Market Overview

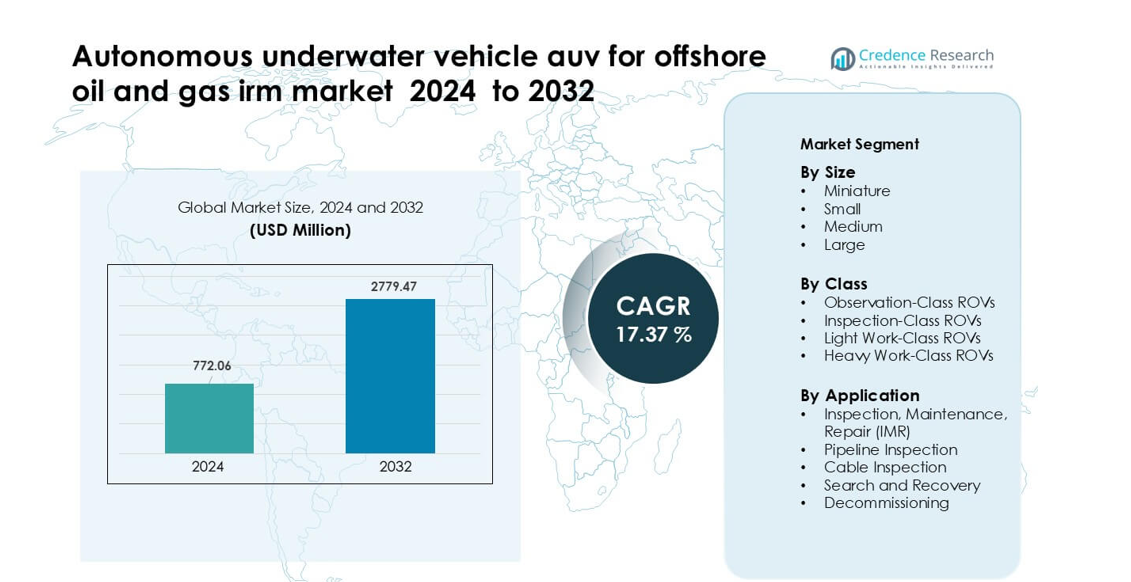

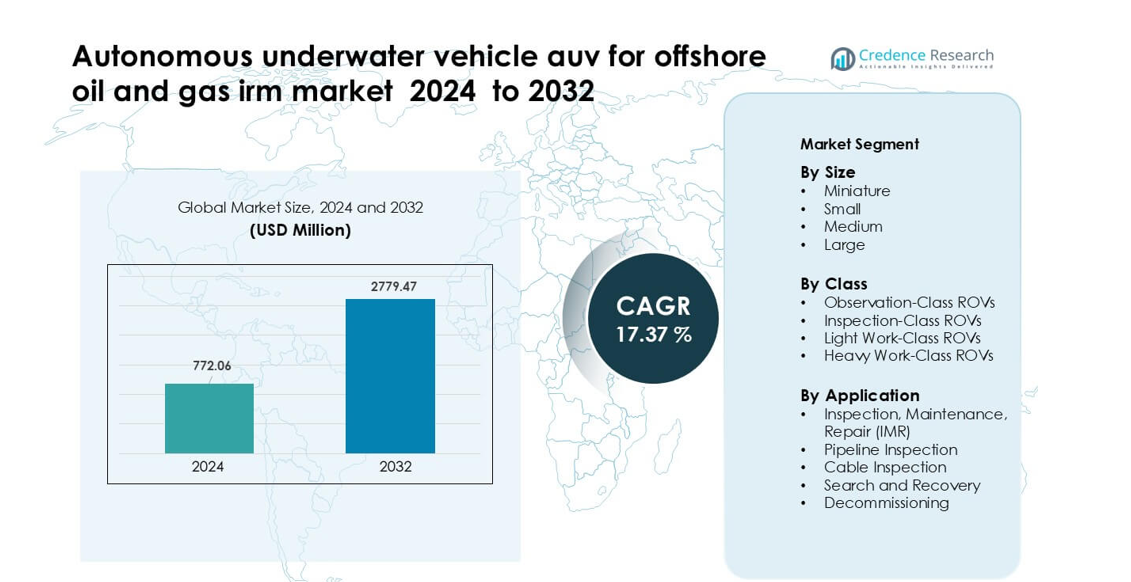

Autonomous underwater vehicle (AUV) for offshore oil and gas IRM market was valued at USD 772.06 million in 2024 and is anticipated to reach USD 2779.47million by 2032, growing at a CAGR of 17.37 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Autonomous Underwater Vehicle (AUV) for Offshore Oil and Gas IRM Market Size 2024 |

USD 772.06 million |

| Autonomous Underwater Vehicle (AUV) for Offshore Oil and Gas IRM Market, CAGR |

17.37% |

| Autonomous Underwater Vehicle (AUV) for Offshore Oil and Gas IRM Market Size 2032 |

USD 2779.47million |

The autonomous underwater vehicle market for offshore oil and gas IMR operations is shaped by major players including TechnipFMC, Bluestream, Sapura Energy Berhad, Schlumberger, Petrofac, Fugro, Oceaneering International, Starke Marine, James Fisher and Sons plc, and Boskalis. These companies strengthened their portfolios with long-endurance AUVs, advanced sonar suites, and AI-enabled inspection tools to support deepwater field integrity work. North America emerged as the leading region in 2024, holding about 34% share due to strong offshore activity in the U.S. Gulf of Mexico and rapid adoption of autonomous subsea monitoring systems across mature deepwater assets.

Market Insights

- The global AUV for offshore oil and gas IRM market is projected to grow from USD 772.06 million in 2024 to USD 2779.47 million by 2032, at a CAGR of 17.37 %.

- A key driver for market growth is increased demand for deepwater inspection and maintenance as aging offshore infrastructure requires more frequent IMR interventions.

- Trends include rising adoption of AI-enabled mission planning and increased use of hybrid AUV/ROV systems to boost operational efficiency and reduce vessel dependence.

- Competitive pressure remains a restraint as high initial procurement cost and complex integration with existing subsea operations slow adoption in some markets.

- Regionally, Asia Pacific led with a ~45.08 % share in 2024, while the small-sized vehicle segment dominated the size-based categorization, reflecting preference for compact systems in shallow and mid-depth inspections.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Size

Small AUVs led the size segment in 2024 with about 41% share. Energy operators used small systems for routine subsea scans because these models balance long endurance with easy deployment from smaller vessels. Demand stayed strong as offshore teams relied on compact platforms to reduce launch time and cut operational cost during shallow and mid-depth inspection tasks. Miniature AUVs saw wider use in confined zones, while medium and large units supported deepwater surveys. Growth in the leading small category came from higher fleet renewal and rising IMR work across mature offshore fields.

- For instance, Teledyne’s Gavia AUV, a compact model, has a diameter of just 200 mm and when configured with two 1.5 kWh battery modules can sustain about 7–8 hours of endurance at 3 knots, enabling efficient inspection missions.

By Class

Inspection-class ROVs dominated the class segment in 2024 with nearly 44% share. Offshore operators favored these units because the class delivers stable maneuvering, clear imaging, and reliable operation around complex subsea assets. The class supported frequent valve checks, anode surveys, and structural assessments across FPSOs and fixed platforms. Observation-class systems expanded for quick visual checks, while light and heavy work-class ROVs addressed tasks needing mechanical force. Growth in the leading inspection-class came from safety rules, denser field layouts, and rising demand for precise digital inspection logs.

- For instance, the Oceanbotics SRV‑8, an observation/inspection-class ROV, is rated to 305 m depth, features 8 brushless DC thrusters giving six‑degree-of-freedom control, and offers up to 6 hours of operation on dual hot-swappable batteries.

By Application

Inspection, Maintenance, and Repair (IMR) held the dominant share in 2024 with about 52%. Offshore operators relied on AUVs for these tasks because IMR cycles increased as wells aged and subsea systems expanded across deeper zones. AUVs reduced diver risk and helped teams complete routine scans with higher repeatability. Pipeline and cable inspection grew with new tie-backs and power-from-shore links, while search-and-recovery and decommissioning needs rose in selective areas. Growth in the leading IMR category came from stricter uptime targets and continuous monitoring needs across global offshore assets.

Key Growth Drivers

Rising Demand for High-Frequency IMR Operations

Growing offshore asset aging pushed operators to conduct more frequent inspection, maintenance, and repair cycles across wells, risers, manifolds, and flowlines. Autonomous underwater vehicles helped operators reduce diver exposure, complete repeatable surveys, and maintain higher uptime across complex subsea layouts. AUVs also delivered consistent data quality for corrosion tracking, fatigue checks, and structural mapping, improving long-term maintenance planning. Increased field complexity in deepwater regions such as the U.S. Gulf and Brazil further strengthened adoption because AUVs offered longer endurance and lower launch needs than crew-intensive ROV methods. This shift created strong demand for modular AUV fleets that support rapid deployment, scalable mission profiles, and lower lifecycle cost.

- For instance, Kongsberg Maritime’s HUGIN 6000 AUV, rated to 6,000 m depth, can run up to 60 hours on its battery energy store, enabling long-duration inspection missions in deepwater fields without frequent recovery.

Expansion of Deepwater and Ultra-Deepwater Projects

Major oil companies increased investment in deepwater and ultra-deepwater fields as these projects delivered stable output and long reserve cycles. AUVs became essential for these environments because they operated efficiently beyond 1,000 meters where strong currents, low visibility, and complex terrain challenged traditional ROVs. Advanced navigation systems, Doppler velocity logs, and synthetic aperture sonar improved terrain mapping and anomaly detection across wide seabed areas. Nations expanding subsea production clusters—such as Norway, Angola, and Guyana relied on AUVs to optimize field layout, inspect long-distance pipelines, and maintain remote infrastructure. The greater focus on deepwater resilience and cost optimization boosted AUV use for long-range scouting missions and continuous asset monitoring.

- For instance, Kongsberg Maritime’s HUGIN Endurance AUV designed for ultra‑deep operations has a 6,000 m depth rating and can sustain missions for up to 15 days, covering a range of 2,200 km even when launched without a dedicated mothership.

Shift Toward Digital Twins and Predictive Maintenance

The industry accelerated adoption of digital twins, predictive modeling, and real-time condition monitoring across subsea assets. AUVs provided the high-resolution data needed for these models, using multi-beam sonar, HD imaging, and advanced analytics to deliver accurate structural profiles. Oil and gas operators used this data to predict failures earlier, reduce unplanned shutdowns, and plan interventions more efficiently. The integration of AUV-generated datasets into cloud platforms enhanced automated fault detection and improved long-term reliability planning. As digital twins became central to asset integrity management, AUVs gained importance as continuous, scalable, and cost-effective data collection platforms supporting remote and autonomous subsea operations.

Key Trend & Opportunity

Growing Use of Hybrid AUV/ROV Systems

Offshore operations moved toward hybrid systems that combine AUV autonomy with the precision of ROV tooling. These platforms enabled operators to perform inspection runs autonomously and then switch to intervention tasks without deploying separate assets. Growth in hybrid architectures created an opportunity for suppliers to integrate high-thrust propulsion, smarter manipulators, and adaptive mission planning software. Energy companies used hybrid units to reduce vessel days, optimize crew size, and perform multi-stage missions in deeper or more hazardous zones. As field layouts became more complex, hybrid vehicles offered a strategic advantage by reducing downtime and supporting seamless inspection-to-intervention workflows.

- For instance, Saab Seaeye’s Sabertooth hybrid AUV/ROV can operate at depths up to 3,000 m in double-hull form and switch between tethered (ROV) and untethered (AUV) modes, giving a single system both endurance and precise control

Rapid Adoption of AI-Driven Mission Planning

Artificial intelligence enhanced AUV navigation, path optimization, object recognition, and multi-vehicle coordination. Operators used AI to automate survey routes, adjust speed based on terrain, and detect anomalies such as coating damage or leak signatures. This enabled faster mission turnaround and better data accuracy during long-range surveys. Vendors gained significant opportunity by offering AI-based analytics suites that process large volumes of imaging and sonar data in real time. The push for autonomous subsea logistics including swarm operations and coordinated pipeline monitoring opened new growth avenues for AUV manufacturers focused on algorithm development and onboard processing upgrades.

- For instance, Beam (formed by the merger of Rovco and Vaarst) deployed an AI-powered AUV to inspect the jacket structures at the Seagreen Offshore Wind Farm; this vehicle completed a full inspection of a foundation submerged 58 m underwater in a single day, using edge AI to make real-time navigation and anomaly-detection decisions

Increasing Integration with Subsea Docking and Charging Stations

Oil and gas companies expanded trials of subsea docking stations that allow AUVs to recharge, transfer data, and upload new missions without surface support. This shift enabled continuous monitoring of pipelines, umbilicals, and wellheads. Long-endurance AUVs supported persistent “resident AUV” concepts where units stay underwater for weeks or months. Vendors found strong opportunity in developing standardized docking interfaces, inductive power transfer mechanisms, and corrosion-resistant housing materials. As offshore operators prioritized remote operations and vessel cost reduction, subsea docking infrastructure emerged as a key enabler for long-term autonomous surveillance.

Key Challenge

High Initial Procurement and Integration Costs

AUV systems involve advanced hardware, high-bandwidth sensors, custom payload modules, and robust pressure-resistant designs, which drive up initial capital cost. Operators also face integration challenges when linking AUV workflows with existing IMR systems, control rooms, and data management platforms. Vessel support, trained crews, and mission-planning tooling add further expenses, making adoption slower for smaller companies. High-depth-rated AUVs need stringent certification and maintenance cycles, increasing lifecycle costs. These financial and operational barriers remain a major restraint for widespread deployment, especially in regions where offshore budgets fluctuate with crude price cycles.

Operational Risks in Harsh and Variable Environments

AUV performance depends heavily on stability, navigation accuracy, and reliable communication, all of which are difficult in strong currents, rugged seabed terrain, or low-visibility conditions. Failures in these environments can lead to data loss, mission cancellation, or vehicle recovery challenges. Complex subsea layouts near wellheads and manifolds also increase collision risks. Battery limits, pressure tolerance, and signal interference further constrain long-duration missions. Such risks force operators to maintain strict mission planning and contingency systems, slowing full autonomy adoption. Environmental unpredictability remains a core operational challenge that manufacturers and offshore teams must address through continuous design and software improvements.

Regional Analysis

North America

North America held the largest share in 2024 with about 34%. The region used AUV fleets for deepwater IMR work across the U.S. Gulf of Mexico. Operators focused on long-range mapping, leak detection, and riser inspections. Strong offshore investment supported higher use of advanced sonar and navigation payloads. Canada expanded use in harsh-water zones with difficult seabed terrain. Regional oil companies also adopted digital twins for integrity work. These factors kept North America ahead in AUV deployment.

Europe

Europe captured nearly 29% share in 2024. Norway and the United Kingdom led demand due to mature subsea fields. The North Sea required frequent IMR cycles, pipeline checks, and corrosion surveys. Harsh weather increased reliance on autonomous platforms for safe inspection. EU operators pushed digital transformation and subsea electrification. This boosted need for high-end AUVs with long endurance. Rising decommissioning activity further strengthened Europe’s market position.

Asia Pacific

Asia Pacific recorded about 23% share in 2024. Australia, China, and Malaysia expanded AUV use across new offshore developments. Deepwater exploration in the South China Sea created strong demand for long-range survey missions. Regional operators adopted AUVs to limit vessel days and improve IMR consistency. National oil companies focused on cost control during complex subsea expansion. Growing inspection needs around long trunk pipelines supported uptake. Rising offshore drilling plans strengthened long-term demand for advanced AUV platforms.

Latin America

Latin America held close to 8% share in 2024. Brazil led the region with wide adoption across pre-salt fields. Deepwater assets required persistent monitoring, pipeline scans, and structural mapping. Operators used AUVs to reduce diver work and limit vessel costs. Harsh-water conditions increased the shift toward autonomous missions. Mexico and Argentina adopted AUVs for selective deepwater surveys. Wider investment in subsea clusters supported regional growth.

Middle East & Africa

Middle East & Africa accounted for roughly 6% share in 2024. Africa led usage through deepwater fields in Angola and Nigeria. These regions relied on AUVs for field surveys, flowline inspections, and structural checks. The Middle East used AUVs for selective pipeline monitoring and coastal asset work. Regional adoption grew with rising digital monitoring programs. Operators used autonomous systems to reduce vessel dependence. Complex offshore expansions supported steady interest in AUV-based IMR operations.

Market Segmentations:

By Size

- Miniature

- Small

- Medium

- Large

By Class

- Observation-Class ROVs

- Inspection-Class ROVs

- Light Work-Class ROVs

- Heavy Work-Class ROVs

By Application

- Inspection, Maintenance, Repair (IMR)

- Pipeline Inspection

- Cable Inspection

- Search and Recovery

- Decommissioning

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the autonomous underwater vehicle (AUV) market for offshore oil and gas IMR operations included leading companies such as TechnipFMC, Bluestream, Sapura Energy Berhad, Schlumberger, Petrofac, Fugro, Oceaneering International, Starke Marine, James Fisher and Sons plc, and Boskalis. These companies expanded their fleets with higher-endurance AUVs equipped with advanced sonar, improved navigation, and long-range communication systems to support deepwater IMR tasks. Vendors focused on resident AUV concepts, subsea docking integration, and AI-driven data processing to strengthen long-term asset monitoring. Competitors also invested in modular payloads that allow fast mission changes, supporting operators in complex subsea environments. Partnerships with national oil companies and engineering firms increased access to new deepwater projects, while service providers enhanced safety compliance and digital inspection workflows to remain competitive. Overall, the market pushed toward greater autonomy, lower operational cost, and advanced data capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TechnipFMC (U.K.)

- Bluestream (Netherlands)

- Sapura Energy Berhad (Malaysia)

- Schlumberger (U.S.)

- Petrofac (Jersey)

- Fugro (Netherlands)

- Oceaneering International (U.S.)

- Starke Marine (Malaysia)

- James Fisher and Sons plc (U.K.)

- Boskalis (Netherlands)

Recent Developments

- In January 2025, Boskalis announced investments / fleet expansions in equipment for offshore/subsea operations, including a new 45,500-ton subsea rock installation vessel and reinforced subsea services capability. Boskalis’s corporate material and 2024/2025 reports highlight continued scaling of subsea inspection, IRM and survey services the operational scale and survey/inspection footprint positions Boskalis to integrate autonomous systems (AUVs/ROVs) into IRM workflows.

- In 2024, James Fisher & Sons plc (U.K.) successfully mobilised and operated the NATO Submarine Rescue System (NSRS) during exercise Dynamic Monarch, demonstrating complex rapid-response underwater systems mobilisation and integration expertise (skills and logistics that underpin deployment of AUV/robotics in harsh offshore environments)

- In May 2024, Sapura Energy, through its Seabras Sapura joint ventures, secured multi-year contracts with Petrobras for six pipelaying support vessels and associated subsea services in Brazil. The scope includes subsea engineering and installation in up to 3,000 m water depth, expanding Sapura’s role in subsea construction and inspection activities that rely on advanced underwater vehicles within offshore IRM programs

Report Coverage

The research report offers an in-depth analysis based on Size, Class, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift toward fully autonomous IMR cycles with reduced surface-vessel support.

- AI will enhance navigation, anomaly detection, and multi-vehicle coordination for complex subsea tasks.

- Long-endurance AUVs will gain wider adoption for continuous deepwater field surveillance.

- Subsea docking systems will enable resident AUV models that operate underwater for months.

- Hybrid AUV/ROV platforms will expand as operators combine autonomy with light intervention capability.

- Digital twin integration will increase demand for high-resolution structural data from AUV fleets.

- Battery innovations will support longer missions and reduce charging frequency in remote fields.

- National oil companies will scale AUV use to optimize IMR cost and improve asset reliability.

- Decommissioning activity will open new opportunities for AUV-based survey and clearance work.

- Cloud-based analytics will strengthen real-time integrity monitoring and remote decision-making across offshore assets.