major global smartphone brands in 2023, showcasing its strong alignment with compact device trends and high-speed data transmission

Infrastructure Development and 5G Rollout Driving High-Speed Connector Demand

Ongoing investments in digital infrastructure and 5G network deployment across Asia Pacific create strong demand for high-frequency and low-latency connectors. Countries such as Japan, China, and South Korea lead in deploying advanced telecom technologies. The Asia Pacific Connector Market supports large-scale integration of connectors in base stations, routers, fiber-optic networks, and data centers. It plays a key role in ensuring stable signal transmission and maintaining system integrity in high-performance communication equipment. Demand for connectors compatible with advanced bandwidth and data speed requirements continues to grow. Telecom providers and hardware manufacturers seek durable and scalable solutions, accelerating regional market growth.

- For instance, TE Connectivity reported shipping over 15 million high-speed 5G-compatible connectors to telecom equipment manufacturers across Asia in 2023, supporting large-scale rollout of base stations and optical network units.

Automotive Electrification and Smart Mobility Solutions Elevating Connector Usage

The rising shift toward electric vehicles (EVs), hybrid vehicles, and autonomous driving systems in the region boosts connector demand across automotive applications. The Asia Pacific Connector Market responds to this trend with high-reliability connectors suitable for battery management, charging systems, infotainment, and advanced driver-assistance systems (ADAS). It supports efficient power distribution and data transfer in increasingly electronic-driven automotive designs. Government incentives and regulatory support for cleaner transportation further drive OEM adoption of advanced connectors. Manufacturers also explore ruggedized connector variants to withstand harsh automotive environments. EV infrastructure, including charging stations and smart grids, expands the market footprint.

Industrial Automation and Robotics Adoption Fueling Market Expansion

Accelerated adoption of Industry 4.0 practices across manufacturing hubs in Asia Pacific fuels the demand for industrial-grade connectors. The Asia Pacific Connector Market supports automation systems, robotics, factory control networks, and sensor integration by providing robust and reliable connectivity. It plays a critical role in real-time monitoring, predictive maintenance, and seamless data flow in smart factories. Governments prioritize automation to improve production efficiency and global competitiveness. Manufacturers require connectors that withstand vibration, temperature variations, and mechanical stress, prompting innovation in rugged designs. This push toward digital transformation sustains long-term growth potential in the region.

Market Trends

Increased Demand for Miniaturized and High-Density Connectors in Compact Devices

Rising consumer preference for lightweight and portable electronics has created demand for miniaturized, high-density connectors. Manufacturers across Asia Pacific invest in compact connector solutions that fit smaller form factors without compromising performance. The Asia Pacific Connector Market reflects this shift through increased production of micro and nano connectors used in smartphones, tablets, and wearables. It supports advanced circuit designs that require minimal space and high-speed data transmission. This trend aligns with the region’s strong presence in electronics manufacturing hubs. Suppliers focus on reducing connector footprint while maintaining mechanical reliability and electrical integrity.

- For instance, Hirose Electric Co., Ltd. introduced the FX30B series micro board-to-board connectors, offering a 0.5mm pitch and supporting up to 5.0Gbps transmission, meeting demands for miniaturization and high performance in consumer devices.

Growing Adoption of Fiber Optic Connectors in Telecommunication Infrastructure

Telecommunication providers increasingly deploy fiber optic networks to meet escalating data transmission demands. The Asia Pacific Connector Market benefits from this trend through rising adoption of fiber optic connectors that support high-speed internet, cloud services, and 5G connectivity. It provides critical components for base stations, data centers, and network expansion projects. The shift toward optical connectivity also addresses latency and bandwidth concerns in modern communication systems. Governments and private investors continue to fund broadband infrastructure projects across the region. This supports sustained demand for precision-engineered connectors with low insertion loss and high return loss performance.

- For instance, Sumitomo Electric Industries Ltd. supplied more than 7.2 million fiber optic connectors in 2023 to telecom clients across Asia, supporting FTTH and backbone optical infrastructure deployment.

Rising Integration of Smart Technologies in Automotive Systems

Automakers incorporate more sensors, infotainment systems, and ADAS technologies, creating a need for intelligent, multi-functional connectors. The Asia Pacific Connector Market reflects this evolution through demand for hybrid connectors that carry power, signal, and data within the same interface. It enables efficient vehicle-to-everything (V2X) communication and supports smart mobility initiatives. As vehicles adopt more electric and electronic control units (ECUs), demand for secure, compact, and heat-resistant connectors rises. Automakers across Japan, South Korea, and China focus on digital vehicle platforms, further driving connector innovation. This supports new production lines tailored for smart automotive infrastructure.

Emphasis on Environmentally Compliant and Sustainable Connector Materials

Sustainability initiatives across the region influence material choices in connector manufacturing. The Asia Pacific Connector Market is witnessing a shift toward recyclable, halogen-free, and RoHS-compliant materials. It supports global environmental standards and responds to corporate ESG goals. Manufacturers adopt low-impact production techniques and seek supply chain transparency in sourcing raw materials. Regulatory pressure in countries like Japan and South Korea drives adoption of eco-friendly connector designs. These developments support long-term brand reputation while addressing consumer and regulatory expectations.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions Impacting Production

Fluctuating prices of key raw materials such as copper, gold, and plastic resins pose a significant challenge for connector manufacturers. The Asia Pacific Connector Market faces rising input costs, which impact profit margins and disrupt pricing strategies. It must also manage delays and shortages stemming from geopolitical tensions, trade restrictions, and natural disasters. These issues disrupt timely sourcing and delivery, especially for specialized components with limited suppliers. Manufacturers struggle to maintain production schedules and often pass higher costs to end-users. This reduces competitiveness in price-sensitive segments such as consumer electronics and automotive components.

Technical Complexity and Standardization Issues in High-Speed Applications

The demand for high-speed data transmission across sectors increases design complexity for connectors. The Asia Pacific Connector Market must align with evolving international standards while addressing diverse regional compliance requirements. It faces challenges in meeting performance expectations for signal integrity, EMI shielding, and thermal stability. Rapid technological advances require continuous investment in R&D, which creates financial pressure on smaller firms. Lack of standardization across industries delays adoption of new connector formats. It complicates integration with legacy systems and hinders the scalability of advanced electronics across markets.

Market Opportunities

Expansion of Electric Vehicle Ecosystem Creating Demand for Specialized Connectors

The growing electric vehicle (EV) ecosystem presents strong opportunities for connector manufacturers. The Asia Pacific Connector Market can capitalize on increasing demand for connectors used in battery management systems, powertrains, inverters, and charging stations. It supports new mobility platforms that require compact, heat-resistant, and vibration-tolerant components. Governments across the region offer incentives for EV adoption and invest in nationwide charging infrastructure. This expands the use of high-voltage and signal connectors tailored for fast-charging and energy-efficient designs. Automotive OEMs actively seek suppliers that can deliver scalable, reliable solutions for future EV platforms.

Rise of Smart Manufacturing and IoT Driving Industrial Connector Innovation

Widespread adoption of Industry 4.0 and IoT technologies across Asia’s manufacturing hubs opens new opportunities for high-performance connectors. The Asia Pacific Connector Market serves this demand by offering rugged, high-speed connectors suitable for automated machinery, robotics, and real-time monitoring systems. It enables seamless integration of sensors and control units within smart factories. Rapid digitalization across sectors such as electronics, textiles, and automotive promotes investment in factory automation and predictive maintenance. Industrial customers require connectors with higher durability, signal integrity, and environmental resistance. This shift supports long-term market expansion through product innovation and sector diversification.

Market Segmentation Analysis:

By Product Type:

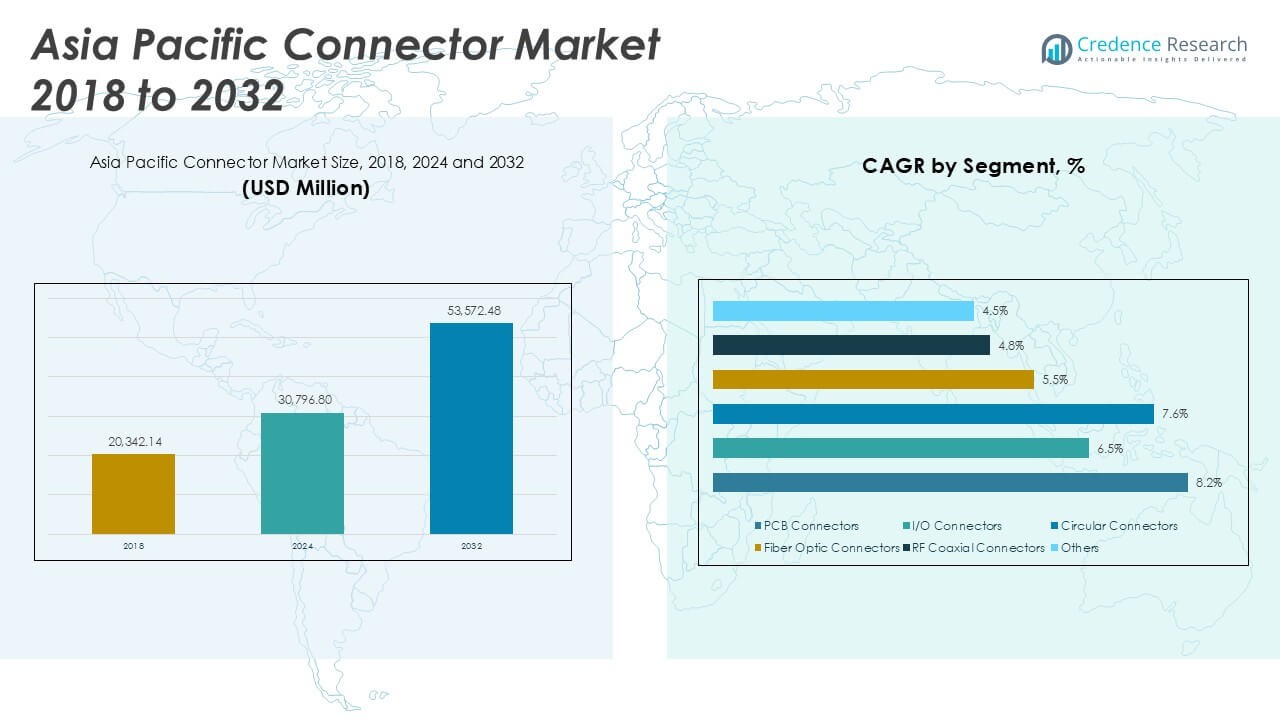

The Asia Pacific Connector Market comprises several key product categories, each serving specific industry needs. PCB connectors hold the largest share due to their widespread use in compact electronic assemblies across consumer electronics and automotive sectors. I/O connectors show strong growth, supported by increasing adoption in servers, routers, and industrial automation systems. Circular connectors remain vital in rugged applications such as transportation, aerospace, and military, where durability is essential. Fiber optic connectors gain traction with the expansion of high-speed internet infrastructure and 5G deployment across the region. RF coaxial connectors are essential for communication devices and satellite systems, driven by rising data consumption and wireless technologies. The “others” category includes custom and hybrid connectors, serving niche or emerging application segments.

- For instance, Molex LLC developed its Mirror Mezz Enhanced connector system, capable of supporting up to 112Gbps PAM4 transmission, and deployed over 500,000 units in data communication systems across the region in 2023.

By Material:

Material selection plays a critical role in connector design, affecting durability, conductivity, and environmental resistance. Copper dominates the segment due to its excellent electrical conductivity and wide usage across all connector types. The Asia Pacific Connector Market also sees rising use of aluminum in lightweight applications, particularly in automotive and consumer electronics. Stainless steel serves well in high-corrosion and high-temperature environments such as industrial and energy applications. Plastic continues to support housing and insulation needs, offering low cost and design flexibility. The “others” category includes emerging composite and eco-friendly materials aligned with regulatory and sustainability goals.

- For instance, Aptiv reported usage of over 18,000 tons of copper in 2023 for its automotive-grade connectors and harness systems manufactured in Asia, reinforcing copper’s dominance in high-conductivity applications.

By End-User:

Consumer electronics represent the largest end-user segment, supported by strong regional manufacturing and growing demand for mobile, wearable, and home devices. The Asia Pacific Connector Market also experiences significant growth in telecommunications and networking, fueled by broadband expansion and data center investments. Automotive applications continue to expand with the rise of EVs and smart vehicle systems requiring high-reliability connectors. Energy and utilities adopt connectors for grid modernization and renewable energy systems. Government and defense sectors demand rugged, secure connector solutions for communication and mission-critical systems. Healthcare presents steady growth through demand for diagnostic equipment, imaging systems, and portable medical devices. The “others” category includes industrial machinery, transportation, and construction equipment that require specialized connector solutions.

Segments:

Based on Product Type:

- PCB Connectors

- I/O Connectors

- Circular Connectors

- Fiber Optic Connectors

- RF Coaxial Connectors

- Others

Based on Material:

- Copper

- Aluminum

- Stainless Steel

- Plastic

- Others

Based on End-User:

- Consumer Electronics

- Telecommunications and Networking

- Automotive

- Energy and Utilities

- Government and Defense

- Healthcare

- Others

Based on the Geography:

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Regional Analysis

China

China holds the dominant position in the Asia Pacific Connector Market, accounting for approximately 46% of the regional revenue. It serves as the core manufacturing hub for consumer electronics, automotive components, and telecommunications infrastructure. The country benefits from a mature supply chain, large-scale production capacity, and strong domestic demand for connectors in smartphones, EVs, and industrial automation systems. Its thriving electric vehicle industry drives significant demand for high-performance connectors used in battery packs, control units, and charging modules. China’s rapid deployment of 5G infrastructure and smart city projects further boosts the adoption of fiber optic and high-frequency connectors. Local manufacturers are highly competitive, offering cost-effective and scalable solutions to global OEMs. Government policies that support innovation and technology localization help maintain China’s leadership in both production and consumption.

Japan

Japan contributes around 17% of the Asia Pacific Connector Market and remains a leading player in high-precision connector technologies. The country’s emphasis on quality, miniaturization, and reliability drives innovation in connectors used in automotive, medical devices, and aerospace sectors. Japanese automakers are early adopters of electric and hybrid vehicles, creating strong demand for power, signal, and charging connectors. Japan also maintains a robust presence in industrial robotics, where connectors must withstand extreme mechanical stress and environmental conditions. The country’s advanced healthcare sector supports steady demand for connectors used in diagnostic and imaging equipment. Japanese firms focus on R&D-intensive products, contributing to premium segments of the connector market. Their expertise in high-speed data transmission and EMI shielding aligns with global demand for next-generation electronics.

South Korea

South Korea holds a 13% share of the Asia Pacific Connector Market, driven by its global leadership in consumer electronics and semiconductor industries. Major Korean brands manufacture smartphones, displays, and household electronics that require high-density and flexible connectors. The market also benefits from rapid 5G deployment and growing investments in data centers and cloud services. Automotive connectors see increasing demand due to South Korea’s expanding EV production and smart mobility initiatives. Strong public-private collaboration in digital innovation supports development of connectors tailored to compact, multifunctional devices. South Korean companies are also exploring sustainable connector solutions by incorporating recyclable materials and reducing environmental impact in production processes.

India

India represents approximately 10% of the Asia Pacific Connector Market, supported by growing investments in electronics manufacturing and digital infrastructure. The government’s “Make in India” initiative and production-linked incentive (PLI) schemes encourage domestic production of connectors for mobile phones, set-top boxes, and automotive electronics. Rising consumer demand for connected devices and expanding telecom networks create steady growth for I/O and fiber optic connectors. India’s emerging EV sector adds demand for charging connectors and in-vehicle systems. The country’s industrial sector also adopts automation and smart manufacturing practices, supporting long-term connector usage. International manufacturers are increasingly establishing local facilities to serve both domestic and export markets.

Rest of Asia Pacific (including ASEAN countries, Australia, and Taiwan)

The Rest of Asia Pacific accounts for 14% of the regional connector market, with contributions from countries like Taiwan, Vietnam, Thailand, Malaysia, and Australia. These countries serve as important secondary hubs for electronics assembly, supported by favorable trade policies and low labor costs. Taiwan plays a key role in the semiconductor and ICT connector supply chain, while Vietnam and Thailand see increasing investments in automotive and consumer electronics manufacturing. Australia’s role remains smaller but contributes to demand from industrial automation and renewable energy projects. Regional cooperation in smart city development and digital transformation supports consistent demand across telecom and utility sectors. These countries collectively benefit from regional supply diversification strategies among multinational firms.

Key Player Analysis

- Amphenol Corporation

- Aptiv

- Foxconn Interconnect Technology (FIT)

- Hirose Electric Co., Ltd.

- Hosiden Corporation

- Japan Aviation Electronics Industry, Ltd. (JAE)

- Luxshare Precision Industry Co., Ltd.

- Molex, LLC

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd

Competitive Analysis

The Asia Pacific Connector Market is highly competitive, characterized by the strong presence of both global leaders and regional specialists. Key players include Amphenol Corporation, TE Connectivity Ltd, Foxconn Interconnect Technology (FIT), Hirose Electric Co., Ltd., Aptiv, Molex LLC, Sumitomo Electric Industries Ltd, Luxshare Precision Industry Co., Ltd., Hosiden Corporation, and Japan Aviation Electronics Industry, Ltd. (JAE). These companies focus on a wide product portfolio, catering to diverse industries such as automotive, consumer electronics, telecommunications, and industrial automation. The market favors firms that can deliver compact, high-speed, and durable connectors suitable for miniaturized and high-performance electronic systems. Competitive advantage often stems from the ability to rapidly scale production, maintain cost efficiency, and comply with evolving environmental and safety regulations. Many manufacturers invest in research and development to create connectors with enhanced signal integrity, EMI shielding, and high-temperature resistance. Strategic moves include expanding local production facilities, strengthening distribution networks, and forming alliances with OEMs to secure long-term contracts. The rise of electric vehicles, 5G infrastructure, and industrial automation continues to reshape the competitive landscape, pushing players to focus on niche segments and sustainable innovation to maintain relevance and growth.

Recent Developments

- In July 2024, the Indian Government had reported that 5 percent of the Universal Service Obligation Fund (USOF) was earmarked for telecoms Research and Development in the fiscal year 2023 – 24. USOF has since been transformed into Digital Bharat Nidhi and was done along with a major spending outlay figure surpassing USD 9.5 billion. The allocation of money has a purpose of providing necessary finance towards the monetization of the R&D work from the telecom industry in order to promote modern practices.

- In May 2024, the semiconductor industry is anticipated to receive a significant boost with investments projected to exceed USD 47 billion after the government of China established its third planned state-backed investment fund. This would in turn grow the market by enhancing adoption of product in consumer electronics & telecommunication industry.

- In October 2023, Amphenol will showcase its latest innovation in the field of connectors for electric vehicles at the Avnet Green Days: e-Mobility 2023 event in Hanoi and Ho Chi Minh, Vietnam, from October 24th to October 27th. The showcased products are DuraEV, MicroSpace High Voltage Crimp-to-Wire Connector, MicroSpaceXS 1.27mm Waterproof Crimp-to-Wire/Wire-to-Wire Connector, MicroSpace Crimp-To-Wire Connector, WireLock, USB, Ve-NET, NETBridge+, and HSBridge+.

- In August 2023, Molex, a leading global connectivity and electronics solutions provider, has captured a prestigious IoT Product Award at the recent OFweek 2023 (8th) IoT / AI Conference recently hosted in Shenzhen, China. Molex received the award for Mezz Pro and Mirror Mezz Enhanced high-speed connectors.

- In July 2023, ABB announced the launch of the world’s first full range of hinged high voltage connector backshells to heavy-duty electric vehicles (EV). Harnessflex EVO connector interfaces increase cable-to-connector stability in high voltage applications.

- In June 2023, FIT Hon Teng, a subsidiary of HonHai, received the “Red Dot Design Award”, known as the “Oscar of the Design Industry.” FIT focused on the hottest topic of AI and showcased its excellent design capabilities with its innovative 800G high-speed connector under the theme “FITCONN,” winning the Design Concept Award. This innovative solution not only adheres to the specifications and design rules of existing data centers but also greatly improves data transmission efficiency.

- In March 2023, Hirose Electric announced the launch of the IT14 Series, a hermaphroditic board-to-board connector that supports up to 112Gbps PAM4 transmission speed. IT14 is the licensed second source for “Mirror Mezz”, which was developed by connector manufacturer Molex in 2018 for applications such as servers, data communications, and telecommunications equipment.

Market Concentration & Characteristics

The Asia Pacific Connector Market exhibits moderate to high market concentration, with a few large multinational companies holding significant shares alongside a growing base of regional manufacturers. It is characterized by a strong emphasis on innovation, product customization, and rapid adaptation to emerging technologies across end-user industries. The market operates within a fast-paced environment shaped by the demand for miniaturized, high-speed, and rugged connectors, particularly in sectors like consumer electronics, automotive, and telecommunications. It benefits from the presence of well-established manufacturing hubs in China, Japan, and South Korea, supported by robust supply chains and government-backed industrial policies. Competitive intensity remains high, with firms prioritizing cost-efficiency, performance reliability, and compliance with evolving regulatory standards. Product lifecycles are shortening, which compels manufacturers to invest consistently in R&D and advanced manufacturing capabilities. The market also reflects a shift toward sustainable materials and energy-efficient production methods, aligning with global environmental expectations while catering to the growing demand for high-performance connectivity solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by increased demand for connectors in electric vehicles and battery systems.

- Advancements in 5G and fiber optic infrastructure will create opportunities for high-speed and low-latency connector solutions.

- Consumer electronics and wearable device proliferation will boost the need for compact and high-density connectors.

- Automation and Industry 4.0 adoption across manufacturing hubs will increase demand for rugged and durable connectors.

- Data center expansion and cloud computing services will drive the uptake of high-frequency and EMI-shielded connectors.

- Companies will invest in sustainable connector materials to align with regional environmental regulations.

- Regional manufacturing expansion in India and Southeast Asia will support supply chain diversification.

- Connector designs will evolve to support multi-functionality, including power, signal, and data integration.

- Demand for medical-grade connectors will rise with growth in diagnostic and imaging equipment.

- Strategic collaborations between OEMs and connector suppliers will strengthen long-term market presence.