Market Overview

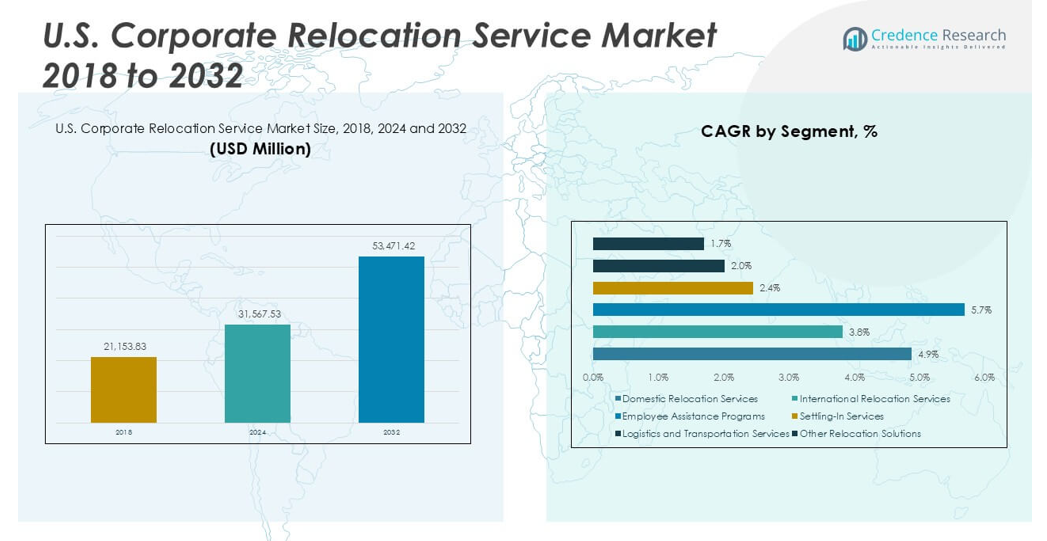

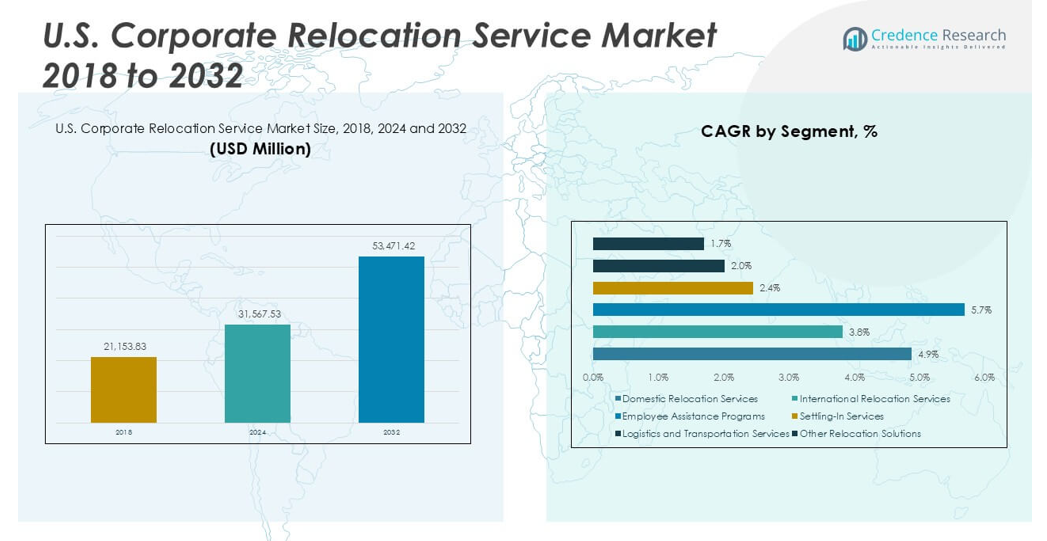

The U.S. Corporate Relocation Service market size was valued at USD 21,153.83 million in 2018, increased to USD 31,567.53 million in 2024, and is anticipated to reach USD 53,471.42 million by 2032, at a CAGR of 6.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Corporate Relocation Service Market Size 2024 |

USD 31,567.53 million |

| U.S. Corporate Relocation Service Market, CAGR |

6.34% |

| U.S. Corporate Relocation Service Market, Size 2032 |

USD 53,471.42 million |

The U.S. Corporate Relocation Service market is led by prominent players such as Cartus, SIRVA, Graebel Companies, Inc., Altair Global, Aires, Sterling Lexicon, and XONEX, each offering integrated relocation solutions tailored to diverse corporate needs. These companies dominate through expansive service portfolios, advanced relocation technologies, and global mobility expertise. Strategic partnerships and digital innovation remain central to their market positioning. Regionally, the South holds the largest market share at 33%, driven by business-friendly environments and high inbound corporate migration. The Northeast and Midwest follow with 28% and 22% respectively, supported by concentrated corporate hubs and expanding regional operations.

Market Insights

- The U.S. Corporate Relocation Service market was valued at USD 31,567.53 million in 2024 and is projected to reach USD 53,471.42 million by 2032, growing at a CAGR of 6.34% during the forecast period.

- Rising workforce mobility, internal restructuring, and talent optimization are driving demand for domestic and international relocation services among large and mid-sized enterprises.

- Increasing adoption of relocation management software and mobile applications is transforming the service delivery landscape, with domestic relocation services holding the largest product segment share.

- The market is highly competitive, led by key players such as Cartus, SIRVA, Graebel Companies, and Altair Global, who are leveraging technology and strategic partnerships to maintain their market position.

- Regionally, the South leads with 33% market share, followed by the Northeast at 28%, Midwest at 22%, and West at 17%; however, high relocation costs and regulatory complexities continue to pose challenges for employers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

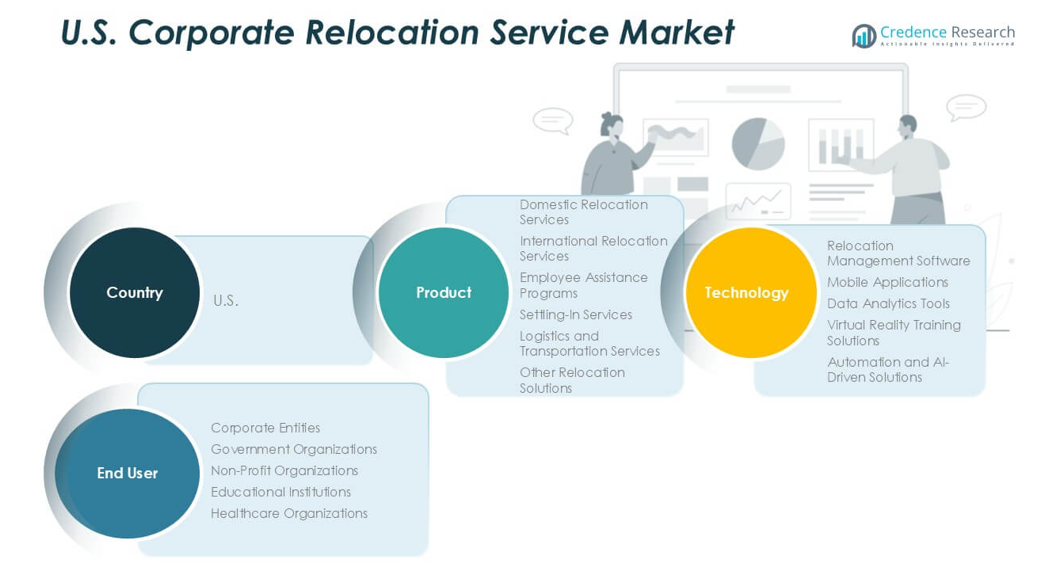

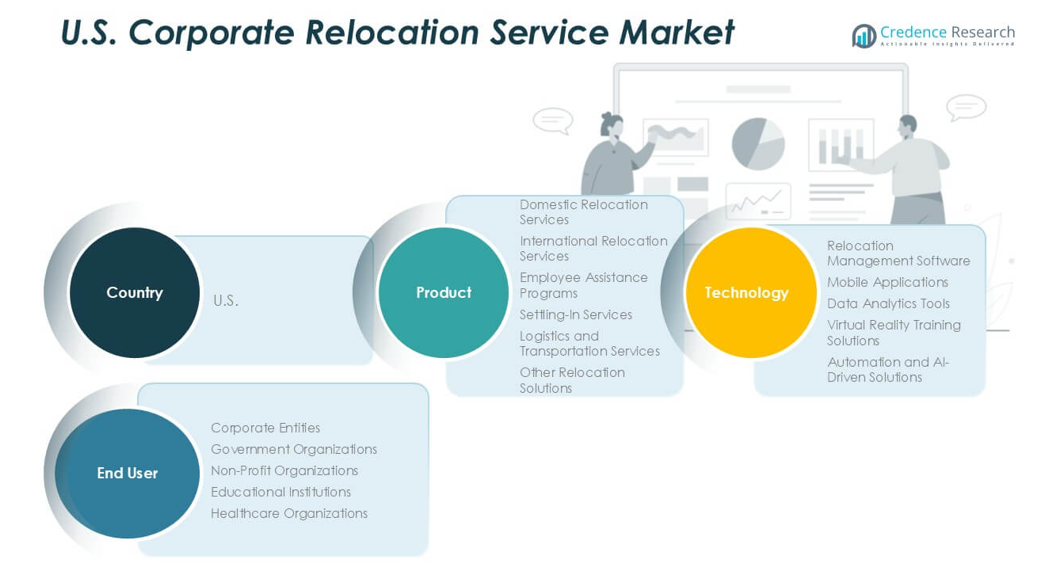

By Product

In the U.S. Corporate Relocation Service market, Domestic Relocation Services emerged as the dominant sub-segment, accounting for the largest market share in 2024. The preference for domestic moves among corporations is driven by internal restructuring, expansion to new states, and centralized talent deployment. These services typically involve home sale and purchase assistance, temporary housing, and moving support. The rise in remote work policies and strategic regional relocations by tech and financial firms further supports the growth of this segment. Meanwhile, international relocation services are gradually gaining traction due to increasing cross-border assignments.

- For instance, Cartus facilitated over 62,000 domestic relocations in the U.S. in 2023 alone, utilizing a network of more than 16,000 agents to handle logistics, temporary housing, and real estate support.

By Technology

Among technology segments, Relocation Management Software held the largest market share in 2024, reflecting a growing demand for streamlined relocation operations. These platforms offer end-to-end visibility, task tracking, and cost management, making them essential tools for HR and mobility managers. The adoption of digital platforms is further fueled by the need for real-time communication, policy compliance, and data security. While mobile applications and AI-driven tools are gaining relevance for user convenience and predictive insights, relocation software remains the preferred choice due to its integration capabilities and comprehensive workflow management.

- For instance, Graebel Companies, Inc. processed over 98,000 relocation cases through its Graebel GlobalCONNECT® platform in 2023, providing clients with real-time dashboards and compliance reporting for over 165 countries.

By End User

Corporate Entities dominated the end user segment, holding the majority share in 2024 due to their frequent and large-scale employee transfers. These organizations invest heavily in structured relocation programs to retain talent, reduce transition stress, and ensure operational continuity across locations. Sectors such as IT, consulting, and manufacturing have shown the highest adoption, driven by national expansion and talent redistribution strategies. Although government organizations and educational institutions also contribute to market demand, their relocation volumes and budgets remain comparatively lower than large private sector employers.

Market Overview

Rising Workforce Mobility Across U.S. Corporations

The growing demand for flexible workforce strategies is a major driver of the U.S. Corporate Relocation Service market. Companies are increasingly relocating employees to strategic locations to optimize operations, access diverse talent pools, and respond to regional market opportunities. With post-pandemic hybrid work models stabilizing, many firms are reshaping physical office footprints, prompting intra-state and inter-state transfers. This shift has intensified the need for comprehensive relocation support services, including housing assistance, temporary accommodations, and logistics management, thereby fueling consistent demand across both small and large enterprises.

- For instance, SIRVA supported more than 250,000 employee moves in North America in 2023, with 60% related to internal workforce restructuring and new branch rollouts.

Increasing Demand for Talent Retention and Employee Satisfaction

To enhance employee retention and engagement, organizations are investing in relocation packages that prioritize convenience and support. Corporate relocation services now emphasize not only the physical move but also the well-being of the relocating employee and their family. Enhanced offerings such as settling-in assistance, educational support for children, and spousal employment help are becoming standard components of relocation policies. These services contribute to improved employee satisfaction, reduced turnover rates, and a stronger employer brand, thereby making relocation service providers vital strategic partners in talent management.

- For instance, Aires reported a 34% increase in adoption of its Family Integration Services between 2022 and 2023, supporting over 18,000 spouses and dependents with transition plaing and school placement services.

Adoption of Technology-Driven Relocation Solutions

The integration of advanced technology into relocation processes is significantly driving market growth. Solutions such as relocation management software, AI-based analytics, and mobile applications have transformed service delivery by offering real-time tracking, personalized recommendations, and cost control. Employers benefit from improved operational transparency and policy compliance, while employees enjoy smoother transition experiences. The use of virtual reality for orientation and automation for document handling has further optimized relocation timelines. This technological shift is encouraging corporations to outsource relocation management to tech-enabled service providers.

Key Trends & Opportunities

Growing Popularity of Sustainable Relocation Practices

Environmental concerns and corporate sustainability goals are reshaping relocation strategies. Companies are increasingly seeking green moving solutions, such as energy-efficient transportation, digital documentation, and partnerships with eco-conscious vendors. This trend presents an opportunity for service providers to differentiate by offering carbon footprint tracking and sustainable move packages. Additionally, firms are aligning relocation processes with broader ESG (Environmental, Social, and Governance) objectives, prompting a demand for vendors that support long-term sustainability commitments while delivering efficient services.

- For instance, Sterling Lexicon introduced its Eco-Move Program in 2023, reducing moving truck emissions by 27% through route optimization and biodegradable packaging across 8,000 U.S.-based relocations.

Expansion of Services for Niche Sectors and Roles

There is rising demand for tailored relocation services catering to niche sectors such as healthcare, academia, and nonprofit organizations. These industries often require specialized handling of employee needs, such as licensing support for healthcare professionals or assistance for international researchers. Furthermore, C-suite and high-skilled technical roles increasingly require VIP-level relocation experiences, presenting providers with opportunities to offer premium, white-glove services. These tailored offerings not only drive revenue growth but also strengthen client loyalty in a competitive market.

- For instance, Altair Global managed over 12,000 healthcare-related employee moves in 2023, including licensure verification, medical facility onboarding, and compliance tracking across 48 states.

Key Challenges

High Cost and Budget Constraints for Employers

One of the primary challenges in the U.S. Corporate Relocation Service market is the rising cost of services, including housing, transportation, and insurance. Inflationary pressures and limited real estate availability in urban areas make relocation packages expensive for employers. Budget constraints, especially among mid-sized and nonprofit organizations, often lead to limited service adoption or reduced support offerings. This poses a barrier to market growth and encourages cost-focused decision-making that may compromise employee experience.

Complex Regulatory and Tax Compliance Issues

Navigating federal, state, and local tax laws, as well as employment and housing regulations, poses a significant challenge for relocation service providers and employers alike. Compliance varies greatly depending on the origin and destination locations, and any misstep can result in penalties, delays, or legal exposure. For companies managing large-scale or cross-border relocations, staying compliant requires significant administrative resources and legal oversight, thereby increasing operational complexity and cost burdens for both internal HR departments and external vendors.

Logistical Disruptions and Supply Chain Constraints

The relocation market is also affected by unpredictable logistical issues, including delays in household goods shipping, vehicle transportation, and availability of temporary housing. Natural disasters, fuel price fluctuations, and labor shortages in the moving industry can cause significant delays and increase costs. These disruptions negatively impact the employee experience and erode confidence in relocation providers. In response, companies must build contingency plans and diversify vendor relationships, which adds further complexity and operational strain.

Regional Analysis

Northeast Region

The Northeast region accounted for a significant share of the U.S. Corporate Relocation Service market in 2024, holding approximately 28% of the total market. This dominance is largely attributed to the presence of major financial, legal, and consulting firms in cities like New York, Boston, and Philadelphia, which frequently engage in employee relocation to meet talent and operational needs. The region’s high cost of living and competitive job market necessitate comprehensive relocation packages, including housing and family support services. Additionally, a dense population and established infrastructure support efficient relocation logistics, further reinforcing its leading market position.

Midwest Region

The Midwest region held around 22% of the U.S. Corporate Relocation Service market in 2024, driven by the growth of manufacturing, healthcare, and technology hubs across cities like Chicago, Minneapolis, and Detroit. The region’s affordability and expanding business environment have made it an attractive destination for corporate expansions and workforce realignments. Companies relocating to or within the Midwest often seek cost-effective relocation solutions, creating demand for bundled services that include logistics, settling-in support, and employee assistance. Moreover, the increasing adoption of regional headquarters by major corporations has boosted internal mobility, further supporting market growth in this region.

South Region

The South region represented the largest share of the U.S. Corporate Relocation Service market in 2024, accounting for approximately 33% of the total. This growth is fueled by rapid business expansion, favorable tax environments, and a lower cost of living in states such as Texas, Florida, Georgia, and North Carolina. The region continues to attract a diverse corporate base, particularly in technology, finance, and healthcare sectors, leading to frequent employee relocations. Additionally, inbound migration trends and corporate restructuring post-pandemic have accelerated demand for full-service relocation providers, making the South a key driver of national market growth.

West Region

In 2024, the West region contributed about 17% to the U.S. Corporate Relocation Service market. Although it holds a smaller share compared to other regions, high-value relocations to tech-driven cities such as San Francisco, Seattle, and Denver remain prevalent. The concentration of technology firms and startups often results in frequent talent mobility, both domestically and internationally. However, the high cost of living and housing shortages in key metropolitan areas present challenges for relocating employees, increasing reliance on premium relocation services. Companies in the West are also early adopters of tech-enabled relocation platforms, contributing to market innovation despite a modest overall share.

Market Segmentations:

By Product:

- Domestic Relocation Services

- International Relocation Services

- Employee Assistance Programs

- Settling-In Services

- Logistics and Transportation Services

- Other Relocation Solutions

By Technology:

- Relocation Management Software

- Mobile Applications

- Data Analytics Tools

- Virtual Reality Training Solutions

- Automation and AI-Driven Solutions

By End User:

- Corporate Entities

- Government Organizations

- Non-Profit Organizations

- Educational Institutions

- Healthcare Organizations

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The U.S. Corporate Relocation Service market is characterized by a competitive landscape dominated by a mix of established players and specialized service providers. Key companies such as Cartus, SIRVA, Graebel Companies, Inc., Altair Global, Aires, Sterling Lexicon, and XONEX offer comprehensive relocation solutions that cater to domestic and international corporate clients. These firms compete on the basis of service breadth, technological integration, global reach, and personalized support. Market leaders are increasingly investing in digital platforms, AI-driven tools, and relocation management software to streamline operations and enhance the employee experience. Strategic mergers, acquisitions, and partnerships are common, aimed at expanding geographic presence and service capabilities. Additionally, companies are focusing on sustainability initiatives and diversity-focused relocation policies to align with evolving corporate values. The competitive intensity is expected to remain high, with innovation and client-centric solutions serving as key differentiators in retaining large enterprise clients and capturing emerging opportunities in mid-market and niche sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cartus

- SIRVA

- Graebel Companies, Inc.

- Altair Global

- Aires

- Sterling Lexicon

- XONEX

Recent Developments

- In July 2025, Graebel launched new global partnerships aimed at enhancing sustainability in its global mobility services and has adopted data-driven decision making through predictive analytics and digital dashboards (globalCONNECT platform). There is also an emphasis on technology, with virtual surveys (partnering with Shyft) to quickly generate cost estimates without in-person visits, and holistic service delivery across 165+ countries.

- In April 2025, Cartus published its US & Canada Domestic Mobility Survey, showing increased or stable relocation volumes for over 70% of companies in 2025. Trends influencing this growth include market expansion, local talent shortages, and company growth. Key developments include rising process costs (addressed by efficiency measures and flexible policy benefits), broader adoption of remote work without corresponding relocation benefits, and increased use of non-traditional services such as discard/donate programs and enhanced settling-in support.

- In 2025, SIRVA is actively expanding its offerings by prioritizing temporary living solutions for relocating employees, recognizing the crucial support needed during the initial transition phase while simultaneously investing in technological advancements to streamline the relocation process, mirroring the broader industry trend towards automation and improved user experience.

Market Concentration & Characteristics

The U.S. Corporate Relocation Service Market shows a moderate to high level of market concentration, with a few dominant players controlling a significant portion of the total market revenue. Companies such as Cartus, SIRVA, Graebel Companies, and Altair Global consistently secure large enterprise contracts due to their broad service portfolios, advanced digital platforms, and global capabilities. It features a blend of full-service providers and niche vendors catering to specific relocation needs, such as settling-in services or employee assistance programs. The market reflects characteristics of high customer dependency, complex service customization, and strong demand for integration with internal HR systems. Technology plays a central role, with relocation management software and data analytics tools becoming standard offerings. Pricing remains competitive, but quality, speed, and service scope often drive vendor selection. Client loyalty depends heavily on service consistency and policy compliance. Long-term contracts and bundled service packages are common, making entry for new firms challenging without differentiated value propositions.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. corporate relocation service market is expected to witness steady growth driven by increased employee mobility and business expansion activities.

- Companies are increasingly investing in streamlined relocation programs to attract and retain top talent across regions.

- Demand for tech-enabled relocation services is rising as businesses seek more efficient and transparent solutions.

- Hybrid and remote work models are reshaping corporate relocation strategies to focus on flexibility and employee preferences.

- The growing number of mergers and acquisitions is prompting a rise in executive relocations and office consolidations.

- Sustainability concerns are influencing relocation service providers to offer eco-friendly moving solutions.

- Outsourcing of relocation processes is becoming more common as firms aim to reduce internal HR workload.

- Data security and compliance are gaining importance as relocation involves sensitive employee and corporate information.

- Customization of relocation packages is becoming a priority to align with varying employee needs and expectations.

- The market is seeing increased competition among vendors offering end-to-end relocation services and value-added support.