Market Overview:

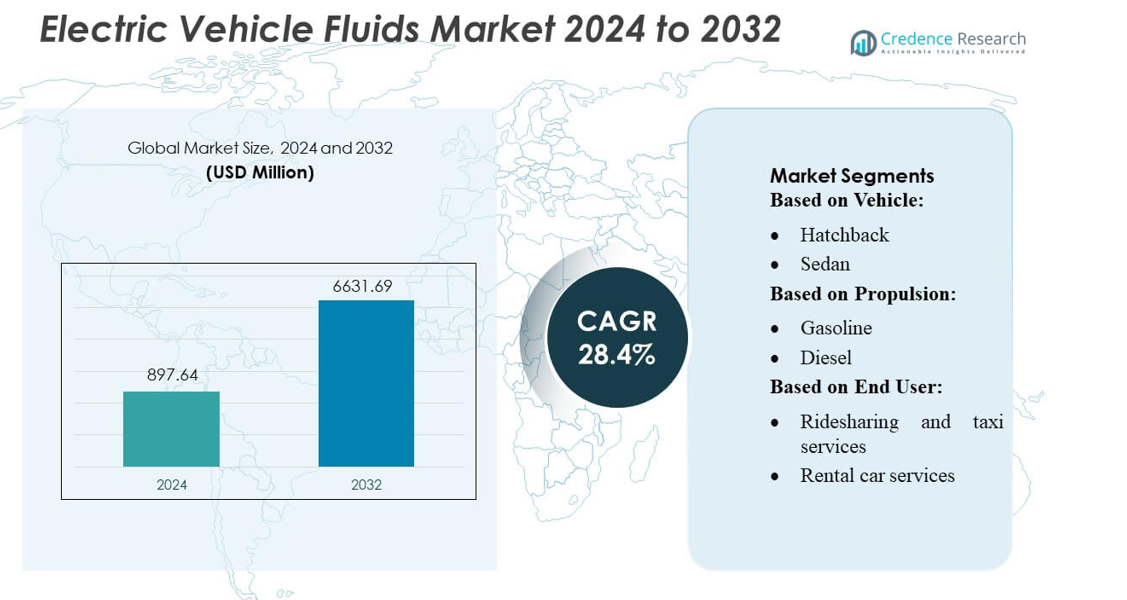

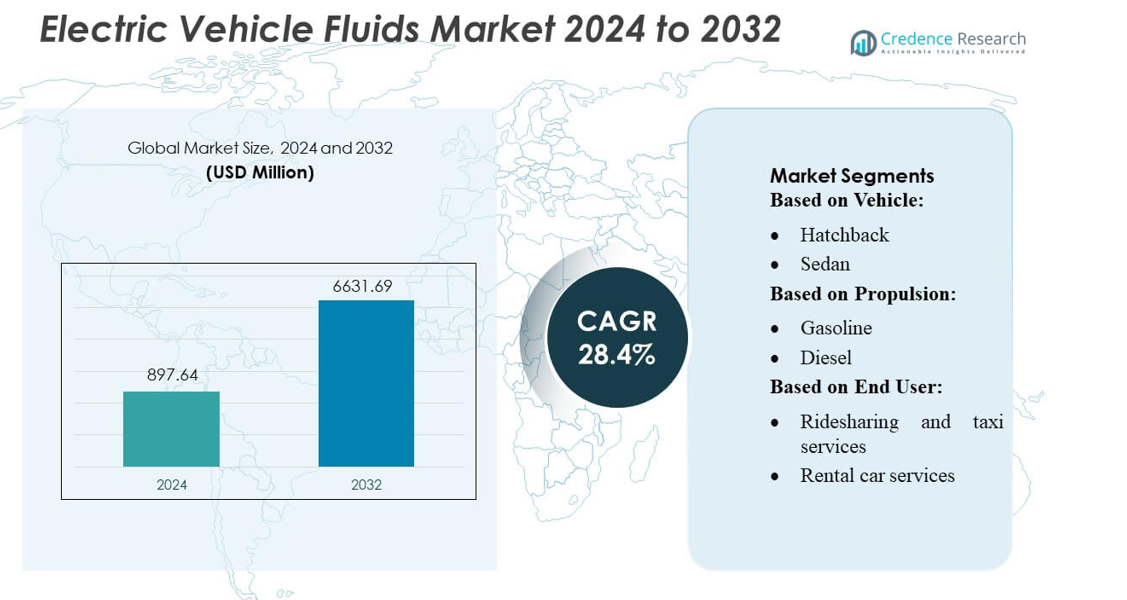

Electric Vehicle Fluids Market size was valued USD 897.64 million in 2024 and is anticipated to reach USD 6631.69 million by 2032, at a CAGR of 28.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Fluids Market Size 2024 |

USD 897.64 million |

| Electric Vehicle Fluids Market, CAGR |

28.4% |

| Electric Vehicle Fluids Market Size 2032 |

USD 6631.69 million |

The Electric Vehicle Fluids Market features strong competition led by major lubricant and thermal management solution providers such as Shell, Castrol, ExxonMobil, Valvoline, TotalEnergies, and Fuchs. These companies focus on advanced battery coolants, dielectric fluids, and e-transmission lubricants designed to enhance thermal stability, support fast-charging, and extend component lifespan. Continuous R&D investment and strategic partnerships with EV manufacturers strengthen their market presence. Asia-Pacific leads the global market with an estimated 38–40% share, driven by large-scale EV production, rapid adoption of electric two-wheelers and passenger vehicles, and expanding battery manufacturing capabilities across China, Japan, South Korea, and India.

Market Insights

- The Electric Vehicle Fluids Market was valued at USD 897.64 million in 2024 and is projected to reach USD 6631.69 million by 2032 at a CAGR of 28.4%, reflecting rapid adoption of EV technologies worldwide.

- Strong market drivers include rising demand for advanced battery coolants, dielectric fluids, and e-transmission lubricants that support fast charging, high power density, and improved drivetrain efficiency.

- Key trends highlight increasing OEM–supplier collaborations, growing investment in thermal management R&D, and expanding use of specialized fluids in battery-electric and hybrid vehicle segments, with battery coolants holding the largest share.

- Competitive intensity remains high as leading players such as Shell, Castrol, ExxonMobil, Valvoline, TotalEnergies, and Fuchs enhance product portfolios while addressing restraints like high formulation costs and evolving EV standards.

- Asia-Pacific dominates with 38–40% regional share, followed by Europe and North America, supported by strong EV manufacturing, rising consumer adoption, and expanding battery production capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle

The Electric Vehicle (EV) Fluids Market shows strong traction across vehicle categories, with SUVs holding the dominant share at approximately 42% due to their higher fluid volume requirements, larger battery systems, and rising global consumer preference for utility vehicles. Hatchbacks and sedans follow, supported by expanding mid-range EV manufacturing in Asia-Pacific and Europe. Sports cars remain a niche segment but exhibit growing demand for advanced thermal management fluids due to high-performance powertrains. The “Others” category includes vans and minibuses, driven by fleet electrification trends. Growth across all segments is supported by increasing EV adoption and advancements in battery cooling technologies.

- For instance, Piaggio’s Vespa Elettrica — a flagship electric scooter — uses a lithium‑ion battery pack with 4.2 kWh energy and delivers a peak motor power of 4 kW (continuous 3.6 kW), with a torque output of 200 Nm.

By Propulsion

Electric propulsion leads the market with an estimated 68% share, driven by rapid global electrification, regulatory pressure to reduce emissions, and expanding production of battery-electric vehicles. These vehicles require specialized coolant, lubricant, and dielectric fluids to enhance battery efficiency and maintain thermal stability. FCEVs represent a small but emerging segment supported by advancements in hydrogen infrastructure and demand for high-performance thermal fluids compatible with fuel-cell stacks. Gasoline and diesel segments reflect hybrid vehicles that still rely on traditional fluids but increasingly adopt EV-compatible thermal fluids as hybridization intensifies.

- For instance, Hyundai Creta Electric — scheduled for 2025 launch — offers two liquid‑cooled lithium‑ion battery pack options: a 51.4 kWh pack and a 42 kWh pack.

By End User

Commercial fleets dominate the end-user segment with about 47% market share, driven by large-scale EV deployment in logistics, last-mile delivery, and corporate mobility programs. Their high vehicle utilization rates demand durable fluids optimized for extended thermal performance and reduced maintenance. Ridesharing and taxi services follow, driven by the shift toward cost-efficient and sustainable fleets in urban centers. Rental car services increasingly adopt EVs to meet consumer preferences and sustainability mandates. Corporate fleets continue to expand their EV portfolios, supported by ESG commitments and the lower total cost of ownership offered by advanced EV fluids.

Key Growth Drivers

Rapid Expansion of Global EV Production

The accelerating shift toward electrification across passenger and commercial vehicle segments significantly drives demand for specialized EV fluids. Automakers are scaling production capacity, supported by government incentives, emission regulations, and rising consumer adoption of battery-electric vehicles. As global EV output increases, manufacturers require advanced fluids for thermal management, drivetrain efficiency, and insulation performance. This expanding vehicle base directly boosts consumption volumes of battery coolants, e-transmission fluids, and dielectric fluids, strengthening long-term market growth.

- For instance, BMW Group, Volkswagen Group reports that a total of 12 all‑electric vehicle (EV) models have been rolling off assembly lines on three continents, underlining a multi‑continent production network for its EV portfolio.

Increasing Need for Advanced Thermal Management Solutions

Thermal efficiency has become a critical performance factor in high-voltage EV systems, driving the adoption of engineered fluids designed to regulate heat in batteries, motors, and power electronics. Modern EV architectures use compact, high-density battery packs that generate substantial heat, necessitating high-performance coolants with improved heat transfer, stability, and longevity. With OEMs focusing on longer driving ranges and faster charging, demand for specialized thermal management fluids continues to rise, supporting sustained growth in the market.

- For instance, INGLO‑based EVs (like Mahindra BE 6e and Mahindra XEV 9e) support fast charging from 20% to 80% in as little as 20 minutes (with a 175 kW DC fast charger for the 79 kWh pack).

Technological Advancements in Fluid Formulations

Continuous innovation in fluid chemistry enables manufacturers to develop next-generation EV fluids optimized for electrical compatibility, low conductivity, oxidation resistance, and improved lubrication under high loads. Companies are introducing advanced synthetic formulations tailored for ultra-efficient e-axles, power electronics, and integrated cooling loops. These improved fluid characteristics enhance overall vehicle reliability, reduce maintenance, and extend system lifespan. As OEMs integrate new powertrain architectures and 800-volt platforms, the need for sophisticated, application-specific fluids becomes a major growth catalyst.

Key Trends & Opportunities

Growing Adoption of Immersion Cooling Technologies

The rise of direct immersion cooling presents a major opportunity for fluid manufacturers to supply high-dielectric, thermally stable fluids for next-generation battery systems. Immersion cooling significantly enhances temperature uniformity and safety while enabling ultra-fast charging capabilities. As OEMs explore solid-state batteries and thermal-intensive chemistries, market demand for engineered immersion cooling fluids with superior electrical insulation, non-flammability, and long service life is expected to accelerate, opening new revenue streams across premium and high-performance EV models.

- For instance, Honda launched the Honda e:Ny1 — a compact, B‑segment all‑electric SUV — built on its newly developed e:N Architecture F platform. This model uses a 68.8 kWh lithium‑ion battery and delivers a WLTP‑certified driving range of up to 412 km on a full charge.

Increasing Focus on Sustainable and Bio-Based Fluids

Environmental considerations are influencing fluid development, creating opportunities for bio-based, low-toxicity, and recyclable formulations. Manufacturers are investing in eco-friendly additives and renewable feedstocks to align with global sustainability goals and circular economy principles. These green fluids offer reduced environmental impact while meeting strict performance standards for EV thermal and lubrication systems. Growing regulatory pressure and OEM sustainability commitments are expected to expand demand for environmentally responsible EV fluid formulations.

- For instance, Tata Motors has committed to achieving net‑zero emissions for its passenger‑vehicle business by 2040 and for its commercial‑vehicles business by 2045, embedding decarbonization into its long‑term strategy.

Rising Integration of E-Axle and Multi-Functional Fluids

The industry is witnessing a shift toward integrated powertrains, where a single fluid supports cooling, lubrication, and electrical insulation functions. This trend enables OEMs to reduce component count and improve system efficiency. Advanced multi-functional fluids offer superior thermal conductivity, lower friction, and enhanced material compatibility. As e-axle adoption grows in mass-market EVs, suppliers will benefit from developing specialized fluids that support higher power densities and compact architectures, creating additional market opportunities.

Key Challenges

High R&D Costs and Complex Qualification Requirements

Developing EV fluids demands extensive research, long testing cycles, and strict compatibility assessments with battery materials, high-voltage components, and polymer seals. Manufacturers must meet stringent OEM performance standards, requiring significant investment in laboratory infrastructure, formulation optimization, and endurance testing. These high development costs create entry barriers for new players and elevate time-to-market, limiting speed of innovation. As EV technologies evolve rapidly, meeting continuous qualification requirements remains a persistent challenge.

Limited Standardization Across EV Platforms

The EV fluids market faces challenges due to lack of universal specifications, as fluid requirements vary widely between manufacturers and vehicle architectures. Differences in battery chemistry, cooling design, voltage levels, and drivetrain configuration necessitate customized formulations rather than standardized solutions. This increases production complexity, inventory requirements, and cost burdens for fluid suppliers. The absence of harmonized global standards also slows adoption, complicates OEM qualification, and adds pressure on manufacturers to develop multiple fluid variants.

Regional Analysis

North America

North America accounts for an estimated 28–30% market share in the Electric Vehicle Fluids Market, supported by rapid EV adoption, strong emission regulations, and increased investment in charging infrastructure. The United States leads consumption as OEMs and fleet operators prioritize advanced thermal management fluids to enhance battery efficiency and extend vehicle lifespan. High demand for electric SUVs and pickup trucks drives the use of specialized coolants, lubricants, and e-transmission fluids. Collaborations between EV manufacturers and lubricant companies, along with strong R&D investment in dielectric and fast-charging compatible fluids, further accelerate regional market expansion.

Europe

Europe holds approximately 32–34% market share, making it one of the most influential regions in the EV Fluids Market. Strict EU carbon reduction targets and high EV penetration—especially in Germany, Norway, the UK, and France—boost demand for premium thermal and lubrication solutions. The region benefits from expanding gigafactory operations and increasing production of battery-electric vehicles, which require optimized cooling and insulating fluids. Continuous innovation in low-viscosity and dielectric fluids supports improved drivetrain efficiency and fast-charging performance. Government incentives, OEM sustainability commitments, and rapid charging infrastructure deployment further reinforce Europe’s leadership in this market.

Asia-Pacific

Asia-Pacific dominates the Electric Vehicle Fluids Market with an estimated 38–40% market share, driven by large-scale EV manufacturing in China, Japan, South Korea, and India. China leads global EV production, increasing demand for advanced thermal fluids, battery coolants, and e-drivetrain lubricants. Government incentives, rising EV exports, and a strong battery supply chain strengthen regional consumption. Rapid penetration of electric two-wheelers, buses, and commercial vehicles further expands fluid requirements. Continuous investment in high-performance dielectric fluids and thermal management solutions positions Asia-Pacific as the fastest-growing and most dynamic region in the global EV fluids industry.

Latin America

Latin America holds a developing yet growing 4–6% market share in the EV Fluids Market, supported by rising electrification efforts in Brazil, Mexico, and Chile. Government initiatives promoting clean mobility, along with gradual improvements in charging infrastructure, are increasing the adoption of electric cars, buses, and fleet vehicles. Demand for battery cooling fluids and drivetrain lubricants is expanding as regional OEMs and importers scale EV offerings. Although market penetration remains modest, partnerships with global automakers and renewable energy integration—particularly in public transportation systems—are expected to accelerate the use of specialized EV fluids in the coming years.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for an emerging 3–4% market share, driven by early-stage but rising interest in EV adoption across the UAE, Saudi Arabia, South Africa, and Morocco. Hot climate conditions amplify the need for high-performance thermal management fluids that maintain battery stability and efficiency. Government-led sustainability initiatives, such as Saudi Vision 2030 and UAE’s clean mobility targets, are supporting EV imports and infrastructure growth. While adoption remains limited, increasing investment in charging networks and electric public transport is expected to boost demand for advanced coolants, dielectric fluids, and e-lubricants.

Market Segmentations:

By Vehicle:

By Propulsion:

By End User:

- Ridesharing and taxi services

- Rental car services

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Vehicle Fluids Market features such as MARUTI SUZUKI INDIA LIMITED, Piaggio & C. SpA, Hyundai Motor India, Mercedes-Benz Group AG, Mahindra & Mahindra Ltd., ASHOK LEYLAND, Honda Motor Co., Ltd., Tata Motors, Bajaj Auto Ltd., and EICHER MOTORS LIMITED. The Electric Vehicle Fluids Market continues to intensify as manufacturers and lubricant developers focus on delivering high-performance thermal management and lubrication solutions tailored for modern EV architectures. Companies are prioritizing advanced battery coolants, dielectric fluids, and e-transmission lubricants designed to support fast charging, enhance battery safety, and improve overall drivetrain efficiency. Strategic collaborations between OEMs and fluid formulators are increasing, enabling the development of formulations that address rising heat loads, higher voltage systems, and compact powertrains. Industry players are also investing in R&D to optimize fluid durability, reduce energy losses, and meet stringent environmental standards. As EV adoption accelerates globally, performance differentiation and innovation in fluid chemistry remain central to gaining a competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Numeros Motors, which is a pioneering force in the indigenous electric vehicle (EV) market, and Perpetuity Capital, which is a non-banking financial company in the EV financing sector, was announced. To enhance the affordability and accessibility of electric vehicles and to provide modified financing solutions to the consumers, along with flexible repayment plans and competitive interest rates, will be the main goal of this collaboration.

- In June 2025, S-OIL and Bumhan Unisolution formed a partnership to develop electric vehicle (EV) battery packs and energy storage systems (ESS) using immersion cooling technology. This technology, which submerges batteries in a non-conductive fluid, is considered a next-generation solution for improving battery safety, lifespan, and performance, particularly for high-power applications like EV batteries.

- In May 2025, Tata Motors has launched the All-New Altroz in India at a starting price of around positioning it as a premium hatchback with a bold design, luxurious interiors, and advanced features. The vehicle now includes segment-first features such as flush door handles, Infinity LED tail lamps, Luminate LED headlamps with DRLs, and a 3D front grille.

- In August 2024, Uber and BYD announced a strategic partnership aimed at integrating 100,000 electric vehicles (EVs) into Uber’s global ride-hailing platform. This multi-year collaboration will initially launch in Europe and Latin America, with plans to expand to regions including the Middle East, Canada, Australia, and New Zealand

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Propulsion, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as global EV adoption rises across passenger, commercial, and two-wheeler segments.

- Demand for advanced thermal management fluids will grow to support fast charging and higher battery power densities.

- Dielectric fluids will gain traction as high-voltage architectures become mainstream in next-generation EVs.

- Manufacturers will increasingly invest in durable, long-life fluids to reduce maintenance needs and improve overall vehicle efficiency.

- Partnerships between OEMs and lubricant formulators will strengthen to develop customized fluid solutions.

- Regulatory pressure will drive the adoption of environmentally compliant and low-emission fluid formulations.

- Growth in gigafactories and battery production will create new opportunities for specialized cooling technologies.

- Emerging markets will witness accelerated uptake of EV fluids as infrastructure and electrification policies advance.

- Innovation in nanotechnology and advanced additives will enhance fluid performance and thermal stability.

- Competition will intensify as suppliers focus on energy-efficient, high-performance fluid chemistries to differentiate their offerings.