Market Overview

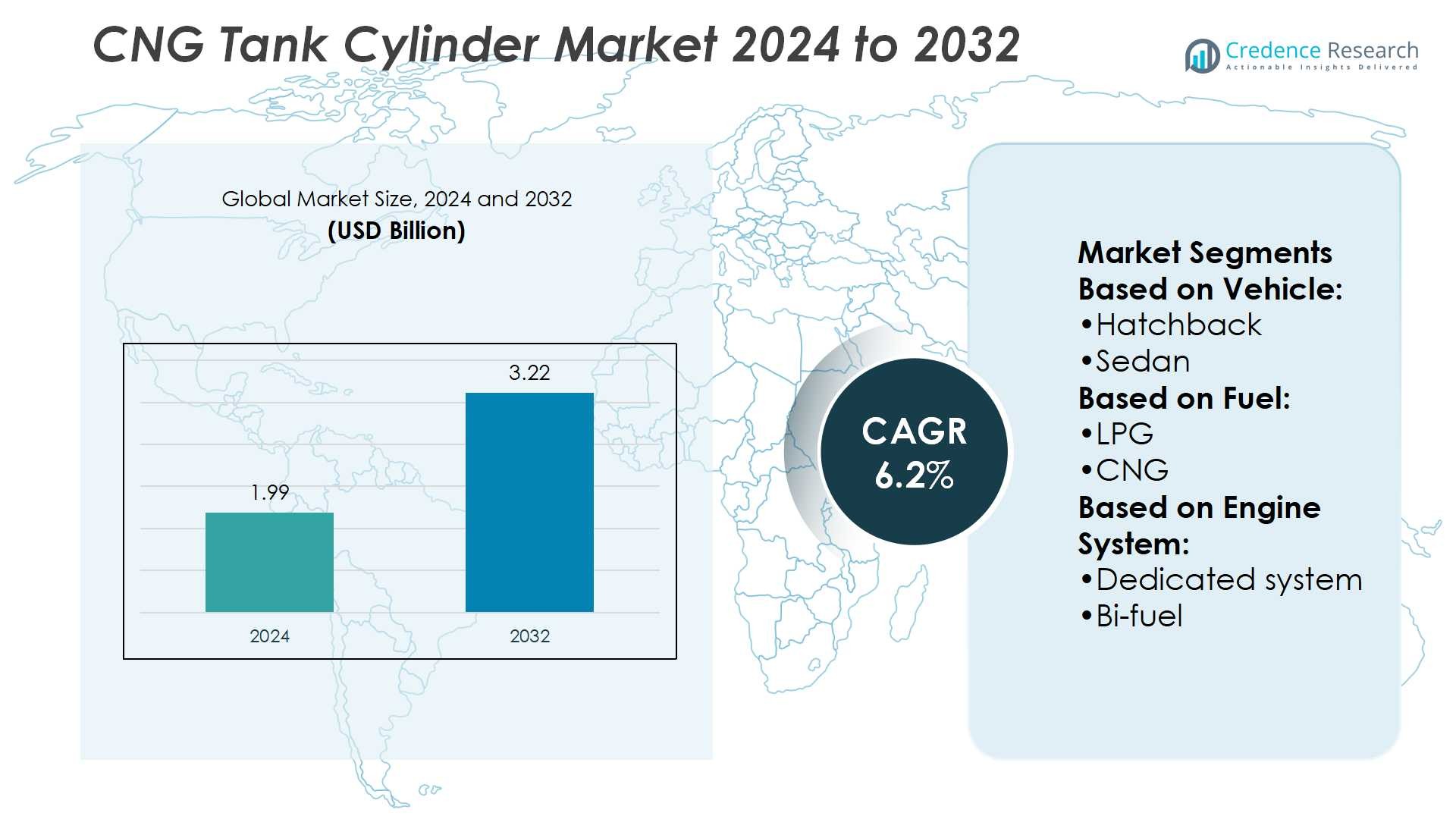

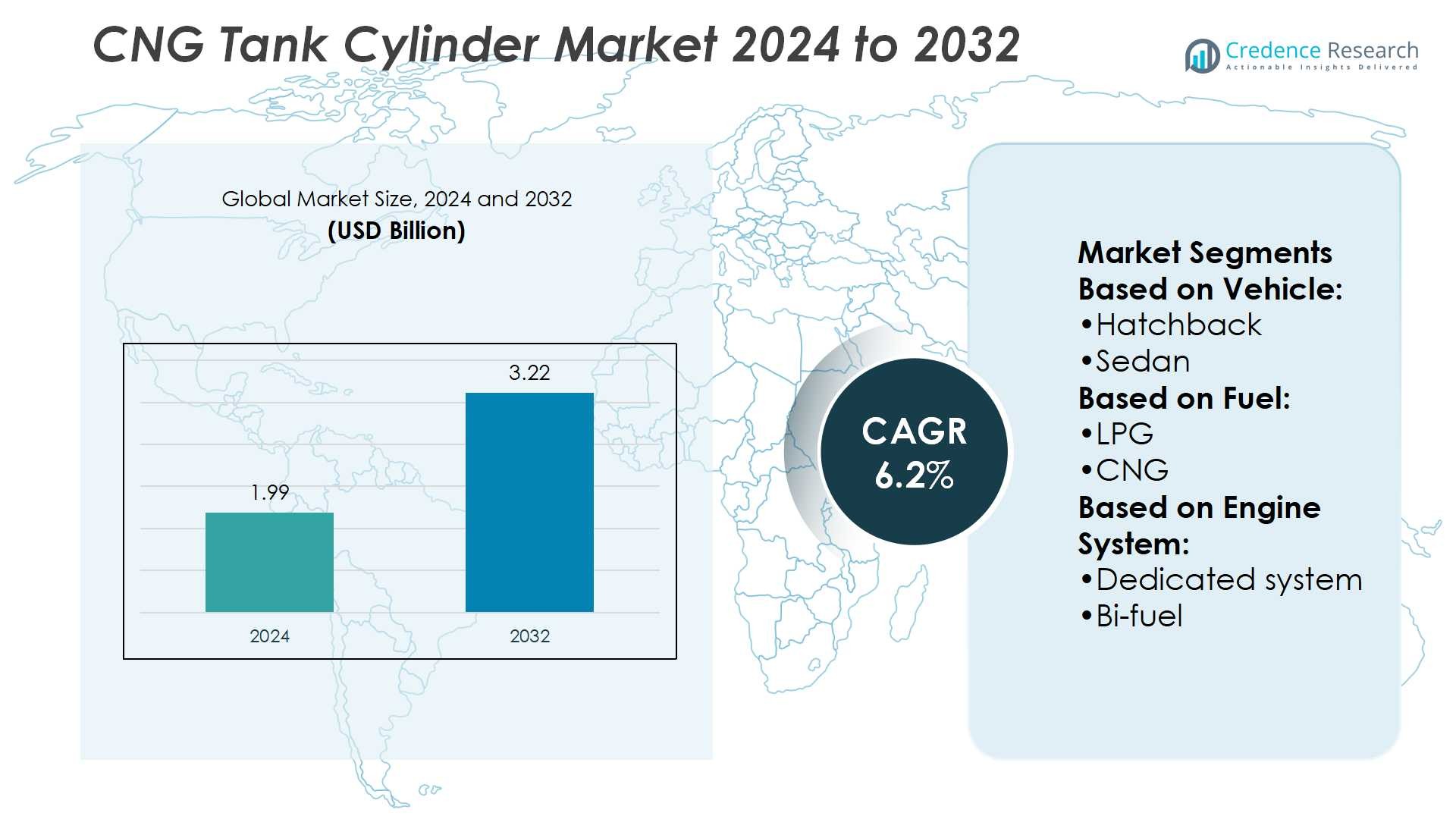

CNG Tank Cylinder Market size was valued USD 1.99 billion in 2024 and is anticipated to reach USD 3.22 billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| CNG Tank Cylinder Market Size 2024 |

USD 1.99 Billion |

| CNG Tank Cylinder Market, CAGR |

6.2% |

| CNG Tank Cylinder Market Size 2032 |

USD 3.22 Billion |

The CNG tank cylinder market is shaped by the presence of major players such as Honda, Volkswagen Group, Tata Motors, Ford Motor Company, Hyundai Motor Company, MAN SE, Toyota, IVECO, Mahindra & Mahindra, and General Motors. These companies focus on factory-fitted CNG vehicle offerings, lightweight composite cylinder innovations, and strategic partnerships with OEMs to strengthen market presence. Asia Pacific leads the global market, commanding a 38% share in 2024, supported by strong adoption in India, China, and Pakistan. Expanding infrastructure, government incentives, and rising fuel price sensitivity further reinforce the region’s dominance in both passenger and commercial vehicle segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The CNG Tank Cylinder Market size reached USD 1.99 billion in 2024 and is projected to attain USD 3.22 billion by 2032, growing at a CAGR of 6.2%.

- Rising demand for cleaner fuels, government incentives, and the shift toward low-emission vehicles act as key drivers, boosting adoption in both passenger and commercial vehicle segments.

- A strong trend is the growing use of lightweight composite cylinders that enhance fuel efficiency, extend range, and meet global safety standards, driving innovation among top manufacturers.

- Competitive dynamics are shaped by leading players focusing on OEM-fitted CNG systems and strategic collaborations, though high upfront conversion costs and limited infrastructure in some regions restrain broader adoption.

- Asia Pacific dominates the global market with 38% share in 2024, driven by adoption in India, China, and Pakistan, while passenger vehicles hold the largest segment share supported by affordability, expanding infrastructure, and rising fuel price sensitivity.

Market Segmentation Analysis:

By Vehicle

In the CNG tank cylinder market, passenger vehicles hold the dominant share, driven by rising adoption of CNG-fueled hatchbacks and sedans in urban areas. Among these, hatchbacks lead due to their affordability, compact design, and strong demand in emerging economies where CNG infrastructure is expanding. SUVs are also witnessing increasing uptake as manufacturers integrate larger storage capacities to extend range. On the commercial side, light commercial vehicles (LCVs) show significant growth, particularly in logistics and last-mile delivery, supported by fleet operators prioritizing low operating costs and regulatory incentives for cleaner fuel adoption.

- For instance, Reputable automotive websites like CarDekho and CarWale, which track vehicle specifications and ARAI figures, list the mileage for the 2012 Honda City (V MT CNG Compatible) as 16.8 km/kg.

By Fuel

CNG accounts for the largest share in the market, supported by its wide acceptance as a cost-effective and environmentally friendly alternative to petrol and diesel. Governments worldwide promote CNG adoption with subsidies, stricter emission regulations, and investments in refueling stations, boosting its dominance. LPG holds a smaller share but remains relevant in certain regions due to existing infrastructure and lower conversion costs. However, CNG continues to outpace LPG growth, particularly in high-density cities where fuel economy and reduced carbon emissions are key purchase drivers for both private users and fleet owners.

- For instance, Volkswagen developed the eco-up! model with a combined 72-liter CNG tank capacity and an additional 10-liter petrol reserve, enabling a total driving range of approximately 600 km. The car achieved remarkably low CO₂ emissions of 79 g/km.

By Engine System

Dedicated systems dominate the engine system segment, capturing a strong share as they are purpose-built for CNG usage, delivering better efficiency, durability, and compliance with emission norms. Bi-fuel and dual-fuel systems, while offering flexibility, face challenges from performance trade-offs and rising consumer preference for fully integrated CNG designs. In fittings, OEM installations lead the market, supported by automakers increasingly offering factory-fitted CNG options to meet growing consumer demand and regulatory pressure. The aftermarket segment remains active, particularly in developing markets, but OEM systems maintain dominance due to higher reliability, safety standards, and warranty assurance.

Key Growth Drivers

Rising Demand for Cleaner Fuels

The increasing focus on reducing greenhouse gas emissions is driving demand for CNG tank cylinders. Governments are implementing stricter emission regulations and encouraging the use of natural gas as a cleaner alternative to petrol and diesel. This push is supported by rising consumer preference for sustainable mobility solutions. Fleet operators in logistics and public transport also adopt CNG due to lower operating costs and environmental benefits. These factors collectively strengthen the market growth trajectory, particularly in urban regions with high vehicle density.

- For instance, Tata Motors launched the Tigor iCNG sedan equipped with dual CNG cylinders totaling 70 liters water equivalent (LWE), delivering a certified mileage of 26.49 km/kg for the manual transmission variant and an even higher 28.06 km/kg for the automatic (AMT) variant.

Government Incentives and Infrastructure Expansion

Subsidies, tax benefits, and incentives from governments are accelerating CNG adoption across passenger and commercial vehicles. Expansion of refueling infrastructure, especially in emerging markets, ensures convenience and accessibility for end users. Strategic partnerships between governments and private entities have improved availability of CNG stations. Such policy-driven initiatives significantly boost confidence among manufacturers and consumers, increasing penetration of CNG-powered vehicles. The enhanced infrastructure base directly drives higher demand for CNG tank cylinders across multiple vehicle categories.

- For instance, Hyundai launched the Grand i10 NIOS CNG variant in India with its “Hy-CNG duo” system, featuring dual cylinders with a combined 60-liter water equivalent (LWE) capacity. This system delivers an ARAI-certified mileage of 27.3 km/kg, positioning it as one of the most fuel-efficient CNG hatchbacks in its class.

Advancements in Tank Technology

Technological improvements in CNG tank design and materials have enhanced safety, performance, and storage efficiency. Lightweight composite cylinders are gaining traction, offering higher fuel capacity with reduced vehicle weight. These advancements improve fuel economy, extend driving range, and comply with evolving safety standards. Manufacturers are investing in R&D to optimize tank durability and cost-effectiveness, strengthening their competitive edge. Such innovations are critical in meeting diverse consumer needs while aligning with environmental and regulatory requirements, making them a strong driver for market expansion.

Key Trends & Opportunities

Growing Adoption in Passenger Vehicles

The increasing shift of consumers toward hatchbacks, sedans, and SUVs with factory-fitted CNG options represents a strong trend. Automakers are expanding their CNG vehicle portfolios to capture the growing urban market, supported by rising fuel price sensitivity. This creates opportunities for OEM suppliers of CNG tank cylinders to scale production.

- For instance, Toyota introduced a bi-fuel (petrol/CNG) Hilux Vigo CNG in Thailand. This model was powered by a 2.7-liter VVT-i gasoline engine with a locally installed CNG system developed in collaboration with aftermarket suppliers.

Expansion in Commercial Fleets

Logistics companies and public transportation providers are turning to CNG-powered fleets to lower operational costs and comply with emission standards. This trend opens significant opportunities for large-capacity CNG tanks, especially in light and medium commercial vehicles. The fleet modernization drive further strengthens long-term demand.

- For instance, IVECO developed the Stralis NP 460 heavy-duty truck, which is available in various natural gas configurations. The truck can be equipped with CNG or LNG tanks, or a combination of both.

Innovation in Lightweight Materials

The shift toward composite and hybrid materials in tank production is reshaping the market. These materials enhance fuel efficiency and extend driving range while maintaining safety standards. Manufacturers focusing on cost-effective composite solutions stand to benefit from increasing adoption across both developed and developing economies.

Key Challenges

High Initial Conversion and Installation Costs

Despite long-term cost savings, the upfront investment for CNG systems and high-performance cylinders remains a barrier. Vehicle owners in cost-sensitive markets often delay adoption due to these expenses. The challenge is particularly evident in developing economies where disposable incomes are limited.

Limited Refueling Infrastructure in Some Regions

While infrastructure is improving in many markets, several regions still face a shortage of CNG stations. This lack of widespread availability hinders consumer confidence in adopting CNG vehicles. Without adequate infrastructure, the growth of CNG tank cylinder demand remains restricted, especially outside urban hubs.

Regional Analysis

North America

North America holds a significant share of the CNG tank cylinder market, accounting for 22% in 2024. The region benefits from strong adoption in commercial fleets; particularly light and medium commercial vehicles used in logistics and urban transport. Government incentives for cleaner fuels and emission reduction policies drive further growth. The U.S. leads the market due to its well-established CNG infrastructure, while Canada is gradually expanding adoption supported by environmental initiatives. Increasing investments in lightweight composite cylinders and advanced tank technologies strengthen the region’s position, ensuring steady growth through fleet modernization and public transportation programs.

Europe

Europe commands 18% of the global CNG tank cylinder market in 2024, driven by stringent emission regulations under the European Green Deal and strong demand for sustainable mobility solutions. Italy, Germany, and Spain remain leading markets due to early adoption of CNG vehicles. The region’s focus on decarbonization and the promotion of alternative fuels boosts OEM integration of factory-fitted CNG tanks. Rising demand in passenger vehicles, especially hatchbacks and sedans, further supports growth. Europe also shows strong potential for lightweight composite tank adoption, which aligns with its push toward efficiency, safety, and reduced carbon footprints in transport systems.

Asia Pacific

Asia Pacific dominates the global CNG tank cylinder market, holding 38% of the total share in 2024. The region’s leadership stems from high adoption in India, China, and Pakistan, where expanding infrastructure and rising fuel price sensitivity drive demand. Government initiatives promoting cleaner mobility, coupled with subsidies for CNG vehicles, accelerate growth. Passenger cars and three-wheelers dominate, while commercial vehicles are increasingly adopting CNG tanks for cost efficiency. Rapid urbanization and fleet modernization enhance market expansion. Asia Pacific also leads in manufacturing capacity, supporting cost-effective production and widespread availability of both OEM and aftermarket cylinders.

Latin America

Latin America represents 12% of the CNG tank cylinder market in 2024, with Argentina and Brazil being the largest contributors. The region’s growth is supported by favorable government policies and significant adoption of aftermarket conversions, particularly in passenger cars and taxis. Rising urban demand for low-cost transportation fuels further boosts the market. While infrastructure development lags compared to Asia, investments in refueling networks are expanding steadily. Latin America also witnesses increasing interest in composite CNG cylinders, driven by demand for lighter and safer alternatives, strengthening long-term adoption across both passenger and commercial vehicle segments.

Middle East & Africa

The Middle East & Africa (MEA) accounts for 10% of the global CNG tank cylinder market in 2024. Adoption is concentrated in countries such as Iran, Egypt, and South Africa, where governments actively promote natural gas vehicles to reduce reliance on oil-based fuels. Growing demand in passenger cars and light commercial vehicles supports regional growth. Infrastructure availability remains a key limitation, but ongoing investments in gas distribution and refueling stations are gradually improving market accessibility. The shift toward OEM-fitted CNG systems in urban centers, coupled with supportive energy diversification policies, enhances the market’s growth outlook in MEA.

Market Segmentations:

By Vehicle:

By Fuel:

By Engine System:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The CNG tank cylinder market players such as Honda, Volkswagen Group, Tata Motors, Ford Motor Company, Hyundai Motor Company, MAN SE, Toyota, IVECO, Mahindra & Mahindra, and General Motors. The CNG tank cylinder market is characterized by intense competition, driven by technological innovation, regulatory compliance, and expanding OEM collaborations. Companies are focusing on developing lightweight composite cylinders to improve fuel efficiency, extend driving range, and ensure safety. Growing demand for factory-fitted CNG systems is pushing manufacturers to strengthen partnerships with automakers, while aftermarket suppliers remain active in cost-sensitive regions. Continuous investments in R&D enhance cylinder durability and performance, supporting long-term adoption. The market also witnesses capacity expansion and regional infrastructure development, ensuring steady supply and availability. Firms prioritizing sustainable designs and compliance with emission norms are positioned to secure a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Hyundai launched a new variant, which is a CNG-powered car that offers consumers with dual-cylinder option. The variant offers an optimal balance of affordability and efficiency.

- In April 2025, Tata Motors is preparing multiple new models, including the Harrier EV and the Sierra lifestyle SUV. The company will soon introduce the CNG version of the SUV Coupe, as testing of the Curvv CNG has already started.

- In February 2025, Nissan magnite, is aiming to diversify its product offerings in India, the company has plan to introduce hybrid and CNG powertrain technology in its car in India. Nissan is aiming to ramp up its sales in India in the next financial year.

- In November 2024, the Ogun State Government partnered with the Standards Organization of Nigeria (SON) to advance the adoption of Compressed Natural Gas (CNG)-powered vehicles. This collaboration aims to enhance safety protocols and streamline the conversion of Premium Motor Spirit (PMS) vehicles to CNG, promoting sustainable and eco-friendly transportation in the state.

- In April 2024, The Gazprom Management Committee acknowledged the updates on the gas supply and infrastructure expansion programs in Russian Federation regions in 2024. This program is scheduled for the period between 2021 and 2025 to cover 72 Russian regions.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Fuel, Engine System and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rising demand from both passenger and commercial vehicle segments.

- Government incentives and stricter emission norms will continue to support CNG adoption.

- Expansion of CNG refueling infrastructure will enhance accessibility and boost cylinder demand.

- Lightweight composite cylinders will gain preference due to improved efficiency and safety.

- OEM-fitted CNG systems will dominate as automakers expand dedicated product lines.

- Aftermarket demand will persist in cost-sensitive regions with high conversion rates.

- Technological innovations will focus on durability, storage capacity, and cost optimization.

- Commercial fleets will increasingly adopt CNG for lower operational costs and compliance.

- Asia Pacific will remain the largest regional market, driven by rapid urbanization.

- Strategic collaborations and R&D investments will shape long-term market competitiveness.