Market Overview

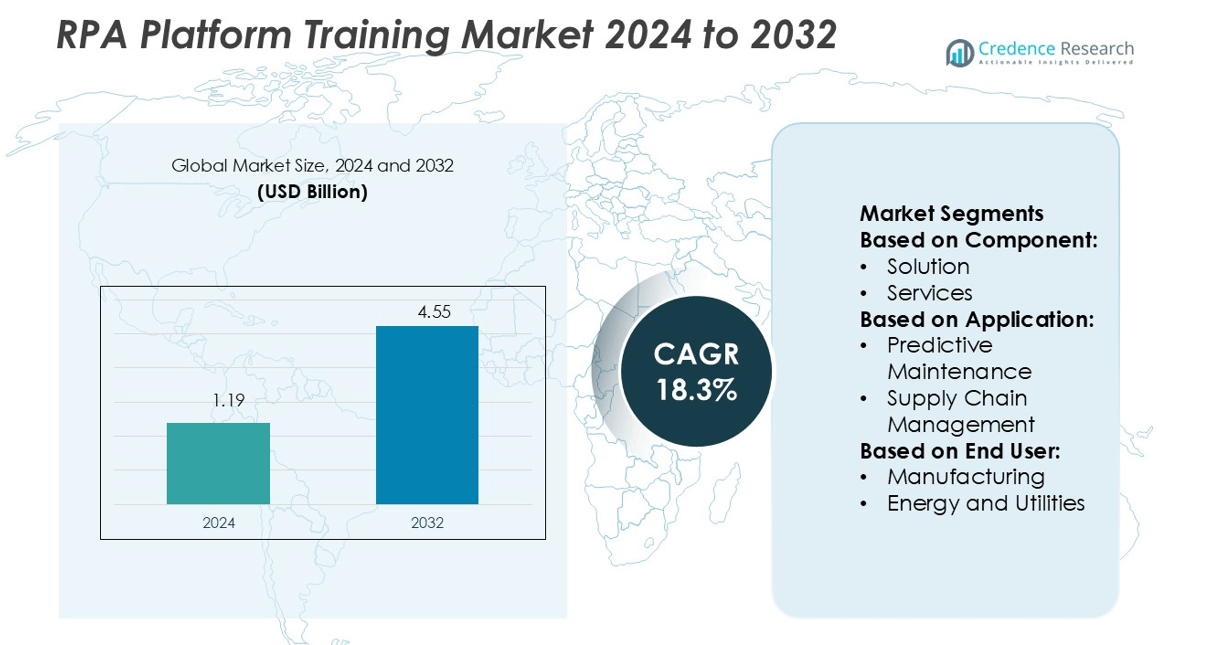

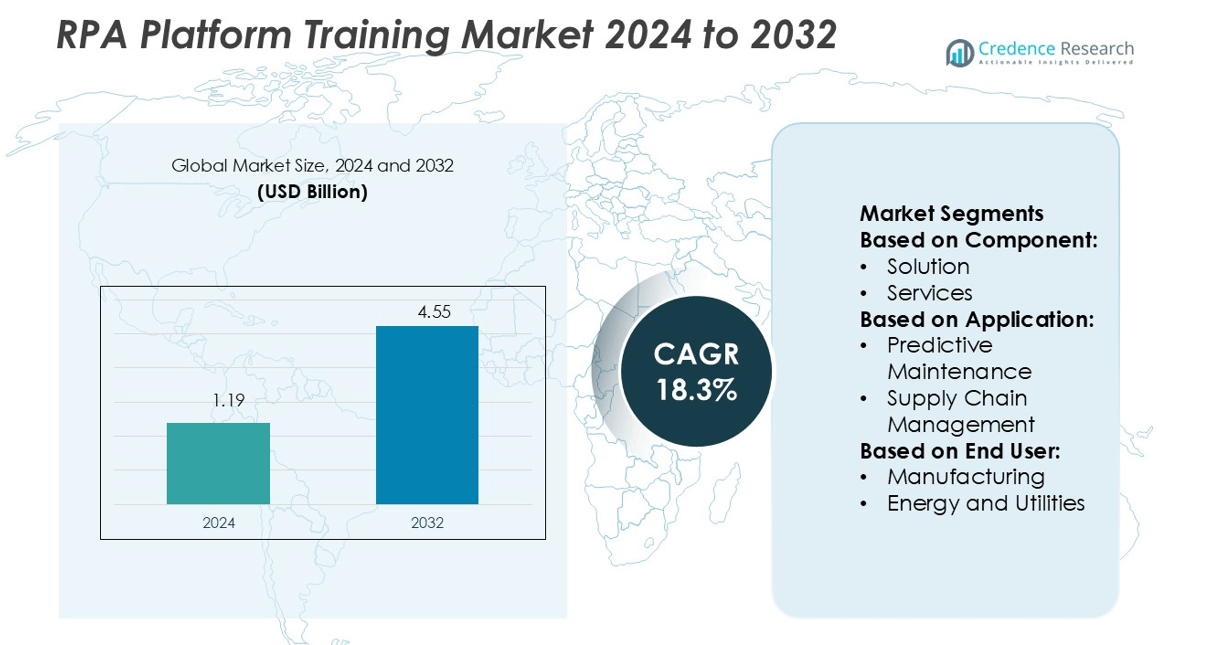

RPA Platform Training Market size was valued USD 1.19 billion in 2024 and is anticipated to reach USD 4.55 billion by 2032, at a CAGR of 18.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RPA Platform Training Market Size 2024 |

USD 1.19 billion |

| RPA Platform Training Market, CAGR |

18.3% |

| RPA Platform Training Market Size 2032 |

USD 4.55 billion |

The RPA platform training market is driven by top players such as Pegasystems Inc., NICE, Blue Prism Limited, FPT Software, OnviSource, Inc., SAP SE, Microsoft, Automation Anywhere Inc., EdgeVerve Systems Limited, and BlackLine Inc. These companies focus on delivering structured learning programs, advanced simulation tools, and globally recognized certifications to meet rising automation demands. Strategic partnerships with enterprises and educational institutions help them expand their market presence. North America leads the market with a 36% share, supported by strong digital transformation initiatives, early technology adoption, and well-developed training infrastructure. This leadership position is reinforced by enterprise investments in workforce reskilling and advanced automation capabilities.

Market Insights

- The RPA Platform Training Market size was valued at USD 1.19 billion in 2024 and is expected to reach USD 4.55 billion by 2032, growing at a CAGR of 18.3%.

- Rising enterprise automation and workforce reskilling initiatives are major growth drivers, supported by structured learning programs and certification demand across industries.

- AI-enabled, cloud-based, and hybrid training models are key trends, offering scalable and adaptive learning experiences for global enterprises.

- Strong competition among Pegasystems Inc., NICE, Blue Prism Limited, FPT Software, OnviSource, SAP SE, Microsoft, Automation Anywhere Inc., EdgeVerve Systems Limited, and BlackLine Inc. drives continuous innovation.

- North America holds a 36% regional share, supported by strong digital infrastructure, while the solution segment leads the component category due to high enterprise adoption of structured training modules.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solution segment holds the largest share in the RPA platform training market. Enterprises are increasingly adopting structured learning modules, simulation labs, and certification programs to support automation rollouts. Solution offerings provide scalable training paths, enabling faster onboarding and higher adoption rates across departments. These platforms integrate real-time learning analytics and interactive tools that enhance workforce productivity. Growing demand from large enterprises for standardized training programs drives market leadership for this segment, while services segment growth is supported by personalized learning and consulting needs.

- For instance, Pega’s official academy page, the “Introduction to Pega Platform ‘24.2” mission is available in five languages: English, French, German, Japanese, and Spanish.

By Application

Supply chain management dominates the application segment due to rising automation in logistics and procurement processes. Companies invest in RPA training to streamline tasks like invoice processing, demand forecasting, and shipment tracking. Training programs focus on creating skilled teams that can design, deploy, and maintain bots for repetitive workflows. Industries value these skills to reduce operational delays and improve accuracy in high-volume transactions. The strong link between automation and cost optimization accelerates training adoption in this application area, with predictive maintenance and APM showing steady growth.

- For instance, NICE introduced its AI-powered desktop analytics tool NEVA Discover which continuously maps and prioritizes automation candidates by analyzing over 200 distinct user action types (keystrokes, mouse selections, applications visited) to identify high-value opportunities.

By End User

The manufacturing segment accounts for the highest market share among end users. Industrial firms invest in RPA training to automate back-office operations, production workflows, and maintenance scheduling. Trained staff enable smoother integration of automation into existing manufacturing systems, improving efficiency and quality control. As industries shift toward smart factories and digital twins, skilled RPA professionals become critical to sustain competitiveness. Energy and utilities and healthcare are also emerging as significant adopters, focusing on regulatory compliance and process optimization.

Key Growth Drivers

Rising Automation Adoption Across Industries

Rapid automation in finance, manufacturing, healthcare, and logistics drives the demand for RPA platform training. Organizations invest in workforce upskilling to improve process efficiency, reduce human error, and accelerate digital transformation. Training programs help employees design, deploy, and maintain bots at scale. Companies also use structured learning to reduce dependency on external developers. This adoption trend strengthens as enterprises seek to integrate automation into complex workflows, making skill development a top priority to ensure successful RPA implementation and maximize return on investment.

- For instance, FPT’s AI-Mentor solution improved workforce knowledge quality by 55 % while reducing required training resources by 80 % in a deployment for a major retail-pharma customer.

Expansion of Enterprise Digital Transformation Programs

Enterprises increasingly view RPA as a core part of digital transformation strategies. Businesses are embedding automation into supply chains, customer service, and compliance processes. To support this shift, structured RPA platform training equips employees with required technical and process knowledge. Upskilled teams drive faster project execution, better governance, and reduced implementation costs. This results in a more agile digital environment. The rising number of transformation programs across industries continues to expand training investments, creating a strong growth driver for the market.

- For instance, SAP’s enterprise automation offering emphasises process mining across 200,000 industry-best-practice benchmarks to identify inefficiencies.

Focus on Workforce Reskilling and Productivity

The global focus on reskilling employees is driving RPA training demand. Companies are shifting from traditional training to interactive, hands-on modules that prepare teams for automation-heavy roles. These programs enhance employee productivity by reducing repetitive tasks and allowing focus on strategic work. Governments and enterprises are also funding training initiatives to address future skill gaps. This structured learning environment creates a skilled talent pool that supports RPA deployment, improving organizational agility and operational efficiency, while strengthening overall market growth.

Key Trends & Opportunities

Integration of AI and Advanced Analytics in Training

AI and analytics are transforming RPA platform training by enabling personalized learning paths. Adaptive platforms assess learner performance and adjust content dynamically. Real-time dashboards offer better insights into training outcomes, improving workforce readiness. Organizations benefit from shorter learning cycles and higher retention rates. AI-driven simulators and use cases allow learners to practice complex automation tasks, bridging the skill gap faster. This integration creates strong opportunities for training providers to deliver scalable and intelligent learning experiences tailored to enterprise needs.

- For instance, Microsoft reports more than 1,000 real-life customer transformation stories using their AI and analytics capabilities across Azure, Microsoft 365 Copilot and Power Platform.

Growing Popularity of Online and Self-Paced Training Models

The shift toward remote learning has accelerated the adoption of online RPA training programs. Self-paced modules offer flexibility and cost-efficiency for organizations managing distributed teams. This approach reduces training costs and allows faster onboarding for new automation projects. Enterprises increasingly use cloud-based training platforms to deliver content globally. The trend supports workforce scalability and continuous skill upgrades without major disruptions. These online models create growth opportunities for vendors offering customizable training solutions for small, medium, and large enterprises.

- For instance, AA documentation for its platform’s performance shows that its IQ Bot model processed 10,000 multi-page documents (totaling 20,000 pages) on a single node in 25 hours, 21 minutes, 42 seconds.

Partnerships Between Technology Vendors and Training Providers

Strategic partnerships between RPA platform developers and training providers are shaping market growth. These collaborations ensure curriculum alignment with the latest platform capabilities and industry use cases. Joint certification programs increase the value of training for professionals and employers. Vendors benefit from a broader ecosystem and faster adoption rates. This trend opens opportunities for co-branded courses, industry-specific modules, and advanced certifications, enhancing the overall quality and relevance of RPA platform training in competitive markets.

Key Challenges

Shortage of Skilled Trainers and Curriculum Standardization

A lack of qualified instructors and standardized training frameworks poses a major challenge. Many regions face skill gaps in both technical and instructional capabilities. Inconsistent course quality affects workforce readiness and implementation success. Companies often need to supplement training with in-house coaching, increasing costs and timelines. The absence of global standards also complicates certification recognition. Addressing this challenge requires structured curriculum development, trainer certification, and collaboration between platform vendors and learning institutions.

High Training Costs and Limited Budget Allocations

Many organizations struggle to allocate sufficient budgets for structured RPA training programs. Advanced certifications, platform licenses, and simulation tools increase overall expenses. Smaller enterprises find it difficult to justify these costs compared to immediate operational needs. This limits their ability to build skilled internal teams, slowing automation initiatives. The lack of affordable training models creates a divide between large and small organizations. Cost-effective and scalable training solutions are needed to overcome this barrier and ensure wider adoption.

Regional Analysis

North America

North America leads the RPA platform training market with a 36% share. The region benefits from early technology adoption, strong enterprise automation programs, and mature IT infrastructure. Major companies in finance, healthcare, and manufacturing invest heavily in workforce upskilling to accelerate digital transformation. Government and private sector collaborations support standardized training and certification. A well-developed ecosystem of platform vendors and certified training providers strengthens the market position. High demand for advanced automation capabilities and AI integration further fuels training adoption, making North America a strategic hub for RPA talent development.

Europe

Europe holds a 28% share of the global RPA platform training market, driven by rapid enterprise automation and strong regulatory frameworks. The region’s focus on digital workforce strategies in countries like Germany, the U.K., and France boosts demand for structured RPA learning programs. Companies emphasize compliance, operational efficiency, and cost control, which align with automation objectives. Collaborations between universities, technology vendors, and enterprises enhance curriculum quality. Adoption of hybrid training models and advanced analytics in learning platforms accelerates skill development, supporting Europe’s position as a key contributor to global RPA training growth.

Asia Pacific

Asia Pacific accounts for a 22% market share, supported by fast-growing automation initiatives across industries. Countries like India, China, Japan, and South Korea are major contributors, investing in large-scale workforce reskilling programs. Expanding IT service sectors and digital transformation projects in manufacturing and logistics drive demand for RPA training. Cost-effective training solutions and strong government support create favorable conditions for rapid adoption. Increasing availability of cloud-based training platforms enables enterprises to scale up learning programs. Asia Pacific shows strong growth potential as organizations prioritize automation to boost productivity and competitiveness.

Latin America

Latin America holds an 8% market share in the RPA platform training market. The region is experiencing steady growth, driven by increasing automation in banking, retail, and manufacturing sectors. Countries like Brazil and Mexico are leading with investments in digital workforce upskilling. Local partnerships between enterprises and training providers help bridge the skill gap. The adoption of online and hybrid learning models improves accessibility for mid-sized businesses. While overall adoption is slower compared to mature markets, improving digital infrastructure and growing enterprise interest are positioning Latin America as an emerging RPA training hub.

Middle East & Africa

Middle East & Africa represent a 6% share of the global market, with growth centered in the UAE, Saudi Arabia, and South Africa. Government-led digital transformation initiatives and smart city projects create demand for skilled RPA professionals. Enterprises in energy, utilities, and finance are adopting automation to enhance operational efficiency. Training programs are expanding through regional partnerships and international collaborations. Limited access to advanced training infrastructure remains a challenge, but increasing investment in digital education and enterprise reskilling programs is expected to boost adoption, strengthening the region’s long-term growth potential.

Market Segmentations:

By Component:

By Application:

- Predictive Maintenance

- Supply Chain Management

By End User:

- Manufacturing

- Energy and Utilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The RPA platform training market is shaped by leading companies including Pegasystems Inc., NICE, Blue Prism Limited, FPT Software, OnviSource, Inc., SAP SE, Microsoft, Automation Anywhere Inc., EdgeVerve Systems Limited, and BlackLine Inc. The RPA platform training market is becoming increasingly competitive, driven by rising enterprise automation and workforce reskilling needs. Companies are focusing on delivering structured, scalable, and AI-integrated training solutions to support large digital transformation programs. Advanced learning platforms offer role-based modules, hands-on simulation labs, and real-time performance analytics to improve learner engagement and retention. Partnerships with universities, training institutes, and industry associations help expand global reach and standardize certification frameworks. Flexible learning formats such as self-paced, instructor-led, and hybrid models enable faster adoption across industries. Continuous innovation in content delivery and technology integration strengthens the overall market position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pegasystems Inc.

- NICE

- Blue Prism Limited

- FPT Software

- OnviSource, Inc.

- SAP SE

- Microsoft

- Automation Anywhere Inc.

- EdgeVerve Systems Limited

- BlackLine Inc.

Recent Developments

- In July 2025, The US Departments of Labor and Education completed a unified workforce administration framework to streamline adult education and vocational grants.

- In December 2024, UiPath partnered with the UAE government’s AI, Digital Economy, and Remote Work End Uses Office to advance Agentic Automation, an AI-powered approach to automation. The collaboration aims to develop AI-driven solutions across government entities while equipping UAE talent with essential AI skills.

- In November 2024, Automation Anywhere Inc. announced a strategic partnership with PwC India, a Business Consulting and Services provider to help enterprises enhance efficiency through GenAI-powered automation solutions. This collaboration combines Automation Anywhere Inc.’s advanced technology with PwC India’s industry knowledge and consulting expertise.

- In June 2024, HSBC launched WorldTrader, a pioneering digital trading platform that allows customers to trade a variety of financial instruments, including equities, exchange-traded funds (ETFs), and bonds, across 77 exchanges in 25 markets globally. Initially introduced in the UAE, WorldTrader aims to cater to the growing demand for international investment opportunities among affluent clients.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong demand from enterprises expanding automation initiatives.

- AI integration will make training programs more adaptive and personalized.

- Cloud-based learning platforms will enable faster global adoption.

- Certification programs will become a standard requirement for RPA roles.

- Partnerships between technology vendors and academic institutions will increase.

- Self-paced and hybrid learning models will dominate enterprise training strategies.

- Skill development will focus more on real-time bot deployment and maintenance.

- Governments will support workforce reskilling through structured digital training programs.

- Advanced analytics will drive better performance tracking and learning outcomes.

- The demand for multilingual and role-specific training modules will rise steadily.