Market Overview:

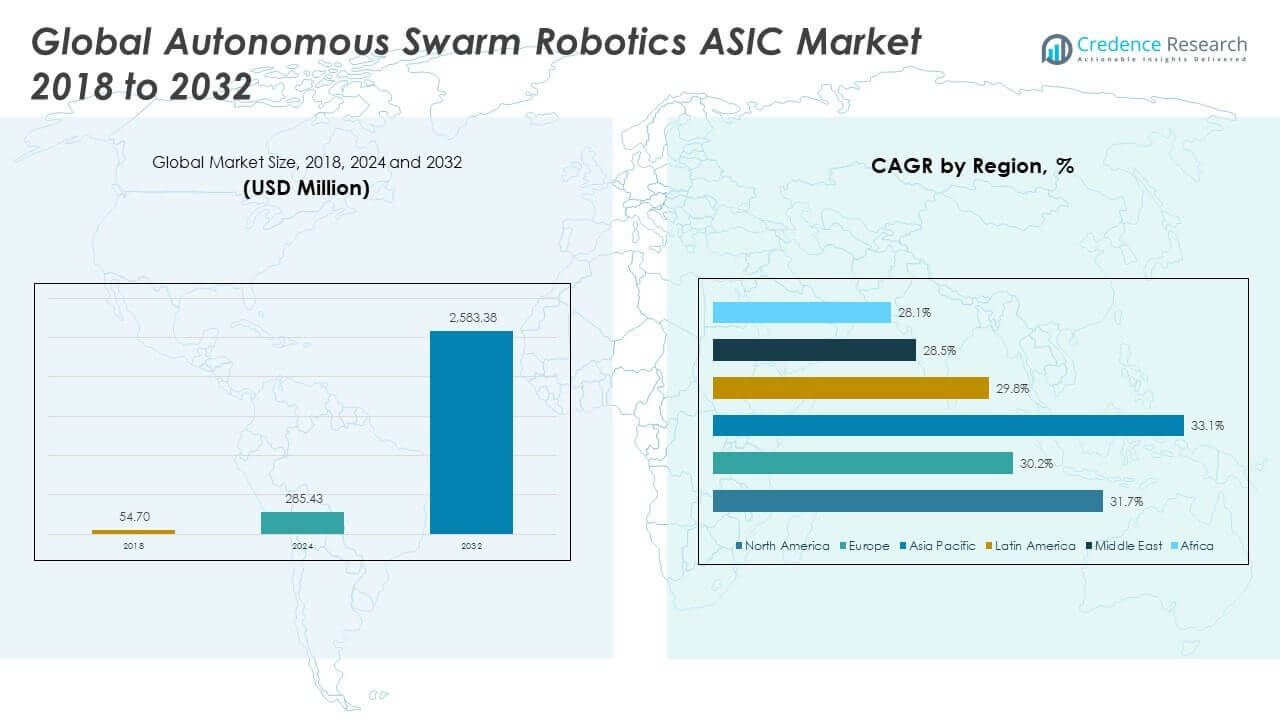

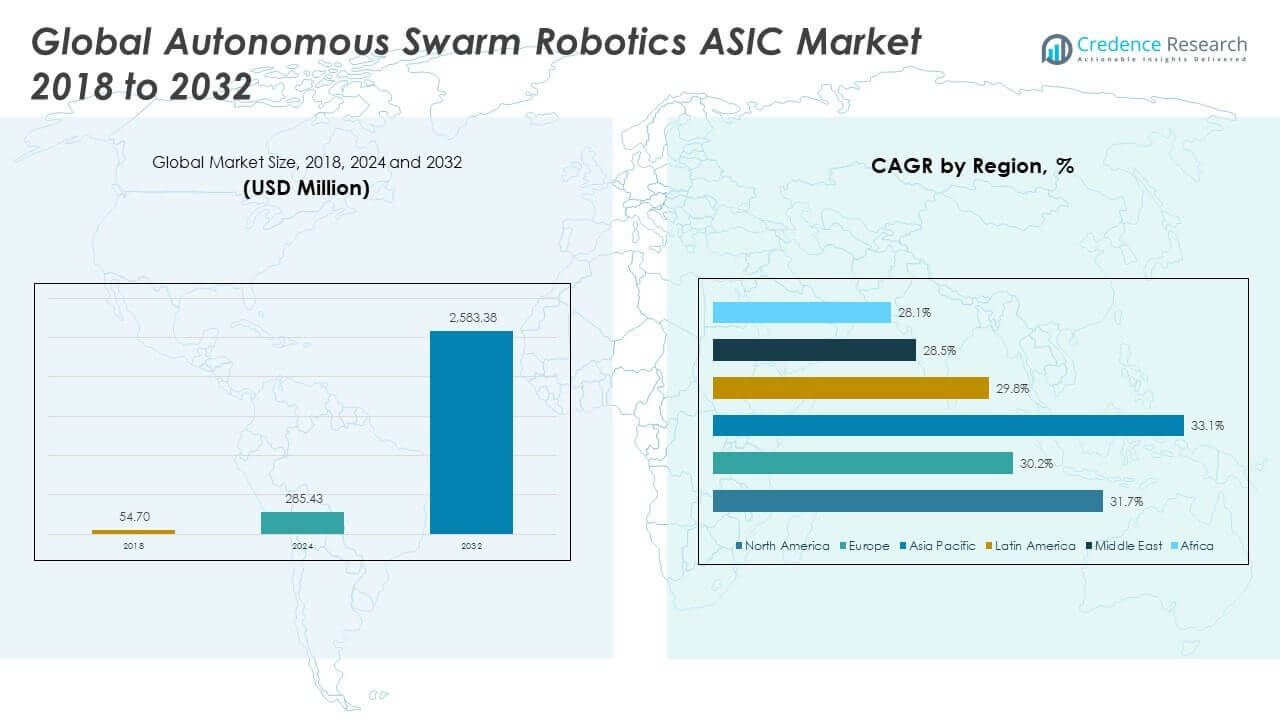

The Global Autonomous Swarm Robotics ASIC Market size was valued at USD 54.70 million in 2018, reaching USD 285.43 million in 2024, and is anticipated to reach USD 2,583.38 million by 2032, at a CAGR of 31.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Global Autonomous Swarm Robotics ASIC Market Size 2024 |

USD 285.43 Million |

| Global Autonomous Swarm Robotics ASIC Market, CAGR |

31.7% |

| Global Autonomous Swarm Robotics ASIC Market Size 2032 |

USD 2,583.38 Million |

The Global Autonomous Swarm Robotics ASIC Market is experiencing substantial growth due to advancements in autonomous robotics technology. The increasing demand for AI and machine learning capabilities is further driving this expansion, with industries like defense, agriculture, and industrial automation adopting swarm robotics. The integration of swarm robotics with application-specific integrated circuits (ASICs) enhances efficiency, flexibility, and performance, allowing these systems to perform complex tasks more effectively. As these technologies evolve, the market is expected to grow rapidly across various industries, driving further innovation and development.

Geographically, North America holds a dominant position in the market due to its strong technological infrastructure and high investments in autonomous systems. Europe follows closely, with significant adoption in defense and industrial sectors. Asia Pacific is also witnessing a sharp rise in the demand for swarm robotics, driven by industrialization and technological advancements in countries like China, Japan, and India. Emerging markets in Latin America, the Middle East, and Africa are expected to contribute significantly to market growth, with increased investments and a shift toward automation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Autonomous Swarm Robotics ASIC Market size was valued at USD 54.70 million in 2018, reaching USD 285.43 million in 2024, and is anticipated to reach USD 2,583.38 million by 2032, at a CAGR of 31.7% during the forecast period.

- North America leads the market with significant investments in autonomous systems, contributing approximately 36% of the global market share by 2024.

- The growing demand for AI-powered autonomous swarm robotics in defense, agriculture, and industrial sectors is a key driver of market growth.

- Asia Pacific is expected to witness the highest growth rate, with a projected CAGR of 33.1% during the forecast period, owing to rapid industrialization and robotics adoption.

- The increasing integration of 5G and IoT in autonomous robotics will enhance real-time communication and scalability, driving further market expansion.

- Custom ASICs designed for specific applications, such as military and healthcare, will continue to gain popularity, offering more efficient and cost-effective solutions.

- The rising trend of sustainability and energy efficiency in robotics will lead to innovations in low-power ASIC designs and environmentally friendly solutions.

Market Drivers:

Growing Demand for AI/ML in Robotics

The demand for advanced AI and machine learning (ML) capabilities is one of the primary drivers of the Global Autonomous Swarm Robotics ASIC Market. These technologies enable autonomous systems to perform tasks such as real-time decision-making, pattern recognition, and adaptive behaviors. Swarm robotics, integrated with AI-powered ASICs, enhances robots’ ability to collaborate effectively, increasing efficiency and reliability. As industries across defense, agriculture, and manufacturing seek to optimize performance, AI and ML technologies are becoming crucial for the development of autonomous robotics.

- For example, Nano Labs Ltd has launched the FPU3.0 ASIC architecture, which integrates advanced 3D DRAM stacking and delivers a fivefold boost in power efficiency compared to its previous FPU2.0 mode.

Increased Adoption in Defense & Military

Defense and military applications are major contributors to market growth. Autonomous swarm robotics, powered by ASICs, are being used more frequently for surveillance, reconnaissance, and tactical operations. These systems provide real-time data processing, low power consumption, and scalability, making them ideal for defense applications. As global defense budgets rise and the shift toward autonomous technologies continues, this segment is expected to lead in both revenue and adoption. The demand for efficient, intelligent systems in defense will continue to drive the growth of autonomous swarm robotics.

Demand for Automation in Industrial and Agricultural Sectors

The demand for automation in industrial and agricultural sectors is another significant market driver. Autonomous swarm robotics, integrated with specialized ASICs, are being increasingly deployed in warehouses, logistics, and precision farming. These robots optimize tasks like material handling, planting, harvesting, and environmental monitoring, all while improving efficiency and reducing operational costs. The growing need for higher productivity and resource optimization in these sectors ensures continued strong growth prospects for autonomous swarm robotics.

Technological Advancements in Robotics

Technological innovations continue to enhance the performance and capabilities of autonomous swarm robotics. Advances in ASIC design, including specialized chips for swarm intelligence, machine vision, and sensor integration, are unlocking new opportunities for more sophisticated robotic systems. As hardware becomes smaller, more efficient, and cost-effective, the potential for swarm robotics expands. These innovations will drive continued growth in both product development and application diversity, enabling more industries to leverage autonomous systems for a wide range of tasks.

- For example, custom ASICs optimized for robotics tasks, such as sensor integration, real-time data fusion, and neural inference, have demonstrated up to a 10x improvement in performance over off-the-shelf CPUs.

Market Trends:

Miniaturization of Robotics Components

The trend toward miniaturization is significantly impacting the Global Autonomous Swarm Robotics ASIC Market. Smaller, more efficient ASICs allow for lightweight, energy-efficient swarm robotics systems with extended operational durations. This trend is particularly crucial in defense and environmental monitoring, where size, weight, and battery life are critical. As these components shrink without compromising performance, the market for autonomous swarm robotics will continue to grow, offering more versatile and scalable solutions for various applications.

Integration of 5G and IoT

The integration of 5G connectivity and the Internet of Things (IoT) is becoming a major trend in autonomous swarm robotics. The combination of high-speed 5G networks and swarm robotics enables real-time data exchange and decision-making across large fleets of autonomous robots. IoT-enabled sensors enhance the robots’ environmental awareness and task performance, while 5G connectivity ensures seamless communication, even in remote or harsh environments. This advancement is driving greater efficiency and collaboration in swarm robotics applications.

- For example, Aalborg University’s 5G Smart Production Lab has demonstrated industrial swarms where autonomous mobile robots (AMRs) and static robotics modules are wirelessly coordinated using ultra-reliable, low-latency 5G links. Their testbed showcases real-time production line reconfiguration, cloud localization, and decentralized AMR fleet control.

Focus on Sustainability and Green Technologies

As industries strive toward sustainability, the demand for energy-efficient and eco-friendly autonomous swarm robotics is increasing. These systems help minimize energy consumption, optimize resource management, and reduce waste, especially in applications like precision agriculture and environmental monitoring. The growing emphasis on green technologies is pushing innovation in ASIC designs, expanding the use of swarm robotics in environmentally conscious sectors, and driving further market growth in the process.

Increased Investment in R&D

With rapid advancements in technology, companies in the autonomous swarm robotics market are investing significantly in research and development (R&D) to stay ahead of the competition. Focused on creating more powerful, compact, and cost-effective ASICs, these investments are essential for meeting the evolving demands of industries. As R&D progresses, we can expect breakthroughs in ASIC technology that will enable more sophisticated, efficient, and versatile swarm robotics systems for diverse applications.

- For example, in December 2023 alone, robotics companies raised $749M across 41 investment rounds, with $200M invested in Shield AI’s autonomy stack for aircraft and $100M in Gecko Robotics’ industrial swarm solutions. focusing specifically on edge-AI and real-time collaborative mapping for UAV fleets.

Market Challenges:

Regulatory and Compliance Challenges

Navigating the complex regulatory landscape is a key challenge for the Global Autonomous Swarm Robotics ASIC Market. As swarm robotics are increasingly integrated into critical sectors like defense, healthcare, and agriculture, strict regulations regarding safety, data privacy, and ethical considerations emerge. These regulatory hurdles can delay the deployment of autonomous systems, increase compliance costs, and present barriers for new market entrants. Meeting these requirements is essential for ensuring the widespread adoption of autonomous swarm robotics across industries.

Economic Pressures and Inflation

Economic factors, including inflation and supply chain disruptions, are creating challenges for market growth. Rising costs of raw materials and components for ASIC production are driving up prices for autonomous swarm robotics systems. Economic instability in key markets may also deter investment in new technologies, slowing the adoption of swarm robotics in industries like defense, manufacturing, and agriculture. These economic pressures may affect profit margins, hindering the expansion of the market and the development of cost-effective autonomous solutions.

Market Opportunities:

Expansion into Emerging Markets

Emerging markets in Latin America, the Middle East, and Africa offer significant growth opportunities for the Global Autonomous Swarm Robotics ASIC Market. These regions are investing in technological infrastructure and automation, driving the demand for advanced robotics systems. Local governments and industries are deploying autonomous technologies in sectors like agriculture, disaster management, and environmental monitoring. This expansion creates new opportunities for swarm robotics, with industries in these regions seeking innovative solutions for efficiency and sustainability, further accelerating market growth.

Advancements in Custom ASIC Design

The rise of custom ASIC designs tailored to specific applications presents a significant opportunity for the market. As industries look to enhance the performance of their swarm robotics systems, custom ASICs provide solutions that optimize processing power, reduce energy consumption, and lower overall costs. This is especially critical in defense, where reliability and performance are paramount. The development of specialized ASICs to meet these industry-specific demands will open new avenues for market expansion, offering a competitive edge to companies focusing on customization.

Market Segmentation Analysis:

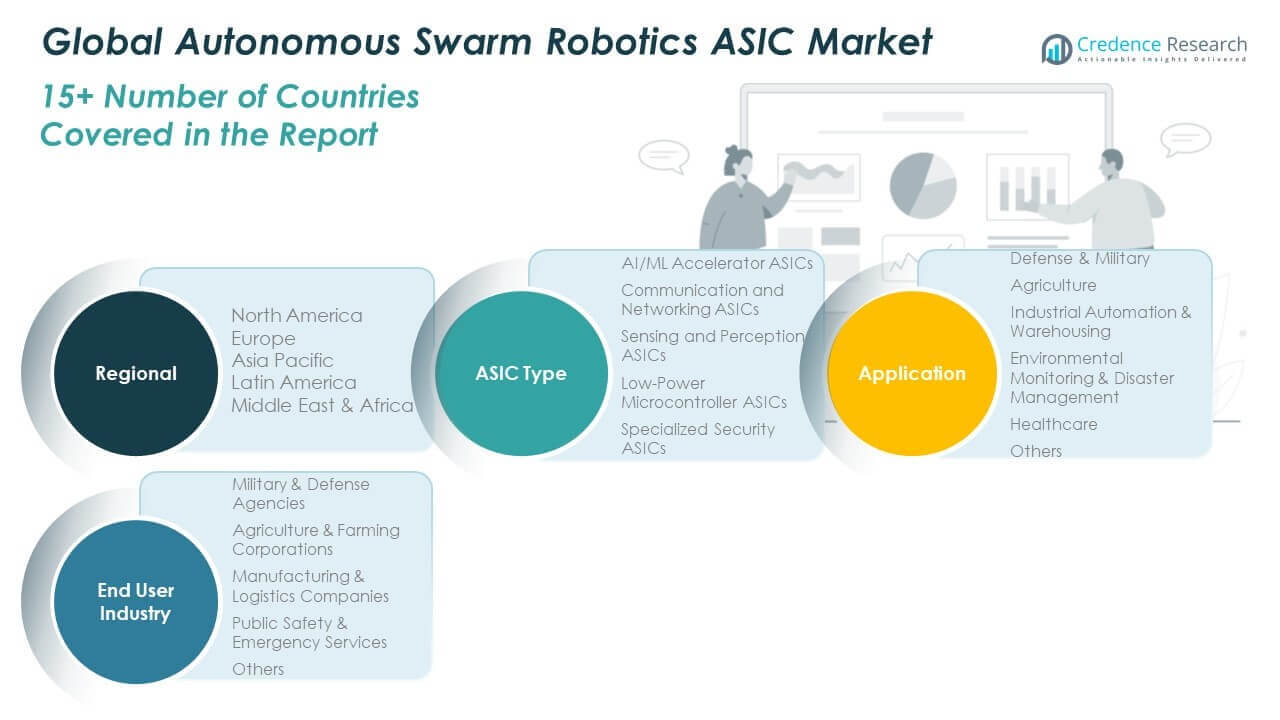

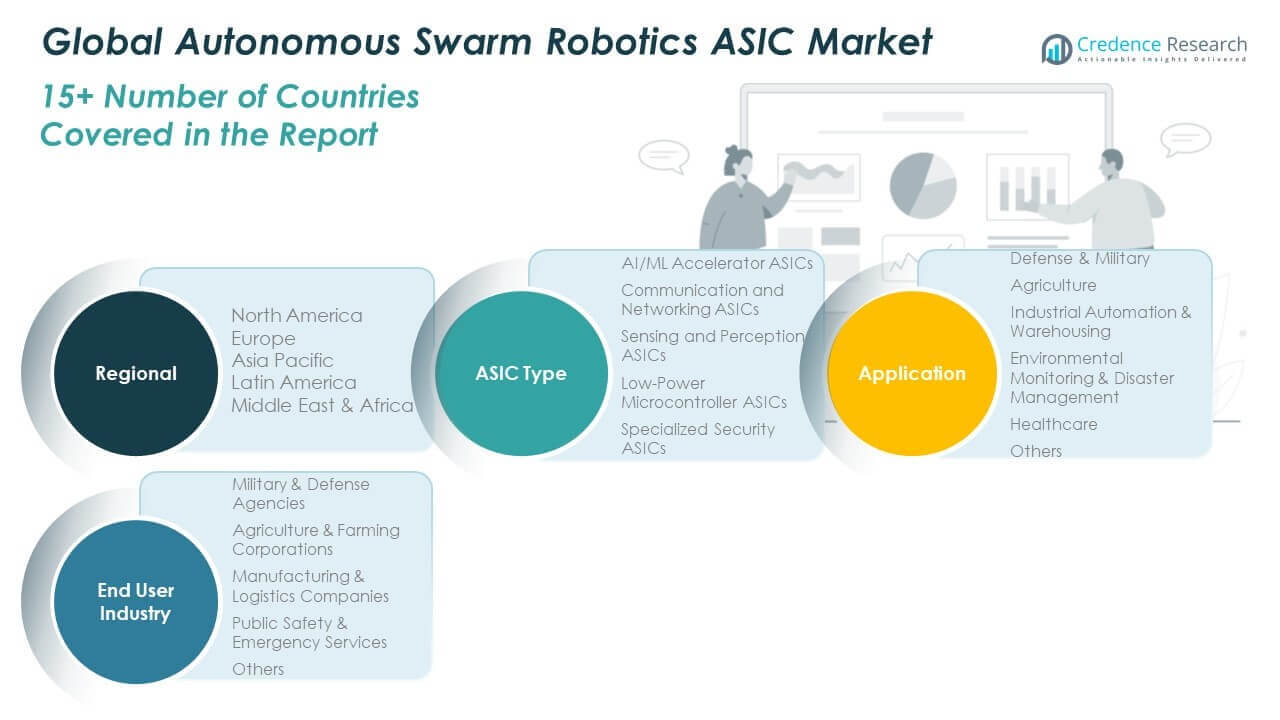

By ASIC Type:

AI/ML Accelerator ASICs enable faster data processing for real-time decision-making in robotics, boosting efficiency across sectors like defense, agriculture, and industrial automation. Communication and Networking ASICs ensure seamless data transfer and coordination between swarm robots, vital for real-time collaboration, particularly in logistics and defense. Sensing and Perception ASICs allow robots to process environmental data from sensors like cameras and LiDAR, essential for autonomous navigation in defense and environmental monitoring. Low-Power Microcontroller ASICs optimize power consumption, making them ideal for energy-sensitive applications in agriculture and military operations. Specialized Security ASICs secure data and communication within autonomous systems, ensuring data integrity and protection, especially in sensitive industries like healthcare and defense.

- For example, Qualcomm’s Robotics RB5 platform integrates a dedicated ASIC for low-latency, high-bandwidth inter-robot communication. The platform supports wireless mesh networking at latencies below 10ms, enabling coordinated logistics swarms in Amazon’s fulfillment centers for synchronized package sorting.

By Application:

Defense & Military applications use swarm robotics for surveillance, reconnaissance, and tactical operations, powered by ASICs for real-time decision-making. Agriculture benefits from swarm robots for precision farming tasks like monitoring and harvesting, improving efficiency and sustainability. Industrial Automation & Warehousing leverage swarm robotics for material handling and sorting, enhancing operational productivity. Environmental Monitoring & Disaster Management use these robots to assess damage and monitor environmental changes in hazardous environments. Healthcare applications utilize swarm robots for surgery assistance, patient monitoring, and drug delivery, ensuring precision and improving patient outcomes.

- For example, Medtronic’s Hugo™ surgical robot uses AI ASICs from NVIDIA to enable autonomous instrument tracking and real-time tissue analysis, reducing procedure times by 20% and improving precision in minimally invasive surgeries.

By End-User Industry:

Military & Defense lead the adoption of swarm robotics for strategic missions. Agriculture & Farming Corporations use them for automating tasks like planting and harvesting. Manufacturing & Logistics sectors apply them for sorting and inventory management. Public Safety & Emergency Services deploy swarm robots for search-and-rescue operations in hazardous conditions, and other industries like research and infrastructure inspection follow suit.

Segmentation:

By ASIC Type:

- AI/ML Accelerator ASICs

- Communication and Networking ASICs

- Sensing and Perception ASICs

- Low-Power Microcontroller ASICs

- Specialized Security ASICs

By Application:

- Defense & Military

- Agriculture

- Industrial Automation & Warehousing

- Environmental Monitoring & Disaster Management

- Healthcare

- Others

By End-User Industry:

- Military & Defense Agencies

- Agriculture & Farming Corporations

- Manufacturing & Logistics Companies

- Public Safety & Emergency Services

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

The North America Global Autonomous Swarm Robotics ASIC Market size was valued at USD 23.59 million in 2018, reaching USD 121.79 million in 2024, and is anticipated to reach USD 1,105.42 million by 2032, at a CAGR of 31.7% during the forecast period. North America holds the largest market share, driven by advancements in technology and substantial investments from defense and industrial sectors. The region is expected to continue leading the market due to its robust infrastructure and growing adoption of autonomous systems in various applications. A key advantage is the presence of leading robotics companies in the region, making North America a hub for innovation. The region is projected to contribute approximately 36% to the total global market share in 2024.

Europe:

The Europe Global Autonomous Swarm Robotics ASIC Market size was valued at USD 10.53 million in 2018, reaching USD 52.01 million in 2024, and is anticipated to reach USD 429.42 million by 2032, at a CAGR of 30.2% during the forecast period. The region is focusing on innovations in robotics and AI technologies, with governments supporting R&D initiatives and fostering collaboration between industry players. Europe is expected to see significant growth in industrial and agricultural automation. With growing regulatory support and technological investments, Europe is rapidly expanding its autonomous robotics capabilities. The market share for Europe is expected to reach approximately 21% in 2024.

Asia Pacific:

The Asia Pacific Global Autonomous Swarm Robotics ASIC Market size was valued at USD 15.65 million in 2018, reaching USD 86.27 million in 2024, and is anticipated to reach USD 852.24 million by 2032, at a CAGR of 33.1% during the forecast period. This region is witnessing rapid industrialization and a shift toward automation in sectors such as agriculture, manufacturing, and defense. The growing demand for smart solutions and robotics in countries like China, Japan, and India is expected to drive significant market growth. The integration of advanced robotics technologies in defense and agriculture will further accelerate this expansion. Asia Pacific’s market share in 2024 is estimated to be approximately 27%.

Latin America:

The Latin America Global Autonomous Swarm Robotics ASIC Market size was valued at USD 2.69 million in 2018, reaching USD 13.85 million in 2024, and is anticipated to reach USD 111.54 million by 2032, at a CAGR of 29.8% during the forecast period. The region is beginning to adopt autonomous technologies in agriculture, defense, and environmental monitoring, and this trend is expected to drive growth. Increasing government support for automation and infrastructure development is expected to fuel this adoption. As more industries embrace robotics to improve productivity, Latin America will experience rapid growth. Latin America’s market share is expected to contribute approximately 3% by 2024.

Middle East:

The Middle East Global Autonomous Swarm Robotics ASIC Market size was valued at USD 1.37 million in 2018, reaching USD 6.48 million in 2024, and is anticipated to reach USD 48.34 million by 2032, at a CAGR of 28.5% during the forecast period. The region is increasingly investing in autonomous technologies for applications in defense, oil & gas, and agriculture. The demand for automation in these sectors is driving significant investments in robotics. Strategic partnerships and collaborations between governments and technology firms are expected to foster market growth in this region. The Middle East is expected to capture approximately 2.5% of the market share in 2024.

Africa:

The Africa Global Autonomous Swarm Robotics ASIC Market size was valued at USD 0.87 million in 2018, reaching USD 5.02 million in 2024, and is anticipated to reach USD 36.42 million by 2032, at a CAGR of 28.1% during the forecast period. The region presents opportunities for growth in sectors such as agriculture, disaster management, and environmental monitoring, with increased interest in automation technologies. Rising investments in technology and infrastructure are further accelerating the adoption of robotics in Africa. With expanding opportunities for automation in rural and agricultural settings, Africa’s market share is expected to be around 1.5% in 2024.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- NVIDIA Corporation

- Intel Corporation

- Qualcomm

- Texas Instruments

- Broadcom Inc.

- Xilinx / AMD

- Analog Devices Inc.

- Boston Dynamics

- Swarm Technologies

- Lockheed Martin

Competitive Analysis:

The Global Autonomous Swarm Robotics ASIC Market is characterized by intense competition among a few dominant players and numerous emerging firms. Leading companies like NVIDIA, Intel, and Qualcomm are at the forefront, driving innovations in AI, communication, and sensor technologies. These firms leverage their expertise in chip manufacturing and robotics to develop high-performance ASICs that enhance the capabilities of autonomous systems. The market structure is shaped by substantial R&D investments, strategic partnerships, and acquisitions. Companies are focusing on creating custom ASICs to meet the specific needs of industries such as defense, agriculture, and healthcare. Players like Boston Dynamics and Lockheed Martin are expanding their portfolios with cutting-edge swarm robotics solutions, catering to both military and commercial sectors. The increasing demand for automation across industries is prompting firms to enhance their competitive position by offering scalable, cost-effective solutions. In addition, companies are targeting emerging markets in Latin America, Asia Pacific, and Africa, where robotics adoption is on the rise.

Recent Developments:

·In May 2025, AMD introduced its Radeon AI PRO R9700 graphics card and Ryzen Threadripper 9000 Series processors, both engineered for AI development and advanced computing workloads. These launches, announced at Computex, reinforce AMD’s commitment to AI and high-performance computing markets, crucial for robotics and swarm applications.

·In March 2025, NVIDIA unveiled the DGX Spark and DGX Station personal AI supercomputers, introducing the Grace Blackwell architecture to desktop-scale computing. These new AI-first platforms empower researchers, robotics developers, and students to experiment with state-of-the-art AI models locally, previously only possible at data center level.

Market Concentration & Characteristics

The Global Autonomous Swarm Robotics ASIC Market is moderately concentrated, with a few dominant players leading the innovation and deployment of advanced autonomous systems. Market leaders such as NVIDIA, Intel, and Qualcomm are at the forefront, investing heavily in R&D to develop specialized ASICs for swarm robotics applications. These companies’ strong financial capabilities and technological expertise enable them to maintain a competitive advantage. The market is characterized by rapid innovation, with companies focused on producing highly efficient, low-power, and performance-driven ASICs that meet the unique demands of autonomous robotics. Barriers to entry include high capital requirements for R&D and manufacturing, as well as the need for specialized knowledge in AI, machine learning, and robotics. While a few large players dominate, emerging startups and smaller firms are making strides by developing niche solutions tailored to specific industries such as agriculture, defense, and healthcare.

Report Coverage:

The research report offers an in-depth analysis based on ASIC Type, Application, and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Autonomous Swarm Robotics ASIC Market is expected to continue its rapid growth, driven by advancements in AI, machine learning, and sensor technologies, enabling more sophisticated autonomous systems.

- As industries like defense, agriculture, and healthcare embrace automation, the demand for swarm robotics with specialized ASICs will increase, creating new market opportunities.

- North America is likely to maintain its lead in the market, but the Asia Pacific region will see the fastest growth, driven by industrialization and increasing investments in robotics.

- The adoption of 5G connectivity and IoT integration will enhance the performance and scalability of swarm robotics, providing real-time communication capabilities across large fleets of robots.

- Customization of ASICs for specific applications will be a key trend, allowing manufacturers to develop more efficient, cost-effective solutions for industries such as military, agriculture, and environmental monitoring.

- The healthcare sector will continue to explore the use of swarm robotics for surgical assistance, patient monitoring, and drug delivery, with ASICs playing a critical role in enhancing precision and reliability.

- The emergence of new startups focusing on niche applications and specialized solutions will diversify the competitive landscape, driving further innovation.

- Sustainability will be a major focus in future robotics development, with a push toward energy-efficient systems that reduce the environmental impact of automation technologies.

- Regulatory frameworks around data privacy, security, and safety standards will evolve, shaping the pace and scope of adoption in different regions.

- Increasing investment in R&D will lead to breakthroughs in autonomous robotics capabilities, enhancing their overall performance and broadening their scope of applications.