Market Overview:

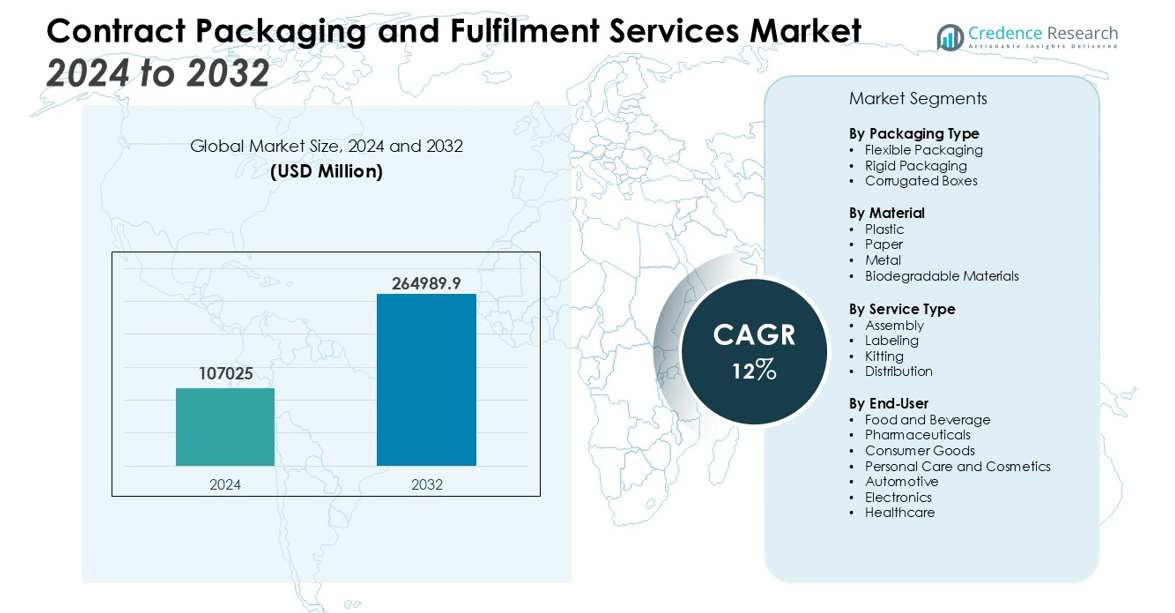

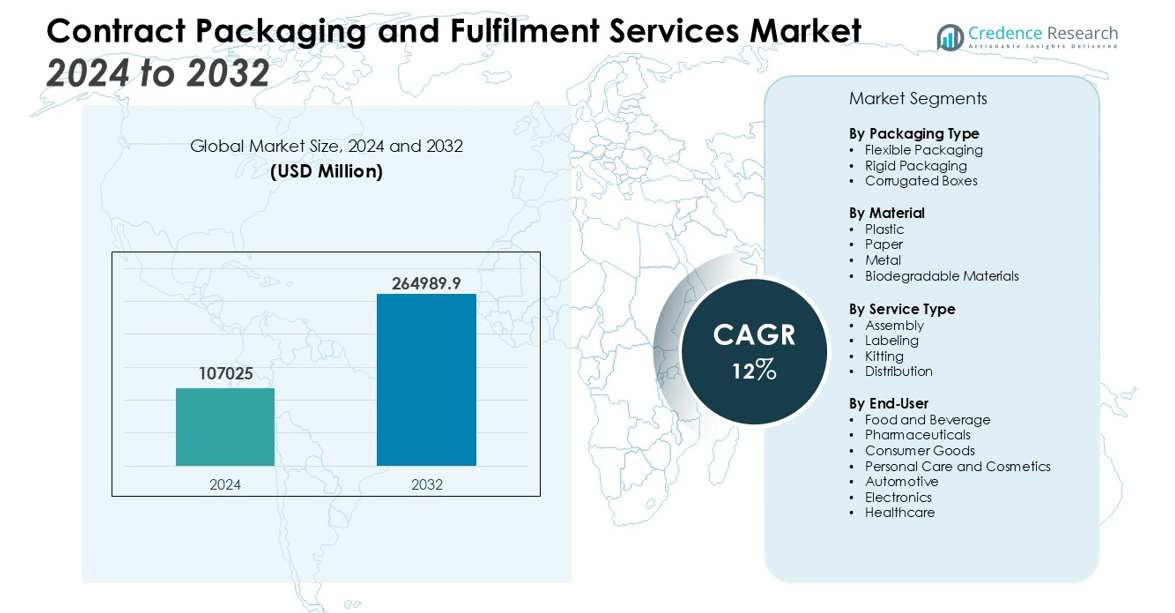

The Contract Packaging and Fulfilment Services Market size was valued at USD 107025 million in 2024 and is anticipated to reach USD 264989.9 million by 2032, at a CAGR of 12% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Contract Packaging and Fulfilment Services Market Size 2024 |

USD 107025 million |

| Contract Packaging and Fulfilment Services Market, CAGR |

12% |

| Contract Packaging and Fulfilment Services Market Size 2032 |

USD 264989.9 million |

Key drivers fueling the market’s growth include the escalating need for customized packaging solutions, advancements in packaging technologies, and heightened focus on sustainability. As companies seek to reduce operational costs and improve time-to-market, third-party contract packaging and fulfillment services offer an attractive solution. Moreover, the increasing trend toward sustainable and eco-friendly packaging materials is further accelerating the demand for contract packaging services. The rise of omnichannel retailing and direct-to-consumer deliveries also plays a pivotal role in driving this growth.

Regionally, North America holds a significant share of the market, supported by the presence of well-established packaging companies and a robust manufacturing infrastructure. The region’s strong demand for packaging services, especially in the pharmaceuticals, food and beverage, and consumer goods sectors, continues to drive growth. Europe also contributes significantly, with strong regulatory frameworks supporting sustainability and eco-friendly practices, while the Asia Pacific region is expected to experience the highest growth due to rapid e-commerce expansion in emerging economies. Additionally, increasing investments in logistics infrastructure across the region are bolstering the growth of the contract packaging and fulfillment services market.

Market Insights:

- The Contract Packaging and Fulfillment Services Market is projected to reach USD 264,989.9 million by 2032, driven by technological innovations and a rising demand for customized packaging solutions.

- Automation, robotics, and advanced packaging machinery are significantly enhancing efficiency, reducing operational costs, and allowing businesses to scale effectively.

- Sustainability is becoming a key driver, with companies increasingly adopting eco-friendly packaging solutions to meet consumer demand and comply with stricter environmental regulations.

- The expansion of e-commerce and direct-to-consumer delivery models is boosting the demand for scalable and efficient packaging and fulfillment services.

- North America leads the market with a 35% share, supported by advanced infrastructure and strong demand across industries like pharmaceuticals, food and beverage, and consumer goods.

- Europe holds a 30% market share, driven by regulatory support for sustainability initiatives and increasing e-commerce activity.

- Asia Pacific, accounting for 25% of the market share, is poised for rapid growth due to expanding e-commerce, rising disposable incomes, and improved logistics infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Customization and Flexibility in Packaging Solutions

The Contract Packaging and Fulfillment Services Market is seeing a significant rise in demand for customized packaging solutions. Brands are seeking packaging that aligns with their unique product requirements and customer expectations, whether in terms of design, functionality, or size. Contract packaging providers are increasingly offering tailored solutions that provide flexibility, allowing companies to deliver differentiated and premium products to market. This shift towards customization is also driven by the need to enhance product appeal and branding, ensuring that packaging becomes an integral part of the consumer experience.

Technological Advancements Driving Efficiency and Cost Reduction

Technological advancements in packaging processes are playing a pivotal role in the growth of the contract packaging and fulfillment services market. The integration of automation, robotics, and advanced packaging machinery enables providers to deliver high-quality packaging solutions more efficiently and at a reduced cost. These innovations optimize production cycles, reduce errors, and improve packaging speed, allowing businesses to scale operations while maintaining quality standards. It enhances the overall efficiency of fulfillment processes, providing businesses with the ability to meet high-volume demands without compromising on cost-effectiveness.

- For instance, the GMFG-1224-B4SD Flexo Printer Slotter Die-Cutter Folder Gluer by Dongguang Fengqi Packaging Machinery Co., Ltd. can process up to 220 cartons per minute, demonstrating how advanced automation can significantly enhance output in the packaging industry.

Growing Focus on Sustainability and Eco-friendly Packaging

Sustainability is increasingly becoming a key driver in the Contract Packaging and Fulfillment Services Market. Companies across various sectors are focusing on reducing their environmental footprint, prompting a rise in demand for eco-friendly packaging options. The growing awareness of environmental impact and stricter regulations on plastic usage are pushing businesses to adopt sustainable packaging materials and processes. This trend not only meets consumer demand for environmentally conscious solutions but also aligns with global sustainability goals, further driving the growth of eco-friendly packaging services in the market.

- For instance, in 2022, Tetra Pak completed a 15-month commercial validation of a fiber-based barrier in its ambient food carton packages, resulting in a significant reduction in CO2 emissions compared to traditional aluminum-layer cartons, while maintaining shelf life and protection properties.

Expansion of E-commerce and Direct-to-Consumer Delivery Models

The rapid expansion of e-commerce and direct-to-consumer delivery models is significantly influencing the contract packaging and fulfillment services market. The shift towards online shopping, accelerated by changing consumer preferences, has led businesses to invest in more efficient and scalable packaging and fulfillment solutions. It is crucial for companies to maintain fast and reliable delivery while ensuring their products are well-packaged to minimize damage during transit. As e-commerce continues to grow, the demand for packaging and fulfillment services that can handle high volumes and deliver products directly to consumers continues to rise.

Market Trends:

Shift Toward Eco-friendly and Sustainable Packaging Solutions

The Contract Packaging and Fulfillment Services Market is experiencing a shift towards more sustainable and eco-friendly packaging options. Companies are under increasing pressure to reduce their environmental impact, and this is driving demand for packaging materials that are recyclable, biodegradable, or made from renewable resources. Packaging providers are innovating to meet these sustainability goals by incorporating materials such as plant-based plastics, compostable films, and recyclable cardboard. Businesses that focus on sustainability are also adopting packaging that reduces waste, minimizes carbon footprints, and meets regulatory requirements for waste management. This trend is not only aligned with consumer demand for environmentally conscious products but also reflects the broader commitment to corporate social responsibility and environmental preservation.

- For instance, Amazon introduced 100% recyclable shipping packaging for all deliveries in Europe in 2023, including cardboard boxes, bags, and envelopes, making it easier for millions of customers to recycle every shipment.

Growth of Omnichannel Retail and Consumer-Centric Fulfillment Services

The rise of omnichannel retail models and direct-to-consumer fulfillment is shaping the Contract Packaging and Fulfillment Services Market. Companies are increasingly adopting hybrid strategies that combine both physical retail and e-commerce platforms. This trend necessitates packaging solutions that can cater to diverse distribution channels, ensuring that products are packaged efficiently for both in-store displays and online deliveries. The demand for more efficient fulfillment processes is also increasing, with an emphasis on faster delivery times and accurate order fulfillment. Packaging providers are responding by enhancing their capabilities to handle various fulfillment channels, offering services that integrate with online platforms, enabling businesses to meet the growing expectations of consumers for fast and seamless shopping experiences.

- For instance, Monta’s packaging solutions provide seamless integration with over 35 webshop platforms, delivering compatibility and enhanced fulfillment efficiency for e-commerce retailers.

Market Challenges Analysis:

Increasing Pressure to Meet Sustainability and Regulatory Standards

One of the significant challenges in the Contract Packaging and Fulfillment Services Market is the increasing pressure to meet stringent sustainability and regulatory standards. Businesses are expected to comply with ever-tightening environmental regulations that govern packaging materials, waste disposal, and recycling processes. These regulations often require companies to adopt eco-friendly packaging solutions, which can lead to higher costs and more complex supply chain management. Packaging providers must invest in new technologies and materials that align with these standards while maintaining cost-effectiveness. The need to balance sustainability with operational efficiency presents an ongoing challenge for companies in the market.

Supply Chain Disruptions and Rising Operational Costs

The Contract Packaging and Fulfillment Services Market faces challenges related to supply chain disruptions and rising operational costs. Global supply chains have been significantly affected by factors such as raw material shortages, labor shortages, and geopolitical uncertainties. These disruptions can lead to delays in production and fulfillment, negatively impacting delivery timelines and customer satisfaction. Furthermore, rising costs for labor, transportation, and raw materials put pressure on packaging providers to maintain competitive pricing while managing these increasing expenses. Efficient supply chain management and cost optimization strategies remain critical to maintaining profitability in the market.

Market Opportunities:

Expansion of E-commerce and Direct-to-Consumer Channels

The continued expansion of e-commerce presents significant opportunities in the Contract Packaging and Fulfillment Services Market. As more consumers shift towards online shopping, businesses are increasingly turning to third-party packaging and fulfillment services to streamline their operations and ensure fast, efficient delivery. This growth in e-commerce, particularly in emerging markets, drives the demand for scalable and flexible packaging solutions that can meet varying order sizes and delivery requirements. Packaging providers can capitalize on this trend by offering tailored solutions for direct-to-consumer businesses, enhancing their ability to compete in a rapidly evolving market.

Advancements in Automation and Smart Packaging Technologies

Advancements in automation and smart packaging technologies offer another key opportunity in the Contract Packaging and Fulfillment Services Market. The adoption of robotics, AI, and Internet of Things (IoT) in packaging and fulfillment processes is increasing, enabling greater efficiency and accuracy. Smart packaging, which includes features like RFID and QR codes, allows companies to improve inventory management, track products in real time, and enhance the consumer experience. These innovations help businesses reduce operational costs and improve supply chain transparency, positioning packaging providers to offer cutting-edge solutions that meet the needs of modern retail and logistics operations.

Market Segmentation Analysis:

By Packaging Type:

Packaging types in the market include flexible packaging, rigid packaging, and corrugated boxes. Flexible packaging dominates the market due to its versatility, lightweight nature, and cost-effectiveness, making it ideal for a wide range of products, including food, beverages, and personal care items. Rigid packaging, often used for high-end consumer goods, accounts for a significant share due to its durability and premium appearance. Corrugated boxes are widely used for shipping and storage applications, contributing to the efficient handling of bulk products.

- For instance, Amcor, in collaboration with Bulldog skincare, saved 8.5 metric tonnes of plastic annually by reducing the wall thickness of its flexible tubes for 50mm diameter products.

By Material:

The material segment includes plastic, paper, metal, and others. Plastic holds the largest share, driven by its durability, cost-effectiveness, and flexibility in design. Paper-based packaging is gaining traction due to sustainability trends and the growing preference for eco-friendly materials. Metal packaging, commonly used for beverages and food products, continues to see stable demand, while biodegradable materials are emerging as a growing segment in response to increasing environmental concerns.

- For instance, Takeda uses up to 10,000 tons of paper annually across its product packaging, with significant initiatives driving this towards sustainable sourcing by working with over 50 certified suppliers worldwide.

By Service Type:

Contract packaging services include assembly, labeling, kitting, and distribution. Labeling and assembly services are crucial for industries requiring precise packaging and efficient product assembly. Kitting services, which involve grouping items together, have seen significant demand in e-commerce, where speed and accuracy are essential. Distribution services are integral for companies looking to streamline logistics and reduce costs. The diverse range of services in this segment supports the growing demand for integrated packaging and fulfillment solutions.

Segmentations:

- By Packaging Type:

- Flexible Packaging

- Rigid Packaging

- Corrugated Boxes

- By Material:

- Plastic

- Paper

- Metal

- Biodegradable Materials

- By Service Type:

- Assembly

- Labeling

- Kitting

- Distribution

- By End-User:

- Food and Beverage

- Pharmaceuticals

- Consumer Goods

- Personal Care and Cosmetics

- Automotive

- Electronics

- Healthcare

- By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Market Dominance Driven by Established Infrastructure

North America holds 35% of the Contract Packaging and Fulfillment Services Market share, accounting for the largest portion of global demand. The region benefits from its well-established infrastructure and advanced supply chain networks, which support the growth of industries such as pharmaceuticals, food and beverage, and consumer goods. Increasing demand for customized packaging and efficient fulfillment services to meet both online and retail needs has contributed to the market’s continued expansion. The U.S. leads this growth due to its advanced logistics systems, technological innovations, and high consumer demand for fast, reliable delivery services.

Europe: Strong Growth Driven by Sustainability Initiatives and Regulatory Support

Europe captures 30% of the Contract Packaging and Fulfillment Services Market share, driven by a focus on sustainability and regulatory support. Governments in the region have introduced stringent environmental regulations that push companies to adopt eco-friendly packaging materials and practices. This shift towards sustainability has spurred the demand for contract packaging services, as companies look for solutions that align with these regulations. The growing e-commerce trend in Western Europe further supports market growth as businesses seek scalable fulfillment services to accommodate rising consumer expectations for fast and reliable delivery.

Asia Pacific: High Growth Potential in Emerging Economies

Asia Pacific holds 25% of the Contract Packaging and Fulfillment Services Market share and is expected to experience the highest growth. The rapid expansion of e-commerce in emerging economies, particularly China, India, and Southeast Asian nations, is driving the demand for packaging and fulfillment services as online shopping continues to surge. Rising disposable incomes and increasing internet penetration further fuel the market’s growth. The growing focus on cost-effective logistics, coupled with improved packaging technologies and rising consumer expectations for timely deliveries, presents significant opportunities for service providers in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Aaron Thomas Company Inc.

- Sharp (UDG Healthcare PLC)

- Boughey Distribution Ltd

- ActionPak Inc.

- Warren Industries Inc.

- Swan Packaging Fulfillment Inc.

- Multi-Pac Solutions LLC

- AmeriPac Inc.

- Kane Logistics

- Assemblies Unlimited Inc.

- PAC Worldwide Inc.

- FW Logistics

Competitive Analysis:

The Contract Packaging and Fulfillment Services Market is highly competitive, with numerous global and regional players offering a variety of solutions. Leading companies such as Amcor, WestRock, and Berry Global dominate the market, leveraging their extensive resources, advanced technologies, and broad service portfolios. These players focus on customization, sustainable packaging solutions, and technological innovations to meet the growing demands of industries like pharmaceuticals, food and beverage, and consumer goods. Smaller regional providers also contribute by offering specialized services tailored to local market needs. The market is characterized by a trend toward consolidation, as large players acquire smaller firms to expand their capabilities and geographical reach. Companies are increasingly focusing on enhancing operational efficiency through automation and optimizing their supply chains to meet the rising demand for fast, reliable, and sustainable packaging solutions. Competition remains intense, with firms continuously striving to innovate and differentiate their offerings.

Recent Developments:

- In November 2024, Aaron Thomas Company Inc. filed a lawsuit against Powered By FTGU, LLC in the U.S. District Court for the District of New Jersey, with official court activity documented throughout November and December 2024.

- In November 2023, ActionPac launched the MINI420, a fully automated packaging solution designed for cannabis packaging, providing precision and accuracy in bud blending and weighing.

- In July 2025, PAC Worldwide announced significant progress in reducing packaging waste through the implementation of reuse and circularity programs, resulting in notable environmental impact by mid-2025.

Market Concentration & Characteristics:

The Contract Packaging and Fulfillment Services Market exhibits moderate concentration, with a few key players holding significant market shares. Major companies such as Amcor, WestRock, and Berry Global lead the market, leveraging their established networks, advanced technologies, and global presence. These firms offer a broad range of services, including packaging design, fulfillment, and distribution, targeting industries like food and beverage, pharmaceuticals, and consumer goods. Smaller regional players also contribute by providing specialized services to cater to local demand and niche markets. The market is highly fragmented, with increasing competition driven by the growing emphasis on sustainability, cost efficiency, and customization. Players are focused on innovations such as automation, smart packaging, and eco-friendly materials to stay competitive. Market dynamics favor large-scale providers with robust supply chain capabilities, but there is room for smaller players offering specialized, tailored solutions in certain regions.

Report Coverage:

The research report offers an in-depth analysis based on Packaging Type, Material, Service Type, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The rapid growth of e-commerce continues to drive demand for efficient packaging and fulfillment solutions.

- Technological advancements, including automation, robotics, and AI, enhance operational efficiency and packaging accuracy.

- Increased consumer preference for eco-friendly packaging materials prompts businesses to adopt sustainable practices.

- The demand for customized packaging solutions grows as brands aim to enhance product appeal and meet specific consumer needs.

- Stricter regulations in industries such as pharmaceuticals and food & beverage push the need for specialized packaging services.

- Companies are focusing on optimizing supply chains to reduce costs and improve delivery timelines.

- The rise of omnichannel retail strategies necessitates flexible and integrated packaging and fulfillment services.

- Expanding middle-class populations in emerging markets, particularly in Asia Pacific, drive the demand for packaged goods.

- Packaging is increasingly seen as an integral part of the customer experience, contributing to improved satisfaction and brand loyalty.

- Companies are investing in advanced infrastructure, including facilities and technologies, to support the growing demand for packaging and fulfillment services.