Market Overview

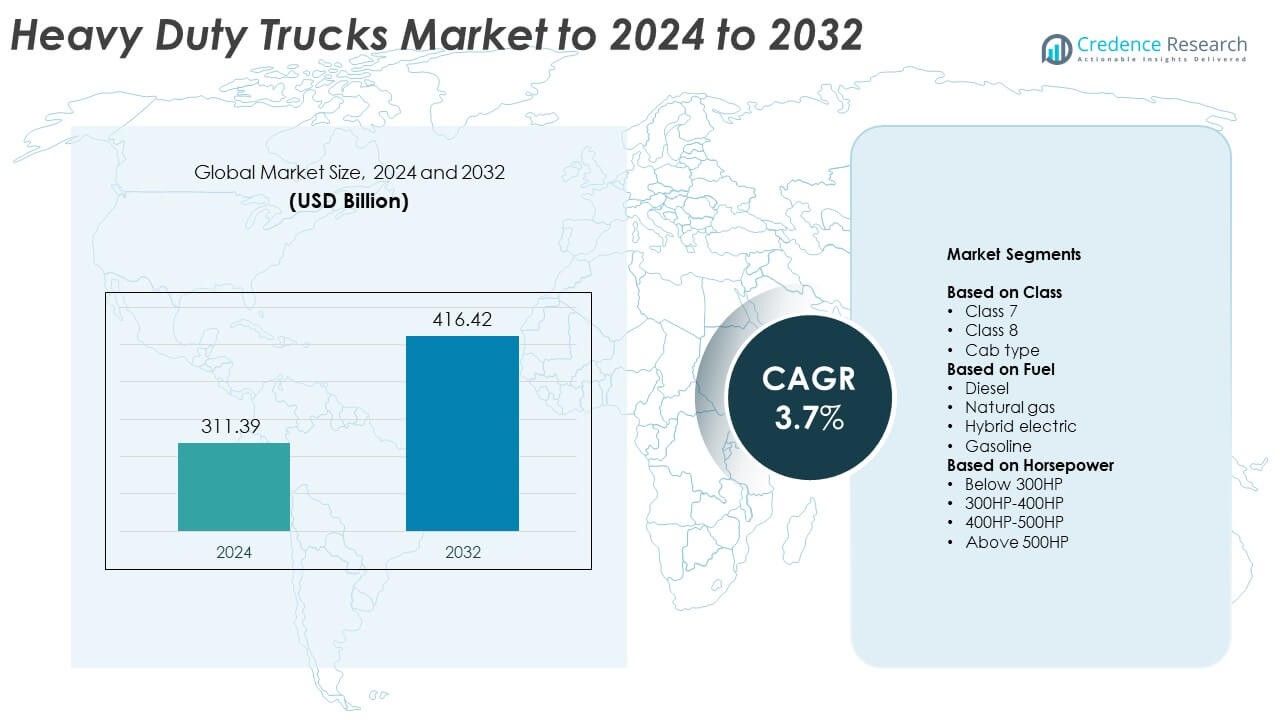

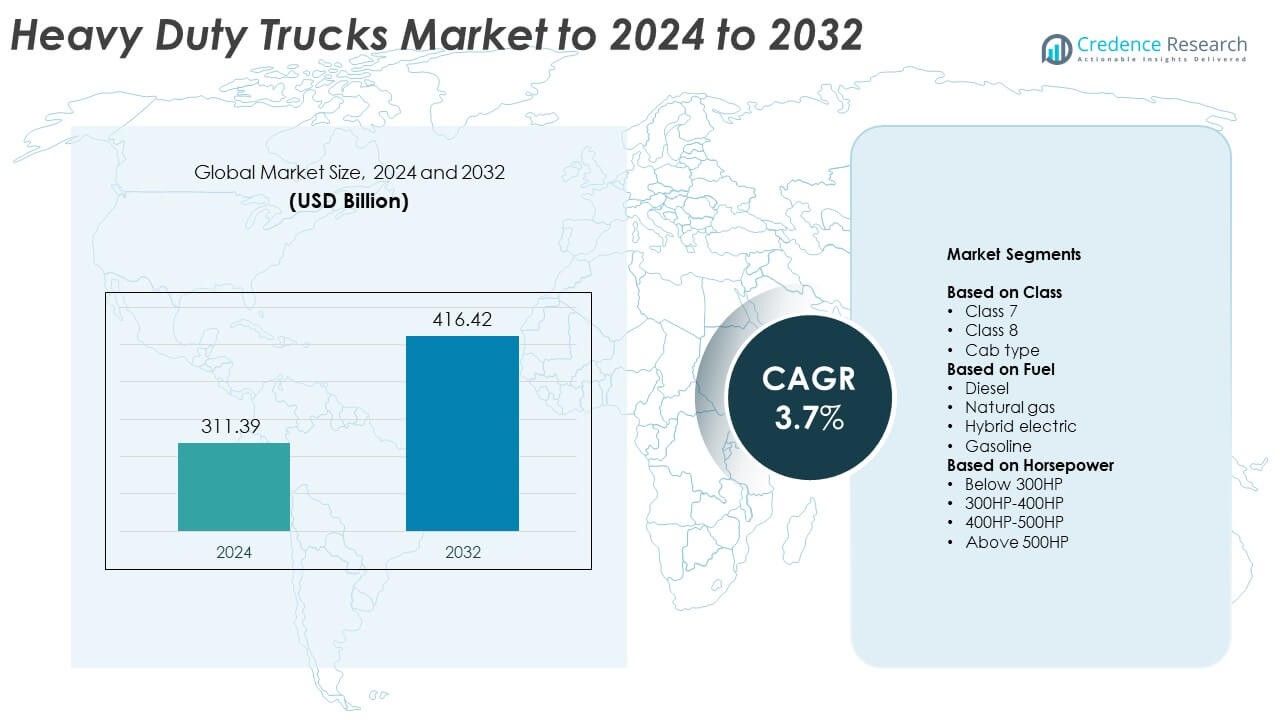

The Heavy Duty Trucks Market size was valued at USD 311.39 billion in 2024 and is anticipated to reach USD 416.42 billion by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heavy Duty Trucks Market Size 2024 |

USD 311.39 Billion |

| Heavy Duty Trucks Market, CAGR |

3.7% |

| Heavy Duty Trucks Market Size 2032 |

USD 416.42 Billion |

The Heavy Duty Trucks market is shaped by major players such as Volvo Trucks, Navistar, MAN, Mack Trucks, Kenworth, Daimler, Isuzu Motors, Scania AB, Hyzon Motors, Freightliner, Peterbilt, and PACCAR (Peterbilt, Kenworth, DAF). These companies compete through innovation in fuel-efficient engines, connected vehicle technologies, and autonomous driving systems. Product diversification and regional expansion strategies enhance their global presence. North America leads the market with a 37% share, followed by Europe at 28% and Asia Pacific at 25%. Continuous advancements in powertrain technologies, fleet electrification, and digital logistics management continue to define the competitive landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Heavy Duty Trucks Market was valued at USD 311.39 billion in 2024 and is projected to reach USD 416.42 billion by 2032, growing at a CAGR of 3.7%.

- Rising freight transportation demand, industrial expansion, and infrastructure development are driving the adoption of Class 8 heavy-duty trucks globally.

- The market is witnessing a strong trend toward electrification, digital connectivity, and integration of autonomous driving and telematics systems to enhance fleet efficiency.

- Competition is shaped by innovation in powertrain design, emission reduction technologies, and partnerships between OEMs and logistics operators to improve supply chain efficiency.

- North America leads the market with a 37% share, followed by Europe at 28% and Asia Pacific at 25%, while the Class 8 segment dominates with nearly 80% of total market volume.

Market Segmentation Analysis:

By Class

The Class 8 segment dominated the heavy-duty trucks market with nearly 80% share in 2024. This segment’s leadership is driven by its use in long-haul freight, construction, and mining operations that demand high payload capacity and endurance. Class 8 trucks are preferred for their durability, advanced powertrains, and enhanced fuel efficiency. Ongoing fleet modernization programs and stricter emission standards encourage companies to adopt new-generation models with telematics, driver-assist, and autonomous features. As infrastructure investments expand across major economies, demand for Class 8 vehicles continues to accelerate globally.

- For instance, PACCAR MX-13 delivers 405–510 hp and 1,550–1,850 lb-ft torque, with B10 life 1,000,000 miles.

By Fuel

The diesel segment accounted for approximately 55% of the market share in 2024, supported by its unmatched energy density and fuel efficiency in heavy-duty applications. Diesel trucks remain the backbone of logistics and industrial transport due to established fueling infrastructure and lower total ownership costs. However, the market is witnessing a gradual shift toward cleaner alternatives such as natural gas and hybrid electric variants. OEMs are introducing LNG and CNG-powered models to reduce carbon emissions, while hybrid systems enhance fuel economy and comply with evolving environmental regulations.

- For instance, Cummins X15N natural-gas engine provides 400–500 hp and 1,450–1,850 lb-ft torque.

By Horsepower

The 400HP–500HP category held about 36% of the global market share in 2024, reflecting its balance between performance and operating efficiency. Trucks in this range are widely used for regional and intercity logistics, offering robust towing capacity and reliability across diverse terrains. Manufacturers are incorporating advanced engine management systems and lightweight materials to boost torque output while minimizing fuel consumption. Growing adoption in construction, mining, and logistics sectors reinforces this segment’s strong position, as fleet owners prioritize vehicles that deliver higher productivity and lower lifecycle costs.

Key Growth Drivers

Rising Freight Transportation Demand

The growing global trade and e-commerce expansion are key drivers for the heavy-duty trucks market. Increasing movement of goods across long distances requires robust transport solutions capable of handling large payloads. Fleet operators are investing in advanced trucks with higher fuel efficiency and improved connectivity to optimize logistics performance. Infrastructure development projects and cross-border trade routes are further boosting heavy-duty vehicle adoption in logistics and distribution networks worldwide.

- For instance, Euro VI caps NOx at 0.40 g/kWh (steady-state) and PM at 0.01 g/kWh; U.S. EPA 2010 sets 0.20 g/bhp-hr NOx and 0.01 g/bhp-hr PM.

Advancements in Powertrain and Emission Technology

Technological improvements in engines, hybrid systems, and emission control solutions are accelerating market growth. Manufacturers are integrating advanced turbocharged engines, after-treatment systems, and low-emission powertrains to meet global sustainability goals. Compliance with Euro VI and EPA emission standards drives demand for cleaner and more efficient trucks. OEMs are also investing in alternative fuel technologies like LNG and hydrogen, expanding the market for next-generation heavy-duty vehicles.

- For instance, Volvo Trucks reports cumulative fuel economy improvements of up to 13% for the I-Save package since its 2019 introduction, with independent tests showing reductions of up to 18% compared to a standard FH model from 2018.

Infrastructure and Industrial Growth

Expanding construction, mining, and energy sectors contribute significantly to the demand for heavy-duty trucks. Large-scale infrastructure projects require high-capacity vehicles for material handling and transportation. Urbanization in developing economies and growing investments in road development are fueling regional truck demand. Governments’ focus on industrial expansion and logistics modernization continues to strengthen the long-term growth outlook of the market.

Key Trends and Opportunities

Adoption of Electric and Hybrid Heavy Trucks

The market is witnessing a major shift toward electric and hybrid truck models as sustainability becomes a priority. Manufacturers are launching battery-electric variants suitable for medium and long-haul transport. Improvements in charging infrastructure, battery density, and cost reduction are making these vehicles commercially viable. This transition creates growth opportunities for OEMs and logistics companies targeting lower operational emissions.

- For instance, Freightliner eCascadia offers different configurations, including a 438 kWh battery pack with a typical 230-mile range and a 291 kWh pack with a typical 155-mile range.

Integration of Connected and Autonomous Technologies

The adoption of telematics, IoT, and autonomous driving systems is reshaping truck fleet management. Real-time data analytics improves route planning, fuel optimization, and safety performance. Advanced driver-assistance systems (ADAS) and remote diagnostics enhance efficiency and reduce downtime. This technological shift is opening new avenues for predictive maintenance and smart fleet operations.

- For instance, Volvo Trucks announced an FH Aero Electric variant targeting a 600 km (373 miles) range per charge, with orders scheduled to open in the second quarter of 2026.

Key Challenges

High Operating and Maintenance Costs

The heavy-duty truck market faces challenges due to the high costs associated with vehicle acquisition, maintenance, and fuel. Smaller fleet operators often struggle to manage rising expenses related to parts replacement, skilled labor, and emission compliance. Additionally, volatile fuel prices and inflationary pressures limit profit margins, pushing companies to focus on cost-efficient operations and fleet optimization.

Stringent Emission and Safety Regulations

Increasingly strict global emission norms and safety mandates present operational challenges for manufacturers. Meeting regulatory standards requires heavy investments in R&D, advanced materials, and testing technologies. While these measures improve environmental performance, they also increase production costs and delay product launches. Balancing sustainability with affordability remains a critical issue for the industry.

Regional Analysis

North America

North America held around 37% of the global heavy-duty trucks market share in 2024. The region’s dominance is supported by strong logistics networks, large-scale freight movement, and growing demand for advanced Class 8 trucks. The U.S. remains a key contributor due to fleet modernization and infrastructure upgrades under federal investment programs. Adoption of electric and hybrid models is increasing, driven by emission reduction mandates and sustainable freight initiatives. Canada and Mexico also experience steady demand, supported by cross-border trade and industrial expansion across mining, construction, and manufacturing sectors.

Europe

Europe accounted for nearly 28% of the heavy-duty trucks market share in 2024. Stringent emission norms and the rise of zero-emission zones are accelerating the adoption of electric and hybrid trucks. Countries such as Germany, France, and the U.K. are investing heavily in clean mobility infrastructure. The region’s advanced automotive manufacturing base and high adoption of telematics systems enhance efficiency and compliance. Fleet operators are upgrading to Euro VI-compliant vehicles, while logistics digitalization and government incentives for sustainable transport continue to drive steady growth.

Asia Pacific

Asia Pacific captured about 25% of the global heavy-duty trucks market in 2024, led by China, Japan, and India. Strong industrial output, urban infrastructure projects, and rising e-commerce logistics fuel market expansion. China dominates regional production with large-scale fleet replacement programs and increased focus on low-emission vehicles. India’s “Make in India” initiative and highway development projects drive strong domestic demand. Rapid urbanization, coupled with expanding cross-border trade, strengthens the region’s outlook. Investments in smart logistics and electric truck development further support sustained market growth.

Latin America

Latin America accounted for nearly 6% of the heavy-duty trucks market share in 2024. Brazil and Mexico are key contributors, driven by the recovery of construction and agricultural industries. Economic growth and expansion in mining and energy sectors create new opportunities for fleet purchases. However, volatile fuel prices and financing constraints limit rapid adoption. Manufacturers are targeting this market with fuel-efficient and durable models suitable for challenging terrains. Government programs to modernize transport infrastructure are expected to boost long-term demand.

Middle East and Africa

The Middle East and Africa region represented around 4% of the global heavy-duty trucks market in 2024. Growing oil and gas projects, infrastructure development, and mining operations drive steady demand for heavy trucks. The Gulf countries are investing in smart logistics corridors and renewable construction projects, supporting future sales. South Africa remains a key market in Sub-Saharan Africa, where commercial vehicle demand is rising for industrial applications. Although limited manufacturing capacity and cost barriers slow growth, regional diversification efforts continue to enhance import and fleet expansion activities.

Market Segmentations:

By Class

By Fuel

- Diesel

- Natural gas

- Hybrid electric

- Gasoline

By Horsepower

- Below 300HP

- 300HP-400HP

- 400HP-500HP

- Above 500HP

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Heavy Duty Trucks market features leading manufacturers such as Volvo Trucks, Navistar, MAN, Mack Trucks, Kenworth, Daimler, Isuzu Motors, Scania AB, Hyzon Motors, Freightliner, Peterbilt, and PACCAR (Peterbilt, Kenworth, DAF). These companies focus on developing energy-efficient, durable, and connected vehicle platforms to meet global demand for sustainable logistics solutions. The competitive environment is marked by continuous investment in advanced powertrains, electric mobility, and autonomous driving technologies. Manufacturers are strengthening production capabilities, expanding aftersales networks, and forming alliances with component suppliers and digital solution providers. Increasing emphasis on lightweight materials, digital fleet monitoring, and predictive maintenance is transforming product strategies. Firms are also aligning with regional emission norms, sustainability goals, and evolving customer needs through modular vehicle architectures. This competition drives technological innovation and enhances reliability, ensuring long-term growth opportunities in the global heavy-duty transport ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Volvo Trucks

- Navistar

- MAN

- Mack Trucks

- Kenworth

- Daimler

- Isuzu Motors

- Scania AB

- Hyzon Motors

- Freightliner

- Peterbilt

- PACCAR (Peterbilt, Kenworth, DAF)

Recent Developments

- In 2024, Volvo Group (AB Volvo) Launched a major product overhaul, including the all-new Volvo VNL long-haul truck for North America, featuring a new platform for improved fuel efficiency.

- In 2024, PACCAR (Peterbilt, Kenworth, DAF) Exhibited next-generation commercial vehicles at CES, including hydrogen fuel cell (Kenworth), battery-electric (Peterbilt and DAF), and advanced driver-assist systems. Launched Amplify Cell Technologies, a U.S. battery manufacturing joint venture.

- In 2022, Daimler Truck (Freightliner, Western Star, Mercedes-Benz) Launched the new Western Star 57X on-highway truck in North America, featuring Detroit engines and DT12 automated manual transmissions for improved fuel efficiency.

Report Coverage

The research report offers an in-depth analysis based on Class, Fuel, Horsepower and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electric and hybrid heavy-duty trucks will gain strong adoption due to stricter emission rules.

- Manufacturers will focus on lightweight materials to improve fuel efficiency and payload capacity.

- Autonomous driving and advanced driver-assistance systems will enhance fleet safety and reliability.

- Digital connectivity and telematics integration will become standard features for real-time monitoring.

- Hydrogen fuel cell trucks will emerge as a sustainable alternative for long-haul transport.

- Fleet electrification incentives and infrastructure development will accelerate clean mobility adoption.

- Aftermarket services and predictive maintenance solutions will see rising investment.

- Asia Pacific will continue leading global production and fleet deployment expansion.

- Partnerships between OEMs and logistics providers will strengthen digital fleet management.

- Ongoing R&D in energy storage and charging technology will redefine operational efficiency.