Market Overview

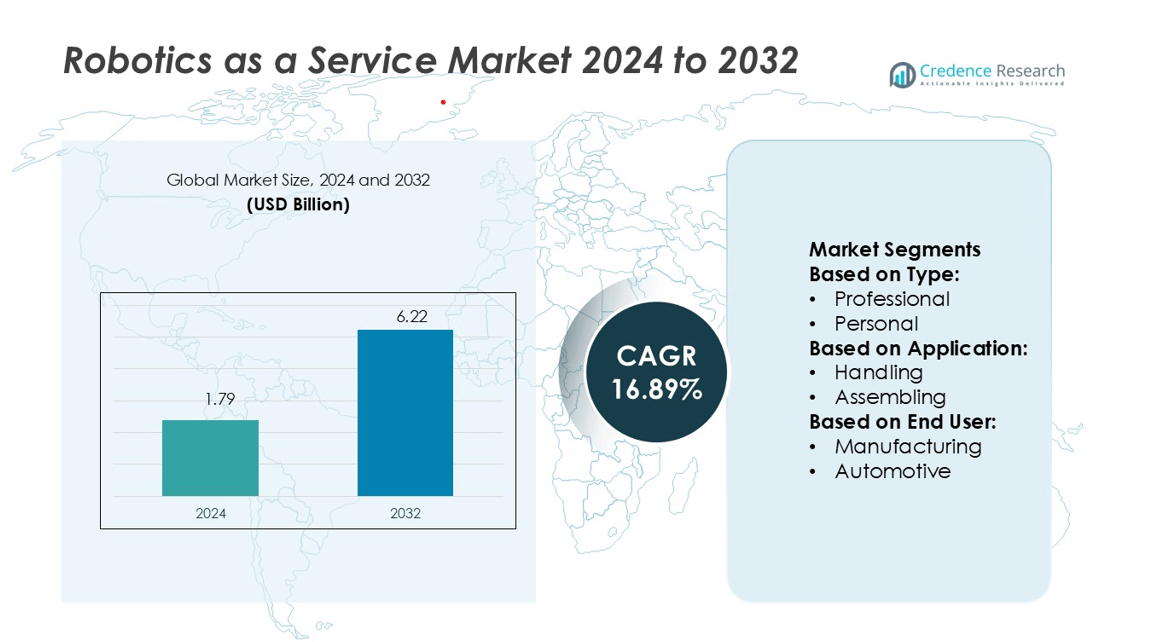

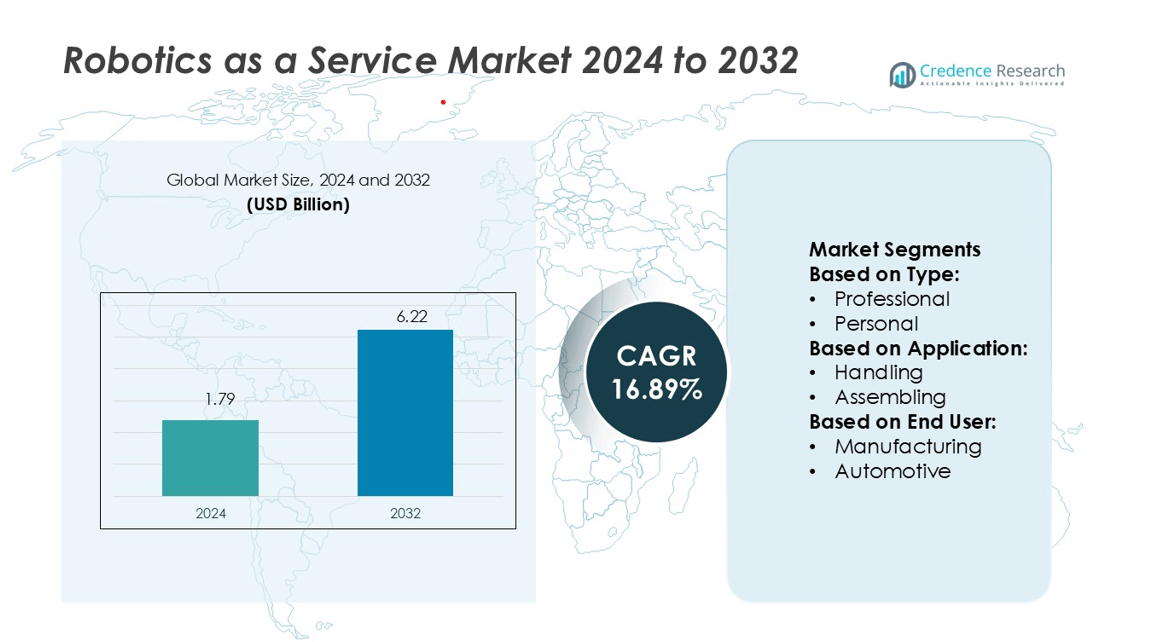

Robotics as a Service Market size was valued USD 1.79 billion in 2024 and is anticipated to reach USD 6.22 billion by 2032, at a CAGR of 16.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotics as a Service Market Size 2024 |

USD 1.79 billion |

| Robotics as a Service Market, CAGR |

16.89% |

| Robotics as a Service Market Size 2032 |

USD 6.22 billion |

The Robotics as a Service market is shaped by top players including Formic Technologies Inc., Exotec, Intuitive Surgical, CYBERDYNE, Inc., Cobalt Robotics, Knightscope, Inc., Hirebotics, Berkshire Grey, Inc., Aethon, and inVia Robotics, Inc. These companies focus on expanding their portfolios through advanced automation, AI integration, and scalable deployment models. Their solutions address key applications across manufacturing, logistics, healthcare, and security. North America leads the global market with a 36.2% share, supported by a strong industrial base, high labor costs driving automation, and robust technological infrastructure. Strategic investments, early adoption of robotics, and a growing shift toward subscription-based automation strengthen the region’s leadership position in the global landscape.

Market Insights

- The Robotics as a Service Market was valued at USD 1.79 billion in 2024 and is expected to reach USD 6.22 billion by 2032, growing at a CAGR of 16.89% during the forecast period.

- Rising automation demand across manufacturing, logistics, and healthcare sectors is driving strong market growth, supported by AI integration and flexible service-based models.

- North America leads the global market with a 36.2% share, followed by Europe and Asia Pacific, driven by industrial maturity and rapid technology adoption.

- The professional robotics segment holds the dominant share due to its widespread use in production, logistics, and security applications.

- High initial integration complexity and data security concerns remain key restraints, while top players focus on strategic partnerships and innovation to strengthen their competitive positions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Professional robots hold the dominant share in the Robotics as a Service market due to their high adoption across industrial applications. These robots offer precise performance, scalability, and ease of integration with automated systems. Industries use professional robots to optimize operations, reduce errors, and increase productivity. Continuous improvements in robotic sensors and AI algorithms enhance their accuracy and flexibility. Personal robots are also growing steadily, driven by demand in household, education, and personal assistance applications, but professional robots remain the key revenue contributor. This dominance is supported by expanding industrial automation investments.

- For instance, Formic Technologies Inc. operates a large independent robot fleet in U.S. factories, emphasizing its high uptime of over 99% and rapid growth in production hours by offering Robots-as-a-Service (RaaS) solutions for manufacturers.

By Application

Handling applications account for the largest market share in the Robotics as a Service market. Automated handling solutions streamline material flow, minimize human errors, and increase operational speed. Manufacturing, logistics, and automotive industries use handling robots for precise operations in warehouses and production lines. Assembling and dispensing applications are also expanding due to increasing adoption in electronics and food processing. Welding and soldering applications remain significant in automotive and heavy industries. Handling leads due to its wide cross-sector deployment and direct impact on cost reduction and productivity.

- For instance, Exotec’s Skypod® robots move at up to 4 m/s (13 ft/s) and climb racks to heights of up to 14 m (46 ft) while carrying loads up to 30 kg (66 lbs). Manufacturing, logistics, and automotive industries use handling robots for precise operations in warehouses and production lines.

By End-user

Manufacturing dominates the Robotics as a Service market among end users. Manufacturers rely on robotics to achieve high output, maintain precision, and reduce labor dependency. Robotics solutions support flexible production lines, predictive maintenance, and real-time quality control. Automotive, logistics, and healthcare sectors are also witnessing strong adoption for assembly, material movement, and medical support applications. Retail and food & beverage sectors are leveraging robots to improve service speed and accuracy. Manufacturing leads the segment due to its early automation adoption and ongoing digital transformation strategies across global facilities.

Key Growth Drivers

Rising Industrial Automation Demand

Increasing demand for industrial automation is driving the Robotics as a Service market. Companies use RaaS solutions to improve efficiency, reduce costs, and enhance production speed. Industries like manufacturing, logistics, and automotive are adopting flexible robotic systems to meet dynamic operational needs. These solutions offer high accuracy, lower downtime, and faster deployment compared to traditional automation models. The subscription-based structure also reduces upfront investment, making advanced robotics more accessible. This shift is accelerating digital transformation across both large enterprises and SMEs.

- For instance, Intuitive’s latest platform, the da Vinci 5, incorporates over 150 design innovations and claims 10,000 × the computing power versus its predecessor. Companies use subscription-style RaaS solutions to improve efficiency, reduce costs, and enhance production speed.

Cost-Effective Deployment Models

The RaaS model allows businesses to access advanced robotics without heavy capital expenditure. This pay-as-you-go structure helps companies scale operations quickly while maintaining financial flexibility. Enterprises use subscription-based robotics to meet seasonal demands or manage variable workloads efficiently. Cost savings in maintenance, training, and upgrades further strengthen its appeal. This model benefits industries with dynamic production cycles and encourages adoption among small and medium-sized businesses. The financial flexibility provided by RaaS supports broader market penetration and rapid technological integration.

- For instance, CYBERDYNE offers its Transportation Robot on rental with a load capacity of 200 kg and a maximum running speed of 30 m/min, allowing companies to deploy robotics on-demand rather than purchase upfront.

Technological Advancements in Robotics

Rapid advancements in AI, IoT, and cloud computing enhance the capabilities of RaaS solutions. Modern robots now offer improved navigation, real-time decision-making, and remote control features. These innovations support more complex and diverse industrial and commercial applications. AI integration enables predictive maintenance, improving efficiency and reducing downtime. The development of collaborative robots (cobots) further boosts adoption in industries with mixed human-robot workflows. Continuous innovation drives market expansion and creates new opportunities across manufacturing, logistics, healthcare, and retail sectors.

Key Trends & Opportunities

Integration of AI and Predictive Analytics

AI and predictive analytics are transforming the RaaS landscape. Companies are deploying intelligent robots capable of learning and adapting to operational needs. Predictive analytics helps detect potential failures early, ensuring optimal performance and reducing costs. This trend supports industries seeking smarter, data-driven automation solutions. Advanced analytics also improves resource allocation and operational planning, making robots more efficient and productive. The rise of AI-powered robotics creates opportunities for high-value applications in manufacturing, logistics, and healthcare.

- For instance, Cobalt’s security robot deployed at enterprise sites uses over 60 distinct sensors to patrol around-the-clock and detect anomalies via machine-learning models.

Expansion into Non-Industrial Sectors

RaaS is rapidly expanding beyond traditional manufacturing environments. Healthcare, retail, and food service sectors are increasingly adopting robotics for operational support. Service robots handle tasks like patient assistance, inventory management, and order fulfillment, improving speed and accuracy. The flexibility of RaaS enables quick deployment in different environments, creating new revenue streams. This expansion is reshaping how businesses across industries use robotics to improve efficiency and customer experience.

- For instance, Knightscope’s K5 Autonomous Security Robot (ASR) stands at 64.6 in height and weighs 420 lbs, enabling it to operate both indoor and outdoor in retail, healthcare, and food-service settings.

Growth of Collaborative Robotics (Cobots)

Collaborative robots are gaining strong momentum in the RaaS market. Cobots are designed to work safely alongside humans, improving productivity without extensive safety infrastructure. Their flexible programming and mobility make them ideal for small and mid-sized businesses. Industries are adopting cobots for assembly, handling, and inspection tasks. This trend is creating significant opportunities for vendors to offer modular, easy-to-integrate RaaS solutions tailored to specific workflows.

Key Challenges

Data Security and Privacy Concerns

RaaS solutions rely heavily on cloud connectivity and data sharing, raising cybersecurity concerns. Unauthorized access, data breaches, or operational disruptions can impact business continuity. Enterprises must implement strict security measures to protect sensitive operational data. Concerns about data ownership and compliance with regulations also slow adoption in sensitive sectors like healthcare and defense. Ensuring robust encryption, secure networks, and compliance frameworks is critical to building trust in RaaS deployments.

Integration Complexity and Workforce Adaptation

Integrating robotics into existing operations can be challenging for many companies. Legacy systems, infrastructure limitations, and skill gaps hinder smooth deployment. Workforce training and adaptation are also critical to achieving operational efficiency. Resistance to change and lack of technical expertise often delay large-scale implementation. Vendors and enterprises must invest in training programs and modular integration approaches to address these barriers and ensure successful adoption of RaaS solutions.

Regional Analysis

North America

North America holds the largest share of the global Robotics as a Service market at 36.2%. The region benefits from advanced automation infrastructure, strong R&D investments, and early technology adoption. Industries such as manufacturing, automotive, healthcare, and logistics drive demand for flexible robotics solutions. High labor costs and a focus on operational efficiency further accelerate adoption. The presence of major RaaS providers and strong cloud infrastructure enhances deployment speed. The U.S. leads the region, supported by strategic investments and favorable policies promoting Industry 4.0. Canada is also emerging as a key contributor to market growth.

Europe

Europe accounts for 27.8% of the global Robotics as a Service market. The region’s strong manufacturing base, particularly in Germany, France, and the U.K., drives extensive use of robotic automation. Supportive government initiatives for digital transformation and strict labor regulations encourage RaaS adoption. The automotive and logistics sectors lead deployment, while healthcare applications are gaining traction. European companies emphasize collaborative robotics to optimize mixed work environments. Strong focus on worker safety and advanced industrial standards further support the regional market. Strategic partnerships and technology integration play a major role in sustaining growth.

Asia Pacific

Asia Pacific captures 24.6% of the Robotics as a Service market, driven by rapid industrialization and strong government support for automation. China, Japan, and South Korea lead adoption due to their advanced robotics ecosystems. The region’s growing manufacturing base and expansion of e-commerce logistics significantly boost demand. Cost-effective production capabilities and large-scale deployments support market expansion. Increasing investments in AI and smart manufacturing strengthen regional competitiveness. RaaS adoption is also rising in emerging markets like India and Southeast Asia, supported by growing SME participation and demand for scalable automation solutions.

Latin America

Latin America holds 6.1% of the global Robotics as a Service market. Brazil and Mexico lead adoption, supported by expanding manufacturing and automotive sectors. Companies in the region are adopting RaaS to reduce operational costs and improve production efficiency. Growing investment in logistics automation and smart warehouses supports further expansion. The subscription-based model makes advanced robotics accessible to medium-sized businesses, driving adoption across various industries. Challenges remain in infrastructure development, but improving connectivity and local partnerships are strengthening the regional ecosystem. Logistics and food processing industries are among the fastest-growing end users.

Middle East & Africa

The Middle East & Africa region accounts for 5.3% of the global Robotics as a Service market. The UAE, Saudi Arabia, and South Africa are leading early adopters, focusing on smart infrastructure and industrial diversification. Governments are investing in advanced automation to support logistics, energy, and healthcare sectors. RaaS helps companies address labor shortages and enhance operational efficiency in critical industries. Strategic partnerships with international providers accelerate deployments. While infrastructure gaps and skill shortages remain, the region shows strong growth potential, supported by smart city projects and national digital transformation strategies.

Market Segmentations:

By Type:

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Robotics as a Service market is shaped by key players such as Formic Technologies Inc., Exotec, Intuitive Surgical, CYBERDYNE, Inc., Cobalt Robotics, Knightscope, Inc., Hirebotics, Berkshire Grey, Inc., Aethon, and inVia Robotics, Inc. The Robotics as a Service market is characterized by rapid technological advancements, strategic partnerships, and strong investment in innovation. Companies are focusing on expanding their service portfolios through AI, cloud integration, and advanced automation capabilities. RaaS providers are competing on factors such as cost efficiency, deployment flexibility, and performance reliability. Growing demand from industries like manufacturing, logistics, healthcare, and security is driving continuous development of customized robotic solutions. Vendors are also strengthening their market presence through subscription-based models and scalable platforms, enabling faster adoption across enterprises of all sizes and accelerating global market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Formic Technologies Inc.

- Exotec

- Intuitive Surgical

- CYBERDYNE, Inc.

- Cobalt Robotics

- Knightscope, Inc.

- Hirebotics

- Berkshire Grey, Inc.

- Aethon

- inVia Robotics, Inc.

Recent Developments

- In June 2024, ABB Ltd launched Omnicore, an advanced robotics platform. This platform is expected to enable businesses to increase productivity with precise automation and expedite the operations with flexibility. OmniCore is developed with an objective to provide versatile automation solutions to a wide range of applications in construction, biotechnology and others.

- In May 2024, United Robotics Group made a launch at VivaTech 2024 with the introduction of its uLink series of service robots. The uLink series, designed to cater to a wide range of service industries, includes robots equipped with advanced AI, seamless connectivity, and intuitive user interfaces. These robots are engineered to perform various tasks, such as customer interaction, delivery, and facility management, to enhance efficiency and elevate the service experience.

- In April 2024, Pudu Robotics launched the PUDU T300, designed to address the demanding needs of industrial environments. It provides robust performance, high precision, and enhanced efficiency. By entering the industrial robotics market, Pudu Robotics aims to leverage its technological expertise to drive productivity and transformation in manufacturing, logistics, and other industrial applications.

- In October 2023, Rockwell Automation purchased Clearpath Robotics, the frontrunner in autonomous industrial robotics. This purchase incorporates Clearpath Robotics’ eponymous research branch, a pioneer in autonomous technology development for the innovation market, and the industrial division- OTTO Motors which offers the market Autonomous Mobile Robots (AMRs)

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption across manufacturing, logistics, and healthcare sectors.

- Subscription-based models will continue to lower entry barriers for businesses.

- AI and machine learning will enhance the intelligence and autonomy of robots.

- Cloud integration will support real-time monitoring and remote management of operations.

- Collaborative robots will gain stronger traction in mixed human-robot environments.

- Service robots will expand into emerging sectors like retail, education, and hospitality.

- Cybersecurity measures will become a critical focus for providers and users.

- Emerging economies will contribute significantly to the overall market growth.

- Strategic partnerships and acquisitions will accelerate technological innovation.

- Scalable and modular solutions will support faster deployment and flexible operations.