Market Overview:

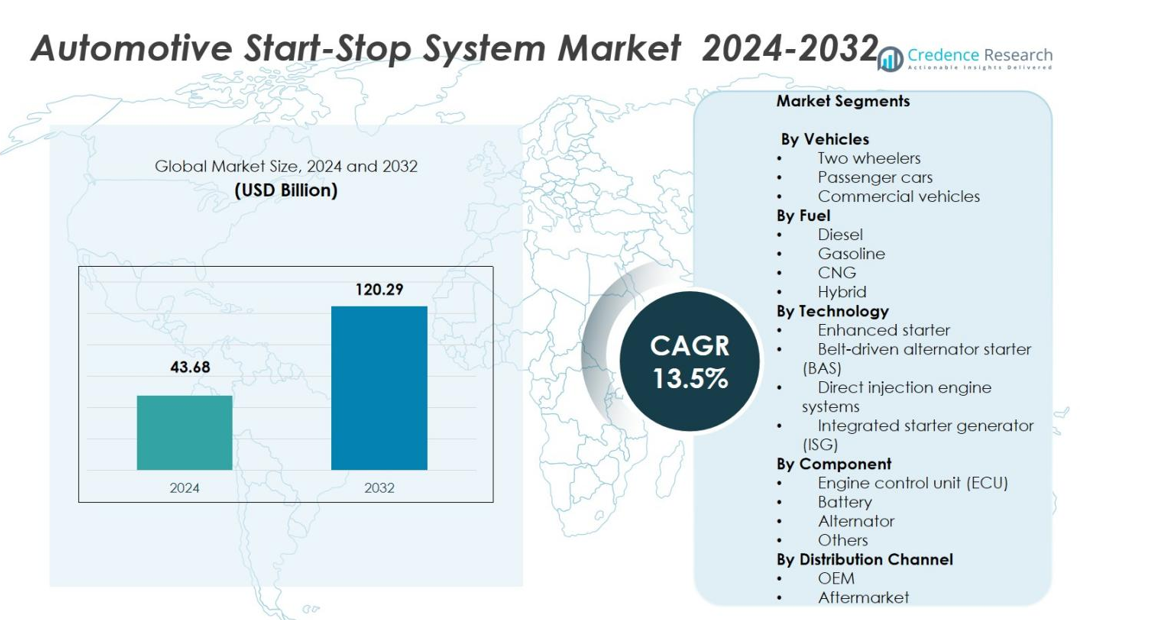

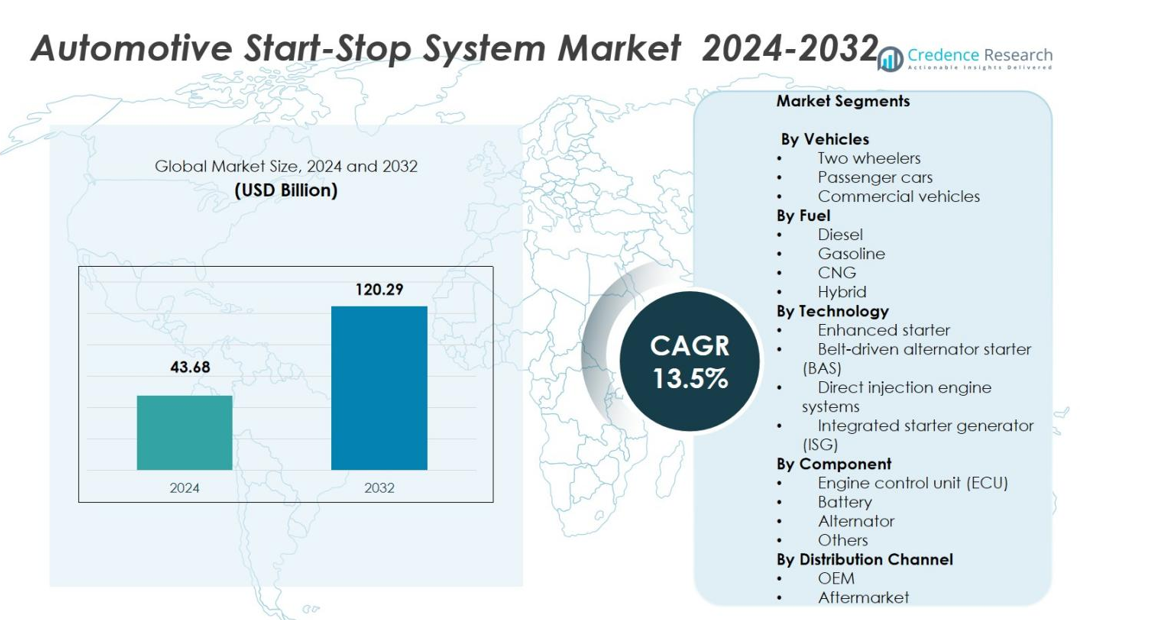

Automotive Start-Stop System Market size was valued at USD 43.68 Billion in 2024 and is anticipated to reach USD 120.29 Billion by 2032, at a CAGR of 13.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Start-Stop System Market Size 2024 |

USD 43.68 Billion |

| Automotive Start-Stop System Market, CAGR |

13.5% |

| Automotive Start-Stop System Market Size 2032 |

USD 120.29 Billion |

The Automotive Start-Stop System Market is dominated by key players such as Robert Bosch, Continental AG, Denso Corporation, ZF Friedrichshafen, Valeo, and Johnson Controls. These companies lead the market through their advanced technological innovations in fuel-efficient automotive solutions, including high-performance starters, control units, and integrated systems. The Asia-Pacific region commands the largest market share, holding 42.94% in 2024, driven by robust automotive production in countries like China, India, Japan, and South Korea. Europe follows with 34.72%, supported by stringent emissions regulations and a strong focus on hybrid vehicle adoption. North America, holding 17.8%, also contributes significantly to market growth as consumer demand for fuel-efficient vehicles increases. These regions are key to the continued growth of start-stop system adoption, driven by both regulatory pressures and evolving consumer preferences for eco-friendly, cost-efficient vehicles.

Market Insights

- The Automotive Start‑Stop System Market stood at USD 43.68 billion in 2024 and is forecast to grow at a CAGR of 13.5%.

- The passenger cars segment dominates the market, with a 58.7% share in 2024, driven by widespread adoption in compact and luxury vehicles seeking fuel efficiency and emissions reduction.

- Gasoline-powered vehicles lead by fuel type with a 53.6% share in 2024, as start‑stop systems align with efforts to reduce fuel consumption in commonly used gasoline cars.

- The belt‑driven alternator starter (BAS) technology holds a 46.4% share in 2024, favored for its simplicity and cost-effectiveness in mass-market passenger vehicles.

- Regionally, Asia-Pacific leads with a 42.94% share in 2024, followed by Europe at 34.72% and North America at 17.8%, reflecting strong automotive manufacturing base, regulatory push for emissions reduction, and rising demand for fuel-efficient vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicles

In the Automotive Start-Stop System Market, the passenger cars segment holds the dominant share, accounting for 58.7% in 2024. This high market share is driven by the growing demand for fuel efficiency and emission reduction in personal vehicles, alongside stricter government regulations on fuel consumption and CO2 emissions. The increasing adoption of start-stop technology in compact and luxury vehicles to enhance fuel economy further fuels this segment’s growth. While commercial vehicles and two-wheelers also contribute to market growth, their adoption rates remain lower compared to passenger cars.

- For instance, the Valeo i-StARS system has been used in Citroen models like the C2 and C3 since 2004, providing efficient start-stop functionality that can stop the engine while the vehicle is still moving at low speeds, thus enhancing fuel savings in urban driving.

By Fuel

The gasoline sub-segment leads the fuel segment, commanding a share of 53.6% in 2024. Gasoline engines, being widely used in passenger cars, make this sub-segment the largest in the Automotive Start-Stop System Market. The growing trend toward reducing fuel consumption and improving engine efficiency supports the demand for start-stop systems in gasoline-powered vehicles. Diesel and hybrid fuel types follow in terms of adoption, with hybrid vehicles gaining traction due to their eco-friendly nature and the increasing consumer preference for fuel-efficient technologies.

- For instance, Mazda’s Smart Idle Stop System in gasoline engines uses combustion to restart the engine within 0.35 seconds, providing quieter and quicker restarts and contributing to fuel savings

By Technology

The belt-driven alternator starter (BAS) sub-segment dominates the technology segment, holding a significant share of 46.4% in 2024. BAS technology is favored due to its simplicity, cost-effectiveness, and ability to seamlessly restart the engine without compromising fuel efficiency. It is increasingly used in passenger vehicles, where affordability and efficiency are crucial. Other technologies, such as enhanced starters and integrated starter generators (ISG), are also gaining traction in high-performance and hybrid vehicles but have a smaller share due to higher costs and complex integration processes.

Key Growth Drivers

Increasing Fuel Efficiency Demand

The growing emphasis on fuel efficiency is one of the primary drivers of the Automotive Start-Stop System Market. As consumers and manufacturers strive to reduce fuel consumption and operating costs, the adoption of start-stop systems has gained significant traction. These systems help reduce fuel consumption by automatically turning off the engine during idling and restarting it when the vehicle moves again, leading to a direct improvement in fuel economy. This demand for energy efficiency is especially prevalent in passenger vehicles, where fuel costs are a significant concern for consumers.

- For instance, Chevrolet’s Malibu features start-stop technology that uses dual 12-volt batteries to conserve energy and enable quick engine restarts without compromising cabin functions like air conditioning and audio, leading to noticeable fuel savings in stop-and-go traffic.

Stringent Environmental Regulations

Governments worldwide are implementing stricter emission and fuel consumption standards, which are driving the demand for start-stop systems in vehicles. These systems play a critical role in reducing carbon emissions and improving vehicle fuel efficiency, aligning with regulatory requirements aimed at environmental sustainability. As environmental awareness continues to grow, automakers are increasingly integrating start-stop technologies to meet emissions reduction targets and regulatory compliance, contributing to the market’s growth. This factor is especially significant in regions such as Europe and North America.

- For instance, Ford introduced start-stop technology in its popular Ford F-150 pickup truck to enhance fuel efficiency in trucks, responding to emission regulations and consumer demand.

Technological Advancements in Automotive Systems

Ongoing advancements in automotive technologies are significantly propelling the adoption of start-stop systems. Innovations such as enhanced starters, integrated starter generators (ISG), and improved battery technologies have increased the reliability and efficiency of start-stop systems. These developments have expanded the scope of start-stop technology beyond traditional gasoline engines, making it compatible with hybrid and electric vehicles as well. With more efficient systems now available, automakers are eager to implement start-stop features across a broader range of vehicle types, further accelerating market growth.

Key Trends & Opportunities

Shift Toward Hybrid and Electric Vehicles

The rise in the adoption of hybrid and electric vehicles (EVs) presents a significant opportunity for the Automotive Start-Stop System Market. As more consumers shift to eco-friendly transportation options, the integration of start-stop systems in hybrid vehicles is becoming increasingly important. These systems optimize fuel efficiency and reduce emissions, aligning perfectly with the goals of hybrid and electric vehicles. As the market for EVs continues to grow, the demand for start-stop systems will likely increase, particularly in markets where fuel efficiency and emissions reduction are critical concerns.

- For instance, Toyota’s Prius, a well-known hybrid, employs a series-parallel hybrid system with integrated start-stop technology to optimize fuel use and reduce emissions efficiently.

Aftermarket Adoption and Retrofitting

The increasing trend of retrofitting start-stop systems into older vehicles presents a new growth opportunity for the market. As consumers look for cost-effective ways to upgrade their vehicles with modern technology, aftermarket start-stop system installation has gained momentum. This trend is especially pronounced in emerging markets, where vehicle fleets are aging, and the demand for affordable fuel-saving technologies is rising. Offering start-stop systems as retrofitted options for existing vehicles could help manufacturers tap into a large untapped market and drive growth in the aftermarket segment.

- For instance, SmartStopStart modules, installed by owners on vehicles like the 2018 Cadillac XT5 and 2020 Jeep Grand Cherokee, with users reporting flawless 2-6 minute setups that eliminate unwanted engine auto-stop without dashboard warnings.

Key Challenges

High Initial Costs

One of the key challenges hindering the widespread adoption of start-stop systems is the high initial cost of the technology. The integration of these systems requires advanced components, such as enhanced starters, batteries, and control units, which can increase vehicle prices, particularly for mass-market consumers. This cost barrier is particularly challenging for emerging markets, where price sensitivity is higher. Manufacturers must focus on reducing the overall cost of these systems while maintaining their effectiveness to encourage more widespread adoption, especially in budget-conscious regions.

Battery Durability and Maintenance Issues

Start-stop systems place additional strain on vehicle batteries, as they are required to perform more frequent starts and stops. This can lead to concerns about battery durability and the need for more frequent replacements. In particular, traditional lead-acid batteries may not withstand the increased load, leading to higher maintenance costs and potentially compromising the system’s long-term reliability. The automotive industry must innovate to develop more durable battery solutions, such as advanced lithium-ion batteries, to ensure the sustainability and efficiency of start-stop systems over the lifespan of the vehicle.

Regional Analysis

Asia‑Pacific

The Asia‑Pacific region led the market in 2024, capturing a share of 42.94%. This dominance stems from a massive and growing automotive production base in countries such as China, India, Japan, and South Korea. Rising fuel prices, increasing urban congestion, and stricter emission regulations have propelled widespread adoption of start‑stop systems, especially in passenger cars and compact vehicles. In many Asia‑Pacific economies, expanding middle‑class purchasing power drives higher vehicle ownership, while favorable regulatory frameworks and growing demand for fuel efficiency boost uptake of start‑stop technologies.

Europe

Europe accounted for 34.72% of the global start‑stop system market in 2023, positioning itself as the second‑largest regional market. The region’s stringent CO₂ emissions standards and aggressive regulatory mandates compel OEMs to integrate start‑stop systems as standard equipment across many vehicle models. High environmental awareness among European consumers and a strong presence of premium and mass‑market automakers further support market penetration. The trend toward hybrid and mild‑hybrid vehicles in Europe also reinforces demand for start‑stop systems, as such technologies improve urban fuel efficiency and emissions performance.

North America

North America continues to show steady growth in the start‑stop system market, benefiting from growing consumer interest in fuel economy and stricter corporate average fuel economy (CAFE) and emission standards. Adoption has accelerated as automakers and consumers increasingly recognize the cost‑saving benefits of reduced idling fuel consumption. Technological advancements — including improved battery systems and engine control units — have enhanced system reliability, encouraging broader integration across new vehicle models. Increasing awareness of environmental impact and rising fuel costs further drive adoption among consumers seeking operational savings and greener mobility options. North America holds 17.8% of the market share in 2024.

Latin America

Latin America’s start‑stop system market is gaining traction, capturing 2.3% of the global share in 2024. Consumers increasingly demand fuel-efficient vehicles, and governments begin to enforce environmental regulations. Growing urbanization and rising fuel costs make start‑stop systems attractive for passenger cars and light commercial vehicles alike. Market growth is especially marked in countries like Brazil and Mexico, where increasing vehicle sales and consumer sensitivity to operating costs foster adoption. As OEMs expand their presence and offer start‑stop–equipped vehicles, the region presents a rising opportunity for both new car markets and retrofit demand.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for 2.3% of the market share in 2024. It is emerging as a developing market for start‑stop systems, driven by growing awareness of fuel efficiency and increasing adoption of hybrid and mild‑hybrid vehicles. Rising fuel prices in oil‑importing nations, coupled with nascent regulatory pushes toward emission reduction, encourage automakers to offer start‑stop systems even in cost‑sensitive markets. While current penetration remains lower than in developed regions, growing urbanization, expanding automotive sales, and gradual regulatory evolution suggest a rising growth trajectory for start‑stop system adoption in this region.

Market Segmentations:

By Vehicles

- Two wheelers

- Passenger cars

- Commercial vehicles

By Fuel

- Diesel

- Gasoline

- CNG

- Hybrid

By Technology

- Enhanced starter

- Belt-driven alternator starter (BAS)

- Direct injection engine systems

- Integrated starter generator (ISG)

By Component

- Engine control unit (ECU)

- Battery

- Alternator

- Others

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Automotive Start-Stop System Market is characterized by the presence of key players such as Robert Bosch, Continental AG, Denso Corporation, ZF Friedrichshafen, Valeo, and Johnson Controls. These companies dominate the market due to their strong technological expertise and extensive R&D investments in fuel-efficient automotive solutions. Bosch and Continental AG lead in offering integrated solutions that include high-performance starter motors and advanced control units, crucial for the reliability of start-stop systems. The market is also seeing increased collaboration between OEMs and suppliers, particularly for the development of hybrid and electric vehicle systems, as demand grows for cleaner, more efficient vehicles. As automakers shift towards integrating electrified powertrains, suppliers like Denso and ZF Friedrichshafen are focusing on expanding their product portfolios to include more sophisticated integrated starter generators and power electronics. Additionally, regional players in emerging markets are becoming increasingly active, enhancing competition in the aftermarket and retrofit sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Valeo

- ZF Friedrichshafen

- BorgWarner

- Johnson Controls

- Hitachi Automotive

- Magna

- Denso

- Aisin Seiki

- Robert Bosch

- Continental

Recent Developments

- In November 2025, Volvo Trucks launched a new heavy‑duty stop/start engine technology under its I‑Roll system to reduce fuel consumption and CO₂ emissions.

- In October 2024, Schaeffler completed acquisition of Vitesco Technologies, integrating their starter‑generator, power‑electronics and drivetrain software operations

Report Coverage

The research report offers an in-depth analysis based on Vehicles, Fuel, Technology, Component, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global adoption of automotive start-stop systems is expected to continue growing as fuel efficiency and emission reduction remain top priorities for consumers and manufacturers.

- Increasing government regulations and environmental policies will drive the demand for start-stop systems, particularly in regions with stringent emissions standards.

- The shift towards electric and hybrid vehicles will create new opportunities for the integration of advanced start-stop systems, enhancing their performance in electrified powertrains.

- Consumer demand for fuel-efficient and cost-effective vehicles will remain a significant growth driver, particularly in emerging markets with rising automotive ownership.

- Technological advancements in battery systems and energy management solutions will improve the reliability and efficiency of start-stop systems, fostering broader adoption.

- The growing popularity of connected and autonomous vehicles will present new applications for start-stop technology, with enhanced integration in smart vehicle systems.

- Aftermarket retrofitting of start-stop systems will see significant growth, especially in regions with large vehicle fleets and a high proportion of older vehicles.

- The increasing prevalence of mild-hybrid and hybrid vehicles in both developed and emerging markets will further propel the adoption of start-stop systems.

- Rising awareness of environmental issues and the shift towards sustainability in automotive production will encourage OEMs to integrate start-stop technologies in a broader range of vehicles.

- As automotive manufacturers focus on optimizing vehicle performance and reducing operational costs, start-stop systems will become standard in more vehicle models across various segments.