Market Overview:

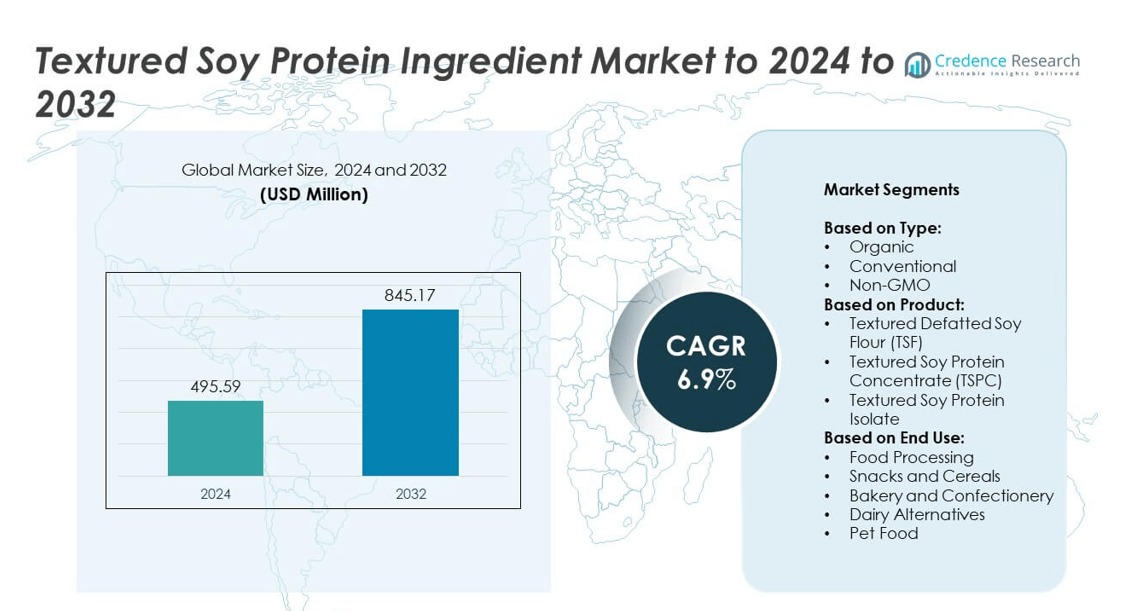

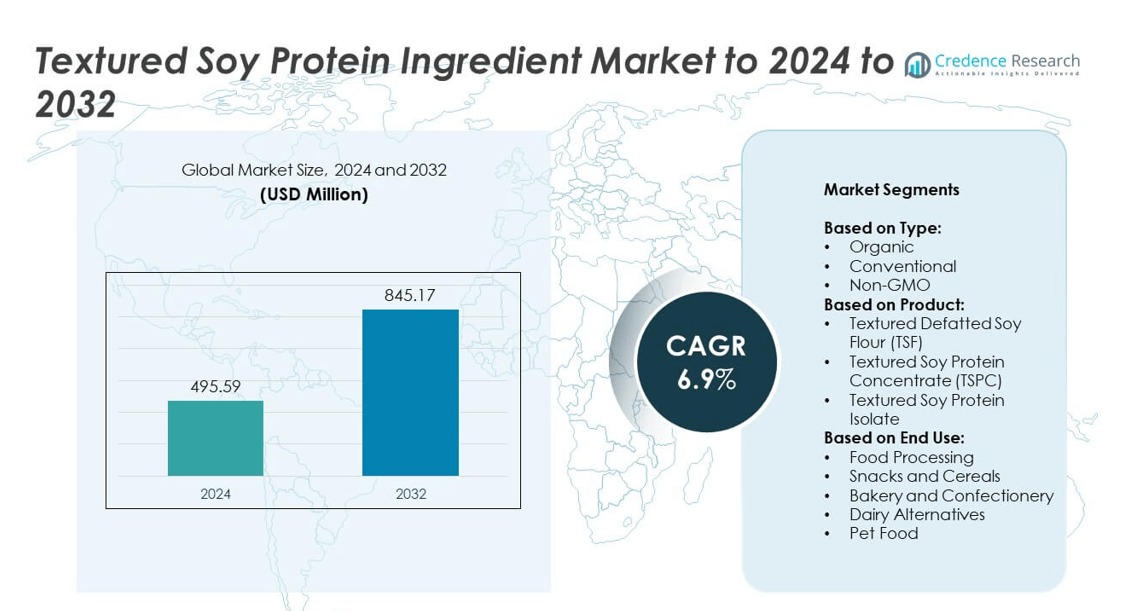

Textured Soy Protein Ingredient Market size was valued USD 495.59 Million in 2024 and is anticipated to reach USD 845.17 Million by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Textured Soy Protein Ingredient Market Size 2024 |

USD 495.59 Million |

| Textured Soy Protein Ingredient Market, CAGR |

6.9% |

| Textured Soy Protein Ingredient Market Size 2032 |

USD 845.17 Million |

The textured soy protein ingredient market is driven by major players including Cargill, ADM, Fuji Oil Holdings Inc., BRF Global, Devansoy, Wilmar International Ltd, AG Processing Inc., International Flavors & Fragrances Inc (IFF), Crown Protein Soya Group Company, and CHS Inc. These companies focus on expanding production capacities, developing non-GMO and organic offerings, and strengthening partnerships with food manufacturers to meet growing demand for plant-based proteins. Regional dynamics highlight North America as the leading market, accounting for over 35% share in 2024, supported by strong adoption of meat alternatives and health-oriented food products. Europe followed with around 28% share, driven by high preference for clean-label and non-GMO products, while Asia Pacific captured nearly 25%, fueled by rising protein consumption and expanding food processing industries.

Market Insights

- The textured soy protein ingredient market was valued at USD 495.59 million in 2024 and is projected to reach USD 845.17 million by 2032, growing at a CAGR of 6.9%.

- Rising demand for plant-based proteins and cost-effective alternatives to meat products are key drivers supporting market expansion across food processing, dairy alternatives, and snack industries.

- Non-GMO and organic product trends are gaining traction, while textured soy protein concentrates lead the product segment with over 45% share in 2024.

- Competition remains strong among global players, with companies focusing on product innovation, sustainability practices, and partnerships to expand distribution and maintain market share.

- North America led the market with over 35% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while Latin America and the Middle East & Africa contributed smaller shares but show steady growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The type segment of the textured soy protein ingredient market is classified into organic, conventional, and non-GMO. Conventional soy protein dominated the market in 2024, holding over 55% share due to its cost-effectiveness, wide availability, and suitability for large-scale food processing. Rising demand from manufacturers for affordable protein alternatives in processed foods and beverages drives this dominance. Non-GMO products are gaining traction with clean-label preferences, while organic soy protein continues to grow steadily as consumers increasingly prioritize natural and sustainable diets. However, conventional soy remains the leading segment in global adoption.

- For instance, in 2022, Cargill announced plans for a new soybean processing facility in Pemiscot County, Missouri, with an annual production capacity of 62 million bushels. The project was later put on hold in 2023 due to shifting market dynamics.

By Product

In the product segment, textured defatted soy flour (TSF), textured soy protein concentrate (TSPC), and textured soy protein isolate are included. Textured soy protein concentrate (TSPC) led the market with over 45% share in 2024, supported by its high protein content, functionality, and suitability for meat analogs and processed foods. The product is widely used by plant-based food manufacturers to deliver desirable texture and taste. While isolates are gaining traction for premium products, concentrates remain preferred for their cost-performance balance, fueling growth across mainstream food applications.

- For instance, ADM’s soy protein concentrates list ≥65% protein (moisture-free) in specs.

By End Use

The end-use segment covers food processing, snacks and cereals, bakery and confectionery, dairy alternatives, and pet food. Food processing held the dominant position with more than 40% share in 2024, driven by extensive use of soy protein in meat substitutes, ready-to-eat meals, and plant-based protein blends. The demand is fueled by rising health awareness, protein-rich diets, and the growing flexitarian consumer base. Dairy alternatives and snacks are also growing quickly, supported by innovation in plant-based beverages and healthy snacking trends. However, food processing remains the key growth engine for the market.

Market Overview

Rising Demand for Plant-Based Protein

The growing adoption of plant-based diets is a key growth driver for the textured soy protein ingredient market. Consumers are shifting toward meat alternatives and vegan options due to health, sustainability, and ethical concerns. Textured soy protein provides high protein content, favorable texture, and cost advantages, making it a preferred choice for meat substitutes and processed food manufacturers. Rising flexitarian and vegan populations worldwide continue to fuel this demand, supporting steady market expansion across food processing, snacks, and dairy alternative applications.

- For instance, MorningStar Farms Chik’n Nuggets provide 12 g protein per 86 g serving.

Cost-Effectiveness and Functional Versatility

Affordability and functional benefits act as a major growth driver in this market. Textured soy protein offers an economical alternative to animal proteins while maintaining desirable texture, binding, and water-holding properties in various food applications. Its versatility makes it suitable for processed meats, bakery, and dairy alternatives, boosting its adoption by manufacturers. With rising food production costs and consumer demand for affordable nutrition, textured soy protein remains an attractive solution, strengthening its role across mainstream and premium food categories.

- For instance, Impossible Foods supplies >45,000 restaurants and locations worldwide.

Expansion in Health and Wellness Products

The rising popularity of high-protein and health-oriented foods is another key growth driver. Increasing awareness of balanced diets and protein intake encourages consumers to choose functional products enriched with soy protein. The inclusion of textured soy protein in ready meals, sports nutrition, and fortified snacks supports its rapid uptake. Demand is further accelerated by the perception of soy protein as a cholesterol-lowering and heart-healthy option. Health-focused innovations by global brands continue to reinforce the role of textured soy protein in nutrition-driven markets.

Key Trends & Opportunities

Growth of Clean Label and Non-GMO Products

Clean-label movement and demand for natural, transparent ingredients create a key trend and opportunity in the textured soy protein market. Non-GMO variants are gaining traction, particularly in North America and Europe, where consumers actively seek verified and sustainable products. Manufacturers are focusing on certifications and sourcing transparency to attract health-conscious buyers. This shift encourages innovation in organic and non-GMO textured soy proteins, presenting strong opportunities for players aiming to differentiate in the competitive plant-based protein landscape.

- For instance, Bunge is building a new soy protein concentrate (SPC) and textured soy protein concentrate (TSPC) facility in Morristown, Indiana, which is expected to process an additional 4.5 million bushels of soybeans per year once operational in mid-2025.

Rising Popularity of Meat Alternatives

The boom in plant-based meat alternatives presents a major opportunity for textured soy protein manufacturers. Textured soy protein delivers the desired texture, chewiness, and protein enrichment essential for replicating meat products. Leading food companies and startups are expanding product lines with soy-based burgers, sausages, and nuggets to capture flexitarian and vegan demand. With ongoing advancements in food technology and rising investments in plant-based foods, textured soy protein remains central to innovations in this segment, offering strong growth potential for global suppliers.

- For instance, Danone’s Silk Nextmilk is Non-GMO Project Verified and sold in 59-oz cartons, but Danone discontinued its Silk Nextmilk product in North America in 2023.

Key Challenges

Competition from Alternative Proteins

The rise of pea protein, wheat protein, and newer sources such as fava beans and chickpeas poses a key challenge for textured soy protein. Consumers increasingly experiment with diverse protein sources due to allergy concerns, sustainability claims, and variety preferences. Alternative proteins also benefit from marketing around hypoallergenic and non-GMO advantages. This competition challenges soy protein’s dominance, forcing producers to innovate and highlight nutritional and functional strengths to maintain market share against the expanding range of plant-based proteins.

Concerns Over Allergies and GMO Use

Soy allergies and GMO concerns present a significant challenge to market expansion. A notable percentage of consumers avoid soy-based foods due to allergy risks, limiting its consumption in certain regions. Additionally, the widespread use of genetically modified soybeans raises consumer hesitance, especially in Europe, where regulatory restrictions on GMO products are strict. These factors create barriers to acceptance, requiring manufacturers to emphasize allergen labeling, promote organic or non-GMO certifications, and invest in consumer education to maintain trust and expand adoption.

Regional Analysis

North America

North America accounted for over 35% of the textured soy protein ingredient market in 2024, making it the largest regional contributor. The region’s dominance is supported by strong demand for plant-based foods, particularly in the United States and Canada, where consumers are adopting vegan and flexitarian diets at a rapid pace. Growing investments by food manufacturers in soy-based meat alternatives and dairy substitutes continue to drive growth. The presence of established players and innovative startups also strengthens the regional outlook, ensuring North America maintains a leading share throughout the forecast period.

Europe

Europe held around 28% share of the textured soy protein ingredient market in 2024, driven by high consumer preference for clean-label and non-GMO food products. The demand is particularly strong in Germany, the UK, and France, where veganism and sustainability-focused diets are expanding rapidly. Stringent food labeling regulations and sustainability commitments encourage the use of organic and non-GMO soy protein in various applications. Expansion of plant-based meat categories across retail channels further boosts growth, with European consumers showing strong acceptance of soy protein ingredients as a key part of healthy and ethical food choices.

Asia Pacific

Asia Pacific captured nearly 25% of the textured soy protein ingredient market in 2024, with China, India, and Japan being major contributors. Rising disposable incomes, increasing urbanization, and a shift toward protein-rich diets drive demand in this region. Soy has traditionally been part of Asian diets, and its growing use in modern food processing strengthens consumption further. Expanding food manufacturing sectors and rising interest in plant-based alternatives fuel market growth. With large-scale soybean production and rising demand for affordable protein, Asia Pacific is positioned as one of the fastest-growing regions in the forecast period.

Latin America

Latin America accounted for about 7% of the textured soy protein ingredient market in 2024, supported by strong soybean production in countries such as Brazil and Argentina. Local availability of raw materials makes soy protein a cost-effective ingredient for food and beverage applications. Increasing adoption of plant-based products and rising health awareness contribute to steady demand. The growth of urban populations and expanding retail networks support higher consumption of soy-based snacks and processed foods. However, limited consumer awareness compared to developed regions keeps growth moderate, though opportunities continue to expand.

Middle East and Africa

The Middle East and Africa region represented close to 5% share of the textured soy protein ingredient market in 2024. Demand is driven by the rising adoption of affordable protein sources and growing popularity of processed food products in urban areas. South Africa, Saudi Arabia, and the UAE are key markets, with increasing penetration of plant-based alternatives among health-conscious consumers. Limited local production of soybeans requires higher imports, slightly impacting affordability. However, rising investments in food processing and increased awareness of plant-based nutrition are expected to gradually strengthen the region’s market presence.

Market Segmentations:

By Type:

- Organic

- Conventional

- Non-GMO

By Product:

- Textured Defatted Soy Flour (TSF)

- Textured Soy Protein Concentrate (TSPC)

- Textured Soy Protein Isolate

By End Use:

- Food Processing

- Snacks and Cereals

- Bakery and Confectionery

- Dairy Alternatives

- Pet Food

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the textured soy protein ingredient market is shaped by key players such as Cargill, Incorporated, ADM, Fuji Oil Holdings Inc., BRF Global, Devansoy, Wilmar International Ltd, AG Processing Inc., International Flavors & Fragrances Inc (IFF), Crown Protein Soya Group Company, and CHS Inc. These companies focus on expanding production capacities, developing advanced processing technologies, and strengthening their global distribution networks to meet rising demand from food, beverage, and pet food industries. Strategic initiatives include product innovation, collaborations with food manufacturers, and investments in clean-label, organic, and non-GMO offerings to capture emerging consumer preferences. Sustainability remains a central priority, with companies increasingly emphasizing responsible sourcing and eco-friendly operations. Regional expansion through mergers, acquisitions, and joint ventures further supports competitiveness, enabling them to strengthen market presence and serve a diverse customer base. Overall, competition remains strong, driven by innovation, pricing strategies, and the ability to adapt to evolving consumer needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cargill, Incorporated

- ADM

- Fuji Oil Holdings Inc.

- BRF Global

- Devansoy

- Wilmar International Ltd

- AG Processing Inc.

- International Flavors & Fragrances Inc (IFF)

- Crown Protein Soya Group Company

- CHS Inc

Recent Developments

- In 2023, ADM established a joint venture with food processing solutions provider Marel to build a Protein Innovation Center.

- In 2023, Cargill introduced TEX PW80 M, a blend of pea and wheat protein in Europe. This innovative product is designed to replicate the texture and juiciness of ground meat, offering food manufacturers a high-performance ingredient for plant-based applications.

- In 2022, IFF launched Supro Tex, a soy-based plant protein designed to mimic the texture of meat.

Report Coverage

The research report offers an in-depth analysis based on Type, Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, supported by growing adoption of plant-based diets.

- Conventional soy protein will remain dominant due to cost efficiency and large-scale availability.

- Non-GMO and organic soy protein will grow faster with rising clean-label demand.

- Food processing will continue as the largest end-use segment across global markets.

- Asia Pacific will emerge as the fastest-growing region driven by urbanization and protein demand.

- Europe will strengthen adoption of organic and non-GMO soy protein ingredients.

- North America will maintain leadership with strong innovation in meat alternatives.

- Competition from alternative proteins like pea and fava beans will intensify.

- Manufacturers will focus on certifications, sustainability, and allergen management to boost trust.

- Rising investments in plant-based innovation will create long-term growth opportunities worldwide.