Market overview

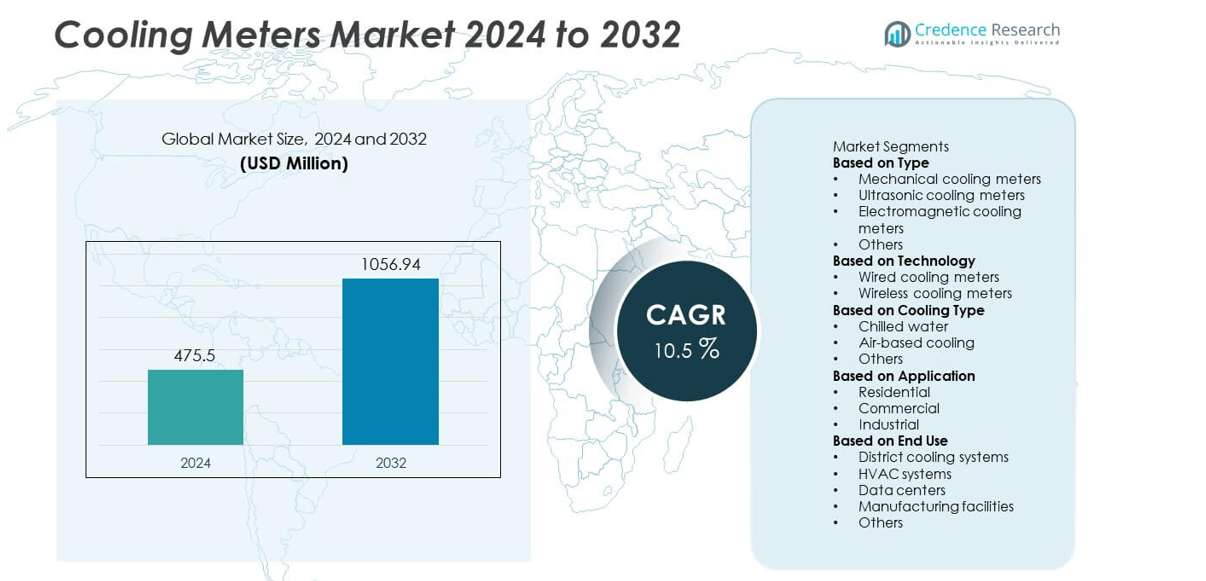

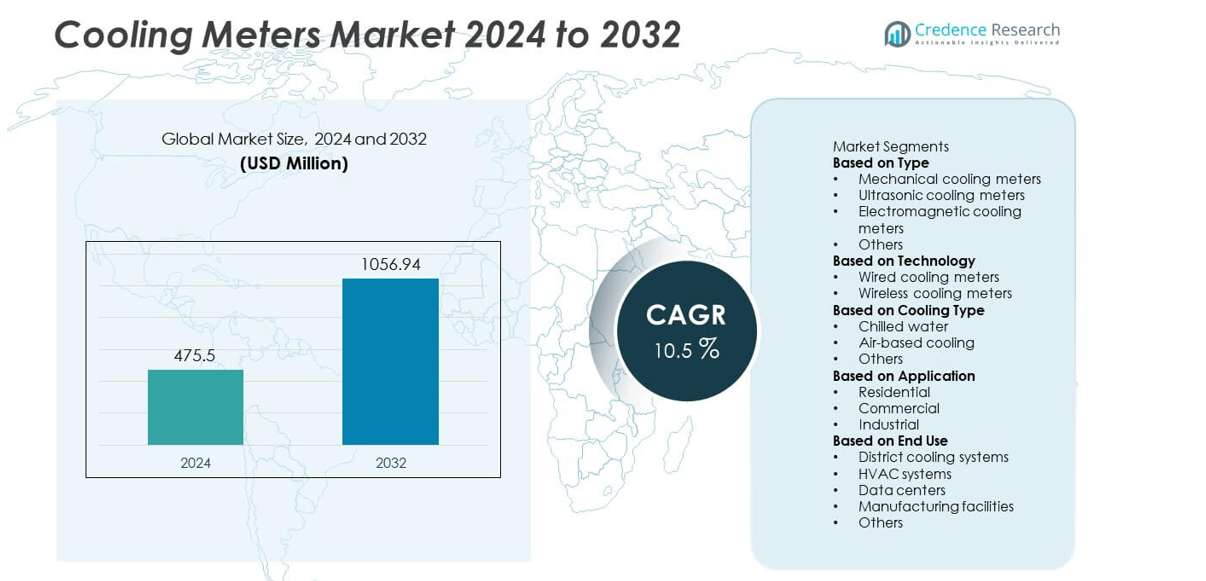

The Cooling Meters market was valued at USD 475.5 million in 2024 and is projected to reach USD 1,056.94 million by 2032, growing at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cooling Meters Market Size 2024 |

USD 475.5 million |

| Cooling Meters Market, CAGR |

10.5% |

| Cooling Meters Market Size 2032 |

USD 1,056.94 million |

The Cooling Meters market is led by major players including Siemens AG, Landis+Gyr AG, Kamstrup A/S, Itron Inc., Diehl Metering GmbH, Danfoss A/S, Zenner International GmbH & Co. KG, Apator SA, Maddalena S.p.A., and Qundis GmbH. These companies are focusing on developing high-precision ultrasonic and IoT-enabled metering solutions to support smart building and district cooling applications. Europe dominated the global market with a 30% share in 2024, driven by strict energy efficiency regulations and extensive adoption of district cooling systems. North America followed with 33%, supported by growing smart infrastructure projects, while Asia-Pacific accounted for 26%, fueled by rapid urbanization and expanding commercial infrastructure.

Market Insights

- The Cooling Meters market was valued at USD 475.5 million in 2024 and is projected to reach USD 1,056.94 million by 2032, expanding at a CAGR of 10.5% during the forecast period.

- Rising demand for energy-efficient cooling solutions and growing adoption of district cooling networks are driving market growth across commercial and residential sectors.

- Key trends include the integration of IoT and smart metering technologies for real-time energy monitoring, data analytics, and remote management in cooling systems.

- The market is competitive, with leading players such as Siemens, Landis+Gyr, Kamstrup, and Danfoss focusing on R&D, partnerships, and digital innovation to enhance metering accuracy and connectivity.

- Europe leads with 30% share, followed by North America at 33% and Asia-Pacific at 26%, while by type, the ultrasonic segment dominates with 46% share due to its high accuracy, low maintenance, and suitability for smart energy management systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The ultrasonic cooling meters segment dominated the Cooling Meters market in 2024, accounting for 46% share. Its leadership is attributed to high measurement accuracy, low maintenance requirements, and long operational lifespan compared to mechanical meters. Ultrasonic meters use advanced flow-sensing technology to measure thermal energy precisely, making them ideal for commercial and district cooling applications. The growing shift toward smart metering systems and sustainability-driven building regulations further boost adoption. Mechanical meters still hold demand in cost-sensitive markets, while electromagnetic meters are gaining popularity in large-scale industrial applications.

- For instance, Kamstrup A/S developed the mains-supplied MULTICAL® 803 ultrasonic cooling meter equipped with an ULTRAFLOW® sensor that supports a wide dynamic flow range and achieves a temperature resolution down to 0.01 °C.

By Technology

The wired cooling meters segment held the largest share of 58% in the Cooling Meters market in 2024. This dominance is driven by their reliability, stable data transmission, and integration in existing district cooling networks. Wired systems are widely used in large commercial and industrial facilities where consistent connectivity and real-time monitoring are critical. However, wireless cooling meters are witnessing rapid growth due to increasing adoption of IoT-based infrastructure and smart energy management systems. Wireless technology also offers flexibility, simplified installation, and scalability in modern smart building projects.

- For instance, Diehl Metering GmbH introduced its SHARKY 775 ultrasonic energy meter, approved for heating and cooling applications according to MID Class 2 and PTB K 7.2. It supports M-Bus and Modbus protocols through optional modules for integration into building automation systems.

By Cooling Type

The chilled water segment led the Cooling Meters market in 2024 with a 61% share. This segment’s growth is supported by extensive use in district cooling systems, commercial complexes, and industrial facilities for efficient thermal energy management. Chilled water-based metering provides accurate energy consumption data, helping optimize system performance and reduce operational costs. The adoption of centralized cooling plants and rising urban infrastructure development further contribute to segment expansion. Air-based cooling systems follow as an emerging category, driven by increasing demand for compact and energy-efficient solutions in residential and light commercial applications.

Key Growth Drivers

Rising Demand for Energy Efficiency and Sustainability

The increasing global emphasis on energy conservation and sustainable cooling solutions is a major driver of the Cooling Meters market. Governments and industries are adopting energy monitoring technologies to reduce carbon emissions and optimize energy consumption. Cooling meters enable precise measurement of thermal energy in district and building-level cooling systems, promoting efficient resource use. Growing adoption of green building certifications and stricter energy regulations across commercial and residential sectors further accelerate the deployment of advanced cooling metering technologies worldwide.

- For instance, Danfoss A/S developed the SonoSelect® 10 ultrasonic cooling meter, which offers top-tier meter accuracy to ensure valid billing for applications including heating, cooling, and combined systems. It is equipped for both primary and secondary installations, allowing for precise energy tracking in sustainable HVAC systems and smart building applications.

Expansion of District Cooling Infrastructure

Rapid urbanization and the expansion of district cooling networks are significantly driving market growth. District cooling systems are gaining traction in urban areas for their cost-effectiveness and environmental benefits compared to traditional air-conditioning systems. Cooling meters are integral components in these systems, ensuring accurate billing and energy accountability. Government-backed infrastructure projects in the Middle East, Europe, and Asia-Pacific are creating strong demand for smart metering solutions. This expansion is boosting large-scale adoption of ultrasonic and wired cooling meters for efficient energy distribution.

- For instance, Siemens AG supplied its SITRANS FUE950 energy meter to district cooling projects in Europe, offering measurement capability up to 25,000 m³/h with an operational pressure of 16 bar. The system integrates with Modbus and M-Bus communication protocols to ensure precise energy allocation and efficient monitoring across large-scale urban cooling networks.

Advancements in Smart and IoT-Enabled Metering Solutions

Technological innovation in smart metering is transforming the Cooling Meters market. The integration of IoT, cloud analytics, and automated data collection systems allows real-time energy monitoring and predictive maintenance. These advancements enable utilities and building operators to detect inefficiencies and optimize cooling performance. Smart meters also support remote access, automated billing, and data-driven decision-making, enhancing overall energy management. As urban infrastructure modernizes, IoT-enabled cooling meters are becoming essential tools for achieving operational transparency and sustainability goals in the energy sector.

Key Trends & Opportunities

Adoption of Smart Cities and Digital Infrastructure

The global rise of smart city initiatives is creating strong opportunities for cooling meter adoption. Governments and developers are focusing on energy-efficient urban planning that includes intelligent building management and district cooling systems. Smart cooling meters enable real-time data sharing across digital platforms, ensuring efficient cooling distribution and reduced energy waste. The integration of metering with advanced analytics and automation technologies enhances system reliability. This trend is expected to accelerate the deployment of connected cooling solutions across commercial and residential complexes.

- For instance, Landis+Gyr AG introduced its E360 smart metering platform featuring two-way communication and data logging intervals as short as 15 seconds. The platform can process over 2 million data points per day, enabling real-time monitoring of district energy systems and seamless integration with urban IoT networks in large-scale smart city projects.

Growing Integration with Renewable and Hybrid Systems

The integration of renewable energy sources with cooling systems presents new market opportunities. As buildings increasingly adopt solar-assisted and hybrid HVAC systems, accurate monitoring of cooling energy becomes critical. Cooling meters help optimize thermal energy flow and maintain balanced energy consumption in renewable-powered systems. The trend aligns with global sustainability goals and the transition toward net-zero energy buildings. Manufacturers are focusing on developing meters compatible with hybrid infrastructures, creating growth potential in energy-efficient and environmentally responsible cooling solutions.

- For instance, Apator SA developed the INVONIC H ultrasonic cooling meter, designed for integration with HVAC installations. The device is specified to meet the requirements of Accuracy Class 2 according to EN 1434. Its modular communication interface allows for connection with various data reading and building management systems.

Key Challenges

High Installation and Maintenance Costs

The high initial cost of installation and maintenance remains a major challenge in the Cooling Meters market. Advanced metering systems, particularly ultrasonic and IoT-enabled models, require significant investment in infrastructure, calibration, and integration. Smaller facilities and residential consumers often struggle with affordability. Additionally, maintaining system accuracy and performance requires periodic servicing, adding to operational costs. While long-term savings and efficiency benefits are notable, the upfront financial burden continues to restrain widespread adoption, especially in emerging economies.

Data Security and Integration Complexity

Data security and system integration pose significant challenges for smart cooling meters. The growing use of IoT and cloud-based communication increases vulnerability to cyber threats and data breaches. Ensuring secure data transmission and compliance with privacy regulations has become essential for utility providers. Furthermore, integrating new metering systems with legacy infrastructure can be complex and time-consuming. Lack of standardization across platforms and communication protocols often leads to interoperability issues, slowing adoption. Overcoming these challenges will require stronger cybersecurity measures and industry-wide technical harmonization.

Regional Analysis

North America

North America held a 33% share of the Cooling Meters market in 2024. The region’s growth is driven by increasing adoption of energy-efficient technologies and smart building management systems. The United States leads the market due to strong implementation of HVAC modernization programs and smart infrastructure projects. Demand for ultrasonic and IoT-enabled cooling meters is rising across commercial and industrial facilities to optimize cooling performance and reduce energy waste. Government incentives promoting sustainable cooling solutions and growing emphasis on carbon footprint reduction continue to strengthen market expansion in North America.

Europe

Europe accounted for a 30% share of the Cooling Meters market in 2024, supported by stringent energy efficiency regulations and widespread adoption of district cooling systems. Countries such as Germany, France, and Sweden are investing heavily in smart metering technologies to improve energy monitoring and billing accuracy. The European Union’s focus on sustainable urban infrastructure and the Green Deal objectives are further driving adoption. Technological advancements in ultrasonic and wired metering solutions, along with rising integration of renewable energy systems, are creating strong growth opportunities for cooling meter manufacturers across the region.

Asia-Pacific

Asia-Pacific captured a 26% share of the Cooling Meters market in 2024, driven by rapid urbanization and expansion of commercial infrastructure. Countries including China, Japan, India, and South Korea are leading adopters of smart cooling technologies in both industrial and residential sectors. Government initiatives supporting energy-efficient cooling and smart city developments are fueling regional growth. Increasing investment in district cooling networks and deployment of ultrasonic and wireless meters across high-density urban centers are further propelling demand. The region’s expanding manufacturing base and technology-driven modernization continue to position Asia-Pacific as a major market growth hub.

Latin America

Latin America held a 6% share of the Cooling Meters market in 2024. Growth in the region is supported by increasing urban construction and the modernization of commercial cooling systems. Countries such as Brazil, Mexico, and Chile are focusing on improving energy efficiency within industrial and residential facilities. While adoption of advanced metering technologies is at an early stage, rising demand for sustainable cooling solutions is expected to drive expansion. Ongoing partnerships between local utilities and international technology providers are improving accessibility to smart cooling meters across developing urban areas in the region.

Middle East & Africa

The Middle East and Africa accounted for a 5% share of the Cooling Meters market in 2024. The region’s growth is largely driven by extensive district cooling projects in the UAE, Saudi Arabia, and Qatar. Increasing adoption of smart and ultrasonic metering systems in large commercial complexes and residential developments supports market demand. Governments are investing in sustainable infrastructure to reduce energy consumption in hot climates. Meanwhile, Africa’s market is expanding gradually with rising construction activity and emerging investments in urban cooling infrastructure, presenting long-term opportunities for smart metering adoption.

Market Segmentations:

By Type

- Mechanical cooling meters

- Ultrasonic cooling meters

- Electromagnetic cooling meters

- Others

By Technology

- Wired cooling meters

- Wireless cooling meters

By Cooling Type

- Chilled water

- Air-based cooling

- Others

By Application

- Residential

- Commercial

- Industrial

By End Use

- District cooling systems

- HVAC systems

- Data centers

- Manufacturing facilities

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the Cooling Meters market is shaped by key players such as Siemens AG, Landis+Gyr AG, Kamstrup A/S, Itron Inc., Diehl Metering GmbH, Danfoss A/S, Zenner International GmbH & Co. KG, Apator SA, Maddalena S.p.A., and Qundis GmbH. These companies focus on advancing smart metering technologies and expanding their product portfolios to meet the growing demand for energy-efficient cooling systems. Strategic initiatives such as mergers, partnerships, and R&D investments are central to maintaining competitiveness. Leading firms emphasize the development of ultrasonic and IoT-enabled meters to enhance accuracy, connectivity, and remote data management. The growing integration of cooling meters in district energy networks and building automation systems is encouraging manufacturers to develop scalable, user-friendly, and cost-efficient solutions. Continuous innovation, coupled with regulatory compliance and digital transformation, is driving intense competition in the global Cooling Meters market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- Landis+Gyr AG

- Kamstrup A/S

- Itron Inc.

- Diehl Metering GmbH

- Danfoss A/S

- Zenner International GmbH & Co. KG

- Apator SA

- Maddalena S.p.A.

- Qundis GmbH

Recent Developments

- In August 2025, Landis+Gyr AG received Frost & Sullivan’s global AMI award. The company also grouped heating and cooling into a “Thermal” segment. The annual report noted continued growth in that segment.

- In 2025, Diehl Metering previewed innovations at E-world 2025. The company promoted its Smart Metering Hub for IoT networks. SHARKY 775 specifications confirmed heating/cooling billing capability.

- In August 2024, Kamstrup A/S named Trilliant an elite distributor in Canada. The deal covers MULTICAL heat/cool meters approved by Measurement Canada. The meters interoperate with Trilliant’s AMI and smart building platforms.

- In 2024, Itron Inc. promoted thermal energy metering offerings online. The portfolio supports AMR and monitoring for heating and cooling billing

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Cooling Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart and connected cooling meters will expand across commercial and residential sectors.

- Integration of IoT and AI technologies will enhance real-time energy tracking and system optimization.

- Demand for ultrasonic meters will grow due to their accuracy and low maintenance requirements.

- Expansion of district cooling infrastructure will increase the need for precise energy measurement.

- Governments will promote energy-efficient cooling systems through regulatory and policy support.

- Cloud-based data management platforms will improve meter performance and remote monitoring capabilities.

- Manufacturers will focus on developing cost-effective and scalable metering solutions for emerging markets.

- Rising urbanization and smart city development will create strong growth opportunities for cooling meters.

- Collaboration between utilities and technology firms will drive innovation in digital metering systems.

- Increasing emphasis on sustainability will push adoption of advanced meters for optimized energy usage.