Market Overview

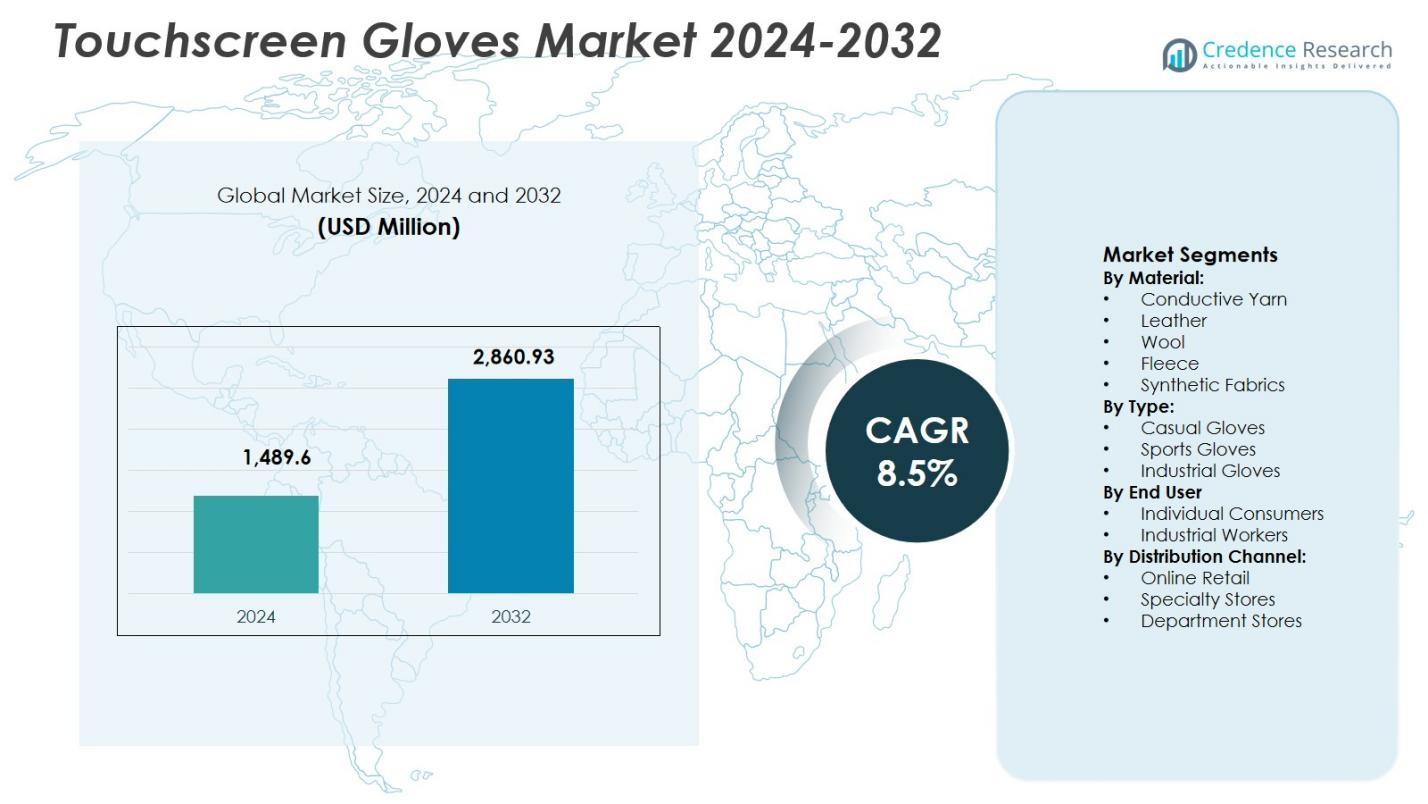

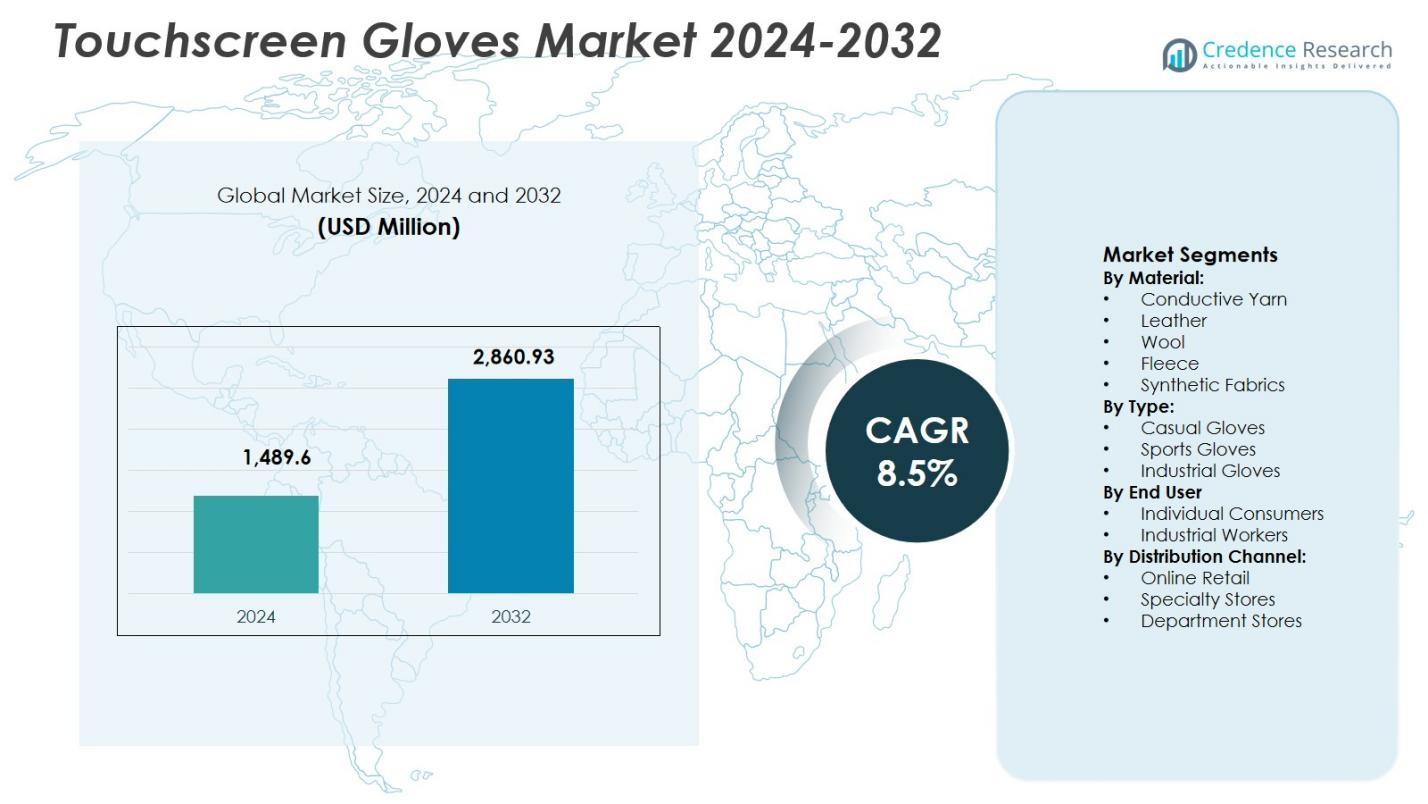

Touch Screen Controller Market size was valued at USD 10,049.6 Million in 2024 and is anticipated to reach USD 29,855.15 Million by 2032, growing at a CAGR of 14.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Touch Screen Controller Market Size 2024 |

USD 10,049.6 Million |

| Touch Screen Controller Market, CAGR |

14.58% |

| Touch Screen Controller Market Size 2032 |

USD 29,855.15 Million |

Touch Screen Controller Market is characterized by the presence of established semiconductor and interface solution providers such as Texas Instruments Incorporated, Analog Devices Inc., STMicroelectronics, NXP Semiconductors, Renesas Electronics Corporation, Microchip Technology Inc., Samsung Electronics Co. Ltd., Synaptics Incorporated, Goodix Technology Inc., and Infineon Technologies AG. These companies focus on advanced capacitive and multi-touch controller solutions to support smartphones, automotive displays, industrial HMIs, and IoT-enabled devices. Asia Pacific leads the Touch Screen Controller Market with a 38.9% market share, driven by large-scale consumer electronics manufacturing and high smartphone penetration, followed by North America with 28.4% share supported by strong adoption in automotive and industrial applications, and Europe with 23.6% share benefiting from advanced automotive and automation ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Touch Screen Controller Market size stood at USD 10,049.6 Million in 2024 and is projected to grow at a CAGR of 14.58% through the forecast period, supported by strong demand across consumer, automotive, and industrial electronics.

- Expanding adoption of smartphones, tablets, wearables, and smart home devices remains a core driver, with capacitive technology leading the market at a 78.6% share due to superior sensitivity and multi-touch capability.

- Increasing integration of touch interfaces in automotive infotainment, digital cockpits, and electric vehicles represents a key trend, reinforcing demand for automotive-grade and high-reliability touch controllers.

- High design complexity, integration costs, and performance reliability challenges in harsh environments act as restraints, particularly for cost-sensitive manufacturers and industrial deployments.

- Asia Pacific dominates the market with a 38.9% regional share driven by large-scale electronics manufacturing, followed by North America at 28.4% and Europe at 23.6%, reflecting strong adoption in automotive, industrial automation, and advanced consumer electronics.

Market Segmentation Analysis:

By Technology:

The Touch Screen Controller Market by technology is led by the capacitive segment, which accounted for 78.6% market share in 2024, driven by its superior sensitivity, durability, and support for advanced gesture recognition. Capacitive controllers dominate smartphones, tablets, automotive infotainment systems, and industrial HMIs due to their ability to deliver precise multi-touch performance and seamless user experience. Growing adoption of bezel-less displays, increasing integration of touch interfaces in vehicles, and rising demand for premium consumer electronics continue to strengthen capacitive technology leadership, while resistive technology remains limited to niche industrial and rugged applications.

- For instance, Synaptics supplies its ClearPad S3708 capacitive touch controller for Xiaomi’s Mi4c smartphone, enabling edge scrolling and tapping for enhanced multi-touch interaction on bezel-less designs.

By Interface:

By interface, Inter-Integrated Circuit (I²C) emerged as the dominant sub-segment with a 42.3% market share in 2024, supported by its low pin count, reduced power consumption, and cost-efficient integration in compact electronic devices. I²C interfaces are widely preferred in smartphones, wearables, and portable consumer electronics where space optimization and energy efficiency are critical. Growing adoption of smart devices, IoT-enabled systems, and touch-enabled embedded applications further drives I²C demand, while SPI, USB, UART, and HID over USB continue to serve performance-specific and legacy system requirements.

- For instance, Sharp’s GP2AP130S00F proximity sensor, mass-produced since May 2021, uses I²C in wearables for ultra-compact detection with low current consumption.

By Touchscreen Technology:

The multi-touch segment led the Touch Screen Controller Market by touchscreen technology, capturing 84.1% market share in 2024, fueled by rising demand for intuitive user interfaces and advanced gesture-based interactions. Multi-touch controllers are extensively deployed across smartphones, tablets, laptops, interactive kiosks, and automotive displays, enabling pinch, zoom, swipe, and multi-finger commands. Expanding use of large-format displays, growth of smart retail and public information systems, and continuous advancements in touch accuracy and response time reinforce multi-touch dominance, while single-touch solutions remain confined to basic and cost-sensitive applications.

Key Growth Driver

Expanding Consumer Electronics Adoption

The rapid expansion of consumer electronics continues to drive the Touch Screen Controller Market. Smartphones, tablets, laptops, wearables, and smart home devices increasingly rely on advanced touch interfaces to deliver seamless and responsive user experiences. Manufacturers prioritize multi-touch capability, high sensitivity, and low power consumption to meet evolving consumer expectations. Frequent product upgrades, rising disposable incomes, and growing penetration of smart devices in emerging economies further accelerate demand. As interactive displays become standard across consumer products, touch screen controllers remain critical components supporting volume-driven market growth.

- For instance, Apple’s iPhone 15 Pro uses a 6.1‑inch LTPO OLED multi‑touch display with up to 120 Hz refresh rate, requiring a high-speed touch controller to support smooth gesture recognition and gaming responsiveness.

Increasing Integration in Automotive Systems

Automotive digital transformation significantly supports growth in the Touch Screen Controller Market. Vehicles increasingly integrate touch-based infotainment, navigation, climate control, and driver assistance interfaces to enhance usability and cabin aesthetics. The shift toward connected and electric vehicles intensifies demand for reliable, automotive-grade touch controllers capable of operating under vibration and temperature variations. Automakers focus on larger displays and advanced human–machine interfaces, driving demand for precise and durable touch solutions. Regulatory focus on safety and driver engagement further reinforces adoption across global automotive platforms.

- For instance, BMW’s iDrive 8 platform combines a 12.3‑inch driver display with a 14.9‑inch curved control touchscreen under a single glass panel, consolidating navigation, media, and climate control functions through a touch interface.

Rising Adoption in Industrial and Commercial Applications

The expanding use of touch-enabled human–machine interfaces in industrial automation, healthcare equipment, retail kiosks, and public information systems drives the Touch Screen Controller Market. Touch controllers enable intuitive operation, faster response, and reduced training requirements in complex environments. Growth in smart factories, digital healthcare infrastructure, and self-service terminals increases demand for robust controllers with long operational life. Industrial digitization and automation investments continue to strengthen adoption, positioning touch screen controllers as essential components across commercial and industrial ecosystems.

Key Trend & Opportunity

Advancements in Multi-Touch and Gesture Recognition

Advancements in multi-touch sensing and gesture recognition are shaping the evolution of the Touch Screen Controller Market. Manufacturers are enhancing touch accuracy, response speed, and support for multiple touch points to enable intuitive and immersive interactions. These improvements support applications such as large-format displays, interactive kiosks, and advanced automotive interfaces. Demand for richer user experiences creates opportunities for suppliers offering high-performance controllers optimized for complex gestures and multi-user input. Continuous innovation in touch technology strengthens differentiation and long-term growth potential.

- For instance, STMicroelectronics’ VL53L5CX Time-of-Flight sensor, paired with STSW-IMG035 software, provides gesture recognition including taps, swipes in four directions, and level control via an 8×8 multi-zone array.

Growth of IoT and Smart Connected Devices

The rapid expansion of IoT and smart connected devices presents strong opportunities for the Touch Screen Controller Market. Touch interfaces are increasingly integrated into smart appliances, industrial control panels, healthcare devices, and home automation systems. Manufacturers seek compact, low-power, and highly reliable touch controllers to support connected environments. Rising deployment of intelligent devices across residential, commercial, and industrial sectors sustains demand. This trend encourages development of scalable and energy-efficient controller solutions aligned with connected ecosystem requirements.

- For instance, Microchip’s maXTouch touchscreen controllers, such as the MXT448UD-HA and MXT640UD-HA models, enable interfaces up to 10 inches for ovens and cooktops, featuring IEC/UL 60730 Class B certification for functional safety and operation up to 105°C near heating elements.

Key Challenge

High Design Complexity and Integration Costs

High design complexity and integration costs present a key challenge for the Touch Screen Controller Market. Advanced controllers require precise calibration, compatibility with diverse display technologies, and seamless processor integration. Managing electromagnetic interference, power efficiency, and performance consistency increases development time and expenses. These factors can limit adoption among cost-sensitive manufacturers and smaller device producers. Balancing advanced functionality with affordability remains a critical challenge, driving the need for simplified architectures and cost-optimized controller designs.

Performance Reliability in Harsh Operating Conditions

Ensuring reliable performance in harsh operating environments remains a major challenge for the Touch Screen Controller Market. Automotive, industrial, and outdoor applications demand stable functionality under extreme temperatures, humidity, vibration, and electrical noise. Maintaining touch accuracy and long-term durability under these conditions requires extensive testing and specialized design approaches. Failure to meet reliability standards can impact system performance and safety, compelling manufacturers to invest in ruggedized solutions and compliance with stringent industry regulations.

Regional Analysis

North America

North America accounted for 28.4% market share in 2024 in the Touch Screen Controller Market, supported by strong demand from consumer electronics, automotive, and industrial automation sectors. The region benefits from high adoption of advanced user interface technologies, widespread penetration of smart devices, and early deployment of touch-enabled automotive infotainment systems. Presence of leading semiconductor manufacturers and technology innovators accelerates product development and integration. Growth in electric vehicles, healthcare devices, and self-service kiosks further strengthens demand, while continuous investments in digital infrastructure sustain long-term market expansion across the United States and Canada.

Europe

Europe held 23.6% market share in 2024 in the Touch Screen Controller Market, driven by increasing adoption in automotive electronics, industrial automation, and public infrastructure projects. Strong presence of automotive OEMs and emphasis on advanced human–machine interfaces support consistent demand for high-performance touch controllers. Growth in smart manufacturing, medical devices, and interactive retail systems further contributes to market expansion. Regulatory focus on safety, quality, and energy efficiency encourages deployment of reliable and compliant touch technologies, positioning Europe as a stable and innovation-driven regional market.

Asia Pacific

Asia Pacific dominated the Touch Screen Controller Market with a 38.9% market share in 2024, supported by large-scale consumer electronics manufacturing and high smartphone penetration. Countries such as China, South Korea, Japan, and Taiwan serve as major production hubs for smartphones, tablets, and display panels, driving high-volume controller demand. Rapid urbanization, expanding middle-class population, and growth of smart appliances strengthen regional consumption. Increasing investments in electric vehicles, industrial automation, and smart infrastructure further reinforce Asia Pacific’s leadership and long-term growth outlook.

Latin America

Latin America captured 5.4% market share in 2024 in the Touch Screen Controller Market, supported by rising adoption of smartphones, tablets, and interactive retail solutions. Improving digital infrastructure and increasing penetration of consumer electronics contribute to gradual market expansion. Growth in automotive assembly, healthcare modernization, and public information systems further supports demand for touch-enabled interfaces. Countries such as Brazil and Mexico lead regional adoption due to expanding manufacturing activities and technology investments. Rising affordability of smart devices continues to enhance growth prospects across emerging Latin American economies.

Middle East & Africa

The Middle East & Africa accounted for 3.7% market share in 2024 in the Touch Screen Controller Market, driven by expanding smart city projects, digital kiosks, and transportation infrastructure. Increasing investments in retail automation, healthcare digitization, and industrial control systems support steady adoption of touch technologies. Gulf countries lead regional demand due to advanced infrastructure development and technology-driven initiatives. Growing smartphone usage and modernization of public services contribute to market growth, while gradual industrial diversification strengthens long-term demand for touch screen controllers across the region.

Market Segmentations:

By Technology:

By Interface:

- Inter-Integrated Circuit

- Serial Peripheral Interface

- Universal Serial Bus

- Univerasal Asynchronous Receiver/Transmitter – UART

- Human Interface Device Over Universal Serial Bus

By Touchscreen Technology:

By Screen Size:

- Small & Medium Screen Size

- Large Screen Size

By Application:

- Consumer Electronics

- Commercial

- Industrial

- Other Application Areas

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

Texas Instruments Incorporated, Analog Devices Inc., STMicroelectronics, NXP Semiconductors, Renesas Electronics Corporation, Microchip Technology Inc., Samsung Electronics Co. Ltd., Synaptics Incorporated, Goodix Technology Inc., and Infineon Technologies AG shape the Touch Screen Controller Market through strong product portfolios and continuous innovation. Leading players focus on high-performance capacitive and multi-touch controllers optimized for smartphones, automotive displays, industrial HMIs, and IoT devices. Strategic emphasis on low-power consumption, enhanced touch accuracy, and support for advanced gesture recognition strengthens differentiation. Companies invest in automotive-grade and industrial-certified solutions to address growing demand beyond consumer electronics. Geographic expansion, long-term OEM partnerships, and integration with display and processor ecosystems further reinforce market positions. Continuous R&D investment and portfolio diversification enable key players to address evolving application requirements and maintain competitive intensity in a technology-driven market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Synaptics Incorporated

- Texas Instruments Incorporated

- Goodix Technology Inc.

- STMicroelectronics

- Renesas Electronics Corporation

- Microchip Technology Inc.

- Samsung Electronics Co. Ltd.

- Analog Devices Inc.

- Cypress (Infineon Technologies AG)

- NXP Semiconductors

Recent Developments

- In April 2025, Synaptics Incorporated introduced its S3930 series touch controllers designed specifically for foldable OLED mobile displays, enhancing responsiveness and energy efficiency for larger, thinner screens.

- In 2025, Microchip Technology expanded its touchscreen portfolio with the M1 Generation of maXTouch® touchscreen controllers targeting automotive and industrial applications.

- In April 2024, AIS Global acquired Touch International, broadening its human–machine interface and touch controller product portfolio.

Report Coverage

The research report offers an in-depth analysis based on Technology, Interface, Touchscreen Technology, Screen Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Touch Screen Controller Market demand will expand steadily with increasing adoption of smart consumer electronics and connected devices.

- Advancements in capacitive and multi-touch technologies will improve touch accuracy, responsiveness, and user experience.

- Automotive integration will accelerate as vehicles adopt larger displays and advanced human–machine interfaces.

- Industrial automation and smart manufacturing will create sustained demand for durable and reliable touch controllers.

- Growth of IoT ecosystems will drive adoption of low-power and compact touch controller solutions.

- Multi-touch interfaces will remain dominant as gesture-based interaction becomes standard across applications.

- Demand for automotive-grade and industrial-certified controllers will increase due to stricter reliability requirements.

- Manufacturers will focus on enhanced EMI resistance and performance stability in harsh operating environments.

- Regional growth in Asia Pacific will remain strong due to large-scale electronics manufacturing and consumption.

- Continuous innovation and product differentiation will intensify competition among established and emerging suppliers.