Market Overview

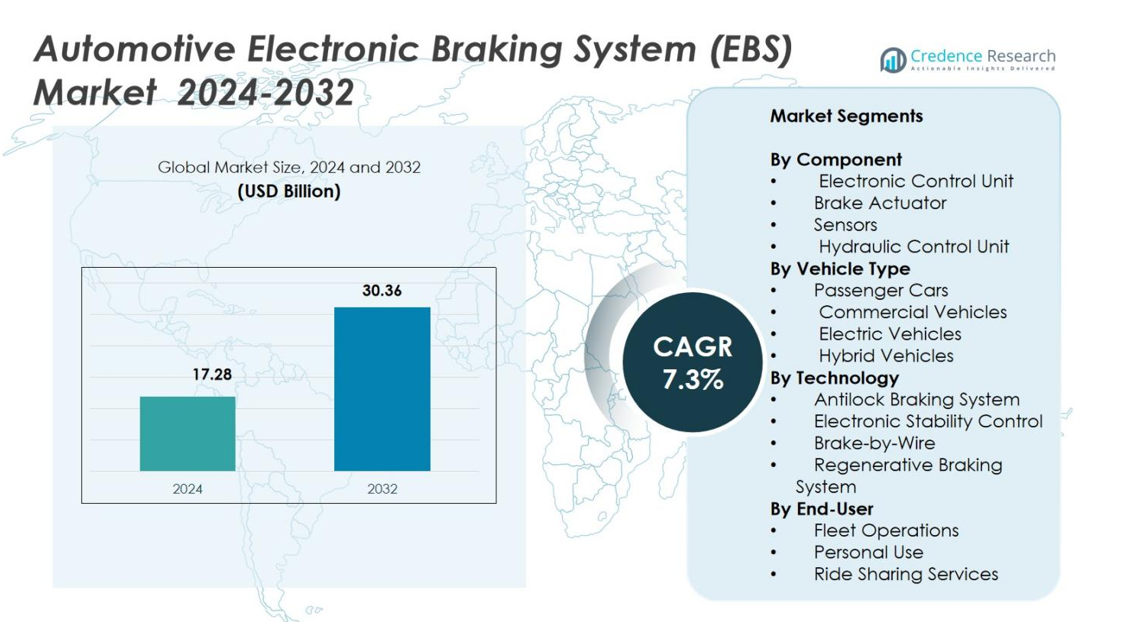

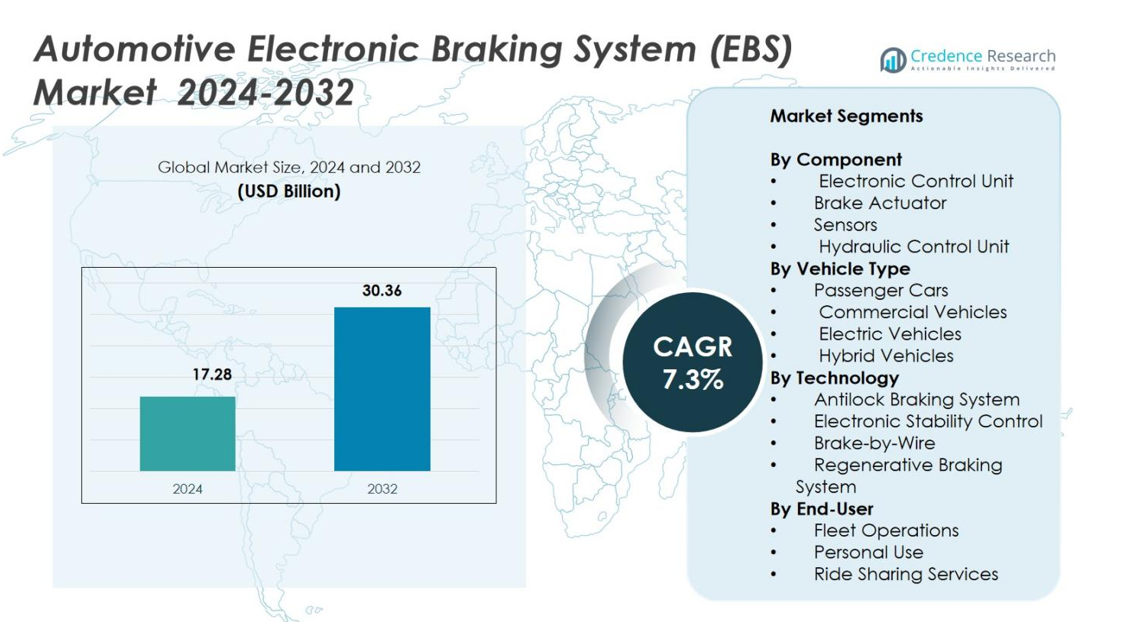

Automotive Electronic Braking System (EBS) Market size was valued at USD 17.28 Billion in 2024 and is anticipated to reach USD 30.36 Billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Electronic Braking System (EBS) Market Size 2024 |

USD 17.28 Billion |

| Automotive Electronic Braking System (EBS) Market, CAGR |

7.3% |

| Automotive Electronic Braking System (EBS) Market Size 2032 |

USD 30.36 Billion |

Automotive Electronic Braking System (EBS) Market is driven by major players such as Knorr-Bremse, TMD Friction, WABCO, ZF Friedrichshafen, Hitachi Automotive Systems, Mando Corporation, Continental, TRW Automotive, Robert Bosch, and DENSO, all of whom focus on advancing ABS, ESC, brake-by-wire, and regenerative braking technologies. These companies strengthen market expansion through strategic OEM collaborations, product innovation, and the integration of intelligent braking electronics. Asia-Pacific leads the global market with a 34.9% share, followed by Europe at 31.7% and North America at 28.4%, reflecting strong safety regulations, rapid EV adoption, and sustained technological advancements across regional automotive industries.

Market Insights

- Automotive Electronic Braking System (EBS) Market reached USD 17.28 Billion in 2024 and is expected to grow at a CAGR of 7.3% through 2032.

- Rising demand is driven by ADAS integration, increased adoption of brake-by-wire, and strong installation of ABS and ESC systems across passenger cars, which held a 46.2% share in 2024.

- Key trends include growing use of regenerative braking in EVs and wider deployment of AI-enabled smart diagnostics that enhance reliability and reduce maintenance downtime.

- Leading players such as Knorr-Bremse, WABCO, ZF Friedrichshafen, Bosch, and Continental expand market presence through electronic actuation innovations and partnerships with global automakers.

- Asia-Pacific dominated with a 34.9% share, followed by Europe at 31.7% and North America at 28.4%, supported by stringent safety regulations, rising EV volumes, and strong OEM adoption of advanced braking technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Component

The Automotive Electronic Braking System (EBS) Market is led by the Electronic Control Unit (ECU) segment, holding a 38.6% share in 2024, driven by its central role in coordinating braking functions, optimizing pressure distribution, and integrating advanced driver-assistance systems. Brake actuators accounted for 27.4% due to rising demand for precise brake force control in premium vehicles. Sensors contributed 21.3% as OEMs increasingly adopt real-time monitoring elements for improved safety. The Hydraulic Control Unit captured 12.7%, supported by its essential function in modulating hydraulic pressure for smooth, responsive braking performance across vehicle categories.

- For instance, ZF offers an EBS for commercial vehicles that according to its 2022 factsheet supports full-electric and hybrid-driven trucks by integrating brake control functions with diagnostics and stability control, ensuring reliable performance even under heavy load or electric-powertrain conditions.

By Vehicle Type

Passenger Cars dominated the Automotive Electronic Braking System (EBS) Market with a 46.2% share in 2024, driven by rising installation of ADAS, stricter global safety standards, and increasing adoption of premium braking technologies in mid-range models. Commercial vehicles held 28.9% as fleets prioritize braking reliability and load-adaptive control systems. Electric vehicles accounted for 15.7%, supported by strong integration of regenerative and brake-by-wire systems. Hybrid vehicles captured 9.2% as manufacturers focus on optimizing energy recovery and braking efficiency to enhance overall vehicle performance.

- For instance, Robert Bosch GmbH tested a hydraulic brake-by-wire system over a 2,050-mile public-road trip through diverse climates including to the Arctic Circle and confirmed that the system works reliably under real-world conditions.

By Technology

The Antilock Braking System (ABS) segment held the largest 41.5% share in 2024, driven by regulatory mandates, rising consumer safety preferences, and widespread deployment across passenger and commercial vehicles. Electronic Stability Control accounted for 29.1%, supported by its critical role in rollover prevention and traction management. Regenerative Braking Systems held 16.8% as EV and hybrid adoption accelerates and manufacturers optimize energy recapture efficiency. Brake-by-Wire captured 12.6%, driven by advancements in electronic actuation, reduced mechanical complexity, and increasing integration into next-generation autonomous and electrified vehicle platforms.

Key Growth Drivers

Rising Adoption of ADAS and Vehicle Safety Technologies

The Automotive Electronic Braking System (EBS) Market experiences strong growth as automakers integrate advanced driver-assistance systems to meet global safety regulations and consumer expectations. EBS enables precise brake modulation, shorter stopping distances, and improved stability, making it essential for technologies like autonomous emergency braking, lane-keeping assist, and adaptive cruise control. Increasing focus on reducing road fatalities and enhancing vehicle performance accelerates OEM demand. Regulatory mandates across Europe, North America, and Asia further reinforce the widespread deployment of EBS across passenger and commercial vehicles.

- For instance, Continental reported that its MK C2 brake-by-wire system enabled up to 30% faster pressure build-up, improving AEB performance in next-generation vehicles.

Electrification of Vehicles and Integration of Regenerative Braking

The surge in electric and hybrid vehicle production significantly boosts EBS adoption, as regenerative braking systems rely heavily on electronic control for efficient energy recovery. EBS enhances braking coordination between mechanical and electric systems, optimizing battery charging and overall vehicle efficiency. Governments worldwide support EV adoption through subsidies and emission regulations, encouraging OEMs to upgrade braking architectures. As EV platforms shift to fully electronic actuation and brake-by-wire systems, EBS becomes a core enabling technology, driving long-term market expansion across global automotive segments.

- For instance, ZF introduced a purely electric brake-by-wire system eliminating hydraulic fluid, aligning with next-generation EV architectures.

Increasing Demand for Brake-by-Wire and Advanced Electronic Actuation

The transition from mechanical to electronic braking architectures drives EBS market growth, supported by automakers’ pursuit of lighter, more efficient, and digitally controlled systems. Brake-by-wire technology eliminates traditional hydraulic components, enhancing responsiveness and supporting autonomous driving capabilities. EBS plays a central role in ensuring system redundancy, real-time pressure control, and seamless integration with smart vehicle electronics. As manufacturers prioritize modular, software-driven vehicle platforms, EBS emerges as a foundational component enabling enhanced performance, reduced maintenance, and improved energy efficiency.

Key Trends & Opportunities

Integration of AI, Predictive Analytics, and Smart Diagnostics

A major trend shaping the Automotive Electronic Braking System (EBS) Market is the integration of AI-driven predictive maintenance and diagnostic capabilities. Advanced sensors and software analytics enable continuous monitoring of brake performance, component wear, and thermal load, reducing system failures and enhancing safety. OEMs increasingly deploy cloud-connected braking systems to support over-the-air updates and real-time error correction. This trend presents significant opportunities for suppliers offering intelligent EBS modules, digital twin modeling, and data-driven braking optimization, particularly as vehicles become increasingly autonomous and connected.

- For instance, Bosch confirmed in 2024 that its Connected Brake System infrastructure integrates OTA software calibration and cloud analytics to support autonomous driving functions.

Growing Demand for Lightweight, Energy-Efficient Braking Architectures

The shift toward lightweight vehicle platforms and improved energy efficiency opens new opportunities for innovative EBS solutions. Automakers are adopting compact actuators, reduced-friction braking components, and integrated electronic units to improve vehicle range and reduce emissions. Lightweight EBS components support the growing EV segment by enhancing battery performance and lowering energy consumption during braking cycles. This trend encourages materials innovation, modular product design, and integrated thermal management systems, creating strong opportunities for suppliers focusing on next-generation braking technologies aligned with sustainability goals.

Key Challenges

High System Cost and Complex Integration Requirements

The implementation of advanced EBS technologies presents a key challenge due to high component costs, expensive electronic architecture integration, and the need for precise calibration. OEMs face additional investment in software development, testing, and validation to ensure reliability across diverse driving conditions. These cost pressures affect adoption in low- and mid-priced vehicles, slowing penetration in price-sensitive markets. Additionally, integrating EBS with multiple vehicle subsystems—such as ADAS, powertrains, and steering—requires significant engineering expertise and creates potential delays in product development cycles.

Cybersecurity Risks and Reliability Concerns in Electronic Systems

As braking systems become increasingly electronic and connected, cybersecurity threats pose a significant challenge to the Automotive Electronic Braking System (EBS) Market. Unauthorized access or system interference can compromise braking performance, creating serious safety risks. Manufacturers must invest heavily in encryption, secure communication protocols, and real-time monitoring to protect against cyberattacks. Reliability concerns also arise from software bugs, sensor failures, and electronic malfunction under extreme conditions. Ensuring fail-safe redundancy and meeting stringent regulatory standards adds complexity, increasing development time and operational costs for OEMs and suppliers.

Regional Analysis

North America

North America held a 28.4% share of the Automotive Electronic Braking System (EBS) Market in 2024, supported by strong adoption of ADAS-equipped vehicles and stringent safety regulations enforced by NHTSA and Transport Canada. The region benefits from high penetration of premium passenger cars and technologically advanced commercial fleets that rely on ABS, ESC, and brake-by-wire systems. Growing EV sales in the U.S. and Canada further accelerate EBS integration, especially with regenerative braking platforms. Continuous investments by leading OEMs and suppliers in digital braking technologies reinforce North America’s position as a key innovation-driven market.

Europe

Europe accounted for a 31.7% share of the Automotive Electronic Braking System (EBS) Market in 2024, driven by stringent Euro NCAP safety mandates and early adoption of advanced braking technologies. The presence of major automakers and Tier-1 suppliers strengthens technological development across ABS, ESC, and regenerative braking systems. High EV penetration, supported by government incentives and emission regulations, boosts EBS deployment across new vehicle models. Germany, France, and the U.K. lead regional demand as manufacturers increasingly integrate brake-by-wire and predictive braking technologies into next-generation autonomous and electrified vehicle platforms.

Asia-Pacific

Asia-Pacific dominated the market with a 34.9% share in 2024, driven by large-scale automotive production, rising vehicle safety awareness, and expanding EV adoption in China, Japan, and South Korea. The region benefits from cost-efficient manufacturing ecosystems and strong government initiatives supporting smart mobility and stringent braking safety standards. Growing demand for passenger cars and commercial vehicles equipped with ABS, ESC, and regenerative braking systems accelerates EBS penetration. Local OEMs increasingly collaborate with global suppliers to integrate electronic braking architectures, solidifying Asia-Pacific’s role as the fastest-growing and largest contributor to EBS demand.

Latin America

Latin America captured a 2.8% share of the Automotive Electronic Braking System (EBS) Market in 2024, supported by increasing adoption of ABS and ESC in mid-range passenger vehicles. Countries such as Brazil and Mexico are strengthening vehicle safety regulations, encouraging OEMs to integrate advanced electronic braking systems. Growth in commercial vehicle fleets and rising investment in manufacturing facilities further boost market demand. However, cost sensitivity and limited EV penetration slow the integration of advanced technologies like brake-by-wire. Continued upgrades in automotive safety standards are expected to drive gradual EBS expansion across the region.

Middle East & Africa

The Middle East & Africa region held a 2.2% share in 2024, influenced by growing demand for commercial vehicles and improved enforcement of safety standards in key markets such as the UAE, Saudi Arabia, and South Africa. Expansion of construction, logistics, and industrial transport sectors supports the adoption of ABS and ESC systems. Although EBS integration remains limited in entry-level vehicles, rising imports of premium passenger cars and electrified models accelerates market growth. Infrastructure development, coupled with gradual regulatory alignment with global safety norms, is expected to enhance the region’s long-term demand for electronic braking solutions.

Market Segmentations

By Component

- Electronic Control Unit

- Brake Actuator

- Sensors

- Hydraulic Control Unit

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

- Hybrid Vehicles

By Technology

- Antilock Braking System

- Electronic Stability Control

- Brake-by-Wire

- Regenerative Braking System

By End-User

- Fleet Operations

- Personal Use

- Ride Sharing Services

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Automotive Electronic Braking System (EBS) Market is shaped by leading players such as Knorr-Bremse, TMD Friction, WABCO, ZF Friedrichshafen, Hitachi Automotive Systems, Mando Corporation, Continental, TRW Automotive, Robert Bosch, and DENSO. These companies strengthen their market presence through continuous innovation in ABS, ESC, brake-by-wire, and regenerative braking technologies to meet evolving vehicle safety and electrification requirements. Manufacturers invest heavily in R&D to enhance system precision, software integration, and real-time control capabilities. Strategic partnerships with OEMs, expansion into EV braking platforms, and development of lightweight, energy-efficient components further reinforce competitive positioning. Companies also focus on global production footprint optimization and advanced sensor integration to support next-generation autonomous mobility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Knorr-Bremse

- TMD Friction

- WABCO

- ZF Friedrichshafen

- Hitachi Automotive Systems

- Mando Corporation

- Continental

- TRW Automotive

- Robert Bosch

- DENSO

Recent Developments

- In April 2024, Robert Bosch GmbH debuted its Electronic Braking System (EBS) for commercial vehicles at Auto China in Beijing, with the locally developed system under validation by China’s first-tier OEMs and scheduled for volume production by the end of 2024.

- In March 2024, Trucknow Technology’s self-developed Electronic Braking System (EBS) for commercial vehicles successfully passed all customer test items in China, marking its formal acceptance for commercial deployment.

Report Coverage

The research report offers an in-depth analysis based on Component, Vehicle Type, Technology, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Automotive Electronic Braking System (EBS) Market will expand rapidly as OEMs accelerate adoption of advanced braking technologies across all vehicle segments.

- Integration of brake-by-wire will increase as manufacturers shift toward fully electronic and autonomous-ready braking platforms.

- Regenerative braking systems will gain stronger penetration with rising EV and hybrid vehicle production globally.

- AI-driven predictive maintenance and smart diagnostics will enhance braking efficiency and reduce system downtime.

- Lightweight and energy-efficient braking components will become a priority to improve EV range and vehicle sustainability.

- Global safety regulations will continue to drive mandatory deployment of ABS, ESC, and other electronic braking technologies.

- Increased collaboration between OEMs and Tier-1 suppliers will accelerate innovation in high-performance braking architectures.

- Adoption of cloud-connected braking systems will rise to support real-time updates and enhanced vehicle monitoring.

- Emerging markets will experience higher EBS integration as safety awareness and regulatory enforcement strengthen.

- Autonomous mobility development will push demand for advanced, redundant, and highly reliable EBS solutions.