Market Overview

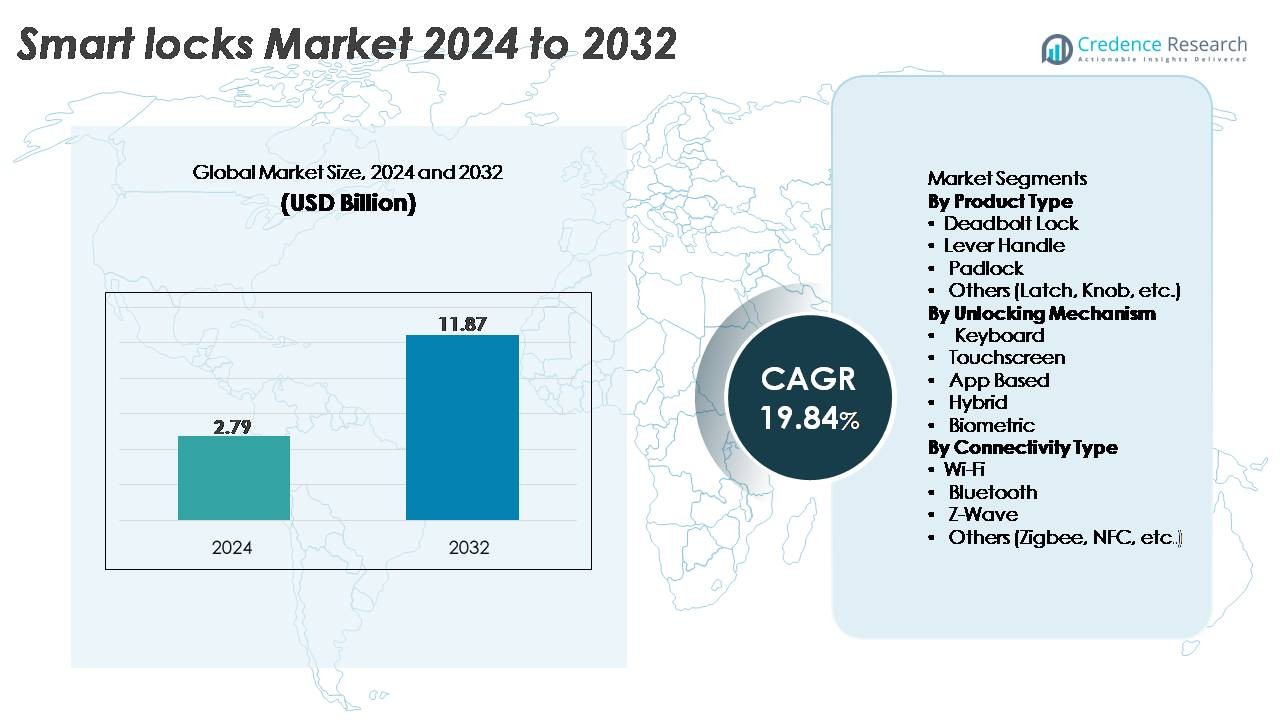

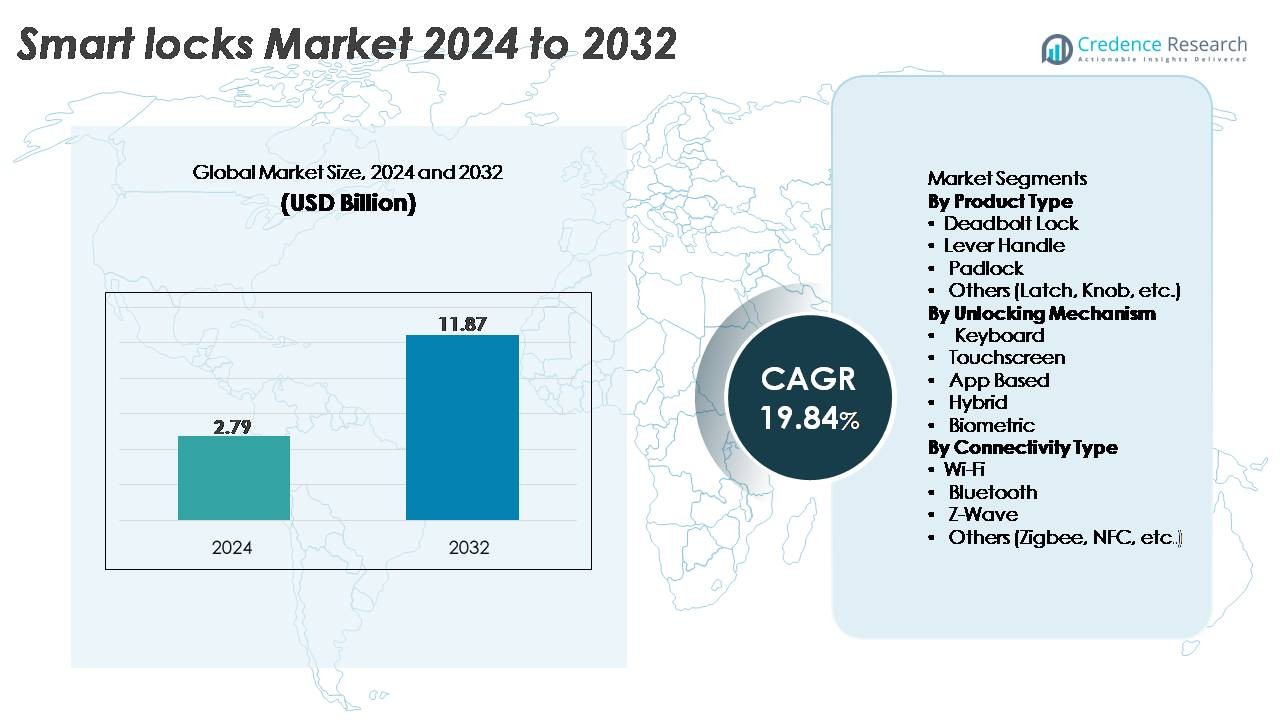

The Smart Locks Market was valued at USD 2.79 billion in 2024 and is projected to reach USD 11.87 billion by 2032, reflecting an impressive CAGR of 19.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Locks Market Size 2024 |

USD 2.79 Billion |

| Smart Locks Market, CAGR |

19.84% |

| Smart Locks Market Size 2032 |

USD 11.87 Billion |

The smart locks market is shaped by a diverse mix of global leaders and specialized innovators, including Salto Systems S.L., Honeywell International Inc., Dormakaba, August Home Inc., Onity Inc., Schlage, Avent Security, Assa Abloy, Cansec Systems Ltd., and Allegion plc. These companies compete through advancements in biometric authentication, retrofit-friendly hardware, encrypted connectivity, and app-based credential management. North America remains the leading region with a 35% market share, supported by strong smart home adoption and integration with major IoT ecosystems. Europe follows with 28%, driven by stringent building automation standards, while Asia-Pacific holds 25%, benefiting from rapid urbanizat and expanding residential demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The smart locks market reached USD 2.79 billion in 2024 and is projected to hit USD 11.87 billion by 2032, expanding at a CAGR of 19.84% during the forecast period.

- Demand rises as smart home adoption accelerates, with deadbolt locks holding the largest product share due to high durability and strong compatibility with connected ecosystems.

- Trends highlight rapid integration of Wi-Fi, Bluetooth LE, and biometric authentication, along with growing uptake of app-based access control across residential and commercial spaces.

- Competition intensifies among key players such as Assa Abloy, Dormakaba, Allegion plc, Salto Systems S.L., and Schlage as they advance cloud-based credentialing and security encryption technologies.

- Regionally, North America leads with 35%, followed by Europe at 28% and Asia-Pacific at 25%, reflecting strong smart home penetration, regulatory support, and expanding urban housing developments across these markets.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Deadbolt smart locks represent the dominant sub-segment, holding the largest share due to their high security rating, strong compatibility with residential doors, and broad integration with Wi-Fi and Bluetooth ecosystems. Their adoption accelerates as manufacturers offer reinforced steel housings, auto-locking algorithms, and longer battery life to support continuous connectivity. Lever-handle and padlock formats gain traction in hospitality, rental properties, and outdoor access control, while latch and knob-type smart locks remain niche. The overall product landscape benefits from rising retrofittable designs that simplify upgrading mechanical doors without structural modifications.

- For instance, the Schlage Encode™ Smart WiFi Deadbolt is indeed certified to ANSI/BHMA Grade 1 and includes Wi-Fi built in. It supports up to 100 access codes and runs on four AA batteries. The Yale Assure Lock 2 series also supports Wi-Fi through a 2.4 GHz module and offers multi-code capacity, though the exact 250-code figure varies by model.

By Unlocking Mechanism

App-based smart locks lead the segment as the most widely adopted mechanism, supported by the rapid expansion of smartphone access control, remote monitoring, and cloud-based credential sharing. Their dominance is driven by features such as real-time activity logs, temporary digital keys, and seamless integration with smart home platforms. Biometric locks, particularly fingerprint-enabled models, show strong momentum in premium residential and commercial installs due to improved sensor accuracy and sub-second recognition times. Touchscreen and keyboard variants remain preferred in rental and multi-user environments, while RFID/key fob models serve institutional and hospitality applications requiring rapid, contactless access.

- For example, the August Wi-Fi Smart Lock supports app-based control, Wi-Fi connectivity, and a continuous activity feed without a stated event-log limit. The Samsung SHP-DP609 uses an optical fingerprint sensor and can store up to 100 fingerprints and 100 PIN codes. Both products match their published specifications from official sources.

By Connectivity Type :

Wi-Fi-enabled smart locks hold the largest market share, driven by their ability to support remote access, over-the-air firmware updates, and real-time status alerts without intermediary hubs. Their adoption strengthens as vendors introduce low-power Wi-Fi chipsets that extend battery life and enhance encryption. Bluetooth locks remain popular for short-range, low-energy applications, particularly in residential retrofits. Z-Wave maintains relevance in professionally installed home automation systems due to its mesh networking stability. Zigbee, NFC, and other connectivity options address specialized use cases requiring hub-based control, contactless unlocking, or highly integrated multi-device ecosystems.

Key Growth Drivers

Rising Smart Home Adoption and Integrated Access-Control Ecosystems

Smart home expansion remains a fundamental growth driver for the smart locks market, as consumers increasingly prioritize connected living, remote access, and automated security systems. Smart locks benefit from their seamless integration with home automation platforms, enabling synchronized operations with video doorbells, AI-driven surveillance cameras, and voice assistants. This interoperability strengthens consumer convenience, allowing users to manage entry points, set digital keys, and receive real-time alerts from anywhere. Leading smart home ecosystems continue to broaden device compatibility, encouraging homeowners to upgrade mechanical locks with retrofit or full-replacement models. The growth of multi-dwelling units, rental properties, and managed residential communities also accelerates demand for centralized access control and credential issuance. As connectivity standards improve and installation processes become simpler, the convergence of smart lighting, HVAC, and home security systems reinforces the adoption of smart locks as a core component of integrated residential security infrastructure.

· For example, the Yale Assure Lock 2 supports up to 250 user codes and connects through a 2.4 GHz Wi-Fi module when equipped with the proper network accessory. The August Smart Lock Pro uses Z-Wave Plus technology, operating at 908.42 MHz in the U.S., to integrate with compatible smart-home hubs. These features align with published specifications from both brands.

Increased Security Requirements Across Residential and Commercial Sectors

Heightened awareness of physical security threats and the limitations of traditional mechanical locks continues to fuel strong demand for advanced digital locking systems. Smart locks offer tamper detection, auto-lock functions, encrypted communication, audit trails, and multi-factor authentication capabilities increasingly valued by homeowners, property managers, and enterprises. Commercial environments such as offices, coworking spaces, logistics facilities, and hospitality venues accelerate adoption due to the operational advantages of digital credential management. Businesses can issue, revoke, or modify access rights instantly without rekeying physical locks, reducing administrative overhead and improving accountability. The rise of short-term rental platforms also contributes, as hosts and property operators adopt smart locks to automate guest access, reduce manual handovers, and enhance operational security. As cyber-secure hardware, biometric modules, and cloud-based access systems mature, smart locks are positioned as high-trust solutions capable of meeting stringent security standards across diverse sectors.

- For example, Schlage’s Control™ Smart Interconnected Lock uses AES-256 encryption and supports audit logging when paired with compatible access-control systems. Dormakaba’s Mobile Access solution delivers secure Bluetooth Low Energy mobile keys and works with MIFARE/DESFire credentials. Salto’s XS4 One supports RFID and mobile access technologies and provides real-time audit trails for commercial deployments.

Technological Advancements in Connectivity, Biometrics, and Energy Efficiency

Rapid innovation in wireless communication, sensor technology, and embedded electronics significantly boosts the performance and appeal of smart locks. Advancements in Wi-Fi and Bluetooth LE technologies have reduced latency, improved encryption, and extended battery life, enabling more reliable remote operations. Enhanced biometric modules now offer faster fingerprint recognition, increased accuracy, and improved spoof resistance, driving adoption in premium residential and enterprise environments. Furthermore, energy-efficient chipsets and optimized power management algorithms prolong battery cycles, reducing maintenance requirements. Cloud platforms and mobile applications continue to evolve with improved real-time monitoring, temporary credential sharing, and integration with AI-driven analytics. These enhancements collectively transform smart locks from basic convenience devices into intelligent, secure access solutions. As manufacturers incorporate auto-unlock proximity features, low-power mesh connectivity, and robust fail-safe mechanisms, technological innovation remains a central catalyst for long-term market expansion.

Key Trends & Opportunities

Growing Adoption of AI-Enabled and Predictive Security Features

Artificial intelligence is emerging as a transformative force in smart lock capabilities, enabling predictive access management and enhanced threat response. AI-driven systems can analyze user behavior, identify unusual entry patterns, and trigger automated alerts or lockdown procedures. When integrated with smart cameras and environmental sensors, smart locks become part of a multi-layered security framework capable of context-aware decision-making. This trend creates opportunities for solution providers to develop intelligent platforms that combine access control, anomaly detection, and real-time analytics. As AI integration matures, smart locks are positioned to support personalized entry profiles, dynamic authentication, and automated user verification across residential and commercial properties. Vendors can further capitalize on AI by offering subscription-based software services that enhance the functionality and long-term value of hardware installations.

· For example, Salto Systems’ BLUEnet wireless platform uses AES-128 encrypted communication between locks, gateways, and nodes. The system supports real-time monitoring and rapid detection of door-status changes. These functions align with Salto’s published specifications for its wireless access-control network.

Expansion of Smart Locks in Hospitality, Rental Management, and Multi-Dwelling Housing

The hospitality and property management sectors present significant opportunities for smart lock deployment due to the high turnover of guests, tenants, and service personnel. Hotels, serviced apartments, and short-term rental operators increasingly adopt digital access systems to streamline check-in processes, reduce labor costs, and minimize security liabilities associated with physical keys. Smart locks enable operators to issue single-use or time-bound digital credentials, improving operational efficiency and enhancing guest experience. In multi-dwelling buildings, centralized access platforms support controlled access to common areas, elevators, and parking zones. As urbanization accelerates and rental markets expand, demand for scalable, remotely managed access solutions will continue to rise. This trend offers vendors opportunities to develop integrated property management platforms that unify access control, maintenance scheduling, and security monitoring.

· For example, Onity’s DirectKey™ platform allows hotels to issue secure mobile keys to guests through their smartphones. The technology is deployed in more than 5,000 hotels and around 800,000 rooms worldwide, according to published company disclosures. These figures are widely reported across Onity’s official announcements.

Increasing Demand for Retrofit-Friendly, Battery-Efficient, and Aesthetic Designs

A growing shift toward retrofit-friendly smart locks creates substantial opportunities, particularly among homeowners seeking to upgrade without extensive door modifications. Manufacturers respond by offering sleek, minimalistic designs that complement modern interiors while retaining durability and weather resistance. Improvements in battery technology such as low-power Bluetooth chips and adaptive sleep modes extend replacement cycles and enhance device reliability. This trend aligns with consumer expectations for long-lasting, low-maintenance devices. Additionally, design-focused smart locks with premium finishes, slim profiles, and customizable faceplates appeal to style-conscious buyers, expanding market reach into luxury residential and boutique hospitality segments. Vendors that successfully combine functionality, energy efficiency, and aesthetic customization are positioned to gain strong competitive advantages.

Key Challenges

Cybersecurity Vulnerabilities and Data Privacy Risks

Cybersecurity remains a major challenge for the smart lock industry, as connected devices inherently introduce potential entry points for unauthorized access. Vulnerabilities in communication protocols, poorly secured mobile applications, or weak encryption methods may expose users to risks ranging from credential theft to device hijacking. As smart locks store access logs, user behavior data, and authentication credentials, concerns around data privacy intensify. Manufacturers must continuously update firmware, reinforce encryption standards, and implement multi-layered security frameworks to mitigate risks. Achieving compliance with global cybersecurity regulations further adds complexity. Failure to address these issues can undermine consumer trust and slow adoption, especially in commercial sectors that demand stringent security assurances.

High Installation Costs and Interoperability Limitations Across Platforms

Despite growing demand, installation costs and inconsistent interoperability across smart home ecosystems present notable barriers. Full replacement smart locks often require professional installation, increasing upfront costs compared to mechanical locks. Retrofit options reduce complexity but may not support advanced features such as integrated biometrics or multi-protocol connectivity. Moreover, fragmented standards across platforms ranging from Wi-Fi, Bluetooth, Zigbee, Z-Wave, to proprietary ecosystems limit seamless device integration. Users may struggle with compatibility issues between smart locks, hubs, and mobile applications, impacting overall satisfaction. Vendors must invest in cross-platform compatibility, simpler installation processes, and universal communication standards to overcome these structural challenges and broaden market accessibility.

Regional Analysis

North America

North America holds the largest share at around 35%, driven by high smart home penetration, rapid adoption of connected security systems, and strong consumer willingness to upgrade residential infrastructure. The U.S. dominates regional demand, supported by extensive integration with leading home automation ecosystems and high usage of app-based and Wi-Fi–enabled smart locks. Commercial uptake continues to grow across hospitality, coworking spaces, and rental property management platforms. Continuous technological innovation, cybersecurity enhancements, and wide availability of retrofit solutions further reinforce North America’s strong position in the global market

Europe

Europe accounts for approximately 28% of the global market, supported by rising adoption of digital access solutions across residential complexes, smart buildings, and hospitality environments. Countries such as Germany, the U.K., and France lead with strong regulatory support for building automation and secure access management. Demand is strengthened by increasing investment in energy-efficient smart home ecosystems and growing preference for biometric and touchscreen-based smart locks. The region’s expanding multi-dwelling housing sector and tourism-driven hospitality upgrades also contribute significantly. Cybersecurity compliance requirements further push manufacturers to introduce robust, encryption-heavy smart lock systems tailored to EU standards.

Asia-Pacific

Asia-Pacific captures around 25% of the market, fueled by rapid urbanization, rising disposable income, and increasing adoption of smart home devices across China, Japan, South Korea, and India. The region benefits from strong manufacturing capabilities, competitive pricing, and continuous product innovation in connectivity and biometrics. Smart lock adoption grows rapidly in high-density residential areas, co-living spaces, and emerging smart city projects. The hospitality and commercial sectors further stimulate demand as digital credential management becomes more prevalent. APAC’s expanding e-commerce-driven distribution networks also accelerate consumer accessibility and regional penetration of mid-range and premium smart lock systems.

Latin America

Latin America holds about 7% of the global market, supported by increasing modernization of residential security systems and a growing shift toward digital access solutions in urban centers. Countries such as Brazil, Mexico, and Argentina show rising adoption due to expanding smart home awareness and improved availability of Wi-Fi and smartphone-based access control. Commercial demand emerges in hospitality and retail segments seeking remote access management and operational efficiency. However, price sensitivity and lower technology penetration rates slow wider adoption. Gradual improvements in digital infrastructure and increased consumer trust in IoT security are expected to support steady regional growth.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of the market, driven by rising investments in luxury residential developments, high-end hotels, and smart city initiatives in the UAE, Saudi Arabia, and Qatar. Demand is underpinned by premium biometric and touchscreen smart locks used in gated communities and commercial buildings. In Africa, adoption remains slower but grows gradually with expanding urbanization and improving internet connectivity. Regional challenges include higher device costs and limited consumer awareness. Nevertheless, government-backed digital infrastructure programs and increasing interest in IoT-driven security solutions indicate long-term growth potential.

Market Segmentations:

By Product Type

- Deadbolt Lock

- Lever Handle

- Padlock

- Others (Latch, Knob, etc.)

By Unlocking Mechanism

- Keyboard

- Touchscreen

- App Based

- Hybrid

- Biometric

By Connectivity Type

- Wi-Fi

- Bluetooth

- Z-Wave

- Others (Zigbee, NFC, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The smart locks market features a competitive landscape defined by continuous innovation, strong brand positioning, and expanding product portfolios across global and regional players. Leading companies focus on advanced connectivity, biometric authentication, and cloud-based access management to strengthen market differentiation. Major players such as Assa Abloy, Allegion, Dormakaba, August Home, Yale, Schlage, and Kwikset drive innovation through Wi-Fi and Bluetooth-enabled models, seamless app integration, and retrofit-friendly designs that simplify installation. Many vendors invest in cybersecurity enhancements and encrypted communication frameworks to address rising digital security concerns. Partnerships with smart home ecosystem providers including Google, Amazon, and Apple expand compatibility and user convenience. In the commercial sector, companies emphasize scalable credential management platforms for hospitality, offices, and multi-dwelling units. Competitive intensity increases as emerging players introduce cost-effective smart locks with sleek aesthetics, longer battery life, and AI-driven access analytics. Overall, innovation, integration, and security remain central to sustaining competitive advantage.

Key Player Analysis

- Salto Systems S.L.

- Honeywell International Inc.

- Dormakaba

- August Home Inc.

- Onity Inc.

- Schlage

- Avent Security

- Assa Abloy

- Cansec Systems Ltd.

- Allegion plc

Recent Developments

- In October 2025, Salto WECOSYSTEM, linked to Salto Systems S.L., announced a minority investment in Normo to revolutionize last-mile delivery, supporting smart lock integrations for logistics and access control.

- In May 2025, Qubo launched five new smart door lock models including Nova, Alpha, and Optima, alongside updated editions of its Select and Essential lines, bolstering its portfolio in the smart locks market.

- In February 2025, Salto Systems S.L. launched the XS4 one S keypad, an advanced smart lock solution that integrates PIN codes, smart keycards, and mobile access for flexible, secure entry with intuitive operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product type, Unlocking mechanism, Connectivity type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Smart locks will increasingly integrate AI-driven behavior analysis to enhance predictive security and automated threat detection.

- Biometric authentication will gain wider adoption as fingerprint and facial recognition sensors become faster, more accurate, and more energy efficient.

- Wi-Fi 6, Bluetooth LE, and Matter-enabled devices will improve interoperability and reduce connectivity barriers across smart home ecosystems.

- Retrofit-friendly designs will expand, allowing consumers to upgrade traditional doors without complex installation or professional support.

- Cloud-based access platforms will grow, enabling remote credential management for homes, offices, rentals, and multi-dwelling units.

- Battery efficiency will improve through low-power chipsets and adaptive power management features that extend replacement cycles.

- Commercial adoption will accelerate in hospitality, coworking spaces, and logistics facilities seeking automated access workflows.

- Cybersecurity advancements will focus on stronger encryption and firmware-level protection to address rising digital security concerns.

- Voice assistants and smart home hubs will increasingly manage access workflows through seamless integrations.

- Demand will rise in emerging markets as urbanization, digital infrastructure, and smart home awareness continue to strengthen.

Market Segmentation Analysis:

Market Segmentation Analysis: