Market Overview:

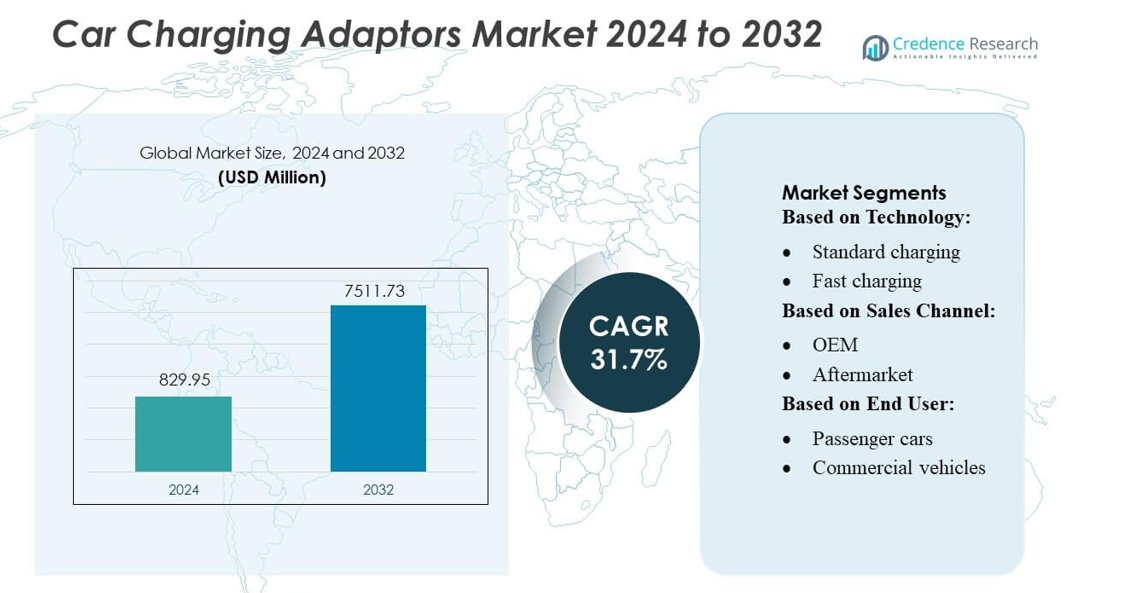

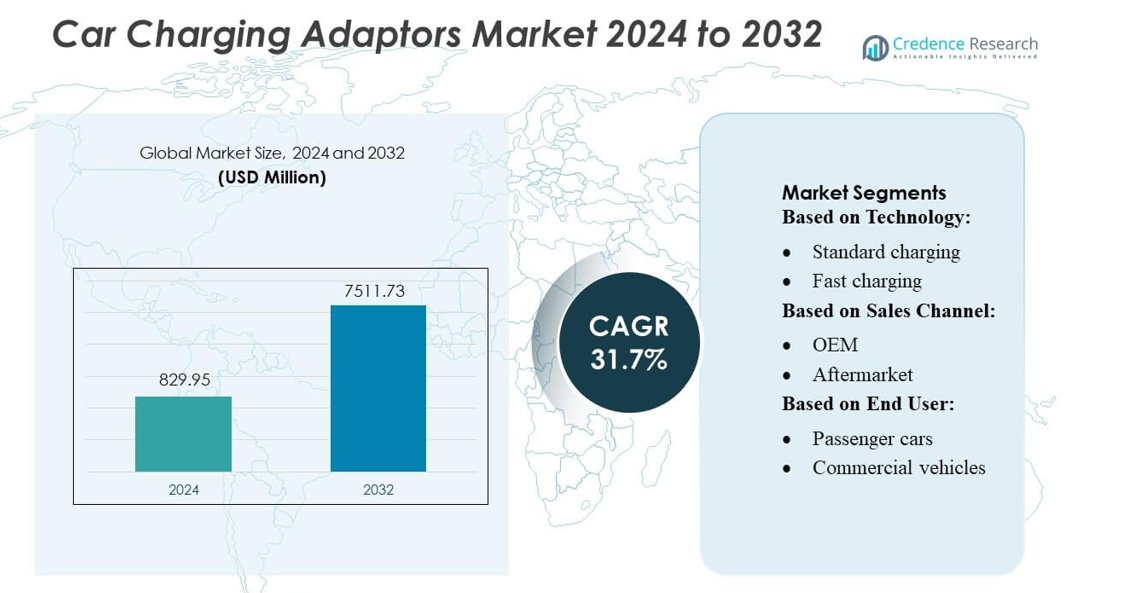

Car Charging Adaptors Market size was valued USD 829.95 million in 2024 and is anticipated to reach USD 7511.73 million by 2032, at a CAGR of 31.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Car Charging Adaptors Market Size 2024 |

USD 829.95 million |

| Car Charging Adaptors Market, CAGR |

31.7% |

| Car Charging Adaptors Market Size 2032 |

USD 7511.73 million |

The Car Charging Adaptors Market is highly competitive, with leading players including Tesla Inc., Siemens, Blink Charging Co., Eaton Corporation plc, Leviton Manufacturing Co., Inc., ABB Ltd., Schneider Electric, Webasto Group, ChargePoint, Inc., and bp pulse (Bp p.l.c.). These companies focus on developing technologically advanced solutions such as fast-charging, wireless, and smart adaptors to meet diverse EV requirements and enhance user convenience. Strategic OEM collaborations, investments in R&D, and expansion of aftermarket offerings strengthen their market positions. North America emerges as the leading region, capturing approximately 35% of the global market share, driven by strong EV adoption, extensive charging infrastructure, and supportive government incentives. The region benefits from high consumer awareness and rapid integration of innovative adaptor technologies, positioning it as the most lucrative market for both passenger and commercial electric vehicles.

Market Insights

- The Car Charging Adaptors Market size was valued at USD 829.95 million in 2024 and is anticipated to reach USD 7511.73 million by 2032, growing at a CAGR of 31.7% during the forecast period.

- Growth is driven by rising electric vehicle adoption, expanding public and private charging infrastructure, and increasing demand for fast-charging, wireless, and smart adaptor technologies.

- Key trends include the emergence of intelligent adaptors with remote monitoring, integration with renewable energy systems, and the expansion of aftermarket solutions for retrofitting older EVs.

- The market is highly competitive, with companies investing in R&D, OEM partnerships, and multi-standard adaptor development, while restraints include high costs, compatibility challenges, and limited awareness in emerging regions.

- North America leads the market with approximately 35% share, followed by Europe and Asia Pacific, while passenger vehicles dominate the end-user segment and fast-charging adaptors hold the largest share by technology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The car charging adaptors market is segmented into standard charging, fast charging, and wireless charging. Fast charging dominates the segment, accounting for approximately 55% of the market share, driven by the increasing adoption of electric vehicles (EVs) requiring reduced downtime. Rapid technological advancements in high-capacity chargers and improved thermal management systems are accelerating consumer preference for fast charging solutions. Standard charging maintains steady adoption for home and workplace use, while wireless charging is emerging, supported by innovation in contactless energy transfer systems, though its market penetration remains limited.

- For instance, Tesla offers a Supercharger V3 system capable of delivering up to 250 kW output — enabling a Tesla vehicle to gain roughly 200 miles of range in 15 minutes under optimal conditions.

By Sales Channel

Within sales channels, OEMs hold the leading position, contributing around 60% of market share, supported by strategic integration of adaptors during vehicle production. OEM channels benefit from streamlined compatibility with vehicle models and the assurance of manufacturer warranties, increasing consumer trust. Aftermarket sales, although smaller, are growing due to rising retrofitting demand and third-party adaptor availability. The segment is driven by expanding EV fleets, rising consumer awareness about charging convenience, and partnerships between adaptor manufacturers and automotive companies to improve distribution and installation support.

- For instance, Siemens recently introduced its SICHARGE FLEX system, capable of delivering between 480 kW and 1.68 MW DC power with up to 1,500 A charging current via MCS/CCS dispensers — a solution explicitly designed for OEM and fleet‑depot deployment.

By End User

Passenger cars represent the dominant end-user sub-segment, capturing roughly 70% of the market share. Growth in this segment is fueled by rising EV adoption in urban areas, government incentives, and consumer demand for home and public charging solutions. Commercial vehicles are witnessing increasing interest due to fleet electrification and logistics companies seeking efficient charging infrastructure to reduce operational downtime. Market drivers include advancements in adaptor efficiency, regulatory push for reduced emissions, and improved charging accessibility, making passenger vehicles the primary revenue contributor while commercial adoption steadily rises.

Key Growth Drivers

Rising Electric Vehicle Adoption

The rapid increase in electric vehicle (EV) adoption is a primary driver for the car charging adaptors market. Governments across regions are offering incentives and subsidies to promote EV purchases, while consumers seek convenient and compatible charging solutions. Increased EV penetration, particularly in passenger vehicles, directly boosts demand for adaptors, as users require reliable and efficient connectivity between vehicles and charging stations. Manufacturers are responding with high-capacity and fast-charging adaptors to cater to diverse EV models, enhancing overall market growth.

- For instance, Blink Charging recently announced that it has surpassed 100,000 chargers sold, deployed, or contracted globally, underscoring its large-scale deployment capacity and contribution to EV infrastructure expansion.

Expansion of Charging Infrastructure

The growing deployment of public and private charging stations is fueling market expansion. Companies and governments are investing in extensive charging networks, including highway corridors and urban centers, which increases the need for compatible adaptors. Improved infrastructure ensures seamless connectivity across different charging points, encouraging EV adoption. Technological innovations, such as modular and universal adaptors, further support infrastructure integration, making charging more convenient and accessible, while reinforcing the market’s expansion trajectory.

- For instance, Eaton — in partnership with ChargePoint — recently unveiled a modular ultrafast DC charging architecture under the “Express Grid” brand that delivers up to 600 kW for passenger EVs and scales to megawatt‑class output for heavy‑duty commercial vehicles.

Technological Advancements in Charging Solutions

Advances in charging technology, including fast and wireless charging adaptors, are driving market growth. Manufacturers are developing adaptors with enhanced thermal management, higher energy efficiency, and multi-standard compatibility to meet diverse consumer needs. Innovations like compact, portable, and intelligent adaptors with integrated safety features enhance user convenience and adoption. Continuous R&D efforts are increasing reliability and reducing charging times, positioning technology improvements as a core growth driver for the car charging adaptors market.

Key Trends & Opportunities

Emergence of Wireless and Smart Charging

Wireless and smart charging technologies are gaining traction as consumers prioritize convenience and automation. Wireless adaptors eliminate physical cable connections, offering a seamless user experience, while smart adaptors enable features like remote monitoring, load management, and predictive maintenance. These innovations create opportunities for OEMs and aftermarket players to differentiate products, attract tech-savvy customers, and capitalize on the growing demand for intelligent charging solutions in both residential and commercial sectors.

- For instance, EV48W model delivers 11.6 kW (208/240 VAC, 48 Amp) via a J1772 connector and connects via Wi‑Fi (802.11 b/g/n), enabling remote control and monitoring through the “My Leviton” app.

Aftermarket Expansion and Retrofit Solutions

The aftermarket segment is expanding due to increasing demand for retrofitting older EV models and compatibility upgrades. Consumers seek cost-effective, reliable adaptors for home and workplace use, encouraging third-party manufacturers to introduce innovative products. Strategic partnerships between adaptor makers and automotive service providers create new distribution channels and support services. This trend provides significant growth potential, as aftermarket solutions complement OEM offerings, enhancing accessibility and convenience for a broader range of EV owners.

- For instance, ABB’s A400 All‑in‑One charger can be field‑upgraded from 200 kW up to 400 kW output, delivering dynamic power sharing across dual outlets with 50 kW granularity.

Integration with Renewable Energy Systems

Integration of adaptors with renewable energy sources, such as solar-powered home charging stations, is emerging as a key opportunity. Eco-conscious consumers and businesses are adopting green charging solutions to reduce carbon footprints and electricity costs. Adaptors capable of interfacing with photovoltaic systems, energy storage, and smart grids enhance efficiency and appeal. This trend aligns with global sustainability goals, driving demand for innovative adaptors while opening opportunities for companies to differentiate through eco-friendly and energy-efficient offerings.

Key Challenges

Compatibility and Standardization Issues

Lack of universal standards across EV models and charging infrastructures remains a significant challenge. Varying connector types, voltage levels, and communication protocols require multiple adaptor designs, complicating manufacturing and increasing costs. Consumers often face difficulties in selecting compatible adaptors, leading to lower adoption rates for third-party solutions. Manufacturers must invest in R&D to ensure interoperability, while industry-wide standardization remains critical to overcome these barriers and enable seamless EV charging experiences.

High Costs and Limited Awareness

The high upfront cost of advanced adaptors, particularly fast and wireless variants, limits widespread adoption. Additionally, limited consumer awareness about product features, compatibility, and benefits affects market penetration. Many EV owners remain unaware of the advantages of upgrading to high-performance adaptors, while cost-sensitive users opt for basic solutions. Companies need to focus on pricing strategies, education campaigns, and value-added services to increase market acceptance and overcome financial and knowledge barriers.

Regional Analysis

North America

North America leads the car charging adaptors market with an estimated 35% share. Strong EV adoption in the U.S. and Canada, combined with extensive public and private charging infrastructure, drives demand. Fast-charging and smart adaptors are highly preferred due to technological advancements and convenience. Government incentives, such as tax credits and grants for charging networks, further accelerate adoption. OEM partnerships with infrastructure providers enhance accessibility, while aftermarket solutions cater to urban EV owners seeking flexible charging options. The region remains a hub for innovation, supporting both passenger and commercial EV segments.

Europe

Europe accounts for approximately 30% of the market, led by Germany, Norway, and France. The region benefits from stringent emission regulations, government subsidies, and expanding EV charging infrastructure. Both passenger and commercial EV segments drive demand for compatible adaptors, including fast and wireless charging solutions. OEM-led integration and aftermarket adoption further strengthen the market. Technological innovations such as universal adaptors and smart connectivity features enhance convenience and adoption. Rising fleet electrification and urban EV initiatives support sustained growth, making Europe a highly competitive and advanced region for charging adaptor deployment.

Asia Pacific

Asia Pacific holds roughly 25% of the market, with China, Japan, and South Korea leading adoption. Rapid urbanization, increasing EV sales, and government incentives accelerate demand for car charging adaptors. OEMs integrate adaptors into EV production, while aftermarket solutions support retrofitting older models. Investments in public charging infrastructure and renewable energy-based charging solutions are significant growth drivers. Consumer awareness of fast and wireless charging technologies is increasing, and innovations in portable, multi-standard adaptors enhance accessibility. The region is emerging as a key growth hub for both passenger cars and commercial vehicles.

Latin America

Latin America captures an estimated 6% of the global market, driven by gradual EV adoption in countries such as Brazil and Chile. Government initiatives promoting sustainable transportation and pilot projects for public charging stations are creating demand. Market growth is constrained by high adaptor costs, limited charging infrastructure, and inconsistent regulatory frameworks. However, aftermarket solutions and partnerships between global OEMs and local energy providers present opportunities. Increasing awareness of environmental sustainability and urban EV adoption is expected to drive incremental growth in passenger and commercial vehicle segments over the coming years.

Middle East & Africa

The Middle East & Africa region accounts for around 4% of the market. EV adoption is in its early stages, with growth primarily in urban centers and high-income regions such as the UAE and South Africa. Investment in charging infrastructure and renewable energy-powered solutions supports gradual market development. Challenges include limited standardization, high costs, and low consumer awareness. Nevertheless, strategic partnerships, pilot projects, and government-backed incentives are creating opportunities for both OEM and aftermarket adaptor sales, targeting passenger cars and commercial EV fleets. Sustainable mobility initiatives are expected to drive long-term market expansion.

Market Segmentations:

By Technology:

- Standard charging

- Fast charging

By Sales Channel:

By End User:

- Passenger cars

- Commercial vehicles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Car Charging Adaptors Market is highly competitive, with key players including Tesla Inc., Siemens, Blink Charging Co., Eaton Corporation plc, Leviton Manufacturing Co., Inc., ABB Ltd., Schneider Electric, Webasto Group, ChargePoint, Inc., and bp pulse (Bp p.l.c.). The Car Charging Adaptors Market is highly competitive and characterized by rapid technological innovation and product differentiation. Companies are focusing on developing advanced adaptors, including fast-charging, wireless, and smart solutions, to meet the growing demands of diverse EV models and consumer segments. Strategic partnerships with OEMs, investments in R&D, and expansion of aftermarket offerings enhance market presence and ensure compatibility with evolving charging infrastructure. Competitive factors include product efficiency, multi-standard connectivity, safety features, and pricing strategies. Companies that can rapidly adapt to regulatory changes, innovate in user-friendly technologies, and expand regional distribution networks are best positioned to capture market share and drive revenue growth across passenger and commercial vehicle segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tesla Inc.

- Siemens

- Blink Charging Co.

- Eaton Corporation plc

- Leviton Manufacturing Co., Inc.

- ABB Ltd.

- Schneider Electric

- Webasto Group

- ChargePoint, Inc.

- bp pulse (Bp p.l.c.)

Recent Developments

- In October 2025, Siemens unveiled SICHARGE FLEX, a megawatt-era DC charging system delivering 480 kW-1.68 MW with dynamic power distribution and modular dispensers, designed for highway and depot use, enabling ultra-fast, multi-vehicle charging and supporting large fleet electrification projects; pilot order announced with OMV.

- In May 2025, Navitas Semiconductor formally announced their collaboration with NVIDIA to develop an 800 V HVDC architecture for next-generation data centers with the primary press release.

- In May 2025, Eaton and ChargePoint formalized an industry-first partnership to streamline EV charging project design, procurement, and deployment, bundling Eaton power gear, site services, and ChargePoint chargers as turnkey offerings to reduce cost and time-to-deploy.

- In February 2023, ChargePoint and Fisker partnered to provide Fisker Ocean drivers with seamless access to public charging stations through the ChargePoint network. This agreement integrates ChargePoint’s extensive network into the Fisker Ocean’s system, allowing drivers to easily locate and use charging facilities, and improving the overall charging experience for new electric vehicle owners

Report Coverage

The research report offers an in-depth analysis based on Technology, Sales Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Electric vehicle adoption is expected to continue rising, driving increased demand for compatible charging adaptors.

- Fast-charging and wireless adaptors will gain higher acceptance due to convenience and reduced charging time.

- Expansion of public and private charging infrastructure will create new opportunities for adaptor manufacturers.

- Integration of smart and connected technologies in adaptors will enhance user experience and monitoring capabilities.

- Aftermarket solutions will grow as consumers seek retrofitting options for existing EVs.

- Renewable energy-powered charging systems will support sustainable and eco-friendly adaptor adoption.

- Standardization of connector types and protocols will improve interoperability across regions.

- Commercial vehicle electrification will increase demand for high-capacity and durable adaptors.

- Technological innovation, including portable and multi-standard adaptors, will remain a key growth driver.

- Regional expansion into emerging markets will create long-term opportunities for market penetration.