Market Overview

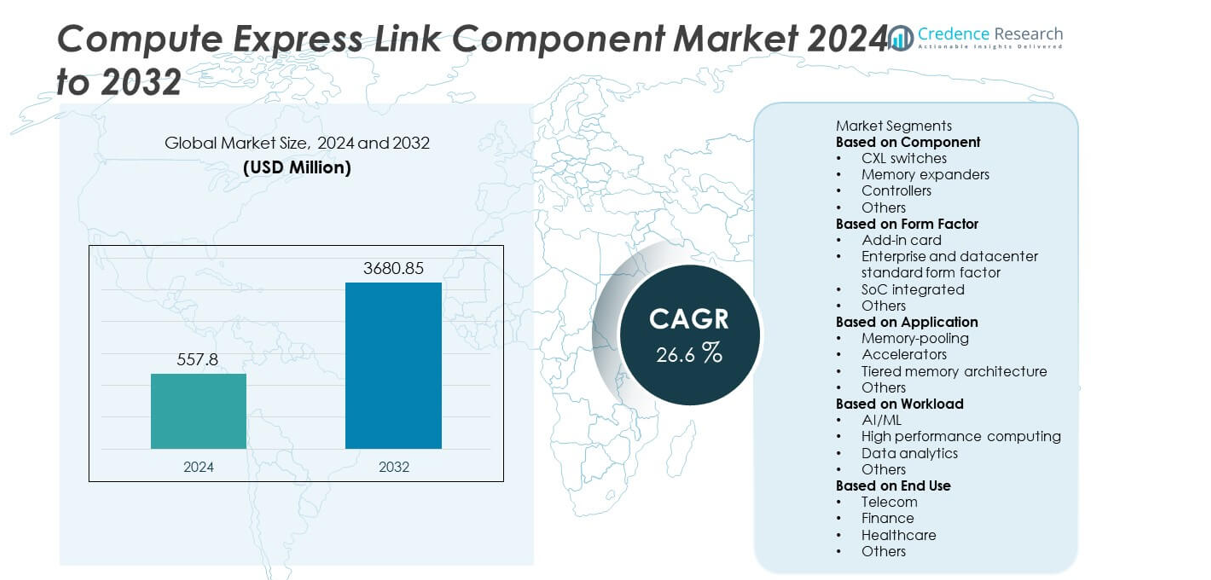

The Compute Express Link (CXL) Component market was valued at USD 557.8 million in 2024 and is projected to reach USD 3,680.85 million by 2032, growing at a CAGR of 26.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compute Express Link Component Market Size 2024 |

USD 557.8 million |

| Compute Express Link Component Market, CAGR |

26.6% |

| Compute Express Link Component Market Size 2032 |

USD 3,680.85 million |

The Compute Express Link (CXL) Component market is led by major players including Intel Corporation, Samsung Electronics Co., Ltd., Marvell Technology, Inc., Micron Technology, Inc., Rambus Inc., Astera Labs, Cadence Design Systems, Inc., Montage Technology Co., Ltd., Advanced Micro Devices, Inc. (AMD), and Mobiveil, Inc. These companies are at the forefront of developing high-performance interconnect and memory expansion solutions to enhance data center efficiency and AI computing capabilities. North America dominates the global market with a 38% share in 2024, supported by advanced semiconductor infrastructure and early adoption of CXL standards. Europe follows with 27% share due to rapid digital transformation, while Asia-Pacific holds 26%, driven by expanding semiconductor manufacturing and rising investment in AI and cloud technologies.

Market Insights

- The Compute Express Link (CXL) Component market was valued at USD 557.8 million in 2024 and is projected to reach USD 3,680.85 million by 2032, growing at a CAGR of 26.6%.

- Rising demand for high-performance computing, AI, and cloud workloads is driving adoption of CXL technology for faster interconnect and improved resource sharing.

- Key trends include growing deployment of CXL 3.0 standards, memory disaggregation, and AI-driven data center infrastructure supporting scalable performance.

- The market is highly competitive, with leading players such as Intel, Samsung, Marvell, Micron, and AMD focusing on R&D, partnerships, and CXL-enabled product launches.

- Regionally, North America leads with 38% share, followed by Europe at 27% and Asia-Pacific at 26%, while by component, CXL switches dominate with 42% share due to their vital role in enabling efficient multi-device communication across modern computing environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The CXL switches segment dominated the Compute Express Link Component market in 2024, accounting for 42% share. This dominance is driven by the rising need for efficient resource sharing and high-bandwidth interconnects in hyperscale data centers. CXL switches enable multiple hosts and devices to communicate seamlessly, reducing data bottlenecks and improving memory utilization. Growing deployment of AI and high-performance computing workloads has further increased reliance on advanced switch components. Memory expanders and controllers are also witnessing steady adoption as enterprises seek scalable memory solutions for complex computing architectures.

- For instance, Astera Labs developed its Scorpio Smart Fabric Switches, featuring high-bandwidth PCIe 6 connectivity for large-scale AI and cloud infrastructure deployments. Its Aries PCIe/CXL Smart Cable Modules and Smart DSP Retimers facilitate low-latency memory and accelerator connectivity.

By Form Factor

The enterprise and datacenter standard form factor segment led the market in 2024 with a 47% share. Its leadership is supported by widespread use in large-scale server infrastructures where flexibility and scalability are critical. This form factor enhances interoperability across multi-vendor environments and supports higher memory bandwidth for AI and data-intensive workloads. Add-in cards are also gaining traction for modular expansion, particularly in cloud and edge computing systems. Meanwhile, SoC-integrated designs are emerging as a preferred choice for compact, energy-efficient deployments in next-generation computing architectures.

- For instance, Samsung Electronics introduced its CXL Memory Module (CMM-D) in the E3.S form factor, supporting 512 GB capacity per module and PCIe Gen 5 ×8 interface. The design delivers up to 32 GT/s per lane data rate and enables dynamic memory pooling across multiple CPUs, significantly improving scalability in enterprise data centers.

By Application

The memory-pooling segment held the largest share of 44% in the Compute Express Link Component market in 2024. Its prominence is due to the growing demand for unified memory architectures that allow multiple processors to access shared memory resources efficiently. This approach significantly enhances workload flexibility, reduces latency, and optimizes hardware utilization. Accelerators and tiered memory architectures are also expanding rapidly, driven by the increasing adoption of AI, ML, and data analytics applications requiring low-latency, high-speed data access. These applications are accelerating the integration of CXL technology across enterprise computing systems.

Key Growth Drivers

Rising Demand for High-Performance Computing (HPC)

The growing adoption of AI, machine learning, and data analytics is driving the need for high-performance computing infrastructure. Compute Express Link (CXL) technology enables faster communication between CPUs, GPUs, and memory devices, improving system efficiency. Its ability to reduce latency and enhance workload performance supports large-scale computing environments. Data centers and enterprises are increasingly integrating CXL components to optimize resource sharing and accelerate complex processing. This trend is fueling significant market growth as organizations seek scalable, low-latency computing architectures.

- For instance, Intel Corporation integrated full CXL 2.0 support into its Xeon 6 Granite Rapids processors, enabling seamless CPU-GPU and CPU-memory communication. This advancement, along with improvements in DDR5 memory and new MRDIMM support, significantly enhances memory throughput, improving performance for large-scale AI and HPC workloads in enterprise data centers.

Expansion of Cloud and Hyperscale Data Centers

Rapid growth in cloud computing and hyperscale data centers is a major driver for the CXL Component market. These facilities require faster data movement between processors and memory to manage expanding workloads efficiently. CXL technology addresses bandwidth limitations and ensures dynamic resource allocation, improving performance in virtualized and distributed systems. Cloud service providers are adopting CXL-based infrastructure to enhance flexibility and reduce operational costs. The increasing deployment of AI workloads and edge computing environments further supports adoption across global hyperscale networks.

- For instance, Marvell Technology introduced its Structera CXL Controller portfolio supporting PCIe Gen 5 with throughput up to 64 GT/s per lane. The controller enables memory expansion across multiple CPU sockets, achieving latency below 80 ns, which improves performance and scalability in hyperscale and cloud data center infrastructures.

Advancements in Memory and Storage Architectures

Continuous innovation in memory technologies is fueling CXL component adoption. CXL enables shared memory access across heterogeneous processors, allowing for improved utilization and reduced redundancy. The rise of memory disaggregation and composable infrastructure models enhances system scalability for data-intensive workloads. Manufacturers are developing next-generation memory expanders and controllers compatible with CXL standards, supporting higher performance and efficiency. As demand for real-time data processing and AI training increases, CXL’s ability to unify memory and compute resources becomes a crucial enabler of modern data infrastructure.

Key Trends & Opportunities

Emergence of CXL 3.0 and Ecosystem Expansion

The introduction of CXL 3.0 has opened new growth opportunities for hardware and software vendors. The standard enhances bandwidth, improves memory pooling, and supports broader device interoperability. Leading semiconductor firms are collaborating to create open ecosystems that enable seamless adoption of CXL-enabled components. This evolution promotes innovation in server design, accelerators, and AI hardware integration. The growing industry alignment around open interconnect standards will accelerate large-scale deployment across data centers, driving new business opportunities for component manufacturers and system integrators.

- For instance, Montage Technology developed its MXC Memory Expander Controller supporting the CXL 3.1 protocol, delivering data transfer speeds of 64 GT/s over PCIe 6.2 ×8 interfaces. The controller integrates DDR5 memory channels operating at 8000 MT/s, enabling scalable, high-bandwidth memory expansion across heterogeneous computing systems.

Growing Adoption in AI and Machine Learning Workloads

AI and machine learning applications are driving significant demand for CXL-enabled architectures. These workloads require high-speed interconnections to handle massive datasets efficiently. CXL components allow processors and accelerators to share memory resources dynamically, improving performance and reducing bottlenecks. The integration of CXL in AI training systems enhances throughput and minimizes latency, especially in data center and edge AI deployments. As enterprises increase investments in AI-driven solutions, CXL-based architectures are expected to play a central role in next-generation intelligent computing systems.

- For instance, AMD integrated CXL 1.1+ support into its EPYC 9004 Genoa processors, enabling cache-coherent memory expansion via CXL-attached memory devices. This enhances AI model training efficiency and supports large-scale inference workloads in high-density computing environments by expanding memory capacity and providing the low-latency communication needed by accelerators.

Key Challenges

High Implementation Costs and Standardization Barriers

The deployment of CXL components involves significant infrastructure upgrades and high initial costs. Transitioning from legacy interconnect systems requires new hardware, testing environments, and software compatibility layers. Smaller enterprises often struggle to justify these investments without clear short-term returns. Additionally, standardization challenges persist as manufacturers align with evolving CXL versions. Ensuring interoperability between devices from different vendors adds complexity to integration. These factors can slow large-scale adoption, particularly among cost-sensitive organizations.

Technical Complexity and Integration Limitations

Implementing CXL technology demands advanced technical expertise and infrastructure readiness. Integrating heterogeneous processors, accelerators, and memory pools requires precise configuration and compatibility management. Many existing data center architectures are not yet optimized for CXL-based communication, creating deployment challenges. Furthermore, limited awareness and a shortage of skilled professionals in CXL system design hinder adoption. Overcoming these barriers will require robust training programs, ecosystem collaboration, and continued hardware-software co-development to ensure smooth integration and operational reliability.

Regional Analysis

North America

North America held the largest share of 38% in the Compute Express Link (CXL) Component market in 2024. The region’s dominance is driven by strong adoption of advanced interconnect technologies across cloud and hyperscale data centers. Major semiconductor companies in the U.S. lead in developing CXL-enabled processors, switches, and memory modules. The rapid expansion of AI workloads and high-performance computing applications further supports growth. Additionally, favorable investments in data infrastructure and early standard adoption position North America as a leading hub for CXL innovation and large-scale commercial deployment.

Europe

Europe accounted for a 27% share of the Compute Express Link Component market in 2024. The region’s growth is supported by rising demand for high-speed computing infrastructure and AI-driven applications. Countries such as Germany, the U.K., and France are investing heavily in advanced data centers and enterprise computing solutions. Adoption of CXL technology in cloud computing and research institutions enhances resource utilization and system efficiency. Strong collaborations among chip manufacturers and data infrastructure developers also boost innovation. Regulatory support for digital transformation further accelerates the deployment of CXL-based components across the region.

Asia-Pacific

Asia-Pacific captured a 26% share of the Compute Express Link Component market in 2024, driven by rapid digital transformation and growing semiconductor manufacturing capacity. Countries such as China, Japan, South Korea, and Taiwan are investing heavily in AI, 5G, and high-performance computing ecosystems. The region’s strong presence of chipmakers and data center operators supports large-scale CXL integration. Increasing demand for cloud computing and enterprise-level memory solutions fuels further adoption. Government-backed technology initiatives and expansion of regional data infrastructure are enhancing Asia-Pacific’s role as a critical growth engine in the global CXL ecosystem.

Latin America

Latin America held a 5% share of the Compute Express Link Component market in 2024. The region is gradually adopting advanced computing technologies to modernize IT infrastructure and data centers. Countries like Brazil and Mexico are witnessing steady growth in digital transformation and cloud-based services. Rising enterprise focus on efficient data management and AI deployment is driving interest in CXL-enabled systems. However, limited technological expertise and high integration costs pose adoption challenges. Despite this, growing partnerships with global semiconductor firms are expected to improve regional accessibility and accelerate technology transfer.

Middle East & Africa

The Middle East and Africa accounted for a 4% share of the Compute Express Link Component market in 2024. The region’s growth is fueled by expanding data center infrastructure and government-led digital initiatives. Countries such as the UAE, Saudi Arabia, and South Africa are increasingly investing in high-performance computing and AI-driven applications. The adoption of CXL technology is emerging in key industries like finance, energy, and defense, where real-time data processing is critical. Growing collaborations with international technology providers are helping strengthen digital infrastructure, supporting gradual but steady market expansion across the region.

Market Segmentations:

By Component

- CXL switches

- Memory expanders

- Controllers

- Others

By Form Factor

- Add-in card

- Enterprise and datacenter standard form factor

- SoC integrated

- Others

By Application

- Memory-pooling

- Accelerators

- Tiered memory architecture

- Others

By Workload

- AI/ML

- High performance computing

- Data analytics

- Others

By End Use

- Telecom

- Finance

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Compute Express Link (CXL) Component market is shaped by key players such as Intel Corporation, Samsung Electronics Co., Ltd., Marvell Technology, Inc., Rambus Inc., Micron Technology, Inc., Astera Labs, Cadence Design Systems, Inc., Montage Technology Co., Ltd., Advanced Micro Devices, Inc. (AMD), and Mobiveil, Inc. These companies are focusing on developing high-speed interconnect solutions and memory architectures that enhance computing efficiency and scalability. Strategic alliances, R&D investments, and standardization efforts under the CXL Consortium are strengthening their market positions. Leading players are emphasizing innovations in CXL switches, controllers, and memory expanders to support next-generation data center and AI workloads. The growing demand for shared memory infrastructure and low-latency processing is fostering collaborations among chipmakers, hardware vendors, and cloud providers. Competitive intensity remains high as firms race to commercialize CXL 3.0-based products and expand their presence across global hyperscale and enterprise computing markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Intel Corporation

- Rambus Inc.

- Samsung Electronics Co., Ltd.

- Marvell Technology, Inc.

- Astera Labs

- Micron Technology, Inc.

- Cadence Design Systems, Inc.

- Montage Technology Co., Ltd.

- Advanced Micro Devices, Inc. (AMD)

- Mobiveil, Inc.

Recent Developments

- In September 2025, Marvell Technology, Inc. achieved full interoperability for its Structera CXL controller portfolio with DDR4 and DDR5 modules from leading manufacturers. The validation across AMD EPYC and 5th Gen Intel Xeon platforms reinforced Structera’s compatibility within multi-vendor ecosystems.

- In May 2025, Samsung Electronics Co., Ltd. advanced its CXL DRAM portfolio by building on its earlier 512 GB DDR5-based module. The new version offers greater scalability for AI and cloud systems, supporting high-speed memory expansion across heterogeneous architectures.

- In April 2025, Rambus Inc. expanded its CXL Memory Initiative, introducing low-latency interface chips designed to enhance memory pooling and tiering. These components optimize connectivity between CPUs, GPUs, and accelerators, improving efficiency in data-intensive applications.

- In September 2024, Intel Corporation launched its 6th-generation Xeon “Granite Rapids” processors featuring native CXL 2.0 support. The platform enables high-bandwidth, low-latency interconnects for next-generation memory expansion, accelerating data throughput in AI and cloud workloads

Report Coverage

The research report offers an in-depth analysis based on Component, Form Factor, Application, Workload, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of CXL-enabled architectures will expand across hyperscale data centers and enterprise computing.

- Integration of CXL 3.0 standards will enhance bandwidth, latency reduction, and memory pooling efficiency.

- Demand for AI and machine learning workloads will accelerate CXL component deployment.

- Semiconductor companies will increase collaboration to ensure ecosystem compatibility and standardization.

- Memory expanders and switches will see strong growth due to shared resource utilization needs.

- Cloud service providers will adopt CXL-based infrastructure to optimize performance and scalability.

- Rising investment in chiplet and composable computing will strengthen CXL market innovation.

- Expansion in edge computing will drive adoption of compact and energy-efficient CXL solutions.

- Government initiatives supporting data center modernization will favor CXL adoption globally.

- Continuous R&D in interconnect technologies will enhance system performance and boost long-term market growth.