Market Overview:

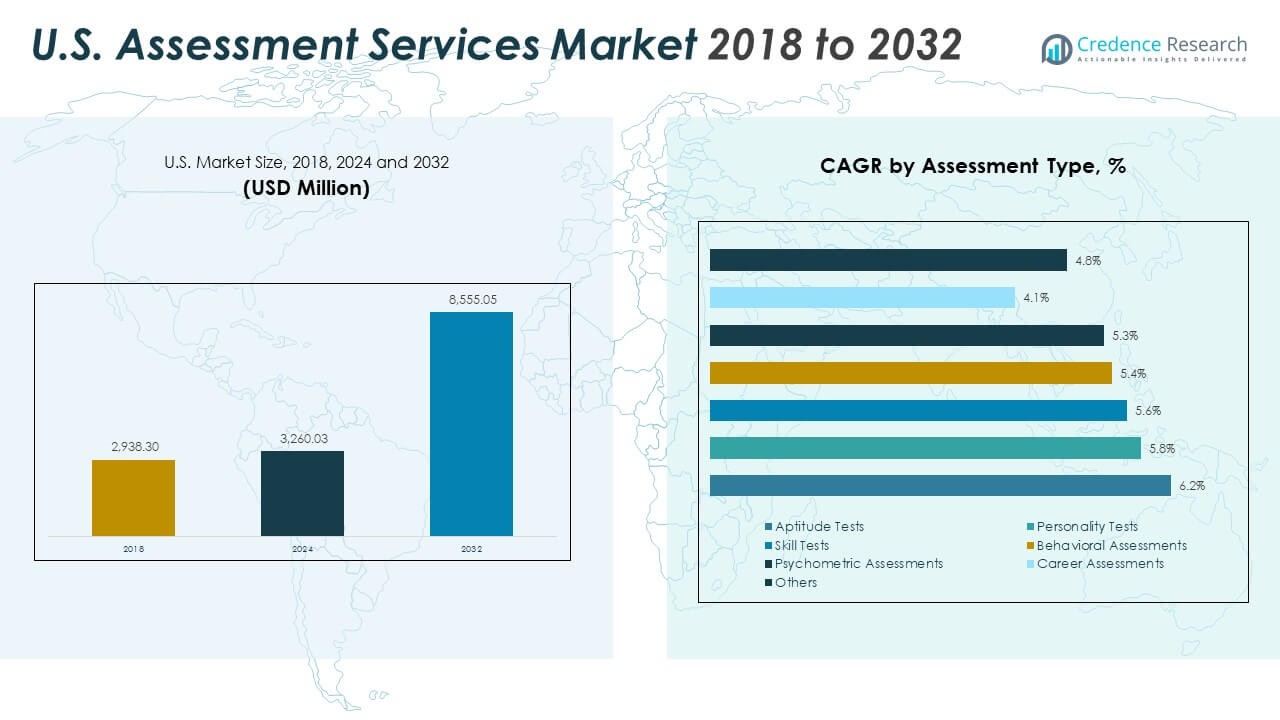

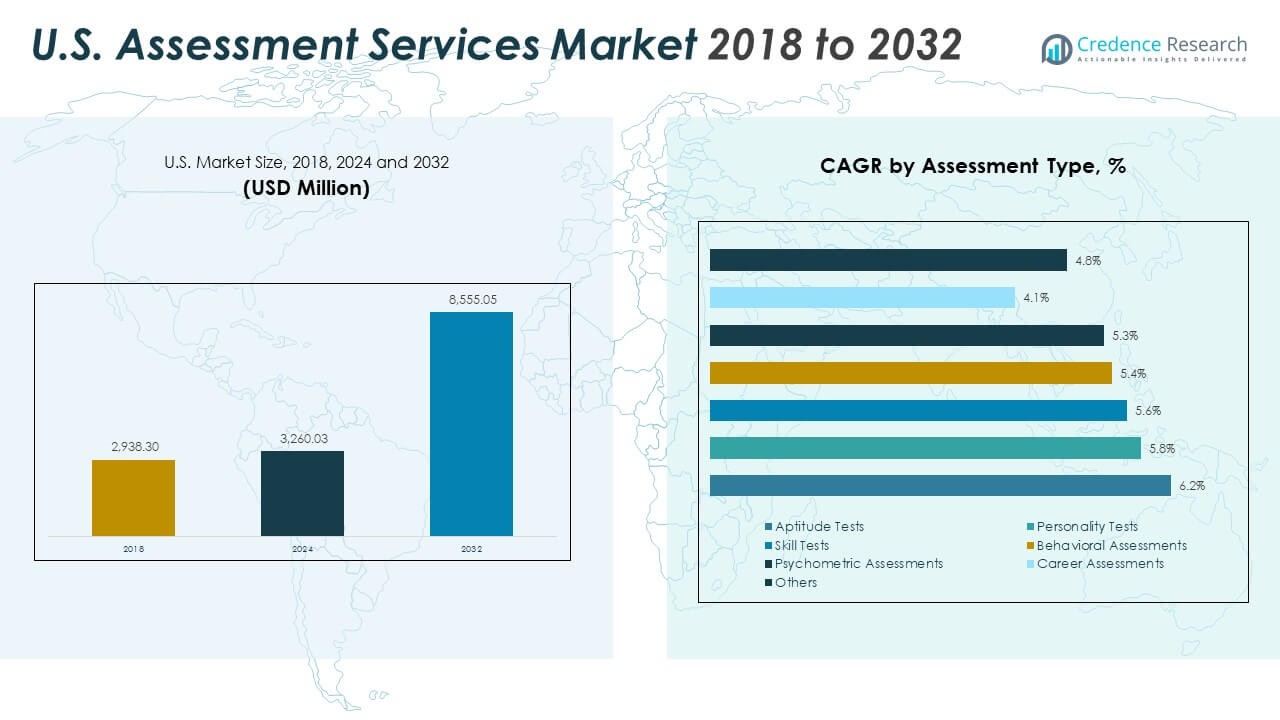

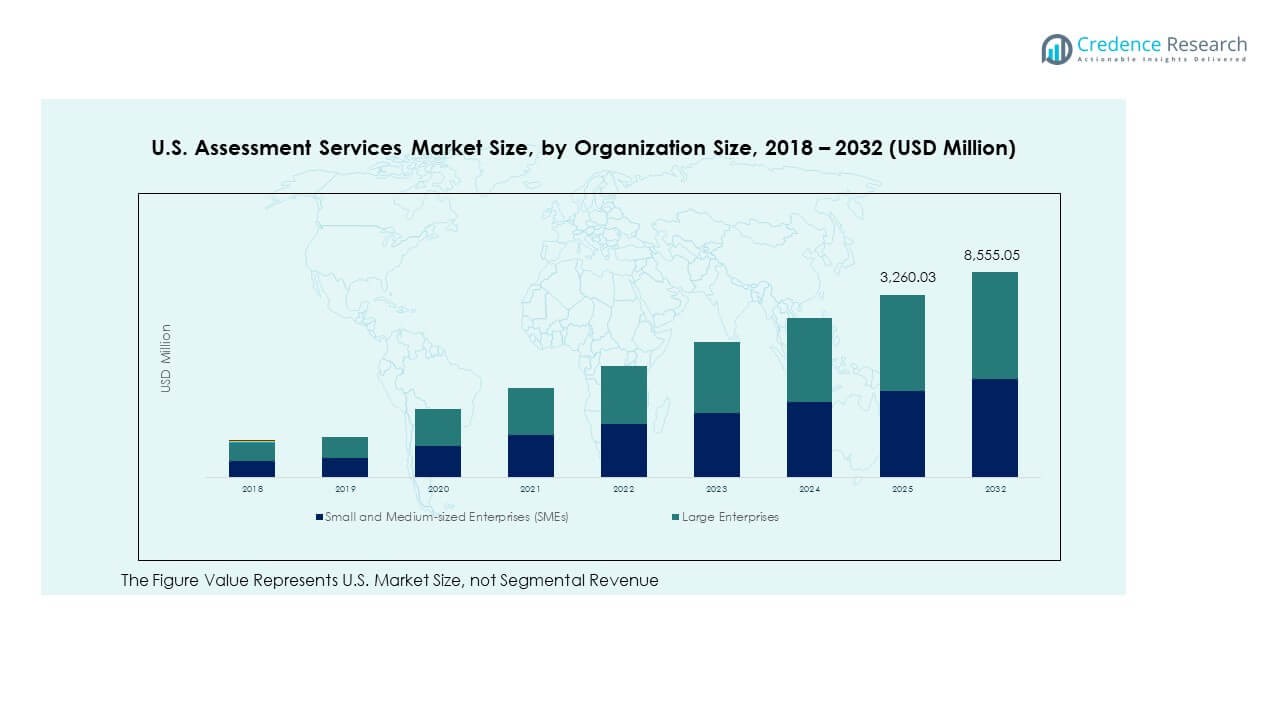

The U.S. Assessment Services Market size was valued at USD 2,938.30 million in 2018 to USD 3,260.03 million in 2024 and is anticipated to reach USD 8,555.05 million by 2032, at a CAGR of 12.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Assessment Services Market Size 2024 |

USD 3,260.03 Million |

| U.S. Assessment Services Market, CAGR |

12.82% |

| U.S. Assessment Services Market Size 2032 |

USD 8,555.05 Million |

Growth in the U.S. Assessment Services Market is being driven by the rising focus on skill-based hiring, digital learning expansion, and AI-driven test systems. Organizations are investing in structured assessment platforms to streamline recruitment, workforce development, and regulatory compliance. Online proctoring systems and secure cloud delivery models are enhancing accessibility and scalability. Education institutions are integrating adaptive testing to improve learning outcomes, while companies use psychometric and behavioral assessments to make better talent decisions.

The U.S. Assessment Services Market demonstrates strong regional concentration across the South, West, Midwest, and Northeast. The South leads due to its robust corporate base and education ecosystem. The West follows, supported by early adoption of edtech and AI-enabled testing tools. The Midwest shows steady growth, driven by manufacturing and healthcare sector demand. The Northeast maintains a stable pace through education and financial services testing adoption. Emerging regional initiatives are enhancing accessibility and boosting market presence nationwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Assessment Services Market was valued at USD 2,938.30 million in 2018, reached USD 3,260.03 million in 2024, and is projected to reach USD 8,555.05 million by 2032, registering a CAGR of 12.82%.

- The South holds the largest share at 34%, followed by the West at 29% and the Midwest at 21%, driven by a strong corporate base, early technology adoption, and sector diversification.

- The West is the fastest-growing region with a 29% share, supported by a vibrant edtech ecosystem, AI integration, and scalable testing infrastructure.

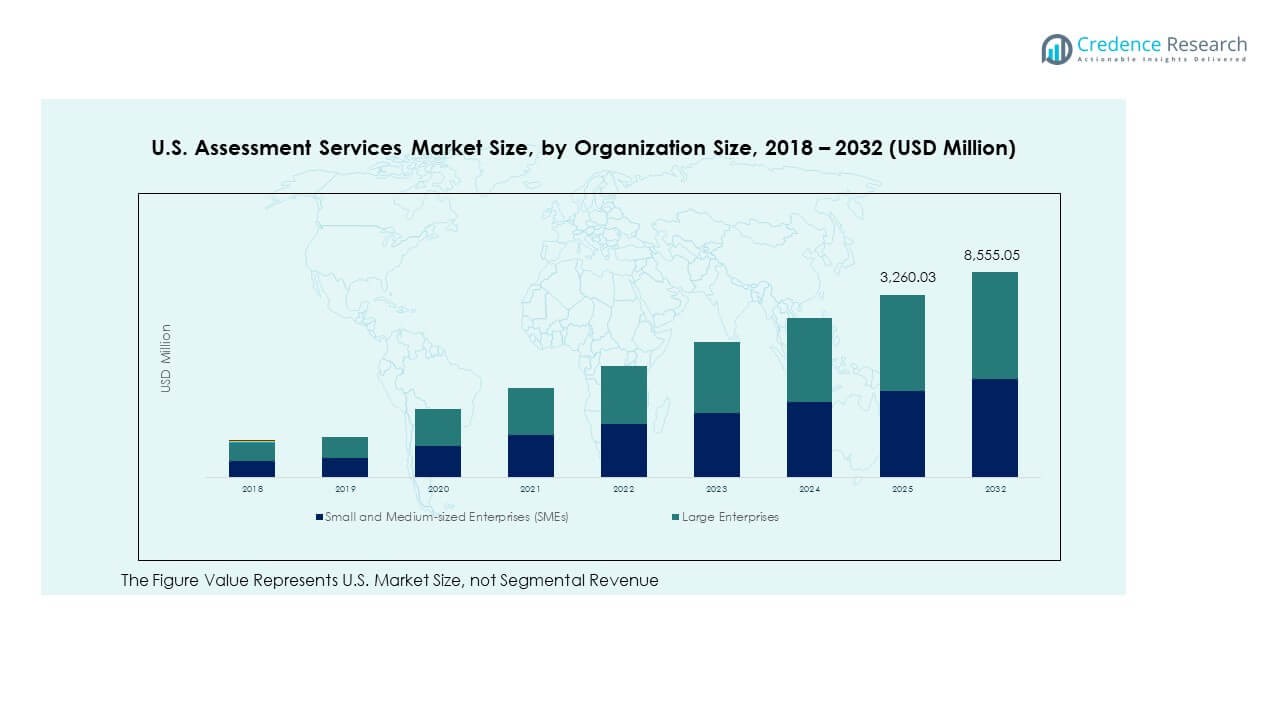

- Large enterprises account for 60% of the market share, reflecting widespread use of enterprise-grade assessment platforms for recruitment and certification.

- SMEs hold 40% of the market share, driven by cost-effective cloud-based solutions and flexible adoption models.

Market Drivers

Rising Focus on Skill-Based Hiring and Workforce Productivity

Growing demand for skill-based hiring has strengthened the need for standardized evaluation solutions across enterprises. The U.S. Assessment Services Market is benefiting from corporate strategies focused on improving workforce productivity. Employers are relying on structured assessments to filter candidates efficiently and reduce recruitment time. Skill and competency mapping improves role alignment, cutting training costs. Companies are integrating advanced assessment platforms to achieve better performance outcomes. The market benefits from organizations expanding their talent pipelines. Workforce readiness programs are expanding across industries. It creates strong adoption momentum within large enterprises.

Expansion of Digital Learning Platforms and Online Proctoring Systems

Digital transformation in education and enterprise learning is pushing higher use of remote evaluation platforms. It encourages organizations to integrate secure, scalable tools for online testing. Proctoring systems help maintain assessment integrity across geographies. Widespread internet availability supports the adoption of remote evaluations. Educational institutions and corporations prefer online delivery for flexibility and lower operational costs. Real-time monitoring strengthens compliance and accuracy. Remote delivery enhances candidate experience and accessibility. This transformation drives continuous platform upgrades and broader deployment across multiple sectors.

- For instance, Talview’s Live Proctoringsystem, listed on Microsoft AppSource (September 2025), incorporates AI-enabled automated proctoring and live human monitoring to administer secure exams at scale. The platform’s AI-powered analytics validates identity in real time, uses 360° environment scans, and produces violation logs with low to high severity flags, improving exam integrity across 120 countries.

Growing Adoption of AI and Data Analytics in Assessment Solutions

AI-driven assessments are transforming the way employers evaluate talent potential. Advanced analytics generate real-time reports, enabling precise hiring and training decisions. It allows organizations to map cognitive, technical, and behavioural skills more effectively. Predictive analytics identify performance trends early, enhancing workforce management. AI tools deliver adaptive testing, improving engagement and efficiency. Integration with HR systems supports faster decision-making. Personalized assessments increase accuracy and reduce bias. This improves the overall value proposition for assessment providers.

- For instance, HireVue, serving over 700 global enterprises including nearly half of the Fortune 100, utilizes AI-based video analytics to assess communication, problem-solving, and cognitive traits.

Increased Emphasis on Regulatory Compliance and Certification Standards

Growing regulatory requirements are driving organizations to adopt certified and standardized assessment platforms. Government programs and industry bodies encourage structured skill validation. It supports consistent evaluation across education and employment sectors. Certification standards promote transparent hiring practices and skill benchmarking. Accredited platforms improve trust and compliance in recruitment. Organizations use verified assessments to reduce liability risks. Education providers align with these standards to enhance credibility. This growing emphasis strengthens market structure and promotes long-term adoption.

Market Trends

Integration of Advanced Technologies for Smarter and Faster Evaluations

The U.S. Assessment Services Market is witnessing increasing integration of AI, ML, and automation. These tools accelerate test creation, delivery, and evaluation. Automated systems enhance scalability while maintaining test reliability. Real-time analytics support instant performance feedback. Advanced adaptive testing improves accuracy and candidate engagement. Facial recognition and biometric verification are improving security layers. Tech integration helps reduce human error and administrative burden. It encourages widespread use in corporate, education, and government settings.

Shift Toward Mobile-First and Cloud-Based Assessment Platforms

Mobile accessibility is reshaping how assessments are delivered and consumed. Cloud-based platforms allow candidates to participate from anywhere with minimal infrastructure. Mobile-first solutions improve reach, particularly in remote areas. It supports flexible scheduling and stronger candidate experience. Seamless access drives participation in both academic and workplace assessments. Scalable cloud systems lower operational costs for organizations. Real-time sync enables instant result analysis. Mobile integration supports growth in high-volume testing scenarios.

Personalized and Adaptive Assessments Enhancing Candidate Experience

Personalized assessments are gaining traction in multiple sectors. Adaptive testing models adjust difficulty based on real-time performance. This ensures fair evaluations and reduces test fatigue. It improves engagement levels and delivers better insights into individual capabilities. Customization helps organizations design job-specific assessments. Education providers use it to improve learning outcomes. Real-time data feedback improves decision-making. This trend aligns with growing demand for user-centric evaluation tools.

- For example, Khan Academy serves over 120 million registered users globally and uses adaptive learning algorithms to adjust question difficulty and pacing in real time. The platform is widely integrated into U.S. schools through its Districts program.

Increasing Role of Gamification and Interactive Content in Testing

Gamified assessment formats are creating more engaging and immersive testing experiences. Interactive simulations evaluate behavioural and problem-solving skills effectively. It encourages higher participation rates and better performance tracking. Employers use scenario-based assessments to measure real-world responses. Education platforms adopt gamified modules to maintain student focus. These formats support continuous learning and engagement. Gamification improves retention and test accuracy. This trend is driving innovation in platform design and delivery.

- For example, the Talent Games has partnered with major employers, including Nestlé and Shell, to use gamified recruitment assessments for large-volume hiring. Its platform enables interactive, mobile-first simulations designed to enhance candidate engagement and streamline graduate recruitment.

Market Challenges Analysis

Data Privacy Concerns and Security Risks in Online Assessment Platforms

The U.S. Assessment Services Market faces rising challenges linked to data protection and security compliance. Online platforms handle sensitive personal information and performance data, making them vulnerable to cyberattacks. Regulatory scrutiny increases the cost and complexity of ensuring compliance. Security breaches can damage brand trust and lead to legal liabilities. It forces providers to invest heavily in encryption and access controls. Balancing ease of use with strict security remains difficult. Rapid adoption of cloud-based delivery increases risk exposure. These concerns limit adoption in sectors with strict compliance norms.

Lack of Standardization and Accessibility Barriers Across Different Sectors

Diverse industries use varying assessment formats, creating fragmentation in the market. Inconsistent standards make it harder to benchmark results effectively. It slows down the pace of platform integration across industries. Some candidates face accessibility barriers due to digital divide issues. SMEs often lack the infrastructure to deploy advanced solutions. Limited digital literacy in specific groups restricts reach. Testing language and cultural differences add further complexity. These factors reduce uniform adoption and hinder market scalability.

Market Opportunities

Rising Demand for Scalable and Cost-Efficient Cloud Platforms

The U.S. Assessment Services Market is positioned to benefit from increasing demand for scalable solutions. Organizations are adopting cloud-native assessment platforms to handle large candidate volumes. Cost efficiency supports higher adoption among SMEs. Real-time reporting improves decision-making at every hiring stage. It reduces the need for complex hardware infrastructure. Broader adoption is expected across corporate, academic, and public sectors. Enhanced analytics create new service opportunities for providers. This creates a strong growth pipeline for cloud-based offerings.

Increasing Government and Industry Collaboration to Build Digital Ecosystems

Public-private partnerships are creating a favourable environment for assessment technology growth. Government initiatives are encouraging digital transformation in education and employment. Industry alliances help build national-level skill testing infrastructure. It supports inclusive access to standardized assessment solutions. Education bodies integrate digital evaluations into curriculum strategies. Companies align hiring practices with these standardized assessments. This collaboration strengthens platform penetration and adoption across diverse user segments.

Market Segmentation Analysis

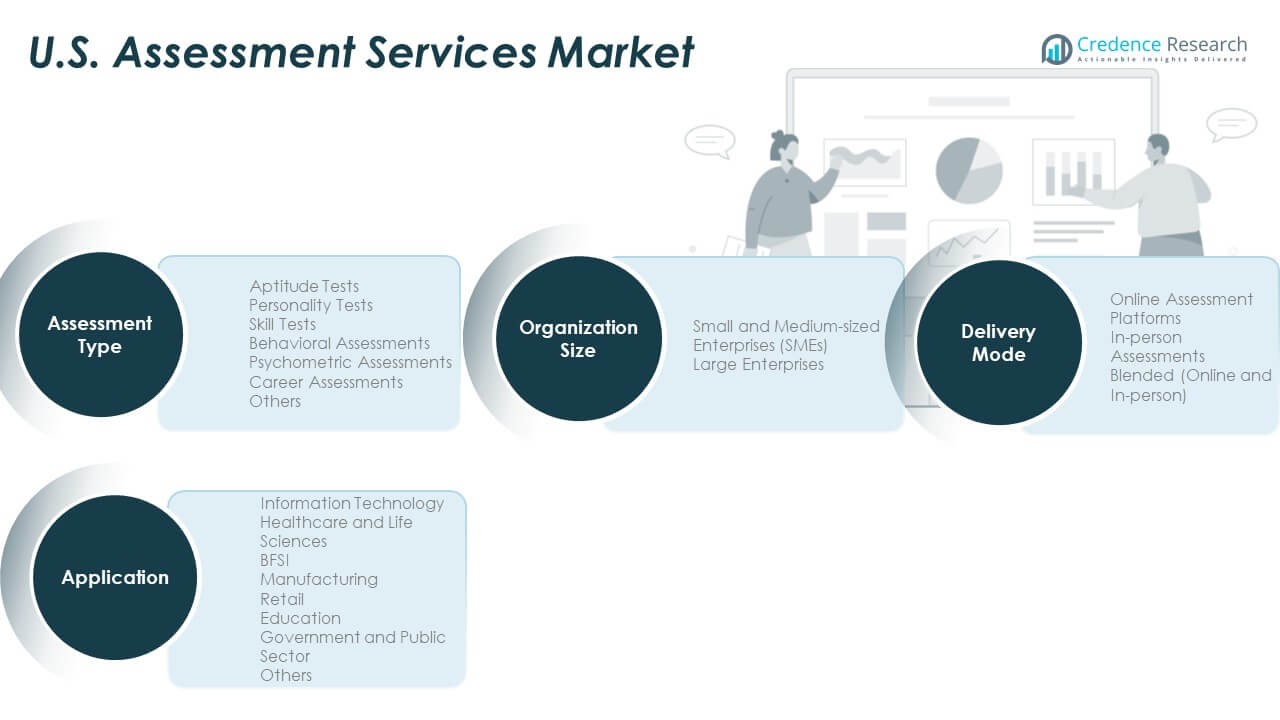

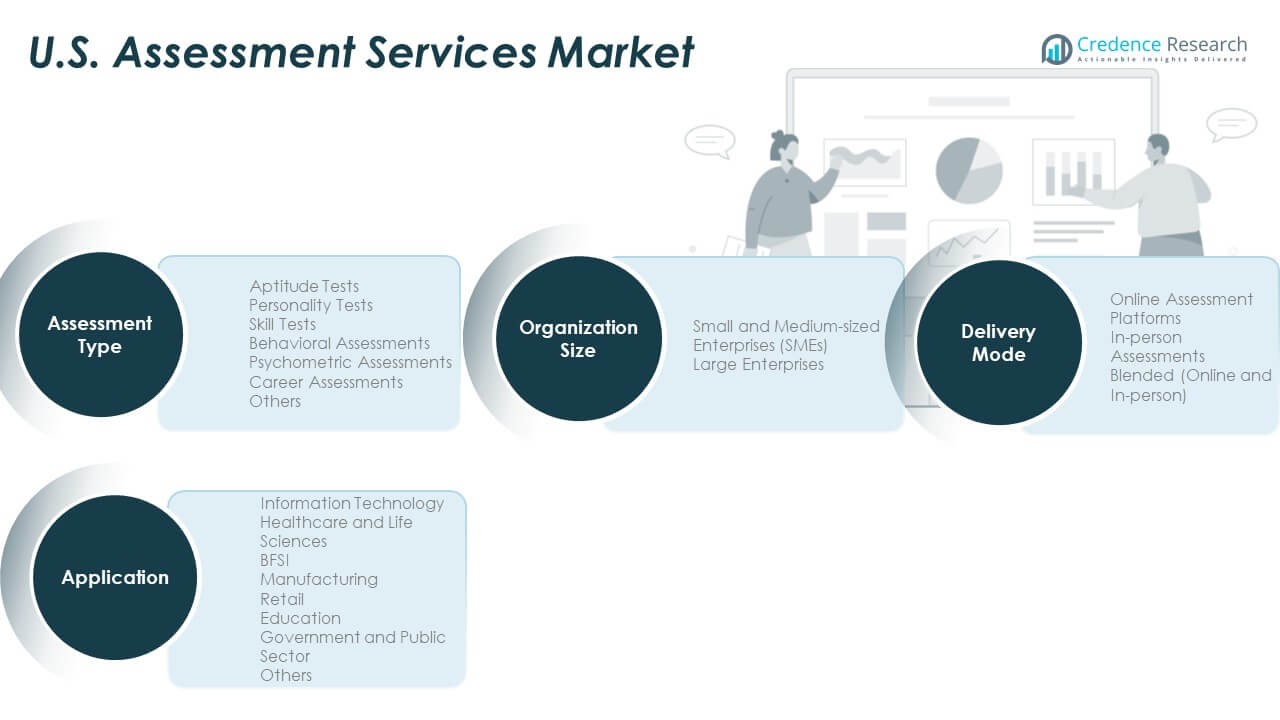

The U.S. Assessment Services Market is segmented by assessment type, application, organization size, and delivery mode.

By assessment type, segments include aptitude tests, personality tests, skill tests, behavioural assessments, psychometric assessments, career assessments, and others. Aptitude and skill tests lead adoption across recruitment and training programs. Personality and behavioural assessments are gaining wider use in talent development strategies.

- For instance, Gallup’s CliftonStrengths Assessmentmeasures candidates across 34 talent themes to personalize development plans, supporting leadership and performance insights validated by LinkedIn’s Learning & Development report.

By application, major segments include information organization size, healthcare and life sciences, BFSI, manufacturing, retail, education, government and public sector, and others. Education and corporate sectors lead adoption due to structured evaluation needs. BFSI and healthcare use these tools for compliance and workforce readiness.

- For exampale, DDI (Development Dimensions International) was named to Training Industry’s 2024 Top 20 Assessment and Evaluation Companies list. The company provides leadership assessment and development solutions to enterprises worldwide.

By organization size, both small and medium-sized enterprises and large enterprises are active users. Large enterprises adopt enterprise-level platforms, while SMEs prefer flexible cloud-based solutions.

By delivery mode, segments include online assessment platforms, in-person assessments, and blended models. Online platforms dominate due to scalability and accessibility, while blended modes gain traction in regulated industries. This segmentation structure supports wide application across industries and use cases.

Segmentation

By Assessment Type

- Aptitude Tests

- Personality Tests

- Skill Tests

- Behavioural Assessments

- Psychometric Assessments

- Career Assessments

- Others

By Application

- Information Organization Size

- Healthcare and Life Sciences

- BFSI

- Manufacturing

- Retail

- Education

- Government and Public Sector

- Others

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Delivery Mode

- Online Assessment Platforms

- In-person Assessments

- Blended (Online and In-person)

Regional Analysis

The U.S. Assessment Services Market is primarily led by the South region, holding 34% of the total share. The region benefits from its dense corporate base and expanding education infrastructure. High concentration of technology firms accelerates demand for online evaluation platforms. It supports rapid adoption across both academic and professional segments. Strong investments in training and certification programs further reinforce this growth. The region’s growing skilled workforce enhances its leadership in digital assessment adoption.

The West region accounts for 29% of the total share and reflects a strong presence of edtech startups and global enterprises. High innovation activity in states like California and Washington drives early adoption of adaptive testing tools. Universities and corporate training centers use digital assessments extensively to streamline operations. Government programs supporting skill-building initiatives enhance platform penetration. It benefits from strong internet infrastructure and a tech-forward population. Rapid uptake across small and medium enterprises strengthens its overall contribution to market growth.

The Midwest holds a 21% share and plays a key role in workforce testing and vocational training expansion. It shows rising adoption among manufacturing and healthcare companies focused on certification programs. Strong partnerships between community colleges and industries drive wider usage of skill tests. Northeast accounts for 16% share and maintains steady growth driven by educational institutions and financial services. The region is leveraging assessment platforms to strengthen learning outcomes and workforce competitiveness. It contributes to balanced market expansion across subregions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The U.S. Assessment Services Market is competitive, with established global players and emerging digital platform providers. Leading companies include Pearson VUE, Mercer | Mettl, Prometric, PSI Services, and Examity. These firms focus on product innovation, secure proctoring technologies, and AI-based adaptive assessment tools. It benefits from partnerships with universities, corporations, and government bodies. Regional players are expanding through specialized solutions targeting specific industries like healthcare and BFSI. Strategic acquisitions and platform integrations help companies strengthen market share. Strong R&D investment and expanding delivery networks support the long-term competitiveness of leading firms.

Recent Developments

- In October 2025, IBM formed a strategic partnership with Groq to enhance AI inference technology for sectors such as finance, healthcare, and manufacturing. The alliance involves integrating GroqCloud’s inference system into IBM’s watsonx Orchestrate platform, with the goal of boosting AI processing speed by up to five times over traditional GPU systems.

- In October 2025, Tata Consultancy Services (TCS) announced two major developments in the U.S. market. On October 9, 2025, the company acquired ListEngage, a U.S.-based Salesforce Summit Partner, to strengthen its Salesforce Marketing Cloud and AI advisory practice. The acquisition added over 100 experts and 400 Salesforce certifications to TCS’s U.S. operations, reflecting the firm’s commitment to expanding its high-value digital business capabilities.

- In September 2025, Pearson VUE announced an exclusive multi-year partnership with Salesforce to become the sole global provider of Salesforce certification exams. Registration for the certification program opened on July 21, 2025, offering a streamlined certification experience through Pearson’s computer-based testing infrastructure.

Report Coverage

The research report offers an in-depth analysis based on Assessment Type, Application, Organization Size and Delivery Mode. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increased adoption of AI-driven adaptive testing will reshape how assessments are designed and delivered.

- Cloud-based delivery models will strengthen market reach, supporting broader accessibility across industries.

- Expansion of mobile-first platforms will accelerate participation rates in both education and workforce evaluations.

- Data analytics integration will enhance decision-making, improving accuracy in hiring and learning outcomes.

- Government–industry collaborations will drive digital ecosystem development and expand testing infrastructure.

- Gamified and interactive assessments will increase candidate engagement and improve testing efficiency.

- Growth of online proctoring solutions will ensure higher security and scalability for remote assessments.

- Market competition will intensify as regional and global players invest in product differentiation.

- Skill-focused evaluation programs will dominate hiring and training strategies across sectors.

- Standardization efforts will improve cross-industry benchmarking, supporting stable and sustainable market expansion.