Market Overview

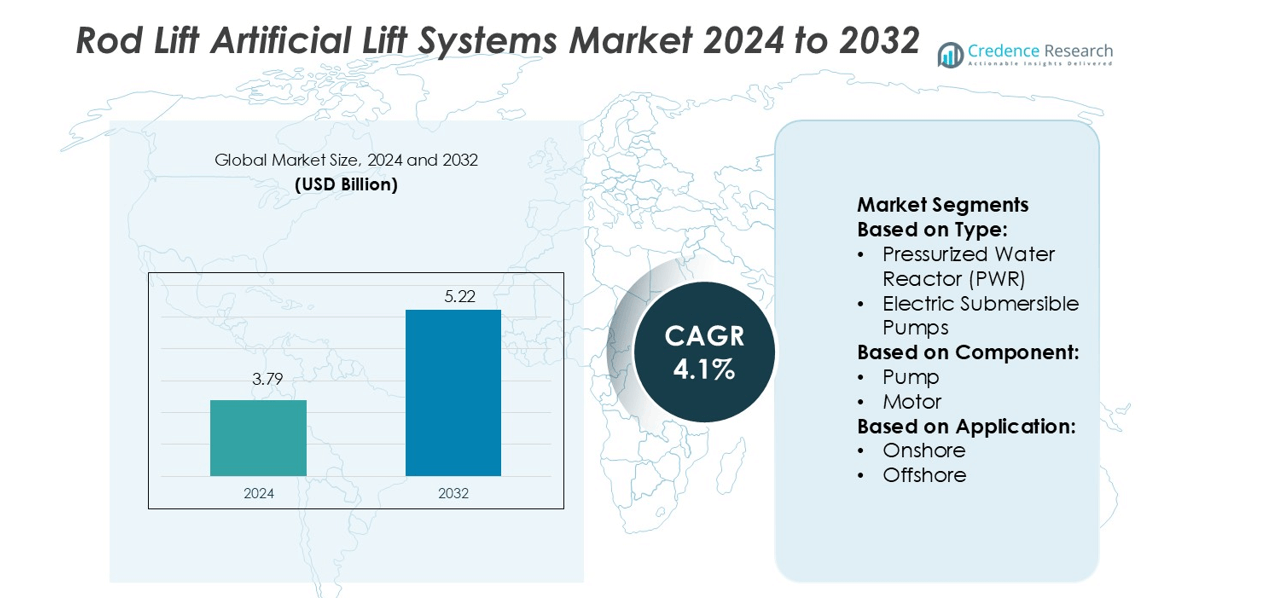

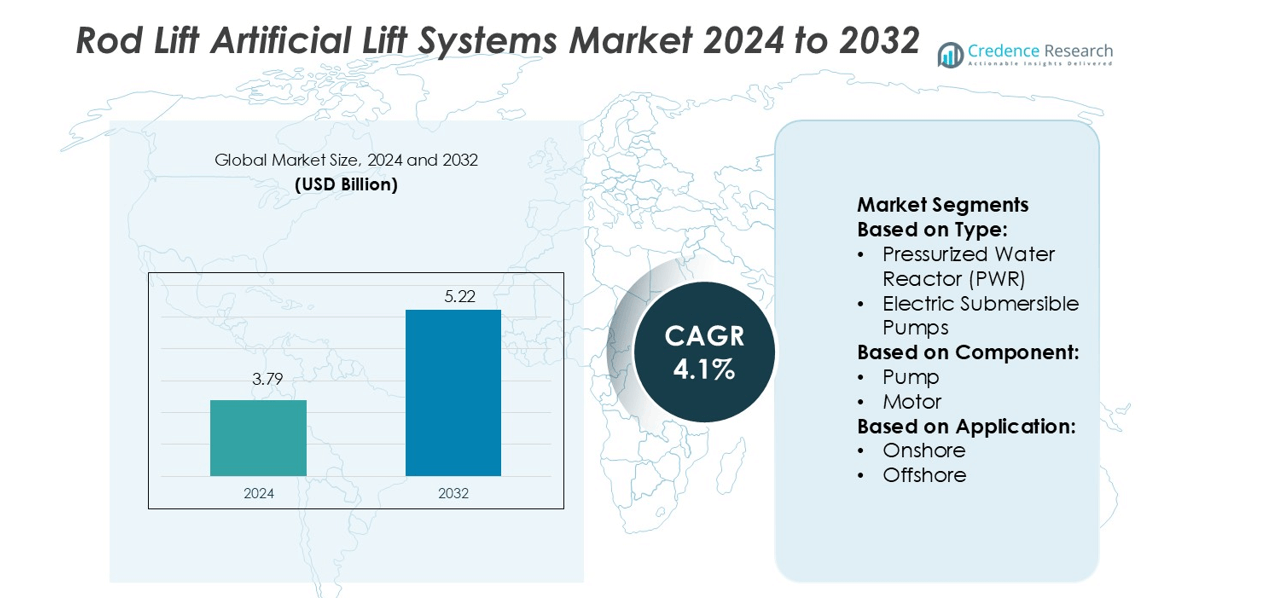

Rod Lift Artificial Lift Systems Market size was valued USD 3.79 billion in 2024 and is anticipated to reach USD 5.22 billion by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rod Lift Artificial Lift Systems Market Size 2024 |

USD 3.79 billion |

| Rod Lift Artificial Lift Systems Market, CAGR |

4.1% |

| Rod Lift Artificial Lift Systems Market Size 2032 |

USD 5.22 billion |

The Rod Lift Artificial Lift Systems Market features strong competition from key players including Liberty Lift Solutions, General Electric, Levare, JJ Tech, Halliburton, National Energy Services Reunited, ChampionX, ELKAM ArtEfficial Lift, BCP Group, and Endurance Lift Solutions International. These companies focus on developing advanced and cost-efficient lift systems to meet growing demand from mature and unconventional oilfields. Strategic priorities include product innovation, digital integration, and expanded service networks to enhance operational performance. North America leads the global market with a 36% share, supported by extensive shale oil production, advanced infrastructure, and early adoption of automation and predictive maintenance technologies. This strong regional base gives the market a competitive edge in technological development and large-scale deployment.

Market Insights

- The Rod Lift Artificial Lift Systems Market size was valued at USD 3.79 billion in 2024 and is anticipated to reach USD 5.22 billion by 2032, at a CAGR of 4.1%.

- Increasing production from mature oilfields and cost-efficient operations are key drivers, supported by rising demand for energy and enhanced recovery.

- Digital integration, automation, and predictive maintenance are shaping trends, improving efficiency and reducing downtime across onshore and offshore applications.

- The market faces restraints from mechanical wear issues and limited performance in high-volume wells, driving demand for advanced designs and durable components.

- North America leads with a 36% share, followed by Europe with 22% and Asia Pacific with 20%, while the pump segment holds the largest share among components, supported by its critical role in optimizing production and field performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Pressurized Water Reactor (PWR) holds the dominant share in the Rod Lift Artificial Lift Systems Market, supported by its high efficiency in handling large production volumes. PWR systems deliver steady flow rates, making them well-suited for mature wells and heavy oil production. Their lower operating costs and reliable performance enhance field economics. Electric Submersible Pumps and Gas Lift methods follow closely, driven by their ability to operate in deeper wells. Progressing Cavity Pumps and Jet Pumps gain traction in unconventional reservoirs, while other methods like hydraulic and plunger lift systems serve niche applications.

- For instance, GE’s acquisition of Lufkin Industries (in 2013) brought rod-lift systems where Lufkin’s surface pumping units can deliver up to 1,200 kN (≈ 270,000 lbf) of polished-rod load capacity.

By Component

The pump segment leads the market with the highest share, driven by its critical role in enhancing production output and optimizing reservoir performance. Advanced pump designs support extended operational life and reduced maintenance requirements, improving overall field productivity. Motors and cable systems follow, supported by growing automation in artificial lift operations. Controllers gain importance as operators adopt digital monitoring and control systems to optimize pump performance. Other components, including seals and protective housings, support reliability and reduce downtime in challenging well environments.

- For instance, Levare’s product brochures specify that their harsh duty and extreme duty ESP systems, which can feature Packet pumps, use TC bearings spaced at 1.1 ft (0.35 m) intervals along the shaft.

By Application

Onshore applications dominate the market, supported by the high number of mature wells and extensive E&P activities. Onshore operations benefit from lower installation and maintenance costs, making rod lift systems highly cost-effective. Offshore segments show steady growth as deepwater production projects adopt advanced lift technologies to enhance output. Increasing investments in marginal field development and rising focus on maximizing recovery rates further support offshore adoption. Both applications are benefiting from digital monitoring and predictive maintenance solutions, which improve operational efficiency and reduce production interruptions.

Key Growth Drivers

Increasing Production from Mature Oilfields

Mature oilfields represent a major revenue source for the Rod Lift Artificial Lift Systems Market. Declining reservoir pressure in aging fields increases the need for efficient lift solutions to maintain output levels. Rod lift systems offer reliable performance, low operational costs, and easy installation, making them suitable for long-term operations. Their adaptability to varying well conditions ensures steady production rates. Energy companies prioritize these systems to maximize recovery and extend well life, driving significant market growth across onshore fields globally.

- For instance, JJ Tech’s ULTRA-FLOW® system pairs a downhole jet pump (with no moving parts) and surface diaphragm pump, allowing retrieval via reverse circulation and enabling run-times of 3 to 5 years without a full workover.

Cost-Efficient Operations and High Reliability

Rod lift systems are favored for their low capital and operating costs compared to other lift methods. The simple mechanical design reduces maintenance frequency and downtime, improving production economics. High reliability makes these systems ideal for wells with stable production profiles and lower gas-to-oil ratios. Their ability to function without complex infrastructure aligns with operators’ cost optimization goals. This operational efficiency strengthens adoption among small and mid-sized producers, contributing to expanding deployment across both established and emerging oil-producing regions.

- For instance, Halliburton also highlights a case where an operator using its “Tiger Shark®” ESP system achieved over 600 days of low-flow production (> 200 barrels per day total fluid) after converting from rod lift, thereby avoiding ~ $150,000 in conversion costs.

Rising Demand for Energy and Enhanced Recovery

Global energy demand continues to increase, pushing operators to improve recovery from existing wells. Rod lift systems enable enhanced oil recovery by maintaining production levels even in low-pressure reservoirs. Their compatibility with digital monitoring and automation further improves efficiency and output. Energy companies invest in artificial lift upgrades to meet supply targets without expanding drilling footprints. This rising focus on optimizing recovery aligns well with the strengths of rod lift technology, creating long-term market growth opportunities.

Key Trends & Opportunities

Integration of Digital Technologies

Digitalization is transforming artificial lift operations through advanced monitoring and control systems. Real-time data analysis helps optimize pump performance, reduce failures, and extend equipment life. Predictive maintenance technologies lower operational costs and unplanned downtime. Integration with SCADA and IoT platforms enhances visibility and remote operation. These developments create opportunities for service providers offering AI-driven optimization tools and performance analytics. The shift toward intelligent lift systems supports improved production efficiency and better asset management across both onshore and offshore wells.

- For instance, XSPOC (version 3.2) draws on data from over 135,000 wells and more than 2,000 ESP systems to apply AI-driven diagnostics and autonomous control.

Expanding Use in Unconventional Reservoirs

Unconventional reservoirs are emerging as a key growth opportunity for rod lift systems. Their robust design and cost-effectiveness make them suitable for horizontal and multi-stage fractured wells. Operators are adapting rod lift configurations to handle varying flow rates and pressure conditions typical of shale and tight formations. This expansion is supported by growing unconventional production in North America, the Middle East, and parts of Asia. Increased deployment in these fields enhances market penetration and drives demand for advanced lift equipment.

- For instance, ELKAM supplies beam pumping units rated at load capacities of 6 tons, 8 tons, and 12 tons, with stroke lengths ranging from 1.2 m to 5 m, for operations at depths up to 2,000 m.

Focus on Sustainability and Energy Efficiency

Energy producers are adopting sustainable technologies to meet regulatory and environmental goals. Rod lift systems consume less power compared to alternative lift methods, aligning with emissions reduction strategies. Manufacturers are investing in energy-efficient motors, variable speed drives, and advanced control units to further lower energy use. These developments improve operational sustainability while reducing total cost of ownership. As companies commit to cleaner production methods, rod lift solutions are expected to gain stronger preference in upcoming projects.

Key Challenges

Mechanical Wear and Maintenance Issues

Frequent mechanical wear remains a significant challenge in rod lift operations. Moving parts such as rods, tubing, and pumps experience stress and fatigue under continuous use, leading to failures. Harsh well conditions, including high temperatures, sand, and corrosive fluids, accelerate equipment degradation. This increases maintenance frequency and raises operational costs. Downtime for repair or replacement can disrupt production schedules. Manufacturers are addressing this with advanced materials and improved designs, but maintenance remains a critical cost factor for operators.

Limited Performance in High-Volume Wells

Rod lift systems face operational limits in wells with high production rates and deep reservoir depths. Excessive fluid volumes can reduce efficiency, leading to increased equipment strain and premature failures. This restricts deployment in certain high-flow offshore or unconventional fields. Competing technologies like electric submersible pumps often handle higher volumes more effectively. These performance constraints challenge rod lift market expansion in high-output segments. Ongoing innovation aims to enhance lifting capacity, but this remains a key technical barrier to wider adoption.

Regional Analysis

North America

North America holds the largest share of the Rod Lift Artificial Lift Systems Market at 36%. The region’s dominance is driven by extensive production from mature fields in the U.S. and Canada. Operators rely on rod lift systems for their cost efficiency and long-term reliability. Strong shale oil production in the Permian Basin further boosts demand. Advancements in automation and predictive maintenance strengthen operational efficiency. Widespread digital integration allows better pump performance monitoring. Supportive regulatory frameworks and sustained investments in upstream activities continue to make North America the most mature and technologically advanced market for rod lift systems.

Europe

Europe accounts for 22% of the global market share, supported by production in mature oilfields in the North Sea and Eastern Europe. The region’s aging wells benefit from rod lift systems’ efficiency and cost-effectiveness. Operators emphasize energy optimization and low-emission technologies, aligning with sustainability goals. Advanced digital control systems are being adopted to enhance pump life and reduce downtime. Stringent environmental regulations encourage the use of low-power solutions, making rod lift technology an attractive option. Steady investment in offshore recovery projects supports market stability, despite declining exploration activities in several European countries.

Asia Pacific

Asia Pacific holds 20% of the market share, with rising adoption of rod lift systems across China, India, Indonesia, and Australia. Expanding upstream activities and growing energy demand drive installations in onshore fields. The region is witnessing increased deployment in marginal and mature wells, supported by government incentives for enhanced recovery. Domestic operators prefer rod lift systems for their low maintenance requirements and adaptability to varying well conditions. Emerging digitalization initiatives and automation in production operations further boost efficiency. Asia Pacific’s growing oil production base makes it one of the fastest-developing markets globally.

Latin America

Latin America represents 12% of the global market share, with Brazil, Mexico, and Argentina leading adoption. Rod lift systems support cost-effective production from mature fields and secondary recovery projects. National oil companies invest in artificial lift upgrades to sustain output amid declining reservoir pressure. The technology’s operational simplicity and adaptability to harsh environments make it a preferred option in remote fields. Increased investment in digital monitoring enhances system performance and reduces downtime. Growing focus on extending well life supports steady market growth, particularly in onshore oil-producing regions across the continent.

Middle East & Africa

The Middle East & Africa region accounts for 10% of the market share, supported by growing deployment in both onshore and offshore projects. National oil companies in Saudi Arabia, the UAE, and Nigeria are investing in artificial lift technologies to sustain output from mature wells. Rod lift systems offer reliability and low operating costs, aligning with cost-control strategies in the region. Rising digital adoption and predictive maintenance tools enhance operational efficiency. Although ESP systems dominate some high-volume wells, rod lift solutions are increasingly used to optimize recovery from low- to medium-output wells. Steady investments support long-term market expansion.

Market Segmentations:

By Type:

- Pressurized Water Reactor (PWR)

- Electric Submersible Pumps

By Component:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Rod Lift Artificial Lift Systems Market is shaped by key players such as Liberty Lift Solutions, General Electric, Levare, JJ Tech, Halliburton, National Energy Services Reunited, ChampionX, ELKAM ArtEfficial Lift, BCP Group, and Endurance Lift Solutions International. The Rod Lift Artificial Lift Systems Market is defined by strong technological advancement, service expansion, and digital integration. Companies focus on developing reliable and energy-efficient systems that meet the demands of mature and unconventional oilfields. Product innovation remains a core strategy, with emphasis on advanced control systems, predictive maintenance, and automation. Many providers are expanding global footprints through partnerships, mergers, and strategic service agreements. Investments in R&D help improve lifting capacity, reduce operational costs, and enhance system durability. This technology-driven competition supports increased market efficiency, operational flexibility, and long-term field performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, H2O.ai introduced agentic AI features for its enterprise platform h2oGPTe at Dell Technologies World, enhancing secure, production-ready deployment of AI across banking, telecom, and government use cases. The updates include integration with Dell AI Factory and Amazon Bedrock, hybrid deployment support, and improved automation and user experience.

- In May 2024, Schneider Electric partnered with Crux to assist in buying 45X advanced manufacturing production from Silfab Solar, a North American company that develops, designs, and manufactures premium solar PV modules. The collaboration is expected to accelerate the development and expansion of solar energy manufacturing within the U.S.

- In April 2024, SLB has introduced two innovative artificial lift systems designed to improve well performance and expand operational capabilities. These solutions enhance production rates and reduce the need for frequent interventions. The new systems incorporate advanced technologies for improved efficiency, cost savings, and extended lifespans.

- In February 2024, ChampionX has acquired Artificial Lift Performance Limited (ALP), a leader in advanced analytics software for oil and gas production. This acquisition enhances ChampionX’s digital solutions portfolio, combining ALP’s Pump Checker™ software with ChampionX’s XSPOC™ production optimization software

Report Coverage

The research report offers an in-depth analysis based on Type, Component, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising adoption of digital monitoring will enhance system efficiency and reduce downtime.

- Expansion of rod lift systems in unconventional reservoirs will boost overall deployment.

- Energy-efficient designs will gain stronger demand due to stricter environmental regulations.

- Advanced automation will improve operational control and production optimization.

- Integration with predictive maintenance tools will lower equipment failure rates.

- Increased investment in mature field recovery will sustain long-term market growth.

- Technological innovation will expand rod lift capacity in deeper and high-volume wells.

- Service-based business models will strengthen aftersales support and customer retention.

- Regional diversification will accelerate market penetration in emerging oil-producing economies.

- Focus on cost-effective production methods will make rod lift systems more competitive.