Table of Content

Chapter No. 1 :….. Introduction.. 26

1.1.1. Report Description. 26

Purpose of the Report 26

USP & Key Offerings 26

1.1.2. Key Benefits for Stakeholders 26

1.1.3. Target Audience. 27

1.1.4. Report Scope 27

1.1.5. Regional Scope 28

Chapter No. 2 :….. Executive Summary.. 29

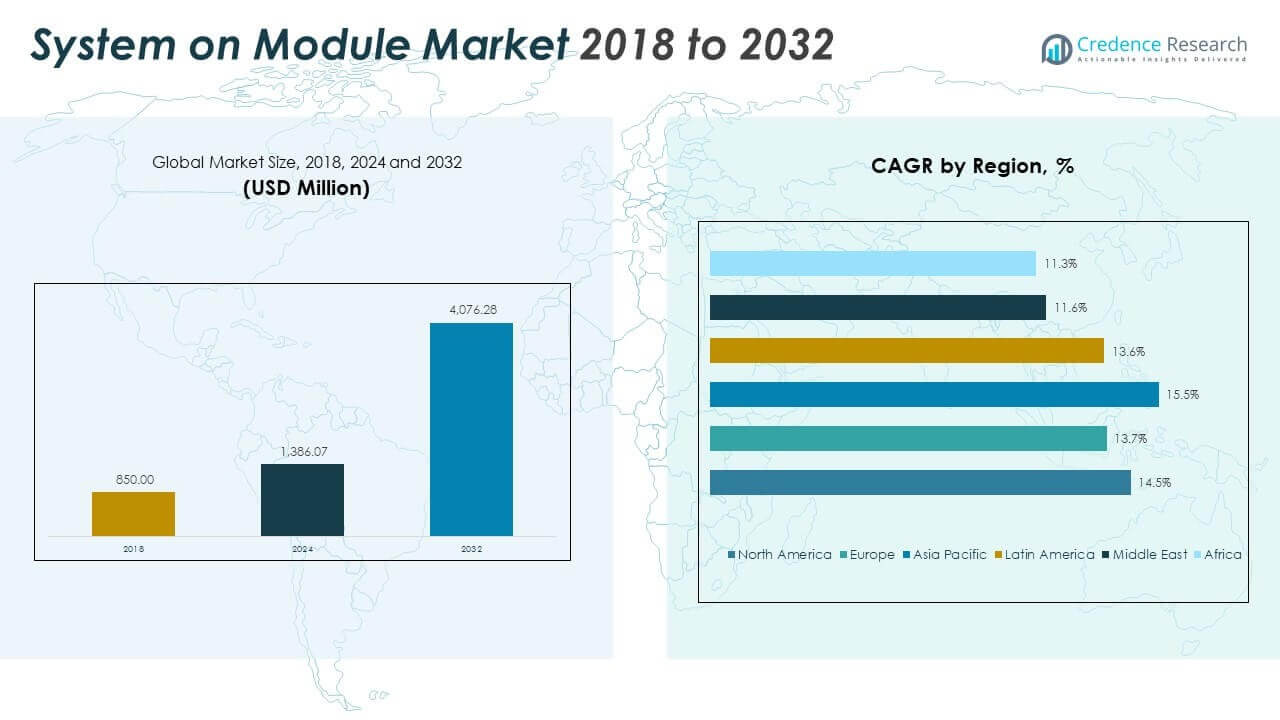

2.1. System on Module Market Snapshot 29

2.1.1. Global System on Module Market, 2018 – 2032 (USD Million) 30

Chapter No. 3 :….. System on Module Market – Industry Analysis. 31

3.1. Introduction 31

3.2. Market Drivers 32

3.2.1. Driving Factor 1 Analysis 32

3.2.2. Driving Factor 2 Analysis 33

3.3. Market Restraints 34

3.3.1. Restraining Factor Analysis 34

3.4. Market Opportunities 35

3.4.1. Market Opportunity Analysis 35

3.5. Porter’s Five Forces Analysis 36

3.6. Value Chain Analysis 37

3.7. Buying Criteria. 38

Chapter No. 4 :….. PESTEL & Adjacent Market Analysis. 39

4.1. PESTEL 39

4.1.1. Political Factors 39

4.1.2. Economic Factors 39

4.1.3. Social Factors 39

4.1.4. Technological Factors 39

4.1.5. Environmental Factors 39

4.1.6. Legal Factors 39

4.2. Adjacent Market Analysis 39

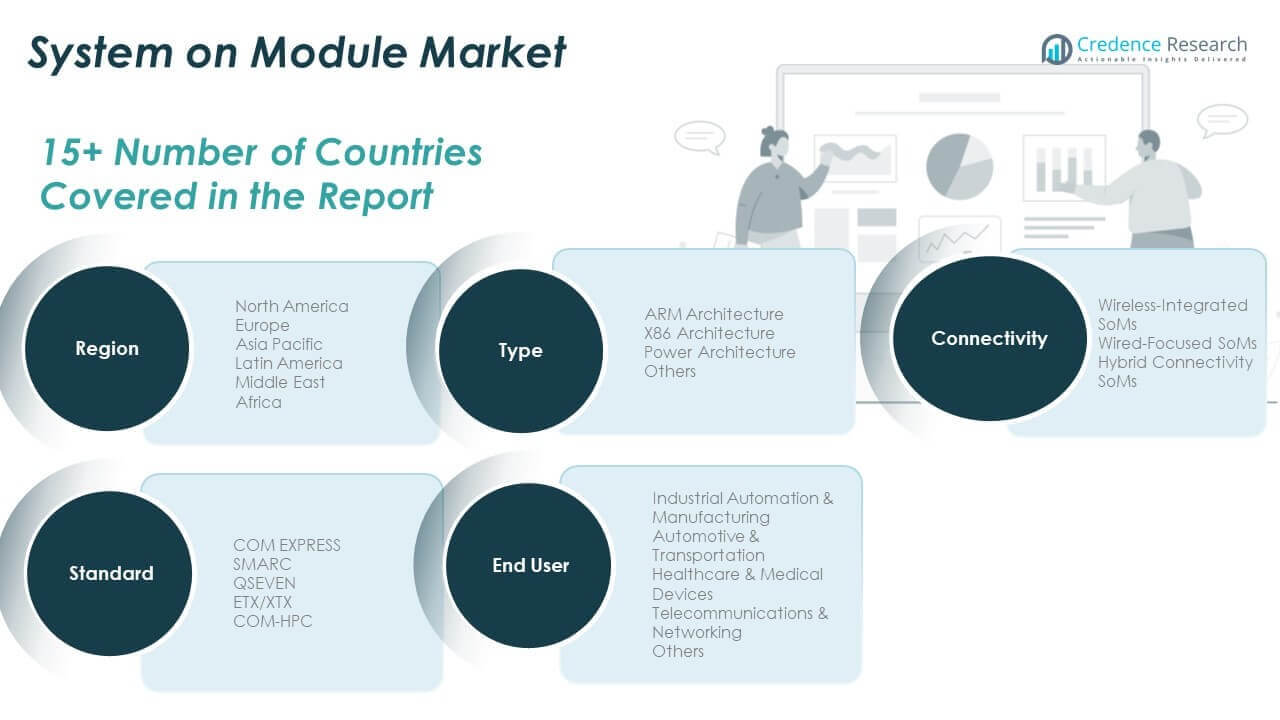

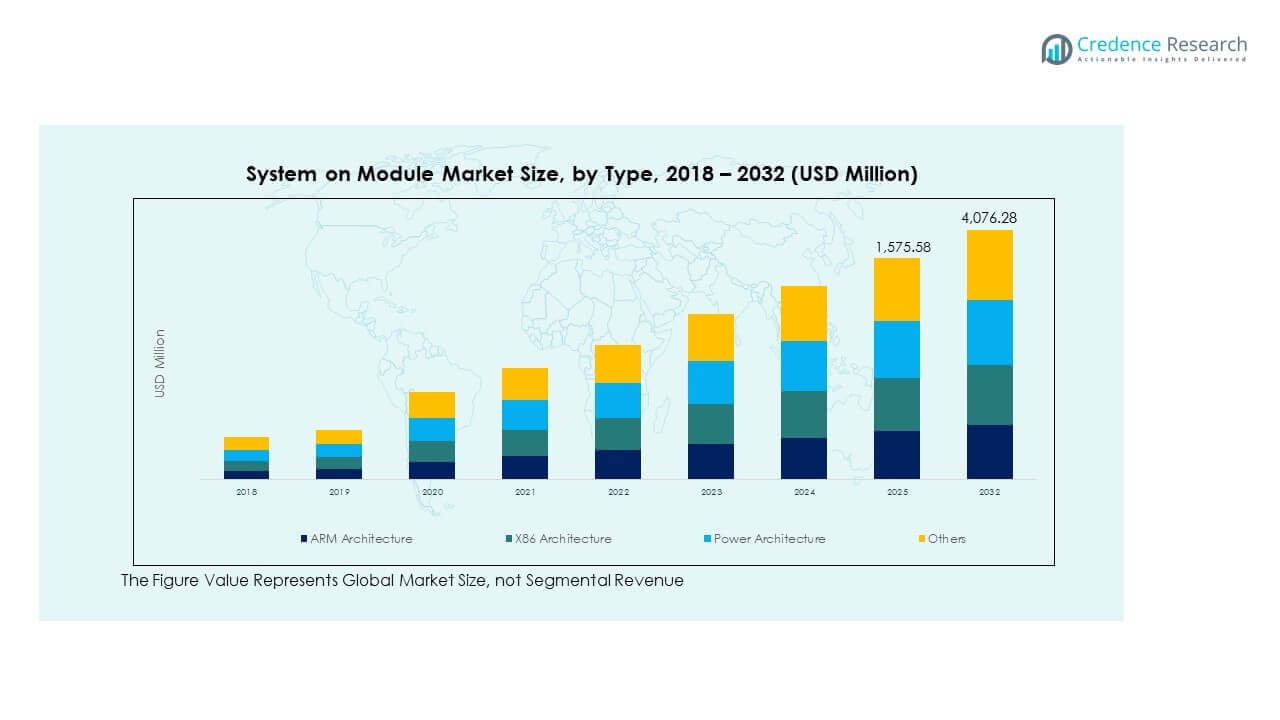

Chapter No. 5 :….. System on Module Market – By Type Segment Analysis. 40

5.1. System on Module Market Overview, by Type Segment 40

5.1.1. System on Module Market Revenue Share, By Type, 2023 & 2032. 41

5.1.2. System on Module Market Attractiveness Analysis, By Type. 42

5.1.3. Incremental Revenue Growth Opportunity, by Type, 2024 – 2032. 42

5.1.4. System on Module Market Revenue, By Type, 2018, 2023, 2027 & 2032. 43

5.2. ARM Architecture. 44

5.2.1. Global ARM Architecture System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 45

5.2.2. Global ARM Architecture System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 45

5.3. X86 Architecture. 46

5.3.1. Global X86 Architecture System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 47

5.3.2. Global X86 Architecture System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 47

5.4. Power Architecture. 48

5.4.1. Global Power Architecture System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 49

5.4.2. Global Power Architecture System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 49

Chapter No. 6 :….. System on Module Market – By Connectivity Segment Analysis. 50

6.1. System on Module Market Overview, by Connectivity Segment 50

6.1.1. System on Module Market Revenue Share, By Connectivity , 2023 & 2032. 51

6.1.2. System on Module Market Attractiveness Analysis, By Connectivity. 52

6.1.3. Incremental Revenue Growth Opportunity, by Connectivity, 2024 – 2032. 52

6.1.4. System on Module Market Revenue, By Connectivity, 2018, 2023, 2027 & 2032. 53

6.2. Wireless-Integrated SoMs 54

6.2.1. Global Wireless-Integrated SoMs System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 55

6.2.2. Global Wireless-Integrated SoMs System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 55

6.3. Wired-Focused SoMs 56

6.3.1. Global Wired-Focused SoMs System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 57

6.3.2. Global Wired-Focused SoMs System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 57

6.4. Hybrid Connectivity SoMs 58

6.4.1. Global Hybrid Connectivity SoMs System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 59

6.4.2. Global Hybrid Connectivity SoMs System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 59

Chapter No. 7 :….. System on Module Market – By Standard Segment Analysis. 60

7.1. System on Module Market Overview, by Standard Segment 60

7.1.1. System on Module Market Revenue Share, By Standard, 2023 & 2032. 61

7.1.2. System on Module Market Attractiveness Analysis, By Standard. 62

7.1.3. Incremental Revenue Growth Opportunity, by Standard, 2024 – 2032. 62

7.1.4. System on Module Market Revenue, By Standard, 2018, 2023, 2027 & 2032. 63

7.2. COM EXPRESS. 64

7.2.1. Global COM EXPRESS System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 65

7.2.2. Global COM EXPRESS System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 65

7.3. SMARC 66

7.3.1. Global SMARC System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 67

7.3.2. Global SMARC System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 67

7.4. QSEVEN 68

7.4.1. Global QSEVEN System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 69

7.4.2. Global QSEVEN System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 69

7.5. ETX/XTX 70

7.5.1. Global ETX/XTX System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 71

7.5.2. Global ETX/XTX System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 71

7.6. Standard 5 72

7.6.1. Global Standard 5 System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 73

7.6.2. Global Standard 5 System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 73

Chapter No. 8 :….. System on Module Market – By End User Segment Analysis. 74

8.1. System on Module Market Overview, by End User Segment 74

8.1.1. System on Module Market Revenue Share, By End User, 2023 & 2032. 75

8.1.2. System on Module Market Attractiveness Analysis, By End User. 76

8.1.3. Incremental Revenue Growth Opportunity, by End User, 2024 – 2032. 76

8.1.4. System on Module Market Revenue, By End User, 2018, 2023, 2027 & 2032. 77

8.2. Industrial Automation & Manufacturing. 78

8.2.1. Global Industrial Automation & Manufacturing System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 79

8.2.2. Global Industrial Automation & Manufacturing System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 79

8.3. Automotive & Transportation. 80

8.3.1. Global Automotive & Transportation System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 81

8.3.2. Global Automotive & Transportation System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 81

8.4. Healthcare & Medical Devices 82

8.4.1. Global Healthcare & Medical Devices System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 83

8.4.2. Global Healthcare & Medical Devices System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 83

8.5. End User 4 84

8.5.1. Global End User 4 System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 85

8.5.2. Global End User 4 System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 85

Chapter No. 9 :….. System on Module Market – Regional Analysis. 86

9.1. System on Module Market Overview, by Regional Segments 86

9.2. Region 87

9.2.1. Global System on Module Market Revenue Share, By Region, 2023 & 2032. 87

9.2.2. System on Module Market Attractiveness Analysis, By Region. 88

9.2.3. Incremental Revenue Growth Opportunity, by Region, 2024 – 2032. 88

9.2.4. System on Module Market Revenue, By Region, 2018, 2023, 2027 & 2032. 89

9.2.5. Global System on Module Market Revenue, By Region, 2018 – 2023 (USD Million) 90

9.2.6. Global System on Module Market Revenue, By Region, 2024 – 2032 (USD Million) 90

9.3. Type 91

9.3.1. Global System on Module Market Revenue, By Type, 2018 – 2023 (USD Million) 91

9.4. Global System on Module Market Revenue, By Type, 2024 – 2032 (USD Million) 91

9.5. Connectivity 92

9.5.1. Global System on Module Market Revenue, By Connectivity, 2018 – 2023 (USD Million) 92

9.5.2. Global System on Module Market Revenue, By Connectivity, 2024 – 2032 (USD Million) 92

9.6. Standard 93

9.6.1. Global System on Module Market Revenue, By Standard, 2018 – 2023 (USD Million) 93

9.6.2. Global System on Module Market Revenue, By Standard, 2024 – 2032 (USD Million) 93

9.7. End User 94

9.7.1. Global System on Module Market Revenue, By End User, 2018 – 2023 (USD Million) 94

9.7.2. Global System on Module Market Revenue, By End User, 2024 – 2032 (USD Million) 94

Chapter No. 10 :… System on Module Market – North America.. 95

10.1. North America 95

10.1.1. Key Highlights 95

10.1.2. North America System on Module Market Revenue, By Country, 2018 – 2023 (USD Million) 96

10.1.3. North America System on Module Market Revenue, By Type, 2018 – 2023 (USD Million) 97

10.1.4. North America System on Module Market Revenue, By Connectivity, 2018 – 2023 (USD Million) 98

10.1.5. North America System on Module Market Revenue, By Standard, 2018 – 2023 (USD Million) 99

10.1.6. North America System on Module Market Revenue, By End User, 2018 – 2023 (USD Million) 100

10.2. U.S. 101

10.3. Canada 101

10.4. Mexico 101

Chapter No. 11 :… System on Module Market – Europe.. 102

11.1. Europe 102

11.1.1. Key Highlights 102

11.1.2. Europe System on Module Market Revenue, By Country, 2018 – 2023 (USD Million) 103

11.1.3. Europe System on Module Market Revenue, By Type, 2018 – 2023 (USD Million) 104

11.1.4. Europe System on Module Market Revenue, By Connectivity , 2018 – 2023 (USD Million) 105

11.1.5. Europe System on Module Market Revenue, By Standard, 2018 – 2023 (USD Million) 106

11.1.6. Europe System on Module Market Revenue, By End User, 2018 – 2023 (USD Million) 107

11.2. UK 108

11.3. France 108

11.4. Germany 108

11.5. Italy 108

11.6. Spain 108

11.7. Russia 108

11.8. Belgium 108

11.9. Netherland 108

11.10. Austria 108

11.11. Sweden 108

11.12. Poland 108

11.13. Denmark 108

11.14. Switzerland 108

11.15. Rest of Europe 108

Chapter No. 12 :… System on Module Market – Asia Pacific.. 109

12.1. Asia Pacific 109

12.1.1. Key Highlights 109

12.1.2. Asia Pacific System on Module Market Revenue, By Country, 2018 – 2023 (USD Million) 110

12.1.3. Asia Pacific System on Module Market Revenue, By Type, 2018 – 2023 (USD Million) 111

12.1.4. Asia Pacific System on Module Market Revenue, By Connectivity , 2018 – 2023 (USD Million) 112

12.1.5. Asia Pacific System on Module Market Revenue, By Standard, 2018 – 2023 (USD Million) 113

12.1.6. Asia Pacific System on Module Market Revenue, By End User, 2018 – 2023 (USD Million) 114

12.2. China 115

12.3. Japan 115

12.4. South Korea 115

12.5. India 115

12.6. Australia 115

12.7. Thailand 115

12.8. Indonesia 115

12.9. Vietnam 115

12.10. Malaysia 115

12.11. Philippines 115

12.12. Taiwan 115

12.13. Rest of Asia Pacific. 115

Chapter No. 13 :… System on Module Market – Latin America.. 116

13.1. Latin America 116

13.1.1. Key Highlights 116

13.1.2. Latin America System on Module Market Revenue, By Country, 2018 – 2023 (USD Million) 117

13.1.3. Latin America System on Module Market Revenue, By Type, 2018 – 2023 (USD Million) 118

13.1.4. Latin America System on Module Market Revenue, By Connectivity , 2018 – 2023 (USD Million) 119

13.1.5. Latin America System on Module Market Revenue, By Standard, 2018 – 2023 (USD Million) 120

13.1.6. Latin America System on Module Market Revenue, By End User, 2018 – 2023 (USD Million) 121

13.2. Brazil 122

13.3. Argentina 122

13.4. Peru 122

13.5. Chile 122

13.6. Colombia 122

13.7. Rest of Latin America. 122

Chapter No. 14 :… System on Module Market – Middle East.. 123

14.1. Middle East 123

14.1.1. Key Highlights 123

14.1.2. Middle East System on Module Market Revenue, By Country, 2018 – 2023 (USD Million) 124

14.1.3. Middle East System on Module Market Revenue, By Type, 2018 – 2023 (USD Million) 125

14.1.4. Middle East System on Module Market Revenue, By Connectivity , 2018 – 2023 (USD Million) 126

14.1.5. Middle East System on Module Market Revenue, By Standard, 2018 – 2023 (USD Million) 127

14.1.6. Middle East System on Module Market Revenue, By End User, 2018 – 2023 (USD Million) 128

14.2. UAE 129

14.3. KSA 129

14.4. Israel 129

14.5. Turkey 129

14.6. Iran 129

14.7. Rest of Middle East 129

Chapter No. 15 :… System on Module Market – Africa.. 130

15.1. Africa 130

15.1.1. Key Highlights 130

15.1.2. Africa System on Module Market Revenue, By Country, 2018 – 2023 (USD Million) 131

15.1.3. Africa System on Module Market Revenue, By Type, 2018 – 2023 (USD Million) 132

15.1.4. Africa System on Module Market Revenue, By Connectivity , 2018 – 2023 (USD Million) 133

15.1.5. Africa System on Module Market Revenue, By Standard, 2018 – 2023 (USD Million) 134

15.1.6. Africa System on Module Market Revenue, By End User, 2018 – 2023 (USD Million) 135

15.2. Egypt 136

15.3. Nigeria 136

15.4. Algeria 136

15.5. Morocco 136

15.6. Rest of Africa 136

Chapter No. 16 :… Company Profiles. 137

16.1. Avalue Technology. 137

16.1.1. Company Overview.. 137

16.1.2. Product Portfolio. 137

16.1.3. Swot Analysis 137

16.1.4. Business Strategy. 138

16.1.5. Financial Overview.. 138

16.2. Renesas Electronic. 139

16.3. iWave Systems 139

16.4. Tessolve 139