Market Overview:

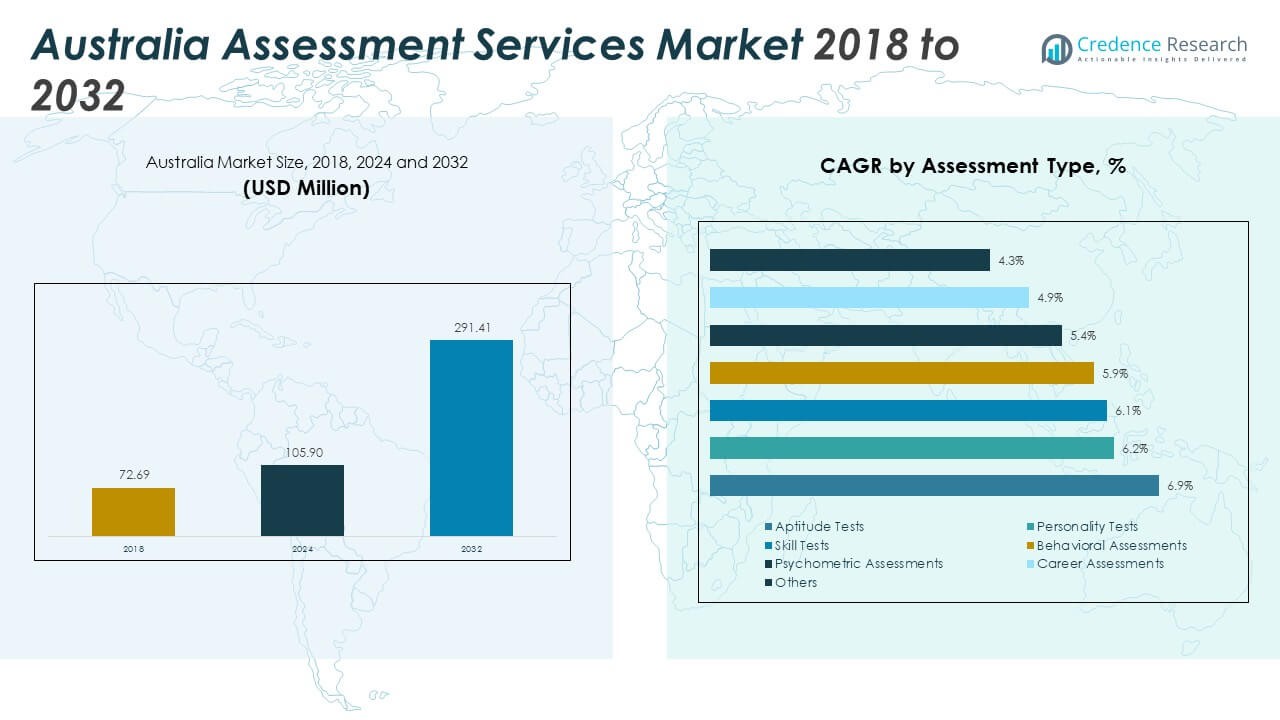

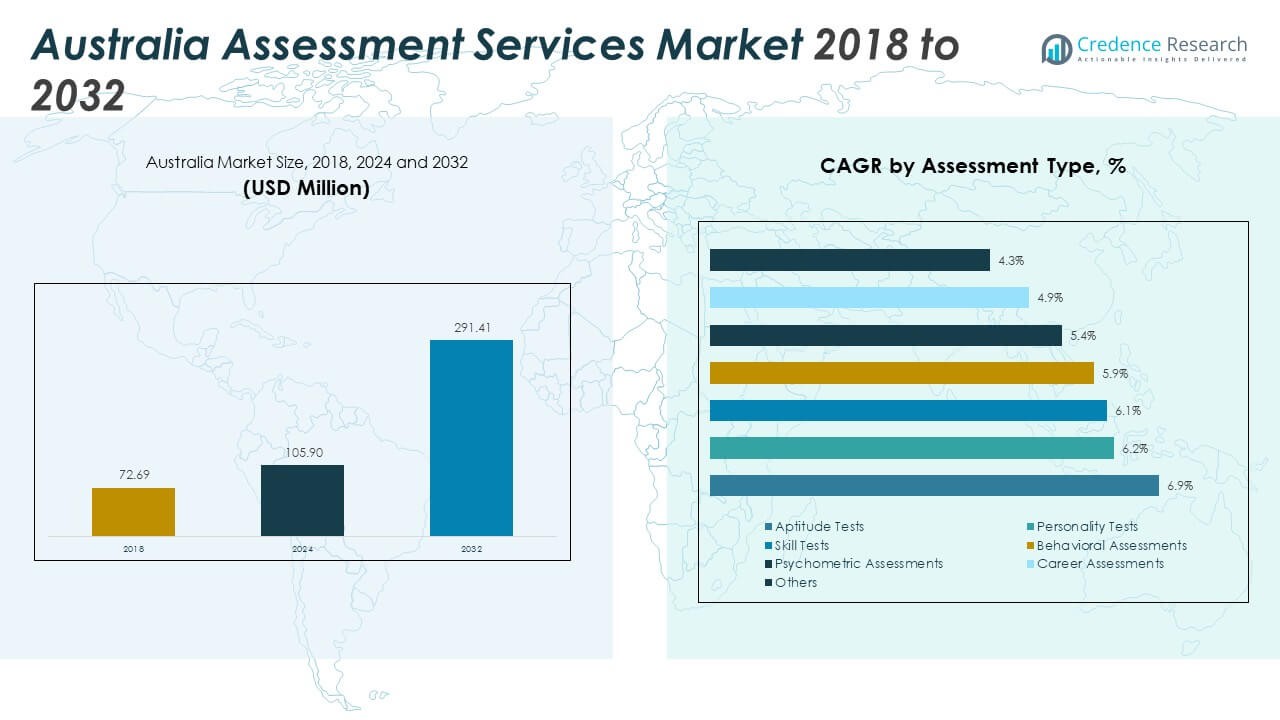

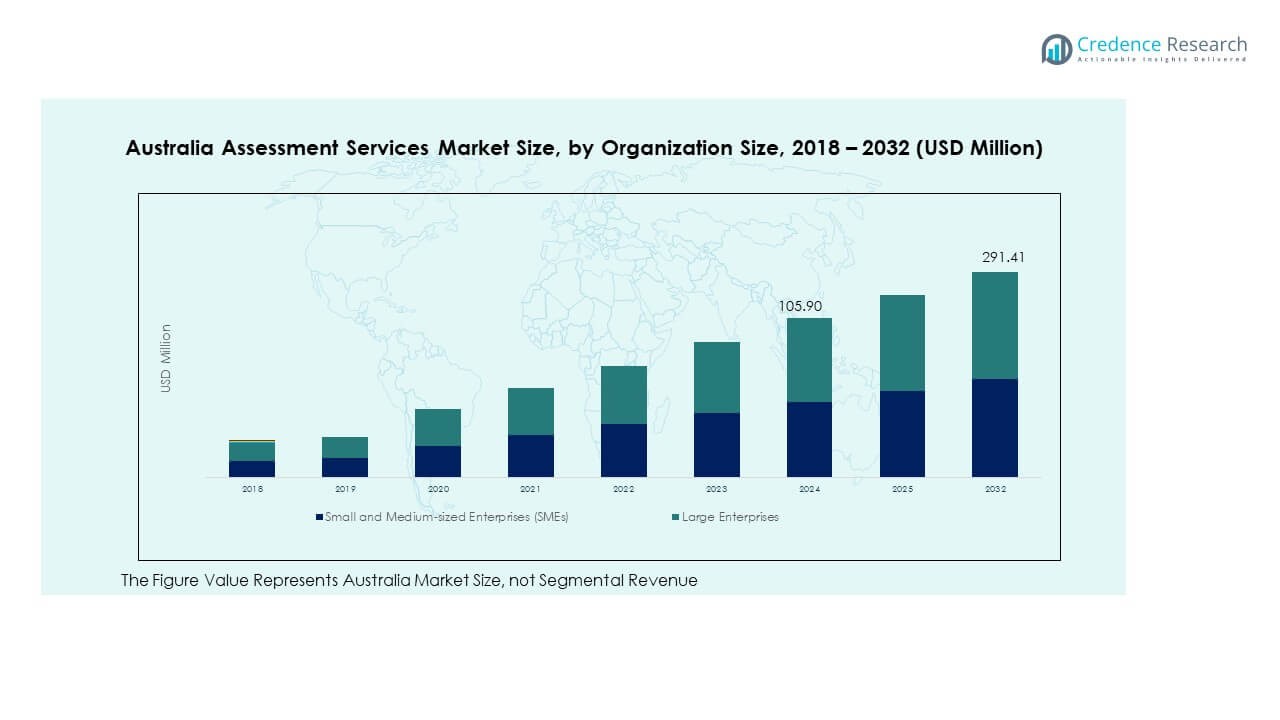

The Australia Assessment Services Market size was valued at USD 72.69 million in 2018 to USD 105.90 million in 2024 and is anticipated to reach USD 291.41 million by 2032, at a CAGR of 13.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Assessment Services Market Size 2024 |

USD 105.90 Million |

| Australia Assessment Services Market, CAGR |

13.49% |

| Australia Assessment Services Market Size 2032 |

USD 291.41 Million |

Rising demand for skills-based evaluation, growing adoption of digital learning platforms, and government focus on competency development are key market drivers. Educational institutions and enterprises are increasingly investing in online assessment tools to measure performance, learning outcomes, and workforce readiness. The rapid expansion of remote learning and hybrid education models has further strengthened the need for secure, scalable, and technology-driven testing solutions across sectors such as education, corporate training, and certification.

Regionally, the eastern and southeastern parts of Australia dominate due to a strong concentration of universities, corporate headquarters, and testing centers. States like New South Wales and Victoria lead market growth, supported by high digital adoption and investment in education technology. Emerging regions such as Queensland and Western Australia are witnessing growing participation in vocational and skill-based assessments, driven by industry diversification, workforce development programs, and regional training initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Assessment Services Market was valued at USD 72.69 million in 2018, reached USD 105.90 million in 2024, and is projected to achieve USD 291.41 million by 2032, registering a CAGR of 13.49% from 2024 to 2032.

- Eastern and southeastern Australia hold the largest regional share of about 55%, supported by the presence of major universities, EdTech hubs, and corporate headquarters that actively adopt digital assessment platforms.

- Northern and western regions account for nearly 25% of the market, driven by rising industrial diversification and government investments in regional training programs that encourage digital testing adoption.

- Southern and central Australia represent close to 20% of the market, emerging as the fastest-growing region due to skill-based learning initiatives and expanding mobile-based assessment access in developing areas.

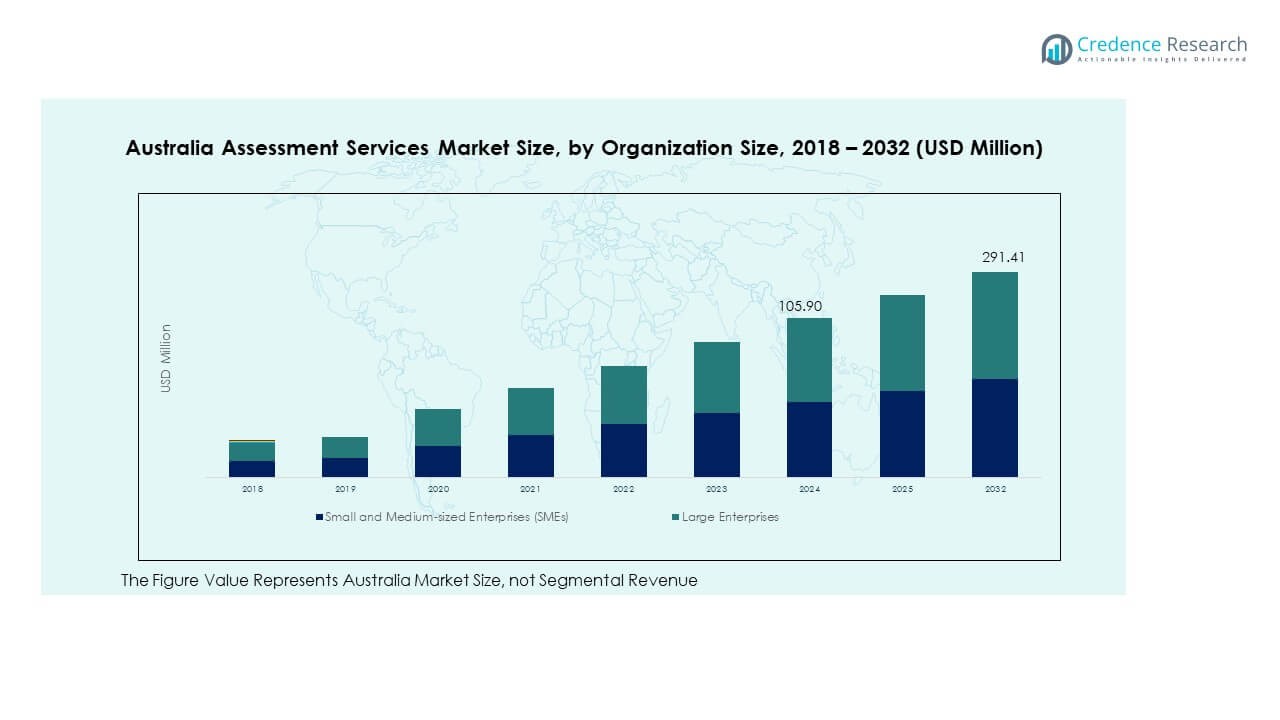

- In terms of organization size, large enterprises hold approximately 60% share, while small and medium-sized enterprises (SMEs) capture around 40%, reflecting increasing SME participation through affordable cloud-based testing platforms.

Market Drivers:

Growing Demand for Competency-Based Assessment Solutions in Education and Employment

The Australia Assessment Services Market is driven by the rising need for skill verification across education and employment sectors. Educational institutions are emphasizing measurable learning outcomes and performance-based testing. Employers seek data-driven insights to assess workforce readiness and job-specific competencies. This shift promotes integration of AI-enabled testing tools and analytics. The adoption of remote assessments is accelerating due to digital learning expansion. Government initiatives supporting skill certification and workforce development reinforce demand. Continuous curriculum reforms also align testing standards with evolving industry needs.

- For instance, Pearson launched its [AI and Assessment: The Essential Framework for Higher Education] in August 2025, introducing structured AI blueprints for learning evaluation and academic integrity, forming part of its national collaboration strategy with Australian universities.

Expansion of Online and Digital Examination Platforms Across Institutions

Digital transformation across schools, universities, and training centers drives growth. Institutions increasingly adopt cloud-based systems for scalable, secure, and flexible assessments. The convenience of remote testing attracts students and professionals across regions. The market benefits from strong investment in EdTech platforms and data analytics. Automation enhances grading efficiency, reducing human error and bias. Growing internet penetration and device accessibility improve participation rates. It strengthens overall digital literacy and supports continuous learning practices.

- For instance, Janison Education Group’s 2023 annual investor presentation reported fully online delivery of 4.4 million NAPLAN assessments for 1.3 million students across 9,000 Australian schools, powered by the Janison Insights platform and backed by Microsoft Azure’s cloud infrastructure.

Government-Led Skill Development and Workforce Certification Initiatives

Australia’s national policies promote skill enhancement through standardized testing frameworks. Public agencies collaborate with private providers to validate competencies in technical and vocational domains. These programs enhance employability and meet labor market demands. It encourages youth participation in digital learning and certification pathways. The emphasis on lifelong learning reinforces a culture of accountability. Government grants and partnerships increase institutional capacity to adopt assessment technologies. The integration of AI and adaptive testing methods supports personalized learning outcomes.

Corporate Training and Continuous Professional Development Integration

Organizations increasingly invest in employee assessments to track performance and learning effectiveness. The market grows through widespread use of digital certification and feedback systems. Assessment platforms enable HR departments to align training outcomes with business goals. It improves productivity by identifying skill gaps early. Continuous evaluation also supports compliance with professional standards. Hybrid work models encourage adoption of online performance testing tools. Data-driven insights from assessments guide future workforce planning.

Market Trends:

Integration of Artificial Intelligence and Machine Learning in Assessment Systems

AI and ML technologies are reshaping testing environments across Australia. Automated proctoring tools ensure fairness and integrity during exams. The Australia Assessment Services Market benefits from intelligent grading systems that evaluate open-ended responses. Predictive analytics helps educators and organizations identify learner performance patterns. Adaptive learning algorithms create personalized question sets for test-takers. These advancements increase test accuracy and reduce administrative workload. The focus on innovation strengthens the credibility and efficiency of assessments nationwide.

Rising Adoption of Cloud-Based and Mobile Assessment Platforms

Cloud infrastructure supports flexible, secure, and scalable assessment delivery. Institutions adopt mobile-enabled systems to improve accessibility and convenience. The rise of remote learning drives migration from paper-based to digital formats. Cloud solutions provide real-time analytics for performance tracking. The Australia Assessment Services Market gains from seamless integration with LMS and ERP platforms. Strong cybersecurity protocols protect sensitive test data and user privacy. The trend accelerates digital transformation across education and corporate ecosystems.

Increasing Focus on Psychometric and Behavioral Assessment Tools

Employers and educators are emphasizing holistic evaluation methods. Psychometric assessments measure critical thinking, emotional intelligence, and leadership potential. The market experiences rising demand for tools that assess personality and cognitive skills. These instruments support recruitment, training, and academic admissions. It promotes fair decision-making through standardized behavioral metrics. Data-driven analysis helps organizations predict future performance more accurately. Continuous improvement in psychometric design enhances test reliability and adoption.

Growing Popularity of Certification Programs and Lifelong Learning Models

Australia’s workforce prioritizes upskilling to remain competitive in a dynamic job market. Certification-based learning models are becoming key to professional advancement. The Australia Assessment Services Market grows through industry-accredited testing solutions. Partnerships between educational institutions and private training providers expand certification access. Flexible modular learning structures align with working professionals’ needs. Continuous learning fosters adaptability in evolving industries. The integration of digital credentials increases trust and transparency in qualification verification.

Market Challenges Analysis:

Data Security, Test Integrity, and Infrastructure Limitations in Remote Assessments

The rapid shift to digital testing exposes vulnerabilities in data protection. Institutions face rising threats of cyberattacks and unauthorized access. Maintaining test integrity in remote environments remains difficult without advanced proctoring tools. The Australia Assessment Services Market must address connectivity gaps in rural areas. Limited technical infrastructure affects real-time monitoring and response accuracy. Educators and companies invest heavily in encryption and secure platforms to reduce risks. Ensuring uniform digital access across socio-economic groups remains a major challenge.

High Implementation Costs and Limited Awareness Among Smaller Institutions

The transition to technology-driven assessment systems requires significant capital investment. Smaller educational institutions struggle with hardware and licensing costs. Lack of awareness about digital testing benefits hinders adoption. The Australia Assessment Services Market encounters resistance from traditional institutions relying on manual testing. Limited technical expertise further slows modernization. Continuous staff training is needed to manage complex software environments. Cost-effective SaaS models and government support are essential for broader market penetration.

Market Opportunities:

Expansion of Skill Certification Programs and Industry-Aligned Learning Pathways

The growing need for workforce adaptability opens opportunities for new certification programs. The Australia Assessment Services Market benefits from collaboration between industry and academia. Tailored testing systems help align learning outcomes with market needs. Digital credentialing platforms enable transparent verification of qualifications. Government-backed training programs strengthen vocational education across emerging sectors. Continuous demand for re-skilling drives adoption of flexible assessment tools. These opportunities support sustainable employment growth and long-term workforce competitiveness.

Adoption of AI-Enabled Assessment Analytics and Cross-Sector Digital Platforms

AI-driven analytics allow precise measurement of learning progress and performance gaps. The market expands through integration of data intelligence in academic and corporate environments. Institutions leverage predictive insights to enhance curriculum design. The Australia Assessment Services Market sees growth from cross-sector partnerships using centralized platforms. These collaborations improve scalability and reduce operational costs. Adaptive testing solutions personalize learning experiences for diverse user groups. Such advancements position Australia as a leader in assessment technology innovation.

Market Segmentation Analysis:

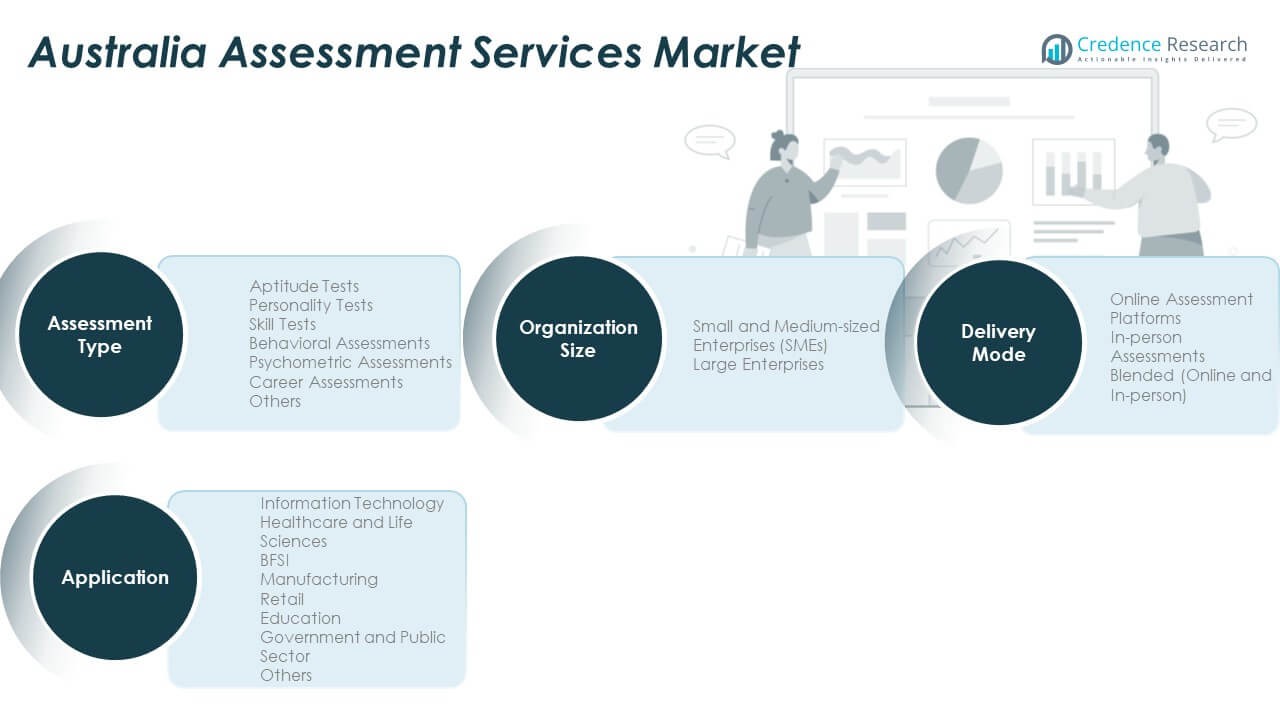

By Assessment Type

The Australia Assessment Services Market is categorized into aptitude tests, personality tests, skill tests, behavioural assessments, psychometric assessments, career assessments, and others. Aptitude and skill tests dominate due to their extensive use in recruitment and education sectors. Personality and behavioural assessments are gaining traction among employers for employee profiling and leadership evaluation. Psychometric and career assessments are expanding through career counselling and academic placement programs. The others category includes customized evaluations tailored to specific corporate and educational needs.

- For instance, Janison’s FY23 performance data showed a 21% growth in its Assessments division, led by products such as ICAS, AAS, and QATs, which recorded 15% growth in school adoption and an exclusive partnership with the University of Sydney to promote digital academic benchmarking.

By Application

Key application areas include information organization size, healthcare and life sciences, BFSI, manufacturing, retail, education, government and public sector, and others. Education and corporate sectors remain primary contributors due to digital learning and workforce development needs. Healthcare and BFSI are adopting structured assessment tools for compliance and capability verification. Government and public organizations invest in standardized evaluation systems for transparency and talent optimization.

- For instance, Janison’s NAPLAN Online extension project with the Australian Curriculum, Assessment and Reporting Authority (ACARA) was renewed through 2030, reinforcing long-term government reliance on AI-backed digital testing frameworks for consistent national skills evaluation.

By Organization Size

The market serves both small and medium-sized enterprises (SMEs) and large enterprises. SMEs are rapidly adopting affordable cloud-based testing platforms to streamline hiring and training. Large enterprises use integrated analytics systems to align human resource decisions with business strategies. It strengthens workforce efficiency through data-driven evaluations.

By Delivery Mode

Delivery modes include online assessment platforms, in-person assessments, and blended models. Online platforms dominate due to scalability, cost-effectiveness, and accessibility. In-person assessments remain vital for high-stakes testing requiring supervision. Blended models are emerging as a preferred approach, balancing convenience with test reliability.

Segmentation:

By Assessment Type

- Aptitude Tests

- Personality Tests

- Skill Tests

- Behavioural Assessments

- Psychometric Assessments

- Career Assessments

- Others

By Application

- Information Organization Size

- Healthcare and Life Sciences

- BFSI

- Manufacturing

- Retail

- Education

- Government and Public Sector

- Others

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Delivery Mode

- Online Assessment Platforms

- In-person Assessments

- Blended (Online and In-person)

Regional Analysis:

Eastern and Southeastern Dominance

Eastern and southeastern Australia account for nearly 55% of the Australia Assessment Services Market share. New South Wales and Victoria lead due to their dense concentration of universities, corporate headquarters, and EdTech startups. These states have advanced digital infrastructure and high internet penetration, supporting widespread adoption of online testing platforms. Sydney and Melbourne act as innovation hubs where technology providers collaborate with academic institutions to develop AI-based assessment tools. Government funding for education and skill development strengthens demand for digital assessment solutions. The region’s mature corporate environment further drives continuous employee training and evaluation programs.

Emerging Growth in Northern and Western Regions

Northern and Western Australia hold around 25% of the total market share, driven by growing industrial diversification and workforce development programs. Mining, oil, and energy sectors in these regions increasingly use skill-based assessments to address labor shortages. The Australia Assessment Services Market benefits from strong government investments in vocational education and regional training centers. Perth and Darwin are evolving into secondary growth centers with rising digital infrastructure investments. The expansion of SMEs in technology and logistics sectors encourages demand for online testing platforms. Educational institutions in these regions are integrating competency-based evaluations to meet modern employment needs.

Southern and Central Expansion Prospects

Southern and central Australia contribute about 20% of the market share, supported by growing educational participation and public sector initiatives. South Australia focuses on skill-based learning programs to boost employability. The Australia Assessment Services Market in these areas gains from partnerships between government training agencies and private providers. Institutions are gradually transitioning from manual to digital assessment frameworks to improve efficiency. Rural and remote areas face infrastructure challenges, yet mobile-based platforms are reducing accessibility gaps. Continuous investment in digital literacy and hybrid testing systems will enhance market penetration in these developing regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Psych Press

- Hays Assessment & Development

- Psytech Australia

- PEK Human Systems

- Stillwell Select Recruitment

- Aon Assessment Solutions

- Value Edge

- Career Management Services

- Talent Focus Recruitment

- Clevry

Competitive Analysis:

The Australia Assessment Services Market is moderately fragmented, with several domestic and international players competing through technology-driven solutions and service quality. Companies focus on developing AI-based testing, data analytics, and customized assessment platforms to enhance precision and engagement. Leading providers such as Psych Press, Hays Assessment & Development, and Aon Assessment Solutions emphasize digital transformation, automation, and cloud-based delivery models. Local firms like Psytech Australia and Stillwell Select Recruitment strengthen competition by offering region-specific assessment tools and psychological testing services. It maintains steady growth through product innovation, partnerships, and diversification across corporate, educational, and government sectors.

Recent Developments:

- In August 2025, Clevry released its Q2 Hiring Intelligence Report (HIRe), highlighting a strategic shift in hiring priorities across Australia, with resilience emerging as the top trait assessed in candidates during the second quarter of 2025. This update reflects Clevry’s ongoing commitment to providing skills-first, scientifically-backed hiring solutions tailored to evolving workforce demands.

- Hays Assessment & Development published the Hays 2025 Skills Report in early 2025, offering comprehensive insights into skills shortages and workforce trends across Australia and New Zealand, based on responses from over 5,600 professionals. The report emphasizes the growing need for continuous upskilling and the importance of vendor-certified training to meet industry demands.

Report Coverage:

The research report offers an in-depth analysis based on assessment type, application, organization size, and delivery mode. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for AI-driven adaptive assessments will continue to rise across education and employment sectors.

- Cloud-based testing platforms will dominate the delivery landscape due to scalability and security.

- Skill-based certifications will gain prominence under government workforce initiatives.

- Partnerships between academic institutions and corporate entities will expand to support career readiness.

- Mobile-based assessment platforms will enhance accessibility in remote and rural areas.

- Behavioral and psychometric assessments will see increasing use in leadership evaluations.

- SMEs will emerge as key adopters due to cost-effective SaaS-based testing solutions.

- Investment in cybersecurity and data integrity will remain a major industry priority.

- Personalized learning and testing experiences will drive product differentiation.

- Continuous innovation in analytics-driven reporting will strengthen market competitiveness.