Market Overview

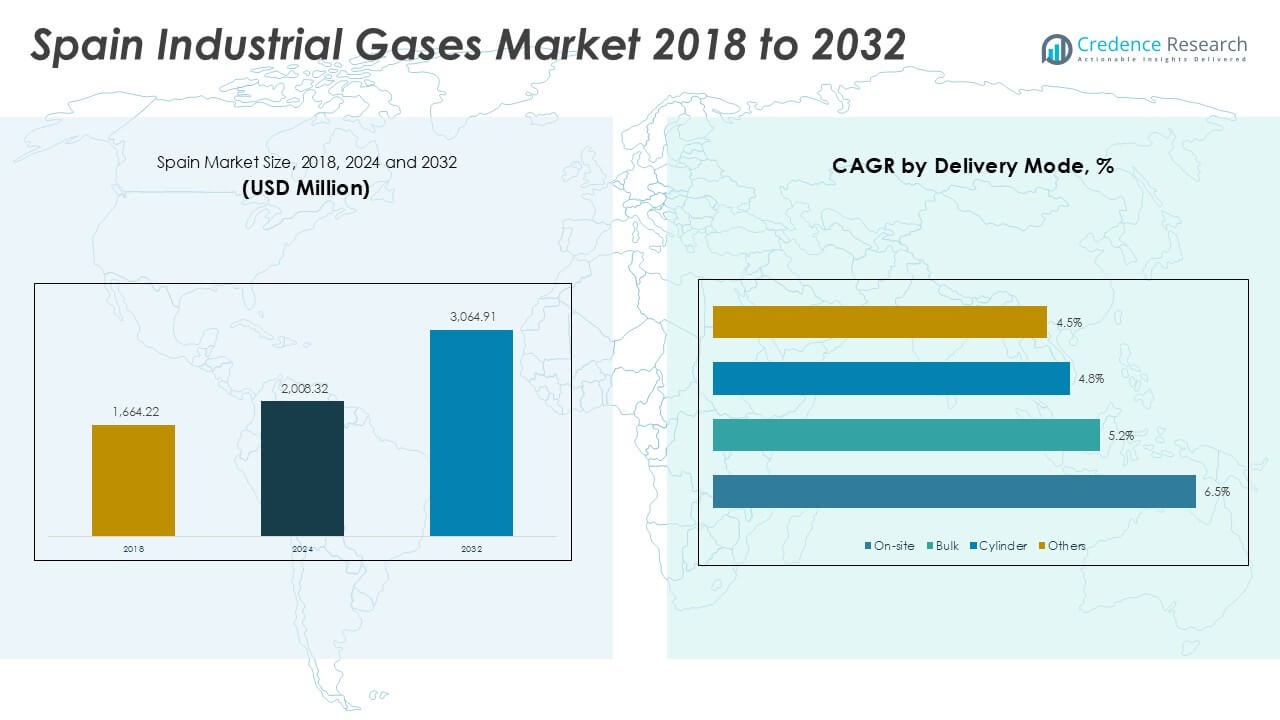

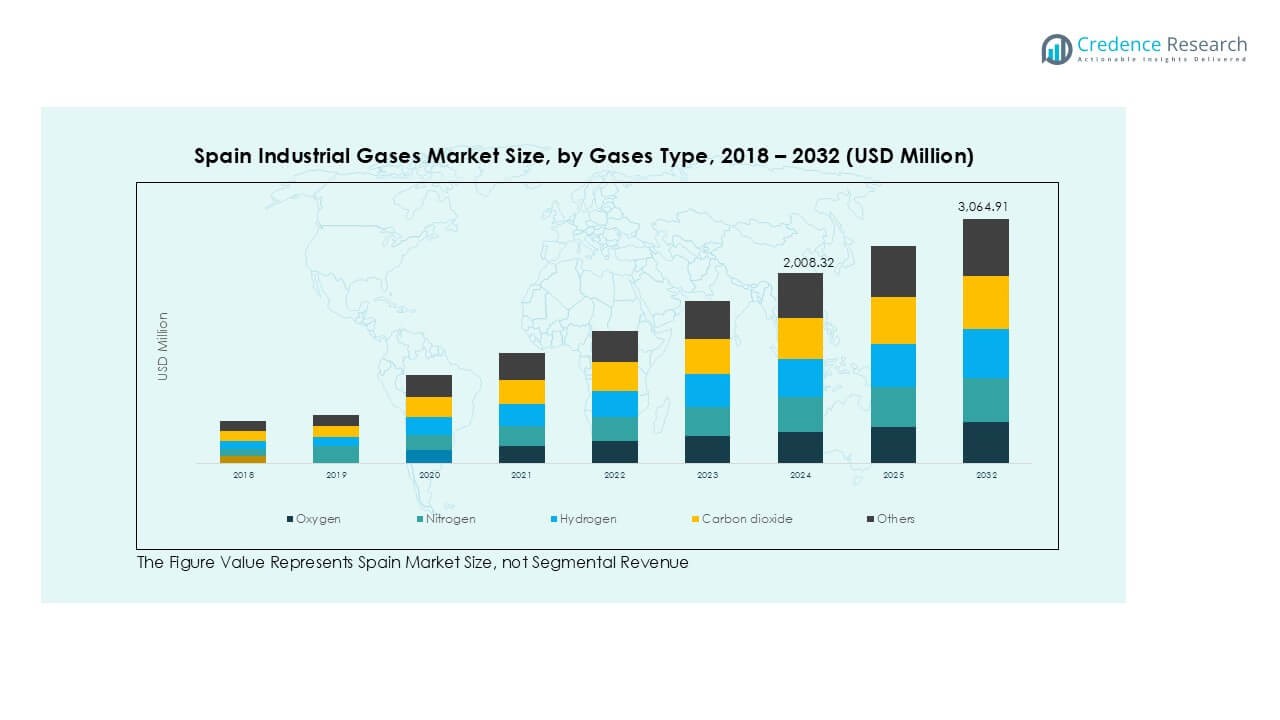

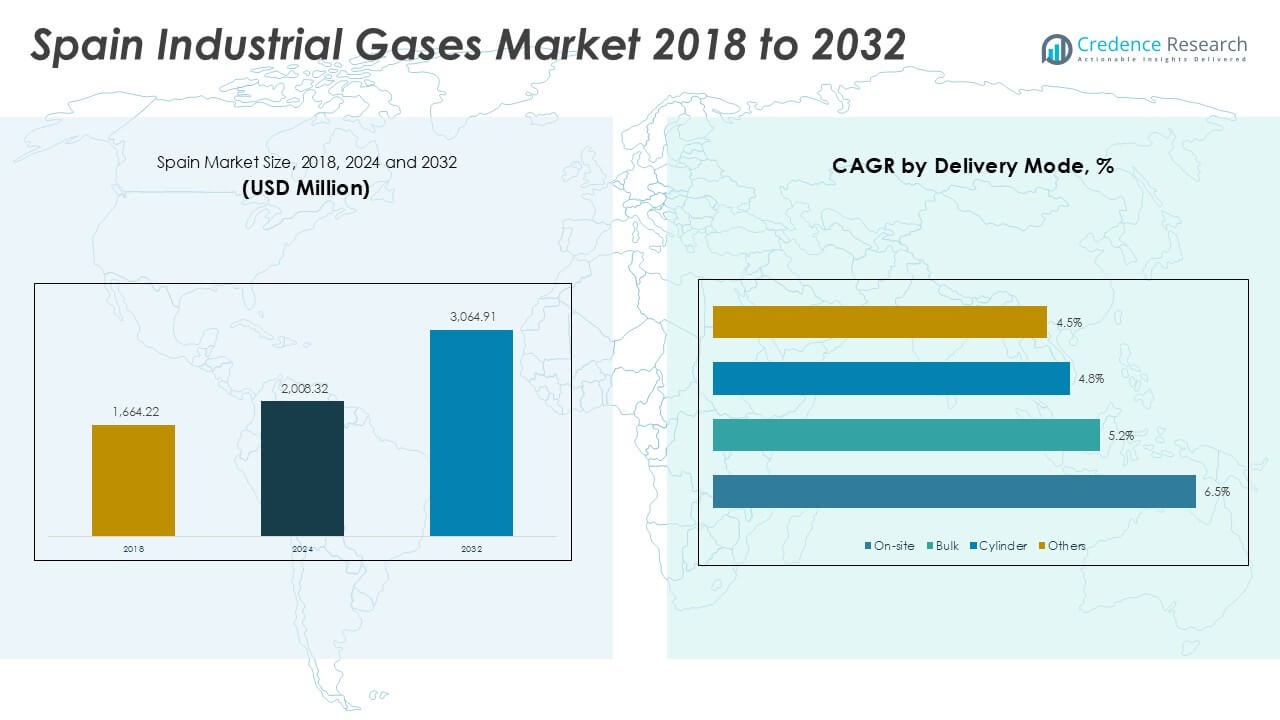

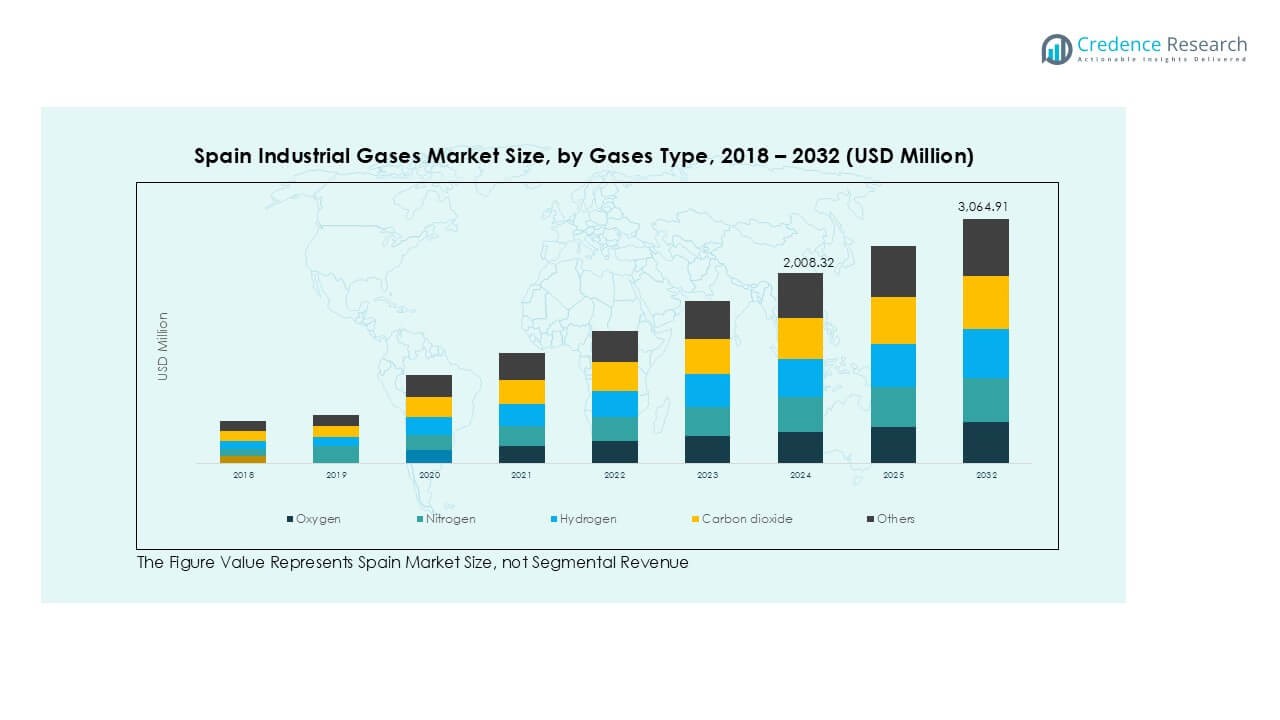

Spain Industrial Gases market size was valued at USD 1,664.22 million in 2018, grew to USD 2,008.32 million in 2024, and is anticipated to reach USD 3,064.91 million by 2032, at a CAGR of 5.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Industrial Gases Market Size 2024 |

USD 2,008.32 Million |

| Spain Industrial Gases Market, CAGR |

5.43% |

| Spain Industrial Gases Market Size 2032 |

USD 3,064.91 Million |

The Spain industrial gases market is led by Carburos Metálicos S.A., Air Liquide España, Linde Gas España (via Praxair/Linde Group), Messer Ibérica de Gases S.A., and SOL España (SOL Group), together accounting for a significant majority of the national supply. These players maintain robust production facilities, advanced distribution networks, and strong customer bases across key industries including healthcare, manufacturing, and food & beverage. Urban centers such as Madrid and Barcelona dominate with a 45% market share in 2024, supported by dense hospital networks, pharmaceutical plants, and automotive manufacturing hubs. Coastal regions contribute 25%, driven by LNG terminals and shipbuilding demand, while rural areas hold 30% due to agriculture and food processing activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Spain industrial gases market was valued at USD 2,008.32 million in 2024 and is projected to reach USD 3,064.91 million by 2032, growing at a CAGR of 5.43% during the forecast period.

- Growing demand from healthcare and pharmaceutical sectors is driving oxygen and nitrogen consumption, supported by rising hospital capacity and vaccine production facilities.

- Key trends include expansion of green hydrogen projects such as Hydrogen Valley of Catalonia and increasing adoption of cryogenic applications in LNG terminals, biobanking, and space research.

- The market is moderately consolidated with major players like Carburos Metálicos, Air Liquide España, Linde Gas España, Messer Ibérica, and SOL España focusing on capacity expansion, long-term contracts, and digital gas monitoring solutions.

- Urban centers hold 45% share, rural areas contribute 30%, and coastal regions account for 25%; oxygen leads by gas type with 35% share, followed by nitrogen and carbon dioxide.

Market Segmentation Analysis:

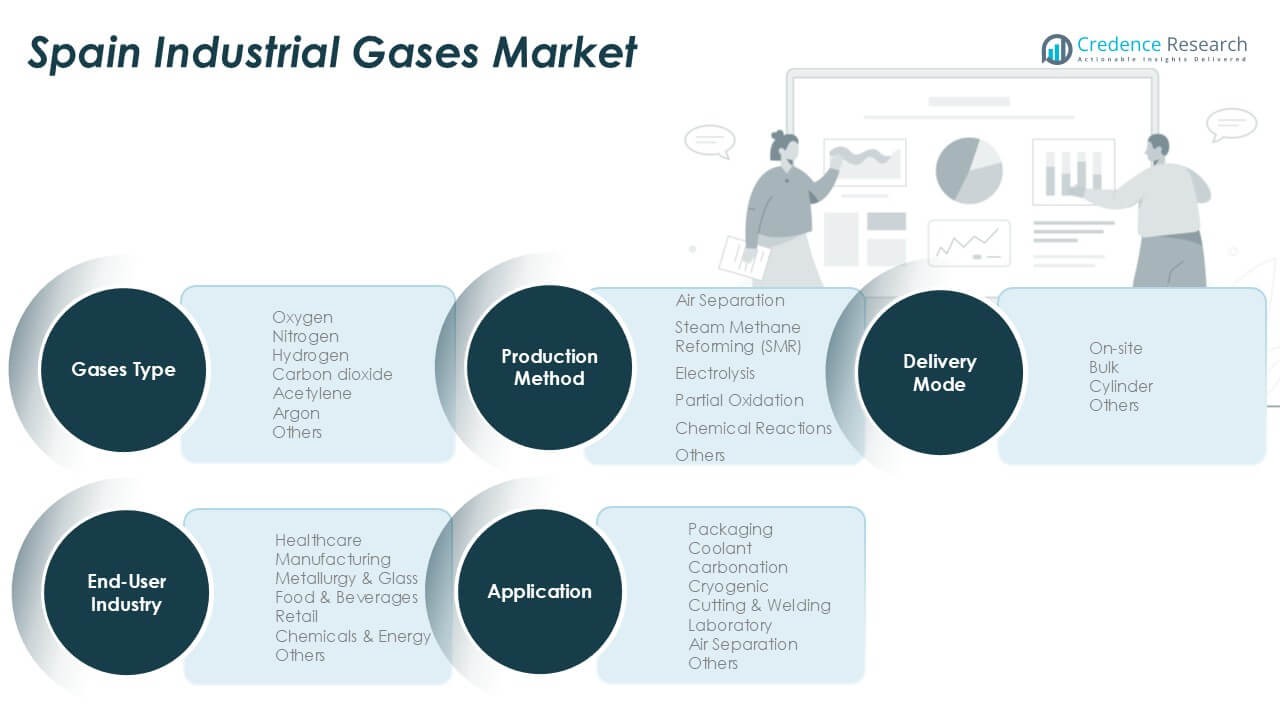

By Gases Type

Oxygen held the dominant share of over 35% in 2024, driven by its critical use in healthcare, metal fabrication, and wastewater treatment. Spain’s strong healthcare sector and rising surgical procedures have boosted oxygen demand in hospitals and clinics. Nitrogen followed closely due to its role in food packaging and preservation, supporting Spain’s large food and beverage industry. Hydrogen demand is growing with the country’s green hydrogen projects under its decarbonization roadmap, while carbon dioxide remains key for carbonation and refrigeration applications. Argon and acetylene maintain steady consumption in welding and metal cutting operations.

- For instance, Air Liquide operates in Spain, where it supplies gases, equipment, and services to a variety of industries, including the metal industry and major hospitals, through its Healthcare division.

By Application

Cutting & welding applications accounted for the largest market share at nearly 30% in 2024, supported by Spain’s robust manufacturing and automotive sectors. The demand is fueled by infrastructure development, shipbuilding, and metal fabrication industries that require precision welding and cutting processes. Carbonation and packaging applications are expanding as the beverage industry grows, particularly in soft drinks and beer production. Cryogenic applications are seeing growth with rising use of liquefied gases in healthcare and energy sectors. Laboratory and air separation applications continue steady demand from research, testing, and chemical production facilities.

- For instance, Navantia’s Ferrol and Cádiz shipyards conduct extensive welding operations for naval ship construction projects, which consume large quantities of oxygen and argon as shielding gases.

By End-User Industry

The manufacturing sector dominated with over 40% share in 2024, supported by Spain’s automotive, machinery, and electronics production base. Industrial gases are widely used for welding, cutting, heat treatment, and protective atmospheres in manufacturing plants. The healthcare industry is a major growth driver due to high oxygen and nitrogen demand in hospitals, diagnostic centers, and pharmaceutical manufacturing. Food and beverage players contribute significantly through carbonation, freezing, and packaging processes. Metallurgy and glass industries consume gases for smelting, refining, and forming operations, while chemicals and energy sectors rely on hydrogen and nitrogen for process efficiency.

Key Growth Drivers

Expanding Healthcare and Pharmaceutical Sector

Spain’s growing healthcare infrastructure is driving strong demand for medical-grade oxygen, nitrogen, and other specialty gases. Rising surgical volumes, ICU capacity, and pharmaceutical production facilities are increasing gas consumption. The expansion of biologics and vaccine manufacturing also requires controlled atmospheres using nitrogen. Government investments in healthcare modernization and EU-funded programs are further boosting infrastructure growth, ensuring sustained demand for industrial gases. This driver continues to play a vital role in supporting consistent supply agreements with hospitals, clinics, and life sciences companies across Catalonia, Madrid, and other major urban centers.

- For instance, Spain performed approximately 3.5 million surgical procedures in 2023, a figure that continues to drive oxygen demand in operating theaters.

Manufacturing and Metal Fabrication Growth

The manufacturing sector remains a cornerstone of Spain’s economy, fueling demand for welding and cutting gases like oxygen, acetylene, and argon. The automotive, shipbuilding, and machinery industries are key consumers, requiring gases for precision fabrication and thermal treatments. Increasing investments in automation and Industry 4.0 technologies are also encouraging the adoption of advanced gas delivery systems. Industrial clusters in Catalonia, Basque Country, and Andalusia are leading this demand. Infrastructure development projects and construction activities further enhance the requirement for industrial gases, driving steady growth in production and distribution capacity across Spain.

- For example, Spain produced over 2.4 million vehicles in 2023, with welding stations consuming large volumes of oxygen and argon daily in assembly plants.

Green Hydrogen and Energy Transition Initiatives

Spain is positioning itself as a European leader in green hydrogen production under its energy transition strategy. Government-backed projects such as Hydrogen Valley of Catalonia and hydrogen corridors are increasing hydrogen consumption for industrial use and mobility applications. Industrial gas suppliers are investing in electrolyzer capacity and distribution networks to meet future demand. These developments create a major growth opportunity for hydrogen supply, storage, and distribution solutions. This shift not only supports Spain’s decarbonization targets but also drives innovation in gas infrastructure, offering long-term growth prospects for market players.

Key Trends & Opportunities

Rising Adoption of Cryogenic Applications

Cryogenic gases are gaining traction in healthcare, energy, and research sectors. Liquid nitrogen and oxygen are increasingly used for medical freezing, biobanking, and advanced research applications. The rise of LNG infrastructure also boosts cryogenic technology adoption. Spain’s growing investment in space research and biotech supports steady demand for high-purity cryogenic gases. Industrial gas producers are focusing on expanding cryogenic storage and transport solutions to meet this rising need. This trend provides suppliers with opportunities to offer specialized delivery systems and improve service reliability for critical applications.

- For instance, Spain’s national biobank network stores over 15 million biological samples, relying on cryogenic liquid nitrogen systems to maintain −196 °C storage conditions.

Food and Beverage Sector Expansion

Spain’s strong position in food exports is driving demand for nitrogen and carbon dioxide for packaging and carbonation. Modified atmosphere packaging (MAP) ensures extended shelf life for meat, seafood, and produce, which is key for export markets. Increasing domestic consumption of soft drinks and beer also contributes to CO₂ demand. Growth in quick-service restaurants and frozen food chains further supports gas consumption. This sector presents opportunities for gas suppliers to offer customized packaging solutions and supply agreements with food processors and beverage producers across Valencia, Andalusia, and Catalonia.

- For example, Spain exported over €70 billion worth of agri-food products in 2023, much of which relied on MAP technology to maintain quality.

Digitalization and Smart Gas Monitoring

Industrial gas suppliers are adopting digital platforms for gas distribution, tracking, and monitoring. IoT-enabled gas cylinders and remote monitoring systems are improving efficiency and reducing downtime for end users. Predictive analytics are helping optimize refilling schedules, enhancing customer service. This digital transformation trend allows suppliers to differentiate themselves by offering value-added services. Spanish industries adopting Industry 4.0 are increasingly open to these smart solutions, creating opportunities for providers to integrate automation and monitoring tools into their gas supply contracts and strengthen long-term client relationships.

Key Challenges

Price Volatility and Supply Chain Disruptions

Fluctuating raw material costs and energy prices affect the production cost of industrial gases. Spain’s reliance on imports for certain gas feedstocks makes the market vulnerable to international supply chain disruptions. Transportation constraints and rising fuel costs can increase distribution expenses, impacting profitability. Companies are adopting long-term contracts and local sourcing strategies to mitigate these risks. However, balancing competitive pricing with profitability remains a challenge for suppliers, especially in a market where demand is highly sensitive to economic cycles and energy price fluctuations.

Regulatory Compliance and Carbon Emission Targets

Spain’s commitment to EU climate goals is pushing industries to reduce greenhouse gas emissions, creating compliance challenges for gas producers. Regulations on CO₂ emissions and stricter safety standards for gas storage and transport require continuous investment in technology upgrades. Smaller players may face difficulty meeting these compliance costs, leading to market consolidation. Additionally, the pressure to transition to low-carbon solutions such as green hydrogen may increase capital expenditure. Meeting these regulatory requirements while maintaining competitive operations is a key challenge for market participants.

Regional Analysis

Urban Centers (Madrid, Barcelona)

Urban centers such as Madrid and Barcelona dominated the Spain industrial gases market with a 45% share in 2024, driven by their concentration of hospitals, pharmaceutical plants, and advanced manufacturing facilities. Medical-grade oxygen and nitrogen consumption is high due to the large number of healthcare institutions and research laboratories. Barcelona’s strong automotive and chemical industries further drive demand for cutting, welding, and process gases. Rapid infrastructure development, logistics networks, and higher adoption of green hydrogen projects in these cities are also supporting market expansion, making urban centers the primary growth engines for the industrial gases sector.

Rural Areas

Rural areas accounted for 30% of the market share in 2024, driven by strong agricultural and food-processing activities that require nitrogen and carbon dioxide for modified atmosphere packaging and cold chain applications. Smaller manufacturing hubs and local workshops contribute to oxygen and acetylene demand for welding and metal fabrication. Rural regions are also witnessing increased adoption of industrial gases in renewable energy projects, particularly for hydrogen production in solar- and wind-rich zones. However, distribution costs remain higher compared to urban centers, pushing suppliers to invest in localized storage and efficient delivery infrastructure to support steady supply.

Coastal Regions

Coastal regions represented 25% of the Spain industrial gases market share in 2024, supported by shipbuilding, port operations, and LNG infrastructure development. Ports such as Valencia, Bilbao, and Algeciras create significant demand for oxygen and acetylene in ship repair and maintenance, as well as for cryogenic applications in LNG terminals. Coastal areas are also at the forefront of Spain’s green hydrogen initiatives, particularly in hydrogen corridor projects linking maritime hubs. Access to import terminals ensures consistent gas availability, making coastal regions a strategic growth area for suppliers expanding into marine, energy, and industrial applications.

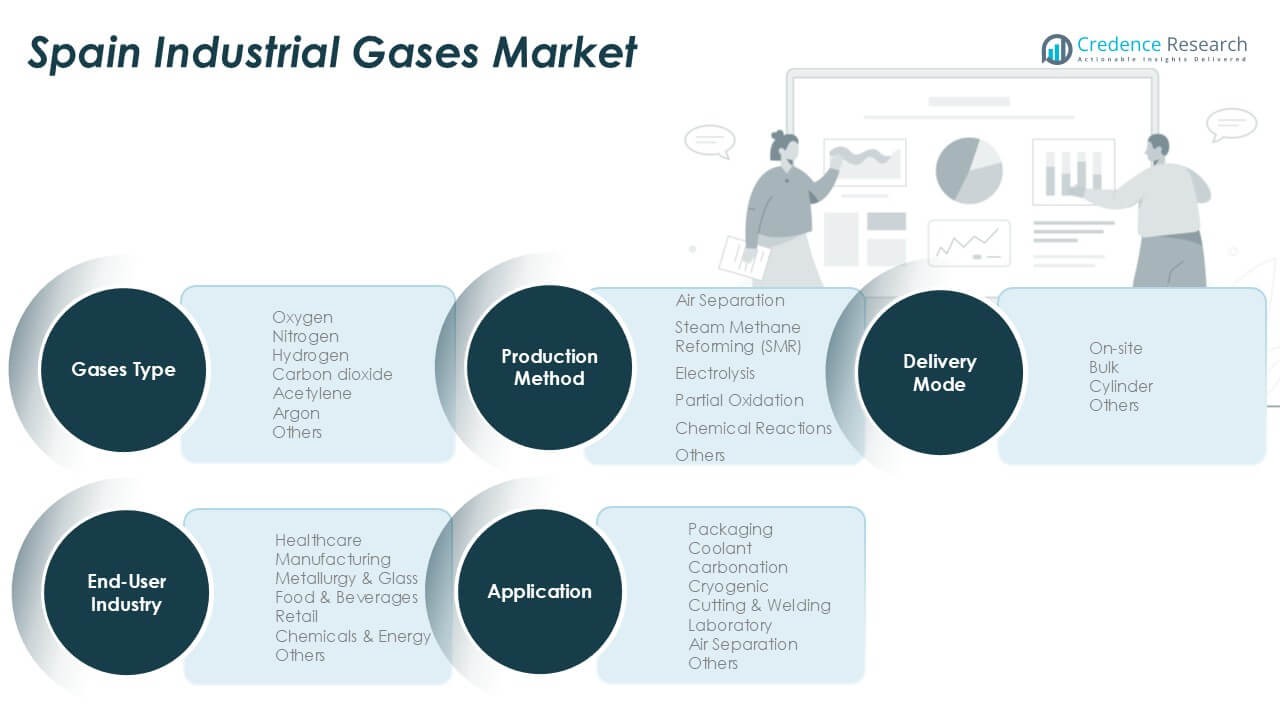

Market Segmentations:

By Gases Type

- Oxygen

- Nitrogen

- Hydrogen

- Carbon Dioxide

- Acetylene

- Argon

- Others

By Application

- Packaging

- Coolant

- Carbonation

- Cryogenic

- Cutting & Welding

- Laboratory

- Air Separation

- Others

By End-User Industry

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

By Production Method

- Air Separation

- Steam Methane Reforming (SMR)

- Electrolysis

- Partial Oxidation

- Chemical Reactions

- Others

By Delivery Mode

- On-site

- Bulk

- Cylinder

- Others

By Geography

- Urban Centers (Madrid, Barcelona)

- Rural Areas

- Coastal regions

Competitive Landscape

The Spain industrial gases market is moderately consolidated, with major players such as Carburos Metálicos S.A., Air Liquide España, Linde Gas España (via Praxair/Linde Group), Messer Ibérica de Gases S.A., and SOL España (SOL Group) holding a dominant share. These companies operate extensive production facilities, distribution networks, and cylinder filling stations across key regions, ensuring reliable supply to healthcare, manufacturing, and food industries. Strategic investments are focused on expanding hydrogen production capacity, cryogenic infrastructure, and digital gas management solutions. Players are actively engaging in partnerships with renewable energy developers to support Spain’s green hydrogen roadmap. Continuous innovation in gas purification, storage, and delivery systems enables them to meet evolving industry standards and regulatory requirements. Competition is primarily based on pricing, supply reliability, and the ability to offer value-added services, with leading companies strengthening long-term contracts with hospitals, industrial clusters, and research institutions to secure market position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Air Liquide announced to supply oxygen to LG Chem for their electric vehicle battery plant in the U.S. Supplying oxygen to LG Chem’s future cathode active material plant, the Group will be supporting the growth of the battery ecosystem in the U.S. This investment will increase the Group’s footprint in a key region and support the development of its industrial merchant market.

- In October 2024, Linde announced an agreement with Tata Steel to obtain and manage two additional Air Separation Units (ASUs) and enhance industrial gas supply to Tata Steel in Odisha, India. This arrangement will more than double Linde’s on-site capacity at Tata Steel’s Kalinganagar facility, where it presently runs two plants. The new ASUs, anticipated to be operational by 2025, will deliver oxygen, nitrogen, and argon to aid Tata Steel’s expansion project and cater to the local merchant market. Linde has additionally acquired renewable energy agreements to lower its scope emissions, in line with its 2035 GHG reduction goals.

- In July 2024, Air Liquide announced an investment of USD 104.914 million to support Aurubis AG, a major global provider of non-ferrous metals and one of the largest recyclers of copper worldwide, in Bulgaria and Germany. This investment will finance a new Air Separation Unit (ASU) in Bulgaria and the upgrading of four existing units in Germany. Besides supplying substantial amounts of oxygen and nitrogen for the rising copper and other metal production by Aurubis, these facilities will also assist in the growth of industrial merchant markets in both areas.

- In January 2024, Air Products, a company in industrial gases and clean hydrogen projects, announced the opening of its expanded Project Delivery Centre in Vadodara, India.

- In July 2023, Nippon Sanso Holdings Corporation announced that Matheson Tri-Gas, Inc, NSHD’s U. S. operating entity, has entered into a gas supply contract with PointFive to deliver oxygen for the carbon capture, utilization, and sequestration company’s inaugural Direct Air Capture (DAC*) facility in Texas. MATHESON will invest in and set up an Air Separation Unit to provide oxygen to “Stratos,” PointFive’s DAC facility currently under construction in Ector County, Texas. The oxygen is utilized in the DAC process to generate a pure stream of CO2, which is subsequently securely sequestered in geological reservoirs.

Report Coverage

The research report offers an in-depth analysis based on Gases Type, Application, End-User Industry, Production Method, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth supported by rising demand from healthcare and manufacturing sectors.

- Green hydrogen projects will boost hydrogen production and distribution capacity across key regions.

- Cryogenic gas applications will expand with increasing adoption in biotech, LNG, and research facilities.

- Industrial automation will drive demand for high-purity gases and advanced gas delivery systems.

- Food and beverage processing will continue to fuel nitrogen and carbon dioxide consumption.

- Companies will invest in digital gas monitoring and IoT-enabled distribution networks for efficiency.

- Strategic partnerships with renewable energy developers will support decarbonization initiatives.

- Regional demand will grow fastest in Catalonia and coastal regions due to industrial activity.

- Long-term supply contracts with hospitals and industrial clusters will secure revenue streams.

- Market consolidation may increase as smaller players face regulatory and cost challenges.