| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chocolate Confectionery Market Size 2024 |

USD 86,970.57 million |

| Chocolate Confectionery Market, CAGR |

4.33% |

| Chocolate Confectionery Market Size 2032 |

USD 125,103.88 million |

Market Overview

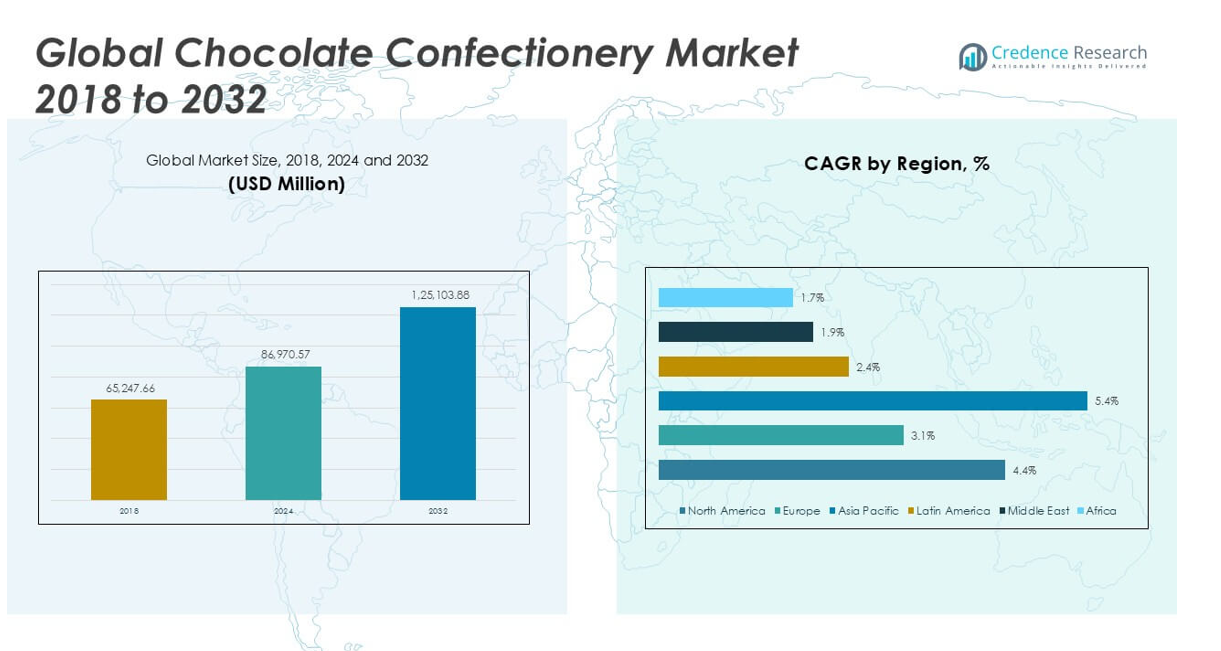

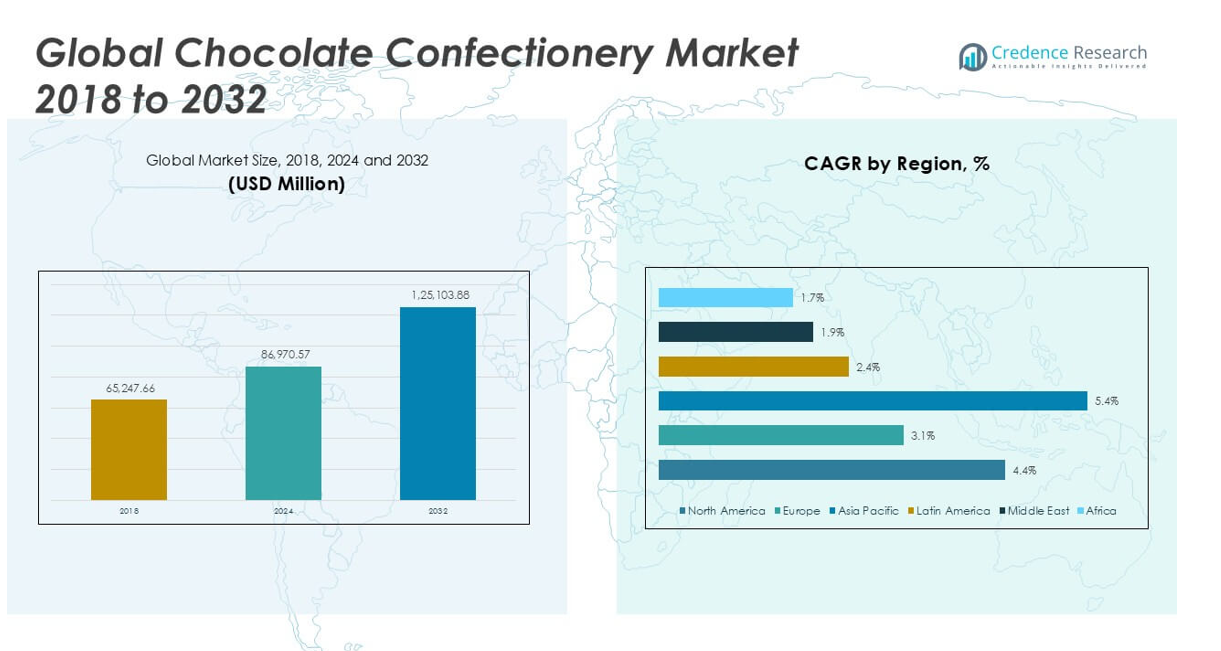

The Chocolate Confectionery Market size was valued at USD 65,247.66 million in 2018, reached USD 86,970.57 million in 2024, and is anticipated to reach USD 125,103.88 million by 2032, at a CAGR of 4.33% during the forecast period.

The Chocolate Confectionery Market is experiencing steady growth, driven by rising consumer demand for premium and innovative chocolate products, expanding urban populations, and increasing disposable incomes. Manufacturers are investing in new flavors, healthier formulations, and sustainable sourcing to capture evolving consumer preferences. The market benefits from the growing popularity of gifting chocolates during festivals and special occasions, as well as a surge in impulse purchases fueled by effective retail merchandising and marketing strategies. Trends such as the introduction of artisanal, organic, and ethically sourced chocolates are gaining traction, reflecting heightened consumer awareness around quality and sustainability. Digital platforms and e-commerce are further supporting market expansion by making premium chocolate brands more accessible. However, the industry faces challenges from fluctuating raw material prices and supply chain disruptions, which may impact profitability and product availability. Despite these hurdles, the market’s outlook remains positive, supported by ongoing product innovation and strong consumer engagement.

The Chocolate Confectionery Market demonstrates robust presence across North America, Europe, and Asia Pacific, with each region contributing distinct growth drivers and consumer trends. North America benefits from strong demand for premium and innovative products, while Europe maintains its leadership in traditional and artisanal chocolate segments, supported by well-established brands and a rich confectionery heritage. Asia Pacific stands out as the fastest-growing region, fueled by rising urbanization, changing consumer preferences, and the expanding middle class in countries like China, Japan, and India. Key players shaping the global landscape include Barry Callebaut, known for its extensive product portfolio and innovation capabilities; Ferrero International S.A., a leader in premium and seasonal chocolates; and Mars, Incorporated, recognized for its broad range of popular consumer brands. The presence of such established companies ensures a competitive and dynamic market environment, continually driving product development and expansion.

Market Insights

- The Chocolate Confectionery Market was valued at USD 65,247.66 million in 2018, reached USD 86,970.57 million in 2024, and is projected to reach USD 125,103.88 million by 2032, with a CAGR of 4.33% during the forecast period.

- Strong consumer demand for premium, artisanal, and innovative chocolate products is driving steady market growth, especially among urban and younger demographics.

- Health and wellness trends are influencing new product development, with companies introducing low-sugar, vegan, organic, and functional chocolates to appeal to evolving consumer preferences.

- Key players such as Barry Callebaut, Ferrero International S.A., Mars, Incorporated, and Mondelez International, Inc. maintain a competitive edge through product innovation, extensive portfolios, and global distribution networks.

- The market faces restraints from volatile raw material prices, particularly cocoa, and ongoing supply chain disruptions that impact manufacturing costs and product availability.

- North America leads in premium chocolate demand and product innovation, Europe is known for artisanal and traditional brands, while Asia Pacific is witnessing the fastest growth due to rising urbanization and expanding middle-class populations.

- Despite challenges, companies are capitalizing on e-commerce channels, personalized offerings, and sustainable sourcing to boost consumer engagement and support long-term market expansion

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Consumer Demand for Premium and Innovative Chocolate Products Fuels Market Expansion

The Chocolate Confectionery Market is benefiting from the heightened consumer appetite for premium chocolates and innovative flavors. Shifting preferences toward high-quality, unique taste experiences are driving manufacturers to introduce specialty and artisanal chocolates. Demand for products with distinct textures, exotic ingredients, and limited-edition collections continues to increase, especially among urban and younger demographics. Brands are investing in research and development to launch chocolates that appeal to adventurous palates, creating greater differentiation and value in a competitive market. Consumers are seeking chocolates that provide both indulgence and novelty, further propelling sales of new product launches. This focus on innovation and quality is enabling the market to retain consumer interest and drive repeat purchases.

- For instance, Ferrero operates 13 global innovation centers employing over 900 R&D experts who develop more than 30 new product launches annually.

Growth in Urbanization and Increasing Disposable Incomes Encourage Higher Consumption Levels

Urbanization is transforming lifestyle patterns and dietary habits, leading to increased demand for convenient and indulgent snacks like chocolate confectionery. The market is seeing positive momentum in developing regions where rapid urban growth coincides with rising disposable incomes. People are spending more on premium food products, treating chocolate not only as an occasional luxury but as a regular treat. Changing work routines and social habits in urban areas are contributing to higher consumption of on-the-go chocolate products. Retail expansion in urban centers is enhancing product visibility and accessibility. It is also encouraging consumers to explore a wider variety of chocolate options, strengthening market growth.

- For instance, Mondelez International operates approximately 800,000 retail outlets in emerging markets and adds nearly 7,000 new retail points annually to expand urban reach.

Marketing Initiatives and Seasonal Gifting Traditions Bolster Sales and Brand Loyalty

The Chocolate Confectionery Market relies heavily on strategic marketing campaigns and the enduring appeal of seasonal gifting. Companies are investing in impactful advertising, celebrity endorsements, and attractive packaging to capture consumer attention and stimulate impulse buying. Seasonal events, festivals, and special occasions remain pivotal, with chocolates considered a preferred gifting choice. Brands are creating themed assortments and personalized offerings to deepen customer loyalty. Point-of-sale promotions and digital engagement initiatives are further amplifying market reach. These efforts are maintaining strong consumer engagement and supporting steady market growth.

Sustainability, Health Trends, and Product Reformulation Shape Market Opportunities

Sustainability and health concerns are reshaping product development in the Chocolate Confectionery Market. Companies are sourcing ethically certified cocoa and adopting eco-friendly packaging to address growing environmental and ethical awareness among consumers. Product reformulation is underway to reduce sugar, introduce natural ingredients, and offer healthier alternatives. The shift toward clean label and organic chocolates is expanding the consumer base, attracting health-conscious individuals. Transparency in sourcing and production practices is becoming an important purchasing criterion. These trends are creating new opportunities for brands to innovate and differentiate within the market.

Market Trends

Premiumization and Artisanal Innovations Drive Consumer Preference in the Chocolate Confectionery Market

The Chocolate Confectionery Market is witnessing a strong trend toward premiumization, with consumers displaying greater interest in high-quality, artisanal chocolates. It is embracing small-batch production, unique flavor combinations, and handcrafted processes to meet evolving taste expectations. Consumers are exploring products that offer a sense of luxury and exclusivity, seeking out chocolates made with single-origin cocoa and exotic inclusions. The rise of bean-to-bar brands and limited-edition product lines is further reinforcing this trend. Companies are highlighting craftsmanship and provenance in their marketing to attract discerning buyers. Premium offerings are gaining traction both in traditional retail outlets and online channels.

- For instance, Lindt & Sprüngli operates over 450 Lindt stores worldwide, which generate more than 20% of the company’s total revenue through premium artisanal product sales.

Health-Conscious Choices and Clean Label Trends Influence Product Development

Health and wellness trends are reshaping the Chocolate Confectionery Market, pushing brands to reformulate products and introduce healthier alternatives. It is prioritizing reduced sugar, natural ingredients, and free-from claims to appeal to health-conscious consumers. Dark chocolates with higher cocoa content and added functional ingredients like nuts and superfoods are gaining popularity. Manufacturers are increasing transparency about sourcing and nutritional content, responding to rising consumer demand for clean label and organic chocolates. Vegan and plant-based options are expanding the market’s reach to new demographics. These trends are redefining product portfolios and broadening consumer appeal.

- For instance, Nestlé reported selling over 3,000 metric tons of its plant-based and organic chocolate products annually, with availability in more than 18 countries.

Sustainable Sourcing and Ethical Practices Gain Prominence Across the Industry

Sustainability is shaping purchasing decisions and brand loyalty within the Chocolate Confectionery Market. Companies are committing to responsible cocoa sourcing, supporting fair trade initiatives, and adopting environmentally friendly packaging solutions. It is prioritizing traceability and ethical certifications to meet the expectations of socially conscious consumers. Brands are leveraging sustainability credentials in marketing strategies, aiming to build trust and strengthen customer relationships. Investments in regenerative agriculture and carbon reduction are becoming more visible. These efforts are supporting long-term growth and aligning industry practices with global environmental goals.

Digital Transformation and Direct-to-Consumer Strategies Reshape Distribution

Digitalization is changing the way the Chocolate Confectionery Market connects with consumers, enabling direct-to-consumer sales and personalized experiences. It is utilizing e-commerce platforms, subscription boxes, and targeted online campaigns to increase brand visibility and engagement. Companies are gathering insights from data analytics to tailor product offerings and refine marketing strategies. Social media channels are driving product discovery and real-time customer feedback. The shift toward omnichannel retailing is strengthening market penetration, making premium and niche chocolate brands more accessible to a wider audience. This digital evolution is accelerating growth and reshaping traditional sales models.

Market Challenges Analysis

Volatile Raw Material Prices and Supply Chain Disruptions Increase Market Uncertainty

The Chocolate Confectionery Market faces persistent challenges from fluctuating prices of key raw materials such as cocoa, sugar, and milk. It must navigate unpredictable supply chains that often suffer from weather-related crop failures, political instability in major cocoa-producing regions, and transportation bottlenecks. These disruptions can lead to higher production costs, impacting profit margins for manufacturers and limiting their ability to maintain consistent product pricing. Sourcing ethically certified cocoa adds further complexity and expense, raising concerns around sustainability and transparency. Companies must invest in supply chain risk management and secure long-term partnerships to mitigate volatility. This environment of uncertainty can hinder product innovation and restrict the entry of smaller brands.

Health Concerns, Regulatory Pressures, and Shifting Consumer Preferences Restrain Growth Prospects

The Chocolate Confectionery Market is under increasing pressure from rising health awareness and stringent food regulations. It faces scrutiny over sugar content, artificial additives, and calorie levels, prompting both governments and consumers to demand healthier alternatives. Regulatory bodies in various regions have imposed labeling requirements and marketing restrictions targeting products perceived as unhealthy. Changing dietary trends, including the shift toward plant-based and low-sugar diets, are impacting traditional chocolate consumption patterns. Manufacturers need to reformulate products and invest in new technologies to align with evolving consumer expectations. These challenges require agile adaptation and ongoing investment to remain competitive in a rapidly changing landscape.

Market Opportunities

Rising Demand for Premium, Artisanal, and Health-Focused Chocolate Opens New Growth Avenues

The Chocolate Confectionery Market can unlock significant growth by expanding premium and artisanal offerings. It can capture a broader audience by introducing innovative products with unique flavors, high cocoa content, and ethically sourced ingredients. Health-focused trends, such as sugar-free, vegan, and organic chocolates, appeal to consumers seeking guilt-free indulgence and align with evolving dietary preferences. Brands can leverage storytelling around craftsmanship, provenance, and sustainability to strengthen brand loyalty and justify premium pricing. The emergence of functional chocolates, infused with superfoods or added health benefits, presents further avenues for differentiation. These opportunities enable companies to move beyond traditional mass-market products and establish a stronger presence in niche segments.

Digital Transformation, E-commerce, and Global Market Expansion Enhance Accessibility and Reach

Digitalization offers the Chocolate Confectionery Market new pathways to reach consumers and drive sales growth. It can utilize e-commerce platforms, subscription services, and targeted online marketing to increase visibility and engage with younger, tech-savvy audiences. Companies can expand into emerging markets where rising disposable incomes and changing lifestyles are fueling chocolate consumption. The ability to personalize products and create direct-to-consumer relationships supports greater customer retention and brand differentiation. Globalization and improved logistics infrastructure further enable brands to distribute their products across borders efficiently. This evolving digital landscape supports long-term market opportunities and accelerates international expansion.

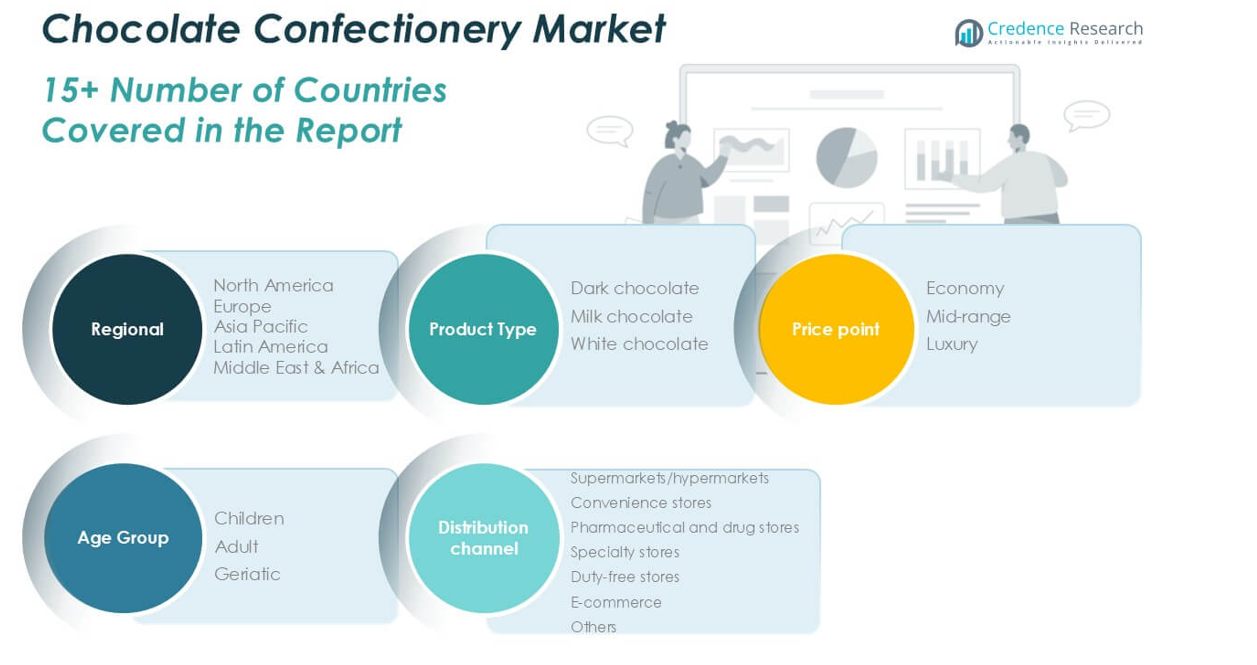

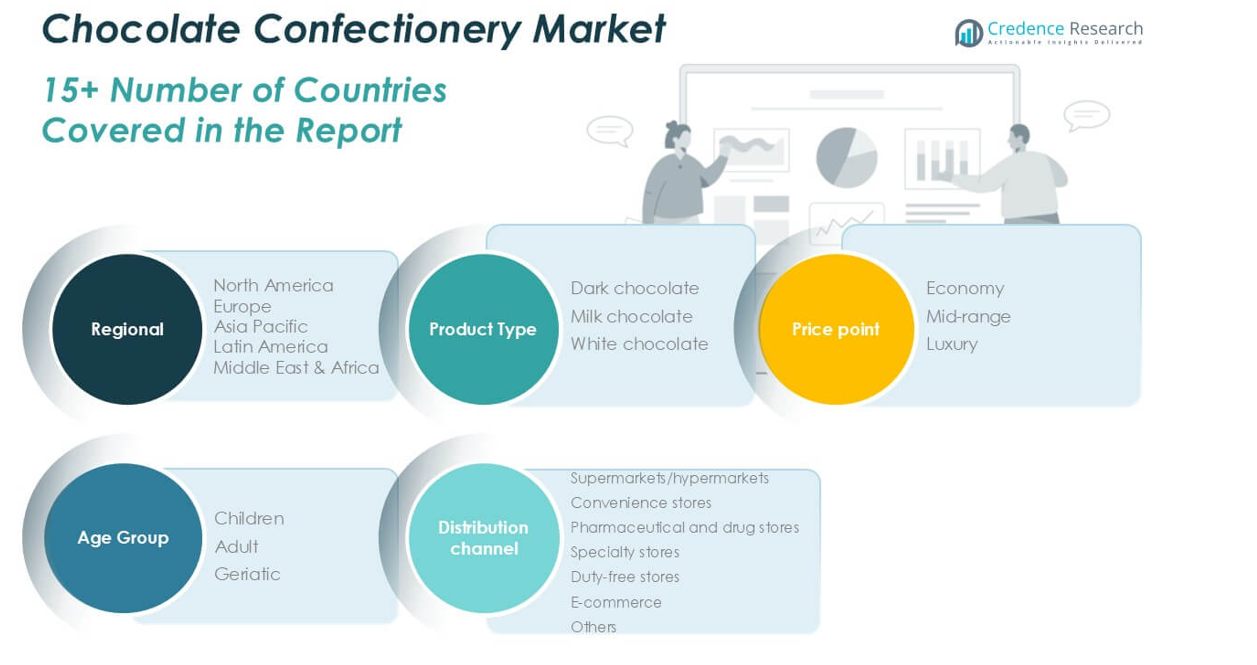

Market Segmentation Analysis:

By Product Type:

The market features dark chocolate, milk chocolate, and white chocolate. Dark chocolate continues to attract health-conscious consumers seeking products with higher cocoa content and perceived wellness benefits. It appeals to mature palates and is favored for its rich flavor and antioxidant profile. Milk chocolate remains the most popular segment, appreciated for its creamy texture and sweet taste that resonates with a broad demographic. White chocolate, though smaller in share, caters to consumers preferring milder flavors and serves as a foundation for innovative product development, including specialty inclusions and limited-edition offerings.

- For instance, Barry Callebaut produces approximately 18,000 metric tons of white chocolate annually, supplying manufacturers worldwide for specialized product lines.

By Price Point:

The market is divided into economy, mid-range, and luxury segments. The economy segment drives high-volume sales in price-sensitive markets, making chocolate accessible to a wider population. It appeals to consumers seeking value without compromising on taste or quality. The mid-range segment balances affordability with premium attributes, attracting middle-income consumers who are open to experimenting with new flavors and packaging innovations. Luxury chocolate, positioned at the high end, captures demand for artisanal, exclusive, and gift-worthy offerings. It benefits from rising consumer willingness to spend more on premium quality, unique ingredients, and ethical sourcing, especially during festive seasons and special occasions.

- For instance, The Hershey Company’s luxury brand, Scharffen Berger, has produced over 900 unique limited-edition batches in recent years, focusing on single-origin beans and handcrafted packaging.

By Age Group:

Segmenting the Chocolate Confectionery Market by age group reveals targeted strategies for children, adults, and geriatric consumers. Children form a core consumer base, driving demand for fun shapes, vibrant packaging, and sweet, approachable flavors. The adult segment is increasingly seeking variety, with interest in dark chocolate, novel taste experiences, and premium offerings that fit gifting occasions. Geriatric consumers, while representing a smaller segment, focus on products that offer health benefits or are easier to consume, such as sugar-free or fortified chocolates. It is responding to the diverse needs of these age groups by innovating product formulations, marketing approaches, and packaging designs to ensure broad appeal and sustained engagement across all segments.

Segments:

Based on Product Type:

- Dark chocolate

- Milk chocolate

- White chocolate

Based on Price Point:

Based on Age Group:

Based on Distribution Channel:

- Supermarkets/hypermarkets

- Convenience stores

- Pharmaceutical and drug stores

- Specialty stores

- Duty-free stores

- E-commerce

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Chocolate Confectionery Market

North America Chocolate Confectionery Market grew from USD 27,745.52 million in 2018 to USD 36,588.43 million in 2024 and is projected to reach USD 52,781.20 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.4%. North America is holding a 42.1% market share. The United States dominates the regional landscape, supported by strong demand for premium chocolates, innovative product launches, and established retail infrastructure. Canada and Mexico are also contributing to growth with rising consumer interest in artisanal and health-oriented products. The market benefits from high per capita consumption and a trend toward indulgent gifting, especially during seasonal events.

Europe Chocolate Confectionery Market

Europe Chocolate Confectionery Market grew from USD 12,158.58 million in 2018 to USD 15,317.05 million in 2024 and is estimated to reach USD 20,031.34 million by 2032, at a CAGR of 3.1%. Europe commands a 17.8% market share. Germany, the United Kingdom, Switzerland, and France lead in both consumption and production, backed by rich chocolate traditions and established global brands. Demand for organic and fair-trade chocolates continues to rise in Western Europe. The market in Eastern Europe is growing at a moderate pace, driven by expanding retail channels and rising disposable incomes.

Asia Pacific Chocolate Confectionery Market grew from USD 19,915.81 million in 2018 to USD 27,949.64 million in 2024 and is anticipated to reach USD 43,662.38 million by 2032, demonstrating a CAGR of 5.4%. Asia Pacific holds a 34.6% market share. China, Japan, and India are the primary growth engines, driven by rapid urbanization, expanding middle-class populations, and rising disposable incomes. The region is witnessing increased adoption of Western confectionery habits and a surge in premium product offerings. Local brands and international players are investing in new product development to cater to diverse consumer tastes.

Latin America Chocolate Confectionery Market

Latin America Chocolate Confectionery Market grew from USD 2,574.41 million in 2018 to USD 3,380.44 million in 2024 and is forecasted to reach USD 4,192.08 million by 2032, at a CAGR of 2.4%. Latin America maintains a 3.3% market share. Brazil and Mexico drive regional demand, supported by growing retail distribution and rising urbanization. The market faces challenges from fluctuating cocoa prices but benefits from the popularity of chocolate during festive seasons. Premiumization trends are gradually emerging, with greater consumer awareness about quality and sustainability.

Middle East Chocolate Confectionery Market

Middle East Chocolate Confectionery Market grew from USD 1,718.95 million in 2018 to USD 2,081.94 million in 2024 and is expected to reach USD 2,494.38 million by 2032, recording a CAGR of 1.9%. The Middle East accounts for a 2.0% market share. Saudi Arabia and the United Arab Emirates are key countries, with demand bolstered by increasing tourism and rising disposable incomes. Product innovations that cater to local tastes, along with the expansion of modern retail, are driving growth. The market remains highly competitive, with both global and regional brands investing in brand visibility and premium assortments.

Africa Chocolate Confectionery Market

Africa Chocolate Confectionery Market grew from USD 1,134.40 million in 2018 to USD 1,653.05 million in 2024 and is set to reach USD 1,942.49 million by 2032, reflecting a CAGR of 1.7%. Africa holds a 1.5% market share. South Africa leads in consumption, supported by growing retail networks and increased consumer awareness. Nigeria and Egypt represent emerging markets with significant growth potential. Economic fluctuations and price sensitivity impact overall demand, but multinational brands are focusing on affordable product formats to penetrate deeper into the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Barry Callebaut

- Chocoladefabriken Lindt & Sprüngli AG

- Delfi Limited

- Ferrero International S.A.

- Lotte Corporation

- Mars, Incorporated

- Mondelez International, Inc.

- Nestlé S.A.

- Perfetti Van Melle

- The Hershey Company

Competitive Analysis

The Chocolate Confectionery Market features a highly competitive landscape, led by prominent players such as Barry Callebaut, Ferrero International S.A., Mars, Incorporated, Mondelez International, Inc., The Hershey Company, Nestlé S.A., Chocoladefabriken Lindt & Sprüngli AG, Lotte Corporation, Delfi Limited, and Perfetti Van Melle. These companies leverage robust global supply chains, strong brand equity, and continuous innovation to maintain their market leadership. They focus on product differentiation by introducing new flavors, premium formulations, and limited-edition offerings that cater to changing consumer preferences and drive brand loyalty. Sustainability and ethical sourcing have become key pillars of competitive strategy, with leading players investing in certified cocoa, eco-friendly packaging, and transparent supply chains. E-commerce, digital marketing, and personalized gifting options are enhancing customer engagement and expanding reach across diverse consumer segments. Strategic mergers, acquisitions, and partnerships enable these companies to strengthen their portfolios and enter new markets efficiently. Despite facing volatility in raw material prices and regulatory challenges, market leaders retain their advantage by prioritizing innovation, agility, and consumer-centric strategies. This dynamic environment encourages ongoing investment in research, product development, and sustainability initiatives to secure long-term growth and relevance in the global market.

Recent Developments

- In May 2025, the company acquired a minority stake in Drools Pet Food Private Limited in India, expanding its presence in the pet food segment within the Indian market.

- In April 2025, Barry Callebaut reported a 4.7% decrease in sales volume for the first half of fiscal year 2024/25, totaling 1,085,048 tonnes. This decline was attributed to volatile cocoa prices and delayed customer orders. Despite this, the company saw growth in its Gourmet, Specialties, and AMEA segments.

- In April 2025, Nestlé announced broad-based growth across markets and categories in Q1 2025, with improving market share trends and positive real internal growth.

- In March 2025, Lindt & Sprüngli achieved strong organic growth of 7.8% in 2024, with group sales increasing by 5.1% to CHF 5.47 billion. All regions contributed to this growth, reflecting the company’s robust global performance.

- In February 2025, Ferrero reported an 8.9% increase in revenue for the 2023/2024 financial year, reaching €18.4 billion. This growth was driven by new product launches and strategic acquisitions.

- In January 2025, the company released its “Top Chocolate Trends 2025” report, highlighting consumer preferences for intense, mindful, and healthy indulgences. The North American chocolate market, valued at over $31 billion in 2024, is projected to grow at a CAGR of 5.8% from 2025 to 2029.

Market Concentration & Characteristics

The Chocolate Confectionery Market exhibits moderate to high concentration, with a handful of multinational corporations commanding significant market share and shaping global trends. It is characterized by strong brand loyalty, high levels of product innovation, and well-established distribution networks that support consistent consumer access. Leading players set industry benchmarks through continual investment in research, development, and marketing, while smaller firms differentiate by focusing on niche segments, artisanal production, or unique flavor profiles. The market demonstrates seasonality, with sales peaking during holidays and gifting occasions, and displays resilience by adapting to changing consumer preferences around health, sustainability, and ethical sourcing. It relies on efficient supply chain management and global sourcing, yet faces volatility from fluctuating raw material prices and evolving regulatory standards. Despite these complexities, the market sustains robust competition, encouraging ongoing innovation and diversification to maintain consumer interest and secure long-term growth.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Price Point, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The chocolate confectionery market will continue to grow due to increasing consumer indulgence and premiumization trends.

- Demand for organic, vegan, and ethically sourced chocolates will drive product innovation and market expansion.

- E-commerce and direct-to-consumer channels will play a significant role in boosting sales and brand engagement.

- Dark chocolate will gain popularity owing to rising health awareness and preference for low-sugar alternatives.

- Asia-Pacific is expected to emerge as a key growth region due to rising disposable incomes and Western lifestyle influence.

- Seasonal and gift-oriented packaging will attract new buyers and enhance brand differentiation.

- Major players will invest in sustainable sourcing and eco-friendly packaging to align with global ESG goals.

- New flavor combinations and limited-edition products will support brand loyalty and repeat purchases.

- Urbanization and fast-paced lifestyles will increase demand for on-the-go and bite-sized chocolate formats.

- Strategic partnerships and acquisitions will help companies expand their product portfolios and market presence.