Market Overview

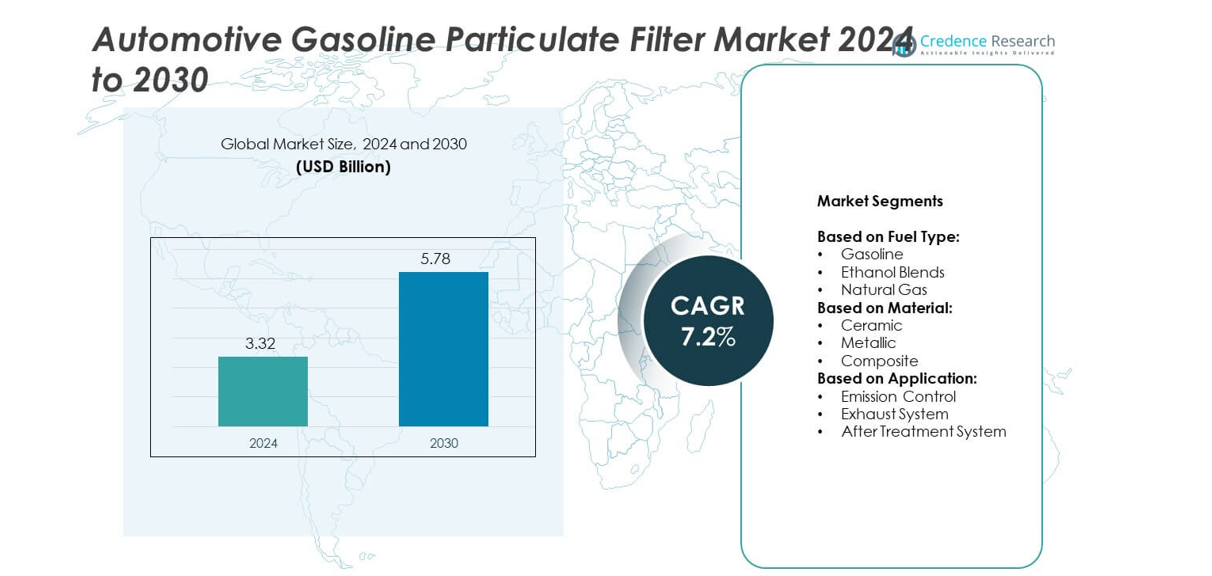

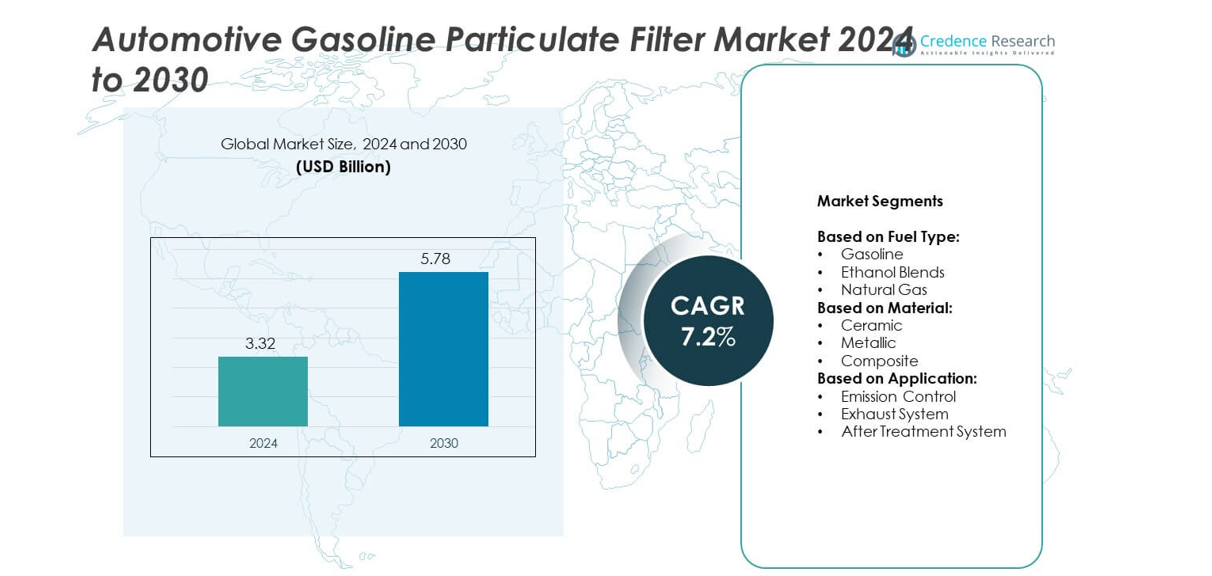

The Automotive Gasoline Particulate Filter market size was valued at USD 3.32 billion in 2024 and is anticipated to reach USD 5.78 billion by 2032, growing at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Gasoline Particulate Filter Market Size 2024 |

USD 3.32 billion |

| Automotive Gasoline Particulate Filter Market, CAGR |

7.2% |

| Automotive Gasoline Particulate Filter Market Size 2032 |

USD 5.78 billion |

The Automotive Gasoline Particulate Filter market grows due to strict global emission norms targeting particulate number limits in GDI and hybrid engines. Rising adoption of turbocharged and downsized engines across vehicle platforms increases demand for effective filtration solutions. OEMs integrate coated and compact filters to meet cold-start and urban driving requirements. Digital design tools accelerate innovation and system optimization. Public focus on urban air quality and health further supports the widespread use of gasoline particulate filters in new vehicle models.

Europe leads the Automotive Gasoline Particulate Filter market due to early enforcement of strict particulate emission norms and wide GDI engine deployment. North America follows with strong regulatory support and high SUV and hybrid adoption. Asia Pacific shows rapid growth driven by China’s regulatory alignment and rising vehicle production. Latin America and Middle East & Africa hold emerging opportunities through regulatory shifts. Key players in the market include NGK Spark Plug Co., Ltd., Robert Bosch GmbH, Denso Corporation, and Continental AG.

Market Insights

- The Automotive Gasoline Particulate Filter market was valued at USD 3.32 billion in 2024 and will reach USD 5.78 billion by 2032, growing at a CAGR of 7.2%.

- Stringent emission regulations across the U.S., Europe, China, and India drive GPF adoption in passenger vehicles.

- OEMs prefer coated GPFs with integrated catalyst functions to improve cold-start performance and meet urban cycle tests.

- Key companies such as Bosch, NGK Spark Plug, Denso, and Tenneco invest in compact, modular, and high-efficiency GPF systems.

- High integration costs and design complexity in hybrid platforms limit product standardization for some automakers.

- Europe leads the market due to strict Euro 6d standards, while Asia Pacific grows fast with China’s regulatory shift.

- North America maintains steady demand with strong hybrid SUV sales, while Latin America and Middle East show emerging opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Stringent Emissions Regulations Continue to Strengthen OEM Demand for Advanced Filtration Technologies

The tightening of global emission standards drives the adoption of gasoline particulate filters in modern vehicles. Europe’s Euro 6d and China’s CN6 regulations mandate limits on particulate number emissions, directly pushing automakers to adopt GPF systems. The Automotive Gasoline Particulate Filter market benefits from regulatory compliance requirements that apply to turbocharged gasoline direct injection (GDI) engines. These engines tend to emit more particulates than port fuel injection types, requiring high-efficiency filtration. Regulatory scrutiny extends to both light-duty and passenger vehicles, making GPF installation a necessary design feature. It enforces a performance-based standard that supports long-term demand.

- For instance, China’s China 6b standard requires gasoline vehicles to comply with a Particle Number (PN) limit of 6.0×10¹¹ particles/km under WLTC.

Growing Penetration of Gasoline Direct Injection Engines Across Vehicle Segments

Gasoline direct injection engines offer better power, fuel economy, and lower CO₂ emissions than traditional designs. However, they release higher particulate matter, making filters a required control measure. The Automotive Gasoline Particulate Filter market gains from the rising share of GDI engines in both developed and emerging economies. GPF technology allows automakers to meet emission norms while preserving engine performance. It supports integration with advanced aftertreatment systems such as three-way catalysts. Carmakers increasingly choose GPFs as standard in turbocharged engine models sold globally.

- For instance, a study published in SAE international journal of Engines, comparing fuels on a modern 2.0-L turbocharged GDI engine found up to 6-fold difference in engine-out PN emissions across certification fuels.

Increasing Focus on Passenger Health and Urban Air Quality Drives System Installations

Awareness of ultrafine particle pollution and its impact on respiratory health raises pressure on OEMs and regulators. Urban air quality initiatives in cities such as Paris, Tokyo, and Los Angeles promote tailpipe emissions reduction across vehicle classes. The Automotive Gasoline Particulate Filter market reflects growing stakeholder interest in protecting passenger and pedestrian health. GPFs effectively reduce particle number emissions without negatively affecting fuel consumption. It provides a passive, maintenance-free solution to meet urban clean air goals. Industry partnerships with environmental authorities help accelerate the deployment of cleaner technologies.

Shift Toward Electrified Powertrains Increases Hybrid Vehicle GPF Integration

Hybrid electric vehicles using gasoline engines also emit particulates during engine operation. These emissions are most frequent during engine start and acceleration, where filtration becomes essential. The Automotive Gasoline Particulate Filter market sees increased integration in plug-in hybrid electric vehicles (PHEVs) and full hybrids. Automakers ensure hybrid fleets remain compliant with strict local and regional emission rules. It allows hybrids to match the air quality performance of battery electric vehicles in many regulated markets. GPFs complement broader electrification strategies across multiple drivetrain platforms.

Market Trends

OEMs Focus on Compact Filter Designs Compatible with Downsized Engine Bays

Automakers demand gasoline particulate filters that fit within limited under-hood spaces. Engine downsizing for efficiency and weight reduction has made compact emission systems essential. Manufacturers respond by developing shorter, lighter GPFs that maintain filtration performance. The Automotive Gasoline Particulate Filter market benefits from integration-friendly designs that ease OEM assembly and layout constraints. It supports modular configurations that combine catalysts and filters in single canister units. This trend reduces cost and simplifies emissions system packaging.

- For instance, in Emissions Analytics testing, deployment of GPF reduced particle number emissions by 86 % on average across various vehicles and driving conditions.

Coated Filter Technologies Gain Preference for Faster Light-Off and Emission Control

Suppliers adopt advanced coating techniques to enhance filter performance under cold start conditions. Coated GPFs with integrated three-way catalyst functionality reduce emissions before the system reaches full operating temperature. The Automotive Gasoline Particulate Filter market shows increased demand for catalytic coatings that support quick light-off and low-temperature reactivity. It enables effective emission reduction during urban stop-and-go driving. The trend also aligns with regulatory test cycles that emphasize early-phase emissions. Coating uniformity and durability remain focus areas for system suppliers.

- For instance, Ford’s “artificial ash” coating increased zero-mileage filtration efficiency from ~75 % to ~90 % when loading the GPF with 1.5 g/L of fine alumina particles.

Advanced Materials Support Long-Term Durability and High Thermal Stability Requirements

Filter substrates made of high thermal resistance materials such as cordierite and silicon carbide dominate current supply. These materials ensure structural integrity under extreme exhaust temperatures. The Automotive Gasoline Particulate Filter market benefits from product innovations that balance porosity, mechanical strength, and backpressure. It supports longer service life and reduces the need for frequent replacement. Material upgrades also help manage soot accumulation and regeneration. Suppliers explore novel compositions to meet durability goals without adding weight.

Simulation and Digital Design Tools Improve Filter Geometry and Flow Distribution

OEMs and suppliers invest in computer-aided engineering (CAE) tools to optimize filter geometry. These tools allow precise modeling of flow dynamics, soot loading, and regeneration cycles. The Automotive Gasoline Particulate Filter market leverages digital platforms to reduce prototyping time and enhance product validation. It ensures even soot distribution and minimal pressure drop. Simulations help fine-tune wall thickness, cell density, and porosity based on engine type. This trend improves system efficiency and supports data-driven engineering processes.

Market Challenges Analysis

Cost Pressure from OEMs and Tier-1s Limits Supplier Flexibility and Innovation Cycles

Automotive manufacturers demand cost-effective emission control solutions without compromising on quality or durability. Suppliers of gasoline particulate filters face pricing pressure due to tight margins and competitive bidding. The Automotive Gasoline Particulate Filter market encounters hurdles in introducing advanced technologies while maintaining affordability. It must balance material cost, coating complexity, and engineering resources to meet OEM targets. Shorter development cycles reduce time available for testing and validation. This challenge slows the pace of innovation and limits design optimization opportunities.

Integration Constraints in Hybrid Powertrains Create Design and Thermal Management Issues

Hybrid and plug-in hybrid vehicles require emission systems that function efficiently across variable operating conditions. GPFs must manage intermittent exhaust flow and fluctuating temperatures during engine-off phases. The Automotive Gasoline Particulate Filter market faces challenges in ensuring consistent filtration under partial load and low-temperature cycles. It requires precise control of regeneration without increasing backpressure or compromising fuel economy. Packaging constraints in hybrid platforms further limit space for exhaust aftertreatment systems. These limitations complicate filter design and performance management.

Market Opportunities

Expansion of Vehicle Emission Standards in Emerging Markets Creates New Demand Zones

Developing regions continue to adopt stricter vehicle emission norms aligned with Euro 6 and China 6 standards. These transitions require the use of gasoline particulate filters in new passenger and light commercial vehicles. The Automotive Gasoline Particulate Filter market finds growth opportunities in Latin America, Southeast Asia, and parts of Africa. It allows global OEMs to maintain platform standardization while meeting local compliance rules. Demand for GDI engines in mid-range vehicles supports filter adoption. Government incentives for cleaner transport further expand deployment potential.

Aftermarket Retrofits and Inspection Programs Open Pathways for Long-Term Volume Growth

Inspection and maintenance programs in developed countries promote retrofit installations of particulate filters in older vehicles. Regulatory agencies focus on real-world emissions testing, identifying high-polluting gasoline vehicles. The Automotive Gasoline Particulate Filter market can tap into this demand by offering standardized retrofit kits for non-compliant models. It enables vehicle owners to meet inspection thresholds without replacing entire exhaust systems. Partnerships with local workshops and certification agencies support this channel. Retrofit demand provides a second revenue stream alongside OEM sales.

Market Segmentation Analysis:

By Fuel Type

Gasoline holds the leading share due to its dominant use in passenger vehicles with GDI engines. Emission standards push OEMs to adopt GPFs to manage soot and particulate number levels from gasoline combustion. The Automotive Gasoline Particulate Filter market benefits from consistent demand across turbocharged and naturally aspirated engines. Ethanol blends show increasing relevance in markets like Brazil and the U.S., where flex-fuel vehicles operate on high-ethanol content. Filters in these vehicles must handle changes in exhaust temperature and soot composition. Natural gas vehicles remain niche but present a future opportunity as OEMs explore alternative clean fuels.

- For instance, Corning’s DuraTrap® GC filters are cordierite-based and by mid-2018 the company had produced its 1,000,000th gasoline particulate filter.

By Material

Ceramic materials, especially cordierite and silicon carbide, dominate the segment due to their high thermal resistance and filtration efficiency. These substrates manage high soot loading while maintaining structural integrity under repeated regeneration cycles. The Automotive Gasoline Particulate Filter market sees ceramic filters as the preferred choice for light-duty applications. Metallic substrates offer quicker heat conduction and durability for performance vehicles and some hybrid models. They enable faster light-off and integrated catalytic functions. Composite materials are emerging as lightweight alternatives for space-constrained designs.

- For instance, current close-coupled GPF designs widely used by OEMs favor 300 cells per square inch (cpsi) substrates with 8-mil wall thickness, as this configuration provides an effective balance between filtration efficiency, pressure drop, and thermal durability.

By Application

Emission control leads the segment due to GPFs being directly installed to reduce particulate number emissions. It supports regulatory compliance across various regional emission standards. The Automotive Gasoline Particulate Filter market reflects strong OEM integration into both exhaust systems and aftertreatment units. Filters used in exhaust systems ensure real-time emission capture and durability during engine operation. Aftertreatment systems include GPFs in combination with three-way catalysts or NOx traps for full emission coverage. It enables modular solutions that fit different vehicle architectures and drivetrain configurations.

Segments:

Based on Fuel Type:

- Gasoline

- Ethanol Blends

- Natural Gas

Based on Material:

- Ceramic

- Metallic

- Composite

Based on Application:

- Emission Control

- Exhaust System

- After Treatment System

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 28.3% of the global Automotive Gasoline Particulate Filter market in 2024. The region benefits from strong regulatory enforcement, led by the U.S. Environmental Protection Agency (EPA) and California Air Resources Board (CARB). These agencies mandate low particulate emissions for gasoline engines across vehicle classes, including SUVs and pickup trucks. The U.S. sees widespread adoption of gasoline direct injection (GDI) engines, which contributes to rising filter demand. Original Equipment Manufacturers (OEMs) integrate GPFs to meet both federal and state-level emission targets. Canada also follows a similar regulatory path, aligning with U.S. standards, which supports regional consistency. The aftermarket segment sees traction in states with rigorous inspection and maintenance requirements, creating additional revenue potential for filter suppliers.

Europe

Europe held the largest share at 34.1% in the Automotive Gasoline Particulate Filter market in 2024. Euro 6d standards, which limit particulate number (PN) emissions, drive mandatory adoption of GPFs in gasoline vehicles. Germany, France, and the U.K. lead the regional demand, supported by early compliance from leading European automakers. Most vehicles with turbocharged or downsized engines come factory-fitted with GPFs across the EU. Hybrid vehicles also include particulate filters to comply with WLTP and RDE test cycles, which emphasize real-world performance. Europe supports innovation in coated filters and integrated catalyst systems. Public awareness of air pollution and urban health further increases political and consumer support for advanced emission control technologies.

Asia Pacific

Asia Pacific captured 26.7% of the global Automotive Gasoline Particulate Filter market in 2024. China plays a central role through the implementation of China 6a and 6b emission norms, which mirror Euro standards. Automakers in Japan and South Korea also comply with strict domestic regulations, using GPFs for both domestic and export vehicles. The region sees high volumes of compact and mid-size gasoline cars, creating a wide base for GPF installations. Local manufacturers invest in in-house emission control technologies to meet both performance and cost objectives. India is also transitioning toward Bharat Stage VI norms, encouraging OEMs to standardize GPF systems in high-volume vehicle segments. Growing middle-class demand for gasoline passenger vehicles further supports volume expansion.

Latin America

Latin America represented 6.1% of the Automotive Gasoline Particulate Filter market in 2024. Countries such as Brazil, Mexico, and Argentina have started aligning their automotive regulations with global emission standards. Brazil, with its large ethanol-blend vehicle fleet, presents a unique application segment requiring flexible filter designs. Mexico’s export-focused vehicle manufacturing sector ensures adoption of GPFs in line with U.S. and European standards. Regional growth is steady but slower due to uneven enforcement and lower consumer pressure. However, policy shifts and urban clean air programs could accelerate GPF usage over the forecast period.

Middle East & Africa

Middle East & Africa accounted for 4.8% of the global Automotive Gasoline Particulate Filter market in 2024. Regulatory enforcement remains less stringent compared to other regions, limiting large-scale adoption. However, some Gulf countries, particularly the UAE and Saudi Arabia, implement Euro-equivalent norms for imported vehicles. South Africa shows moderate demand driven by urban fleet modernization. Growth prospects exist through rising awareness of vehicle pollution and the presence of global OEM assembly plants. OEMs selling into the region increasingly fit vehicles with GPFs by default to meet export readiness and emissions labeling requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NGK Spark Plug Co., Ltd.

- Parker Hannifin Corporation

- Robert Bosch GmbH

- Hanon Systems

- Eberspächer Group

- Aisin Seiki Co., Ltd.

- Tenneco Inc.

- Valeo S.A.

- Denso Corporation

- Johnson Matthey Plc

- Schaeffler AG

- Continental AG

- Mann+Hummel

- Faurecia S.A.

- BorgWarner Inc.

Competitive Analysis

The competitive landscape of the Automotive Gasoline Particulate Filter market features leading players including NGK Spark Plug Co., Ltd., Parker Hannifin Corporation, Robert Bosch GmbH, Hanon Systems, Eberspächer Group, Aisin Seiki Co., Ltd., Tenneco Inc., Valeo S.A., Denso Corporation, Johnson Matthey Plc, Schaeffler AG, Continental AG, Mann+Hummel, Faurecia S.A., and BorgWarner Inc. These companies focus on advanced material integration, thermal stability, and low-pressure-drop filter designs. Leading suppliers collaborate directly with OEMs to deliver platform-specific GPF systems optimized for regulatory compliance. Many players develop coated filters that combine particulate filtration with catalytic functions to reduce cost and save space. Continuous investment in R&D strengthens their ability to deliver compact, modular solutions for both ICE and hybrid vehicles. Manufacturers also explore vertical integration strategies to control substrate manufacturing, coating technology, and final assembly. Strategic partnerships with automakers and emission control system integrators support long-term supply contracts. Global production footprints enable faster delivery and customization across regions. Competitive differentiation centers on filter durability, regeneration efficiency, and cold-start performance. Market leaders maintain strong IP portfolios that cover materials, design architecture, and thermal management. Each company continues to focus on product validation under real-world driving conditions to meet evolving emission norms.

Recent Developments

- In 2024, Valeo held its INVENT 2024 Aftermarket Innovations Roadshow where it revealed new automotive trends and strategies

- In 2023, NGK presented technical data on Gasoline Particulate Filters (GPFs) for the Indian market at a conference organized by the Indian Emission Control Manufacturers Association (ECMA).

- In 2023, Eberspächer Group opened a new technology plant for its subsidiary, Purem by Eberspächer, in Xuchang, China, to produce exhaust technology for passenger and commercial vehicles

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global adoption of gasoline particulate filters will rise due to tighter emissions norms across all regions.

- OEMs will integrate GPFs as standard in all gasoline direct injection and hybrid vehicle platforms.

- Demand will shift toward coated filters that support faster light-off and cold-start performance.

- Compact and modular filter designs will dominate to meet space constraints in downsized engine bays.

- Suppliers will invest in advanced materials to improve thermal resistance and regeneration stability.

- Retrofit opportunities will grow in regions enforcing real-driving emission inspections on older vehicles.

- Hybrid vehicle growth will create new demand for GPFs in intermittent and low-temperature applications.

- Digital simulation tools will support faster design cycles and reduce validation time for new filters.

- Regulatory alignment in emerging markets will drive first-time adoption of GPFs in new vehicle fleets.

- Collaboration between OEMs and tier-1 suppliers will focus on cost reduction and durability optimization.