Market Overview

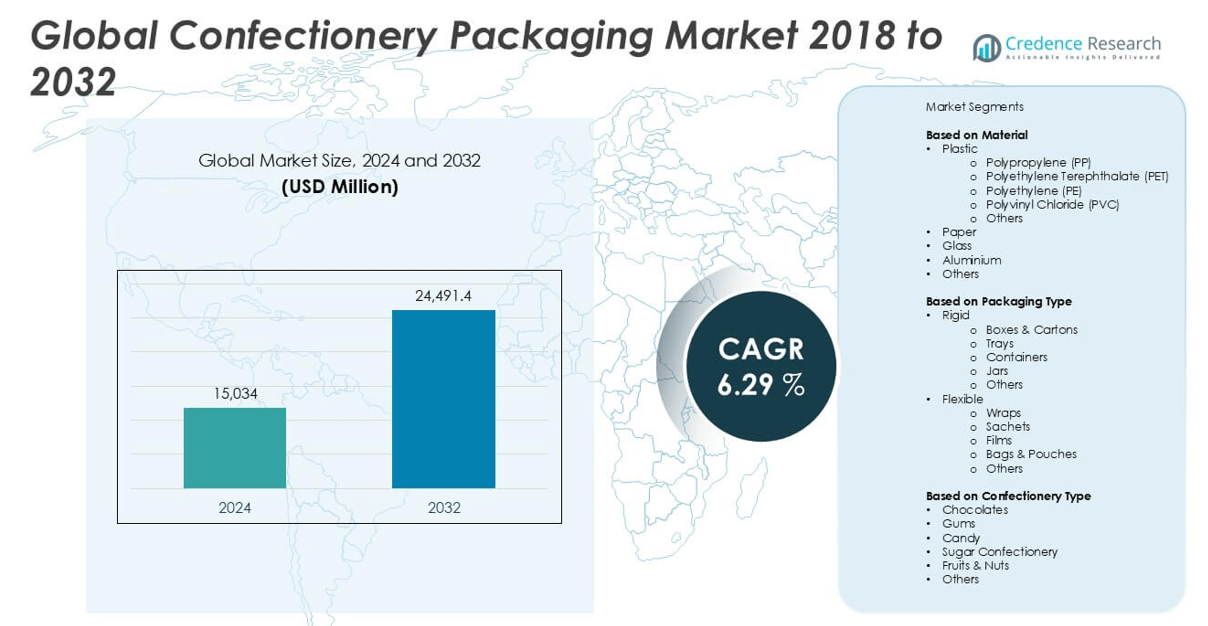

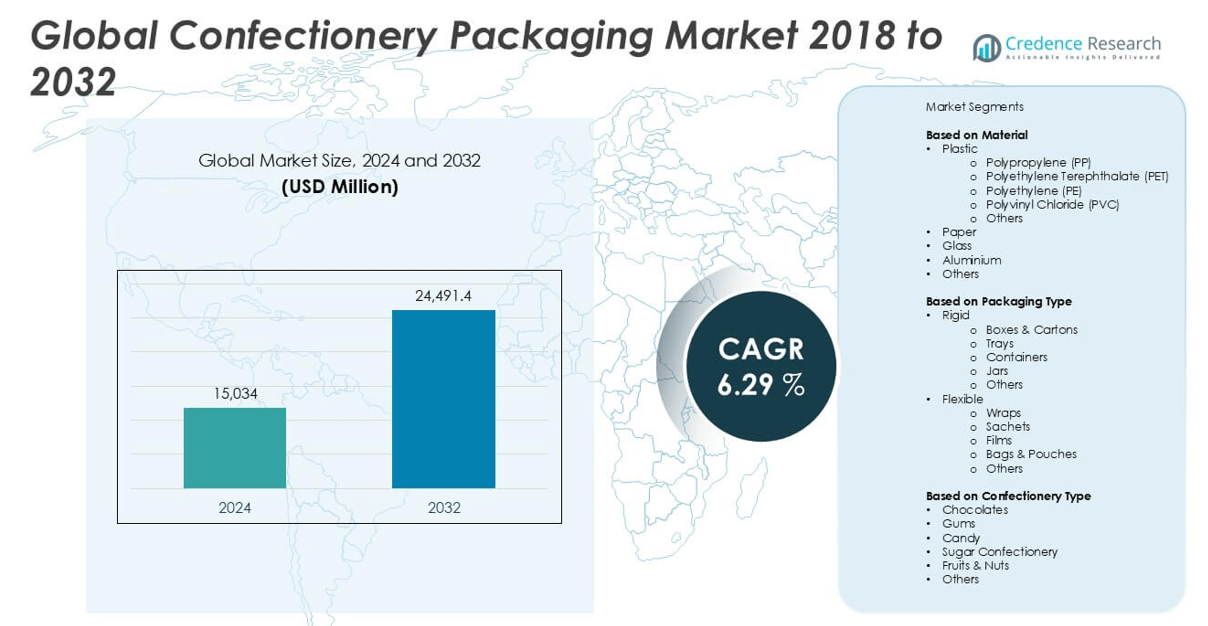

The Confectionery Packaging market size was valued at USD 15,034 million in 2024 and is anticipated to reach USD 24,491.4 million by 2032, at a CAGR of 6.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Confectionery Packaging Market Size 2024 |

USD 15,034 million |

| Confectionery Packaging Market, CAGR |

6.29% |

| Confectionery Packaging Market Size 2032 |

USD 24,491.4 million |

The confectionery packaging market is led by prominent players such as Amcor plc, Smurfit Kappa, Huhtamaki Oyj, Constantia Flexibles, Coveris, and Printpack, along with regional contenders like Rengo Co., Ltd, Stanpac Inc, Toppan Inc., and Novel Packaging. These companies focus on sustainable materials, innovative designs, and advanced packaging technologies to meet the rising demand for attractive, functional, and eco-friendly solutions. North America emerged as the leading region in 2024, commanding approximately 28% of the global market share, driven by high confectionery consumption, premiumization trends, and strong retail infrastructure.

Market Insights

- The confectionery packaging market was valued at USD 15,034 million in 2024 and is projected to reach USD 24,491.4 million by 2032, growing at a CAGR of 6.29% during the forecast period.

- Growing demand for convenient, single-serve packaging and increasing global confectionery consumption are driving market growth, especially in chocolates and sugar confectionery segments.

- Flexible packaging, led by bags & pouches, dominates due to its lightweight and cost-effective nature, while sustainable materials like paper and bio-plastics are gaining traction as key trends.

- Major players such as Amcor plc, Smurfit Kappa, and Huhtamaki Oyj are focusing on recyclable and innovative packaging; regional players are investing in customizable and seasonal packaging formats.

- North America holds the largest regional share at 28%, followed by Europe at 26% and Asia Pacific at 22%; plastic remains the leading material segment, driven by widespread use of polypropylene (PP) for its durability and cost efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Plastic held the dominant share in the confectionery packaging market in 2024, accounting for over 60% of the overall revenue. Within this segment, Polypropylene (PP) emerged as the leading sub-segment due to its excellent barrier properties, lightweight nature, and cost-effectiveness. The growing demand for individually wrapped confectionery items and extended shelf life is driving the preference for plastic packaging. Paper packaging is witnessing rising adoption due to increasing environmental concerns and sustainability initiatives. However, the adoption of alternatives like glass and aluminum remains niche, mostly used for premium confectionery products due to their higher cost and weight.

- For instance, Amcor developed ultra-thin high-barrier PP-based films with a thickness of 20 microns, now adopted by over 70 confectionery brands across Europe to enhance freshness retention and reduce packaging material usage.

By Packaging Type

Flexible packaging dominated the market, capturing more than 55% of the share in 2024. Bags & Pouches emerged as the leading sub-segment within this category, driven by their convenience, lightweight design, and suitability for on-the-go consumption. The demand for flexible packaging is supported by advancements in materials that enhance product protection while maintaining visual appeal. Rigid packaging, including boxes and cartons, remains significant in premium and gift-oriented confectionery segments, especially during festive seasons. However, the rising preference for cost-effective and sustainable formats continues to shift focus toward flexible packaging types.

- For instance, Constantia Flexibles introduced its EcoLam mono-material pouch, which reduced carbon emissions by 32 kilograms per 1,000 packs compared to conventional multilayer pouches and is now used by more than 25 global confectionery brands.

By Confectionery Type

Chocolates were the largest contributor to the confectionery packaging market, accounting for over 40% of the market share in 2024. The increasing global consumption of chocolates, particularly in Asia Pacific and Europe, and the continuous launch of seasonal and limited-edition products drive packaging innovation in this segment. Sugar confectionery and gums follow, supported by their broad consumer base, including children and young adults. Packaging for fruits & nuts is growing steadily, driven by the health-conscious trend, though it still represents a smaller share. Diverse packaging solutions are tailored to meet the product type’s shelf life, texture, and consumer appeal.

Market Overview

Rising Demand for Convenient and On-the-Go Packaging

The increasing preference for portable, single-serve confectionery products is significantly driving the demand for innovative packaging solutions. Urbanization, fast-paced lifestyles, and changing snacking habits have led consumers to opt for on-the-go products, which require lightweight, resealable, and protective packaging formats. Flexible packaging types such as pouches, wraps, and sachets are gaining traction due to their convenience and extended shelf life. Additionally, busy consumers value packaging that offers ease of use, portability, and portion control, propelling manufacturers to focus on compact and functional packaging innovations.

- For instance, Huhtamaki Oyj developed a line of on-the-go pouches with resealable zippers that improved consumer reseal rates by 84%, contributing to reduced food waste in over 100 million retail units annually.

Growth in Global Confectionery Consumption

The rising global consumption of chocolates, candies, and sugar confectionery directly boosts demand for effective and attractive packaging. Markets in Asia Pacific, particularly India and China, are witnessing robust growth in confectionery sales, supported by rising disposable incomes and expanding retail infrastructure. Seasonal demand spikes during festivals, holidays, and gifting occasions further stimulate the packaging industry. Brand competition and consumer preference for aesthetically appealing packaging drive investments in advanced designs, vibrant printing technologies, and customized packaging, fostering consistent growth across the market.

- For instance, Toppan Inc. installed high-definition gravure printing systems capable of 12-color outputs, which have been used in over 60 new SKUs launched by confectionery producers in Japan, increasing shelf visibility and brand recall.

Advancements in Sustainable Packaging Solutions

Sustainability has emerged as a critical growth driver in the confectionery packaging market. Increasing regulatory pressure, corporate sustainability goals, and environmentally conscious consumers are compelling manufacturers to adopt recyclable, biodegradable, and compostable materials. Paper-based and bio-plastic packaging are gaining prominence as brands strive to reduce their environmental footprint without compromising on functionality or aesthetics. These advancements not only support regulatory compliance but also enhance brand reputation, offering companies a competitive advantage in a market where eco-conscious choices are becoming integral to consumer buying behavior.

Key Trends & Opportunities

Technological Integration in Smart Packaging

Smart packaging technologies such as QR codes, NFC tags, and temperature-sensitive indicators are creating new engagement avenues in the confectionery sector. These solutions offer enhanced traceability, anti-counterfeiting features, and interactive consumer experiences. Brands are leveraging these technologies to convey product origin, nutritional information, and promotional content, thereby increasing transparency and customer trust. As digital engagement becomes a competitive differentiator, integrating smart features into packaging opens new opportunities for brand visibility and loyalty, especially among tech-savvy and health-conscious consumers.

- For instance, Printpack launched a digital traceability system using serialized QR codes, deployed across 120 million confectionery packs globally, enabling real-time authentication and generating over 2.8 million consumer interactions within one year.

Premium and Seasonal Packaging Innovations

The trend toward premiumization in confectionery is creating strong demand for high-quality, aesthetically appealing packaging, especially in gifting and festive segments. Customized boxes, limited-edition designs, and luxury materials are increasingly used to enhance the unboxing experience and elevate product perception. This trend is prominent in regions with high seasonal gifting culture, such as North America and Europe. As competition intensifies, brands are investing in creative packaging designs to differentiate their products, build emotional connections with consumers, and capture a larger share of the premium confectionery market.

- For instance, Smurfit Kappa produced over 15 million luxury rigid boxes with magnetic closures and foil stamping for confectionery brands in Europe during the 2023 holiday season, leading to a 47% increase in premium shelf-space allocations.

Key Challenges

Environmental Concerns and Plastic Waste Regulation

Stringent environmental regulations and the growing backlash against plastic usage present a major challenge for confectionery packaging manufacturers. While plastic offers cost-efficiency and durability, its non-biodegradable nature raises sustainability concerns. Governments worldwide are implementing policies to limit single-use plastics and promote recyclable alternatives, forcing companies to redesign packaging formats. Complying with these mandates while maintaining product safety, shelf life, and visual appeal creates technical and economic pressure, especially for small and mid-sized players with limited resources.

Volatility in Raw Material Prices

Fluctuations in the prices of key packaging materials such as plastic resins, paperboard, and aluminum can significantly impact production costs and profit margins. The confectionery packaging market is particularly sensitive to global supply chain disruptions, energy costs, and geopolitical tensions that affect material availability and pricing. This volatility can lead to frequent pricing revisions, reduced competitiveness, and operational inefficiencies for packaging suppliers and confectionery brands alike. Managing cost fluctuations without compromising on quality or sustainability remains a persistent industry challenge.

Balancing Aesthetic Appeal with Functional Performance

Confectionery packaging must strike a balance between visual appeal and functional requirements such as barrier protection, freshness retention, and durability. Meeting both demands simultaneously can be technologically complex and costly, especially when using sustainable materials that may not match plastic’s performance. Brands seeking to attract attention through vibrant graphics or unique shapes may face limitations in material choice or structural integrity. This challenge intensifies as consumers expect high-quality design, environmental responsibility, and product protection—all within a cost-effective solution.

Regional Analysis

North America

North America held a substantial share of the confectionery packaging market in 2024, accounting for approximately 28% of the global revenue. The region’s dominance is driven by high per capita consumption of confectionery, especially chocolates and sugar-based products. Consumers’ preference for convenient, portion-controlled packaging and premiumization trends has boosted demand for flexible and rigid packaging formats. The United States leads the regional market with strong retail infrastructure and product innovation. Additionally, the rising focus on sustainable packaging materials has encouraged manufacturers to adopt recyclable and biodegradable options, aligning with the region’s stringent environmental regulations and consumer preferences.

Europe

Europe accounted for around 26% of the global confectionery packaging market in 2024, driven by a strong confectionery culture, particularly in countries like Germany, the UK, and Switzerland. The region’s high demand for premium chocolates and seasonal confectionery has supported growth in rigid packaging, including decorative boxes and cartons. Sustainability remains a key focus, with increasing regulations on plastic use prompting the shift toward paper-based and recyclable materials. European consumers are also highly brand-conscious, encouraging visually appealing and innovative packaging. The region’s advanced manufacturing capabilities and strict compliance standards continue to attract investments in eco-friendly and functional packaging formats.

Asia Pacific

Asia Pacific emerged as the fastest-growing region in the confectionery packaging market, holding a market share of approximately 22% in 2024. Rapid urbanization, rising disposable incomes, and evolving consumer tastes have fueled demand for packaged confectionery in countries such as China, India, and Japan. Flexible packaging dominates the market, driven by cost efficiency and suitability for mass-market distribution. Moreover, local manufacturers are embracing modern retail trends and digital packaging technologies to capture young, urban consumers. The region’s vast population base and increasing penetration of convenience stores and e-commerce platforms offer strong growth potential for both local and global packaging providers.

Latin America

Latin America contributed to nearly 12% of the global confectionery packaging market share in 2024. Brazil and Mexico are the leading markets, supported by rising confectionery consumption and growing demand for affordable, visually appealing packaging. Economic recovery and increased urban consumption have led to greater adoption of flexible packaging solutions, especially pouches and sachets. Regional manufacturers are increasingly focusing on product differentiation through packaging design. Although sustainability awareness is still developing, interest in biodegradable materials is growing. The region presents opportunities for packaging innovations tailored to budget-conscious consumers and culturally specific confectionery preferences during festive occasions.

Middle East & Africa (MEA)

The Middle East & Africa region held around 7% of the global confectionery packaging market in 2024. The market is expanding steadily, supported by population growth, urbanization, and increased consumer exposure to international confectionery brands. Countries like South Africa, the UAE, and Saudi Arabia are witnessing rising demand for packaged confectionery, particularly among younger demographics. Flexible packaging leads the market due to its affordability and shelf appeal. However, infrastructure and supply chain limitations pose challenges to large-scale packaging innovation. Nonetheless, increasing investment in retail development and gradual adoption of sustainable practices are likely to support market growth in the coming years.

Market Segmentations:

By Material

- Plastic

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Others

- Paper

- Glass

- Aluminium

- Others

By Packaging Type

- Rigid

- Boxes & Cartons

- Trays

- Containers

- Jars

- Others

- Flexible

- Wraps

- Sachets

- Films

- Bags & Pouches

- Others

By Confectionery Type

- Chocolates

- Gums

- Candy

- Sugar Confectionery

- Fruits & Nuts

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the confectionery packaging market is characterized by the presence of both global packaging giants and regional players striving to enhance product differentiation, sustainability, and operational efficiency. Key players such as Amcor plc, Smurfit Kappa, Huhtamaki Oyj, and Constantia Flexibles dominate the market by offering a wide range of innovative and eco-friendly packaging solutions tailored to the evolving needs of confectionery manufacturers. These companies focus on strategic collaborations, acquisitions, and investments in sustainable technologies to gain a competitive edge. For instance, the shift toward recyclable and biodegradable materials has led to increased R&D investments across the board. Regional players like Rengo Co., Ltd, Stanpac Inc, and Novel Packaging are enhancing their market presence by offering cost-effective and customizable packaging formats, catering to localized tastes and seasonal demands. Market competition is further intensified by continuous innovation in flexible packaging, digital printing technologies, and smart packaging features that enhance consumer engagement and product shelf appeal.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor plc

- Smurfit Kappa

- Rengo Co., Ltd

- Coveris

- Huhtamaki Oyj

- Constantia Flexibles

- Printpack

- Stanpac Inc

- Toppan Inc.

- Novel Packaging

Recent Developments

- In October 2023, Adapa launched new PaperTwister(re) packaging for confectionery products. The new twist-wrap solutions offer an easy-release feature that helps deliver a seamless unwrapping experience for customers, replacing typically sticky packaging. The packaging solution has been designed to deliver the highest speeds of up to 2,300 pieces per minute.

- In March 2023, Melodea, an Israel-based supplier of sustainable coating products for consumer packaged goods, launched its latest packaging solution, VBseal. It provides resistance to water vapor, aromas, and oils and heat-sealing capabilities. The coating materials are designed to replace single-use plastic in fast food, fresh food, cereal and confectionery packaging.

- In March 2023, Parkside launched a new recyclable mono-polymer film. The new film possesses superior gas, light, oil, water and UV barrier performance to extend product shelf-life performance and decrease food waste. The products are perfect for various food applications, including soup, coffee, and confectionery.

- In February 2023, Mars Wrigley China launched the first package containing 100% rPET in the local chocolate brand. The 216g canister lid of CXM is made from 100% rPET. It demonstrates a new chapter in recycled content application for Mars Wrigley China’s package portfolio.

- In July 2024, Smurfit Kappa announced the acquisition of WestRock. Smurfit Westrock is now one of the largest packaging organizations.

- In June 2024, Saica Group and Mondelēz joined forces to introduce paper-based products, for multipacks-products, for chocolates, biscuits and confectionery markets. The product meets sustainability standards of the Confederation of European Paper (CEPI).

- In June 2024, Constantia Flexibles introduced EcoTwistPaper. It is a wax free twist wrap product made from paper and supports shift towards sustainable products and is a packaging solution for confectionery industry.

Market Concentration & Characteristics

The Confectionery Packaging Market exhibits moderate to high market concentration, with a mix of global leaders and regional players shaping the competitive environment. Large multinational companies such as Amcor plc, Smurfit Kappa, and Huhtamaki Oyj dominate the landscape through extensive product portfolios, advanced manufacturing capabilities, and strong global distribution networks. It features a high degree of product differentiation, driven by evolving consumer preferences, seasonal demand, and branding requirements. The market favors companies that can offer sustainable, cost-efficient, and visually appealing packaging formats. Innovation, especially in flexible and eco-friendly solutions, plays a critical role in maintaining competitiveness. Regional players contribute by offering localized designs and catering to niche preferences, often focusing on cost-sensitive markets. Entry barriers remain moderate due to capital investment requirements, compliance standards, and the need for strong supply chain integration. It demonstrates responsiveness to shifting regulatory frameworks and environmental policies, particularly in developed regions. Consumer demand for convenience, freshness, and sustainability continues to influence product development and packaging strategies.

Report Coverage

The research report offers an in-depth analysis based on Material, Packaging Type, Confectionery Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The confectionery packaging market will continue to grow steadily, driven by rising global consumption of chocolates, candies, and gums.

- Flexible packaging formats such as pouches and wraps will dominate due to their convenience, cost efficiency, and suitability for single-serve products.

- Demand for sustainable and recyclable packaging materials will increase as environmental regulations tighten and consumer awareness grows.

- Premium and seasonal packaging will gain traction, especially during holidays and festivals, boosting demand for innovative rigid formats.

- Smart packaging technologies like QR codes and interactive labels will enhance consumer engagement and brand transparency.

- Asia Pacific will emerge as a key growth region due to urbanization, expanding retail infrastructure, and increasing disposable income.

- Manufacturers will invest more in lightweight, durable, and tamper-evident packaging to improve shelf life and product safety.

- Personalization and customization in packaging design will grow, especially in premium and gifting confectionery segments.

- E-commerce growth will fuel demand for protective and visually appealing packaging suitable for direct-to-consumer delivery.

- Companies will focus on automation and digital printing technologies to enhance production efficiency and reduce lead times.