Market Overview

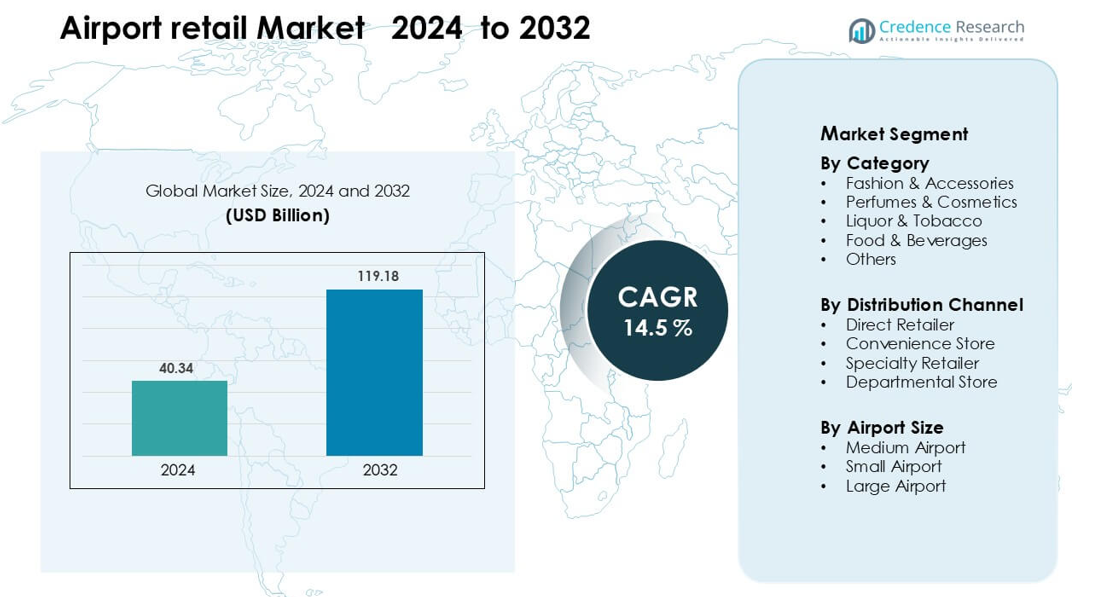

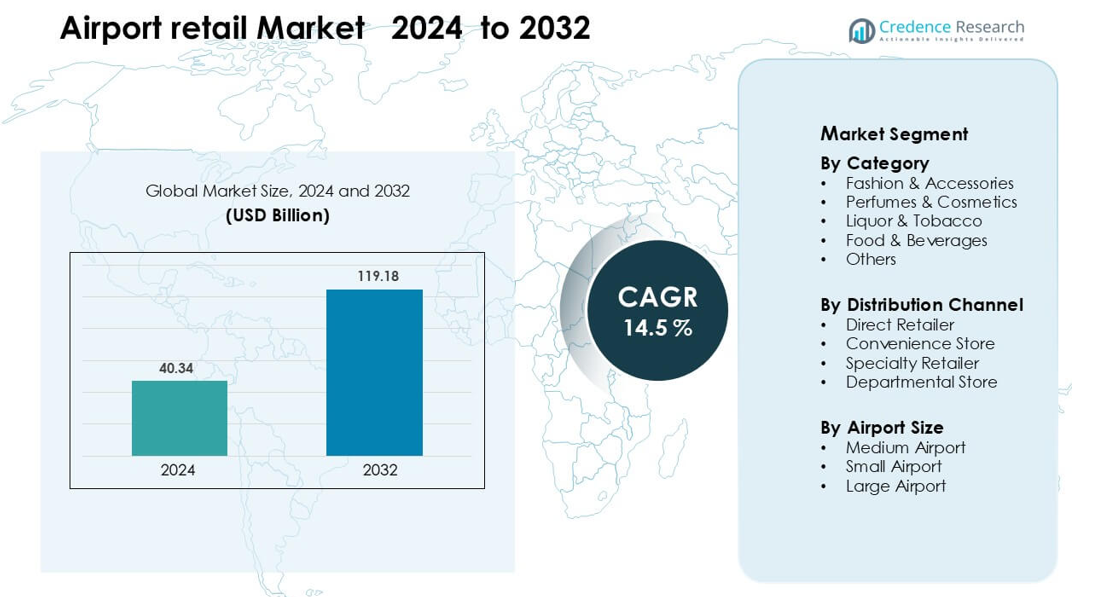

Airport retail Market was valued at USD 40.34 billion in 2024 and is anticipated to reach USD 119.18 billion by 2032, growing at a CAGR of 14.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airport retail Market Size 2024 |

USD 40.34 billion |

| Airport retail Market, CAGR |

14.5% |

| Airport retail Market Size 2032 |

USD 119.18 billion |

The airport retail market is driven by leading operators such as Airport Retail Group LLC, Dubai Duty Free, WH Smith plc, China Duty Free Group, The Shilla Duty Free, DFS Group, Autogrill S.p.A., Flemingo International Ltd., InMotion Entertainment, and SSP Group plc. These players strengthen their positions through exclusive brand partnerships, high-visibility walk-through formats, and strong duty-free assortments across fashion, cosmetics, liquor, and travel essentials. Asia-Pacific remained the dominant region in 2024 with about 34% share, supported by rapid passenger growth, strong luxury spending, and large-scale airport expansions across major hubs.

Market Insights

- The Airport Retail Market was valued at USD 40.34 billion in 2024 and is projected to reach USD 119.18 billion by 2032 at a CAGR of 14.5 %.

- Market growth is driven by rising global passenger traffic, strong demand for duty-free luxury goods, and increased adoption of digital retail formats that enhance shopper engagement.

- Walk-through retail layouts, experiential store concepts, and travel-exclusive product lines remain key trends strengthening impulse purchases and boosting revenue per passenger.

- Competition intensifies as major players like Dubai Duty Free, China Duty Free Group, WH Smith, and Autogrill expand premium assortments while facing high concession fees and fluctuating passenger spending.

- Asia-Pacific led the market in 2024 with about 34% share, followed by North America at 31% and Europe at 29%, while the fashion & accessories segment dominated category sales with nearly 34% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Category

Fashion & accessories led the airport retail market in 2024 with about 34% share due to strong passenger demand for luxury goods, premium brands, and last-minute travel purchases. Travelers preferred this category because global brands offered exclusive collections and tax-advantaged pricing. Growth stayed steady as airports expanded flagship stores and improved walk-through retail layouts. Perfumes and cosmetics followed closely, supported by high impulse buying and strong promotional bundles. Liquor and tobacco also remained important, driven by duty-free savings and consistent tourist traffic across major hubs.

- For instance, Dubai Duty Free recorded that in 2024, it sold 55.1 million units of merchandise, of which perfumes and cosmetics were among the top categories.

By Distribution Channel

Direct retailers dominated the distribution channel segment in 2024 with nearly 41% share. The model remained strong because airports favored retail partners that offered unified pricing, wider assortments, and better control over merchandising. Direct retailers also invested in omnichannel features like click-and-collect and digital storefronts that boosted conversion rates. Specialty retailers gained traction in fashion, electronics, and cosmetics due to focused assortments and curated shopping experiences. Convenience stores continued to grow as rising passenger volumes increased demand for quick-purchase items and essential travel goods.

- For instance, Lagardère Travel Retail operates over 4,970 stores (across all locations) or more than 5,000 points of sale.

By Airport Size

Large airports held the leading position in 2024 with roughly 57% share, driven by higher international traffic, spacious commercial zones, and strong duty-free operations. Retail growth advanced as large hubs expanded walk-through designs, upgraded luxury brand presence, and integrated digital advertising to increase passenger engagement. Medium airports showed rising momentum due to regional tourism and improved retail partnerships. Small airports held a smaller share but benefited from growing domestic routes and targeted store formats that focused on essential goods and localized products.

Key Growth Drivers

Rising Global Passenger Traffic

Global passenger traffic continues to expand each year, and this steady rise fuels sustained growth in the airport retail market. More travelers generate higher footfall across duty-free zones, walk-through stores, and specialty outlets. Airports benefit from a wider mix of business, leisure, and transit passengers who often seek premium and convenience-focused products. This growth also pushes airports to expand commercial areas, introduce new brand partnerships, and redesign retail layouts for higher engagement. Increased airline connectivity and tourism recovery strengthen purchasing activity, especially in fashion, cosmetics, and liquor categories. As hubs upgrade terminals to handle larger crowds, retail operators gain broader exposure and higher transaction volumes, creating long-term revenue potential.

- For instance, Dubai International Airport (DXB) processed 92.3 million passengers in 2024, making it one of the world’s busiest international hubs.

Expansion of Duty-Free and Luxury Retail

Duty-free and luxury retail remain major engines of airport retail growth, strengthened by attractive pricing, exclusive assortments, and the global appeal of premium brands. Travelers often treat airports as key shopping destinations due to tax advantages and the reliability of authentic branded goods. Luxury groups continue to open flagship boutiques inside major terminals, improving visibility and boosting the premium category. Airports invest in upscale store designs, digital price displays, and multilingual staff to enhance the experience. Strong demand from high-income travelers, especially in Asia-Pacific and the Middle East, further elevates luxury sales. The combination of aspirational buying and limited-edition product launches ensures strong momentum for premium retail formats.

- For instance, Lagardère Travel Retail opened a Tory Burch “Mercer” concept boutique in Singapore Changi Airport Terminal 1 in 2024, covering over 1,000 sq ft, and even introduced two bags that are exclusive to that store.

Growing Adoption of Digital and Omnichannel Retailing

Digital transformation has become a core growth driver for airport retail as operators adopt omnichannel platforms to streamline purchasing. Passengers can browse inventories online, reserve products, and pick up items in-store, creating faster and more seamless shopping journeys. Airports deploy digital signage, mobile apps, and QR-based promotions to improve engagement and boost conversion rates. Retailers benefit from data-driven insights that tailor product recommendations to traveler profiles. These tools help reduce wait times, increase impulse purchases, and support smooth navigation across retail zones. As airports enhance infrastructure with high-speed Wi-Fi and smart payment systems, digital features become central to both passenger satisfaction and revenue expansion.

Key Trend & Opportunity

Rise of Walk-Through and Experiential Retail Formats

Walk-through retail layouts are expanding rapidly as airports redesign terminals to increase shopper exposure and encourage impulse buying. These formats require passengers to pass through curated retail zones before reaching their gates, significantly boosting store visibility and cross-category purchases. Experiential retail also grows as brands introduce product testing zones, interactive displays, and travel-exclusive collections that enhance engagement. Airports invest in modern visual merchandising, duty-free lounges, and themed zones to deliver memorable shopping experiences. This trend aligns with global shifts toward experiential consumption, helping operators increase dwell time and improve revenue per passenger while strengthening brand positioning.

- For instance, Zurich Airport partnered with Highsnobiety to launch the GATEZERO concept store, featuring more than 15 lifestyle brands in a constantly evolving space, which encourages passengers to linger through rotating brand activations and immersive layouts.

Growth of Regional Airports and Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and the Middle East provide major growth opportunities as governments expand aviation infrastructure and regional airports upgrade retail capacity. Rising middle-class travel boosts demand for accessible luxury, convenience retail, and food service offerings. Retail operators can leverage lower competition to introduce new store concepts and tailored assortments that match local preferences. Expanding domestic and international connectivity also increases passenger throughput, helping regional airports attract global brands seeking early-market entry. Duty-free reforms, improved leasing policies, and expansion programs open new revenue pathways for retailers across developing aviation hubs.

- For instance, ASUR, or Grupo Aeroportuario del Sureste, has entered into an agreement to acquire the airport portfolio of Brazilian infrastructure operator Motiva.

Key Challenge

High Operating Costs and Complex Leasing Models

Airport retail faces significant challenges due to high rental costs, complex concession agreements, and strict regulatory requirements. Retailers must operate in premium terminal spaces where leasing fees often exceed traditional mall or high-street locations. Airports impose revenue-sharing models, operational restrictions, and stringent security standards that increase compliance expenses. Limited storage space, long operating hours, and high staffing needs add further pressure. These challenges reduce margins for small and mid-sized retailers and limit the entry of new players. Volatile passenger volumes can also disrupt sales stability, making long-term planning more difficult for retail operators.

Shifts in Passenger Spending Behavior

Passenger spending patterns continue to evolve, influenced by economic conditions, digital shopping habits, and changing preferences. Many travelers now spend less time browsing due to faster check-in processes, mobile entertainment, and gate-focused movement. Some categories, including tobacco and certain luxury items, face reduced demand due to health awareness and regulatory constraints. The rise of e-commerce also affects duty-free purchases, as travelers compare prices online before buying. Budget-conscious passengers prioritize essentials over high-value items, reducing the average transaction size. These shifts require retailers to continuously adapt assortments, pricing strategies, and promotional approaches to maintain sales performance.

Regional Analysis

North America

North America held about 31% share of the airport retail market in 2024, supported by high international traffic, strong duty-free operations, and premium brand presence across major hubs like JFK, LAX, and Toronto Pearson. The region benefited from steady business travel recovery and strong spending on fashion, cosmetics, and food service formats. Airports enhanced omnichannel features, upgraded walk-through layouts, and expanded luxury boutiques to increase revenue per passenger. Rising tourism in cities such as Miami and Vancouver further supported sales momentum and strengthened the region’s leadership in digitalized airport retail operations.

Europe

Europe accounted for nearly 29% share in 2024, driven by dense airport networks, long-haul connectivity, and strong duty-free culture. Major hubs such as Heathrow, Paris-Charles de Gaulle, Frankfurt, and Schiphol offered wide assortments of luxury brands, perfumes, liquor, and confectionery. The region also benefited from high intra-EU travel, consistent tourist inflows, and strong retail partnerships with global luxury groups. Airports upgraded terminal designs, expanded premium shopping zones, and adopted digital signage to enhance passenger engagement. Seasonal tourism peaks and strong spending by international travelers reinforced Europe’s position as a mature and stable airport retail market.

Asia-Pacific

Asia-Pacific dominated the market in 2024 with roughly 34% share, supported by rapid passenger growth, expanding aviation infrastructure, and strong spending by Chinese, South Korean, and Southeast Asian travelers. Major hubs like Singapore Changi, Hong Kong International, Seoul Incheon, and Tokyo Haneda led retail sales through wide luxury assortments, experiential stores, and strong duty-free pricing. Rising middle-class travel and regional tourism growth increased demand for fashion, cosmetics, and electronics. Governments continued investing in airport expansion projects, enabling larger retail footprints. High traveler engagement and strong brand presence positioned Asia-Pacific as the fastest-growing airport retail region.

Latin America

Latin America captured around 4% share in 2024, supported by growing regional tourism and rising international routes across Brazil, Mexico, Colombia, and Chile. Airports such as São Paulo-Guarulhos, Mexico City, and Bogota expanded retail zones and added global fashion, liquor, and travel-essential brands to attract passengers. Currency fluctuations influenced purchasing behavior, yet duty-free retail remained resilient due to competitive pricing. Increasing investment from global operators and airport modernization programs improved store layouts and product assortments. The region showed steady momentum as governments upgraded infrastructure and international travel rebounded across major tourism destinations.

Middle East & Africa

The Middle East & Africa region held nearly 6% share in 2024, buoyed by strong premium retail operations in major hubs like Dubai, Doha, and Abu Dhabi. These airports offered extensive luxury boutiques, electronics stores, and large-scale duty-free complexes that attracted high-spending international travelers. Growing transit traffic and expanding airline networks increased footfall and supported category diversification. Africa showed gradual progress as airports in South Africa, Kenya, and Morocco upgraded retail spaces. Continued investment in terminal expansion and premium retail partnerships strengthened the region’s profile as an emerging high-value airport retail destination.

Market Segmentations:

By Category

- Fashion & Accessories

- Perfumes & Cosmetics

- Liquor & Tobacco

- Food & Beverages

- Others

By Distribution Channel

- Direct Retailer

- Convenience Store

- Specialty Retailer

- Departmental Store

By Airport Size

- Medium Airport

- Small Airport

- Large Airport

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the airport retail market features a strong mix of global duty-free operators, specialty retailers, convenience chains, and luxury brand partners competing for high-value passenger spending. Leading companies such as Airport Retail Group LLC, Dubai Duty Free, WH Smith plc, China Duty Free Group, The Shilla Duty Free, DFS Group, and Autogrill S.p.A. expand their presence through strategic terminal partnerships, exclusive brand agreements, and premium store formats. Players invest in walk-through retail layouts, omnichannel shopping, and digital engagement tools to increase conversion rates and dwell-time-driven sales. Duty-free operators strengthen their position with curated luxury assortments, travel-exclusive lines, and competitive pricing, while specialty retailers grow through focused categories such as electronics, books, fashion, and travel essentials. Market competition intensifies as airports demand higher revenue-share models and improved customer experiences. To maintain an edge, companies focus on experiential retail, store modernization, personalized promotions, and operational excellence across major global hubs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Airport Retail Group LLC (U.S.)

- Dubai Duty Free (UAE)

- The Shilla Duty Free (Singapore)

- WH Smith plc (U.K.)

- China Duty Free Group Co. Ltd. (China)

- InMotion Entertainment (U.S.)

- DFS Group Ltd. (France)

- Autogrill S.p.A. (Italy)

- Flemingo International Ltd. (Sri Lanka)

- SSP Group plc (U.K.)

Recent Developments

- In March 2025, Autogrill S.p.A.: Opened a new Bindi Dolci & Caffè restaurant at Milan Linate Airport (bringing its Italian cafe/restaurant concept further into Milan’s airports as part of its ongoing F&B expansion.

- In 2024, India’s Mumbai Travel Retail Pvt. Ltd. (MTRPL) is expected to rebrand their stores worldwide. The rebranding pulls together the company’s duty-free operations at seven airplane terminals in India and will make it less demanding to offered for contracts all inclusive. The rebrand coordinating all of MTRPL’s air terminal duty-free businesses driven by Mumbai, the company’s lead area with a developing notoriety for whisky retailing.

- In November 2023, Lagardère Travel Retail, through its joint venture Lagardère Capital with Abu Dhabi Capital Group, became one of the biggest concessionaires within the new Terminal A by opening 12 duty-free and 6 food and beverage outlets at the Abu Dhabi International Airport (now officially known as Zayed International Airport). An additional retail unit and eatery were due to open in mid-2024 as part of the ongoing operational rollout

Report Coverage

The research report offers an in-depth analysis based on Category, Distribution channel, Airport size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Airport retail will expand as global passenger volumes rise across major international hubs.

- Digital and omnichannel retailing will grow as travelers prefer online browsing and in-terminal pickup.

- Walk-through and experiential store formats will increase impulse buying and drive higher engagement.

- Luxury brands will strengthen airport presence through exclusive collections and premium boutique formats.

- Duty-free operators will invest in personalization, data analytics, and targeted promotions.

- Regional airports will gain traction as infrastructure upgrades attract new retail partnerships.

- Food and beverage outlets will modernize menus and adopt faster service models for higher turnover.

- Automation and smart payment solutions will improve checkout speed and reduce congestion.

- Sustainability efforts will rise with eco-friendly packaging and energy-efficient retail layouts.

- Retail operators will focus on resilience strategies to manage fluctuating passenger spending and regulatory shifts.