Market Overview

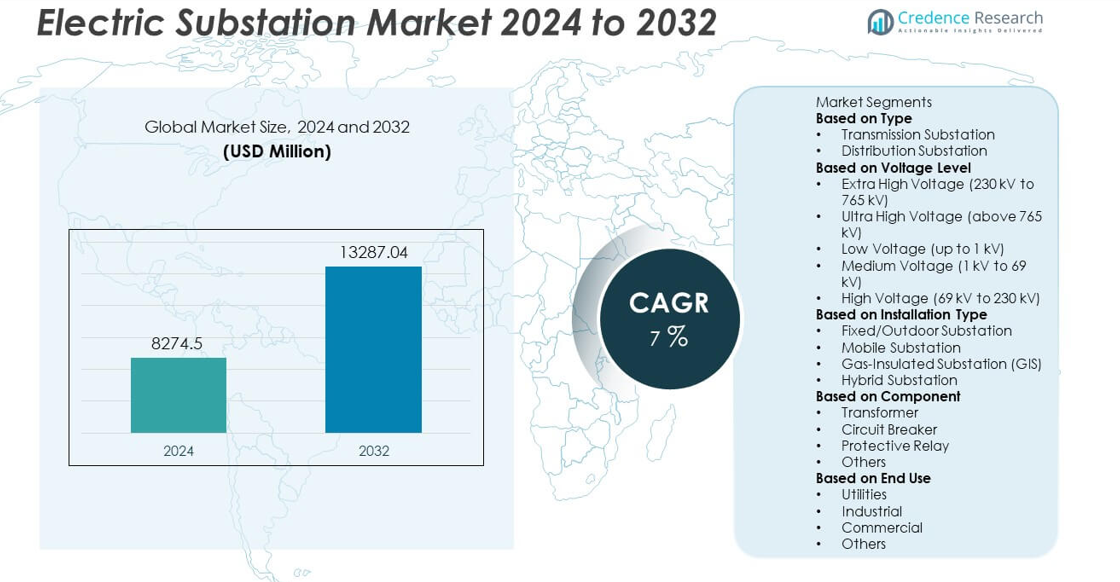

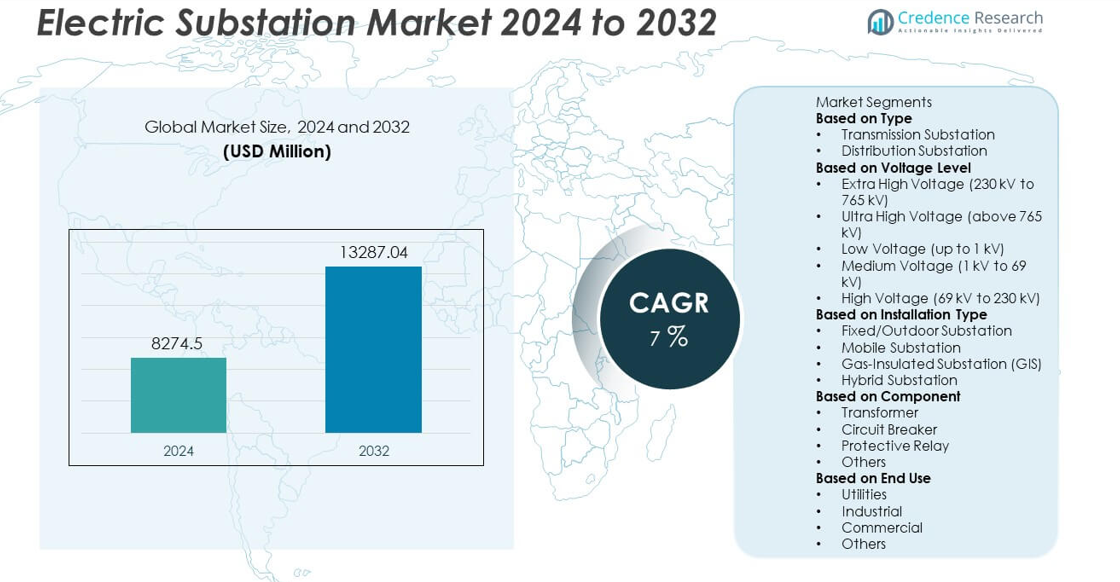

The Electric Substation Market was valued at USD 8,274.5 million in 2024 and is projected to reach USD 13,287.04 million by 2032, expanding at a CAGR of 7 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Substation Market Size 2024 |

USD 8,274.5 million |

| Electric Substation Market, CAGR |

7% |

| Electric Substation Market Size 2032 |

USD 13,287.04 million |

The Electric Substation Market is dominated by key players including Schneider, ABB, Eaton, CG, Siemens, Mitsubishi, Toshiba, General Electric, Caverion, and Larsen & Toubro. These companies lead the market through advanced automation technologies, strong engineering expertise, and large-scale infrastructure projects. Asia-Pacific emerged as the leading region with a 36 percent market share in 2024, driven by expanding industrialization and renewable energy integration. North America followed with 29 percent, supported by grid modernization initiatives and high-voltage upgrades. Europe accounted for 23 percent, focusing on sustainable transmission networks and cross-border power connectivity.

Market Insights

- The Electric Substation Market was valued at USD 8,274.5 million in 2024 and is projected to reach USD 13,287.04 million by 2032, growing at a CAGR of 7 percent.

- Growing demand for reliable power transmission and increasing renewable energy integration are major market drivers, supported by grid modernization and urban infrastructure expansion.

- The market is witnessing trends such as digital substation deployment, automation, and adoption of gas-insulated designs to improve efficiency and reduce maintenance needs.

- Key players including Schneider, ABB, Siemens, Mitsubishi, and General Electric are focusing on smart grid technology, innovation, and strategic collaborations to strengthen global presence.

- Asia-Pacific led the market with a 36 percent share in 2024, followed by North America with 29 percent and Europe with 23 percent, while the distribution substation segment dominated with 63 percent share due to its vital role in regional power distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The distribution substation segment dominated the Electric Substation Market in 2024, accounting for 63 percent of the total share. Its dominance is driven by the rapid expansion of urban and rural electricity distribution networks. Growing electricity demand from residential, commercial, and industrial users has boosted investment in reliable power delivery infrastructure. Utilities are focusing on modernizing aged distribution grids to improve efficiency and reduce transmission losses. The integration of smart meters, automation systems, and digital control units further strengthens the performance and reliability of distribution substations worldwide.

- For instance, Schneider Electric has deployed digital distribution substations under its EcoStruxure Grid program, each utilizing IoT-enabled sensors to enable capabilities such as predictive maintenance, real-time monitoring, and remote fault isolation across regional electricity networks. The program leverages IoT, analytics, and other technologies to help utilities improve reliability and efficiency.

By Voltage Level

The high voltage (69 kV to 230 kV) segment held the largest share of 41 percent in 2024, driven by strong demand for efficient long-distance power transmission. These substations are essential for connecting generation plants to regional distribution grids. Growing industrialization and cross-border electricity trade are fueling investment in high-voltage infrastructure. Governments in North America, Europe, and Asia-Pacific are prioritizing grid reliability and renewable integration through voltage upgrades. The rising deployment of high-voltage substations supports reduced transmission losses and enhanced network stability across major power corridors.

- For instance, a utility in the Philippines commissioned a new gas-insulated substation, integrating digital control relays for grid stability. The installation, which included GIS switchgear and transformers, improves energy transmission efficiency and system redundancy in parts of Luzon.

By Installation Type

The gas-insulated substation (GIS) segment led the market with a 47 percent share in 2024, owing to its compact design, high reliability, and superior performance in urban and space-constrained areas. GIS technology minimizes maintenance needs and provides strong resistance to pollution, moisture, and environmental stress. Increasing renewable integration and urban power demand are encouraging utilities to adopt GIS systems for enhanced efficiency. Countries in Asia-Pacific and the Middle East are investing heavily in GIS projects to modernize their transmission networks and ensure uninterrupted power supply in densely populated regions.

Key Growth Drivers

Expansion of Renewable Energy Integration

The rapid integration of renewable energy sources such as solar and wind is a major growth driver for the Electric Substation Market. Rising renewable generation requires efficient transmission and grid stability, increasing demand for advanced substations. Utilities are investing in flexible, automated systems capable of managing variable power flows. Digital substations enable real-time monitoring and optimized power distribution. Governments worldwide are funding grid modernization projects to enhance renewable integration, accelerating the need for high-capacity, smart substations across both urban and remote locations.

- For instance, ABB (now Hitachi Energy) supplied equipment for the Hornsea 2 offshore wind farm in the UK, which has a total capacity of 1.32 GW. ABB provided high-voltage gas-insulated switchgear (GIS) for the substation to help transmit power to the onshore grid.

Rising Demand for Reliable Power Transmission

Increasing global electricity consumption is driving investments in robust transmission and distribution infrastructure. Substations serve as critical nodes for voltage transformation and efficient energy transfer across large networks. Population growth, industrial expansion, and electrification of transport sectors have intensified the need for uninterrupted power supply. Utilities are upgrading aging networks with high-voltage substations to ensure stability and minimize power losses. This demand for reliability continues to push utilities and governments toward modern, digitally controlled substation installations.

- For instance, L&T Construction commissioned India’s first 765 kV gas-insulated substation (GIS) in Pune, Maharashtra, in partnership with Hyosung. The facility was part of a larger transmission scheme that included a 2×1500 MVA 765/400 kV Air Insulated Substation in Rajasthan, supporting long-distance power transmission and strengthening connectivity between regional grids.

Modernization of Aging Grid Infrastructure

Aging transmission networks in developed and emerging regions are undergoing large-scale modernization. Many existing substations are reaching operational limits, requiring replacement with more efficient and automated systems. The adoption of gas-insulated and hybrid substations is growing due to their compactness and lower maintenance needs. Upgrades focus on improving grid resilience, fault detection, and operational safety. Governments and utilities are allocating significant investments to replace outdated infrastructure, ensuring long-term reliability and improved energy efficiency across national grids.

Key Trends and Opportunities

Adoption of Smart and Digital Substations

Digital transformation is reshaping substation operations through automation, IoT, and AI integration. Smart substations use digital relays, sensors, and communication systems to enhance real-time data analysis and predictive maintenance. This shift reduces downtime and improves grid flexibility. Manufacturers are focusing on interoperable platforms for remote control and diagnostics. The growing emphasis on intelligent power management and grid optimization is creating new opportunities for digital substation deployment, particularly in technologically advanced economies.

- For instance, Siemens Energy, in collaboration with Norwegian utilities like BKK Nett and Glitre Energi Nett, has implemented digital technologies in substations across Norway. These projects, which often use the IEC 61850 protocol for intelligent electronic devices, leverage AI-driven data analytics and condition monitoring to improve grid reliability and efficiency.

Shift Toward Compact and Gas-Insulated Designs

Gas-insulated substations are becoming a preferred choice in urban and industrial areas where space and reliability are critical. Their ability to operate efficiently in harsh environments with minimal maintenance drives adoption. The technology also reduces environmental exposure and improves operational safety. Governments are promoting GIS installations as part of sustainable infrastructure programs. This shift presents strong opportunities for equipment manufacturers specializing in high-voltage, compact, and eco-efficient substation technologies.

- For instance, Hitachi Energy delivered a 400 kV gas-insulated substation in Dubai’s Jebel Ali area, designed with 80% smaller footprint compared to conventional AIS systems. The substation houses 28 GIS bays using fluoronitrile-based insulation that cuts SF₆ gas use by 85 tons annually while maintaining the same dielectric performance and operational reliability.

Key Challenges

High Initial Investment and Installation Costs

Electric substations, especially digital and gas-insulated types, involve significant upfront costs for equipment, installation, and technology integration. Developing countries often face financial constraints that delay modernization projects. Long project timelines and complex regulatory approvals further increase expenses. Manufacturers are exploring modular designs to lower costs and simplify setup. However, the high capital requirement remains a major barrier to widespread substation adoption in cost-sensitive regions.

Complex Maintenance and Technical Skill Requirements

Modern substations require skilled personnel for installation, operation, and maintenance. The integration of automation, sensors, and digital systems increases technical complexity. Inadequate workforce training and limited technical expertise can lead to operational inefficiencies and equipment downtime. Developing nations, in particular, face a shortage of qualified engineers to manage advanced substations. Utilities are investing in training programs and digital monitoring tools to overcome this challenge, but workforce development remains a key limiting factor for efficient grid modernization.

Regional Analysis

North America

North America held a market share of 29 percent in 2024, driven by strong investments in grid modernization and renewable integration. The United States and Canada are upgrading aging transmission infrastructure to support electric vehicle expansion and decentralized power generation. The presence of key utility providers and advanced automation technologies supports large-scale digital substation deployment. Government initiatives promoting reliable and resilient grids further strengthen market growth. Continuous innovation in smart grid solutions and the integration of high-voltage substations ensure sustained development across industrial and residential applications in the region.

Europe

Europe accounted for 23 percent of the Electric Substation Market in 2024, supported by robust investments in renewable energy and cross-border power networks. Countries such as Germany, France, and the United Kingdom are focusing on grid stability and efficient electricity transmission. The region’s commitment to carbon neutrality and the adoption of advanced digital substations enhance operational performance. Ongoing modernization of distribution networks and large-scale offshore wind integration are accelerating infrastructure upgrades. Government-backed funding and collaborative research programs continue to drive the adoption of sustainable substation technologies across Europe.

Asia-Pacific

Asia-Pacific dominated the market with a 36 percent share in 2024, fueled by expanding urbanization, industrialization, and power demand in China, India, and Japan. Growing renewable energy installations and rural electrification initiatives are increasing substation deployment across the region. Governments are investing in advanced grid networks to handle rising energy loads and ensure reliability. The development of high-voltage transmission corridors and large-scale renewable integration projects is driving growth. The presence of cost-effective manufacturers and rapid infrastructure development further enhance the market’s expansion across emerging Asia-Pacific economies.

Middle East and Africa

The Middle East and Africa captured 7 percent of the global market share in 2024, supported by large-scale oil and gas infrastructure projects and renewable energy initiatives. Countries such as Saudi Arabia, the UAE, and South Africa are expanding transmission capacity to meet industrial and urban electricity needs. Investments in gas-insulated substations and hybrid designs are growing to enhance grid resilience in harsh environments. Government strategies promoting energy diversification and electrification of remote regions continue to drive substation installations across both developed and developing parts of the region.

Latin America

Latin America accounted for 5 percent of the global Electric Substation Market in 2024, led by infrastructure expansion and renewable power generation projects in Brazil and Mexico. Increasing government focus on energy reliability and regional interconnection supports steady growth. Investments in solar and wind energy integration are encouraging the construction of new substations and modernization of existing networks. Utility companies are adopting automated and digital control systems to improve efficiency and safety. Continued economic recovery and energy reforms are expected to drive further substation deployment across Latin America.

Market Segmentations:

By Type

- Transmission Substation

- Distribution Substation

By Voltage Level

- Extra High Voltage (230 kV to 765 kV)

- Ultra High Voltage (above 765 kV)

- Low Voltage (up to 1 kV)

- Medium Voltage (1 kV to 69 kV)

- High Voltage (69 kV to 230 kV)

By Installation Type

- Fixed/Outdoor Substation

- Mobile Substation

- Gas-Insulated Substation (GIS)

- Hybrid Substation

By Component

- Transformer

- Circuit Breaker

- Protective Relay

- Others

By End Use

- Utilities

- Industrial

- Commercial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Substation Market includes major players such as Schneider, ABB, Eaton, CG, Siemens, Mitsubishi, Toshiba, General Electric, Caverion, and Larsen & Toubro. These companies lead the market through strong technological capabilities, extensive product portfolios, and global service networks. They are focusing on developing smart and digital substations integrated with IoT, AI, and advanced automation systems to enhance grid reliability and efficiency. Strategic partnerships, acquisitions, and renewable-focused infrastructure projects are key approaches used to expand market presence. Manufacturers are prioritizing sustainable solutions, including gas-insulated and hybrid substations, to address space limitations and environmental concerns. Continuous investment in research, software-based grid management, and modular substation technologies strengthens competitiveness across global and regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schneider

- ABB

- Eaton

- CG

- Siemens

- Mitsubishi

- Toshiba

- General Electric

- Caverion

- Larsen & Toubro

Recent Developments

- In July 2025, ABB completed the electrical substation scope for Dogger Bank C, floating out the substation for offshore installation in the UK.

- In June 2025, ABB secured a contract to design and build substation automation and eHouses for Petrobras FPSOs, using IEC 61850 standards.

- In March 2025, Siemens announced at DISTRIBUTECH its showcase of digital substation technology combining protection relays, intelligent control, and secure communications.

- In March 2025, Schneider Electric launched its One Digital Grid Platform to enable AI-driven grid resilience and interoperability across substations

Report Coverage

The research report offers an in-depth analysis based on Type, Voltage Level, Installation Type, Component, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to rising electricity demand and urban expansion.

- Integration of renewable energy sources will drive advanced substation installations.

- Digital and smart substations will become standard across transmission networks.

- Gas-insulated substations will gain popularity for compact and low-maintenance operation.

- Governments will invest heavily in grid modernization and energy security.

- Automation and IoT technologies will enhance monitoring and operational efficiency.

- Manufacturers will focus on modular and hybrid designs for flexible deployment.

- Emerging economies will experience strong growth through electrification projects.

- Collaboration between utilities and technology firms will accelerate innovation.

- Asia-Pacific will remain the leading market supported by industrialization and power infrastructure development.