Market Overview:

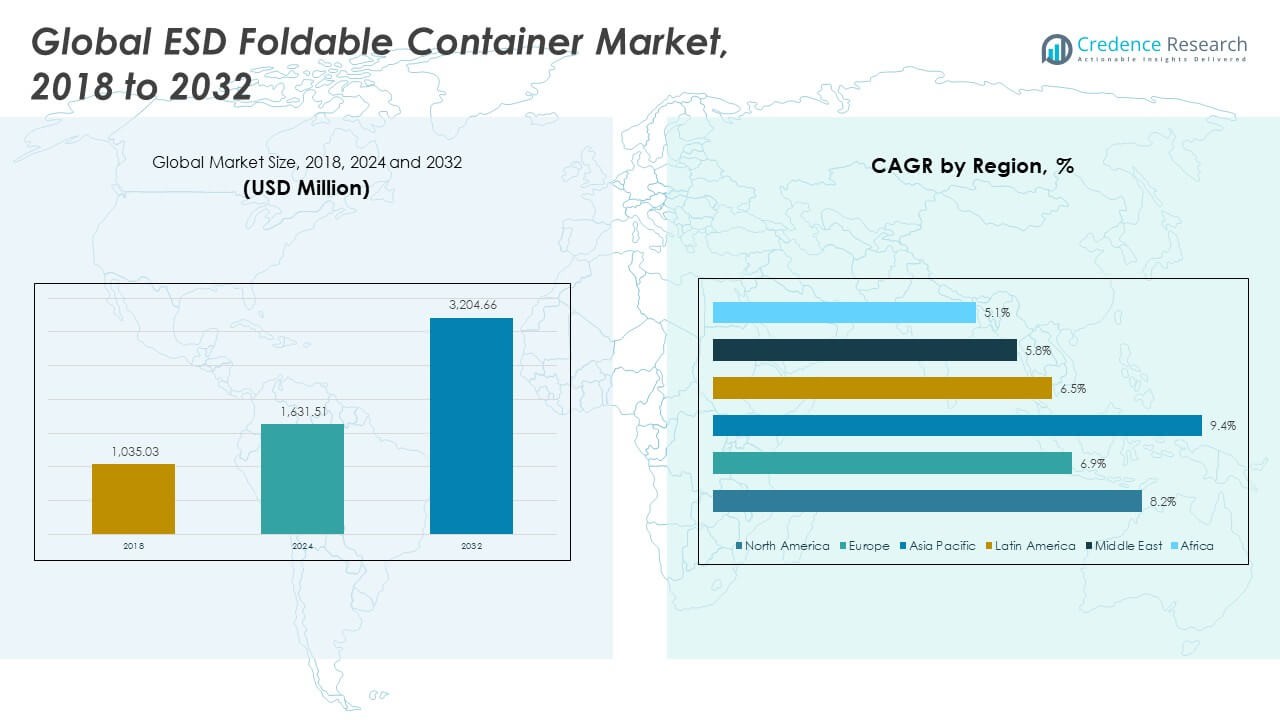

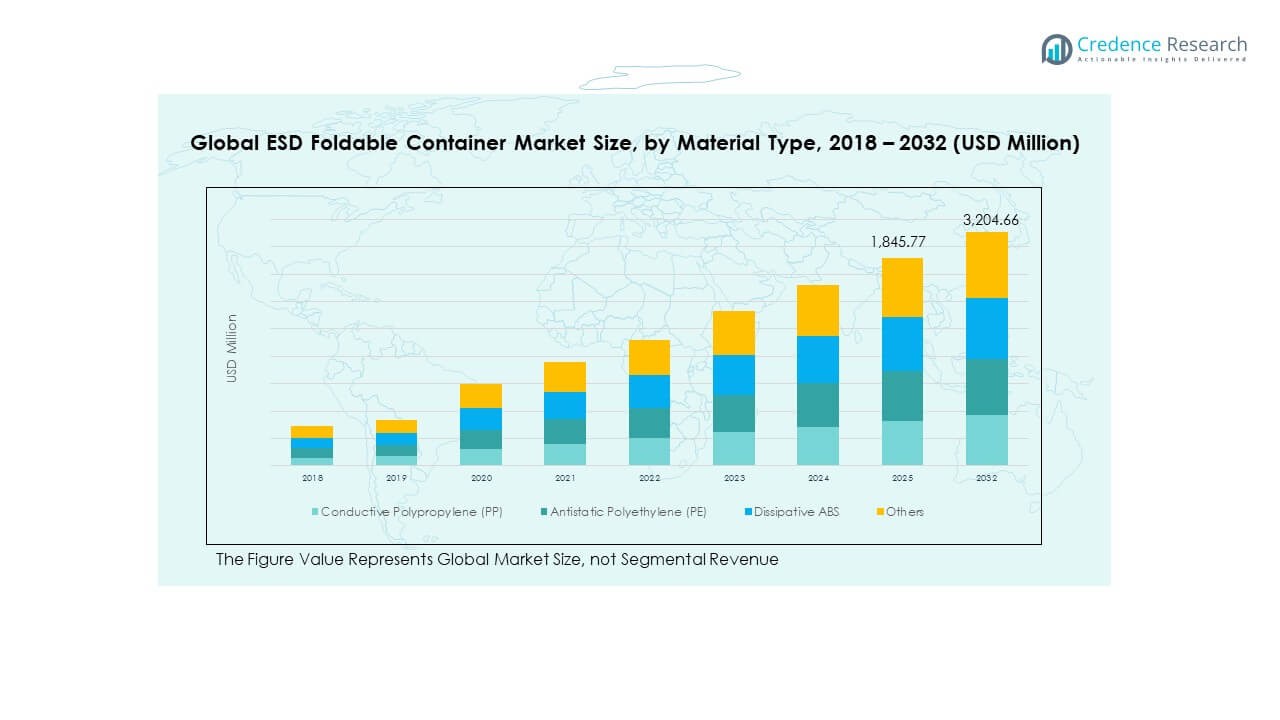

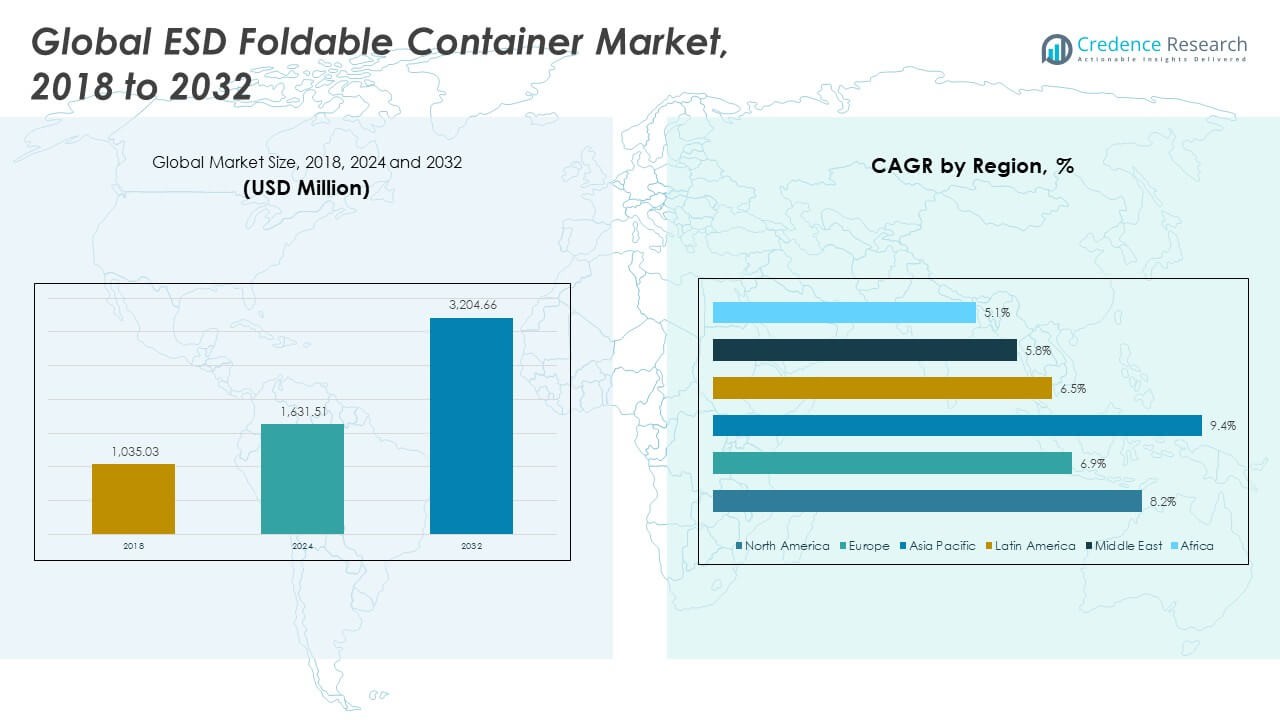

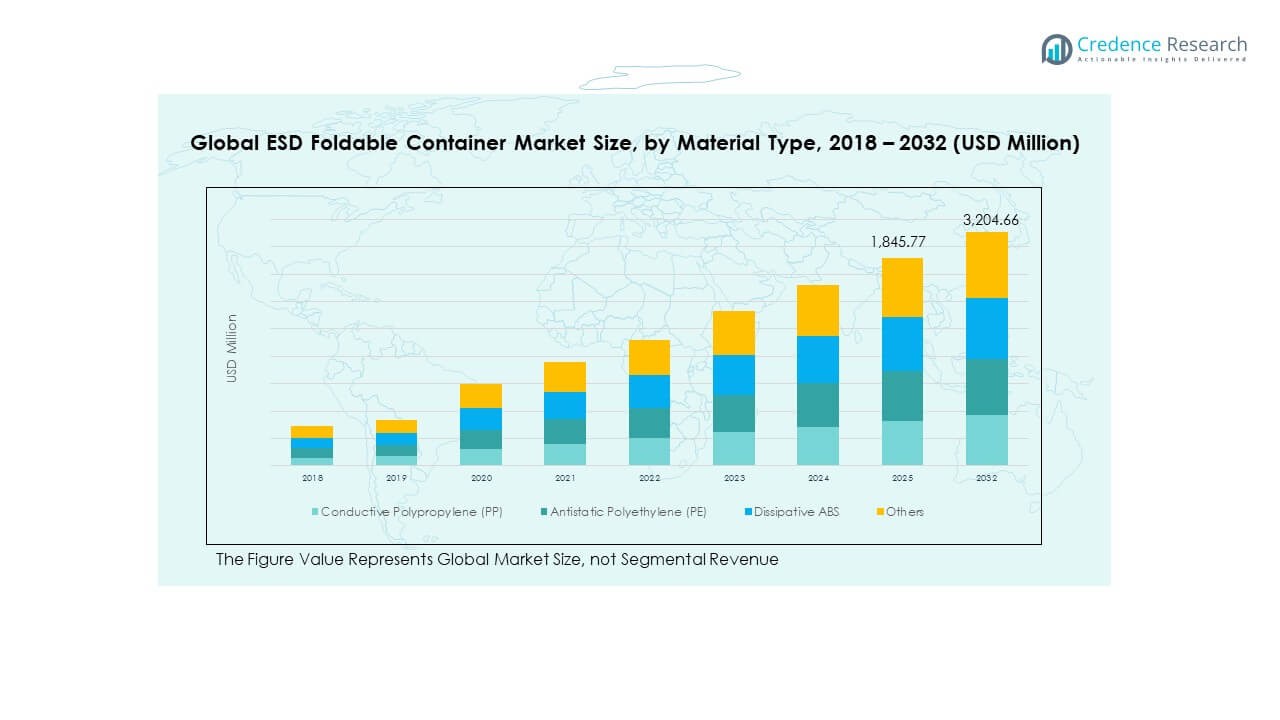

The Global ESD Foldable Container Market size was valued at USD 1,035.03 million in 2018 to USD 1,631.51 million in 2024 and is anticipated to reach USD 3,204.66 million by 2032, at a CAGR of 8.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ESD Foldable Container Market Size 2024 |

USD 1,631.51 Million |

| ESD Foldable Container Market, CAGR |

8.20% |

| ESD Foldable Container Market Size 2032 |

USD 3,204.66 Million |

The Global ESD Foldable Container Market is driven by growing demand for safe and efficient handling of electronic components across manufacturing, logistics, and automotive sectors. The increasing adoption of electrostatic discharge (ESD) protection in storage and transport solutions helps reduce material damage and enhance operational efficiency. Rising awareness about sustainable packaging and cost savings through reusable containers also supports market expansion among end users.

Regionally, Asia-Pacific leads due to strong electronics manufacturing in China, Japan, and South Korea. North America and Europe follow, driven by established semiconductor industries and strict safety standards in material handling. Emerging markets in Latin America and Southeast Asia are witnessing rapid adoption of ESD-safe storage solutions as industrialization and automation accelerate across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global ESD Foldable Container Market size was valued at USD 1,035.03 million in 2018, reached USD 1,631.51 million in 2024, and is projected to reach USD 3,204.66 million by 2032, expanding at a CAGR of 8.20% during the forecast period.

- Asia Pacific (36%), North America (34%), and Europe (18%) collectively dominate the market, driven by strong electronics manufacturing, technological innovation, and regulatory support for safe material handling.

- Asia Pacific is the fastest-growing region, propelled by industrial expansion, increasing semiconductor production, and government incentives for sustainable logistics and ESD-safe packaging adoption.

- Conductive Polypropylene (PP) accounts for nearly 45% of the market share due to its durability, conductivity, and suitability for automotive and electronics applications.

- Antistatic Polyethylene (PE) and Dissipative ABS collectively hold about 40% share, reflecting their expanding role in component storage and cost-effective ESD protection solutions.

Market Drivers:

Rising Adoption of ESD Protection in Electronics and Automotive Industries

The Global ESD Foldable Container Market benefits from increasing demand for ESD-safe handling systems in electronic and automotive manufacturing. Companies seek packaging solutions that prevent static discharge, which can damage sensitive components. These containers offer protection during transportation, storage, and assembly line operations. Growth in electric vehicles and semiconductor devices amplifies the need for reliable ESD packaging. Manufacturers are shifting toward foldable containers to enhance efficiency and storage optimization. Reusable designs reduce material waste and support lean production processes. Industry players focus on design innovations for improved durability and safety. This trend strengthens market penetration across diverse sectors.

- For instance, Sanko Co., Ltd. has established a proven portfolio of foldable polypropylene containers for automotive supply chains, known for supporting Toyota and Denso with product lines like the P41B model, which offer robust surface resistivity and significant space efficiency for reusable logistic flows.

Growing Focus on Sustainable and Cost-Efficient Packaging Solutions

Organizations are embracing foldable ESD containers for their eco-friendly and reusable features. They reduce dependency on single-use plastics and lower long-term packaging costs. Environmental regulations promote the use of recyclable materials in industrial packaging. The market grows as firms prioritize sustainable logistics practices. ESD foldable containers combine protection with cost savings through reduced freight space. Their collapsible design minimizes storage footprint when not in use. Businesses recognize the operational benefits of reduced waste disposal expenses. These advantages increase adoption across high-volume production facilities.

- For instance, Schoeller Allibert launched its EuroClick crate series in 2025, made with ultra-versatile, recyclable polypropylene, aligning with plastic waste reduction initiatives and displaying container design tested to last for hundreds of logistic cycles while supporting major automotive clients.

Expanding Manufacturing and Logistics Infrastructure Across Emerging Economies

Rapid industrialization in Asia-Pacific, Latin America, and Eastern Europe creates strong demand for ESD-safe storage systems. Expanding electronics and automotive manufacturing hubs drive adoption in these regions. Governments invest heavily in industrial automation and smart manufacturing initiatives. The Global ESD Foldable Container Market benefits from supportive infrastructure and rising export volumes. Firms seek scalable, durable, and lightweight packaging for efficient logistics. The rise of contract manufacturing encourages standardized ESD packaging across supply chains. Local suppliers are enhancing production capacity to meet global quality standards. Increased trade activities and warehouse expansion further boost product demand.

Technological Innovations Enhancing Material Strength and Static Control Efficiency

Advances in material science lead to improved ESD resistance and mechanical performance. Modern containers integrate conductive polymers and anti-static coatings for greater protection. These innovations extend product lifespan and reduce maintenance requirements. Automated testing ensures compliance with international safety regulations. The Global ESD Foldable Container Market experiences product diversification across weight capacities and sizes. Companies introduce designs compatible with robotic handling systems. Enhanced durability supports repeated use under harsh conditions. Continuous R&D investments strengthen competitiveness and operational reliability.

Market Trends:

Integration of Smart Tracking and Monitoring Technologies in ESD Containers

Manufacturers integrate IoT sensors and RFID tags within foldable ESD containers to monitor asset movement. This digital integration enables real-time tracking, reducing losses and improving logistics transparency. The Global ESD Foldable Container Market is shifting toward intelligent packaging systems that offer data visibility. Companies use analytics to optimize material handling and reduce downtime. Smart systems detect environmental factors such as humidity and charge buildup. These insights support predictive maintenance in supply chains. Businesses gain higher operational efficiency through connected container networks. Adoption of traceable ESD containers continues to rise in automated warehouses.

Increased Customization Based on Industry-Specific Needs

Industries demand ESD containers tailored to their unique workflows and product dimensions. Manufacturers offer custom inserts, surface resistivity options, and size variations. The Global ESD Foldable Container Market witnesses a surge in bespoke designs that ensure precise component protection. Automotive, aerospace, and semiconductor sectors favor specialized designs that enhance handling safety. Modular construction allows flexibility in assembly and cleaning. End users value adaptability to automated systems and conveyors. Customization drives differentiation among manufacturers, improving customer retention. This trend supports long-term partnerships and integrated packaging solutions.

- For instance, manufacturers like Sanko and Schoeller Allibert provide custom-sized foldable containers—Sanko’s P51B offers modularity for automotive parts, while Schoeller Allibert’s EuroClick delivers adjustable heights optimized for sector-specific requirements in component handling.

Shift Toward Lightweight and High-Durability Composite Materials

The market is moving toward lightweight yet durable materials that balance strength and efficiency. Composite polymers and reinforced plastics are replacing traditional materials. The Global ESD Foldable Container Market benefits from reduced logistics costs and improved ergonomics. Lighter containers enhance worker safety and speed up warehouse operations. Improved thermal stability ensures component safety in fluctuating environments. Suppliers focus on material innovations that offer high conductivity and low environmental impact. Long-lasting materials extend container lifespan, reducing total ownership costs. This shift promotes sustainability and design evolution across industries.

Expansion of Circular Economy and Reuse-Oriented Logistics Models

Businesses are adopting reusable container systems to align with circular economy goals. Manufacturers design ESD foldable containers for multiple life cycles and easy recyclability. The Global ESD Foldable Container Market aligns with industry efforts to minimize carbon footprints. Companies track container lifespans to optimize reuse patterns. Recycling initiatives strengthen partnerships between packaging suppliers and logistics firms. Reuse-based models reduce the environmental burden of packaging waste. This approach enhances corporate sustainability image and cost efficiency. The trend supports long-term environmental compliance across global operations.

Market Challenges Analysis:

High Initial Investment and Complex Handling Requirements

The Global ESD Foldable Container Market faces challenges due to high setup and procurement costs. Initial investments in conductive materials and testing systems deter smaller manufacturers. Specialized storage and cleaning processes increase operational complexity. Companies require trained personnel to maintain ESD integrity. Inconsistent handling practices may reduce effectiveness over time. Small enterprises often struggle to balance quality with affordability. Market adoption slows in cost-sensitive sectors due to capital constraints. Despite benefits, economic feasibility remains a major barrier for widespread implementation.

Limited Standardization and Fluctuating Raw Material Costs

Lack of uniform global standards for ESD protection complicates cross-border supply operations. Variations in testing and certification lead to product inconsistency. The Global ESD Foldable Container Market faces supply chain disruptions due to fluctuating polymer and conductive additive prices. Raw material volatility impacts production cost planning. Dependence on petrochemical-derived components raises environmental concerns. Manufacturers must invest in quality control to maintain compliance. Regulatory differences between regions affect import and export operations. This inconsistency limits scalability and global uniformity for manufacturers.

Market Opportunities:

Rising Adoption of Automation and Smart Warehousing Solutions

Growth in automated warehouses and Industry 4.0 ecosystems creates new opportunities for ESD containers. The Global ESD Foldable Container Market is well-positioned to supply smart-compatible packaging. Robotic systems require standardized, modular, and lightweight designs. Integration with automated handling improves speed and accuracy in logistics operations. Firms are exploring ESD-safe designs compatible with conveyor and AGV systems. Increasing investment in digital logistics accelerates this adoption. Companies offering smart-ready packaging gain a competitive edge.

Expansion in Emerging Economies and Focus on Sustainable Production

Expanding industrial zones in Asia-Pacific, Africa, and Latin America create fresh growth potential. Governments support green manufacturing initiatives and sustainable packaging solutions. The Global ESD Foldable Container Market can leverage demand for recyclable, durable, and low-maintenance designs. Firms focusing on eco-friendly production and local sourcing benefit from regulatory incentives. Collaborations with regional manufacturers improve accessibility and reduce transport costs. Rising export activities strengthen long-term growth prospects. Sustainability-focused product innovations will attract global buyers seeking compliant packaging systems.

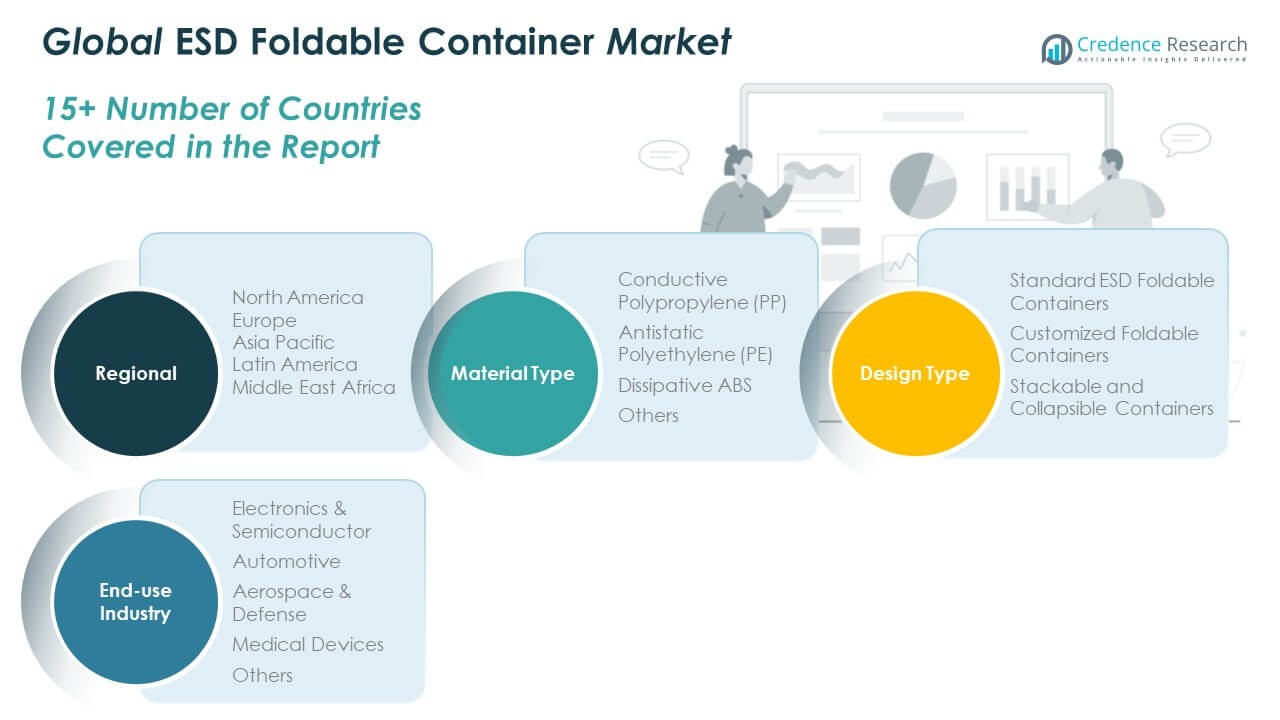

Market Segmentation Analysis:

By Material Type

The Global ESD Foldable Container Market is categorized by material type into Conductive Polypropylene (PP), Antistatic Polyethylene (PE), Dissipative ABS, and Others. Conductive Polypropylene (PP) dominates due to its high strength, lightweight nature, and superior conductivity. Antistatic Polyethylene (PE) is gaining traction in cost-sensitive industries requiring moderate static control. Dissipative ABS offers excellent rigidity and dimensional stability for handling sensitive electronic components. Other materials include hybrid composites designed for specialized industrial uses. Manufacturers prefer recyclable materials to meet sustainability targets and regulatory requirements.

- For instance, RTP Company manufactures conductive PP and ABS-based ESD containers for electronics packaging, achieving surface resistivity levels from less than 104104 to 10111011 Ω/sq and compliance with international ATEX and RoHS regulations, which major firms like Conductive Containers Inc. leverage for standardized ESD-safe product lines.

By Design Type

Based on design type, the market is segmented into Standard ESD Foldable Containers, Customized Foldable Containers, and Stackable and Collapsible Containers. Standard containers hold a major share due to their cost-effectiveness and suitability for mass applications. Customized containers are increasing in demand where component-specific protection is critical, particularly in semiconductor and defense sectors. Stackable and collapsible containers offer operational efficiency, space savings, and ease of transport. Their growing use in logistics and automated warehouses enhances scalability and cost reduction for end users.

- For instance, ORBIS Corporation added the StakPak Plus™ container line which features stackable modular collars to accommodate uniquely shaped automotive components and is designed for millions of return logistics cycles with Bosch and General Motors, while providing 100% recyclability at end of service life.

By End-use Industry

The market by end-use industry includes Electronics & Semiconductor, Automotive, Aerospace & Defense, Medical Devices, and Others. The electronics and semiconductor segment leads due to rising ESD safety standards and high production volumes. Automotive follows, driven by demand for safe handling of electronic assemblies and sensors. Aerospace and medical sectors adopt ESD containers for precision equipment protection. Growing industrial automation and component miniaturization across sectors continue to propel segmental demand globally.

Segmentation:

- By Material Type

- Conductive Polypropylene (PP)

- Antistatic Polyethylene (PE)

- Dissipative ABS

- Others

- By Design Type

- Standard ESD Foldable Containers

- Customized Foldable Containers

- Stackable and Collapsible Containers

- By End-use Industry

- Electronics & Semiconductor

- Automotive

- Aerospace & Defense

- Medical Devices

- Others

- By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global ESD Foldable Container Market size was valued at USD 458.99 million in 2018 to USD 716.11 million in 2024 and is anticipated to reach USD 1,410.44 million by 2032, at a CAGR of 8.2% during the forecast period. North America holds around 34% share of the overall market, driven by robust industrial automation and advanced manufacturing systems. The United States leads the region due to strong electronics, semiconductor, and automotive industries. High awareness of ESD protection standards and strict safety regulations support steady demand. It benefits from established logistics networks and early adoption of smart packaging solutions. Key market players are expanding through strategic partnerships and localized manufacturing. The region’s focus on sustainability and reusable packaging further strengthens long-term growth prospects. Canada and Mexico are also contributing through growing adoption in export-driven industries.

Europe

The Europe Global ESD Foldable Container Market size was valued at USD 191.72 million in 2018 to USD 285.53 million in 2024 and is anticipated to reach USD 509.56 million by 2032, at a CAGR of 6.9% during the forecast period. Europe accounts for about 18% of the total market share, supported by stringent environmental policies and advanced production standards. Germany, France, and the UK are key contributors due to their strong automotive and aerospace bases. It benefits from innovation-driven packaging and adoption of recyclable conductive materials. Growing use of automation in logistics and manufacturing strengthens market penetration. European Union directives encouraging sustainable industrial practices influence product adoption. Regional manufacturers emphasize durability, customization, and ESD compliance. Emerging countries in Eastern Europe are adopting ESD containers to support export manufacturing growth.

Asia Pacific

The Asia Pacific Global ESD Foldable Container Market size was valued at USD 292.46 million in 2018 to USD 487.32 million in 2024 and is anticipated to reach USD 1,045.79 million by 2032, at a CAGR of 9.4% during the forecast period. Asia Pacific leads the market with around 36% share, supported by rapid industrialization and large-scale electronics production in China, Japan, South Korea, and India. The region’s dominance is attributed to expanding semiconductor fabrication and automotive assembly plants. It benefits from cost-effective manufacturing, export-focused industries, and government incentives promoting smart logistics. Rising awareness about ESD protection in electronic component handling drives widespread adoption. Regional suppliers are investing in advanced materials and modular container designs. Increasing warehousing automation supports market expansion in developing economies. Continuous innovation and industrial growth maintain Asia Pacific’s leadership position.

Latin America

The Latin America Global ESD Foldable Container Market size was valued at USD 47.85 million in 2018 to USD 74.47 million in 2024 and is anticipated to reach USD 129.11 million by 2032, at a CAGR of 6.5% during the forecast period. Latin America contributes nearly 6% of the global market, driven by growing manufacturing activity and logistics modernization. Brazil and Mexico are the leading adopters, supported by expanding automotive and electronics sectors. The market benefits from trade integration and gradual improvement in industrial infrastructure. It is gaining traction among multinational firms seeking reliable ESD-safe packaging for exports. Rising awareness of reusable containers supports demand growth in industrial hubs. Local manufacturers are emphasizing cost-effective materials to capture domestic market share. Sustainable initiatives in the region are encouraging reusable packaging solutions.

Middle East

The Middle East Global ESD Foldable Container Market size was valued at USD 28.30 million in 2018 to USD 40.69 million in 2024 and is anticipated to reach USD 67.10 million by 2032, at a CAGR of 5.8% during the forecast period. The region holds around 4% share of the global market, led by increasing industrial diversification and growth in logistics infrastructure. The United Arab Emirates, Saudi Arabia, and Turkey are key markets supporting adoption. It benefits from expanding electronics assembly and defense manufacturing sectors. Rising demand for safe storage and transport solutions drives product use. Regional companies are partnering with global packaging firms to enhance quality standards. Government investments in industrial parks and free zones encourage localized production. Growing focus on reducing material waste supports wider use of foldable ESD containers.

Africa

The Africa Global ESD Foldable Container Market size was valued at USD 15.70 million in 2018 to USD 27.40 million in 2024 and is anticipated to reach USD 42.66 million by 2032, at a CAGR of 5.1% during the forecast period. Africa contributes about 2% share of the global market, reflecting its early-stage industrial development. South Africa leads regional growth, supported by expanding automotive and electronics distribution networks. It benefits from increased investment in logistics and warehousing facilities. The region’s gradual adoption of ESD-safe solutions is driven by import activities and industrial safety awareness. Local manufacturers are exploring cost-efficient production using conductive polymers. Rising interest in sustainable and reusable packaging fosters long-term demand. Strengthening trade relations with Asia and Europe further encourages market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Stakrak Ltd.

- Conductive Containers, Inc.

- AUER Packaging GmbH

- ELCOM (UK) Ltd.

- SSI SCHAEFER

- Protektive Pak

- Yufa Polymer Products Co. Ltd.

- Shanghai Leenol Industrial Co. Ltd.

- Kinetic Polymers

- Elmes Packaging Inc.

Competitive Analysis:

The Global ESD Foldable Container Market is highly competitive, featuring both global and regional manufacturers focusing on innovation and sustainability. Key players emphasize lightweight, durable, and recyclable materials to enhance ESD protection and operational efficiency. It is witnessing steady consolidation through strategic collaborations and capacity expansions. Companies are investing in automated production systems and smart packaging technologies to improve precision and traceability. Continuous R&D efforts aim to enhance performance under varied industrial conditions. Competition is shaped by pricing strategies, product quality, and global distribution networks. The growing emphasis on eco-friendly packaging and compliance with ESD standards defines market differentiation among leading brands.

Recent Developments:

- In March 2023, Stakrak Ltd. was acquired by Slingsby, with Slingsby purchasing certain assets of Stakrak Limited for £110,000. This acquisition was aimed at expanding Slingsby’s portfolio in workplace equipment, especially mesh cages, and strengthening its competitive market position in the UK.

- In November 2023, Conductive Containers, Inc. completed the acquisition of Crestline Plastics, a manufacturer of thermoformed packaging for optical and precision electronics. The deal, facilitated in part by Great River Capital Partners, saw all Crestline employees joining the CCI team and Crestline continuing to operate as a division under CCI Static Holdings LLC.

Report Coverage:

The research report offers an in-depth analysis based on material type, design type, and end-use industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for reusable and eco-friendly ESD containers will drive global adoption.

- Integration of smart sensors and RFID systems will enhance asset tracking capabilities.

- Growing industrial automation will increase the need for durable and modular containers.

- Expansion in semiconductor and EV manufacturing will create high-value opportunities.

- Material innovation using conductive polymers will improve product performance.

- Asia Pacific will continue leading due to its strong manufacturing and export base.

- Strategic alliances will strengthen distribution networks and regional presence.

- Sustainability goals will push producers toward circular packaging solutions.

- Custom-designed containers will gain preference in aerospace and medical sectors.

- Continuous technological development will ensure better compliance with ESD safety standards.