| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Maritime Megawatt Charging Market Size 2024 |

USD 285.65 Million |

| Maritime Megawatt Charging Market, CAGR |

13.74% |

| Maritime Megawatt Charging Market Size 2032 |

USD 858.55 Million |

Market Overview

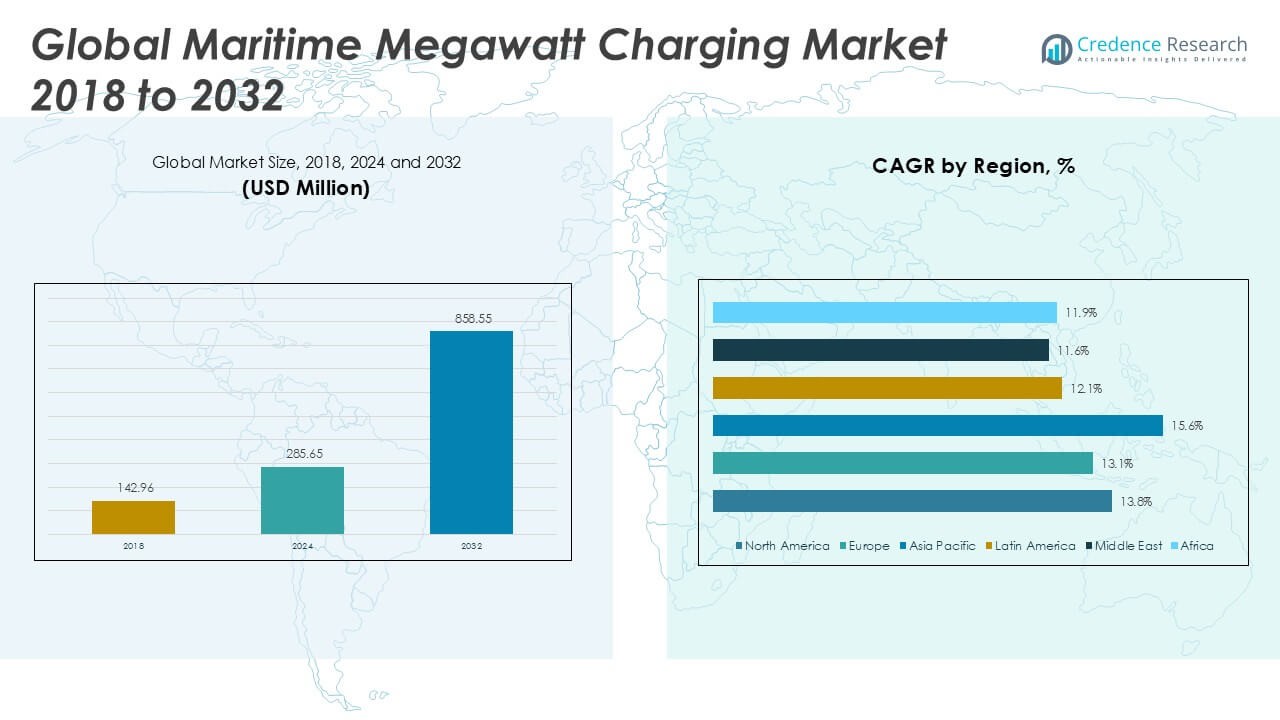

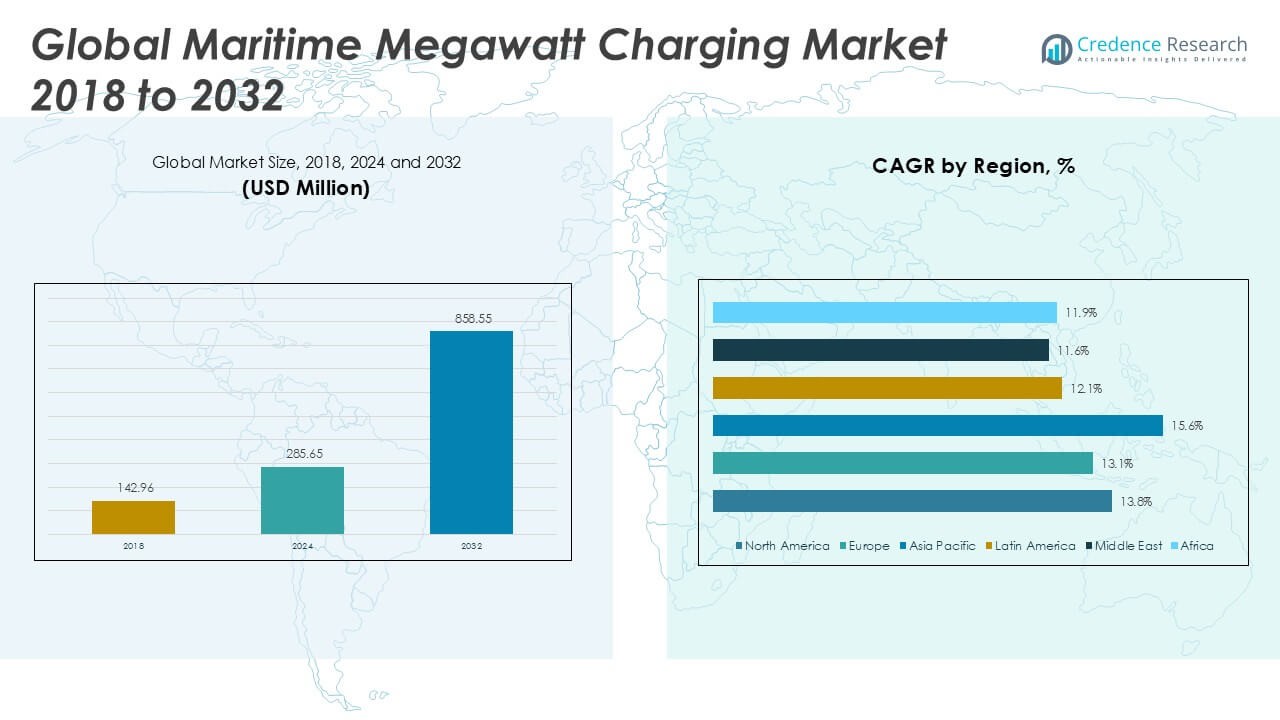

The Maritime Megawatt Charging Market was valued at USD 142.96 million in 2018 and reached USD 285.65 million in 2024. It is anticipated to reach USD 858.55 million by 2032, reflecting a compound annual growth rate (CAGR) of 13.74% during the forecast period.

The Maritime Megawatt Charging Market is experiencing robust growth due to rising demand for electrification across ports and marine vessels, driven by stringent environmental regulations and the global push for carbon emission reduction. The increasing adoption of electric and hybrid vessels, alongside advancements in battery technology, accelerates the need for high-capacity charging infrastructure. Port authorities and shipping operators are investing in megawatt-scale charging solutions to enable rapid turnaround and minimize downtime for vessels. Growing focus on sustainable maritime operations and government incentives for green port initiatives further support market expansion. Trends indicate a shift toward standardization of charging systems, integration with renewable energy sources, and deployment of smart charging networks to optimize energy use and support large-scale vessel electrification, positioning the Maritime Megawatt Charging Market as a critical enabler of the maritime industry’s decarbonization journey.

Geographical analysis of the Maritime Megawatt Charging Market reveals strong growth in regions such as North America, Europe, and Asia Pacific, driven by investments in port electrification, adoption of electric and hybrid vessels, and supportive regulatory frameworks. Leading countries including the United States, Germany, China, and Japan focus on upgrading port infrastructure and implementing clean maritime initiatives to meet emission targets. The market benefits from active government support and industry collaboration across major shipping hubs, fostering rapid deployment of megawatt-scale charging solutions. Key players shaping the competitive landscape include ABB Ltd., Siemens AG, and Wärtsilä Corporation, each offering advanced charging technologies, integrated energy solutions, and a strong presence in global maritime projects. These companies drive innovation and facilitate the transition toward sustainable and electrified shipping operations worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Maritime Megawatt Charging Market was valued at USD 142.96 million in 2018, reached USD 285.65 million in 2024, and is projected to hit USD 858.55 million by 2032, reflecting a CAGR of 13.74%.

- Growing global focus on decarbonizing maritime transport and stricter emission regulations are driving the rapid adoption of high-capacity megawatt charging infrastructure for electric and hybrid vessels.

- The market sees strong investment in standardizing charging technologies, with key trends including the integration of renewable energy sources and deployment of smart charging networks at major ports.

- Leading companies such as ABB Ltd., Siemens AG, and Wärtsilä Corporation are actively developing advanced charging stations and digital solutions, enhancing their global reach and technical capabilities.

- High capital requirements for port electrification, complex grid upgrades, and lack of unified technical standards restrain the pace of market adoption, especially in emerging regions.

- North America, Europe, and Asia Pacific remain the most dynamic regions, benefiting from early policy adoption, green port initiatives, and significant government funding, while Latin America, the Middle East, and Africa show steady but slower infrastructure growth.

- The competitive landscape features strategic partnerships, pilot projects, and government collaborations, fostering technological innovation and accelerating the global transition toward sustainable maritime operations.

Market Drivers

Rising Environmental Regulations and Decarbonization Mandates Stimulate Market Demand

Stringent environmental regulations imposed by international bodies such as the International Maritime Organization (IMO) have created a pressing need for cleaner maritime operations. Governments worldwide now enforce strict emission reduction targets, pushing ports and shipping operators to adopt greener technologies. The Maritime Megawatt Charging Market responds to these mandates by offering high-capacity charging infrastructure capable of supporting electric and hybrid vessels. Regulatory frameworks accelerate the transition toward electrification by imposing deadlines and penalties for non-compliance. Shipowners and port authorities prioritize investment in megawatt charging to ensure future readiness. This regulatory pressure directly drives adoption rates and underpins the market’s long-term expansion.

- For instance, ABB Ltd. delivered a shore power system in the Port of Gothenburg with a capacity of 16 MW, enabling Stena Line’s vessels to connect and draw 6.5 MW of electricity during each port call.

Technological Advancements in Battery and Charging Solutions Drive Infrastructure Growth

Continuous improvements in battery technology and charging systems provide a robust foundation for the Maritime Megawatt Charging Market. Higher energy density, faster charging cycles, and longer battery lifespans increase the feasibility of electric vessels for a wider range of operations. The market benefits from rapid development in megawatt-scale charging stations that allow quick turnaround for ships. It incorporates intelligent charging management to optimize energy delivery and ensure system reliability. Integration with port automation and smart grid technologies supports large-scale deployments. The technological progress ensures the market can meet growing energy demands efficiently.

- For instance, Siemens AG’s SICHARGE UC charging system delivers up to 1,000 kW per charging point, supporting electric ferries with turnaround times as short as 25 minutes in Norway’s Flakk–Rørvik route.

Expansion of Electric and Hybrid Vessel Fleets Spurs Infrastructure Investments

Global shipping companies actively expand their electric and hybrid vessel fleets to align with sustainability goals. It propels demand for robust, high-capacity charging solutions capable of accommodating various vessel sizes and energy requirements. Operators require reliable infrastructure to minimize operational downtime and maximize vessel utilization. The Maritime Megawatt Charging Market supports this transition by enabling rapid, safe, and scalable charging. Increased vessel electrification translates directly into higher infrastructure deployment across major ports. Market players focus on developing modular and interoperable charging solutions to serve diverse client needs.

Government Incentives and Green Port Initiatives Accelerate Market Adoption

National and regional governments introduce incentives and funding programs to stimulate investment in green maritime infrastructure. Port authorities leverage grants and tax benefits to implement megawatt charging stations, advancing port decarbonization objectives. Strategic partnerships between public and private sectors enhance market visibility and drive project implementation. The Maritime Megawatt Charging Market receives a boost from pilot programs and demonstration projects that showcase the feasibility of large-scale vessel electrification. These government-led initiatives foster innovation and strengthen collaboration among stakeholders, expediting the market’s adoption curve.

Market Trends

Standardization Efforts Shape Market Dynamics and Foster Interoperability

Standardization of megawatt charging systems emerges as a pivotal trend within the Maritime Megawatt Charging Market. Industry stakeholders collaborate to create unified protocols that ensure compatibility between different vessels and charging infrastructures. This movement toward standardized connectors, safety measures, and communication protocols streamlines deployment across global ports. Unified standards help port operators reduce installation complexities and operational uncertainties. Shipbuilders and charging equipment manufacturers can optimize their product offerings, facilitating broader adoption. The trend supports seamless integration with evolving maritime technologies and sets the stage for future-proof, scalable infrastructure.

- For instance, Cavotec SA launched the Mega Watt Charging System (MWC) using a standardized CCS2 connector rated for 3,000 amperes and 1,500 volts DC, enabling a maximum power transfer of 4.5 MW per connector.

Integration with Renewable Energy Sources Supports Decarbonization Goals

Integration of megawatt charging stations with renewable energy sources gains momentum, supporting the maritime sector’s decarbonization objectives. Ports incorporate solar, wind, and battery storage solutions to power high-capacity charging infrastructure. This trend reduces reliance on fossil fuels and minimizes greenhouse gas emissions linked to vessel operations. The Maritime Megawatt Charging Market leverages renewable integration to create more resilient and sustainable energy systems. Market participants develop hybrid energy management solutions that balance fluctuating supply and demand patterns. The push toward green port operations encourages new business models centered on clean energy supply for vessel charging.

- For instance, Wärtsilä Corporation provided a hybrid battery energy storage system of 10 MWh at the Port of Rotterdam, supporting the charging needs of multiple electric vessels connected to the port’s renewable energy grid.

Smart Charging Networks Enable Optimized Energy Management

Deployment of smart charging networks marks a significant trend in the Maritime Megawatt Charging Market. Digital platforms, IoT devices, and advanced analytics allow operators to monitor energy consumption, predict peak usage, and automate charging schedules. These networks help ports manage grid loads efficiently and reduce operational costs. It also improves vessel turnaround times and enhances reliability through real-time diagnostics. Smart networks facilitate predictive maintenance, reducing unexpected downtime. The trend accelerates the digital transformation of port operations and encourages data-driven decision-making across the industry.

Expansion of Public-Private Partnerships Drives Large-Scale Implementation

Public-private partnerships play a critical role in accelerating the rollout of megawatt charging infrastructure. Governments collaborate with private companies, research institutions, and port authorities to finance and deploy pilot projects. The Maritime Megawatt Charging Market benefits from these alliances by gaining access to technical expertise, shared risks, and funding resources. Partnerships also promote knowledge exchange, enabling best practices and innovation. Such collaborative efforts speed up regulatory approvals and encourage the replication of successful models across different regions. The trend supports widespread adoption and rapid scaling of megawatt charging solutions globally.

Market Challenges Analysis

High Capital Investment and Complex Infrastructure Requirements Hinder Rapid Adoption

Deployment of megawatt-scale charging systems requires substantial capital investment and advanced technical expertise. Ports must upgrade electrical grids, install high-capacity power delivery systems, and ensure robust safety measures. These infrastructure demands present significant financial and logistical challenges, particularly for smaller ports or developing regions. The Maritime Megawatt Charging Market faces delayed projects and slower adoption rates where funding or technical skills are limited. Project developers must address site-specific challenges such as grid stability, land availability, and integration with legacy systems. High upfront costs and uncertainty around return on investment can deter early adopters.

Regulatory Uncertainty and Lack of Unified Standards Create Market Fragmentation

Evolving regulations and the absence of universally accepted standards complicate the market landscape. Ports and shipping operators encounter uncertainty regarding compliance requirements, technology compatibility, and future regulatory changes. The Maritime Megawatt Charging Market must navigate regional differences in safety, environmental, and operational codes. Lack of standardized connectors, protocols, and certification processes can slow the rollout of large-scale infrastructure projects. Industry stakeholders invest in collaborative efforts to develop harmonized standards, but fragmentation persists in the interim. Navigating this complex regulatory environment requires ongoing investment in risk management and compliance strategies.

Market Opportunities

Expansion of Electric and Hybrid Vessel Fleets Opens New Growth Avenues

The rapid growth in electric and hybrid vessel fleets presents significant opportunities for the Maritime Megawatt Charging Market. Shipowners and operators seek reliable high-capacity charging solutions to support new vessel deployments and retrofitting projects. The market can benefit from rising interest in sustainable shipping, especially for ferries, container ships, and harbor craft. Investments in charging infrastructure at strategic ports help capture a growing share of vessel electrification demand. Market players can develop modular and scalable solutions tailored to various vessel types and port sizes. It positions itself to serve a wider customer base through technological innovation and flexible deployment models.

Government Support and Green Port Initiatives Accelerate Infrastructure Development

Supportive government policies, funding programs, and international green port initiatives create fertile ground for market expansion. Grants, tax incentives, and regulatory frameworks encourage port authorities to adopt megawatt charging technologies. The Maritime Megawatt Charging Market leverages these opportunities by partnering with public and private stakeholders to pilot and scale infrastructure projects. Successful demonstration programs increase stakeholder confidence and facilitate faster market acceptance. Strategic collaborations and knowledge sharing further strengthen the market’s role in driving sustainable maritime operations. These factors collectively enable robust infrastructure growth and long-term market sustainability.

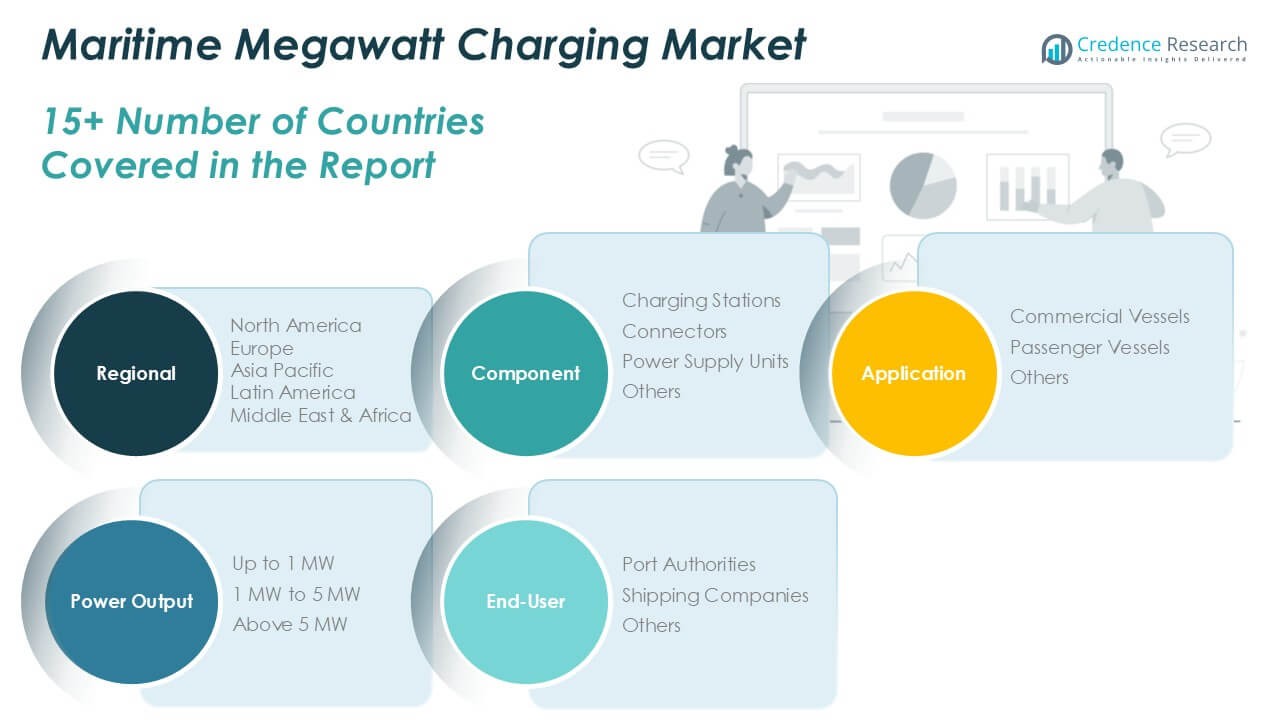

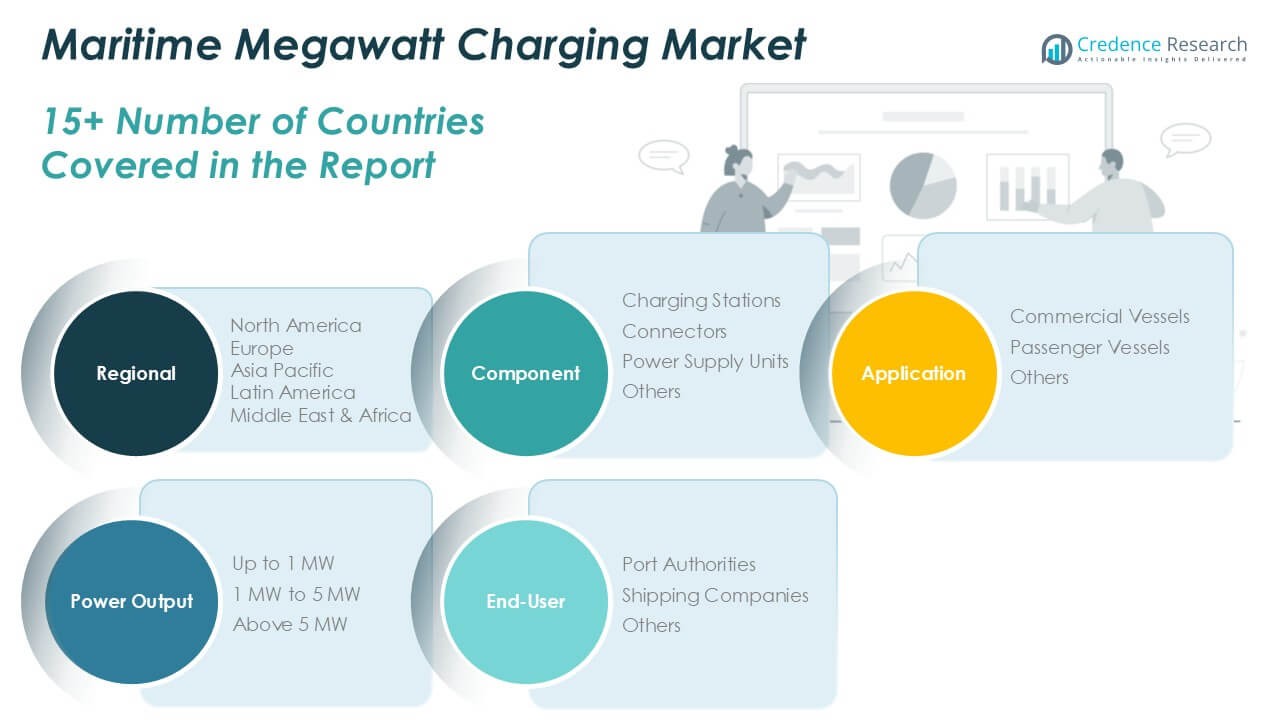

Market Segmentation Analysis:

By Component:

The Maritime Megawatt Charging Market consists of key components such as charging stations, connectors, power supply units, and others. Charging stations hold the largest share due to their central role in facilitating high-capacity charging for electric and hybrid vessels. It relies on robust and scalable charging infrastructure to minimize vessel turnaround times and ensure reliable operations. Connectors represent a vital segment, driven by the push for standardized interfaces that enhance interoperability and safety across ports. Power supply units contribute to market growth by supporting stable and efficient energy delivery to vessels. The “others” segment includes control systems and auxiliary equipment, providing essential support for seamless charging operations.

- For instance, Schneider Electric delivered 212 power supply units for shore-to-ship connections at the Port of Marseille, ensuring continuous power delivery to docked vessels.

By Application:

Commercial vessels lead the application segment, reflecting the strong demand for electrification within cargo ships, tankers, and workboats. The Maritime Megawatt Charging Market addresses the unique requirements of these vessels, enabling rapid and large-scale charging capabilities for demanding commercial operations. Passenger vessels, including ferries and cruise ships, represent a growing segment as operators seek to reduce emissions and comply with strict environmental regulations. It supports the passenger segment with fast-charging solutions designed for high-frequency and short-duration docking schedules. The “others” application category includes specialized and support vessels, contributing to the market’s diversification and broadening its addressable base.

- For instance, Siemens AG installed three megawatt charging stations at the Port of Kiel for Color Line’s passenger ferry, each station delivering 3,600 kW, allowing the vessel to recharge during its 30-minute stopover.

By Power Output:

The market segments by power output into up to 1 MW, 1 MW to 5 MW, and above 5 MW. Charging systems rated between 1 MW and 5 MW are the fastest-growing segment, driven by their suitability for a wide range of vessel sizes and port requirements. The Maritime Megawatt Charging Market sees increasing deployment of above 5 MW systems, targeting large commercial ships and ports handling high traffic volumes. The up to 1 MW segment serves smaller vessels and auxiliary craft, supporting ports with lower electrification demand. It aligns product development with the diverse power needs of global maritime fleets, ensuring the market can meet the evolving requirements of port operators and vessel owners.

Segments:

Based on Component:

- Charging Stations

- Connectors

- Power Supply Units

- Others

Based on Application:

- Commercial Vessels

- Passenger Vessels

- Others

Based on Power Output:

- Up to 1 MW

- 1 MW to 5 MW

- Above 5 MW

Based on End-User

- Port Authorities

- Shipping Companies

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Maritime Megawatt Charging Market

North America Maritime Megawatt Charging Market grew from USD 45.52 million in 2018 to USD 89.67 million in 2024 and is projected to reach USD 270.54 million by 2032, reflecting a compound annual growth rate (CAGR) of 13.8%. North America is holding a 32% market share. The United States leads this region, supported by early adoption of electric vessels and robust investment in port electrification. Canada is advancing initiatives to reduce emissions at major ports, boosting infrastructure expansion. Regulatory policies and funding support drive rapid market uptake across leading coastal cities.

Europe Maritime Megawatt Charging Market

Europe Maritime Megawatt Charging Market grew from USD 55.68 million in 2018 to USD 108.33 million in 2024 and is projected to reach USD 311.85 million by 2032, at a CAGR of 13.1%. Europe accounts for a 36% market share, led by countries such as Germany, Norway, and the Netherlands. It benefits from stringent emission reduction targets and widespread government support for green maritime solutions. Major European ports are deploying megawatt charging systems to support expanding fleets of electric ferries and cargo vessels. The European Union’s regulatory frameworks foster technology standardization and infrastructure integration.

Asia Pacific Maritime Megawatt Charging Market

Asia Pacific Maritime Megawatt Charging Market grew from USD 26.50 million in 2018 to USD 57.55 million in 2024 and is expected to reach USD 196.71 million by 2032, at a CAGR of 15.6%. Asia Pacific represents a 23% market share. China, Japan, and South Korea drive demand, focusing on large-scale port upgrades and fleet electrification. Governments implement ambitious sustainability targets, promoting rapid market adoption. Growing export activity and coastal urbanization further expand the market’s addressable base in this region.

Latin America Maritime Megawatt Charging Market

Latin America Maritime Megawatt Charging Market grew from USD 6.93 million in 2018 to USD 13.67 million in 2024 and is forecasted to reach USD 36.49 million by 2032, reflecting a CAGR of 12.1%. Latin America commands a 4% market share. Brazil, Mexico, and Chile prioritize port modernization and green shipping initiatives. Public-private partnerships encourage investment in high-capacity charging infrastructure. Market growth remains steady as governments target emission reductions in key shipping corridors.

Middle East Maritime Megawatt Charging Market

Middle East Maritime Megawatt Charging Market grew from USD 4.46 million in 2018 to USD 8.23 million in 2024 and is anticipated to reach USD 21.31 million by 2032, reflecting a CAGR of 11.6%. The Middle East holds a 3% market share. The UAE and Saudi Arabia lead the region, leveraging investments in smart port development. Focus on international shipping routes and energy diversification strategies fuels demand for megawatt charging technologies. The region emphasizes infrastructure resilience and regulatory alignment with global standards.

Africa Maritime Megawatt Charging Market

Africa Maritime Megawatt Charging Market grew from USD 3.87 million in 2018 to USD 8.20 million in 2024 and is projected to reach USD 21.65 million by 2032, at a CAGR of 11.9%. Africa accounts for a 2.5% market share. South Africa, Egypt, and Nigeria spearhead infrastructure upgrades in major ports. Investment in green maritime solutions is rising, supported by international collaboration. The market is poised for gradual growth as regional economies prioritize sustainable development.

Key Player Analysis

- ABB Ltd.

- Siemens AG

- Schneider Electric

- General Electric

- Hitachi Ltd.

- Toshiba Corporation

- Wärtsilä Corporation

- Rolls-Royce Holdings plc

- MAN Energy Solutions

- Cavotec SA

Competitive Analysis

The Maritime Megawatt Charging Market features robust competition among established players such as ABB Ltd., Siemens AG, Schneider Electric, General Electric, Hitachi Ltd., Toshiba Corporation, Wärtsilä Corporation, Rolls-Royce Holdings plc, MAN Energy Solutions, and Cavotec SA. These companies leverage extensive experience in marine and power technologies to offer advanced megawatt-scale charging stations, integrated digital solutions, and customized port electrification services. They maintain strong R&D capabilities, enabling the continuous development of innovative, high-capacity charging systems that align with evolving maritime standards and regulatory requirements. Strategic partnerships and collaborations with port authorities, shipping companies, and government agencies form a core part of their market approach, accelerating the rollout of demonstration projects and commercial installations worldwide. Key players compete on reliability, safety, interoperability, and energy efficiency, positioning their solutions for compatibility with future vessel electrification needs. Expansion into emerging markets and focus on green port initiatives further enhance their competitive positioning. The ability to provide scalable, modular, and interoperable charging solutions differentiates these companies and strengthens their leadership in the global Maritime Megawatt Charging Market.

Recent Developments

- In January 2025, Schneider Electric partnered with The Mobility House to deploy smart EV fleet charging infrastructure, highlighted by the Brookville Smart Energy Bus Depot project featuring a 6.5 MW microgrid and large-scale charging for electric buses. This partnership supports scalable, high-capacity charging suitable for maritime and heavy-duty fleet applications.

- In April 2024, Siemens Smart Infrastructure completed the first successful 1 MW charge using a prototype Megawatt Charging System (MCS) during testing. This marks a significant step in developing high-power charging solutions for large electric vehicles, including maritime applications.

- In March 2024, Hitachi Energy and Penske Truck Leasing partnered to launch a significant pilot program in Stockton, California, utilizing Hitachi Energy’s Grid-eMotion Fleet system to provide high-capacity electric truck charging at a centralized location, enabling the charging of various commercial vehicles like heavy-duty trucks, potentially even maritime vessels, with its scalable and space-efficient technology.

- In December 2023, ABB announced it will deliver the maritime industry’s first megawatt charging system (MCS) for all-electric and hybrid-electric ferries for Auckland Transport in New Zealand. This shore-to-ship system uses a standardized interface common to trucking and aviation, aiming to lower barriers for electric vessel adoption. The rollout of five complete charging solutions is scheduled for 2024 and 2025.

Market Concentration & Characteristics

The Maritime Megawatt Charging Market demonstrates moderate to high market concentration, with a handful of global technology and engineering leaders driving innovation, project execution, and standard-setting across key regions. It is characterized by strong barriers to entry due to the need for significant capital investment, advanced technical expertise, and compliance with evolving international maritime regulations. Leading companies offer comprehensive portfolios that integrate charging hardware, digital management systems, and support services tailored for large-scale port environments. The market features a high degree of technological sophistication, with a focus on modular and scalable solutions capable of supporting diverse vessel types and future expansion. Close collaboration among technology providers, port authorities, and government bodies shapes the competitive landscape and accelerates the deployment of high-capacity charging infrastructure. The Maritime Megawatt Charging Market prioritizes reliability, safety, and interoperability, reflecting its mission-critical role in enabling the maritime sector’s transition to sustainable, electrified operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Power Output, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Maritime Megawatt Charging Market will continue to expand its infrastructure across major global ports.

- Vessel electrification efforts will increase, driving demand for faster and higher-capacity charging solutions.

- Integration of megawatt charging systems with renewable energy sources will shape future development strategies.

- Emergence of smart-grid charging networks will enhance energy management and improve grid stability.

- Standardization of connectors and protocols will advance, enabling interoperability across regions and manufacturers.

- Strategic public–private partnerships will support large-scale pilot programs and commercial rollouts.

- Technological innovations in power electronics and control systems will optimize system efficiency and reliability.

- Regulatory frameworks will strengthen, providing clearer guidance and incentives for port electrification projects.

- Expansion into emerging markets will accelerate, driven by sustainability targets in Asia, Latin America, and Africa.

- The market will see heightened competition, prompting providers to offer scalable, modular, and service-oriented charging solutions.