Market Overview:

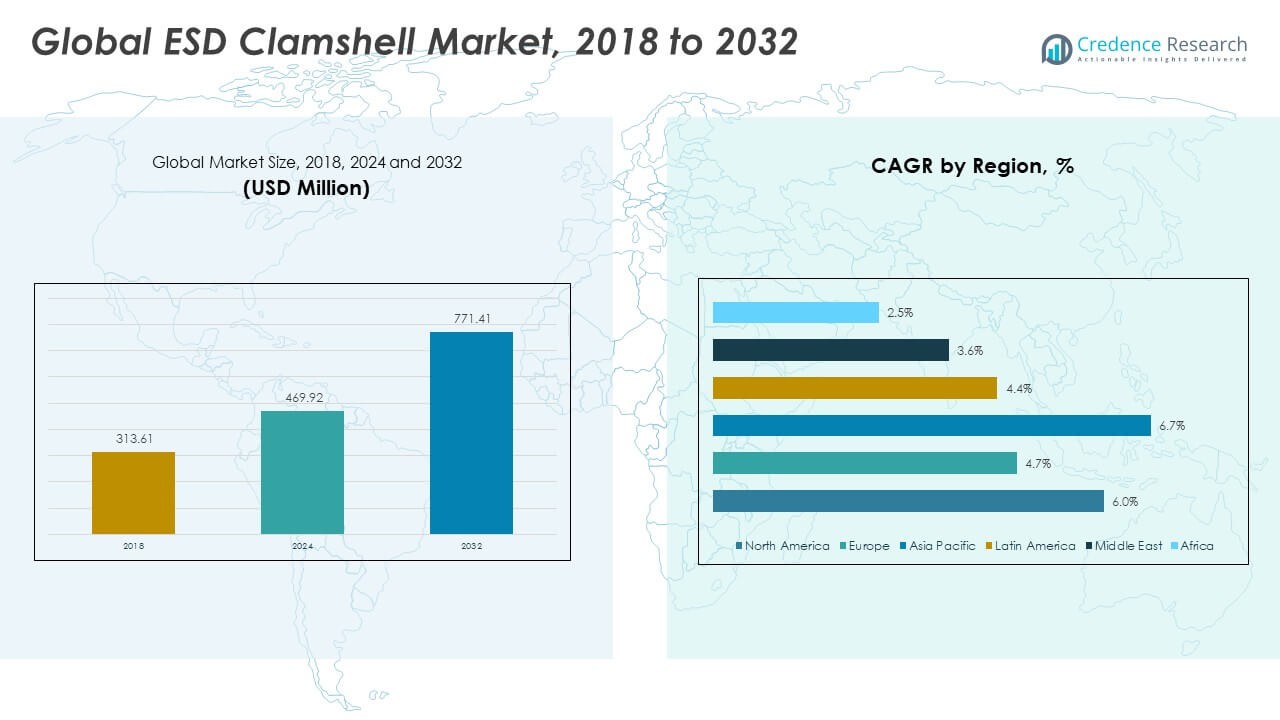

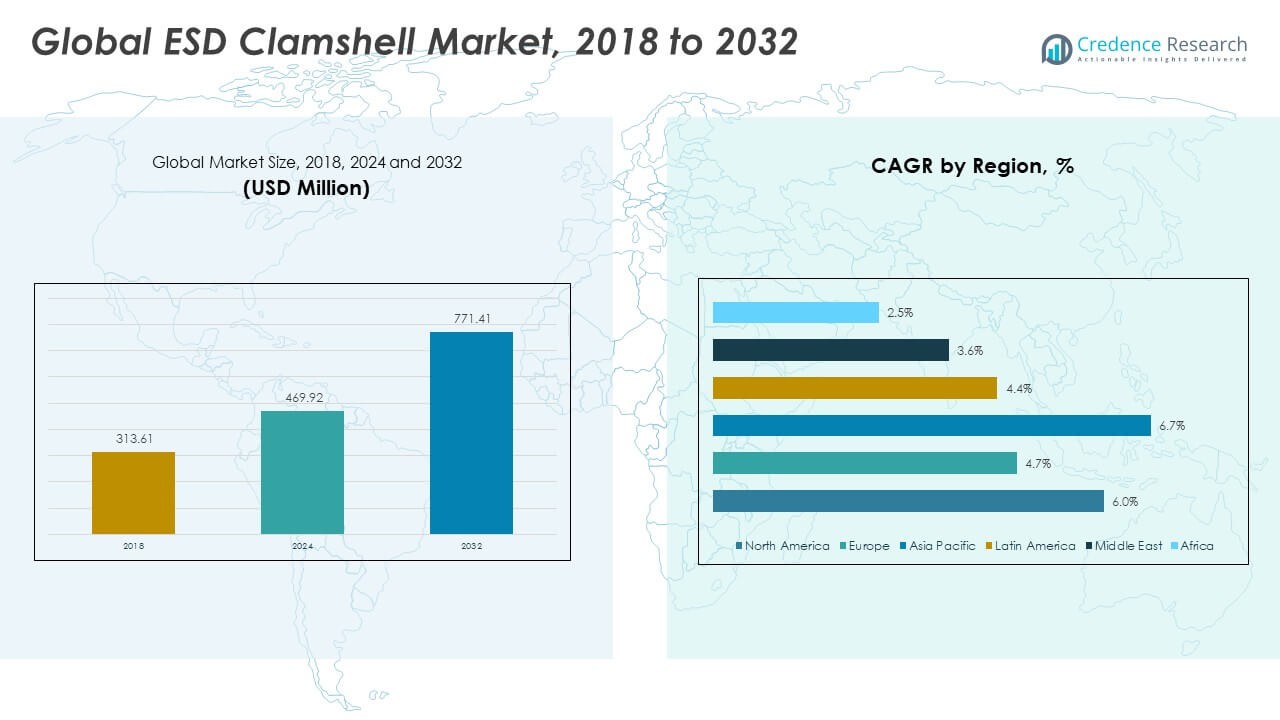

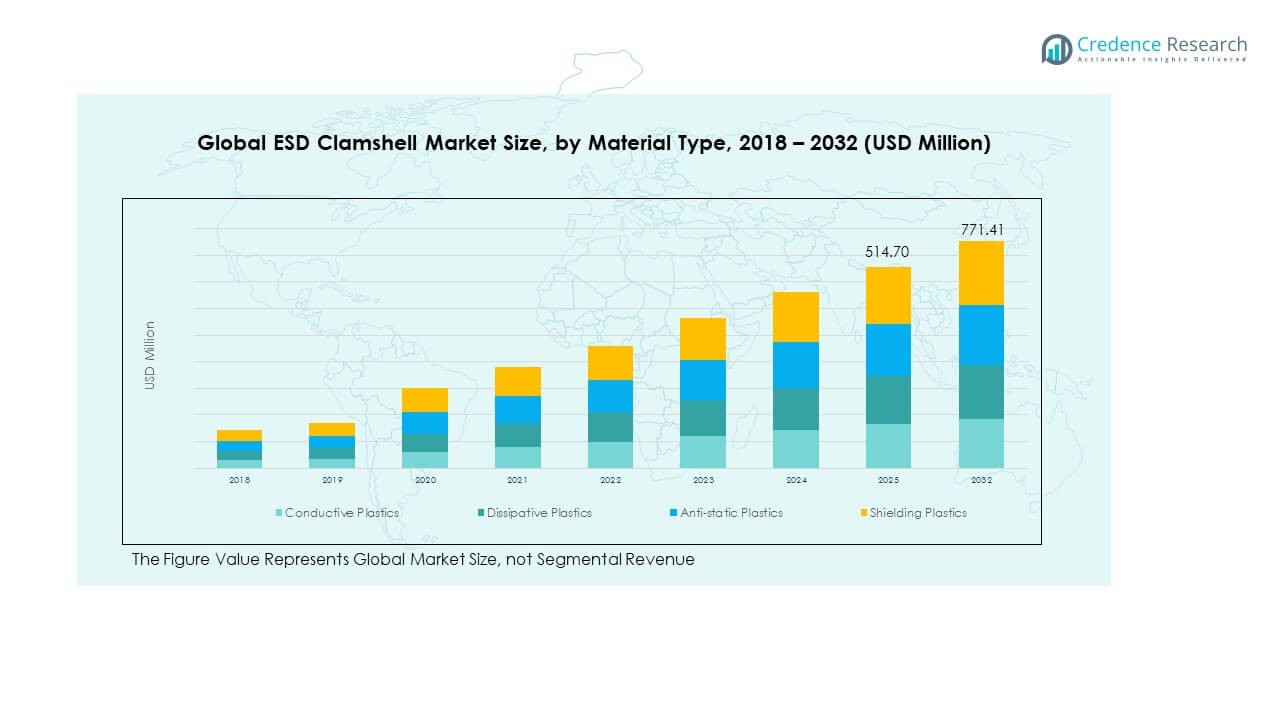

The Global ESD Clamshell Market size was valued at USD 313.61 million in 2018 to USD 469.92 million in 2024 and is anticipated to reach USD 771.41 million by 2032, at a CAGR of 5.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ESD Clamshell Market Size 2024 |

USD 469.92 Million |

| ESD Clamshell Market, CAGR |

5.95% |

| ESD Clamshell Market Size 2032 |

USD 771.41 Million |

The market growth is driven by rising demand for static protection in electronic packaging, expanding semiconductor and consumer electronics production, and growing adoption of ESD-safe materials across logistics and handling operations. Increasing automation in manufacturing and higher awareness of electrostatic discharge risks are also supporting the adoption of clamshell packaging in industrial and electronic sectors. Companies are developing cost-efficient, recyclable ESD clamshells to meet sustainability and compliance standards.

Regionally, Asia-Pacific dominates the market due to strong electronics manufacturing bases in China, Japan, and South Korea. North America follows, supported by robust semiconductor research and packaging innovation. Europe demonstrates stable growth, driven by strict quality standards and the expansion of advanced manufacturing facilities. Emerging regions such as Latin America and the Middle East are gaining traction with rising electronics assembly and distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global ESD Clamshell Market was valued at USD 313.61 million in 2018, increased to USD 469.92 million in 2024, and is projected to reach USD 771.41 million by 2032, growing at a CAGR of 5.95% during the forecast period.

- Asia Pacific holds the largest share of 40%, driven by robust semiconductor and electronics manufacturing in China, Japan, and South Korea. North America follows with 24%, supported by strong technological infrastructure and R&D capabilities, while Europe contributes 18%, driven by its advanced automotive and aerospace sectors.

- The Asia Pacific region is the fastest-growing market, supported by rapid industrialization, expansion of electronic exports, and increasing adoption of ESD-safe packaging solutions across consumer electronics and cleanroom environments.

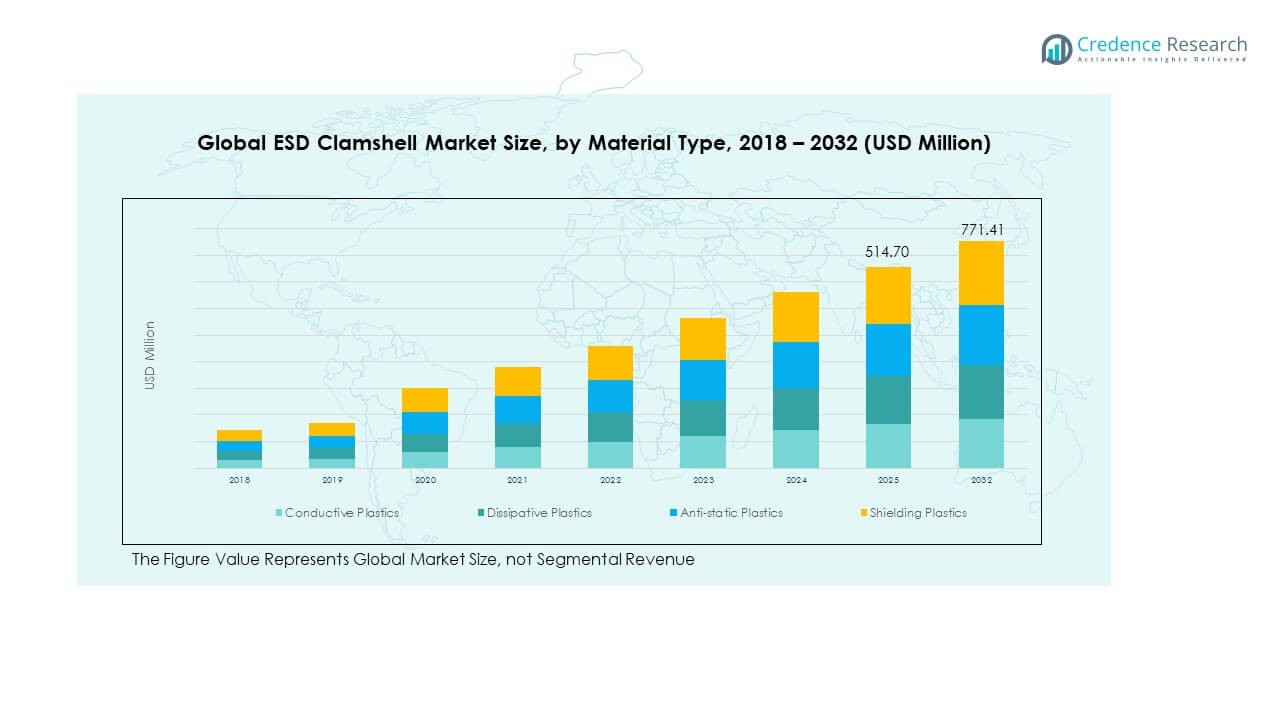

- By material type, Conductive Plastics dominate the market, accounting for around 45% share, due to superior static control and widespread application in high-precision electronics packaging.

- Anti-static and Shielding Plastics collectively hold around 35% share, reflecting their rising adoption in semiconductor handling, transport protection, and aerospace applications.

Market Drivers:

Growing Demand for Electrostatic Discharge Protection Across Electronics Packaging

The Global ESD Clamshell Market is expanding due to the rising need for effective static control in electronics manufacturing and packaging. Companies across semiconductor, automotive, and consumer electronics industries rely on ESD-safe clamshells to prevent costly component damage. Increasing device miniaturization has made static protection more critical during transportation and assembly. Manufacturers are adopting high-performance polymer materials that enhance anti-static properties and durability. It supports efficient handling and product safety across extended supply chains. The push toward automation and precision handling further drives adoption. It ensures both safety and compliance with international ESD standards, strengthening reliability across production networks.

- For instance, Texas Instruments has introduced specialized ESD protection devices for HDMI and DisplayPort applications, optimizing board layout and boosting reliability for PC and consumer electronics, with devices like the TPD8S009 available for system-level ESD control.

Sustainability Initiatives Driving Use of Recyclable and Reusable ESD Packaging

Rising environmental awareness and regulatory focus are encouraging manufacturers to use eco-friendly ESD clamshells. Companies are transitioning to recyclable and reusable materials, reducing plastic waste from single-use packaging. The shift toward sustainable packaging supports circular economy goals in major electronics-producing nations. It also helps brands align with global sustainability frameworks and reduce operational costs over time. Advances in biodegradable ESD polymers are widening material choices for producers. Firms are investing in research to create lightweight yet durable clamshells. The demand for cost-efficient, green packaging continues to reshape procurement and production strategies across industries.

- For instance, Sealed Air Corporation committed its packaging portfolio to be 100% recyclable or reusable by 2025, with a goal of achieving 50% average recycled content and 60% post-consumer recycled content across its solutions.

Expansion of Semiconductor and Electronic Component Manufacturing Units Worldwide

The rapid growth in semiconductor and printed circuit board production across Asia-Pacific and North America fuels demand for protective packaging. ESD clamshells are essential in safeguarding sensitive chips and modules during transit and storage. Governments are promoting domestic chip manufacturing, leading to higher packaging material consumption. It benefits suppliers with scalable production capabilities and established distribution networks. The rise of IoT and 5G technologies further strengthens packaging requirements for miniaturized components. Firms are adopting specialized clamshells designed for precision parts and custom-fit protection. Growing industrial automation and robotics also expand end-use applications of ESD-safe packaging solutions.

Growing Adoption in Automotive and Medical Electronics Applications

Automotive electronics and medical device industries are emerging as key users of ESD clamshells. Both sectors require contamination-free and static-safe environments for storing sensitive modules and instruments. Increased integration of electronic control systems in vehicles heightens packaging safety needs. Medical device makers use ESD clamshells to protect diagnostic sensors and monitoring devices. It offers shock resistance and traceability features critical for quality assurance. Regulatory compliance in both industries enhances demand for certified packaging solutions. This broadening application base supports long-term market stability and diversification of product lines for manufacturers.

Market Trends:

Integration of Smart and RFID-Enabled Packaging Solutions

The Global ESD Clamshell Market is witnessing the integration of smart technologies into packaging solutions. Manufacturers are embedding RFID tags and QR codes to improve traceability across supply chains. These features help monitor temperature, humidity, and static exposure in real time. Companies in electronics and defense industries are adopting data-enabled packaging for asset tracking and authentication. It enhances transparency in logistics and supports predictive maintenance strategies. The trend also supports compliance with evolving industry standards. Growing demand for connected packaging solutions fosters collaboration between packaging suppliers and IoT developers worldwide.

- For instance, Avery Dennison and Becton Dickinson co-developed RFID-enabled syringe authentication solutions, embedding digital identities for traceability through the entire lifecycle, as showcased in January 2025 at Pharmapack.

Rising Customization in Design and Material Composition

Clients now seek tailored ESD clamshell designs that fit specific product dimensions and protection levels. Manufacturers are focusing on modular and compartmentalized layouts for multi-component storage. The demand for ergonomic, tamper-proof, and stackable formats has surged. It enables space optimization and improved logistics handling for complex assembly lines. Material innovation, such as anti-static PET and conductive polypropylene, supports both performance and sustainability goals. Digital manufacturing tools like 3D modeling are enabling faster prototyping and design iterations. This growing emphasis on customization enhances product differentiation among ESD packaging providers globally.

- For instance, RTP Company launched its CCX Conductive Masterbatches in August 2019, using technologies like carbon nanotubes and stainless steel fiber to deliver high conductivity for ESD applications in multi-component storage, with precise compatibility for injection molding and modular layouts.

Automation in ESD Packaging Production and Handling

Automation plays a growing role in scaling ESD clamshell production and packaging operations. Robotic assembly lines are improving output consistency and minimizing human contact with sensitive components. It reduces manufacturing defects while increasing throughput efficiency. Automated sealing, inspection, and labeling systems enhance precision in packaging workflows. Major packaging firms are investing in AI-based process control for static testing. Integration of robotics also lowers operational costs and improves flexibility for small-batch production. The trend aligns with Industry 4.0 adoption and digital transformation efforts across manufacturing hubs.

Shift Toward Lightweight and High-Performance Conductive Materials

Material science advancements are shaping the evolution of ESD clamshells. Lightweight polymers with superior conductivity and heat resistance are replacing traditional plastics. It helps lower freight costs and carbon footprint across logistics. The use of carbon-filled and metalized compounds enhances static dissipation performance. The transition supports higher durability and strength while maintaining low surface resistance. Manufacturers are testing hybrid composites for balanced flexibility and environmental resilience. Continuous innovation in conductive materials ensures better compatibility with emerging electronic components. These improvements make next-generation clamshells adaptable for varied industrial applications.

Market Challenges Analysis:

High Manufacturing Costs and Limited Material Availability Impact Market Scalability

The Global ESD Clamshell Market faces cost pressures linked to specialized raw materials and processing requirements. Conductive and anti-static polymers often carry higher production expenses compared to standard plastics. Manufacturers struggle to maintain profit margins while ensuring compliance with quality and safety standards. Supply chain disruptions and limited access to advanced ESD additives create procurement challenges, especially for small-scale producers. It raises dependency on regional suppliers and import sources for consistent material quality. Developing economies find it difficult to adopt ESD-safe packaging due to higher setup and tooling costs. The need for precise molding and static testing equipment also limits scalability. Companies must balance between affordability, sustainability, and technical performance to remain competitive.

Lack of Standardization and Recycling Complexity Hinder Market Expansion

Differences in ESD compliance standards across regions complicate global trade and certification processes. Variations in testing methods and material classifications make it difficult for manufacturers to maintain uniform quality benchmarks. It restricts interoperability and increases approval time for product deployment across multiple geographies. The recyclability of ESD clamshells poses another challenge due to the mix of conductive fillers and polymer bases. Separation and reuse of such materials require specialized recycling systems not widely available in most markets. Companies also face difficulties in waste management compliance, especially within electronics-heavy industries. Regulatory gaps in developing countries slow down the adoption of proper ESD disposal frameworks. These challenges collectively limit the pace of innovation and market integration.

Market Opportunities:

Expanding Applications in Electric Vehicles, Semiconductor Packaging, and Cleanroom Environments

The Global ESD Clamshell Market presents opportunities through its rising integration across advanced industries. Electric vehicle components, such as battery management systems and power modules, require static-protective packaging. It creates a new demand channel for specialized clamshells designed for automotive-grade electronics. Semiconductor packaging growth in Asia and North America opens doors for localized suppliers with innovative anti-static solutions. The medical, aerospace, and pharmaceutical sectors also seek contamination-free packaging, expanding the product scope. Rapid cleanroom expansion across industrial facilities enhances long-term market potential. Emerging applications in defense electronics and renewable energy devices further strengthen the opportunity landscape for manufacturers.

Technological Innovation and Sustainable Material Development Driving Growth Prospects

Sustained investments in polymer engineering and material recycling technologies are creating growth pathways. It supports the development of lightweight, high-durability ESD clamshells with improved conductivity and environmental safety. Smart manufacturing solutions like digital twins and AI-assisted quality checks improve precision and reduce waste. The trend toward eco-friendly packaging aligns with global environmental goals, creating stronger brand positioning. Firms adopting renewable feedstock and low-carbon manufacturing gain competitive advantages. Partnerships between material suppliers and packaging producers encourage innovation in green composites. These advancements will help the market attract new investments and achieve sustainable, high-volume growth in the coming years.

Market Segmentation Analysis:

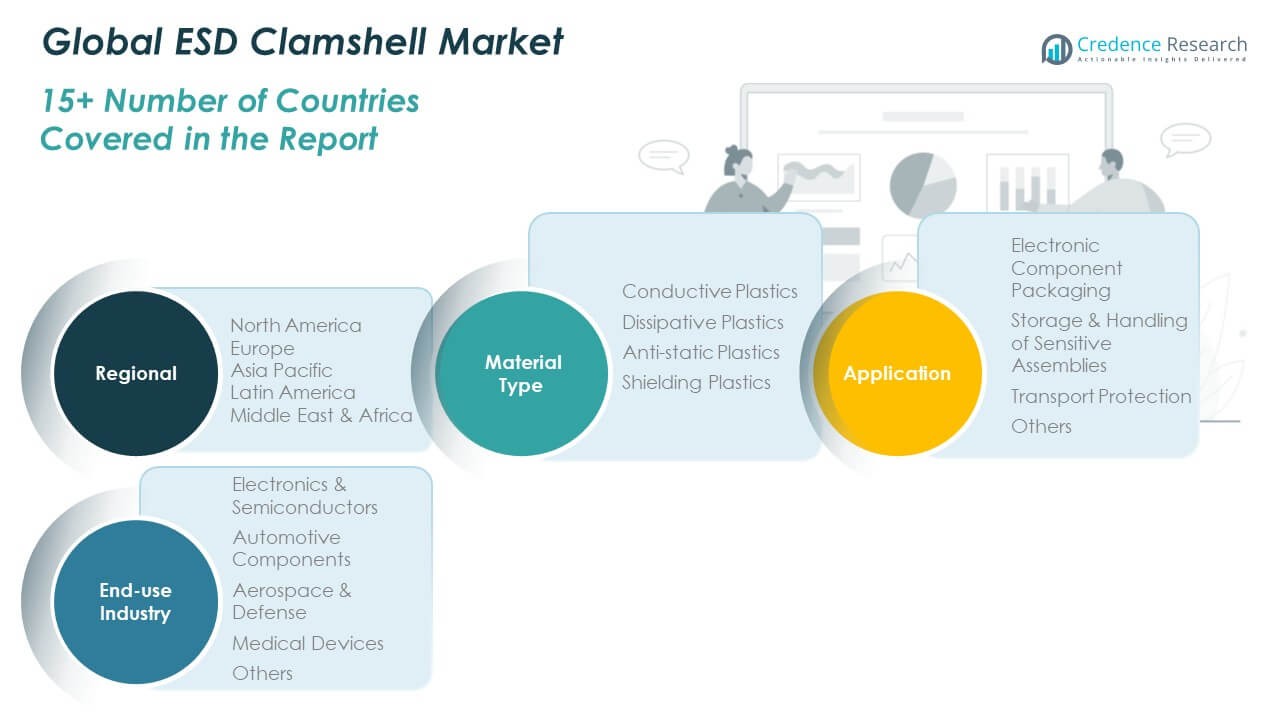

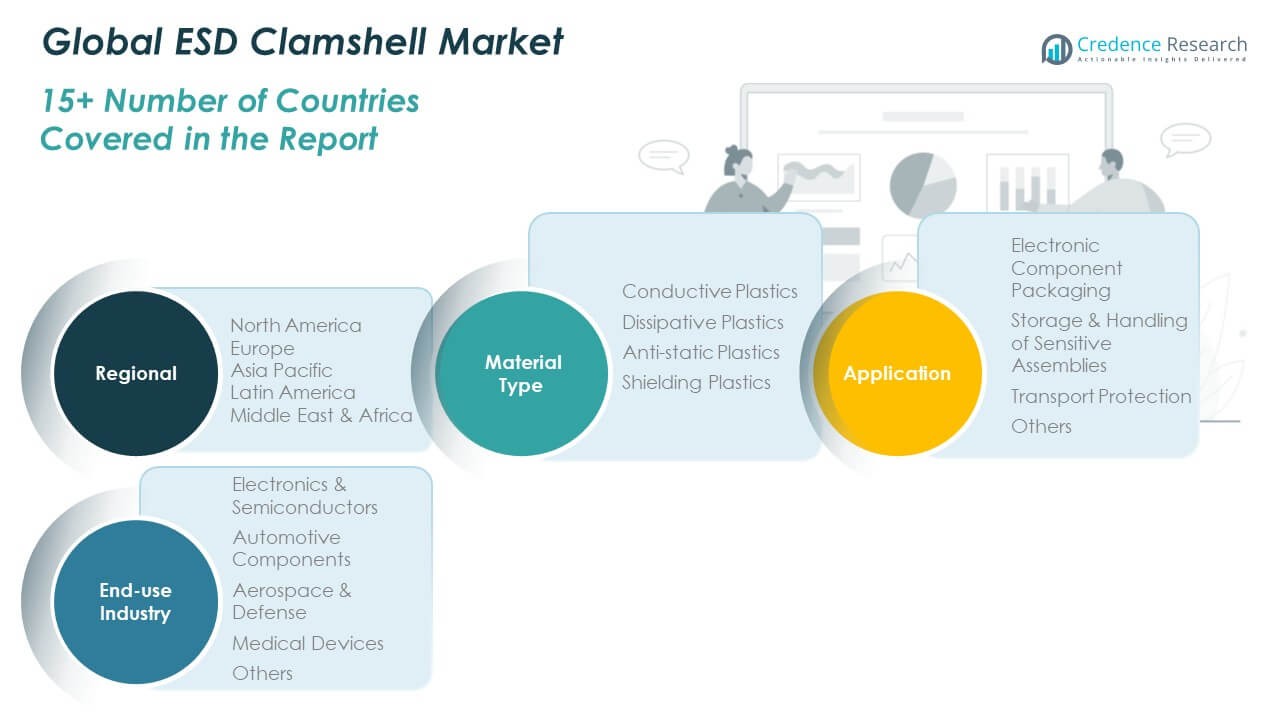

By Material Type

The Global ESD Clamshell Market is segmented into conductive plastics, dissipative plastics, anti-static plastics, and shielding plastics. Conductive plastics dominate due to their superior ability to control charge build-up and ensure stable resistance levels. Dissipative plastics are preferred for moderate protection and cost efficiency. Anti-static plastics find applications in temporary protection and short-term handling. Shielding plastics are gaining traction in environments with high static sensitivity, especially in semiconductor and aerospace sectors. Continuous material innovation supports the development of lightweight, recyclable, and durable ESD materials, strengthening product reliability and environmental compliance.

- For instance, RTP Company engineered carbon-based conductive thermoplastic compounds that provide immediate dissipation of static charges and support surface and bulk conductivity for molded electronics packaging parts, meeting strict ESD protection requirements and consistent performance in aerospace applications.

By Application

Key applications include electronic component packaging, storage and handling of sensitive assemblies, transport protection, and others. Electronic component packaging leads the segment due to expanding semiconductor production and miniaturized devices. Storage and handling solutions are critical for maintaining safe environments in assembly and testing facilities. Transport protection applications are growing rapidly with global trade and cross-border electronic shipments. Each application demands customized clamshell configurations for durability, reusability, and static control performance.

By End-use Industry

Major end users include electronics and semiconductors, automotive components, aerospace and defense, medical devices, and others. Electronics and semiconductors remain the largest sector, driven by consistent innovation and high-volume component handling. Automotive and aerospace industries adopt ESD clamshells to protect complex sensors and circuits. Medical device packaging emphasizes contamination-free and static-safe protection, reflecting stringent quality standards.

Segmentation:

- By Material Type:

- Conductive Plastics

- Dissipative Plastics

- Anti-static Plastics

- Shielding Plastics

- By Application:

- Electronic Component Packaging

- Storage & Handling of Sensitive Assemblies

- Transport Protection

- Others

- By End-use Industry:

- Electronics & Semiconductors

- Automotive Components

- Aerospace & Defense

- Medical Devices

- Others

- By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global ESD Clamshell Market size was valued at USD 89.14 million in 2018 to USD 131.44 million in 2024 and is anticipated to reach USD 216.69 million by 2032, at a CAGR of 6.0% during the forecast period. North America accounts for around 24% of the total market share. The region’s dominance is driven by strong semiconductor production, advanced electronics packaging, and widespread automation. The United States leads due to a high concentration of manufacturers and established R&D centers. It benefits from regulatory compliance standards and a preference for sustainable ESD materials. Canada contributes through its expanding electronics assembly sector, while Mexico supports regional growth with cost-effective manufacturing capabilities. The rise of electric vehicles and smart devices further accelerates market expansion. Strong collaborations between packaging firms and tech manufacturers sustain innovation across the region.

Europe

The Europe Global ESD Clamshell Market size was valued at USD 58.09 million in 2018 to USD 82.24 million in 2024 and is anticipated to reach USD 122.66 million by 2032, at a CAGR of 4.7% during the forecast period. Europe holds approximately 18% of the market share. The region’s growth is supported by stringent quality regulations, sustainability policies, and demand from automotive and aerospace industries. Germany, France, and the United Kingdom dominate production due to strong industrial bases and innovation-led manufacturing. It focuses on high-performance, recyclable ESD materials to meet environmental targets. European packaging companies emphasize energy-efficient manufacturing and lifecycle optimization. Rising adoption of Industry 4.0 solutions enhances ESD packaging automation. The region’s mature logistics infrastructure supports export-driven production for global markets.

Asia Pacific

The Asia Pacific Global ESD Clamshell Market size was valued at USD 138.37 million in 2018 to USD 214.93 million in 2024 and is anticipated to reach USD 374.14 million by 2032, at a CAGR of 6.7% during the forecast period. Asia Pacific commands the largest share of 40% in the global market. The region’s leadership is driven by large-scale semiconductor, electronics, and consumer device manufacturing hubs. China, Japan, and South Korea are key contributors, supported by government investments and integrated supply chains. India and Southeast Asia are emerging centers for ESD packaging due to expanding industrial infrastructure. It benefits from low-cost manufacturing, skilled labor, and continuous technological upgrades. Rapid urbanization and export-led production further strengthen regional competitiveness. Growing emphasis on sustainability and digital packaging technologies supports future growth.

Latin America

The Latin America Global ESD Clamshell Market size was valued at USD 15.16 million in 2018 to USD 22.44 million in 2024 and is anticipated to reach USD 32.71 million by 2032, at a CAGR of 4.4% during the forecast period. Latin America contributes around 7% to the global market share. Brazil and Mexico drive demand through growing electronics assembly and automotive manufacturing sectors. It benefits from gradual adoption of ESD standards in logistics and export packaging. Local companies are investing in anti-static material production and recycling programs. Expanding regional trade agreements are supporting cross-border supply chains. Government initiatives to attract technology investments further stimulate growth. The region’s improving industrial ecosystem and workforce development sustain moderate long-term expansion.

Middle East

The Middle East Global ESD Clamshell Market size was valued at USD 8.54 million in 2018 to USD 11.67 million in 2024 and is anticipated to reach USD 16.07 million by 2032, at a CAGR of 3.6% during the forecast period. The Middle East holds about 6% of the global market share. The market is influenced by increasing investments in electronics assembly, defense, and aerospace maintenance operations. The GCC countries lead regional demand due to growing industrial diversification and infrastructure projects. It benefits from expanding free zones and logistics hubs supporting international trade. Regional governments are encouraging technology-based manufacturing, fostering gradual adoption of ESD-safe solutions. Local packaging producers are forming partnerships with global firms to enhance quality standards. The focus on smart city and renewable energy projects creates new opportunities for ESD packaging applications.

Africa

The Africa Global ESD Clamshell Market size was valued at USD 4.30 million in 2018 to USD 7.21 million in 2024 and is anticipated to reach USD 9.15 million by 2032, at a CAGR of 2.5% during the forecast period. Africa represents around 5% of the total market share. Growth is driven by gradual industrialization and expansion of consumer electronics distribution networks. South Africa and Egypt are the leading contributors, supported by rising local manufacturing activity. It benefits from international partnerships promoting technology transfer and production efficiency. Limited access to high-grade ESD materials and equipment remains a challenge. The market is gaining traction in packaging, automotive parts handling, and small electronics assembly. Increasing government support for industrial zones strengthens long-term potential. Africa’s improving trade connectivity and investment inflows create a foundation for future ESD packaging adoption.

Key Player Analysis:

Competitive Analysis:

The Global ESD Clamshell Market is moderately consolidated, with a mix of multinational corporations and specialized regional players competing on innovation, material quality, and customization. It focuses on cost optimization, recyclable materials, and advanced static control technologies. Companies are investing in research to develop lightweight, reusable clamshells that meet strict ESD compliance standards. Strategic collaborations and product diversification remain key growth approaches. The market’s competitive landscape is defined by continuous technological upgrades, expanding manufacturing capacity, and a strong emphasis on sustainability-driven differentiation among major suppliers.

Recent Developments:

- In Q2 2025, Sealed Air Corporation embarked on a strategic turnaround and business reorganization, designating protective packaging—including ESD clamshell products—as a core segment. It also recently opened a manufacturing facility in Florida, part of its manufacturing footprint optimization plan. The protective packaging segment reported stable volumes and a focus on substrate-agnostic approaches, including enhanced fiber and non-plastic solutions.

- In 2025, 3M unveiled a $3.5 billion R&D investment plan aimed at launching 1,000 new products between 2025 and 2027, targeting key segments like electronics, automotive, and industrial automation. In October 2025, 3M announced a partnership with PT Pipa Mas Putih in Indonesia to develop high-resistance Ceramic Sand Screens, enhancing local manufacturing capabilities and technological integration.

Report Coverage:

The research report offers an in-depth analysis based on material type, application, end-use industry, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising semiconductor and electronics production will fuel long-term demand.

- Increased focus on recyclable and biodegradable materials will define innovation.

- Adoption of smart tracking and RFID integration will expand product functionality.

- Automotive and aerospace sectors will emerge as high-potential end-users.

- Regional manufacturing hubs in Asia Pacific will remain central to global supply chains.

- Automation in packaging processes will improve efficiency and quality control.

- Strategic partnerships will accelerate technological and material advancements.

- Sustainability certification will become a key market differentiator.

- Expansion in cleanroom and defense applications will strengthen niche demand.

- Evolving ESD regulations worldwide will create compliance-driven opportunities.