Market Overview

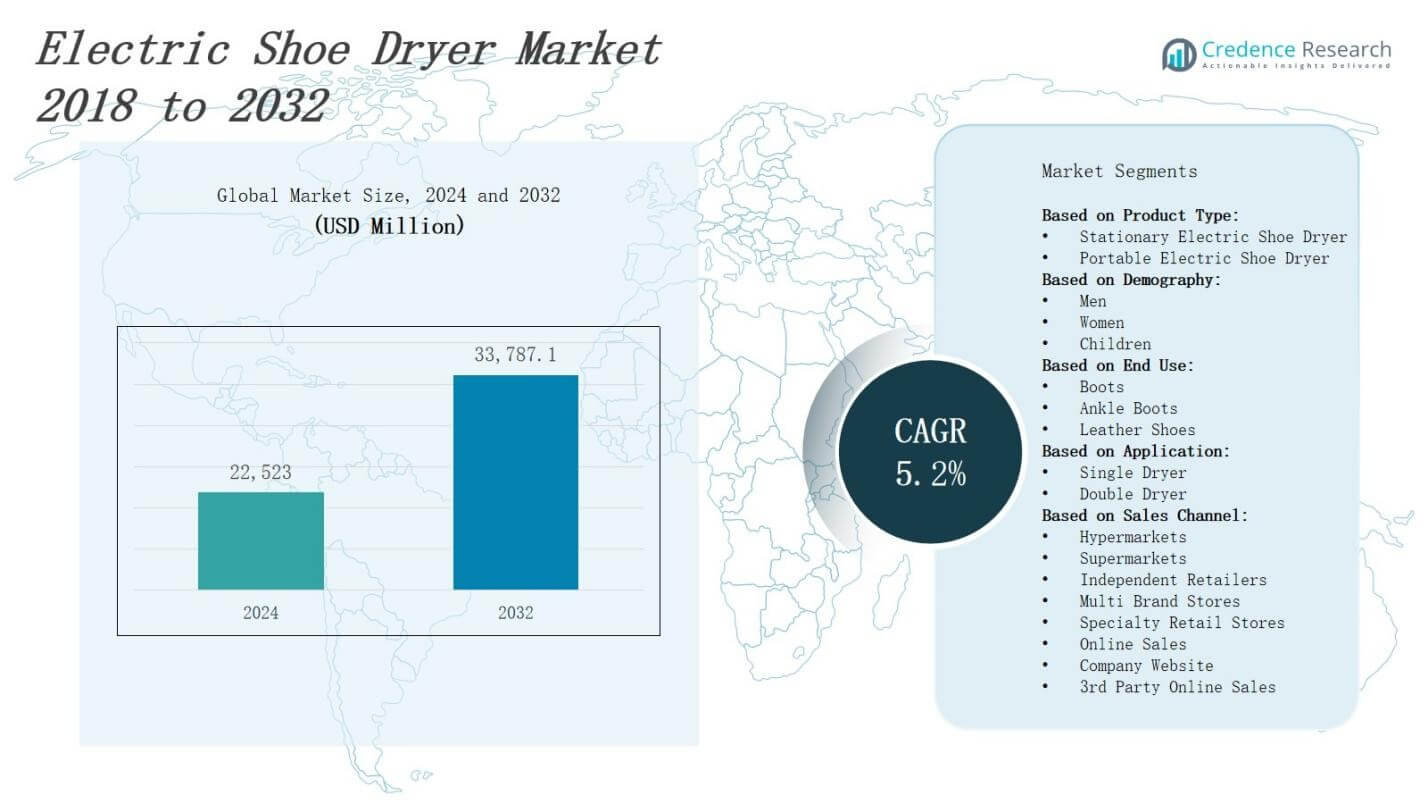

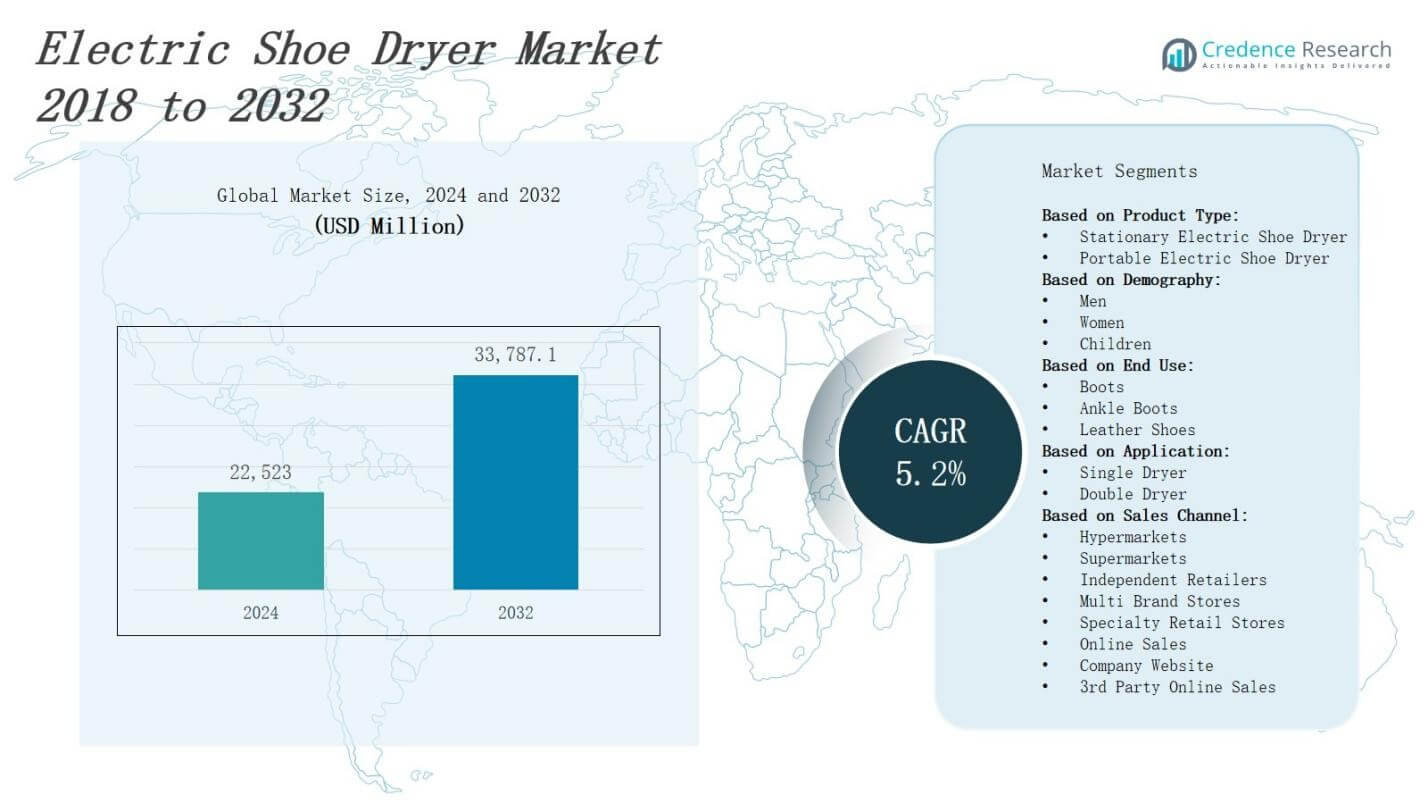

The electric shoe dryer market is projected to grow from USD 22,523 million in 2024 to USD 33,787.1 million by 2032, reflecting a compound annual growth rate of 5.2%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Shoe Dryer Market Size 2024 |

USD 22,523 million |

| Electric Shoe Dryer Market, CAGR |

5.2% |

| Electric Shoe Dryer Market Size 2032 |

USD 33,787.1 million |

Manufacturers in the electric shoe dryer market accelerate product innovation to meet rising demand for efficient moisture removal and bacterial control in footwear, driven by growing athleisure trends and heightened consumer focus on hygiene. The market benefits from increased disposable incomes and expanded retail channels, enabling broader access to advanced dryers featuring adjustable temperature settings, smart sensors, and energy‑saving modes. Technological advancements integrate IoT connectivity for remote monitoring and maintenance alerts. Meanwhile, sustainability initiatives prompt the use of eco‑friendly materials and recyclable components. Growing awareness of foot health and seasonal precipitation patterns further propels market expansion globally and rapidly worldwide.

North America leads the electric shoe dryer market with 36% share, driven by high consumer awareness and smart home adoption. Europe holds 29% share and values energy‑efficient, CE‑certified models. Asia Pacific accounts for 24% share due to humid climate and rising incomes. Latin America and Middle East & Africa hold 6% and 5% respectively, fueled by growing retail networks and localized offerings. Key players such as StinkBOSS, Apontus, Peet Shoe Dryer, Inc., Caframo Limited and Housmile Electronics compete on performance, design and service to capture regional demand.

Market Insights

- The electric shoe dryer market is projected to grow from USD 22,523 million in 2024 to USD 33,787.1 million by 2032 at a 5.2% CAGR.

- Heightened consumer focus on foot health drives demand for devices that remove moisture and limit bacterial growth.

- Integration of IoT connectivity enables remote temperature control and maintenance alerts to enhance user experience.

- Expansion of athleisure trends fuels demand for portable models that deliver rapid drying of athletic footwear.

- Sustainability initiatives push the adoption of eco‑friendly materials and recyclable components in product designs.

- North America leads with 36% share, followed by Europe at 29%, Asia Pacific at 24%, Latin America at 6%, and Middle East & Africa at 5%.

- Key players such as StinkBOSS, Apontus, Peet Shoe Dryer, Inc., Caframo Limited and Housmile Electronics compete on performance, design and service.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Heightened Consumer Focus on Foot Health

Growing consumer awareness of foot health drives demand for electric shoe dryer market solutions. It removes moisture and reduces bacterial growth to maintain footwear hygiene. Brands promote dryers that deliver rapid heat distribution and odor elimination. Consumers invest in devices that extend shoe lifespan and prevent fungal infections. Manufacturers emphasize user-friendly controls and safety features. Retailers expand product offerings to meet evolving wellness demands. It supports seasonal and indoor uses.

- For instance, shoe dryers with forced air and infrared technology effectively reduce drying time and eliminate odors, improving hygiene for athletes and outdoor enthusiasts.

Integration of Smart Connectivity and Performance Optimization

Integration of IoT connectivity drives innovation in electric shoe dryer market devices. It enables remote temperature control and maintenance alerts through smartphone apps. Manufacturers incorporate energy‑efficient thermostats and automated timers to optimize performance. Consumers value customizable settings and data‑driven usage reports for proactive care. Brands collaborate with tech partners to design intuitive interfaces. Retailers feature connected models alongside traditional units. Research fosters sensor accuracy improvement and user experience.

- For instance, Shenzhen Shooscam Technology Co., Ltd offers the DYP-102 Portable Mini Smart Shoe Dryer, which incorporates overheat protection and energy-efficient PTC heating elements with rapid heating in just 3 seconds, controlled via simple, user-friendly interfaces.

Acceleration of Athleisure and Sports Applications

Expansion of athleisure trends propels demand within the electric shoe dryer market. It caters to athletes who require rapid drying after intense training sessions. Brands target sports facilities and home users with compact, portable models. Partnerships with fitness influencers increase product visibility. Retailers launch seasonal promotions around winter and rainy periods. Consumers appreciate devices that dry specialized footwear like cleats and running shoes. Manufacturers prioritize durable materials to withstand use.

Emphasis on Sustainability and Regulatory Compliance

Stricter environmental regulations encourage eco‑friendly designs in electric shoe dryer market products. It uses recyclable plastics and energy‑efficient motors to meet compliance standards. Manufacturers reduce carbon footprint through optimized heat transfer technologies. Consumers support brands that demonstrate sustainability commitments. Retailers promote low‑power consumption models in green marketing campaigns. Industry bodies collaborate on testing protocols for safety and efficiency. Companies invest in closed‑loop manufacturing to minimize material waste. It aligns globally.

Market Trends

Growth of Smart Home Integration and Connectivity

Manufacturers embed Wi‑Fi modules and Bluetooth chips in electric shoe dryer market devices. It enables remote control through smartphone apps and voice assistants. Consumers adjust temperature settings without manual intervention. Brands update firmware to deliver real‑time performance metrics. Retailers feature connected models in smart home sections. IoT partners collaborate on seamless ecosystem compatibility. It responds to user demand for convenience and automation. It drives product differentiation and premium pricing.

- For instance, Legrand’s Excel Life Smart Starter Kit includes Wi-Fi and Bluetooth-enabled devices that allow users to customize and control settings conveniently from their phones.

Expansion of Customized Drying Modes and Material Care

Manufacturers equip electric shoe dryer market units with multiple heat levels and timer presets. It treats leather, synthetic, and technical fabrics without damage. Brands offer moisture sensors that halt operation upon dryness. Consumers select modes that preserve shoe shape and material integrity. Retailers highlight care‑specific functions for winter boots and sports shoes. It reduces wear and tear. Designers integrate UV light to combat odors.

- For instance, LNIDEAS manufactures electric shoe dryers featuring digital controls and timer functions, with foldable and scalable ports suited for drying shoes, boots, gloves, and socks efficiently while eliminating odors through ozone deodorization technology.

Rise of Commercial and Professional Applications in Sports and Hospitality

Facilities adopt electric shoe dryer market solutions for locker rooms and rental services. It dries multiple pairs within hours to maintain operational efficiency. Coaches rely on rapid turnaround during training camps and competitions. Hotels include shoe care stations to enhance guest experience. Manufacturers develop multi‑unit racks that support high throughput. It supports event organizers with portable units for outdoor venues. Service providers offer maintenance plans and warranties.

Trend Toward Compact Designs and Eco‑Friendly Materials

Consumers prefer electric shoe dryer market devices that occupy minimal space in closets and entryways. It integrates foldable arms and wall‑mount features to save room. Brands select recycled plastics and energy‑efficient heating elements. Retailers showcase slimline models in home appliance displays. It reduces electricity consumption while maintaining performance. Manufacturers adopt minimal packaging to cut waste. Designers create modular units that adapt to user lifestyle. It appeals to eco‑conscious buyers.

Market Challenges Analysis

High Initial Cost and Consumer Reluctance

High purchase price hinders widespread adoption in the electric shoe dryer market. It places pressure on manufacturers to justify premium features. Consumers compare cost against traditional drying methods and delay purchases. Retailers face resistance during price negotiations with distributors. It prompts brands to explore financing options to lower entry barriers. Extension of warranties and bundled accessories helps overcome hesitation. Market education campaigns must highlight long‑term benefits and total cost savings.

Regulatory Standards and Technical Constraints Restricting Innovation

Stringent safety and energy efficiency requirements govern the electric shoe dryer market. It demands rigorous testing to comply with regional electrical codes. Manufacturers struggle to balance rapid heat output and power consumption limits. Retailers encounter delays when certifications arrive late. It forces design revisions that increase development cycles. Patent disputes and lack of interoperability among smart models complicate integration. Collaboration with regulatory bodies can streamline approval and support future innovation.

Market Opportunities

Expansion through E‑Commerce and Subscription Models

Retailers tap online platforms to boost visibility of the electric shoe dryer market. It leverages direct‑to‑consumer channels to reduce distribution costs and improve margins. Brands partner with major e‑tailers and footwear subscription services to bundle dryers with shoe deliveries. It offers maintenance plans that guarantee timely replacements and extended warranties. Targeted digital campaigns highlight hygiene benefits and promote gift‑pack options during peak seasons. Manufacturers create limited‑edition models for loyal subscriber bases. It supports rapid scalability without traditional retail constraints.

Penetration into Emerging Regions and Custom Solutions

Companies pursue growth in developing economies where humid climates threaten footwear integrity. It adapts product lines to local voltage standards and cultural preferences. Brands collaborate with regional distributors to establish after‑sales networks and training centers. It develops modular attachments for boots, athletic shoes, and specialty footwear. Sustainability drives use of bio‑based plastics and energy‑efficient heating elements. Manufacturers explore B2B sales to sports clubs and hospitality chains. It cultivates brand recognition through localized marketing and customized service offerings.

Market Segmentation Analysis:

By Product Type

Stationary and portable variants dominate the electric shoe dryer market. Stationary units install in closets and garages to handle multiple pairs simultaneously. It secures shoes with fixed arms and delivers consistent airflow without manual repositioning. Portable models offer compact design and plug‑and‑play operation for travel and small spaces. It appeals to frequent travelers and athletes who require on‑the‑go drying. Brands optimize both formats for energy efficiency and user convenience.

- For instance, the Hedgehog Dryer offers advanced stationary drying with adjustable heat settings and integrated odor elimination, optimizing energy efficiency and drying performance.

By Demography

Manufacturers target men, women, and children with tailored features in the electric shoe dryer market. It adapts size and temperature settings to suit adult and youth footwear dimensions. Brands offer color and style options that resonate with each demographic segment. It integrates safety lock mechanisms for children’s models to prevent accidental burns. Retailers promote gender‑neutral designs and specialized attachments for youth sports shoes. It enhances family‑wide adoption through versatile configurations.

- For instance, the company PEET Shoe Dryer offers adjustable temperature settings and size options to accommodate both adult and youth footwear, ensuring a precise fit and drying efficiency.

By End Use

Product lines cater to boots, ankle boots, and leather shoes in the electric shoe dryer market. It delivers adjustable heat profiles to protect delicate leather and synthetic materials. Brands include insulating sleeves for tall boots and streamlined arms for ankle‑length styles. It prevents deformation in leather shoes by maintaining shape during drying. Manufacturers develop vented racks and UV modules to target odor‑prone footwear. It expands usage across casual, formal, and specialized footwear categories.

Segments:

Based on Product Type:

- Stationary Electric Shoe Dryer

- Portable Electric Shoe Dryer

Based on Demography:

Based on End Use:

- Boots

- Ankle Boots

- Leather Shoes

Based on Application:

- Single Dryer

- Double Dryer

Based on Sales Channel:

- Hypermarkets

- Supermarkets

- Independent Retailers

- Multi Brand Stores

- Specialty Retail Stores

- Online Sales

- Company Website

- 3rd Party Online Sales

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the electric shoe dryer market with robust demand from residential and commercial sectors. It benefits from high consumer awareness of footwear hygiene and widespread smart home adoption. Manufacturers introduce models that integrate with existing HVAC systems and laundry appliances. Retailers expand online offerings and in‑store demonstrations to drive sales. North America accounts for 36% market share, followed by Europe at 29%, Asia Pacific at 24%, Latin America at 6%, and Middle East & Africa at 5%. It continues to influence global product standards and distribution strategies.

Europe

Europe sustains steady growth in the electric shoe dryer market through stringent safety regulations and strong focus on sustainable design. It enforces energy efficiency standards that shape product development and certification processes. Brands collaborate with certification bodies to secure CE marks and green product labels. Retailers highlight low‑power consumption models to attract eco‑conscious buyers. North America holds 36% market share, followed by Europe at 29%, Asia Pacific at 24%, Latin America at 6%, and Middle East & Africa at 5%. It drives innovation in materials and manufacturing practices.

Asia Pacific

Asia Pacific emerges as a high‑growth region in the electric shoe dryer market thanks to rising disposable incomes and humid climates. It adapts product lines to local voltage standards and footwear preferences. Manufacturers partner with e‑commerce platforms to reach tier‑2 and tier‑3 cities. Retailers leverage social media influencers to educate consumers on shoe care. North America commands 36% market share, followed by Europe at 29%, Asia Pacific at 24%, Latin America at 6%, and Middle East & Africa at 5%. It promises significant expansion opportunities through localized strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- StinkBOSS

- Apontus

- Peet Shoe Dryer, Inc.

- ManaKey Group

- Housmile Electronics

- ROK Industries

- Drdry

- Kendal, KMS Designs Inc.

- Danner, Inc.

- Impulse LLC

- BeesClover

- Caframo Limited

Competitive Analysis

Market players compete on product performance, design differentiation and distribution reach in the electric shoe dryer market. It leverages rapid heat delivery, smart connectivity and modular configurations to capture consumer interest. Brands such as StinkBOSS and Apontus emphasize energy‑efficient motors and durable materials to justify premium pricing. Peet Shoe Dryer, Inc. and Caframo Limited focus on multi‑pair capacity and professional‑grade units for sports and hospitality sectors. Emerging entrants undercut incumbents on affordability and online‑only sales. Established companies strengthen retail partnerships and offer extended warranties to build trust. Smaller innovators introduce UV sanitization and IoT monitoring to stand out. It balances R&D investment against regulatory compliance and market feedback to refine product roadmaps. Companies also develop comprehensive after‑sales service networks, training programs for distributors, and refurbishment schemes to enhance customer loyalty and extend device lifecycles. Continuous feature upgrades, targeted marketing campaigns and strategic alliances determine leadership positions and future growth trajectories.

Recent Developments

- In August 14, 2023, Hedgehog Dryer’s Hanger Shoe Dryer and Deodorizer became available on Amazon.

- In February 2025, Hedgehog Dryer unveiled Hedgehog Go, a compact dual‑purpose shoe and hair dryer, on Kickstarter.

- In 2025, OdorStop released its Odor Eliminator Boot Dryer, featuring heat blower technology and multi‑footwear capability.

Market Concentration & Characteristics

Market concentration in the [ electric shoe dryer market ] is moderate, with the top five players commanding approximately 58% of global revenue. It features a blend of established manufacturers and emerging entrants competing on product innovation, price, and distribution network strength. Leading companies leverage energy‑efficiency, smart connectivity and durable materials to differentiate offerings and justify premium pricing. Mid‑tier players focus on affordability and niche segments such as travel‑friendly portable designs. Retailers and e‑commerce platforms shape dynamics by prioritizing visibility of connected models. Regional firms tailor voltage compatibility and style preferences to gain footholds in Asia Pacific, Latin America and Middle East & Africa. It maintains moderate barriers to entry due to regulatory certifications and intellectual property protections. Partnerships with sports clubs and hospitality chains further consolidate positions. Technological advancements in sensor accuracy and UV sanitization support gradual diversification of product portfolios.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Demography, End-Use, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Brands will integrate AI‑driven sensors and adaptive controls to personalize footwear drying, enhancing hygiene, convenience.

- Retailers will bundle electric shoe dryers with popular footwear releases to boost cross‑selling and satisfaction.

- Manufacturers will develop compact, foldable electric shoe dryer models designed specifically for space‑constrained urban apartments.

- Companies will introduce subscription‑based maintenance and replacement programs to ensure consistent performance and customer retention.

- Vendors will partner with fitness centers and sports clubs to supply high‑capacity shoe drying stations.

- Developers will embed UV‑C sanitization modules into shoe dryers to eliminate pathogens, control unpleasant odors.

- Designers will offer modular attachments to accommodate boots, athletic shoes and delicate leather footwear precisely.

- Suppliers will integrate recycled and bio‑based materials into dryer components, lowering environmental impact, attracting buyers.

- Distributors will deploy AR‑enabled product demos to showcase dryer benefits, increase engagement, optimize purchase decisions.

- Stakeholders will pursue cross‑industry collaborations to integrate shoe dryers with home appliances, footwear maintenance systems.