Market Overview:

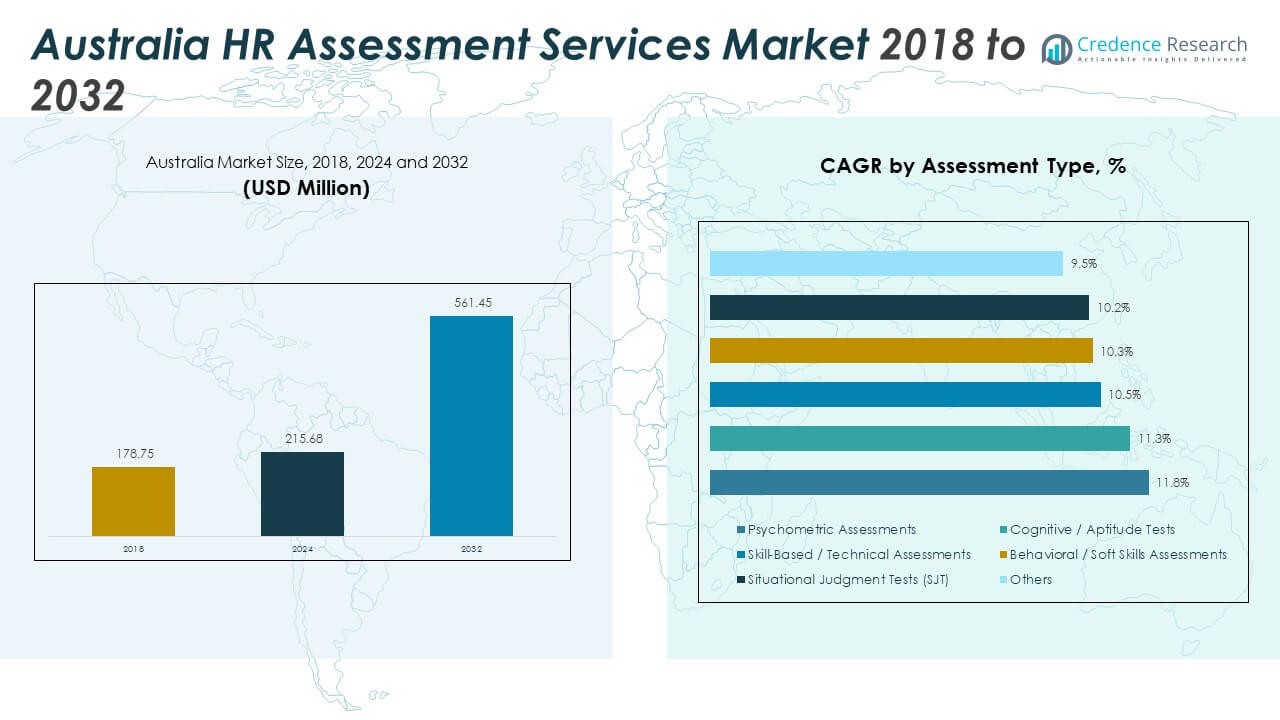

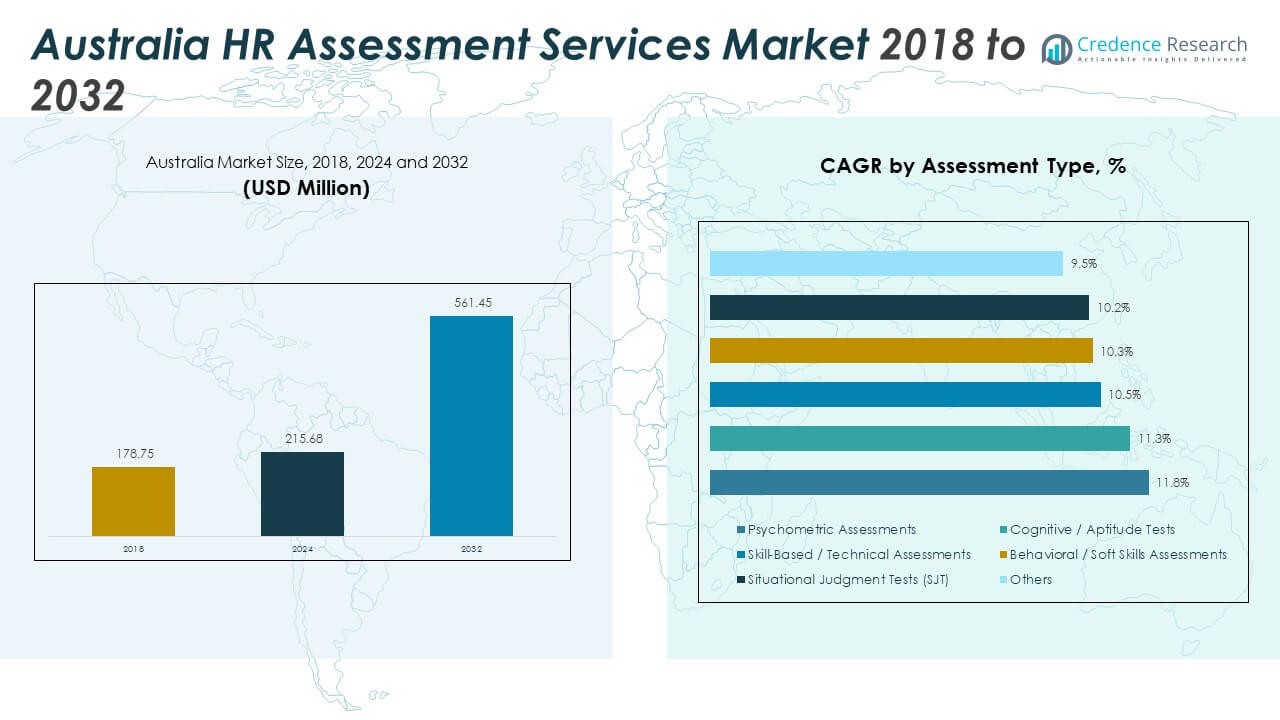

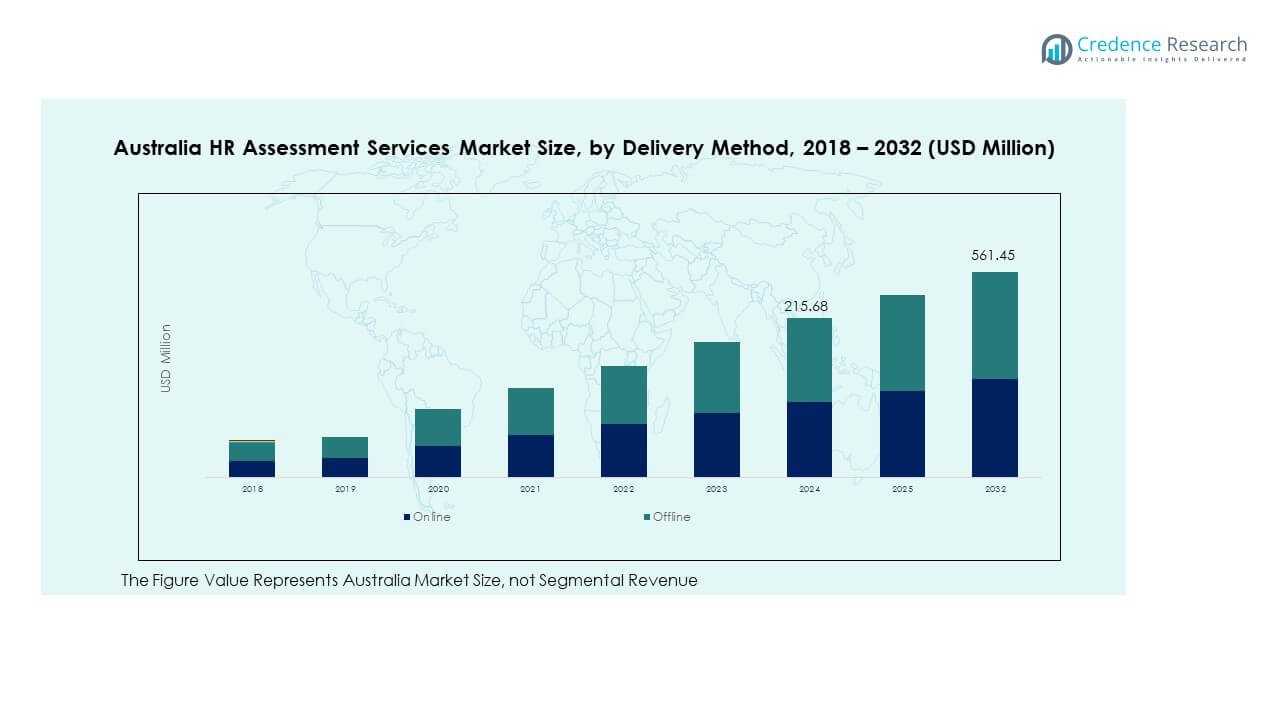

The Australia HR Assessment Services Market size was valued at USD 178.75 million in 2018 to USD 215.68 million in 2024 and is anticipated to reach USD 561.45 million by 2032, at a CAGR of 12.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia HR Assessment Services Market Size 2024 |

USD 215.68 Million |

| Australia HR Assessment Services Market, CAGR |

12.70% |

| Australia HR Assessment Services Market Size 2032 |

USD 561.45 Million |

Growing adoption of digital recruitment platforms, AI-driven psychometric testing, and data-based talent analytics are driving market expansion. Organizations are prioritizing effective talent identification, employee engagement, and workforce optimization. The demand for customized assessments tailored to industry-specific needs is increasing, while remote and hybrid work models are encouraging companies to invest in scalable online assessment solutions. The focus on reducing hiring bias and improving workforce productivity further strengthens the demand for HR assessment services.

Within Australia, major urban centers such as Sydney, Melbourne, and Brisbane represent key hubs for HR technology adoption due to their high concentration of corporate offices and start-ups. Regional areas are gradually catching up, driven by public sector digitalization initiatives and growing employment opportunities in mining and education. The expanding influence of multinational HR service providers and strategic collaborations with local firms are also contributing to nationwide market penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia HR Assessment Services Market was valued at USD 178.75 million in 2018, reached USD 215.68 million in 2024, and is projected to attain USD 561.45 million by 2032, growing at a CAGR of 12.70% during the forecast period.

- Eastern and Southeastern Australia collectively hold 68% of the market share, supported by high corporate density, advanced digital infrastructure, and concentration of HR technology adoption in Sydney and Melbourne.

- Western Australia and Queensland account for 22% share, showing steady expansion driven by industrial automation, energy sector recruitment, and regional workforce development initiatives.

- Northern Territory, Tasmania, and South Australia collectively represent 10% share and are the fastest-growing regions due to digital transformation in public services and education-led employment programs.

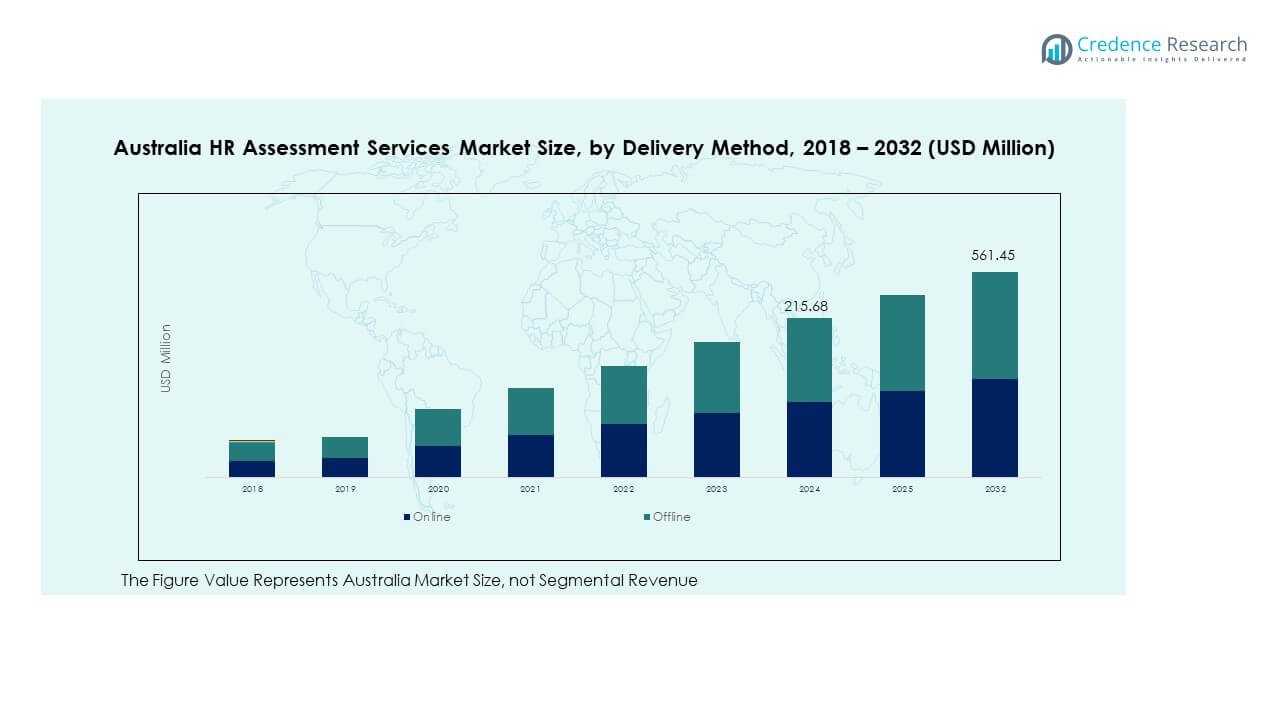

- The online delivery segment contributes nearly 65% of total market revenue, while offline delivery holds 35%, supported by industries requiring on-site evaluations and regulatory compliance testing.

Market Drivers:

Growing Focus on Talent Optimization and Data-Based Hiring

The Australia HR Assessment Services Market is expanding due to a strong focus on optimizing workforce potential and improving hiring accuracy. Organizations are using psychometric and skill-based assessments to identify suitable candidates faster. Employers seek data-driven insights to reduce turnover and align talent with business goals. Technology integration, such as AI and machine learning, enhances predictive analytics and decision-making. Increased awareness of employee engagement’s impact on productivity drives adoption. Companies are investing in comprehensive platforms that offer performance analysis and training support. Demand for real-time feedback and behavioral analytics continues to rise. It is becoming a strategic tool for organizations to build agile and high-performing teams.

- For instance, Xref’s automated reference checking platform is used by major Australian companies such as Woolworths to process reference checks in approximately 18 hours on average, which significantly reduces traditional manual screening times and enables organizations to make faster, data-driven decisions.

Rising Adoption of Digital Assessment Tools Across Sectors

The use of digital platforms for talent assessment has accelerated across Australia’s corporate, education, and government sectors. Growing preference for online and mobile-based assessments ensures efficiency, scalability, and accessibility. Cloud-based systems enable seamless data management and integration with HR software. Employers prefer AI-powered tests to eliminate human bias and enhance fairness. These tools reduce manual workload, increase objectivity, and deliver faster outcomes. Educational institutions are adopting similar platforms for student evaluation and career readiness programs. The trend supports broader digital transformation initiatives in HR functions. It is transforming recruitment into a data-enriched and technology-led process.

- For instance, Criteria Corp’s Cognitive Aptitude Test (CCAT), a 50-question assessment which uses percentile-based scoring, has been administered more than 10 million times by clients for analyzing cognitive aptitude across large candidate pools.

Increasing Emphasis on Employee Retention and Skill Development

Organizations in Australia are using HR assessments not just for recruitment but also for internal development. The rising importance of employee retention pushes companies to assess soft skills, adaptability, and leadership potential. Personalized learning programs are designed using assessment data to improve career growth. Upskilling and reskilling initiatives depend heavily on such analytics to address future skill gaps. Companies rely on assessment insights to identify training needs and track performance improvement. The integration of HR assessments into learning management systems strengthens workforce planning. Enhanced focus on long-term talent management supports steady demand. It is fostering a culture of continuous learning and improvement across enterprises.

Integration of Artificial Intelligence and Predictive Analytics

AI and predictive analytics are driving transformation in HR assessment methodologies. Automation enables faster, bias-free evaluations with higher accuracy. Predictive algorithms help forecast candidate performance and cultural fit. Advanced analytics assist in identifying leadership potential and succession planning. Companies use natural language processing and sentiment analysis to assess personality traits. AI-powered gamified assessments improve engagement and candidate experience. Continuous AI model training enhances the reliability of psychometric outcomes. It is enabling organizations to make informed, transparent, and scalable hiring decisions.

Market Trends:

Growth of Remote and Hybrid Hiring Assessment Models

The Australia HR Assessment Services Market is witnessing rapid adoption of remote assessment tools due to flexible work environments. Companies rely on virtual interviews, cognitive tests, and simulation platforms to assess distributed teams. Online proctoring ensures fairness and integrity in evaluations. This trend reduces recruitment costs and broadens access to diverse talent pools. Hybrid assessment models combining human insights and AI analytics are gaining traction. Employers use adaptive testing to personalize assessments based on candidate responses. The flexibility of these platforms supports both large enterprises and SMEs. It is reshaping traditional hiring workflows and promoting inclusivity in talent selection.

Expansion of Gamified and Behavioral Assessment Techniques

Gamification is emerging as a popular trend for evaluating behavioral and cognitive skills. Interactive games make assessments more engaging and reduce candidate anxiety. Behavioral analytics derived from game interactions provide deep insights into decision-making patterns. Employers use these insights to predict job performance and cultural alignment. Gamified formats also improve completion rates and enhance brand perception. Tech-driven firms in Australia are adopting these tools to attract young and tech-savvy professionals. The balance between entertainment and assessment accuracy remains a key design focus. It is redefining how organizations measure aptitude and potential beyond traditional questionnaires.

- For instance, Harver’s AI-powered assessment platform offers intelligent automation and remote interview experiences, which aim to increase process efficiency and reduce bias in hiring.

Rising Demand for Customizable Assessment Frameworks

Organizations are increasingly demanding tailored assessment models that match their specific job roles and values. Customization ensures better predictive accuracy and alignment with company culture. HR tech providers offer modular solutions allowing clients to choose relevant test categories. Industries such as finance, healthcare, and IT prioritize domain-specific skill tests. This flexibility supports diverse workforce structures and regulatory needs. The ability to modify frameworks quickly gives enterprises a competitive advantage. It strengthens organizational agility in managing evolving talent demands. Customizable assessments are becoming a key differentiator in the competitive HR technology landscape.

Adoption of Analytics-Driven Workforce Planning and Reporting Tools

Advanced analytics in HR assessments are transforming how organizations plan workforce strategies. Companies are using integrated dashboards to track performance, identify skill gaps, and forecast hiring needs. Predictive analytics tools provide real-time visibility into talent trends and succession readiness. Data integration across recruitment, training, and retention improves workforce alignment. This analytics-driven approach ensures resource efficiency and strategic HR planning. Employers rely on data visualization for quick interpretation of assessment results. It enhances collaboration between HR teams and top management. The Australia HR Assessment Services Market is witnessing strong traction for analytics-led platforms that simplify complex HR decisions.

Market Challenges Analysis:

High Implementation Costs and Limited Adoption by SMEs

The Australia HR Assessment Services Market faces a challenge due to high setup and subscription costs. Small and medium enterprises often find advanced HR tools financially restrictive. The need for trained professionals to interpret complex analytics adds to expenses. Integration with existing HR software can be time-consuming and technically demanding. Many SMEs still depend on traditional hiring practices to save costs. Limited awareness about long-term ROI from assessment solutions slows adoption. Vendor pricing inconsistencies across platforms create confusion in budget planning. It continues to affect the widespread penetration of digital HR assessments in smaller organizations.

Concerns Over Data Privacy, Accuracy, and Candidate Perception

Growing dependence on AI and analytics introduces challenges related to data security and ethical concerns. Misuse of candidate data or algorithmic bias can damage brand credibility. Organizations must comply with Australia’s privacy regulations and global data protection norms. Technical inaccuracies in assessments may lead to unfair evaluation outcomes. Candidates sometimes perceive digital assessments as impersonal or stressful. Maintaining transparency in scoring and decision logic remains critical. Companies need to balance automation with human judgment to ensure fairness. It is essential to build trust among applicants while maintaining compliance and reliability.

Market Opportunities:

Expansion of AI-Powered Assessment Ecosystems and Automation Tools

The Australia HR Assessment Services Market offers opportunities for AI-driven innovations that automate evaluation processes. Automated scoring, adaptive questioning, and AI-based feedback improve efficiency and precision. Start-ups are introducing niche platforms focused on soft-skill analytics and cultural fit prediction. Demand for AI tools in candidate screening and workforce analytics is growing across industries. Integration with HRIS and ATS systems enhances end-to-end talent management. The push for digital transformation in HR departments fuels investment in advanced technologies. It is creating opportunities for vendors to offer scalable, subscription-based models.

Rising Demand from Education, Healthcare, and Government Sectors

Expanding adoption of HR assessments across non-corporate sectors presents new growth avenues. Universities and training institutions use assessments for career mapping and admissions. Healthcare organizations apply psychometric tests to evaluate emotional intelligence and stress management. Government departments employ standardized tests for recruitment and promotion processes. The trend supports inclusive and data-backed decision-making across sectors. Vendors offering specialized solutions tailored to these needs will benefit most. The demand for secure, multilingual, and customizable platforms continues to grow. It is broadening the long-term scope of this evolving market.

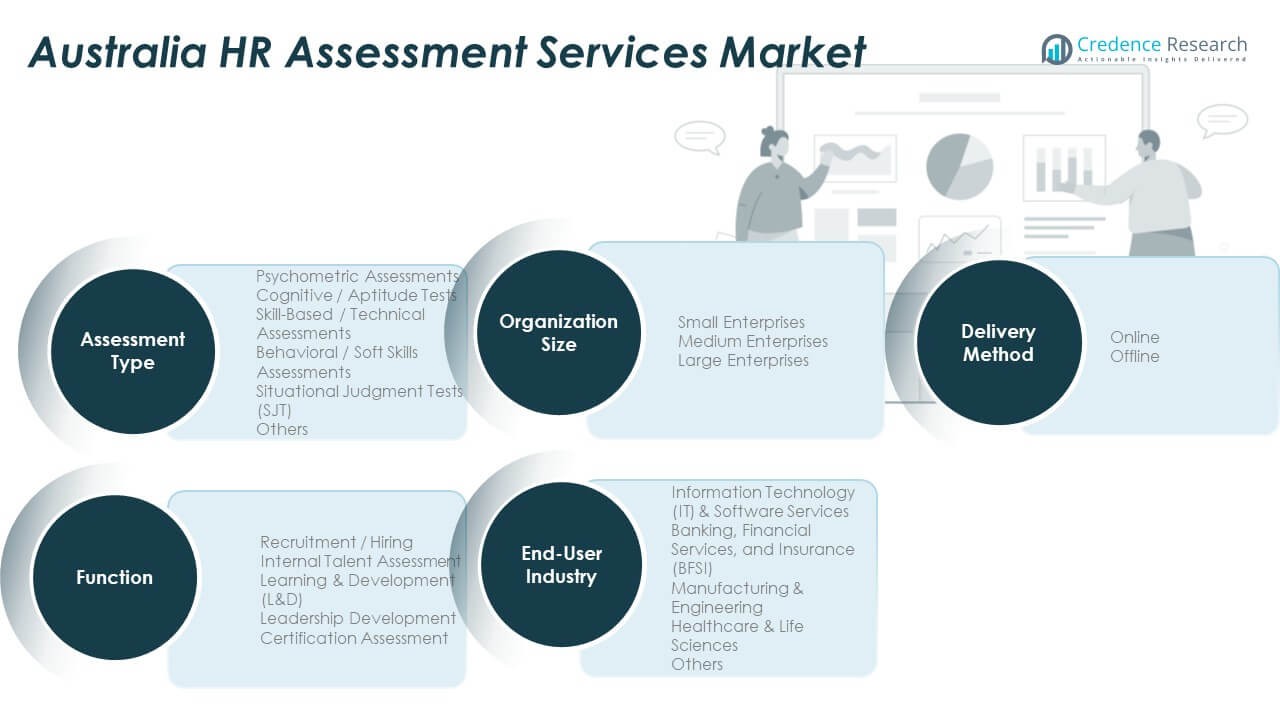

Market Segmentation Analysis:

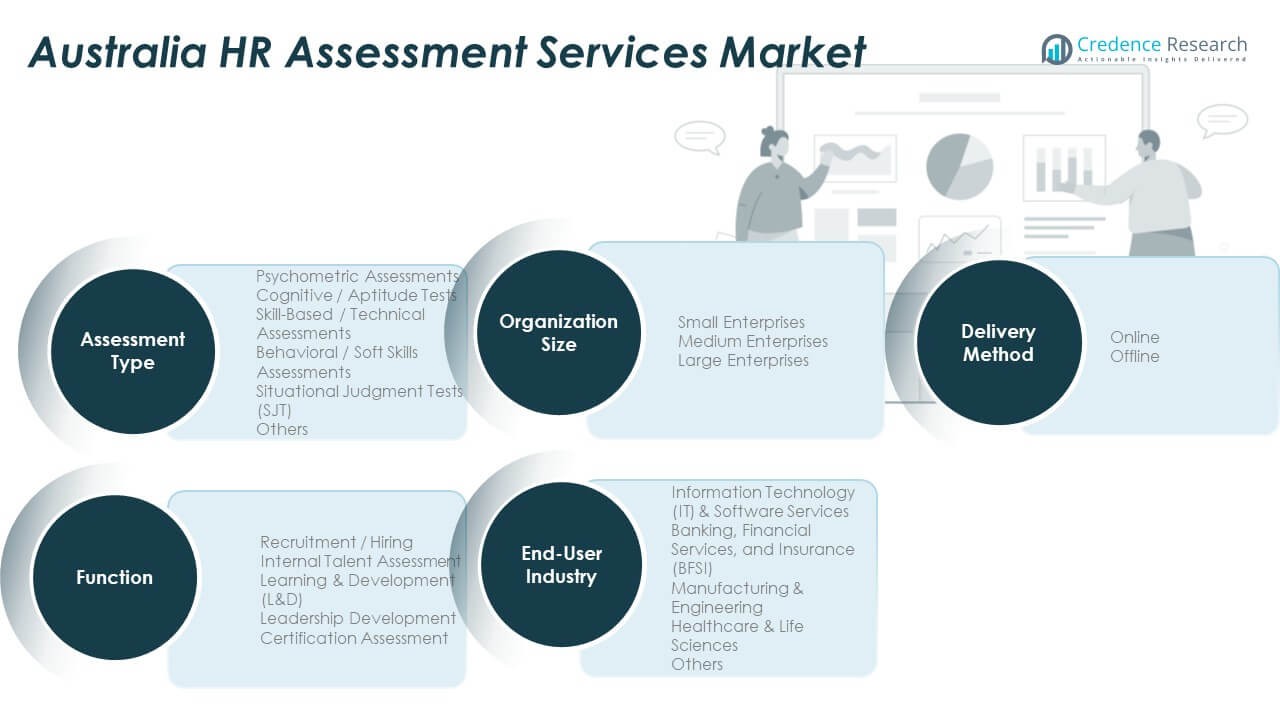

By Assessment Type

The Australia HR Assessment Services Market is categorized into psychometric, cognitive or aptitude, skill-based or technical, behavioural or soft skills, situational judgment tests, and others. Psychometric assessments dominate due to their effectiveness in evaluating personality, motivation, and cultural fit. Cognitive and skill-based tests are widely used in technology and engineering sectors to gauge problem-solving and technical capabilities. Behavioural and SJT assessments are gaining traction for leadership and teamwork evaluations. The growing need for data-backed hiring decisions strengthens adoption across enterprises.

- For instance, SHL’s psychometric assessments catalog—used by Atlassian and other Australian tech firms—offers more than 450 scientifically validated instruments, with analytics frameworks measuring improvements in retention, time-to-productivity, and cost-per-hire across thousands of candidates annually.

By Delivery Method

Online assessments lead the market, driven by convenience, scalability, and cost efficiency. Remote and hybrid work environments have accelerated demand for cloud-based and AI-enabled testing platforms. Offline assessments continue to serve regulated sectors where in-person evaluation is essential. The shift toward digital delivery aligns with Australia’s HR modernization and automation initiatives.

- For instance, Vervoe’s skills testing platform was chosen by leading Australian insurance providers to process thousands of candidate assessments, with AI-powered scoring and practical job simulations improving hiring throughput and supporting digital transformation goals for clients in Australia’s financial sector.

By End-User Industry

Information technology and BFSI sectors are key users due to large-scale recruitment and regulatory compliance needs. Manufacturing, healthcare, and life sciences sectors show steady growth through skill and compliance-based assessments. Expanding demand across education and public services further widens the user base.

By Function

Recruitment and hiring functions dominate, supported by internal talent and leadership assessments. Learning and development programs increasingly rely on analytics-driven evaluations. Certification and skill validation are expanding across technical fields.

By Organization Size

Large enterprises lead adoption due to structured HR systems and budgets. Medium and small enterprises are increasingly adopting affordable cloud-based tools to improve workforce quality and efficiency.

Segmentation:

- By Assessment Type

- Psychometric Assessments

- Cognitive / Aptitude Tests

- Skill-Based / Technical Assessments

- Behavioural / Soft Skills Assessments

- Situational Judgment Tests (SJT)

- Others

- By Delivery Method

- By End-User Industry

- Information Technology (IT) & Software Services

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing & Engineering

- Healthcare & Life Sciences

- Others

- By Function

- Recruitment / Hiring

- Internal Talent Assessment

- Learning & Development (L&D)

- Leadership Development

- Certification Assessment

- By Organization Size

- Small Enterprises

- Medium Enterprises

- Large Enterprises

Regional Analysis:

Eastern and Southeastern Australia – Dominant Economic and Corporate Hub

The Australia HR Assessment Services Market is primarily driven by the dominance of Eastern and Southeastern regions, which together hold nearly 68% market share. New South Wales and Victoria, led by Sydney and Melbourne, serve as the major business and technology centers. High corporate density, developed infrastructure, and concentration of multinational headquarters fuel strong adoption of HR assessment technologies. Enterprises across IT, BFSI, and consulting sectors invest heavily in digital recruitment and psychometric evaluation platforms. The presence of a skilled workforce and advanced HR practices strengthens market penetration. It benefits from continuous innovation, R&D investment, and corporate digitization programs.

Western Australia and Queensland – Expanding Industrial and Resource-Based Demand

Western Australia and Queensland collectively account for around 22% market share, supported by industrial expansion and diversified employment structures. Mining, engineering, and energy sectors are key contributors to HR service utilization. Organizations emphasize skill-based and technical assessments for workforce qualification and safety compliance. Regional diversification drives recruitment across remote and regional areas, encouraging adoption of online evaluation systems. State governments’ digital transformation initiatives also promote e-assessment frameworks in training and certification. It continues to experience steady growth driven by industrial automation and workforce optimization efforts.

Northern Territory, Tasmania, and South Australia – Emerging Growth Corridors

Northern Territory, Tasmania, and South Australia together represent nearly 10% market share, showing growing interest in structured HR assessment tools. These regions are focusing on education, healthcare, and public service digitalization to enhance recruitment quality. Local enterprises and government bodies increasingly prefer hybrid assessment methods to address workforce challenges. Rising awareness of data-driven hiring is creating opportunities for domestic HR solution providers. Gradual modernization of organizational practices supports consistent adoption in these developing areas. It is expected to witness accelerated growth in the next decade through policy support and talent development programs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Revelian

- Culture Amp

- Mentorloop

- ELMO Software

- PageUp

- Workday Australia

- Ceridian Australia

- BrightHR

Competitive Analysis:

The Australia HR Assessment Services Market is characterized by a mix of established players and emerging HR technology providers competing through innovation and service differentiation. Local firms such as Revelian, Culture Amp, and ELMO Software maintain strong domestic presence with integrated talent analytics and engagement platforms. Global companies like Workday and Ceridian Australia strengthen competition through cloud-based HR suites and AI-driven assessments. Intense rivalry pushes providers to enhance product accuracy, automation, and user experience. It continues to evolve through technology partnerships, client customization, and expanded service portfolios across industries.

Recent Developments:

- In August 2025, Revelian continued expanding its offerings under the unified Criteria brand, following its acquisition by Criteria Corp, with enhanced assessment portfolios for emotional intelligence and game-based testing now widely available to APAC customers. This rollout is part of a global integration strategy that’s increasing the reach and depth of their scientifically validated assessment tools, benefiting Australian organizations with improved hiring and employee assessment capabilities.

- In January 2025, Culture Amp announced a prestigious two-year partnership with Tennis Australia, becoming the official Employee Experience Partner and team sponsor of Australia’s Davis Cup and Billie Jean King Cup teams. This collaboration demonstrates Culture Amp’s expertise in driving organizational performance and culture for national sports entities, with their platform directly supporting thousands across Australian tennis.

- In July and September 2025, Mentorloop unveiled new product features, making their mentoring software platform more versatile for organizations in Australia. The most recent updates include advanced reporting and surveys to improve program management, as well as continuous recognition as a top mentoring software by G2 for ROI and customer satisfaction. These developments highlight Mentorloop’s investment in usability and analytics for HR professionals across Australia.

- In June 2025, ELMO Software made headlines by acquiring the UK-based workforce management platform Rotageek. This strategic acquisition enables ELMO to provide more comprehensive HR solutions, further streamlining workforce management for its Australian clients and supporting their international expansion plans.

Report Coverage:

The research report offers an in-depth analysis based on Assessment Type, Delivery Method, End-User Industry, Function, and Organization Size. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing digital adoption will continue to reshape assessment delivery and candidate analytics.

- AI integration will improve assessment precision, reducing human bias in recruitment.

- Cloud-based and mobile-first platforms will dominate service deployment across enterprises.

- Gamified and behavioural tools will expand their role in leadership and culture evaluation.

- Education, healthcare, and government sectors will emerge as new demand frontiers.

- Partnerships between HR tech firms and corporates will accelerate solution innovation.

- Predictive analytics will drive performance forecasting and retention strategies.

- SMEs will adopt affordable subscription-based HR solutions to enhance hiring quality.

- Focus on data privacy and ethical AI will shape regulatory compliance frameworks.

- The market will experience steady long-term growth supported by digital transformation initiatives.