| REPORT ATTRIBUTE |

DETAILS |

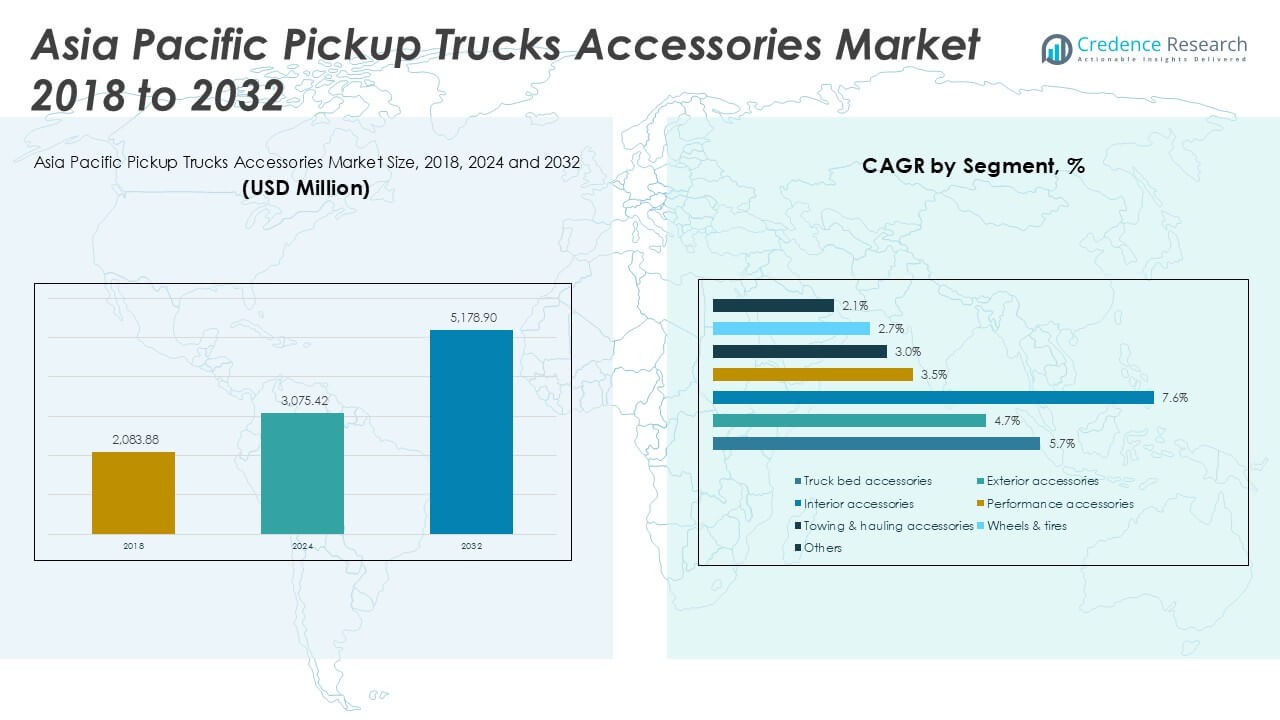

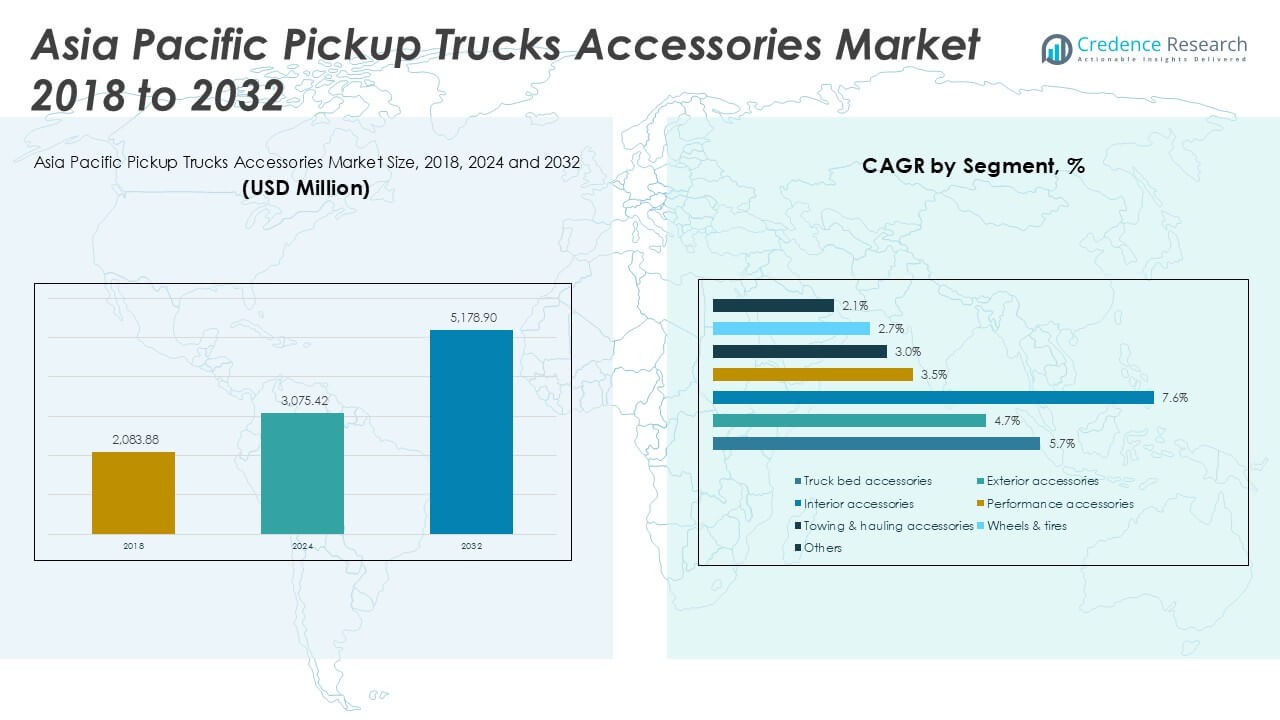

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Pickup Trucks Accessories Market Size 2024 |

USD 3,075.42 Million |

| Asia Pacific Pickup Trucks Accessories Market, CAGR |

6.36% |

| Asia Pacific Pickup Trucks Accessories Market Size 2032 |

USD 5,178.90 Million |

Market Overview

The Asia Pacific Pickup Trucks Accessories Market was valued at USD 2,083.88 million in 2018, reached USD 3,075.42 million in 2024, and is anticipated to reach USD 5,178.90 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.36% during the forecast period.

The Asia Pacific Pickup Trucks Accessories Market is experiencing robust growth driven by increasing vehicle ownership, rising consumer preference for vehicle customization, and expanding e-commerce platforms that enhance product accessibility. The surge in construction, mining, and logistics activities across emerging economies fuels demand for functional accessories such as bed liners, covers, towing equipment, and security solutions. Advancements in technology and the introduction of smart, lightweight, and durable materials further elevate product appeal and performance. Environmental regulations and the push for fuel efficiency encourage the adoption of aerodynamic accessories and energy-saving innovations. Meanwhile, shifting consumer lifestyles, rising disposable incomes, and urbanization drive higher spending on aesthetic enhancements and comfort features. Trends such as digitalization, direct-to-consumer sales, and growing aftermarket service networks contribute to market expansion, while social media influences consumer preferences, accelerating the adoption of new styles and premium products in the pickup trucks accessories market across the region.

The geographical landscape of the Asia Pacific Pickup Trucks Accessories Market features strong demand across China, Japan, South Korea, India, and Southeast Asia, each region contributing unique consumer preferences and market dynamics. China leads with its expansive automotive industry and thriving aftermarket, while Japan emphasizes quality and advanced technology in accessories. South Korea and India show rising interest in both utility-driven and lifestyle-oriented enhancements, reflecting broader trends in vehicle personalization and commercial use. Key players shaping the competitive environment include Aeroklas, ARB 4×4 Accessories, and Mahindra & Mahindra. These companies drive innovation through diverse product portfolios, advanced manufacturing capabilities, and strong regional distribution networks. Their focus on meeting local needs and adapting to changing market trends positions them as influential leaders within the Asia Pacific region, supporting sustained growth and competitive differentiation in the pickup trucks accessories market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific Pickup Trucks Accessories Market was valued at USD 3,075.42 million in 2024 and is expected to reach USD 5,178.90 million by 2032, registering a CAGR of 6.36% during the forecast period.

- Rapid urbanization, expanding commercial fleets, and rising vehicle ownership are driving consistent growth in pickup trucks accessories demand across the region.

- Product innovation focuses on smart, lightweight, and customizable accessories, with consumers seeking both functional upgrades and aesthetic enhancements for their vehicles.

- Digitalization of sales channels and growing influence of e-commerce platforms have accelerated aftermarket sales, making accessories more accessible and driving direct-to-consumer engagement.

- Intense competition among key players such as Aeroklas, ARB 4×4 Accessories, and Mahindra & Mahindra spurs ongoing investment in product development, regional distribution, and brand differentiation.

- The market faces challenges from fluctuating raw material prices, regulatory complexities, and the widespread presence of counterfeit products, impacting profitability and consumer trust.

- China leads in demand and innovation, while Japan, South Korea, India, and Southeast Asia present distinct opportunities based on local consumer preferences and commercial activities, shaping a dynamic regional landscape.

Market Drivers

Rising Vehicle Ownership and Commercial Expansion Fuel Demand

The Asia Pacific Pickup Trucks Accessories Market benefits significantly from a surge in vehicle ownership and commercial vehicle usage across the region. Economic development in countries like China, India, and Southeast Asia has led to increased demand for pickup trucks among small businesses, logistics providers, and private consumers. The rapid growth of e-commerce and construction sectors supports higher fleet purchases and boosts requirements for practical and protective accessories. Companies seek solutions that enhance cargo security, durability, and operational efficiency, making accessories such as bed liners, toolboxes, and racks essential. Growing investments in infrastructure and logistics create long-term opportunities for accessory manufacturers. The region’s expanding road networks and rural connectivity further drive the need for customization and aftersales support.

- For instance, Aeroklas manufactures over 300,000 truck bed liners annually from its Thailand facilities, using advanced twin-sheet thermoforming technology to improve durability and fit for commercial fleets.

Consumer Preference for Customization and Aesthetic Upgrades Drives Product Innovation

A growing appetite for vehicle personalization among Asia Pacific consumers supports continuous product innovation in the pickup trucks accessories segment. Urbanization and rising disposable income allow consumers to invest more in aesthetic enhancements and comfort features, transforming pickup trucks into lifestyle vehicles. Social media and online automotive communities influence purchasing decisions, increasing interest in premium and stylish accessories. Manufacturers respond by introducing unique grille guards, lighting kits, custom wheels, and interior upgrades. The shift toward direct-to-consumer models makes these products more accessible, accelerating market adoption. It enables buyers to select accessories that reflect their tastes and meet specific functional requirements.

- For instance, ARB 4×4 Accessories has expanded its product catalog to include more than 1,800 unique part numbers for pickup upgrades, ranging from modular storage systems to proprietary LED driving lights with up to 20,000 lumens output.

Advancements in Materials and Technology Accelerate Market Growth

Continuous advancements in materials and manufacturing technologies underpin the growth of the Asia Pacific Pickup Trucks Accessories Market. The introduction of lightweight, high-strength composites, corrosion-resistant coatings, and smart accessories enables manufacturers to offer durable and high-performance solutions. Integration of electronics, such as advanced security systems and telematics devices, elevates the value proposition for fleet owners and individual users. Innovation drives differentiation in a competitive landscape, supporting higher margins for industry players. It strengthens product portfolios and enhances customer satisfaction by meeting emerging needs related to convenience, safety, and fuel efficiency. The market leverages these advancements to remain resilient against fluctuating raw material costs.

Government Regulations and Environmental Awareness Shape Accessory Demand

Government regulations concerning vehicle emissions, safety, and environmental protection directly impact the design and adoption of pickup trucks accessories. Authorities enforce standards that encourage the use of aerodynamic, energy-saving, and recyclable products, fostering innovation and responsible manufacturing practices. Sustainability trends influence both manufacturers and consumers to prioritize eco-friendly solutions, such as low-drag tonneau covers and reusable cargo organizers. Incentives for fuel-efficient vehicles prompt automakers and aftermarket suppliers to align their offerings with evolving standards. It fosters a shift toward environmentally conscious accessory options, ensuring compliance and supporting brand reputation. Industry participants recognize the importance of regulatory trends and sustainability in shaping future product development.

Market Trends

E-Commerce and Digital Channels Redefine Distribution Landscape

The Asia Pacific Pickup Trucks Accessories Market is undergoing a transformation driven by the rapid adoption of e-commerce and digital platforms. Online marketplaces and direct-to-consumer websites have expanded product visibility, making a wide range of accessories easily accessible to consumers and commercial buyers. It increases competition among suppliers and encourages transparent pricing, which benefits end users. E-commerce platforms facilitate informed purchasing through detailed product specifications, reviews, and virtual consultations. This trend shortens lead times and improves convenience for customers seeking customized solutions. The digital shift supports the rise of new brands and enables traditional players to diversify their sales channels for greater market reach.

- For instance, RealTruck processes more than 40,000 e-commerce orders monthly through its online portal, offering live customer support and advanced fitment tools for buyers across Asia Pacific.

Preference for Premiumization and Lifestyle-Oriented Accessories

A clear trend toward premiumization is evident in the Asia Pacific Pickup Trucks Accessories Market, with consumers investing in high-quality, lifestyle-oriented products. The shift from basic utility to style, comfort, and advanced functionality reflects changing preferences among urban and affluent buyers. Brands focus on offering luxury finishes, bespoke interior features, and innovative safety add-ons that enhance both the appearance and experience of pickup trucks. It fosters loyalty and repeat purchases among consumers who value exclusivity and personalization. Social media, automotive influencers, and online forums contribute to growing awareness of global accessory trends, which accelerates market adoption of new premium offerings.

- For instance, Mountain Top Industries supplies over 100,000 premium aluminum tonneau covers annually to OEM partners, using proprietary anodizing technology for scratch resistance and enhanced aesthetics.

Integration of Smart Technologies and Advanced Materials

Smart technologies and the use of advanced materials are setting new benchmarks for product performance in the pickup trucks accessories sector. Manufacturers are incorporating features such as wireless charging, remote-controlled bed covers, and integrated LED lighting systems that improve usability and safety. The adoption of lightweight, corrosion-resistant materials not only enhances durability but also supports fuel efficiency and compliance with environmental standards. It allows brands to differentiate their products in a highly competitive market. Demand for technology-driven accessories is strong among both commercial fleet operators and private consumers seeking value-added solutions.

Focus on Sustainability and Eco-Friendly Solutions Shapes Product Portfolios

The Asia Pacific Pickup Trucks Accessories Market is experiencing a shift toward sustainability, with both manufacturers and consumers prioritizing eco-friendly solutions. Companies invest in recyclable materials, energy-efficient manufacturing, and green supply chains to address environmental concerns. It aligns with evolving regulatory requirements and consumer expectations for responsible product choices. Sustainable accessories such as low-drag covers, reusable cargo organizers, and biodegradable packaging gain traction, signaling a broader movement within the industry. The focus on sustainability not only enhances brand reputation but also prepares the market for future environmental standards and global best practices.

Market Challenges Analysis

Regulatory Complexity and Counterfeit Products Hinder Market Growth

The Asia Pacific Pickup Trucks Accessories Market faces significant challenges due to regulatory complexity and the prevalence of counterfeit products. Stringent and frequently changing regulations concerning vehicle modifications, emissions, and safety standards create uncertainty for manufacturers and distributors. Compliance requires ongoing investment in product certification, testing, and adaptation, which increases operational costs and can delay product launches. The presence of counterfeit and substandard accessories in the market threatens consumer safety, undermines trust, and puts legitimate brands at a disadvantage. It forces companies to intensify quality assurance measures and invest in anti-counterfeiting technologies. Regulatory inconsistencies across countries in the region further complicate cross-border trade and hinder seamless market expansion.

Fluctuating Raw Material Prices and Market Fragmentation Impact Profitability

Volatility in raw material prices poses a significant challenge for the Asia Pacific Pickup Trucks Accessories Market, impacting cost structures and profit margins for industry players. Unpredictable shifts in the prices of metals, plastics, and advanced composites can disrupt supply chains and reduce the competitiveness of locally manufactured accessories. Market fragmentation, with numerous small and unorganized players, results in price-based competition and limits the ability of brands to differentiate through innovation or quality. It creates hurdles for companies seeking to build brand loyalty and scale operations. The lack of standardized quality norms across the region further intensifies competition, making it difficult for leading manufacturers to maintain consistent standards and customer satisfaction.

Market Opportunities

Expansion of Aftermarket Services and Customization Solutions Creates New Revenue Streams

The Asia Pacific Pickup Trucks Accessories Market holds significant opportunities through the expansion of aftermarket services and customization solutions. Growing consumer interest in personalizing vehicles to match individual preferences supports strong demand for specialized accessories, installation, and maintenance services. Dealerships and independent service providers can capitalize on this trend by offering bundled packages, extended warranties, and expert consulting. Digital platforms further enable businesses to showcase product catalogs, facilitate easy ordering, and streamline customer engagement. It allows brands to build customer loyalty and secure recurring revenue through value-added offerings. The evolving needs of commercial fleets for operational efficiency and brand identity create long-term potential for tailored accessory solutions.

Advancement in Smart and Eco-Friendly Accessory Innovations Supports Market Differentiation

Rising investment in smart technologies and eco-friendly materials presents significant growth avenues for the Asia Pacific Pickup Trucks Accessories Market. Manufacturers developing advanced products such as IoT-enabled security systems, integrated lighting, and lightweight, recyclable materials can address changing consumer and regulatory demands. It provides a pathway for brands to differentiate themselves in a competitive landscape and capture new customer segments focused on safety, sustainability, and convenience. Partnerships with technology providers and material scientists accelerate product development and expand the market for premium offerings. The region’s focus on sustainable mobility and digital transformation enhances the prospects for innovative accessory solutions that meet the next generation of market expectations.

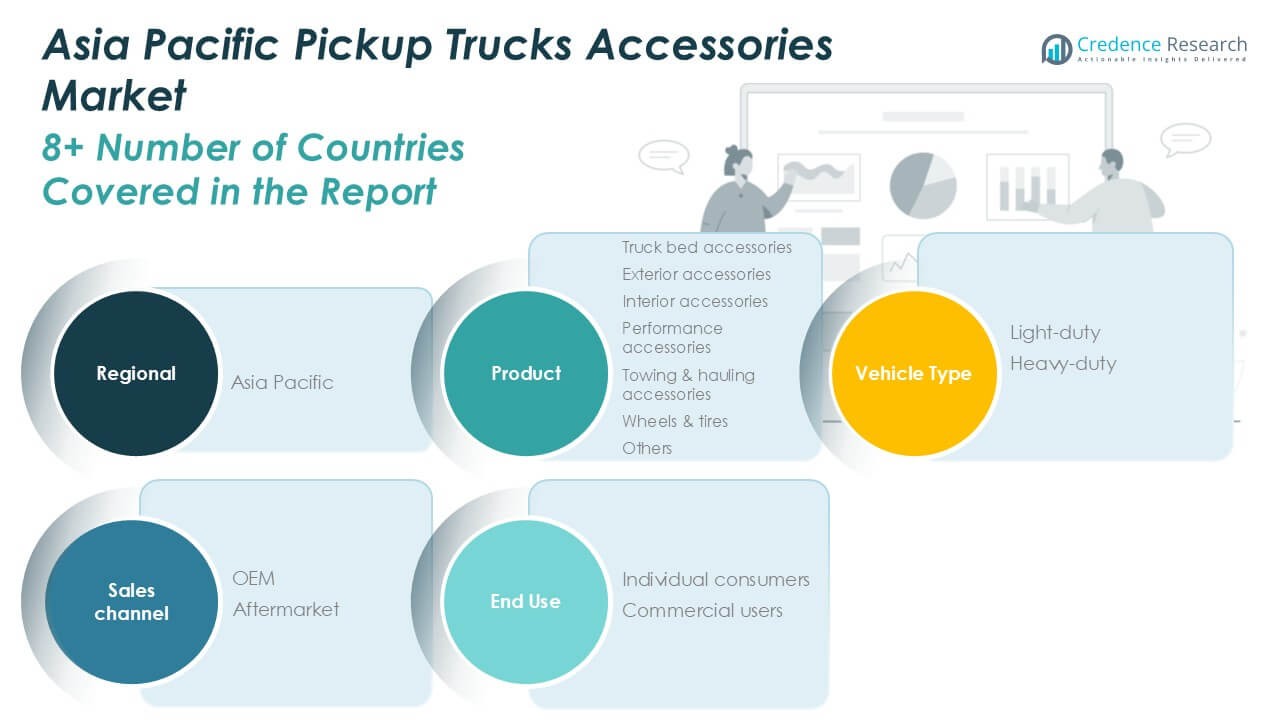

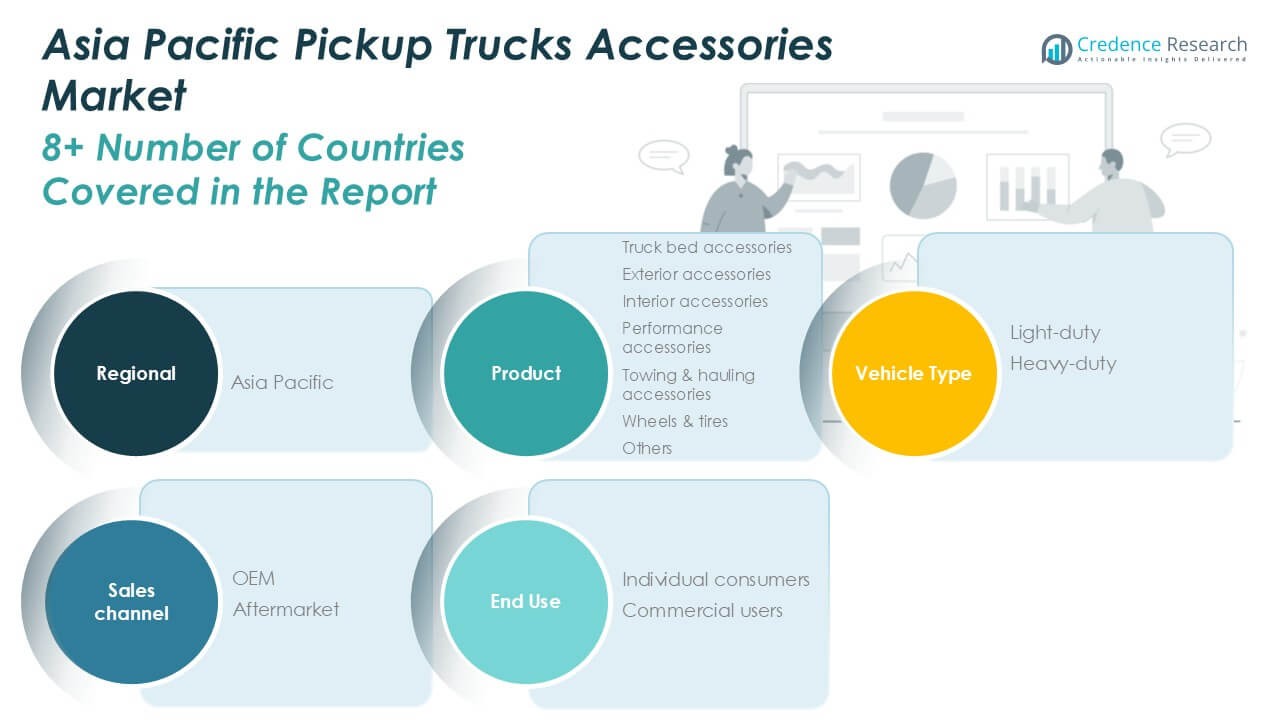

Market Segmentation Analysis:

By Product:

Truck bed accessories represent a substantial share, driven by high demand for cargo security, organization, and weather protection among commercial and private users. Exterior accessories, such as grille guards, side steps, and lighting kits, attract consumers seeking to enhance vehicle durability and aesthetic appeal. Interior accessories, including seat covers, floor mats, and infotainment upgrades, support rising interest in comfort, convenience, and personalization. Performance accessories, such as suspension kits and air intakes, appeal to customers aiming to improve driving dynamics and vehicle efficiency. Towing and hauling accessories, including hitches and tie-downs, play a crucial role in supporting logistics, construction, and recreational needs. Wheels and tires remain a popular upgrade area, with buyers focusing on safety, performance, and visual enhancement. The “others” segment, encompassing niche products like toolboxes and specialty electronics, captures emerging customization trends.

- For instance, LINE-X LLC has installed spray-on protective coatings on more than 4 million truck beds worldwide, offering certified protection against abrasion and corrosion for both personal and commercial users.

By Vehicle Type:

Light-duty pickup trucks constitute the dominant segment, benefiting from strong adoption by individual consumers, small businesses, and urban fleet operators. The light-duty category attracts buyers prioritizing versatility, maneuverability, and lower ownership costs. Heavy-duty pickups, while smaller in market share, cater to sectors such as construction, mining, and agriculture that require robust accessories for intensive use and operational reliability. It creates consistent demand for heavy-duty bed liners, towing solutions, and reinforced components.

- For instance, Mahindra & Mahindra produced 67,171 units of the Bolero Pik-Up in the latest fiscal year, supporting its wide network of heavy-duty accessory suppliers for commercial and industrial applications.

By Sales channel:

The aftermarket segment commands a significant portion of the Asia Pacific Pickup Trucks Accessories Market, fueled by consumer interest in retrofitting and upgrading vehicles post-purchase. It offers flexibility in product selection and encourages experimentation with new styles and features. OEM channels maintain a steady presence, supported by brand partnerships, factory-installed accessories, and warranty coverage.

Segments:

Based on Product:

- Truck bed accessories

- Exterior accessories

- Interior accessories

- Performance accessories

- Towing & hauling accessories

- Wheels & tires

- Others

Based on Vehicle Type:

Based on Sales channel:

Based on End- Use:

- Individual consumers

- Commercial users

Based on the Geography:

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

Regional Analysis

China

China commands the largest share of the Asia Pacific Pickup Trucks Accessories Market, accounting for approximately 38% of the regional market. The country’s dominance stems from its vast automotive manufacturing base, robust aftermarket ecosystem, and high adoption rate of pickup trucks among both individual consumers and commercial users. Urbanization and industrial growth drive sustained demand for truck bed accessories, exterior styling kits, and performance upgrades, particularly among logistics, construction, and small business segments. China’s aggressive e-commerce expansion enhances the accessibility and distribution of accessories nationwide, supporting rapid product innovation and consumer engagement. It also benefits from a mature supply chain for automotive components, enabling competitive pricing and a wide product assortment. Manufacturers in China consistently respond to shifting consumer trends, launching new models and tailored accessory lines to capture a diverse and growing market.

Japan

Japan holds the second-largest share of the Asia Pacific Pickup Trucks Accessories Market, representing around 19% of total regional revenue. The Japanese market is characterized by a preference for technologically advanced, high-quality accessories that align with the country’s reputation for precision engineering and innovation. Pickup truck ownership in Japan, while not as widespread as in China, is concentrated in niche segments such as agriculture, forestry, and small business operations. Consumers value durability, reliability, and compliance with stringent safety and environmental standards, fueling demand for OEM-approved accessories and advanced performance components. Japan’s established dealer networks and strong brand loyalty contribute to consistent aftermarket activity, while regulatory focus on emissions and sustainability shapes the direction of new product development.

South Korea

South Korea accounts for roughly 11% of the Asia Pacific Pickup Trucks Accessories Market, driven by a combination of technological prowess and evolving consumer preferences. The country’s automotive industry is globally recognized for its innovation and high production standards, which translate into a vibrant market for premium accessories. South Korean consumers show growing interest in personalization and advanced in-vehicle technology, spurring demand for smart accessories, infotainment systems, and safety enhancements. The country’s export-oriented industry structure also enables local manufacturers to introduce cutting-edge products to both domestic and international markets. South Korea’s competitive landscape encourages continuous improvement, supporting growth in both OEM and aftermarket channels.

India

India represents about 14% of the regional market share, emerging as a dynamic growth center for the Asia Pacific Pickup Trucks Accessories Market. Rising urbanization, infrastructure investments, and the expansion of small and medium enterprises contribute to increased pickup truck sales and, consequently, greater demand for accessories. Indian consumers focus on cost-effective upgrades, utility-driven modifications, and durable components suited to diverse road and climate conditions. The aftermarket segment flourishes as a result of competitive pricing and a large base of independent accessory retailers and service providers. Digitalization and e-commerce platforms further stimulate market expansion by bridging gaps in product availability and distribution across urban and rural regions.

Southeast Asia

Southeast Asia captures approximately 12% of the Asia Pacific Pickup Trucks Accessories Market, reflecting robust demand from countries such as Thailand, Indonesia, Malaysia, and the Philippines. Pickup trucks play a central role in both commercial and personal transportation, making accessories for towing, hauling, and weather protection particularly popular. Economic development and infrastructure projects drive sustained fleet purchases and encourage customization. The diversity of consumer preferences across the region creates opportunities for localized product offerings and innovative distribution models. E-commerce penetration and strategic partnerships with local retailers strengthen market access and customer service, supporting steady year-on-year growth.

Rest of Asia Pacific

The Rest of Asia Pacific, encompassing smaller markets like Australia, New Zealand, and neighboring nations, accounts for around 6% of the market share. These regions show a stable but moderate demand for pickup trucks accessories, primarily driven by utility needs in agriculture, mining, and recreation. The mature nature of these markets supports a steady flow of OEM and aftermarket products, with consumers prioritizing safety, quality, and compatibility with global standards. Despite their smaller size, these countries contribute to the diversity and resilience of the overall Asia Pacific Pickup Trucks Accessories Market by adopting global trends and supporting international trade in accessories.

Key Player Analysis

- Aeroklas

- ARB 4×4 Accessories

- EGR Group

- Foton Motor

- LINE-X LLC

- Mahindra & Mahindra

- Mountain Top Industries

- RealTruck

- Sammitr Group

- Toyota TRD

Competitive Analysis

The Asia Pacific Pickup Trucks Accessories Market demonstrates a highly competitive landscape shaped by established industry leaders and innovative regional players. Key companies such as Aeroklas, ARB 4×4 Accessories, EGR Group, Mahindra & Mahindra, RealTruck, LINE-X LLC, Foton Motor, Mountain Top Industries, Sammitr Group, and Toyota TRD set the pace for product development, brand visibility, and customer engagement across diverse markets. These players leverage robust manufacturing capabilities, comprehensive product portfolios, and extensive distribution networks to secure a competitive advantage and expand their market presence. Extensive distribution networks and a strong focus on digital and direct-to-consumer channels enhance reach and customer engagement, enabling brands to adapt quickly to evolving trends. Market leaders invest heavily in research and development to address local needs, regulatory requirements, and shifting consumer preferences for both utility-driven and lifestyle accessories. The ability to offer comprehensive product portfolios and responsive aftersales service is crucial for sustaining customer loyalty in a fragmented market. Strategic partnerships, supply chain optimization, and regional adaptation remain key factors influencing the competitive dynamics, helping companies maintain their advantage amid regulatory complexities and pricing pressures in the Asia Pacific Pickup Trucks Accessories Market.

Recent Developments

- In April 2025, at Auto Shanghai 2025, GAC Commercial Vehicle launched the Pickup 01 concept, presenting a design with an emphasis on “all-domain technology aesthetics” and flexibility. The concept is centered around modularity to provide different accessory configurations according to diversified users’ demands.

- In March 2025, South Korean company KGM introduced the Musso EV, its first electric pickup truck with 80.6kWh battery and 500kg payload capacity. The Musso EV has classic accessories like deck top, roll bar and sliding cover, and an aim for urban practicality and usability.

- In March 2024, Toyota said that it would be starting to mass-produce its battery-electric Hilux pickup truck by the end of 2025 in Thailand. The project is focused on meeting the increasing demand for electric cars in Southeast Asia especially in Thailand, where pickup vehicles account for a large percentage of car sales.

- In October 2024, Kia launched its very first pickup truck, Kia Tasman, aimed at markets such as Australia, Korea, and the Middle East. The Tasman has several accessory configurations in store, ranging from Single Decker and Double Decker to Sports Bar and Ladder Rack, for both commercial and recreational purposes. This makes Kia’s move into the mid-size pickup market, a point of focus on customization and flexibility.

Market Concentration & Characteristics

The Asia Pacific Pickup Trucks Accessories Market displays a moderate to high degree of market concentration, shaped by the presence of established global brands and a significant number of regional players. It features a diverse product landscape, ranging from basic utility upgrades to premium, technology-enhanced accessories, reflecting both commercial and personal customization needs. The market is characterized by strong aftermarket activity, rapid product innovation, and an expanding role of e-commerce in reaching customers across urban and rural areas. Regional differences in consumer preferences, vehicle usage patterns, and regulatory environments contribute to a highly segmented market structure. Leading companies benefit from robust manufacturing capabilities, established distribution networks, and close alignment with OEMs, while smaller firms compete on price, local relevance, and niche offerings. Intense competition drives continuous improvement in product quality, design, and service standards. The Asia Pacific Pickup Trucks Accessories Market demonstrates adaptability and resilience, maintaining steady growth in response to changing mobility trends, evolving consumer expectations, and regulatory pressures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Vehicle Type, Sales channel, End- Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness sustained growth driven by rising pickup truck ownership across emerging economies.

- Demand for premium, smart, and customizable accessories will increase among both individual and commercial users.

- E-commerce platforms will continue to expand their role in aftermarket sales and product accessibility.

- Technological integration, including IoT-enabled and safety-focused accessories, will become more prominent.

- Sustainability trends will influence the adoption of eco-friendly materials and energy-efficient product designs.

- Manufacturers will invest in research and development to address changing regulatory requirements and consumer expectations.

- Aftermarket service offerings and bundled customization solutions will attract greater consumer interest.

- Regional adaptation of products will remain essential to meet the unique needs of diverse markets in Asia Pacific.

- Competitive pricing and product differentiation will shape market strategies for both large and small players.

- Industry consolidation may occur as leading companies pursue strategic partnerships and acquisitions to strengthen their market positions.