Market Overview

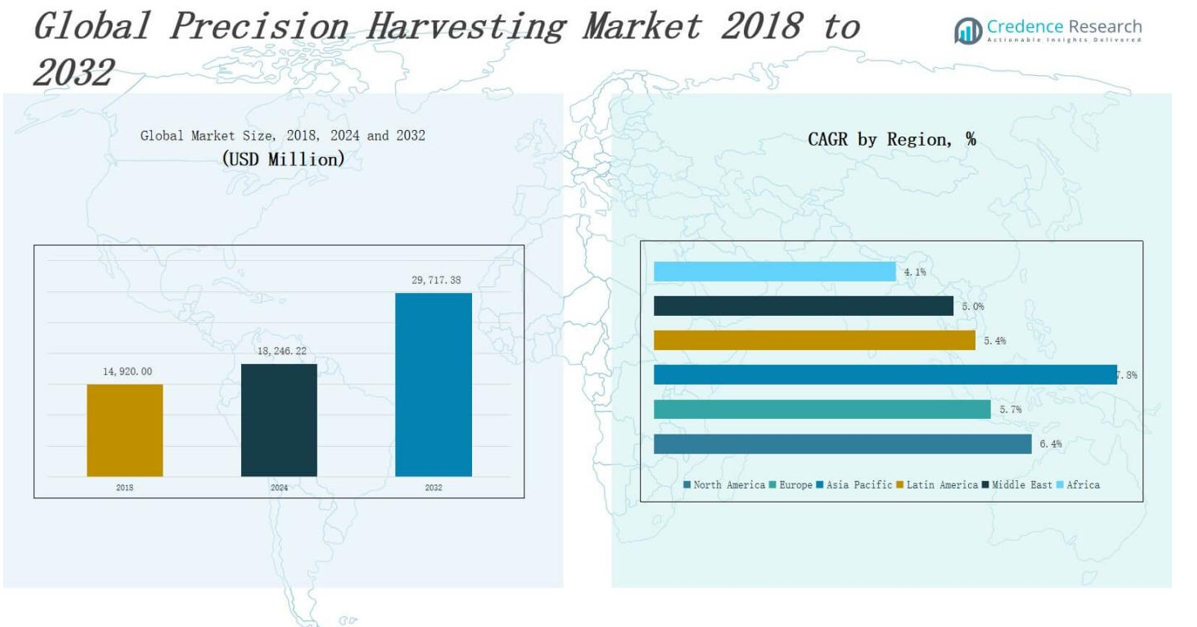

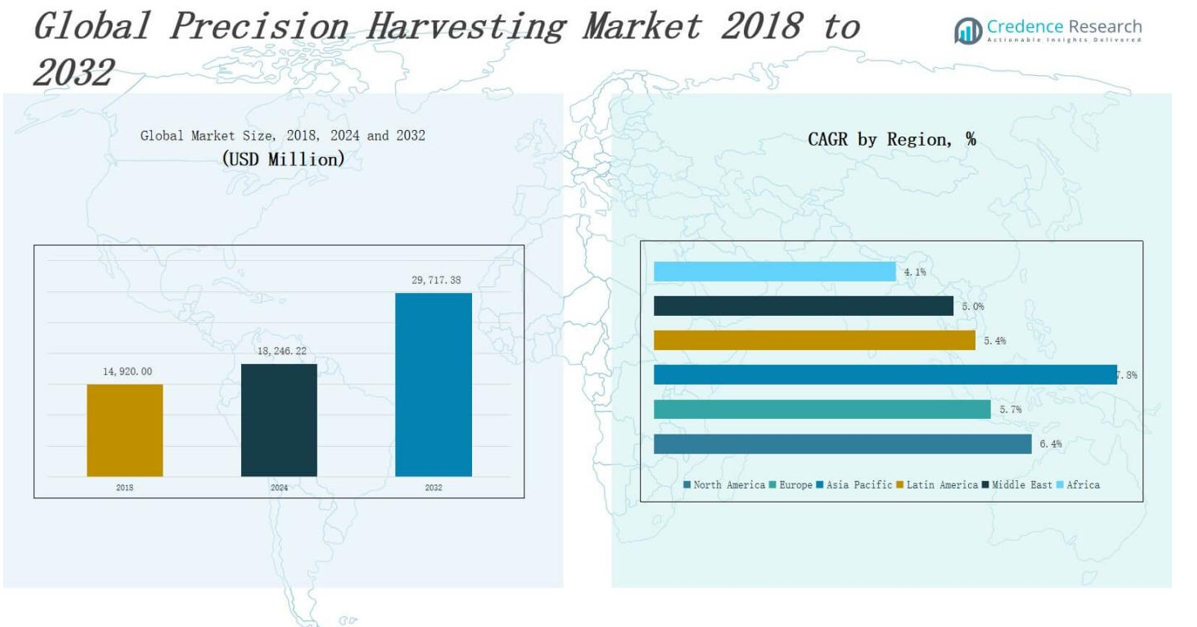

The Precision Harvesting Market size was valued at USD 14,920.00 million in 2018 to USD 18,246.22 million in 2024 and is anticipated to reach USD 29,717.38 million by 2032, at a CAGR of 6.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Precision Harvesting Market Size 2024 |

USD 18,246.22 million |

| Precision Harvesting Market, CAGR |

6.35% |

| Precision Harvesting Market Size 2032 |

USD 29,717.38 million |

The Precision Harvesting Market is driven by the growing demand for higher agricultural productivity and operational efficiency amid shrinking arable land and rising global food needs. Increasing labor shortages in the agricultural sector have accelerated the adoption of automated and semi-automated harvesting systems. Advancements in technologies such as GPS, AI, IoT, and remote sensing are enabling real-time crop monitoring, improved decision-making, and optimal resource utilization. Farmers are increasingly investing in smart harvesters, drones, and precision combine systems to reduce post-harvest losses and enhance profitability. Supportive government policies and subsidies aimed at promoting modern farming techniques further contribute to market growth. Additionally, the growing focus on sustainable farming practices and environmental conservation is encouraging the use of precision equipment to minimize waste and reduce the ecological footprint. Trends such as data-driven agriculture, machine learning integration, and the development of autonomous harvesting robots are shaping the future of precision harvesting, offering scalable and cost-effective solutions for both large and small-scale farmers.

The Precision Harvesting Market exhibits strong geographical diversity, with North America leading in market share due to high adoption of advanced technologies, followed by Europe with robust policy support for smart agriculture. Asia Pacific emerges as the fastest-growing region, driven by rising food demand and government-led modernization. Latin America shows steady growth, especially in Brazil and Argentina, supported by export-oriented agriculture. The Middle East leverages precision harvesting for resource-efficient farming under challenging conditions, while Africa presents long-term potential despite slower adoption. Key players shaping the market include Deere & Company, AGCO Corporation, KUBOTA Corporation, CNH Industrial N.V., CLAAS KGaA mbH, Raven Industries, Ag Leader Technology, TeeJet Technologies, TOPCON CORPORATION, and DICKEY-john. These companies compete through innovations in automation, sensing devices, and software integration to meet global demand for efficient and sustainable harvesting solutions.

Market Insights

- The Precision Harvesting Market was valued at USD 14,920.00 million in 2018 and is projected to reach USD 29,717.38 million by 2032, growing at a CAGR of 6.35%.

- Demand for higher agricultural productivity and operational efficiency is driving adoption of automated and semi-automated harvesting systems globally.

- Integration of AI, IoT, GPS, and sensing technologies enables real-time monitoring, optimal crop harvesting, and reduced post-harvest losses.

- Labor shortages and aging farming populations are accelerating mechanization, with autonomous harvesting systems gaining preference.

- Government subsidies, sustainability targets, and digital farming policies are promoting market growth in both developed and developing regions.

- North America leads the market share, while Asia Pacific is the fastest-growing region; Europe, Latin America, the Middle East, and Africa show steady to moderate growth.

- Key players include Deere & Company, AGCO Corporation, CNH Industrial N.V., KUBOTA Corporation, CLAAS KGaA mbH, Raven Industries, Ag Leader Technology, TeeJet Technologies, TOPCON CORPORATION, and DICKEY-john.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Enhanced Agricultural Productivity

The Precision Harvesting Market is witnessing strong growth due to the global need to improve crop yields and food production efficiency. Farmers and agribusinesses seek advanced tools to maximize output from limited arable land. Precision harvesting technologies such as sensor-equipped harvesters and data analytics tools enable timely, accurate decision-making during the harvesting process. These solutions help reduce post-harvest losses and ensure high crop quality. With population growth outpacing food supply, reliance on precision farming tools is intensifying. Government programs in several regions promote precision agriculture to strengthen food security. The Precision Harvesting Market benefits significantly from these targeted interventions and increasing farmer awareness.

- For instance, in June 2025, John Deere launched new S-Series combine harvesters equipped with advanced AI-driven data analytics and GPS-guided auto-steering, enabling farmers to optimize forage quality and minimize grain loss through precise, automated harvesting operations.

Technological Advancements in Smart Agriculture

Automation, artificial intelligence, and GPS-guided equipment play a pivotal role in the expansion of the Precision Harvesting Market. Integration of real-time data and machine learning in harvesters ensures accurate crop detection, optimal harvest timing, and minimal waste. Smart systems enable remote operation and monitoring, offering labor efficiency and cost reduction. These technologies also support multi-crop adaptability, increasing the machine’s utility across farming cycles. Investment in agri-tech startups and R&D accelerates product innovation and system integration. It positions the Precision Harvesting Market as a core pillar of the future-ready farming ecosystem.

- For instance, Farmonaut’s satellite-based crop health monitoring system provides farmers with real-time NDVI and soil moisture data, enabling precise irrigation and fertilizer adjustments.

Labor Shortages Accelerating Mechanization

The global agricultural workforce continues to decline, pushing demand for mechanized harvesting systems. Manual harvesting often proves inefficient, time-consuming, and inconsistent across large-scale farms. Autonomous and semi-autonomous equipment now fills this gap by offering precision and reliability. The Precision Harvesting Market benefits from this transition by providing solutions that reduce dependency on seasonal labor. Countries facing aging farming populations and youth migration to urban centers increasingly adopt precision technologies. It offers a sustainable alternative to traditional practices in both developed and developing economies.

Government Support and Sustainability Goals

Government initiatives supporting digital farming and equipment subsidies have created favorable conditions for the Precision Harvesting Market. These efforts align with national objectives to improve agricultural efficiency and reduce environmental impact. Incentives for sustainable practices, such as reduced chemical input and soil conservation, align with precision harvesting methods. Environmental agencies advocate precision tools for their resource-efficient nature. It reduces overharvesting, conserves fuel, and limits crop damage. Growing pressure to adopt eco-friendly practices reinforces the market’s position in modern agriculture.

Market Trends

Adoption of AI and Machine Learning for Decision Support

Artificial intelligence and machine learning are becoming central to the evolution of the Precision Harvesting Market. These technologies power real-time data analytics, enabling machines to make accurate decisions about crop readiness and harvesting patterns. Advanced algorithms help predict optimal harvesting windows based on weather forecasts, soil health, and crop maturity levels. AI-powered systems also improve route planning, reducing fuel consumption and time spent in the field. Integration with GPS and satellite imagery allows seamless operation and superior field coverage. The Precision Harvesting Market benefits from the accuracy and efficiency that these tools deliver.

- For instance, Deere & Company has integrated AI-powered sensors and machine learning algorithms into its combine harvesters, allowing the machines to automatically adjust settings and optimize harvesting based on crop maturity and field conditions, resulting in improved yield and reduced waste.

Rising Integration of IoT and Connected Devices

The use of IoT-enabled sensors and connected platforms is shaping the Precision Harvesting Market. These devices monitor crop and equipment conditions continuously and transmit data to centralized systems. Farmers can track harvesting progress, machine performance, and crop health from remote locations using smartphones or computers. This connectivity improves operational visibility and facilitates preventive maintenance, reducing downtime. IoT platforms also support data sharing between devices, allowing for a more synchronized harvesting process. It strengthens productivity while minimizing crop loss during peak harvesting periods.

- For instance, John Deere’s HarvestLab 3000 uses IoT-enabled sensors to continuously monitor crop quality and yield during harvesting, transmitting live data to the Operations Center platform so farmers can remotely track machine performance and crop conditions using their smartphones or computers.

Emergence of Autonomous and Robotic Harvesters

The development of autonomous and robotic harvesting systems marks a major trend in the Precision Harvesting Market. These machines use vision systems, robotics, and artificial intelligence to identify and pick crops without human intervention. Manufacturers are launching robots capable of working in various crop environments, from orchards to row crops. These machines address labor shortages and increase efficiency in regions with limited workforce availability. Their consistent performance also ensures less damage to crops during harvesting. It creates long-term value by reducing operational costs and improving harvesting precision.

Expansion of Cloud-Based Farm Management Systems

Cloud computing is playing a critical role in modernizing operations across the Precision Harvesting Market. Farm management systems hosted on the cloud offer real-time data access, storage, and analytics from anywhere. These platforms integrate with harvesting equipment, enabling seamless communication and coordination across the farm. Farmers can make informed decisions, monitor yields, and adjust harvest plans quickly using cloud dashboards. The scalability of these systems supports large and small farms alike. It enhances operational agility, improves resource allocation, and supports the transition to data-driven agriculture.

Market Challenges Analysis

High Initial Investment and Limited Access in Developing Regions

The high upfront cost of precision harvesting equipment poses a significant barrier to adoption, especially for small and medium-scale farmers. Advanced harvesters, sensors, and supporting software often require substantial capital investment, which limits market penetration in cost-sensitive regions. Many farmers lack access to financing or subsidies, making it difficult to upgrade traditional machinery. The Precision Harvesting Market faces slower adoption in developing countries where digital infrastructure and technical training are insufficient. It requires sustained efforts from governments and private stakeholders to bridge the affordability gap and expand reach. Without broader access, the market’s global potential remains partially untapped.

Technical Complexity and Data Management Issues

Precision harvesting systems rely on advanced technologies that demand a certain level of technical expertise for operation and maintenance. Farmers without adequate training may find it difficult to integrate or troubleshoot these systems. The collection and interpretation of large volumes of field data also present challenges. It creates issues around data privacy, storage, and standardization across platforms. Limited interoperability between different systems can hinder seamless operation and reduce efficiency. The Precision Harvesting Market must overcome these technical constraints to ensure broader and more effective implementation

Market Opportunities

Growing Demand for Sustainable and Data-Driven Agriculture

The increasing focus on sustainability and responsible farming creates strong opportunities for the Precision Harvesting Market. Governments, consumers, and industry stakeholders are pushing for practices that reduce waste, conserve resources, and improve environmental impact. Precision harvesting systems enable targeted operations that minimize fuel usage and crop loss. Data-driven approaches help farmers apply inputs more efficiently and harvest only when conditions are optimal. This supports traceability and compliance with sustainability standards. The Precision Harvesting Market stands to gain from this shift toward eco-conscious agriculture and smarter decision-making.

Expansion Potential in Emerging Agricultural Economies

Emerging markets in Asia, Latin America, and Africa present untapped growth potential for the Precision Harvesting Market. Rising food demand, urbanization, and climate change pressures are driving interest in modern farming solutions. Many governments are launching programs to digitize agriculture and improve yield resilience. Partnerships with agri-tech firms and financial institutions can support equipment adoption through leasing and subsidy models. It can unlock significant opportunities by addressing infrastructure and affordability gaps. Expansion into these regions will help scale precision technologies and extend market reach.

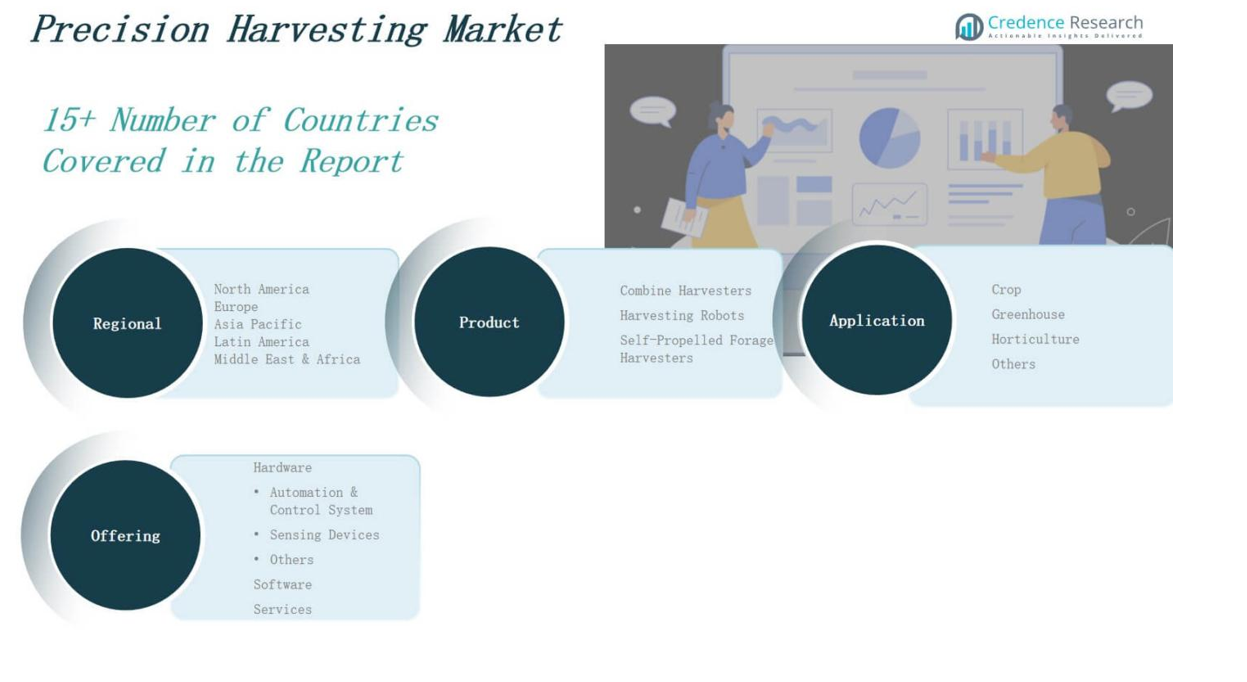

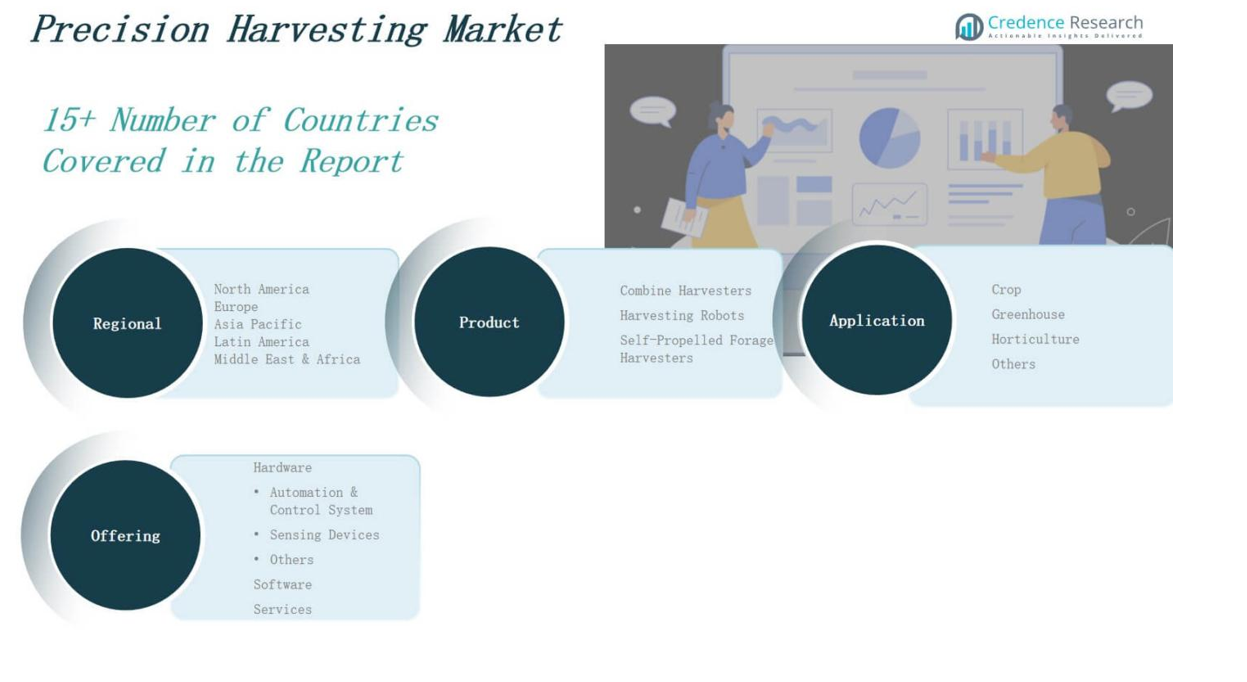

Market Segmentation Analysis:

By Product

The Precision Harvesting Market, based on product, is segmented into combine harvesters, harvesting robots, and self-propelled forage harvesters. Combine harvesters dominate the segment due to their widespread use in large-scale grain harvesting. Harvesting robots are gaining traction, driven by rising labor shortages and the need for automation in fruit and vegetable harvesting. Self-propelled forage harvesters serve specialized applications in livestock feed production, offering efficient chopping and collection. It reflects growing mechanization across farming operations.

- For instance, John Deere’s S700 Series combine harvesters are widely used across North America and Europe, with advanced automation features that help farmers optimize grain quality and reduce losses.

By Application

Based on application, the Precision Harvesting Market includes crop, greenhouse, horticulture, and others. The crop segment holds the largest share due to the extensive cultivation of cereals, grains, and oilseeds. Greenhouse and horticulture segments are expanding steadily due to the rising demand for high-value produce and year-round cultivation. Precision tools support controlled harvesting environments, improving efficiency and reducing waste. It supports growth across varied farming formats, including protected cultivation and diversified cropping.

By Offering

The offering segment of the Precision Harvesting Market comprises hardware, software, and services. Hardware includes automation and control systems, sensing devices, and other components, forming the technological backbone of precision machines. Software enables data analysis, remote monitoring, and intelligent control. Services support system integration, maintenance, and training. It strengthens the adoption and functionality of precision harvesting systems by ensuring continuous performance and adaptability across applications.

- For instance, Trimble Inc. offers the Connected Farm software platform, which integrates data from various harvesting equipment and sensors, enabling remote monitoring and analysis to optimize field operations and crop outcomes.

Segments:

Based on Product:

- Combine Harvesters

- Harvesting Robots

- Self-Propelled Forage Harvesters

Based on Application:

- Crop

- Greenhouse

- Horticulture

- Others

Based on Offering:

- Hardware

- Automation & Control System

- Sensing Devices

- Others

- Software

- Services

Based on Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The North America Precision Harvesting Market size was valued at USD 5,490.56 million in 2018 to USD 6,634.21 million in 2024 and is anticipated to reach USD 10,790.44 million by 2032, at a CAGR of 6.4% during the forecast period. North America holds the largest market share, driven by advanced agricultural infrastructure, high mechanization rates, and strong investments in precision technologies. The U.S. leads the region, supported by favorable government programs, research funding, and early adoption of autonomous harvesting machinery. Canada also shows strong growth, with farmers increasingly turning to data-driven equipment to improve yields and reduce labor dependence. It continues to benefit from widespread use of AI-integrated solutions and smart farming tools. The region’s focus on sustainability and operational efficiency strengthens its leadership position in the Precision Harvesting Market.

Europe

The Europe Precision Harvesting Market size was valued at USD 4,293.98 million in 2018 to USD 5,064.65 million in 2024 and is anticipated to reach USD 7,832.10 million by 2032, at a CAGR of 5.7% during the forecast period. Europe ranks as the second-largest market, fueled by supportive agricultural policies, innovation in smart farming, and growing adoption of eco-efficient machinery. Countries like Germany, France, and the Netherlands invest heavily in automation and robotics to counter labor shortages and meet sustainability goals. The Common Agricultural Policy (CAP) encourages precision harvesting through subsidies and technological integration. It reflects a strong trend toward digital transformation in agriculture. Demand for high-quality, traceable food products further accelerates the need for precision harvesting tools across the region.

Asia Pacific

The Asia Pacific Precision Harvesting Market size was valued at USD 3,240.62 million in 2018 to USD 4,160.97 million in 2024 and is anticipated to reach USD 7,563.10 million by 2032, at a CAGR of 7.8% during the forecast period. Asia Pacific is the fastest-growing regional market, driven by expanding agricultural activities, increasing food demand, and rising government support for smart farming. Countries such as China, India, Japan, and Australia are actively deploying precision machinery to modernize their farming sectors. Rapid urbanization and shrinking rural labor force drive demand for automation in harvesting. It gains momentum through public-private partnerships and investments in agri-tech startups. The region’s large-scale crop production and economic shift toward digital agriculture support sustained market growth.

Latin America

The Latin America Precision Harvesting Market size was valued at USD 972.78 million in 2018 to USD 1,178.52 million in 2024 and is anticipated to reach USD 1,785.12 million by 2032, at a CAGR of 5.4% during the forecast period. Latin America shows promising growth, especially in Brazil and Argentina, where large agricultural economies dominate. Farmers are adopting precision harvesting solutions to optimize soybean, corn, and sugarcane production. Regional efforts to increase yield and reduce waste create new demand for automated equipment. It benefits from export-driven agriculture and improving access to digital technologies. Government programs and industry collaborations promote mechanization and smart equipment deployment. Cost-sensitive adoption remains a challenge, but gradual uptake supports steady market expansion.

Middle East

The Middle East Precision Harvesting Market size was valued at USD 580.39 million in 2018 to USD 665.87 million in 2024 and is anticipated to reach USD 980.84 million by 2032, at a CAGR of 5.0% during the forecast period. The region experiences moderate growth, led by countries such as Israel and the Gulf Cooperation Council (GCC) states. Scarce arable land and limited water resources drive demand for highly efficient and targeted farming solutions. Precision harvesting plays a key role in maximizing productivity under constrained conditions. It gains relevance in greenhouse farming and horticulture, where yield optimization is essential. Government focus on food security and sustainable practices encourages innovation and adoption. Strategic investments in agri-tech strengthen long-term growth potential in the region.

Africa

The Africa Precision Harvesting Market size was valued at USD 341.67 million in 2018 to USD 541.99 million in 2024 and is anticipated to reach USD 765.79 million by 2032, at a CAGR of 4.1% during the forecast period. Africa holds a relatively smaller share but presents long-term opportunities due to its large agricultural base. Mechanization remains limited in many areas, but governments and NGOs are pushing for modernization. South Africa leads the region, followed by Kenya, Egypt, and Nigeria, where smart farming adoption is gradually increasing. It faces challenges related to cost, infrastructure, and digital literacy. However, rising food demand and support for technology transfer create future growth potential. Expansion of training programs and access to affordable precision tools will support wider adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

- Deere & Company

- AGCO Corporation

- KUBOTA Corporation

- Raven Industries, Inc.

- CLAAS KGaA mbH

- Ag Leader Technology

- TeeJet Technologies

- TOPCON CORPORATION

- DICKEY-john

- CNH Industrial N.V.

Competitive Analysis

The Precision Harvesting Market features a competitive landscape led by global players focused on innovation, automation, and data integration. Companies such as Deere & Company, AGCO Corporation, and CNH Industrial N.V. dominate through strong product portfolios and strategic investments in AI-driven harvesting systems. It reflects a high level of R&D activity aimed at enhancing machine intelligence and reducing operational costs. Emerging players like Ag Leader Technology and Raven Industries are gaining market share by offering advanced sensing and control solutions. Key firms pursue partnerships, acquisitions, and geographic expansion to strengthen their market presence. The focus remains on improving machine precision, optimizing resource use, and delivering scalable technologies for various farm sizes. It creates a dynamic and technology-intensive environment where differentiation depends on product efficiency, digital compatibility, and service support. The competitive intensity is expected to grow as more agricultural regions adopt precision technologies to address productivity and sustainability challenges.

Recent Developments

- In February 2025, John Deere launched the Precision Essentials hardware kit, enabling farmers to retrofit legacy and mixed-fleet equipment with precision GPS, modem, and display systems.

- In April 2024, AGCO Corporation officially launched PTx, a precision agriculture portfolio developed with PTx Trimble, enabling retrofit and factory-fit precision technology across more than 100 equipment brands.

- In January 2025, Kubota showcased its KATR multifunctional autonomous robot and electric tractor concept during CES 2025, focusing on automation and connectivity in agri-equipment.

- In August 2024, New Holland debuted its next‑generation digital and precision farming stack at the Farm Progress Show, which included FieldOps™, Connectivity Included, Active Implement Guidance, and the CR10 combine and FR Forage Cruiser models.

Market Concentration & Characteristics

The Precision Harvesting Market is moderately concentrated, with a mix of global industry leaders and regional players competing through product innovation, automation, and digital integration. Major companies such as Deere & Company, CNH Industrial N.V., AGCO Corporation, and KUBOTA Corporation dominate due to their extensive distribution networks, strong R&D capabilities, and comprehensive product portfolios. It features high barriers to entry due to the capital-intensive nature of advanced harvesting systems and the need for technical expertise. The market is characterized by a strong focus on data-driven agriculture, with players integrating IoT, GPS, and AI to enhance machine performance and decision-making. Demand for scalable solutions, multi-crop adaptability, and sustainability is shaping product development. Partnerships, acquisitions, and localized production strategies are common as companies aim to strengthen their market position and serve diverse agricultural needs. It continues to evolve rapidly, supported by technological advancements and growing awareness of precision farming benefits.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Offering and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of autonomous and semi-autonomous harvesting equipment will expand across both developed and emerging agricultural markets.

- Demand for precision technologies will rise due to the global push for higher crop yield and reduced resource waste.

- Integration of AI, machine learning, and big data will enhance real-time decision-making during harvesting operations.

- IoT-connected devices and smart sensors will play a larger role in monitoring crop health and harvest readiness.

- Farmers will increasingly invest in data-driven platforms for remote equipment management and performance optimization.

- Regional government support through subsidies and digital farming programs will encourage wider adoption of advanced harvesting systems.

- Companies will continue to invest in R&D to create more compact, energy-efficient, and cost-effective machinery.

- Growth in protected farming and horticulture will drive demand for specialized precision harvesting solutions.

- Collaborations between agri-tech startups and OEMs will accelerate innovation and accessibility of smart harvesting tools.

- The market will shift toward integrated solutions that combine hardware, software, and services in a unified ecosystem.